Key Insights

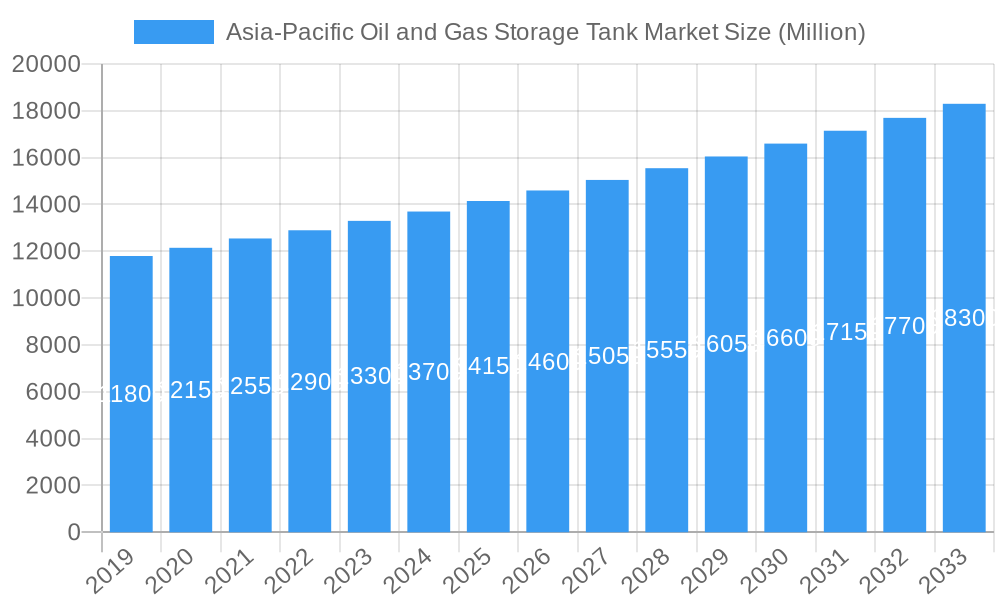

The Asia-Pacific oil and gas storage tank market is projected for substantial growth, expected to reach 2315.2 million by 2025, with a CAGR of 4.4%. This expansion is driven by increasing regional energy demands from industrialization, population growth, and rising per capita consumption. Key growth factors include the development of new exploration and production facilities, expanded refining capacities, and the need for secure storage of crude oil, LNG, diesel, gasoline, kerosene, and LPG. Government initiatives focused on energy security and infrastructure development further support market prospects. Emerging economies in Asia-Pacific are investing significantly in upgrading existing and building new storage infrastructure. Technological advancements in materials like advanced steel alloys and FRP for enhanced durability, corrosion resistance, and safety also influence market dynamics.

Asia-Pacific Oil and Gas Storage Tank Market Market Size (In Billion)

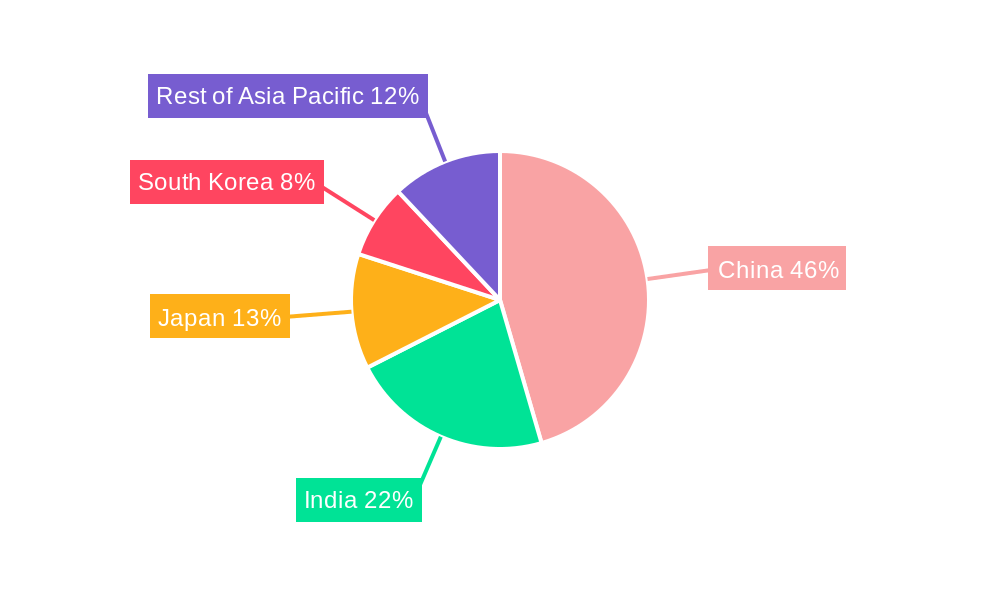

Market segmentation indicates that "Crude Oil" and "Diesel" will hold significant shares. The "Steel" material segment is anticipated to lead due to its strength and cost-effectiveness. China is expected to dominate the market due to its large refining capacity and consumption. India will be a major growth driver, fueled by its expanding economy and energy needs. Mature markets like Japan and South Korea will contribute through facility modernization. The "Rest of Asia-Pacific" presents considerable opportunities driven by burgeoning economies. Challenges include stringent environmental regulations and high initial investment costs for advanced solutions, but the overall trend points to sustained market expansion.

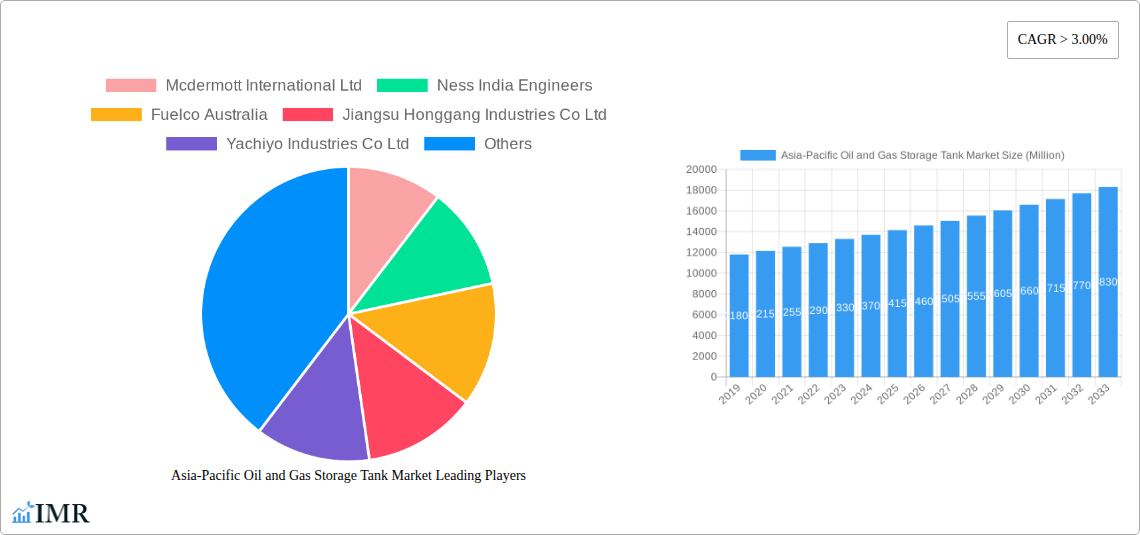

Asia-Pacific Oil and Gas Storage Tank Market Company Market Share

Asia-Pacific Oil and Gas Storage Tank Market Analysis and Forecast (2025-2033)

This report provides a detailed analysis of the Asia-Pacific oil and gas storage tank market, offering critical insights for stakeholders. It covers market evolution, technological advancements, and competitive landscapes for various products (crude oil, LNG, diesel, gasoline, kerosene, LPG) and materials (steel, carbon steel, FRP), with a geographical breakdown including China, India, Japan, South Korea, and the Rest of Asia-Pacific. The study spans the forecast period 2025-2033, with 2025 as the base year.

Asia-Pacific Oil and Gas Storage Tank Market Market Dynamics & Structure

The Asia-Pacific oil and gas storage tank market exhibits a moderately concentrated structure, with leading players like McDermott International Ltd, Toyo Kanetsu K K, and Jiangsu Honggang Industries Co Ltd holding significant market share. Technological innovation is a key driver, with advancements in materials science and tank design focusing on enhanced safety, efficiency, and environmental compliance. Regulatory frameworks, particularly those related to environmental protection and safety standards, are increasingly stringent, influencing product development and market entry strategies. Competitive product substitutes, though limited for large-scale oil and gas storage, exist in terms of modular solutions and advanced containment systems. End-user demographics are shaped by the region's robust industrial growth and expanding energy demands, particularly from emerging economies. Mergers and acquisitions (M&A) are notable, driven by the pursuit of market consolidation, technology acquisition, and expanded geographical reach. For instance, significant M&A activity in the past has focused on integrating specialized engineering capabilities and securing supply chains.

- Market Concentration: Moderately concentrated, with a few key players dominating market share.

- Technological Innovation: Driven by demand for safety, efficiency, and sustainability in storage solutions.

- Regulatory Frameworks: Increasingly stringent environmental and safety standards impacting manufacturing and design.

- Competitive Landscape: Focus on specialized solutions and advanced containment systems.

- End-User Demographics: Influenced by industrial expansion and evolving energy needs across the region.

- M&A Trends: Driven by consolidation, technology access, and supply chain enhancement.

Asia-Pacific Oil and Gas Storage Tank Market Growth Trends & Insights

The Asia-Pacific oil and gas storage tank market is poised for substantial growth, driven by a confluence of factors including robust economic expansion, increasing energy consumption, and significant investments in infrastructure development across the region. Market size evolution is marked by a consistent upward trajectory, with projected expansion fueled by the rising demand for refined petroleum products and the strategic importance of secure energy storage. Adoption rates of advanced storage technologies are accelerating, spurred by stricter environmental regulations and the need for improved operational efficiency. Technological disruptions, such as the development of self-healing coatings and advanced sensor systems for real-time monitoring, are enhancing tank performance and longevity. Consumer behavior shifts are also playing a role, with greater emphasis on sustainability and safety influencing the demand for high-quality, compliant storage solutions. The CAGR for the forecast period is estimated to be robust, reflecting the region's dynamic energy landscape. Market penetration of advanced materials like FRP tanks is also expected to rise in specific applications where corrosion resistance and lightweight properties are paramount. The region's expanding refining capacity and increasing import/export volumes of crude oil and refined products further underscore the growing need for substantial and sophisticated storage infrastructure.

Dominant Regions, Countries, or Segments in Asia-Pacific Oil and Gas Storage Tank Market

China stands out as the dominant force in the Asia-Pacific oil and gas storage tank market, driven by its immense industrial base, burgeoning energy demand, and strategic government initiatives to bolster energy security. The country's expansive refining sector and its significant role as both a producer and consumer of crude oil and its derivatives necessitate a vast network of storage facilities. India follows closely, with its rapidly growing economy and expanding population fueling an ever-increasing demand for oil and gas products, leading to substantial investments in storage infrastructure. Japan and South Korea, despite their mature economies, continue to represent significant markets due to their advanced industrial capabilities and focus on maintaining strategic petroleum reserves.

- Dominant Segment (Product): Crude Oil holds the largest market share due to the fundamental role of crude oil in the energy value chain and the sheer volume handled across the region.

- Dominant Segment (Material): Steel remains the predominant material owing to its durability, cost-effectiveness, and established manufacturing infrastructure for large-scale storage tanks. However, there is a growing adoption of Fiberglass-Reinforced Plastic (FRP) for specialized applications requiring enhanced corrosion resistance.

- Dominant Geography: China leads the market, followed by India, owing to their massive energy consumption, ongoing industrialization, and significant investments in oil and gas infrastructure. The "Rest of Asia-Pacific" also represents a substantial and growing market segment, encompassing developing economies with increasing energy needs.

Key drivers of dominance include:

- Economic Policies: Government support for the oil and gas sector, including infrastructure development and energy security initiatives.

- Infrastructure Development: Massive investments in new refineries, petrochemical plants, and transportation networks that require integrated storage solutions.

- Energy Demand: Continuously rising consumption of fuels and petrochemicals driven by population growth and industrial activities.

- Technological Adoption: Increasing preference for modern, efficient, and environmentally compliant storage solutions.

Asia-Pacific Oil and Gas Storage Tank Market Product Landscape

The product landscape for oil and gas storage tanks in the Asia-Pacific region is characterized by a diverse range of solutions tailored to specific product requirements and operational environments. Innovations are focused on enhancing tank integrity, reducing environmental impact, and improving operational efficiency. Key product innovations include double-walled tanks for enhanced containment, floating roof designs to minimize evaporation losses for volatile products like gasoline and diesel, and specialized internal coatings for corrosion resistance against aggressive fuels. Performance metrics such as capacity, pressure rating, temperature tolerance, and lifespan are critical considerations for end-users. Technological advancements are also leading to the development of smart tanks equipped with advanced monitoring systems for leak detection and structural health assessment, offering unique selling propositions in terms of safety and predictive maintenance.

Key Drivers, Barriers & Challenges in Asia-Pacific Oil and Gas Storage Tank Market

Key Drivers: The Asia-Pacific oil and gas storage tank market is propelled by several key drivers. Foremost is the surging energy demand across the region, fueled by economic growth and industrial expansion, necessitating increased storage capacity for crude oil, LNG, diesel, and gasoline. Significant government investments in oil and gas infrastructure, including new refineries, petrochemical complexes, and import/export terminals, directly translate into higher demand for storage tanks. Technological advancements in tank design and manufacturing, leading to more durable, efficient, and environmentally friendly solutions, also act as a catalyst. Furthermore, the increasing adoption of stringent safety and environmental regulations is driving the demand for advanced and compliant storage systems.

Barriers & Challenges: Despite the strong growth trajectory, the market faces several challenges. High initial capital investment for large-scale storage projects, coupled with long project execution timelines, can act as a restraint. Fluctuations in crude oil prices can impact investment decisions and the pace of new project developments. Stringent regulatory compliance, while a driver for advanced solutions, can also present a barrier for smaller manufacturers or those with legacy technologies, requiring significant investment in upgrades. Supply chain disruptions, particularly for specialized materials and components, can lead to project delays and increased costs. Intense competition among established players and emerging local manufacturers can also lead to price pressures, impacting profit margins.

Emerging Opportunities in Asia-Pacific Oil and Gas Storage Tank Market

Emerging opportunities within the Asia-Pacific oil and gas storage tank market are abundant, driven by evolving energy landscapes and technological advancements. The rapid growth of Liquefied Natural Gas (LNG) imports and domestic production presents a significant opportunity for specialized cryogenic storage tanks. Furthermore, the increasing focus on renewable energy sources and the potential integration of hydrogen storage solutions offer a nascent but promising avenue for innovation and market expansion. The development and implementation of smart storage solutions, incorporating IoT and AI for predictive maintenance and enhanced safety, represent another key opportunity. Moreover, retrofitting and upgrading existing storage facilities to meet new environmental and safety standards also opens up a substantial market segment.

Growth Accelerators in the Asia-Pacific Oil and Gas Storage Tank Market Industry

Several factors are acting as significant growth accelerators for the Asia-Pacific oil and gas storage tank industry. The ongoing digital transformation within the energy sector is leading to the adoption of advanced monitoring and control systems for storage tanks, enhancing efficiency and safety. Strategic partnerships and collaborations between global tank manufacturers and local players are facilitating technology transfer and market penetration. The increasing emphasis on sustainability and the circular economy is also driving demand for tanks made from recycled materials or designed for easier dismantling and recycling. Furthermore, government policies promoting energy independence and strategic reserves are creating sustained demand for robust storage infrastructure across the region.

Key Players Shaping the Asia-Pacific Oil and Gas Storage Tank Market Market

- McDermott International Ltd

- Ness India Engineers

- Fuelco Australia

- Jiangsu Honggang Industries Co Ltd

- Yachiyo Industries Co Ltd

- CST Composites

- Wenzhou Ace Machinery Co Ltd

- DFC Pressure Vessel Manufacturer Co Ltd

- Beltecno Corporation

- Toyo Kanetsu K K

Notable Milestones in Asia-Pacific Oil and Gas Storage Tank Market Sector

- March 2022: Adani Ports and Special Economic Zone signed an agreement with Indian Oil Corporation to increase crude oil storage volumes in Mundra port. As per the agreement, the Indian Oil Corporation would build 12 tanks with a capacity of 7.2 lakh kiloliters. The total investment would be about USD 10 billion, significantly boosting storage capacity.

- October 2021: Chemie-Tech won the contract for the engineering, procurement, and construction of four double-wall storage tanks for the HPCL Rajasthan refinery, HRRL, in India. The 96000 cubic meters tanks (combined capacity) are expected to store the petroleum products like refrigerated ethylene and propylene, showcasing advancements in specialized storage solutions.

In-Depth Asia-Pacific Oil and Gas Storage Tank Market Market Outlook

The future outlook for the Asia-Pacific oil and gas storage tank market is exceptionally promising, driven by sustained demand from developing economies and a continuous push for technological innovation. Strategic investments in expanding refining capacities, increasing LNG import terminals, and enhancing energy security infrastructure across countries like China and India will be key growth accelerators. The adoption of smart tank technologies, focusing on predictive maintenance, enhanced safety features, and environmental compliance, will redefine market standards and create new opportunities for advanced solutions. Furthermore, the growing exploration of cleaner energy alternatives and the potential for hydrogen storage infrastructure development present long-term growth avenues. Stakeholders are advised to focus on developing high-capacity, durable, and environmentally sustainable storage solutions to capitalize on the region's evolving energy landscape and secure their competitive position.

Asia-Pacific Oil and Gas Storage Tank Market Segmentation

-

1. Product

- 1.1. Crude Oil

- 1.2. Liquefied Natural Gas (LNG)

- 1.3. Diesel

- 1.4. Gasoline

- 1.5. Kerosene

- 1.6. Liquefied Petroleum Gas (LPG)

- 1.7. Other Products

-

2. Material

- 2.1. Steel

- 2.2. Carbon Steel

- 2.3. Fiberglass-Reinforced Plastic

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia-Pacific

Asia-Pacific Oil and Gas Storage Tank Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

Asia-Pacific Oil and Gas Storage Tank Market Regional Market Share

Geographic Coverage of Asia-Pacific Oil and Gas Storage Tank Market

Asia-Pacific Oil and Gas Storage Tank Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Upcoming New Renewable Projects in the Country4.; Expansions of Transmission and Distribution Network

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Private Participation in the Country's Power Sector

- 3.4. Market Trends

- 3.4.1. LNG Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Oil and Gas Storage Tank Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Crude Oil

- 5.1.2. Liquefied Natural Gas (LNG)

- 5.1.3. Diesel

- 5.1.4. Gasoline

- 5.1.5. Kerosene

- 5.1.6. Liquefied Petroleum Gas (LPG)

- 5.1.7. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Steel

- 5.2.2. Carbon Steel

- 5.2.3. Fiberglass-Reinforced Plastic

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. China Asia-Pacific Oil and Gas Storage Tank Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Crude Oil

- 6.1.2. Liquefied Natural Gas (LNG)

- 6.1.3. Diesel

- 6.1.4. Gasoline

- 6.1.5. Kerosene

- 6.1.6. Liquefied Petroleum Gas (LPG)

- 6.1.7. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Material

- 6.2.1. Steel

- 6.2.2. Carbon Steel

- 6.2.3. Fiberglass-Reinforced Plastic

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. South Korea

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. India Asia-Pacific Oil and Gas Storage Tank Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Crude Oil

- 7.1.2. Liquefied Natural Gas (LNG)

- 7.1.3. Diesel

- 7.1.4. Gasoline

- 7.1.5. Kerosene

- 7.1.6. Liquefied Petroleum Gas (LPG)

- 7.1.7. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Material

- 7.2.1. Steel

- 7.2.2. Carbon Steel

- 7.2.3. Fiberglass-Reinforced Plastic

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. South Korea

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Japan Asia-Pacific Oil and Gas Storage Tank Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Crude Oil

- 8.1.2. Liquefied Natural Gas (LNG)

- 8.1.3. Diesel

- 8.1.4. Gasoline

- 8.1.5. Kerosene

- 8.1.6. Liquefied Petroleum Gas (LPG)

- 8.1.7. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Material

- 8.2.1. Steel

- 8.2.2. Carbon Steel

- 8.2.3. Fiberglass-Reinforced Plastic

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. South Korea

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. South Korea Asia-Pacific Oil and Gas Storage Tank Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Crude Oil

- 9.1.2. Liquefied Natural Gas (LNG)

- 9.1.3. Diesel

- 9.1.4. Gasoline

- 9.1.5. Kerosene

- 9.1.6. Liquefied Petroleum Gas (LPG)

- 9.1.7. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Material

- 9.2.1. Steel

- 9.2.2. Carbon Steel

- 9.2.3. Fiberglass-Reinforced Plastic

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. South Korea

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Rest of Asia Pacific Asia-Pacific Oil and Gas Storage Tank Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Crude Oil

- 10.1.2. Liquefied Natural Gas (LNG)

- 10.1.3. Diesel

- 10.1.4. Gasoline

- 10.1.5. Kerosene

- 10.1.6. Liquefied Petroleum Gas (LPG)

- 10.1.7. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Material

- 10.2.1. Steel

- 10.2.2. Carbon Steel

- 10.2.3. Fiberglass-Reinforced Plastic

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. South Korea

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Mcdermott International Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ness India Engineers

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fuelco Australia

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Jiangsu Honggang Industries Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Yachiyo Industries Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CST Composites

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Wenzhou Ace Machinery Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DFC Pressure Vessel Manufacturer Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Beltecno Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Toyo Kanetsu K K

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Mcdermott International Ltd

List of Figures

- Figure 1: Asia-Pacific Oil and Gas Storage Tank Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Oil and Gas Storage Tank Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Oil and Gas Storage Tank Market Revenue million Forecast, by Product 2020 & 2033

- Table 2: Asia-Pacific Oil and Gas Storage Tank Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: Asia-Pacific Oil and Gas Storage Tank Market Revenue million Forecast, by Material 2020 & 2033

- Table 4: Asia-Pacific Oil and Gas Storage Tank Market Volume K Unit Forecast, by Material 2020 & 2033

- Table 5: Asia-Pacific Oil and Gas Storage Tank Market Revenue million Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Oil and Gas Storage Tank Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 7: Asia-Pacific Oil and Gas Storage Tank Market Revenue million Forecast, by Region 2020 & 2033

- Table 8: Asia-Pacific Oil and Gas Storage Tank Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Asia-Pacific Oil and Gas Storage Tank Market Revenue million Forecast, by Product 2020 & 2033

- Table 10: Asia-Pacific Oil and Gas Storage Tank Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 11: Asia-Pacific Oil and Gas Storage Tank Market Revenue million Forecast, by Material 2020 & 2033

- Table 12: Asia-Pacific Oil and Gas Storage Tank Market Volume K Unit Forecast, by Material 2020 & 2033

- Table 13: Asia-Pacific Oil and Gas Storage Tank Market Revenue million Forecast, by Geography 2020 & 2033

- Table 14: Asia-Pacific Oil and Gas Storage Tank Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Oil and Gas Storage Tank Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Oil and Gas Storage Tank Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Oil and Gas Storage Tank Market Revenue million Forecast, by Product 2020 & 2033

- Table 18: Asia-Pacific Oil and Gas Storage Tank Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 19: Asia-Pacific Oil and Gas Storage Tank Market Revenue million Forecast, by Material 2020 & 2033

- Table 20: Asia-Pacific Oil and Gas Storage Tank Market Volume K Unit Forecast, by Material 2020 & 2033

- Table 21: Asia-Pacific Oil and Gas Storage Tank Market Revenue million Forecast, by Geography 2020 & 2033

- Table 22: Asia-Pacific Oil and Gas Storage Tank Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: Asia-Pacific Oil and Gas Storage Tank Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: Asia-Pacific Oil and Gas Storage Tank Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Oil and Gas Storage Tank Market Revenue million Forecast, by Product 2020 & 2033

- Table 26: Asia-Pacific Oil and Gas Storage Tank Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 27: Asia-Pacific Oil and Gas Storage Tank Market Revenue million Forecast, by Material 2020 & 2033

- Table 28: Asia-Pacific Oil and Gas Storage Tank Market Volume K Unit Forecast, by Material 2020 & 2033

- Table 29: Asia-Pacific Oil and Gas Storage Tank Market Revenue million Forecast, by Geography 2020 & 2033

- Table 30: Asia-Pacific Oil and Gas Storage Tank Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 31: Asia-Pacific Oil and Gas Storage Tank Market Revenue million Forecast, by Country 2020 & 2033

- Table 32: Asia-Pacific Oil and Gas Storage Tank Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: Asia-Pacific Oil and Gas Storage Tank Market Revenue million Forecast, by Product 2020 & 2033

- Table 34: Asia-Pacific Oil and Gas Storage Tank Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 35: Asia-Pacific Oil and Gas Storage Tank Market Revenue million Forecast, by Material 2020 & 2033

- Table 36: Asia-Pacific Oil and Gas Storage Tank Market Volume K Unit Forecast, by Material 2020 & 2033

- Table 37: Asia-Pacific Oil and Gas Storage Tank Market Revenue million Forecast, by Geography 2020 & 2033

- Table 38: Asia-Pacific Oil and Gas Storage Tank Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 39: Asia-Pacific Oil and Gas Storage Tank Market Revenue million Forecast, by Country 2020 & 2033

- Table 40: Asia-Pacific Oil and Gas Storage Tank Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Asia-Pacific Oil and Gas Storage Tank Market Revenue million Forecast, by Product 2020 & 2033

- Table 42: Asia-Pacific Oil and Gas Storage Tank Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 43: Asia-Pacific Oil and Gas Storage Tank Market Revenue million Forecast, by Material 2020 & 2033

- Table 44: Asia-Pacific Oil and Gas Storage Tank Market Volume K Unit Forecast, by Material 2020 & 2033

- Table 45: Asia-Pacific Oil and Gas Storage Tank Market Revenue million Forecast, by Geography 2020 & 2033

- Table 46: Asia-Pacific Oil and Gas Storage Tank Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 47: Asia-Pacific Oil and Gas Storage Tank Market Revenue million Forecast, by Country 2020 & 2033

- Table 48: Asia-Pacific Oil and Gas Storage Tank Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Oil and Gas Storage Tank Market?

The projected CAGR is approximately 4.4%.

2. Which companies are prominent players in the Asia-Pacific Oil and Gas Storage Tank Market?

Key companies in the market include Mcdermott International Ltd, Ness India Engineers, Fuelco Australia, Jiangsu Honggang Industries Co Ltd, Yachiyo Industries Co Ltd, CST Composites, Wenzhou Ace Machinery Co Ltd, DFC Pressure Vessel Manufacturer Co Ltd, Beltecno Corporation, Toyo Kanetsu K K.

3. What are the main segments of the Asia-Pacific Oil and Gas Storage Tank Market?

The market segments include Product, Material, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2315.2 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Upcoming New Renewable Projects in the Country4.; Expansions of Transmission and Distribution Network.

6. What are the notable trends driving market growth?

LNG Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Lack of Private Participation in the Country's Power Sector.

8. Can you provide examples of recent developments in the market?

March 2022: Adani Ports and Special Economic Zone signed an agreement with Indian Oil Corporation to increase crude oil storage volumes in Mundra port. As per the agreement, the Indian Oil Corporation would build 12 tanks with a capacity of 7.2 lakh kiloliters. The total investment would be about USD 10 billion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Oil and Gas Storage Tank Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Oil and Gas Storage Tank Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Oil and Gas Storage Tank Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Oil and Gas Storage Tank Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence