Key Insights

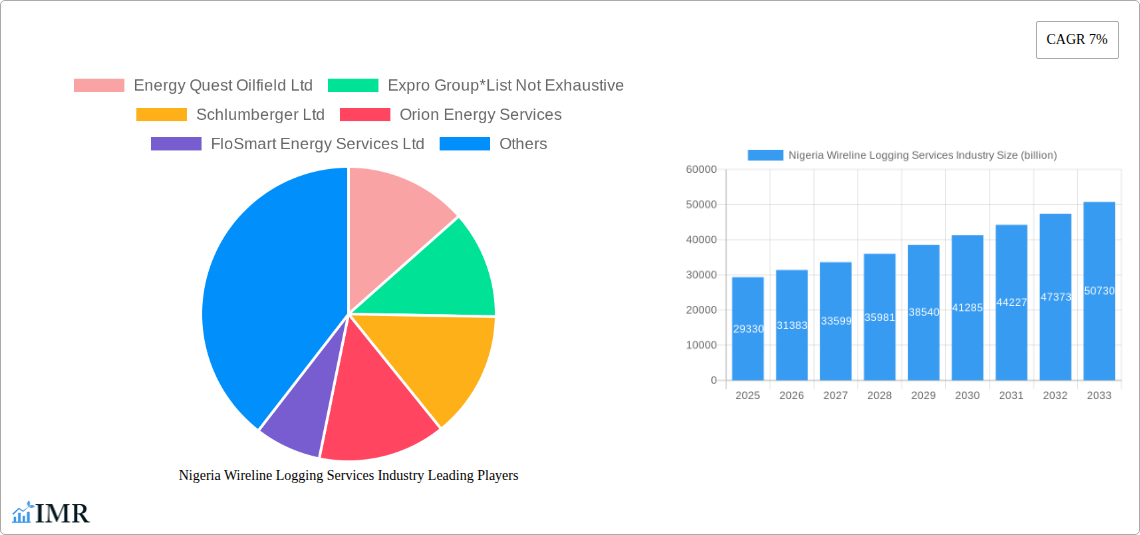

The Nigerian Wireline Logging Services industry is poised for significant expansion, projecting a market size of $29.33 billion in 2025, fueled by a robust compound annual growth rate (CAGR) of 7%. This growth trajectory is intrinsically linked to the nation's sustained investment in its oil and gas sector, a critical component of its economy. As exploration and production activities intensify, particularly in both open and cased hole applications, the demand for sophisticated wireline logging services to assess reservoir characteristics, monitor well performance, and ensure operational efficiency will escalate. The increasing focus on optimizing existing reserves and exploring new frontiers underscores the vital role of these services. Furthermore, the adoption of advanced technologies, including electric line (E-Line) and slick line operations, which offer diverse functionalities from data acquisition to intervention, is a key driver. Major industry players such as Schlumberger, Halliburton, and Baker Hughes are actively participating in this dynamic market, bringing their expertise and technological prowess to meet the evolving needs of Nigerian exploration and production companies.

Nigeria Wireline Logging Services Industry Market Size (In Billion)

The market's growth is further bolstered by strategic initiatives aimed at enhancing domestic refining capacity and expanding downstream operations, which indirectly necessitate advanced upstream services like wireline logging. While the industry benefits from these drivers, it also faces certain challenges. The fluctuating global oil prices, though a perennial factor, can impact investment decisions in exploration and development, consequently influencing the demand for logging services. Additionally, the need for continuous technological adaptation to meet increasingly complex reservoir challenges and stringent environmental regulations presents an ongoing requirement for innovation and investment. Despite these potential headwinds, the inherent strategic importance of oil and gas to Nigeria's economy, coupled with the indispensable nature of wireline logging in optimizing hydrocarbon recovery, firmly positions the market for sustained and significant growth throughout the forecast period. The participation of a competitive landscape of established and emerging service providers ensures a dynamic and evolving service offering.

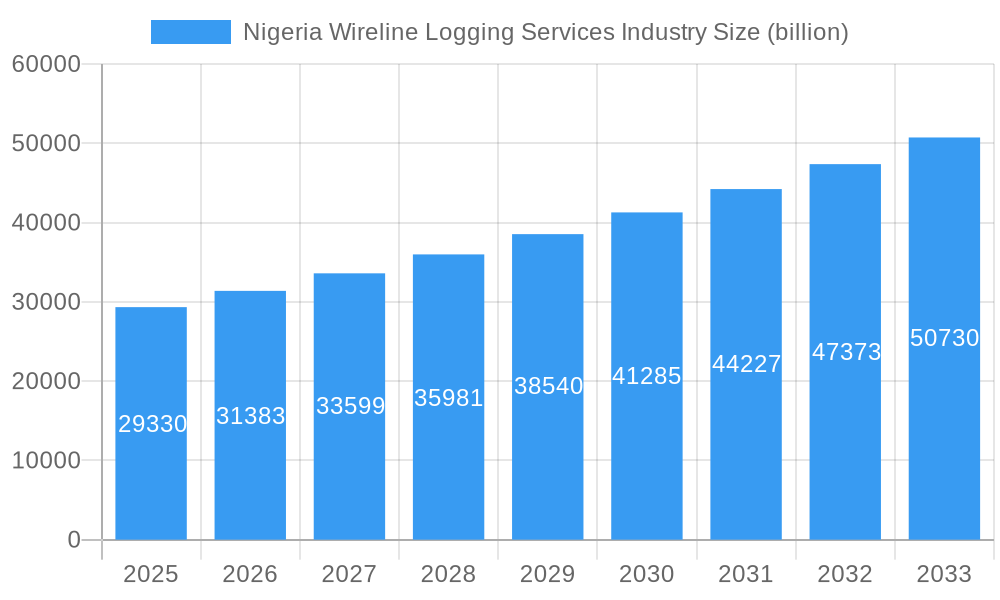

Nigeria Wireline Logging Services Industry Company Market Share

Here's a SEO-optimized report description for the Nigeria Wireline Logging Services Industry, meticulously crafted to meet your requirements.

This in-depth report provides a definitive analysis of the Nigeria Wireline Logging Services Industry, exploring its current dynamics, historical trajectory, and projected future growth. Leveraging extensive data from 2019 to 2033, with a Base Year of 2025, this comprehensive study offers unparalleled insights into market size, segmentation, key players, and emerging trends. We delve into the parent and child markets, dissecting the intricate web of factors influencing this critical sector of Nigeria's oil and gas industry. Maximize your understanding and strategic decision-making with this essential resource, packed with high-traffic keywords for unparalleled search engine visibility.

Nigeria Wireline Logging Services Industry Market Dynamics & Structure

The Nigeria Wireline Logging Services Industry is characterized by a moderate market concentration, with key players like Schlumberger Ltd, Baker Hughes Company, and Halliburton Company holding significant market share. Technological innovation is a primary driver, with companies continuously investing in advanced logging tools and data interpretation techniques to enhance reservoir characterization and production optimization. The regulatory framework, though evolving, plays a crucial role in ensuring operational safety and environmental compliance. Competitive product substitutes are minimal, with wireline logging services offering specialized capabilities not easily replicated. End-user demographics are primarily dominated by national and international oil exploration and production (E&P) companies, seeking to maximize hydrocarbon recovery. Mergers and acquisitions (M&A) trends, while not currently at peak levels, are indicative of strategic consolidation and capability expansion within the sector. Barriers to innovation include high capital investment for advanced technologies and the need for skilled personnel.

- Market Concentration: Moderate to High in key segments.

- Technological Innovation Drivers: Advanced Formation Evaluation, Production Logging, Well Integrity monitoring.

- Regulatory Framework: Focus on safety, environmental standards, and local content.

- Competitive Substitutes: Limited, with specialized applications.

- End-User Demographics: National and International Oil Companies (NOCs & IOCs).

- M&A Trends: Strategic acquisitions for technological enhancement and market consolidation.

- Innovation Barriers: High R&D costs, specialized talent acquisition.

Nigeria Wireline Logging Services Industry Growth Trends & Insights

The Nigeria Wireline Logging Services Industry is poised for significant expansion, driven by increasing oil and gas exploration activities and the imperative to optimize production from existing fields. The market size is projected to witness a substantial CAGR of XX% during the forecast period (2025-2033). Adoption rates of advanced logging technologies are steadily increasing as companies seek to reduce operational costs and improve recovery rates. Technological disruptions, such as the integration of artificial intelligence (AI) and machine learning (ML) in data analytics, are revolutionizing how wireline data is interpreted, leading to more precise reservoir insights. Consumer behavior shifts are evident, with a growing demand for integrated service solutions and real-time data delivery. The market penetration of specialized logging services, particularly in cased hole applications for well integrity and production optimization, is expected to rise. The historical period (2019-2024) laid the groundwork for this growth, with steady investments in infrastructure and technology. The estimated market size for 2025 is projected to be $X.X billion.

- Market Size Evolution: Projected to reach $XX.X billion by 2033.

- CAGR (2025-2033): XX%.

- Adoption Rates: Increasing for advanced logging technologies and integrated solutions.

- Technological Disruptions: AI/ML in data analytics, real-time data transmission, enhanced sensor technologies.

- Consumer Behavior Shifts: Demand for holistic service packages and data-driven decision-making.

- Market Penetration: Deepening for cased hole logging, intervention services, and formation evaluation.

- Historical Growth (2019-2024): Steady expansion driven by exploration and marginal field development.

Dominant Regions, Countries, or Segments in Nigeria Wireline Logging Services Industry

The Open Hole segment within the Nigeria Wireline Logging Services Industry is currently the dominant driver of market growth, owing to its critical role in initial reservoir characterization and exploration phases. This segment is witnessing substantial investment as new exploration blocks are being awarded and companies focus on identifying new hydrocarbon reserves. The Electric Line (E-Line) wireline type further amplifies this dominance, offering high-resolution data acquisition essential for comprehensive formation evaluation. The Niger Delta region remains the epicenter of these activities, characterized by extensive offshore and onshore exploration campaigns. Economic policies promoting investment in the oil and gas sector, coupled with ongoing infrastructure development for exploration and production, are key factors supporting the growth of this segment. Market share within the Open Hole/E-Line segment is substantial, estimated to be XX% of the total wireline logging market. Growth potential is exceptionally high due to the vast untapped hydrocarbon resources in Nigeria.

- Dominant Segment: Open Hole Logging, driven by exploration and new field development.

- Dominant Wireline Type: Electric Line (E-Line), offering high-fidelity data for formation evaluation.

- Dominant Region: Niger Delta, encompassing offshore and onshore exploration activities.

- Key Growth Drivers:

- New exploration block licensing and award.

- Focus on identifying and appraising new hydrocarbon reserves.

- Technological advancements in open-hole logging tools.

- Government policies encouraging upstream investment.

- Existing infrastructure supporting exploration logistics.

- Market Share (Open Hole/E-Line): XX%.

- Growth Potential: High, due to significant hydrocarbon reserves and ongoing exploration.

Nigeria Wireline Logging Services Industry Product Landscape

The product landscape of the Nigeria Wireline Logging Services Industry is defined by continuous innovation in logging tools and data acquisition technologies. Innovations focus on enhancing data accuracy, improving operational efficiency, and providing more comprehensive reservoir insights. This includes advancements in formation testers, resistivity tools, sonic and image logs, and spectral gamma ray tools for Open Hole, and production logging tools (PLT), cement bond logs (CBL), and captive logging tools for Cased Hole. Applications span from initial exploration and formation evaluation to production monitoring, well integrity assessment, and intervention services. Performance metrics are constantly being refined to deliver higher resolution data and faster turnaround times. Unique selling propositions lie in integrated logging solutions, real-time data streaming, and specialized tools for complex geological formations.

Key Drivers, Barriers & Challenges in Nigeria Wireline Logging Services Industry

Key Drivers: The primary forces propelling the Nigeria Wireline Logging Services Industry include sustained global demand for oil and gas, ongoing exploration and appraisal activities, and the imperative to maximize recovery from mature fields. Technological advancements enabling more precise reservoir characterization and improved operational efficiency are significant drivers. Government incentives for local content development and increased investment in the upstream sector also contribute to market growth.

Barriers & Challenges: Challenges include the fluctuating global oil prices, which can impact exploration budgets, and the inherent risks associated with hydrocarbon exploration. Supply chain disruptions, particularly for specialized equipment and spare parts, can lead to project delays. Regulatory hurdles, including evolving local content policies and permitting processes, can pose challenges. Furthermore, intense competitive pressures among service providers, requiring significant capital expenditure for technological upgrades, also present a restraint. The projected impact of fluctuating oil prices on exploration budgets is estimated to cause a X% volatility in market demand annually.

Emerging Opportunities in Nigeria Wireline Logging Services Industry

Emerging opportunities in the Nigeria Wireline Logging Services Industry lie in the increasing demand for advanced cased hole logging services for well integrity and production optimization, particularly in mature fields. The development of unconventional gas reserves, though nascent, presents a future growth avenue requiring specialized logging techniques. Furthermore, the growing emphasis on environmental monitoring and carbon capture, utilization, and storage (CCUS) projects may open new avenues for specialized logging applications. The digitalization of the oilfield and the adoption of IoT technologies are creating opportunities for enhanced data management and remote monitoring services.

Growth Accelerators in the Nigeria Wireline Logging Services Industry Industry

Growth accelerators in the Nigeria Wireline Logging Services Industry are primarily driven by ongoing technological breakthroughs in logging tools, such as the development of advanced sensor technologies for real-time formation evaluation and the integration of AI for predictive analytics. Strategic partnerships between service providers and E&P companies are fostering collaborative innovation and service delivery models. Market expansion strategies, including the targeting of marginal field development and the expansion into offshore deepwater exploration, are also significant growth catalysts. The increasing focus on efficient reservoir management and enhanced oil recovery (EOR) techniques further accelerates the demand for sophisticated wireline logging solutions.

Key Players Shaping the Nigeria Wireline Logging Services Industry Market

- Energy Quest Oilfield Ltd

- Expro Group

- Schlumberger Ltd

- Orion Energy Services

- FloSmart Energy Services Ltd

- Baker Hughes Company

- Halliburton Company

- Nabors Industries Ltd

Notable Milestones in Nigeria Wireline Logging Services Industry Sector

- 2019: Increased investment in offshore exploration activities following new bid rounds.

- 2020: Introduction of advanced real-time data transmission technologies for wireline logging.

- 2021: Focus on enhanced oil recovery (EOR) projects, driving demand for production logging.

- 2022: Significant mergers and acquisitions aimed at consolidating service capabilities.

- 2023: Growing adoption of digital transformation initiatives and AI in data interpretation.

- 2024: Increased emphasis on well integrity assessment services.

In-Depth Nigeria Wireline Logging Services Industry Market Outlook

The Nigeria Wireline Logging Services Industry is projected for robust growth, fueled by a combination of technological advancements, strategic investments, and evolving industry needs. Key growth accelerators include the widespread adoption of AI and ML for data analytics, enabling more precise reservoir characterization and production optimization, expected to contribute XX% to market value. Strategic partnerships between global service providers and local operators will further enhance service delivery and foster innovation. The increasing exploration of deepwater and frontier basins, coupled with the drive to maximize production from existing assets, presents significant market potential. The industry's future trajectory is firmly set towards providing integrated, data-driven solutions that enhance operational efficiency and hydrocarbon recovery. The market outlook remains exceptionally positive, projecting sustained expansion throughout the forecast period.

Nigeria Wireline Logging Services Industry Segmentation

-

1. Hole Type

- 1.1. Open Hole

- 1.2. Cased Hole

-

2. Wireline Type

- 2.1. Electric Line (E-Line)

- 2.2. Slick Line

Nigeria Wireline Logging Services Industry Segmentation By Geography

- 1. Niger

Nigeria Wireline Logging Services Industry Regional Market Share

Geographic Coverage of Nigeria Wireline Logging Services Industry

Nigeria Wireline Logging Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Demand for Electricity across the Region 4.; Increasing Investments on Solar Energy Projects

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Emphasis on Natural Gas Power Generation

- 3.4. Market Trends

- 3.4.1. E-Line Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Nigeria Wireline Logging Services Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Hole Type

- 5.1.1. Open Hole

- 5.1.2. Cased Hole

- 5.2. Market Analysis, Insights and Forecast - by Wireline Type

- 5.2.1. Electric Line (E-Line)

- 5.2.2. Slick Line

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Niger

- 5.1. Market Analysis, Insights and Forecast - by Hole Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Energy Quest Oilfield Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Expro Group*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Schlumberger Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Orion Energy Services

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 FloSmart Energy Services Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Baker Hughes Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Halliburton Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nabors Industries Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Energy Quest Oilfield Ltd

List of Figures

- Figure 1: Nigeria Wireline Logging Services Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Nigeria Wireline Logging Services Industry Share (%) by Company 2025

List of Tables

- Table 1: Nigeria Wireline Logging Services Industry Revenue billion Forecast, by Hole Type 2020 & 2033

- Table 2: Nigeria Wireline Logging Services Industry Revenue billion Forecast, by Wireline Type 2020 & 2033

- Table 3: Nigeria Wireline Logging Services Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Nigeria Wireline Logging Services Industry Revenue billion Forecast, by Hole Type 2020 & 2033

- Table 5: Nigeria Wireline Logging Services Industry Revenue billion Forecast, by Wireline Type 2020 & 2033

- Table 6: Nigeria Wireline Logging Services Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nigeria Wireline Logging Services Industry?

The projected CAGR is approximately 7%.

2. Which companies are prominent players in the Nigeria Wireline Logging Services Industry?

Key companies in the market include Energy Quest Oilfield Ltd, Expro Group*List Not Exhaustive, Schlumberger Ltd, Orion Energy Services, FloSmart Energy Services Ltd, Baker Hughes Company, Halliburton Company, Nabors Industries Ltd.

3. What are the main segments of the Nigeria Wireline Logging Services Industry?

The market segments include Hole Type, Wireline Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 29.33 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Demand for Electricity across the Region 4.; Increasing Investments on Solar Energy Projects.

6. What are the notable trends driving market growth?

E-Line Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Rising Emphasis on Natural Gas Power Generation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nigeria Wireline Logging Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nigeria Wireline Logging Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nigeria Wireline Logging Services Industry?

To stay informed about further developments, trends, and reports in the Nigeria Wireline Logging Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence