Key Insights

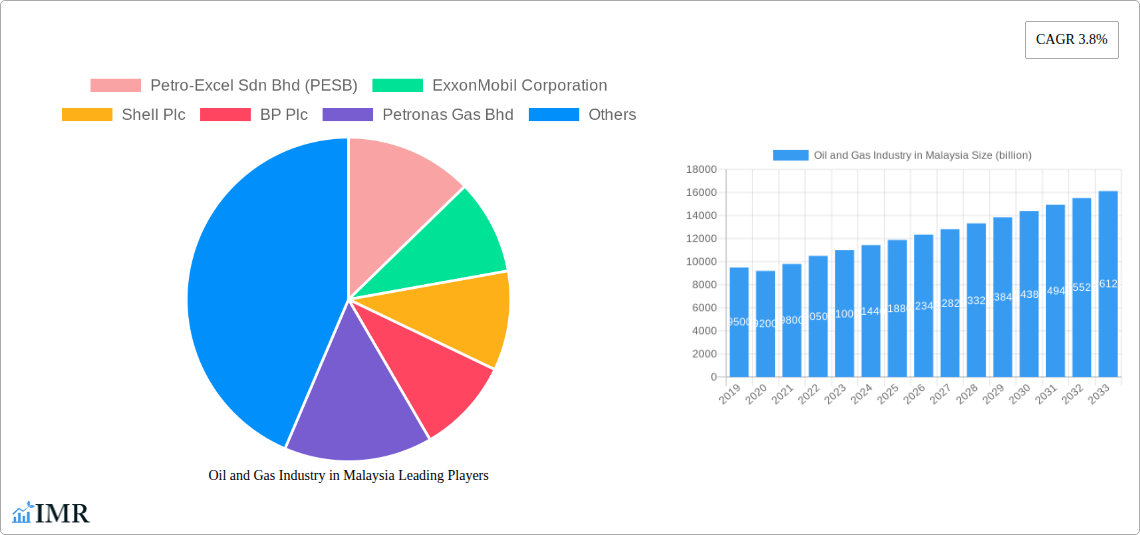

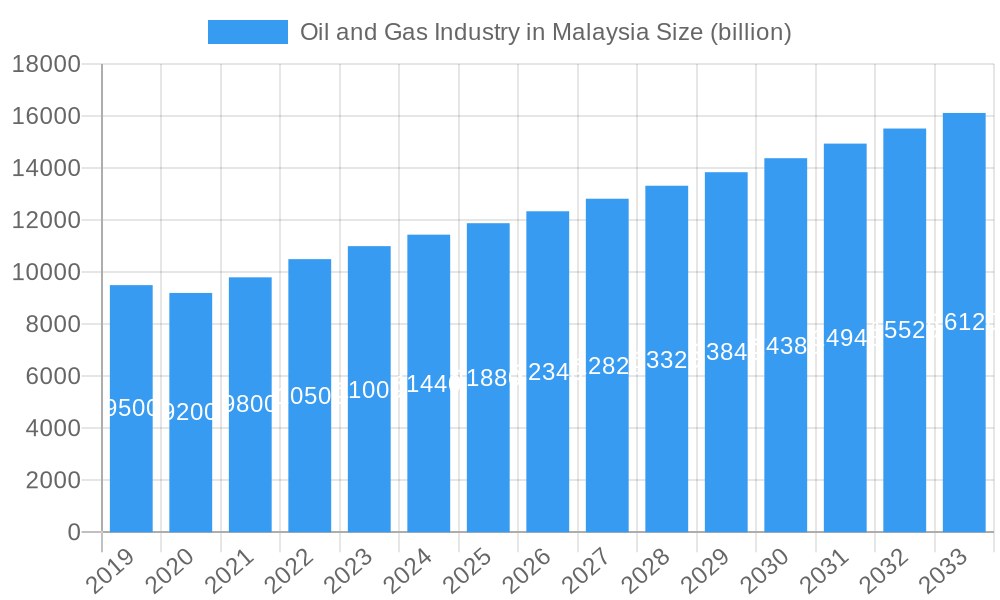

The Malaysian oil and gas industry is poised for steady expansion, projected to reach a market size of USD 11.44 billion in 2024. With a projected Compound Annual Growth Rate (CAGR) of 3.8%, the sector is expected to demonstrate consistent growth throughout the forecast period of 2025-2033. This growth is underpinned by several key drivers, including increasing domestic energy demand, continued investment in exploration and production activities, and the government's strategic initiatives to enhance the country's energy security and export capabilities. Malaysia's position as a significant producer of crude oil and natural gas, coupled with its robust refining and petrochemical infrastructure, provides a strong foundation for this sustained market development. The industry is actively adapting to evolving global energy landscapes, with a focus on optimizing existing resources and exploring new frontiers.

Oil and Gas Industry in Malaysia Market Size (In Billion)

The industry's segmentation into upstream, midstream, and downstream sectors highlights a comprehensive value chain. The upstream segment, encompassing exploration and production, remains crucial, driven by technological advancements and the need to replenish reserves. The midstream sector, involved in transportation and storage, benefits from increased production volumes and the development of new pipelines and LNG terminals. The downstream segment, including refining, petrochemicals, and marketing, is experiencing growth fueled by a rising demand for refined products and petrochemical derivatives. Key trends shaping the market include a greater emphasis on digitalization and automation to improve operational efficiency, investments in renewable energy integration within the oil and gas value chain, and a growing focus on environmental, social, and governance (ESG) practices. While global price volatility and the transition towards cleaner energy sources present potential restraints, the industry's resilience and strategic adaptations are expected to mitigate these challenges, ensuring a dynamic and evolving market landscape.

Oil and Gas Industry in Malaysia Company Market Share

Malaysia Oil and Gas Industry Report: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the Malaysian oil and gas industry, a critical sector for the nation's economy. Covering the study period of 2019–2033, with a base year of 2025, this report provides detailed insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, emerging opportunities, growth accelerators, and the competitive landscape. We meticulously analyze both upstream, midstream, and downstream segments, alongside crucial industry developments. This report is indispensable for stakeholders seeking to understand the future of Malaysia's energy sector, including oil and gas exploration, production, refining, and distribution. Discover how key players like Petronas Gas Bhd, ExxonMobil Corporation, and Shell Plc are shaping the market. This report delves into the parent market of Southeast Asia's energy sector and the child market of Malaysia's specific oil and gas operations, presenting all values in billion units.

Oil and Gas Industry in Malaysia Market Dynamics & Structure

The Malaysian oil and gas industry exhibits a dynamic market structure influenced by a confluence of factors. Market concentration remains high, largely dominated by Petronas Gas Bhd and multinational giants like ExxonMobil Corporation, Shell Plc, and Chevron Corporation, which collectively hold significant market shares in exploration, production, and downstream operations. Technological innovation is a key driver, with advancements in digital oilfield technologies, enhanced oil recovery (EOR) techniques, and the development of nearshore floating LNG facilities, as evidenced by the January 2023 EPCC contract secured by JGC Corporation and Samsung Heavy Industries. The regulatory framework, primarily shaped by the Petroleum Development Act 1974, ensures national control and equitable resource management, though evolving environmental regulations and carbon pricing mechanisms are introducing new complexities. Competitive product substitutes, particularly renewable energy sources, are gradually gaining traction but are yet to pose a significant threat to the core operations of the oil and gas sector in the medium term. End-user demographics in Malaysia are characterized by increasing energy demand from industrial sectors, transportation, and growing residential needs. Mergers and acquisition (M&A) trends are subtle, often focused on consolidating assets or acquiring specialized technological capabilities rather than large-scale market consolidation, reflecting a mature but evolving competitive landscape. The industry faces innovation barriers related to high capital expenditure for R&D, the long lead times for new technology adoption, and the need for skilled personnel to operate advanced systems.

- Market Concentration: High, with significant market share held by Petronas Gas Bhd, ExxonMobil Corporation, Shell Plc, and Chevron Corporation.

- Technological Innovation Drivers: Digital oilfield, EOR, floating LNG, and automation are key technological advancements.

- Regulatory Frameworks: Governed by the Petroleum Development Act 1974, with increasing emphasis on environmental sustainability and energy transition policies.

- Competitive Product Substitutes: Renewable energy sources are emerging but currently represent a minor competitive threat.

- End-User Demographics: Driven by industrial, transportation, and residential energy consumption.

- M&A Trends: Primarily focused on asset consolidation and technology acquisition.

- Innovation Barriers: High CapEx, long adoption cycles, and skilled workforce requirements.

Oil and Gas Industry in Malaysia Growth Trends & Insights

The Malaysian oil and gas industry is poised for sustained growth throughout the forecast period of 2025–2033, driven by robust demand and strategic investments. The market size evolution is projected to be significant, with the parent market in Southeast Asia experiencing continued expansion, and Malaysia playing a pivotal role within it. This growth is underpinned by stable exploration and production activities, alongside an increasing focus on gas monetization and downstream petrochemical development. Adoption rates for new technologies, particularly those enhancing efficiency and reducing environmental impact, are expected to accelerate, spurred by both regulatory pressures and economic incentives. Technological disruptions are less about replacing core oil and gas operations in the immediate future and more about optimizing existing processes and integrating with the broader energy ecosystem. For instance, advancements in carbon capture, utilization, and storage (CCUS) technologies are becoming increasingly relevant. Consumer behavior shifts are more pronounced in the downstream segment, with a growing preference for cleaner fuels and energy-efficient products, influencing retail operations and product development by companies like Petronas Gas Bhd.

The market penetration of liquefied natural gas (LNG) is projected to increase, fueled by demand for cleaner energy and Malaysia's strategic location in global trade routes. The CAGR for the industry is anticipated to be a healthy XX% over the forecast period, reflecting a steady but significant expansion. The upstream segment, while mature in some basins, continues to see exploration success, such as the December 2022 discovery at the Nahara well in Block SK 306 by Petronas Carigali. Midstream infrastructure, including pipelines and LNG terminals, is undergoing upgrades and expansions to meet growing demand and facilitate trade. Downstream activities, particularly petrochemical production, are expected to benefit from integrated refinery operations and a focus on higher-value specialty chemicals. The industry's ability to adapt to the global energy transition, while maintaining its essential role in the current energy mix, will be crucial for sustained growth. This includes navigating evolving policies around emissions and investing in lower-carbon solutions. The interplay between national energy security objectives and international market dynamics will continue to shape the growth trajectory.

Dominant Regions, Countries, or Segments in Oil and Gas Industry in Malaysia

The upstream segment of the Malaysian oil and gas industry is a primary driver of market growth, largely owing to its substantial offshore hydrocarbon reserves. This dominance is further bolstered by the nation's strategic position in the South China Sea, a region known for its prolific oil and gas fields. Malaysia boasts a mature but still productive upstream sector, with significant contributions from deepwater exploration and enhanced oil recovery (EOR) projects. Petronas Carigali, a wholly owned subsidiary of Petronas, plays a pivotal role as the operator of numerous Production Sharing Contracts (PSCs), demonstrating the national oil company's continued leadership and expertise in exploration and production activities. The December 2022 discovery at the Nahara well in Block SK 306 highlights the ongoing success in identifying new reserves.

- Upstream Dominance Factors:

- Abundant Offshore Reserves: Significant discoveries in the South China Sea contribute to sustained production.

- Advanced Exploration Technologies: Continuous investment in seismic surveys and drilling technologies to access challenging reserves.

- Strategic Production Sharing Contracts (PSCs): A framework that encourages investment and maximizes national resource utilization, with Petronas Carigali holding a significant share.

- Government Support and Incentives: Favorable policies for exploration and production activities, including tax incentives.

- Infrastructure Development: Existing offshore platforms and subsea infrastructure support continued production.

- Growth Potential: Focus on deepwater and ultra-deepwater exploration, as well as EOR projects, offers significant untapped potential. The market share in upstream is estimated to be XX billion in 2025, with projected growth to XX billion by 2033.

While upstream activities are foundational, the midstream segment is gaining prominence, driven by the need for efficient transportation and processing of hydrocarbons. Malaysia's strategic location facilitates its role as a key player in regional LNG trade. The downstream segment, encompassing refining and petrochemicals, is also experiencing robust growth, fueled by domestic demand and export opportunities for refined products and chemicals. The January 2023 announcement of Malaysia's first nearshore floating LNG facility underscores the innovative advancements in the midstream and downstream integration. This project, with a minimum production capacity of 2 million tonnes of LNG annually, is set to become a world-first, highlighting Malaysia's commitment to pioneering new technologies and expanding its LNG capabilities. This development will significantly boost the midstream sector and create opportunities in related downstream processing.

Oil and Gas Industry in Malaysia Product Landscape

The product landscape of the Malaysian oil and gas industry is diverse, spanning from crude oil and natural gas to a wide array of refined products and petrochemical derivatives. Crude oil and natural gas remain the primary commodities produced, with ongoing efforts to maximize recovery from existing fields and explore new reserves. In the downstream sector, refined products such as gasoline, diesel, jet fuel, and lubricants cater to domestic and international transportation and industrial needs. A significant area of product innovation lies within the petrochemical segment, where companies are increasingly focusing on higher-value specialty chemicals, polymers, and fertilizers. The development of Malaysia's first nearshore floating LNG facility signifies a leap in the LNG product offering, enhancing the nation's capacity for producing and exporting liquefied natural gas. Technological advancements are enabling the production of cleaner fuels and more sustainable chemical products, aligning with global environmental trends.

Key Drivers, Barriers & Challenges in Oil and Gas Industry in Malaysia

Key Drivers:

- Sustained Domestic and Regional Energy Demand: Robust economic growth in Malaysia and the wider Southeast Asian region fuels demand for oil and gas products.

- Government Support and Strategic Policies: Favorable regulatory frameworks and incentives for exploration, production, and infrastructure development, particularly through Petronas.

- Technological Advancements: Adoption of EOR techniques, digital oilfield solutions, and innovative LNG technologies to enhance efficiency and output.

- Strategic Location for Trade: Malaysia's position as a hub for LNG trade and refined product distribution in the Asia-Pacific region.

- Natural Resource Endowment: Significant proven reserves of oil and natural gas continue to support production.

Barriers & Challenges:

- Price Volatility: Fluctuations in global crude oil prices significantly impact profitability and investment decisions.

- Environmental Regulations and Climate Change Pressures: Increasing scrutiny and evolving regulations related to carbon emissions and sustainability initiatives.

- Geopolitical Instability: Global geopolitical events can disrupt supply chains and influence market sentiment.

- High Capital Expenditure: Exploration, development, and infrastructure projects require substantial upfront investment.

- Talent Acquisition and Retention: The need for skilled labor in specialized areas of the industry.

- Competition from Renewables: The growing global focus on renewable energy sources poses a long-term challenge.

Emerging Opportunities in Oil and Gas Industry in Malaysia

Emerging opportunities in the Malaysian oil and gas industry are primarily centered around the energy transition and the expansion of gas utilization. The development of hydrogen production technologies and the exploration of ammonia as a fuel and feedstock present significant future potential. Furthermore, the increasing demand for specialty petrochemicals and high-value polymers offers avenues for downstream diversification and value addition. The integration of carbon capture, utilization, and storage (CCUS) technologies presents a crucial opportunity to decarbonize existing operations and develop new business models. The expansion of nearshore and offshore floating LNG facilities, like the one planned for completion in 2027, opens up new markets and enhances Malaysia's role in global energy supply chains. Investing in digitalization and AI to optimize upstream operations and improve supply chain efficiency also presents a key growth area.

Growth Accelerators in the Oil and Gas Industry in Malaysia Industry

Several catalysts are driving long-term growth in the Malaysian oil and gas industry. Technological breakthroughs, particularly in digitalization, automation, and the development of lower-carbon solutions, are enhancing operational efficiency and reducing costs. Strategic partnerships and joint ventures, both domestically and internationally, facilitate access to new markets, advanced technologies, and capital. The government's proactive approach to attracting foreign investment and developing robust infrastructure acts as a significant growth accelerator. Furthermore, the increasing regional demand for natural gas as a cleaner transition fuel, coupled with Malaysia's strong position in LNG liquefaction and regasification, provides a sustained impetus for growth. The industry's commitment to research and development, exemplified by initiatives from Petronas, is crucial for maintaining a competitive edge and exploring new frontiers in energy production and sustainability.

Key Players Shaping the Oil and Gas Industry in Malaysia Market

- Petronas Gas Bhd

- ExxonMobil Corporation

- Shell Plc

- BP Plc

- Chevron Corporation

- Altus Oil & Gas Malaysia Sdn Bhd

- Malaysiaian General Petroleum Corporation

- Malaysiaian Natural Gas Holding Company

- Petro Teguh (M) Sdn Bhd

Notable Milestones in Oil and Gas Industry in Malaysia Sector

- January 2023: A consortium of JGC Corporation and Samsung Heavy Industries (SHI) secured an EPCC contract with Petronas for Malaysia's first nearshore floating LNG facility project. This facility, slated for completion in 2027, is set to be the world's first nearshore floating LNG facility with a minimum production capacity of 2 million tonnes of LNG annually, significantly impacting LNG production and export capabilities.

- December 2022: Petronas announced the oil and gas discovery at the Nahara well in Block SK 306. Petronas Carigali, the operator with 100 percent participating interest, highlighted the ongoing success in exploration efforts and the potential for new reserves, bolstering the upstream segment.

In-Depth Oil and Gas Industry in Malaysia Market Outlook

The Malaysian oil and gas industry's market outlook remains promising, driven by a strategic blend of continued exploration and production, a robust midstream infrastructure, and an expanding downstream sector. Growth accelerators include the increasing regional demand for natural gas as a transition fuel, alongside the nation's pioneering role in LNG technology, exemplified by the upcoming nearshore floating LNG facility. Strategic investments in digitalization and CCUS technologies are expected to enhance efficiency and address environmental concerns. The industry is well-positioned to leverage its existing infrastructure and expertise to navigate the evolving global energy landscape, focusing on both traditional hydrocarbon revenues and emerging low-carbon energy solutions. Future market potential lies in the development of specialty petrochemicals, hydrogen production, and further optimization of offshore and deepwater operations.

Oil and Gas Industry in Malaysia Segmentation

- 1. Upstream

- 2. Midstream

- 3. Downstream

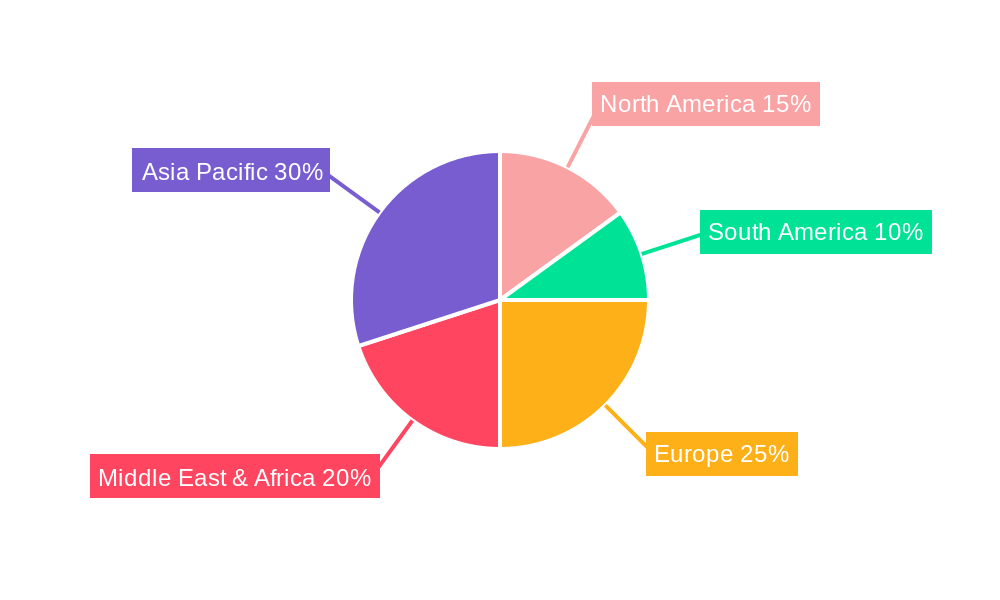

Oil and Gas Industry in Malaysia Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Oil and Gas Industry in Malaysia Regional Market Share

Geographic Coverage of Oil and Gas Industry in Malaysia

Oil and Gas Industry in Malaysia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Surging Demand For Refined Petroleum Products4.; Significant Untapped Petroleum Reserves in the Sedimentary Basins

- 3.3. Market Restrains

- 3.3.1. 4.; High Volatility of Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Midstream Sector is Expected to Have Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Oil and Gas Industry in Malaysia Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Upstream

- 5.2. Market Analysis, Insights and Forecast - by Midstream

- 5.3. Market Analysis, Insights and Forecast - by Downstream

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Upstream

- 6. North America Oil and Gas Industry in Malaysia Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Upstream

- 6.2. Market Analysis, Insights and Forecast - by Midstream

- 6.3. Market Analysis, Insights and Forecast - by Downstream

- 6.1. Market Analysis, Insights and Forecast - by Upstream

- 7. South America Oil and Gas Industry in Malaysia Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Upstream

- 7.2. Market Analysis, Insights and Forecast - by Midstream

- 7.3. Market Analysis, Insights and Forecast - by Downstream

- 7.1. Market Analysis, Insights and Forecast - by Upstream

- 8. Europe Oil and Gas Industry in Malaysia Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Upstream

- 8.2. Market Analysis, Insights and Forecast - by Midstream

- 8.3. Market Analysis, Insights and Forecast - by Downstream

- 8.1. Market Analysis, Insights and Forecast - by Upstream

- 9. Middle East & Africa Oil and Gas Industry in Malaysia Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Upstream

- 9.2. Market Analysis, Insights and Forecast - by Midstream

- 9.3. Market Analysis, Insights and Forecast - by Downstream

- 9.1. Market Analysis, Insights and Forecast - by Upstream

- 10. Asia Pacific Oil and Gas Industry in Malaysia Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Upstream

- 10.2. Market Analysis, Insights and Forecast - by Midstream

- 10.3. Market Analysis, Insights and Forecast - by Downstream

- 10.1. Market Analysis, Insights and Forecast - by Upstream

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Petro-Excel Sdn Bhd (PESB)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ExxonMobil Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Shell Plc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BP Plc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Petronas Gas Bhd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Chevron Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Altus Oil & Gas Malaysia Sdn Bhd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Malaysiaian General Petroleum Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Malaysiaian Natural Gas Holding Company*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Petro Teguh (M) Sdn Bhd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Petro-Excel Sdn Bhd (PESB)

List of Figures

- Figure 1: Global Oil and Gas Industry in Malaysia Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Oil and Gas Industry in Malaysia Volume Breakdown (Thousand, %) by Region 2025 & 2033

- Figure 3: North America Oil and Gas Industry in Malaysia Revenue (billion), by Upstream 2025 & 2033

- Figure 4: North America Oil and Gas Industry in Malaysia Volume (Thousand), by Upstream 2025 & 2033

- Figure 5: North America Oil and Gas Industry in Malaysia Revenue Share (%), by Upstream 2025 & 2033

- Figure 6: North America Oil and Gas Industry in Malaysia Volume Share (%), by Upstream 2025 & 2033

- Figure 7: North America Oil and Gas Industry in Malaysia Revenue (billion), by Midstream 2025 & 2033

- Figure 8: North America Oil and Gas Industry in Malaysia Volume (Thousand), by Midstream 2025 & 2033

- Figure 9: North America Oil and Gas Industry in Malaysia Revenue Share (%), by Midstream 2025 & 2033

- Figure 10: North America Oil and Gas Industry in Malaysia Volume Share (%), by Midstream 2025 & 2033

- Figure 11: North America Oil and Gas Industry in Malaysia Revenue (billion), by Downstream 2025 & 2033

- Figure 12: North America Oil and Gas Industry in Malaysia Volume (Thousand), by Downstream 2025 & 2033

- Figure 13: North America Oil and Gas Industry in Malaysia Revenue Share (%), by Downstream 2025 & 2033

- Figure 14: North America Oil and Gas Industry in Malaysia Volume Share (%), by Downstream 2025 & 2033

- Figure 15: North America Oil and Gas Industry in Malaysia Revenue (billion), by Country 2025 & 2033

- Figure 16: North America Oil and Gas Industry in Malaysia Volume (Thousand), by Country 2025 & 2033

- Figure 17: North America Oil and Gas Industry in Malaysia Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Oil and Gas Industry in Malaysia Volume Share (%), by Country 2025 & 2033

- Figure 19: South America Oil and Gas Industry in Malaysia Revenue (billion), by Upstream 2025 & 2033

- Figure 20: South America Oil and Gas Industry in Malaysia Volume (Thousand), by Upstream 2025 & 2033

- Figure 21: South America Oil and Gas Industry in Malaysia Revenue Share (%), by Upstream 2025 & 2033

- Figure 22: South America Oil and Gas Industry in Malaysia Volume Share (%), by Upstream 2025 & 2033

- Figure 23: South America Oil and Gas Industry in Malaysia Revenue (billion), by Midstream 2025 & 2033

- Figure 24: South America Oil and Gas Industry in Malaysia Volume (Thousand), by Midstream 2025 & 2033

- Figure 25: South America Oil and Gas Industry in Malaysia Revenue Share (%), by Midstream 2025 & 2033

- Figure 26: South America Oil and Gas Industry in Malaysia Volume Share (%), by Midstream 2025 & 2033

- Figure 27: South America Oil and Gas Industry in Malaysia Revenue (billion), by Downstream 2025 & 2033

- Figure 28: South America Oil and Gas Industry in Malaysia Volume (Thousand), by Downstream 2025 & 2033

- Figure 29: South America Oil and Gas Industry in Malaysia Revenue Share (%), by Downstream 2025 & 2033

- Figure 30: South America Oil and Gas Industry in Malaysia Volume Share (%), by Downstream 2025 & 2033

- Figure 31: South America Oil and Gas Industry in Malaysia Revenue (billion), by Country 2025 & 2033

- Figure 32: South America Oil and Gas Industry in Malaysia Volume (Thousand), by Country 2025 & 2033

- Figure 33: South America Oil and Gas Industry in Malaysia Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Oil and Gas Industry in Malaysia Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe Oil and Gas Industry in Malaysia Revenue (billion), by Upstream 2025 & 2033

- Figure 36: Europe Oil and Gas Industry in Malaysia Volume (Thousand), by Upstream 2025 & 2033

- Figure 37: Europe Oil and Gas Industry in Malaysia Revenue Share (%), by Upstream 2025 & 2033

- Figure 38: Europe Oil and Gas Industry in Malaysia Volume Share (%), by Upstream 2025 & 2033

- Figure 39: Europe Oil and Gas Industry in Malaysia Revenue (billion), by Midstream 2025 & 2033

- Figure 40: Europe Oil and Gas Industry in Malaysia Volume (Thousand), by Midstream 2025 & 2033

- Figure 41: Europe Oil and Gas Industry in Malaysia Revenue Share (%), by Midstream 2025 & 2033

- Figure 42: Europe Oil and Gas Industry in Malaysia Volume Share (%), by Midstream 2025 & 2033

- Figure 43: Europe Oil and Gas Industry in Malaysia Revenue (billion), by Downstream 2025 & 2033

- Figure 44: Europe Oil and Gas Industry in Malaysia Volume (Thousand), by Downstream 2025 & 2033

- Figure 45: Europe Oil and Gas Industry in Malaysia Revenue Share (%), by Downstream 2025 & 2033

- Figure 46: Europe Oil and Gas Industry in Malaysia Volume Share (%), by Downstream 2025 & 2033

- Figure 47: Europe Oil and Gas Industry in Malaysia Revenue (billion), by Country 2025 & 2033

- Figure 48: Europe Oil and Gas Industry in Malaysia Volume (Thousand), by Country 2025 & 2033

- Figure 49: Europe Oil and Gas Industry in Malaysia Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe Oil and Gas Industry in Malaysia Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East & Africa Oil and Gas Industry in Malaysia Revenue (billion), by Upstream 2025 & 2033

- Figure 52: Middle East & Africa Oil and Gas Industry in Malaysia Volume (Thousand), by Upstream 2025 & 2033

- Figure 53: Middle East & Africa Oil and Gas Industry in Malaysia Revenue Share (%), by Upstream 2025 & 2033

- Figure 54: Middle East & Africa Oil and Gas Industry in Malaysia Volume Share (%), by Upstream 2025 & 2033

- Figure 55: Middle East & Africa Oil and Gas Industry in Malaysia Revenue (billion), by Midstream 2025 & 2033

- Figure 56: Middle East & Africa Oil and Gas Industry in Malaysia Volume (Thousand), by Midstream 2025 & 2033

- Figure 57: Middle East & Africa Oil and Gas Industry in Malaysia Revenue Share (%), by Midstream 2025 & 2033

- Figure 58: Middle East & Africa Oil and Gas Industry in Malaysia Volume Share (%), by Midstream 2025 & 2033

- Figure 59: Middle East & Africa Oil and Gas Industry in Malaysia Revenue (billion), by Downstream 2025 & 2033

- Figure 60: Middle East & Africa Oil and Gas Industry in Malaysia Volume (Thousand), by Downstream 2025 & 2033

- Figure 61: Middle East & Africa Oil and Gas Industry in Malaysia Revenue Share (%), by Downstream 2025 & 2033

- Figure 62: Middle East & Africa Oil and Gas Industry in Malaysia Volume Share (%), by Downstream 2025 & 2033

- Figure 63: Middle East & Africa Oil and Gas Industry in Malaysia Revenue (billion), by Country 2025 & 2033

- Figure 64: Middle East & Africa Oil and Gas Industry in Malaysia Volume (Thousand), by Country 2025 & 2033

- Figure 65: Middle East & Africa Oil and Gas Industry in Malaysia Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East & Africa Oil and Gas Industry in Malaysia Volume Share (%), by Country 2025 & 2033

- Figure 67: Asia Pacific Oil and Gas Industry in Malaysia Revenue (billion), by Upstream 2025 & 2033

- Figure 68: Asia Pacific Oil and Gas Industry in Malaysia Volume (Thousand), by Upstream 2025 & 2033

- Figure 69: Asia Pacific Oil and Gas Industry in Malaysia Revenue Share (%), by Upstream 2025 & 2033

- Figure 70: Asia Pacific Oil and Gas Industry in Malaysia Volume Share (%), by Upstream 2025 & 2033

- Figure 71: Asia Pacific Oil and Gas Industry in Malaysia Revenue (billion), by Midstream 2025 & 2033

- Figure 72: Asia Pacific Oil and Gas Industry in Malaysia Volume (Thousand), by Midstream 2025 & 2033

- Figure 73: Asia Pacific Oil and Gas Industry in Malaysia Revenue Share (%), by Midstream 2025 & 2033

- Figure 74: Asia Pacific Oil and Gas Industry in Malaysia Volume Share (%), by Midstream 2025 & 2033

- Figure 75: Asia Pacific Oil and Gas Industry in Malaysia Revenue (billion), by Downstream 2025 & 2033

- Figure 76: Asia Pacific Oil and Gas Industry in Malaysia Volume (Thousand), by Downstream 2025 & 2033

- Figure 77: Asia Pacific Oil and Gas Industry in Malaysia Revenue Share (%), by Downstream 2025 & 2033

- Figure 78: Asia Pacific Oil and Gas Industry in Malaysia Volume Share (%), by Downstream 2025 & 2033

- Figure 79: Asia Pacific Oil and Gas Industry in Malaysia Revenue (billion), by Country 2025 & 2033

- Figure 80: Asia Pacific Oil and Gas Industry in Malaysia Volume (Thousand), by Country 2025 & 2033

- Figure 81: Asia Pacific Oil and Gas Industry in Malaysia Revenue Share (%), by Country 2025 & 2033

- Figure 82: Asia Pacific Oil and Gas Industry in Malaysia Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Oil and Gas Industry in Malaysia Revenue billion Forecast, by Upstream 2020 & 2033

- Table 2: Global Oil and Gas Industry in Malaysia Volume Thousand Forecast, by Upstream 2020 & 2033

- Table 3: Global Oil and Gas Industry in Malaysia Revenue billion Forecast, by Midstream 2020 & 2033

- Table 4: Global Oil and Gas Industry in Malaysia Volume Thousand Forecast, by Midstream 2020 & 2033

- Table 5: Global Oil and Gas Industry in Malaysia Revenue billion Forecast, by Downstream 2020 & 2033

- Table 6: Global Oil and Gas Industry in Malaysia Volume Thousand Forecast, by Downstream 2020 & 2033

- Table 7: Global Oil and Gas Industry in Malaysia Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global Oil and Gas Industry in Malaysia Volume Thousand Forecast, by Region 2020 & 2033

- Table 9: Global Oil and Gas Industry in Malaysia Revenue billion Forecast, by Upstream 2020 & 2033

- Table 10: Global Oil and Gas Industry in Malaysia Volume Thousand Forecast, by Upstream 2020 & 2033

- Table 11: Global Oil and Gas Industry in Malaysia Revenue billion Forecast, by Midstream 2020 & 2033

- Table 12: Global Oil and Gas Industry in Malaysia Volume Thousand Forecast, by Midstream 2020 & 2033

- Table 13: Global Oil and Gas Industry in Malaysia Revenue billion Forecast, by Downstream 2020 & 2033

- Table 14: Global Oil and Gas Industry in Malaysia Volume Thousand Forecast, by Downstream 2020 & 2033

- Table 15: Global Oil and Gas Industry in Malaysia Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Oil and Gas Industry in Malaysia Volume Thousand Forecast, by Country 2020 & 2033

- Table 17: United States Oil and Gas Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: United States Oil and Gas Industry in Malaysia Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 19: Canada Oil and Gas Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Canada Oil and Gas Industry in Malaysia Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 21: Mexico Oil and Gas Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Mexico Oil and Gas Industry in Malaysia Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 23: Global Oil and Gas Industry in Malaysia Revenue billion Forecast, by Upstream 2020 & 2033

- Table 24: Global Oil and Gas Industry in Malaysia Volume Thousand Forecast, by Upstream 2020 & 2033

- Table 25: Global Oil and Gas Industry in Malaysia Revenue billion Forecast, by Midstream 2020 & 2033

- Table 26: Global Oil and Gas Industry in Malaysia Volume Thousand Forecast, by Midstream 2020 & 2033

- Table 27: Global Oil and Gas Industry in Malaysia Revenue billion Forecast, by Downstream 2020 & 2033

- Table 28: Global Oil and Gas Industry in Malaysia Volume Thousand Forecast, by Downstream 2020 & 2033

- Table 29: Global Oil and Gas Industry in Malaysia Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Global Oil and Gas Industry in Malaysia Volume Thousand Forecast, by Country 2020 & 2033

- Table 31: Brazil Oil and Gas Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Brazil Oil and Gas Industry in Malaysia Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 33: Argentina Oil and Gas Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Argentina Oil and Gas Industry in Malaysia Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 35: Rest of South America Oil and Gas Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Oil and Gas Industry in Malaysia Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 37: Global Oil and Gas Industry in Malaysia Revenue billion Forecast, by Upstream 2020 & 2033

- Table 38: Global Oil and Gas Industry in Malaysia Volume Thousand Forecast, by Upstream 2020 & 2033

- Table 39: Global Oil and Gas Industry in Malaysia Revenue billion Forecast, by Midstream 2020 & 2033

- Table 40: Global Oil and Gas Industry in Malaysia Volume Thousand Forecast, by Midstream 2020 & 2033

- Table 41: Global Oil and Gas Industry in Malaysia Revenue billion Forecast, by Downstream 2020 & 2033

- Table 42: Global Oil and Gas Industry in Malaysia Volume Thousand Forecast, by Downstream 2020 & 2033

- Table 43: Global Oil and Gas Industry in Malaysia Revenue billion Forecast, by Country 2020 & 2033

- Table 44: Global Oil and Gas Industry in Malaysia Volume Thousand Forecast, by Country 2020 & 2033

- Table 45: United Kingdom Oil and Gas Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom Oil and Gas Industry in Malaysia Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 47: Germany Oil and Gas Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Germany Oil and Gas Industry in Malaysia Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 49: France Oil and Gas Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: France Oil and Gas Industry in Malaysia Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 51: Italy Oil and Gas Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Italy Oil and Gas Industry in Malaysia Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 53: Spain Oil and Gas Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Spain Oil and Gas Industry in Malaysia Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 55: Russia Oil and Gas Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: Russia Oil and Gas Industry in Malaysia Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 57: Benelux Oil and Gas Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Benelux Oil and Gas Industry in Malaysia Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 59: Nordics Oil and Gas Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 60: Nordics Oil and Gas Industry in Malaysia Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 61: Rest of Europe Oil and Gas Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Rest of Europe Oil and Gas Industry in Malaysia Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 63: Global Oil and Gas Industry in Malaysia Revenue billion Forecast, by Upstream 2020 & 2033

- Table 64: Global Oil and Gas Industry in Malaysia Volume Thousand Forecast, by Upstream 2020 & 2033

- Table 65: Global Oil and Gas Industry in Malaysia Revenue billion Forecast, by Midstream 2020 & 2033

- Table 66: Global Oil and Gas Industry in Malaysia Volume Thousand Forecast, by Midstream 2020 & 2033

- Table 67: Global Oil and Gas Industry in Malaysia Revenue billion Forecast, by Downstream 2020 & 2033

- Table 68: Global Oil and Gas Industry in Malaysia Volume Thousand Forecast, by Downstream 2020 & 2033

- Table 69: Global Oil and Gas Industry in Malaysia Revenue billion Forecast, by Country 2020 & 2033

- Table 70: Global Oil and Gas Industry in Malaysia Volume Thousand Forecast, by Country 2020 & 2033

- Table 71: Turkey Oil and Gas Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: Turkey Oil and Gas Industry in Malaysia Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 73: Israel Oil and Gas Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: Israel Oil and Gas Industry in Malaysia Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 75: GCC Oil and Gas Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: GCC Oil and Gas Industry in Malaysia Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 77: North Africa Oil and Gas Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 78: North Africa Oil and Gas Industry in Malaysia Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 79: South Africa Oil and Gas Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 80: South Africa Oil and Gas Industry in Malaysia Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 81: Rest of Middle East & Africa Oil and Gas Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 82: Rest of Middle East & Africa Oil and Gas Industry in Malaysia Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 83: Global Oil and Gas Industry in Malaysia Revenue billion Forecast, by Upstream 2020 & 2033

- Table 84: Global Oil and Gas Industry in Malaysia Volume Thousand Forecast, by Upstream 2020 & 2033

- Table 85: Global Oil and Gas Industry in Malaysia Revenue billion Forecast, by Midstream 2020 & 2033

- Table 86: Global Oil and Gas Industry in Malaysia Volume Thousand Forecast, by Midstream 2020 & 2033

- Table 87: Global Oil and Gas Industry in Malaysia Revenue billion Forecast, by Downstream 2020 & 2033

- Table 88: Global Oil and Gas Industry in Malaysia Volume Thousand Forecast, by Downstream 2020 & 2033

- Table 89: Global Oil and Gas Industry in Malaysia Revenue billion Forecast, by Country 2020 & 2033

- Table 90: Global Oil and Gas Industry in Malaysia Volume Thousand Forecast, by Country 2020 & 2033

- Table 91: China Oil and Gas Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 92: China Oil and Gas Industry in Malaysia Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 93: India Oil and Gas Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 94: India Oil and Gas Industry in Malaysia Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 95: Japan Oil and Gas Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 96: Japan Oil and Gas Industry in Malaysia Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 97: South Korea Oil and Gas Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 98: South Korea Oil and Gas Industry in Malaysia Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 99: ASEAN Oil and Gas Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 100: ASEAN Oil and Gas Industry in Malaysia Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 101: Oceania Oil and Gas Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 102: Oceania Oil and Gas Industry in Malaysia Volume (Thousand) Forecast, by Application 2020 & 2033

- Table 103: Rest of Asia Pacific Oil and Gas Industry in Malaysia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 104: Rest of Asia Pacific Oil and Gas Industry in Malaysia Volume (Thousand) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oil and Gas Industry in Malaysia?

The projected CAGR is approximately 3.8%.

2. Which companies are prominent players in the Oil and Gas Industry in Malaysia?

Key companies in the market include Petro-Excel Sdn Bhd (PESB), ExxonMobil Corporation, Shell Plc, BP Plc, Petronas Gas Bhd, Chevron Corporation, Altus Oil & Gas Malaysia Sdn Bhd, Malaysiaian General Petroleum Corporation, Malaysiaian Natural Gas Holding Company*List Not Exhaustive, Petro Teguh (M) Sdn Bhd.

3. What are the main segments of the Oil and Gas Industry in Malaysia?

The market segments include Upstream, Midstream, Downstream.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.44 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Surging Demand For Refined Petroleum Products4.; Significant Untapped Petroleum Reserves in the Sedimentary Basins.

6. What are the notable trends driving market growth?

Midstream Sector is Expected to Have Significant Market Share.

7. Are there any restraints impacting market growth?

4.; High Volatility of Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

January 2023: A consortium of JGC Corporation and Samsung Heavy Industries (SHI) secured an engineering, procurement, construction, and commissioning (EPCC) contract with Petronas for Malaysia's first nearshore floating LNG facility project. The planned facility is set to become the world's first nearshore floating LNG facility. It has a minimum production capacity of 2 million tonnes of LNG annually and is scheduled for completion in 2027.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Thousand.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oil and Gas Industry in Malaysia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oil and Gas Industry in Malaysia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oil and Gas Industry in Malaysia?

To stay informed about further developments, trends, and reports in the Oil and Gas Industry in Malaysia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence