Key Insights

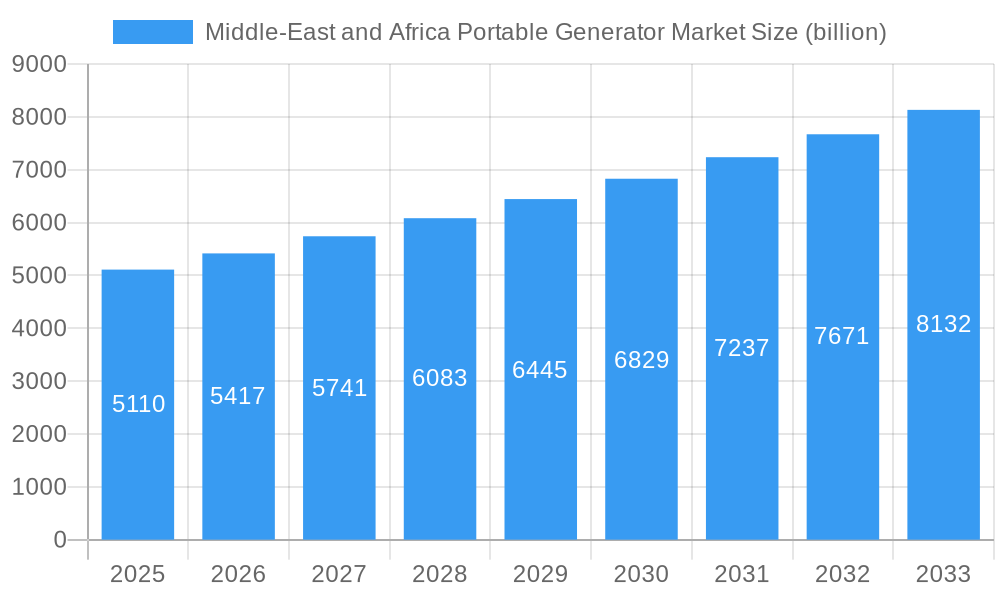

The Middle East and Africa portable generator market is poised for substantial growth, driven by increasing demand for reliable power solutions across various sectors. The market size is estimated at USD 5.11 billion in 2025, with a projected Compound Annual Growth Rate (CAGR) of 6% during the forecast period of 2025-2033. This robust expansion is fueled by several key factors. Growing industrialization and infrastructure development projects, particularly in oil and gas, construction, and mining, necessitate consistent power, making portable generators indispensable. Furthermore, the rising adoption of these generators in the residential sector for backup power during frequent outages, coupled with their use in commercial establishments like retail spaces and hospitality, further propels market demand. The increasing electrification efforts across the African continent and the ongoing need for supplemental power in remote or underserved areas also contribute significantly to this market's upward trajectory. The "Other Fuel Types" segment, encompassing hybrid and advanced fuel technologies, is expected to witness notable expansion as sustainability concerns grow.

Middle-East and Africa Portable Generator Market Market Size (In Billion)

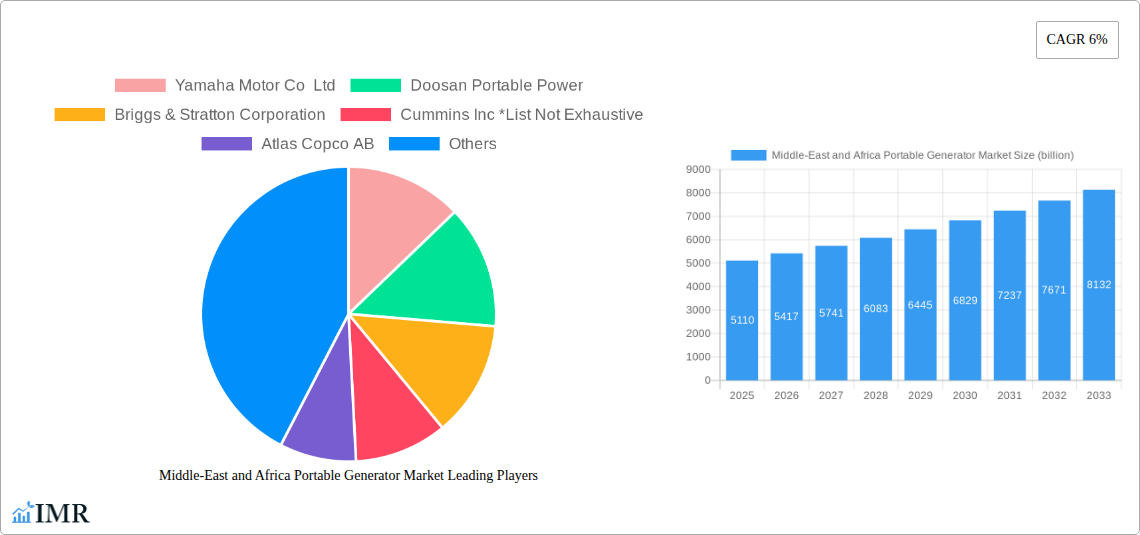

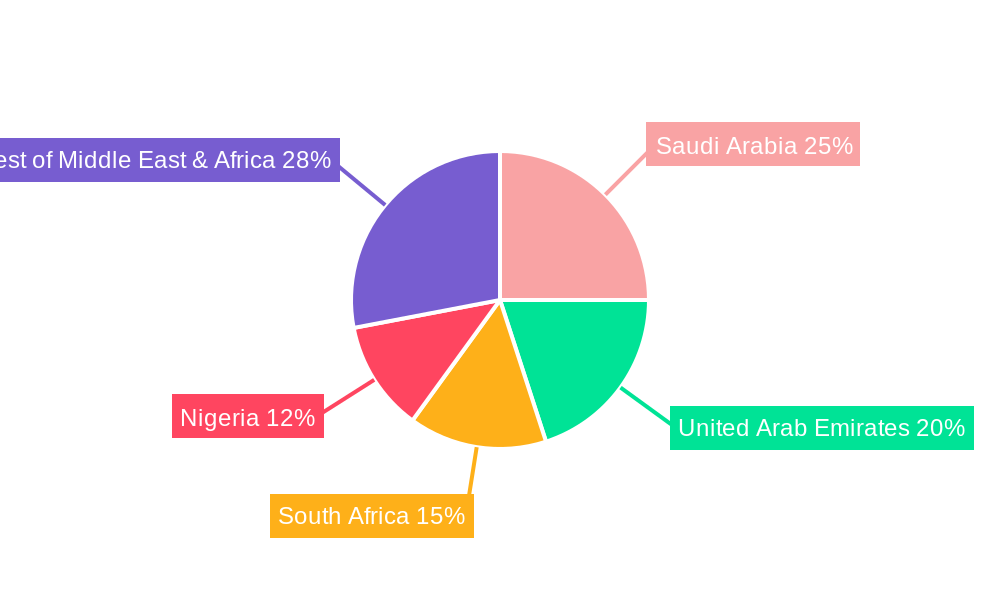

The market is segmented across fuel types, applications, and geographies, offering diverse opportunities. While gas and diesel generators continue to dominate, the demand for generators utilizing other fuel types, including cleaner alternatives, is on the rise, reflecting a global shift towards sustainable energy. Geographically, Saudi Arabia and the United Arab Emirates are anticipated to remain key revenue contributors due to their advanced economies and ongoing large-scale projects. South Africa and Nigeria represent significant growth markets owing to their developing economies and increasing power demands. The "Rest of Middle East & Africa" region also presents considerable untapped potential. Key players like Caterpillar Inc., Cummins Inc., and Yamaha Motor Co., Ltd. are actively participating in this market, focusing on product innovation, strategic partnerships, and expanding their distribution networks to cater to the diverse needs of this dynamic region.

Middle-East and Africa Portable Generator Market Company Market Share

This in-depth report provides a comprehensive analysis of the Middle-East and Africa portable generator market, a rapidly expanding sector driven by increasing demand for reliable power solutions across residential, commercial, and industrial applications. We delve into market dynamics, growth trends, regional dominance, product landscapes, key drivers, barriers, and emerging opportunities, offering actionable insights for stakeholders. The study encompasses a detailed examination of the parent market (portable generators) and its child markets (segmented by fuel type, application, and geography), providing a granular understanding of market forces. With extensive data covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this report is an essential resource for understanding the future trajectory of this vital industry.

Middle-East and Africa Portable Generator Market Market Dynamics & Structure

The Middle-East and Africa portable generator market is characterized by a moderate to high level of market concentration, with key players actively investing in technological innovation and product development. The growing need for stable and uninterrupted power supply, particularly in regions with developing or unreliable grid infrastructure, fuels market expansion. Regulatory frameworks, while evolving, are increasingly focusing on emissions standards and generator efficiency, influencing product design and adoption. Competitive product substitutes, such as uninterruptible power supplies (UPS) and grid infrastructure upgrades, present a challenge, but the cost-effectiveness and mobility of portable generators maintain their strong market position. End-user demographics are shifting, with increasing adoption in residential settings for backup power and a robust demand from commercial and industrial sectors for construction, remote operations, and disaster relief. Mergers and acquisitions (M&A) trends are evident as larger companies seek to consolidate market share and expand their product portfolios.

- Market Concentration: Dominated by a few key global and regional manufacturers, with increasing consolidation through strategic acquisitions.

- Technological Innovation Drivers: Focus on fuel efficiency, reduced emissions, noise reduction, smart connectivity, and enhanced portability.

- Regulatory Frameworks: Evolving environmental regulations and safety standards are shaping product development and market entry.

- Competitive Product Substitutes: Limited for primary backup power needs, but UPS and grid improvements influence niche applications.

- End-User Demographics: Diversifying from industrial reliance to significant growth in residential and small business sectors.

- M&A Trends: Strategic acquisitions aimed at expanding geographical reach and product offerings, with an estimated XX deal volumes in the historical period.

Middle-East and Africa Portable Generator Market Growth Trends & Insights

The Middle-East and Africa portable generator market is projected to experience robust growth throughout the forecast period. This expansion is underpinned by a confluence of factors, including ongoing infrastructure development projects, increasing urbanization, and a growing awareness of the critical need for reliable backup power solutions across diverse sectors. The market size evolution is indicative of a healthy CAGR, driven by a steady increase in adoption rates, particularly in countries with nascent power grids or susceptibility to power outages. Technological disruptions, such as advancements in inverter generator technology offering quieter operation and cleaner power, are significantly influencing consumer purchasing decisions. Shifts in consumer behavior, including a greater emphasis on energy independence and resilience against climate-related disruptions, are further accelerating demand. The penetration of portable generators in both developed and developing economies within the region is expected to rise considerably, signifying a maturing market with significant untapped potential.

- Market Size Evolution: The global market size for portable generators reached approximately $XX billion in 2024 and is forecasted to reach $XX billion by 2033, exhibiting a strong CAGR of approximately XX% during the forecast period.

- Adoption Rates: Steadily increasing across residential, commercial, and industrial segments, with a notable surge in demand for backup power during power outages and for remote operations.

- Technological Disruptions: The advent of inverter generator technology has revolutionized the market by offering fuel efficiency, quieter operation, and cleaner power output, appealing to a wider consumer base.

- Consumer Behavior Shifts: Growing emphasis on energy independence, disaster preparedness, and the need for uninterrupted power for essential services and business continuity.

- Market Penetration: Expected to witness significant increases in regions with underdeveloped grid infrastructure and a rising middle class seeking enhanced lifestyle amenities.

Dominant Regions, Countries, or Segments in Middle-East and Africa Portable Generator Market

The Middle-East and Africa portable generator market is exhibiting strong growth across several key segments, with Diesel fuel type and the Industrial application dominating market share. Geographically, Saudi Arabia and the United Arab Emirates are emerging as the leading markets, driven by ambitious infrastructure development projects and a strong focus on economic diversification. Nigeria also represents a significant market due to its substantial population and ongoing energy deficit. The Industrial application segment's dominance is attributed to its critical role in powering construction sites, remote mining operations, oil and gas exploration, and manufacturing facilities that often operate in areas with unreliable grid access. The preference for Diesel generators stems from their robustness, fuel efficiency for long-duration operations, and wide availability of diesel fuel across the region. Saudi Arabia's Vision 2030 initiatives and the UAE's mega-projects like Expo 2020 and future urban developments are significant drivers of demand for portable generators in the Commercial and Industrial sectors, respectively.

- Dominant Fuel Type: Diesel generators hold the largest market share due to their durability, fuel efficiency for extended use, and widespread fuel availability, estimated at XX% of the market.

- Dominant Application: The Industrial segment leads market demand, driven by construction, oil & gas, mining, and manufacturing sectors, accounting for approximately XX% of the market.

- Leading Geographies:

- Saudi Arabia: Experiencing substantial growth fueled by Vision 2030 projects like NEOM, Red Sea Project, and Amaala, requiring extensive construction power.

- United Arab Emirates: Ongoing urbanization, infrastructure upgrades, and a thriving business sector drive consistent demand.

- Nigeria: Significant demand from industries and households for reliable backup power due to persistent grid instability.

- Growth Potential: The "Rest of Middle East & Africa" segment, encompassing diverse economies and emerging markets, presents substantial untapped growth potential.

Middle-East and Africa Portable Generator Market Product Landscape

The product landscape of the Middle-East and Africa portable generator market is characterized by continuous innovation aimed at enhancing efficiency, portability, and user experience. Manufacturers are focusing on developing lightweight yet powerful units, incorporating advanced inverter technology for cleaner and more stable power output, crucial for sensitive electronics. Noise reduction is a significant development, making generators more suitable for residential and urban commercial use. Smart features, such as remote monitoring and control capabilities, are also gaining traction, offering convenience and operational insights. The demand for eco-friendly options and generators with extended run times is influencing product design, with a focus on optimizing fuel consumption.

- Key Product Innovations: Lightweight designs, advanced inverter technology for stable power, enhanced noise reduction, and smart connectivity features.

- Performance Metrics: Emphasis on fuel efficiency (gallons per hour), power output (kW/kVA), portability (weight, dimensions), and durability in harsh environmental conditions.

- Unique Selling Propositions: Quiet operation, extended run times, fuel economy, and integrated smart features for remote management.

Key Drivers, Barriers & Challenges in Middle-East and Africa Portable Generator Market

The Middle-East and Africa portable generator market is propelled by several key drivers. The ongoing and planned infrastructure development projects across the region, especially in Saudi Arabia and the UAE, necessitate significant temporary power solutions. Furthermore, the persistent challenge of unreliable grid infrastructure in many African nations drives demand for portable generators as essential backup power. Economic growth and urbanization are also contributing factors, increasing the need for supplementary power in both residential and commercial settings.

Conversely, the market faces several barriers and challenges. Fluctuations in fuel prices can impact the operational cost and, consequently, the demand for fuel-powered generators. Stringent environmental regulations regarding emissions and noise pollution, while promoting cleaner technologies, can increase manufacturing costs and necessitate compliance investments. Supply chain disruptions, particularly for components and raw materials, can affect production timelines and costs. Intense competition among manufacturers, leading to price pressures, is another significant challenge.

Emerging Opportunities in Middle-East and Africa Portable Generator Market

Emerging opportunities within the Middle-East and Africa portable generator market are diverse and promising. The increasing adoption of renewable energy sources in conjunction with hybrid generator systems presents a significant avenue for growth, offering a blend of on-demand power and sustainable energy. The expanding demand for portable generators in the healthcare sector, particularly for mobile clinics and remote medical facilities in underserved areas, offers a niche but vital market. Furthermore, the growing tourism sector in many African countries necessitates reliable power for lodges and resorts in remote locations, creating a sustained demand. The development of smaller, more fuel-efficient, and quieter generators tailored for residential use is another key opportunity as disposable incomes rise across the region.

Growth Accelerators in the Middle-East and Africa Portable Generator Market Industry

Several catalysts are accelerating the long-term growth of the Middle-East and Africa portable generator market. Technological breakthroughs in battery storage solutions, enabling hybrid generator systems that reduce fuel consumption and emissions, are significant growth accelerators. Strategic partnerships between generator manufacturers and local distributors are crucial for expanding market reach and providing localized support and services. Government initiatives promoting industrialization and infrastructure development, coupled with incentives for adopting energy-efficient technologies, also play a vital role. Furthermore, market expansion strategies targeting new applications, such as portable power solutions for agricultural activities and disaster relief efforts, will contribute to sustained growth.

Key Players Shaping the Middle-East and Africa Portable Generator Market Market

- Yamaha Motor Co Ltd

- Doosan Portable Power

- Briggs & Stratton Corporation

- Cummins Inc

- Atlas Copco AB

- Eaton Corporation PLC

- Caterpillar Inc

- Kohler Power Systems

- Wacker Neuson SE

- Generac Holdings Inc

Notable Milestones in Middle-East and Africa Portable Generator Market Sector

- December 2021: Enrogen, a UK-based diesel generator firm, secured an agreement to supply 30 MW of diesel generators to a major Saudi Arabian data center, comprising 12 x 2.5-MVA generators for crucial backup power.

- December 2021: KiCE Construction partnered with Al Falah Readymix in the UAE to deliver 100 generators for their mega projects in Saudi Arabia, including Neom, Redsea, and Amaala, alongside batching and ice plants to enhance productivity.

In-Depth Middle-East and Africa Portable Generator Market Market Outlook

The outlook for the Middle-East and Africa portable generator market remains exceptionally positive, driven by persistent demand for reliable power solutions. Growth accelerators, such as the integration of hybrid power systems and government support for infrastructure projects, are poised to shape the market's future. Strategic partnerships and technological innovations in fuel efficiency and emissions reduction will be critical for sustained success. The market is expected to witness a significant expansion in its service offerings, including rental and maintenance solutions, catering to the diverse needs of the region. Untapped markets and evolving consumer preferences for smarter and more sustainable power generation will create new avenues for growth and market penetration in the coming years.

Middle-East and Africa Portable Generator Market Segmentation

-

1. Fuel Type

- 1.1. Gas

- 1.2. Diesel

- 1.3. Other Fuel Types

-

2. Application

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. United Arab Emirates

- 3.3. South Africa

- 3.4. Nigeria

- 3.5. Rest of Middle East & Africa

Middle-East and Africa Portable Generator Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. South Africa

- 4. Nigeria

- 5. Rest of Middle East

Middle-East and Africa Portable Generator Market Regional Market Share

Geographic Coverage of Middle-East and Africa Portable Generator Market

Middle-East and Africa Portable Generator Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; The Increasing Demand for Uninterrupted and Reliable Power Supply4.; Increased Demand from the Commercial Sector

- 3.2.2 Including the Healthcare Industry

- 3.3. Market Restrains

- 3.3.1. 4.; The Growing Demand for Generators Based on Alternative Fuels

- 3.4. Market Trends

- 3.4.1. Diesel is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Portable Generator Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. Gas

- 5.1.2. Diesel

- 5.1.3. Other Fuel Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. South Africa

- 5.3.4. Nigeria

- 5.3.5. Rest of Middle East & Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. South Africa

- 5.4.4. Nigeria

- 5.4.5. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. Saudi Arabia Middle-East and Africa Portable Generator Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6.1.1. Gas

- 6.1.2. Diesel

- 6.1.3. Other Fuel Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.2.3. Industrial

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. United Arab Emirates

- 6.3.3. South Africa

- 6.3.4. Nigeria

- 6.3.5. Rest of Middle East & Africa

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7. United Arab Emirates Middle-East and Africa Portable Generator Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7.1.1. Gas

- 7.1.2. Diesel

- 7.1.3. Other Fuel Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.2.3. Industrial

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. United Arab Emirates

- 7.3.3. South Africa

- 7.3.4. Nigeria

- 7.3.5. Rest of Middle East & Africa

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8. South Africa Middle-East and Africa Portable Generator Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8.1.1. Gas

- 8.1.2. Diesel

- 8.1.3. Other Fuel Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.2.3. Industrial

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. United Arab Emirates

- 8.3.3. South Africa

- 8.3.4. Nigeria

- 8.3.5. Rest of Middle East & Africa

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9. Nigeria Middle-East and Africa Portable Generator Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9.1.1. Gas

- 9.1.2. Diesel

- 9.1.3. Other Fuel Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.2.3. Industrial

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. United Arab Emirates

- 9.3.3. South Africa

- 9.3.4. Nigeria

- 9.3.5. Rest of Middle East & Africa

- 9.1. Market Analysis, Insights and Forecast - by Fuel Type

- 10. Rest of Middle East Middle-East and Africa Portable Generator Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Fuel Type

- 10.1.1. Gas

- 10.1.2. Diesel

- 10.1.3. Other Fuel Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.2.3. Industrial

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Saudi Arabia

- 10.3.2. United Arab Emirates

- 10.3.3. South Africa

- 10.3.4. Nigeria

- 10.3.5. Rest of Middle East & Africa

- 10.1. Market Analysis, Insights and Forecast - by Fuel Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Yamaha Motor Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Doosan Portable Power

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Briggs & Stratton Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cummins Inc *List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Atlas Copco AB

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Eaton Corporation PLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Caterpillar Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kohler Power Systems

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Wacker Neuson SE

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Generac Holdings Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Yamaha Motor Co Ltd

List of Figures

- Figure 1: Middle-East and Africa Portable Generator Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle-East and Africa Portable Generator Market Share (%) by Company 2025

List of Tables

- Table 1: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 2: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 6: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 10: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 14: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 18: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 22: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Application 2020 & 2033

- Table 23: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Middle-East and Africa Portable Generator Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Portable Generator Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Middle-East and Africa Portable Generator Market?

Key companies in the market include Yamaha Motor Co Ltd, Doosan Portable Power, Briggs & Stratton Corporation, Cummins Inc *List Not Exhaustive, Atlas Copco AB, Eaton Corporation PLC, Caterpillar Inc, Kohler Power Systems, Wacker Neuson SE, Generac Holdings Inc.

3. What are the main segments of the Middle-East and Africa Portable Generator Market?

The market segments include Fuel Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.11 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; The Increasing Demand for Uninterrupted and Reliable Power Supply4.; Increased Demand from the Commercial Sector. Including the Healthcare Industry.

6. What are the notable trends driving market growth?

Diesel is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Growing Demand for Generators Based on Alternative Fuels.

8. Can you provide examples of recent developments in the market?

In December 2021, Enrogen, a diesel generator firm based out of York, United Kingdom, signed an agreement to supply 30 MW of diesel generators to a big Saudi Arabian data center. The 12 2.5-MVA generators will operate as backup power for a new data center being built in the northeast of Saudi Arabia by a global computing business.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Portable Generator Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Portable Generator Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Portable Generator Market?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Portable Generator Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence