Key Insights

Chile's wind energy sector is set for substantial growth, with a projected market size of $2.34 billion by 2024, driven by a robust Compound Annual Growth Rate (CAGR) of 9.6%. This expansion is underpinned by Chile's strong renewable energy commitments, supportive government policies including incentives and streamlined permitting, and abundant wind resources, particularly along its coastline. The increasing global demand for clean energy to address climate change and reduce fossil fuel dependence is a significant growth catalyst. Technological advancements enhancing wind turbine efficiency and the development of offshore wind projects will further propel the market forward.

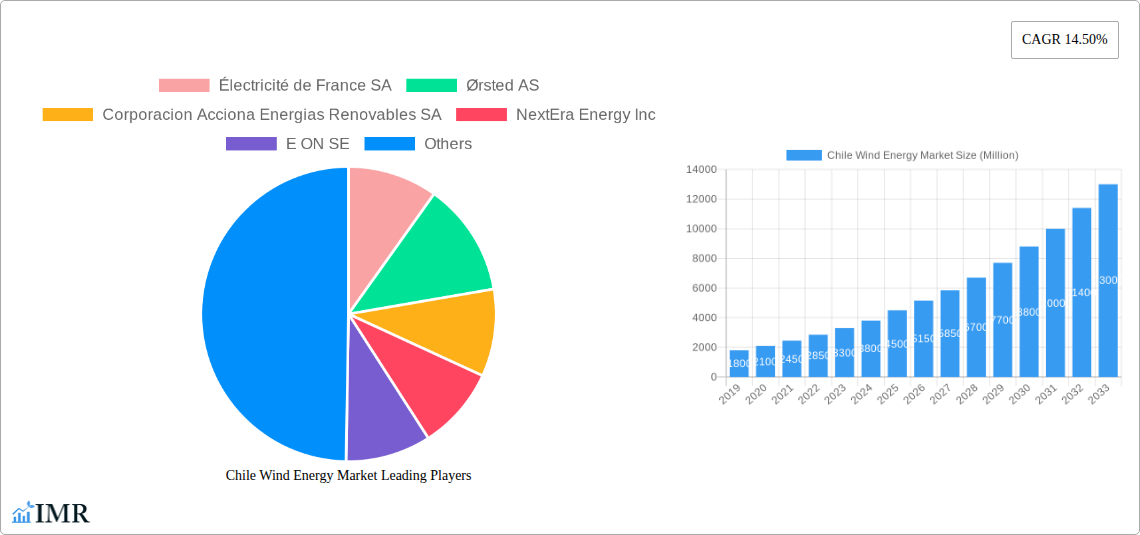

Chile Wind Energy Market Market Size (In Billion)

The market is segmented by deployment type, encompassing both onshore and offshore wind projects. While onshore wind currently leads, offshore wind installations are gaining momentum, promising significant future capacity. Key emerging trends include the integration of energy storage for intermittency management, the growth of corporate power purchase agreements (PPAs) attracting private investment, and the exploration of floating offshore wind technologies for deeper water access. Potential challenges include grid infrastructure limitations, substantial capital investment requirements, and environmental impact assessments. Nevertheless, with strategic investments and ongoing policy support, Chile's wind energy market is positioned to become a leading renewable energy hub in Latin America.

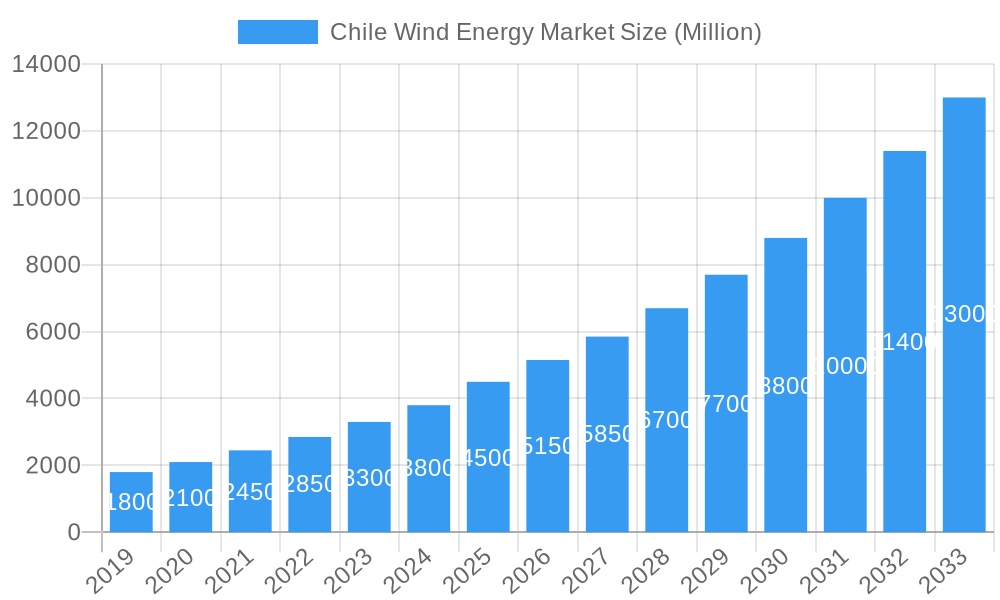

Chile Wind Energy Market Company Market Share

Chile Wind Energy Market: Comprehensive Industry Analysis & Forecast (2019-2033)

Explore the dynamic Chilean wind energy landscape with this in-depth report. Uncover market size, growth trajectory, technological advancements, and strategic opportunities shaping the future of wind power in Chile. This report provides essential intelligence for stakeholders, investors, and policymakers navigating this rapidly expanding sector.

Chile Wind Energy Market Market Dynamics & Structure

The Chilean wind energy market is characterized by a moderately concentrated structure, with key players actively investing in and developing large-scale projects. Technological innovation is primarily driven by the pursuit of higher efficiency wind turbines and advanced energy storage solutions. Robust regulatory frameworks, including renewable energy mandates and auction mechanisms, are crucial in fostering market growth. Competitive product substitutes, such as solar and hydropower, exist but the cost-effectiveness and reliability of wind power are increasingly positioning it as a preferred choice. End-user demographics are diverse, encompassing industrial consumers, commercial entities, and residential segments increasingly seeking sustainable energy solutions. Mergers and acquisitions (M&A) are a significant trend, with established energy companies and independent power producers consolidating their presence.

- Market Concentration: Dominated by a mix of international and domestic developers, with increasing consolidation.

- Technological Innovation Drivers: Focus on larger turbine capacities, improved grid integration, and hybrid renewable energy systems.

- Regulatory Frameworks: Government incentives, renewable energy targets, and auction systems are key enablers.

- Competitive Product Substitutes: Solar PV, hydropower, and thermal power are present, but wind energy's levelized cost of energy (LCOE) is highly competitive.

- End-User Demographics: Growing demand from mining, manufacturing, and commercial sectors for cost-effective, green energy.

- M&A Trends: Consolidation among developers and utility companies seeking to expand their renewable portfolios.

Chile Wind Energy Market Growth Trends & Insights

The Chile wind energy market is poised for significant expansion, driven by its abundant wind resources and supportive government policies. The market size is projected to experience a robust compound annual growth rate (CAGR) of approximately 8.5% during the forecast period of 2025-2033. Adoption rates for wind energy technologies are accelerating, fueled by declining LCOE and increasing corporate demand for renewable energy. Technological disruptions, particularly in the realm of larger, more efficient wind turbines and integrated battery storage solutions, are enhancing the reliability and dispatchability of wind power. Consumer behavior is shifting towards sustainability, with businesses actively seeking to reduce their carbon footprint and meet environmental, social, and governance (ESG) targets. This growing demand for clean energy is directly translating into increased investment and deployment of wind power projects across the country.

- Market Size Evolution: The market is expected to grow from an estimated value of $1,500 Million in 2025 to over $3,000 Million by 2033.

- Adoption Rates: Increasing penetration of wind energy in the national energy mix, driven by economic competitiveness and environmental regulations.

- Technological Disruptions: Advancements in turbine technology (e.g., larger rotor diameters, higher hub heights) and energy storage solutions are key growth enablers.

- Consumer Behavior Shifts: Growing corporate power purchase agreements (PPAs) for renewable energy, driven by sustainability goals and cost savings.

- Market Penetration: Wind energy's share in Chile's total electricity generation is projected to significantly increase by 2033.

Dominant Regions, Countries, or Segments in Chile Wind Energy Market

The Onshore segment overwhelmingly dominates the Chilean wind energy market, driven by favorable geographical conditions and established infrastructure for land-based installations. Regions in Northern Chile, particularly the Atacama Desert, are prime locations due to exceptionally strong and consistent wind speeds. The Tarapacá and Antofagasta regions are also significant contributors to onshore wind power generation. Offshore wind development, while in its nascent stages, holds immense long-term potential due to Chile's extensive coastline, but faces higher initial investment costs and regulatory complexities.

- Key Drivers for Onshore Dominance:

- Exceptional Wind Resources: Northern Chile offers some of the best onshore wind resources globally.

- Favorable Topography: Open, arid terrain in the north facilitates easier turbine installation and access.

- Existing Infrastructure: Developed road networks and grid connections in key development zones.

- Cost-Effectiveness: Lower capital and operational expenditures compared to offshore installations.

- Dominant Regions for Onshore Development:

- Atacama Region: Home to numerous large-scale wind farms, benefiting from consistent wind speeds and government support.

- Tarapacá Region: Significant potential and ongoing development of wind projects.

- Antofagasta Region: A major hub for industrial activity, driving demand for renewable energy and thus wind power.

- Market Share (Onshore): Estimated to account for over 95% of the total installed wind capacity in the near to mid-term.

- Growth Potential (Onshore): Continued expansion through repowering of older wind farms and development of new projects in promising areas.

- Offshore Wind Potential: Significant untapped resource along the Chilean coast, with early-stage feasibility studies and interest from developers.

Chile Wind Energy Market Product Landscape

The Chilean wind energy market's product landscape is defined by the deployment of increasingly advanced and efficient wind turbine technologies. Manufacturers are focusing on turbines with larger rotor diameters and higher power capacities to maximize energy capture. Innovations in gearbox technology, blade materials, and control systems are enhancing performance and reliability. Hybrid systems, integrating wind turbines with battery energy storage systems (BESS), are emerging as a key product offering to address intermittency and improve grid stability. These solutions are crucial for ensuring a consistent supply of renewable energy.

- Product Innovations: Focus on larger capacity turbines (e.g., 4 MW to 7 MW and beyond), advanced aerodynamic blade designs, and improved nacelle technology.

- Applications: Primarily electricity generation for the national grid, serving industrial, commercial, and residential consumers through wholesale and direct PPAs.

- Performance Metrics: Emphasis on higher capacity factors, reduced O&M costs, and improved power quality through advanced control systems.

- Unique Selling Propositions: Cost-competitiveness, environmental benefits, and increasingly, the ability to integrate with energy storage for enhanced reliability.

- Technological Advancements: Integration of predictive maintenance systems, digital twins for performance monitoring, and smart grid compatibility.

Key Drivers, Barriers & Challenges in Chile Wind Energy Market

The Chilean wind energy market is propelled by several key drivers:

- Abundant Wind Resources: Chile possesses some of the most consistent and powerful wind resources globally, particularly in the north.

- Supportive Government Policies: Ambitious renewable energy targets, tax incentives, and auction mechanisms foster investment.

- Declining LCOE: The decreasing cost of wind turbine technology makes wind power increasingly competitive with fossil fuels.

- Corporate Demand for Green Energy: Businesses are actively seeking to meet ESG goals and reduce their carbon footprint.

- Energy Security and Independence: Reducing reliance on imported fossil fuels.

However, the market also faces barriers and challenges:

- Grid Integration and Transmission Capacity: Existing grid infrastructure may require upgrades to accommodate the intermittent nature of wind power and connect remote generation sites.

- Environmental and Social Impact Assessments: Obtaining permits and addressing concerns related to local communities and wildlife can be time-consuming.

- Supply Chain Constraints: Potential for bottlenecks in the availability of specialized components and skilled labor during periods of rapid expansion.

- Intermittency and Storage: While improving, managing the variability of wind power requires significant investment in energy storage solutions.

- Financing and Investment Risks: While declining, securing long-term financing for large-scale projects can still be a hurdle.

Emerging Opportunities in Chile Wind Energy Market

Emerging opportunities in the Chile wind energy market lie in the expansion of hybrid renewable energy systems, combining wind with battery storage to provide firm and dispatchable power. The untapped potential of offshore wind along Chile's extensive coastline presents a significant long-term growth avenue. Furthermore, the increasing electrification of industries, such as green hydrogen production, will create substantial demand for clean, reliable electricity, which wind power is ideally positioned to supply. Repowering of older wind farms with newer, more efficient turbines also represents a significant opportunity for increasing generation capacity without requiring new sites.

- Hybrid Renewable Energy Systems: Integrating wind with battery storage and potentially solar PV to enhance grid stability and reliability.

- Offshore Wind Development: Exploring the vast offshore wind potential along Chile's coastline.

- Green Hydrogen Production: Leveraging wind power to produce hydrogen for industrial and transportation sectors.

- Repowering Projects: Upgrading existing wind farms to boost energy output and efficiency.

Growth Accelerators in the Chile Wind Energy Market Industry

The long-term growth of the Chile wind energy market is being significantly accelerated by ongoing technological breakthroughs in turbine efficiency and energy storage. Strategic partnerships between developers, manufacturers, and grid operators are crucial for overcoming infrastructure challenges and facilitating large-scale project deployment. Market expansion strategies, including the development of new wind farm sites in previously undeveloped regions and the active pursuit of international investment, are also playing a vital role in propelling the industry forward. The continuous innovation in turbine design, leading to higher power output and improved performance in varying wind conditions, further solidifies wind energy's position as a cornerstone of Chile's sustainable energy future.

Key Players Shaping the Chile Wind Energy Market Market

- Électricité de France SA

- Ørsted AS

- Corporacion Acciona Energias Renovables SA

- NextEra Energy Inc

- E ON SE

- Siemens Gamesa Renewable Energy SA

- Trident Winds Inc

- Duke Energy Corporation

- EnBW Energie Baden-Wurttemberg AG

- Enel Green Power Chile

- ACCIONA Energy

Notable Milestones in Chile Wind Energy Market Sector

- February 2023: Ibereolica Repsol Renovables Chile began producing electricity at the 165-MW Atacama wind farm, aiming to generate approximately 450 GWh annually and avert 320,000 metric tons of CO2 emissions.

- December 2022: FairWind was selected as the installation partner for the Horizonte Wind Park, Latin America's largest onshore wind farm under development, which will install 140 Enercon E-160 EP5 turbines.

- November 2022: Enel's renewables division commenced work on a project in Chile that integrates wind turbines with a 34-MW battery energy storage system (BESS), representing a USD 190 million investment by Enel Green Power Chile for 224.8 MW of wind capacity and a 34.3 MW lithium-ion BESS.

In-Depth Chile Wind Energy Market Market Outlook

The Chile wind energy market's future outlook is exceptionally promising, driven by a confluence of robust growth accelerators. Continued advancements in turbine technology will ensure greater energy capture and efficiency, while innovative energy storage solutions will mitigate intermittency concerns. Strategic partnerships among industry stakeholders, coupled with proactive government policies, will facilitate the development of critical grid infrastructure and open new development frontiers. The increasing global and domestic emphasis on decarbonization and sustainable energy sources will continue to fuel demand, positioning wind power as a central pillar of Chile's energy transition and a key contributor to its economic development.

Chile Wind Energy Market Segmentation

-

1. BY LOCATION OF DEPLOYMENT

- 1.1. Onshore

- 1.2. Offshore

Chile Wind Energy Market Segmentation By Geography

- 1. Chile

Chile Wind Energy Market Regional Market Share

Geographic Coverage of Chile Wind Energy Market

Chile Wind Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Wind Power Projects4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Alternate Energy Sources

- 3.4. Market Trends

- 3.4.1. Onshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Chile Wind Energy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by BY LOCATION OF DEPLOYMENT

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Chile

- 5.1. Market Analysis, Insights and Forecast - by BY LOCATION OF DEPLOYMENT

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Électricité de France SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ørsted AS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Corporacion Acciona Energias Renovables SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 NextEra Energy Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 E ON SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Siemens Gamesa Renewable Energy SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Trident Winds Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Duke Energy Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 EnBW Energie Baden-Wurttemberg AG*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Enel Green Power Chile

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 ACCIONA Energy

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Électricité de France SA

List of Figures

- Figure 1: Chile Wind Energy Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Chile Wind Energy Market Share (%) by Company 2025

List of Tables

- Table 1: Chile Wind Energy Market Revenue billion Forecast, by BY LOCATION OF DEPLOYMENT 2020 & 2033

- Table 2: Chile Wind Energy Market Volume gigawatt Forecast, by BY LOCATION OF DEPLOYMENT 2020 & 2033

- Table 3: Chile Wind Energy Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Chile Wind Energy Market Volume gigawatt Forecast, by Region 2020 & 2033

- Table 5: Chile Wind Energy Market Revenue billion Forecast, by BY LOCATION OF DEPLOYMENT 2020 & 2033

- Table 6: Chile Wind Energy Market Volume gigawatt Forecast, by BY LOCATION OF DEPLOYMENT 2020 & 2033

- Table 7: Chile Wind Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Chile Wind Energy Market Volume gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chile Wind Energy Market?

The projected CAGR is approximately 9.6%.

2. Which companies are prominent players in the Chile Wind Energy Market?

Key companies in the market include Électricité de France SA, Ørsted AS, Corporacion Acciona Energias Renovables SA, NextEra Energy Inc, E ON SE, Siemens Gamesa Renewable Energy SA, Trident Winds Inc, Duke Energy Corporation, EnBW Energie Baden-Wurttemberg AG*List Not Exhaustive, Enel Green Power Chile , ACCIONA Energy.

3. What are the main segments of the Chile Wind Energy Market?

The market segments include BY LOCATION OF DEPLOYMENT.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.34 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Wind Power Projects4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Onshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Alternate Energy Sources.

8. Can you provide examples of recent developments in the market?

In February 2023, Ibereolica Repsol Renovables Chile began producing electricity at the 165-MW Atacama wind farm. It plans to generate around 450 GWh per year, equivalent to the annual consumption of more than 150,000 Chilean families and avert 320,000 metric tons of CO2 emissions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chile Wind Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chile Wind Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chile Wind Energy Market?

To stay informed about further developments, trends, and reports in the Chile Wind Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence