Key Insights

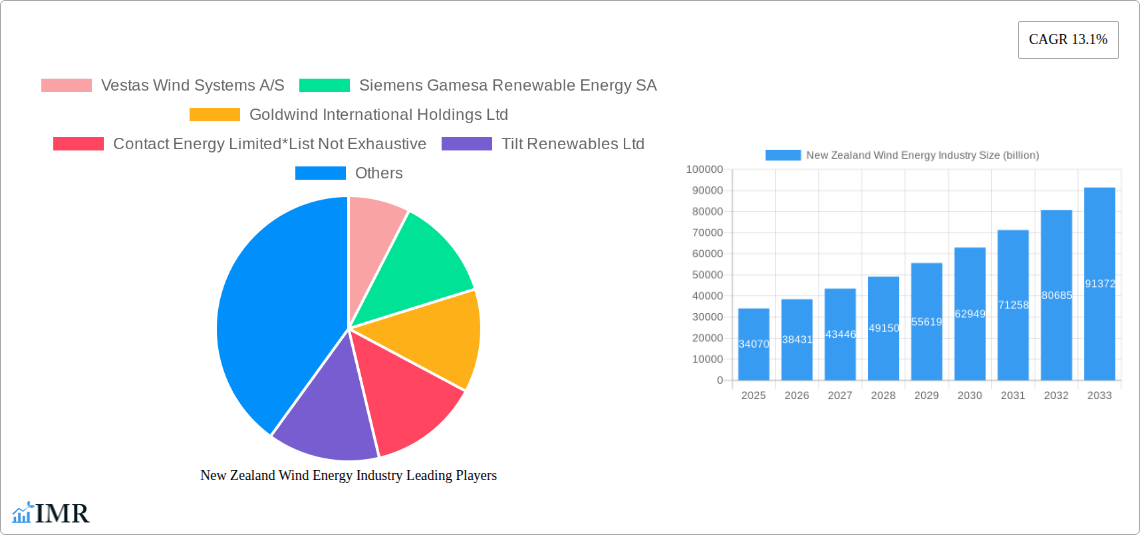

The New Zealand wind energy industry is poised for significant expansion, projected to reach an estimated $34.07 billion by 2025. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 13.1% over the forecast period of 2025-2033. This upward trajectory is primarily driven by a concerted global and national push towards renewable energy sources to combat climate change and enhance energy security. New Zealand’s commitment to decarbonization, coupled with favorable wind resources, makes wind power a cornerstone of its energy future. Investments in large-scale wind farms, technological advancements in turbine efficiency, and supportive government policies aimed at accelerating renewable energy deployment are critical factors propelling this market forward. The industry is also experiencing a surge in demand for clean electricity, driven by both industrial and residential sectors looking to reduce their carbon footprints.

New Zealand Wind Energy Industry Market Size (In Billion)

While the outlook is exceptionally positive, the industry faces certain considerations that could shape its evolution. These include potential challenges related to grid infrastructure upgrades needed to accommodate increasing wind power generation, land use considerations for new developments, and the ongoing need for skilled labor in manufacturing, installation, and maintenance. However, the prevailing trends favor continued growth, with a strong emphasis on innovation in energy storage solutions to address intermittency, the development of offshore wind potential, and the integration of smart grid technologies. Major players like Vestas Wind Systems, Siemens Gamesa Renewable Energy, and General Electric are actively involved in the New Zealand market, contributing to technological advancements and project development, further solidifying the industry’s growth trajectory. The market's segmented analysis across production, consumption, imports, exports, and price trends will offer deeper insights into the specific dynamics within the New Zealand wind energy landscape.

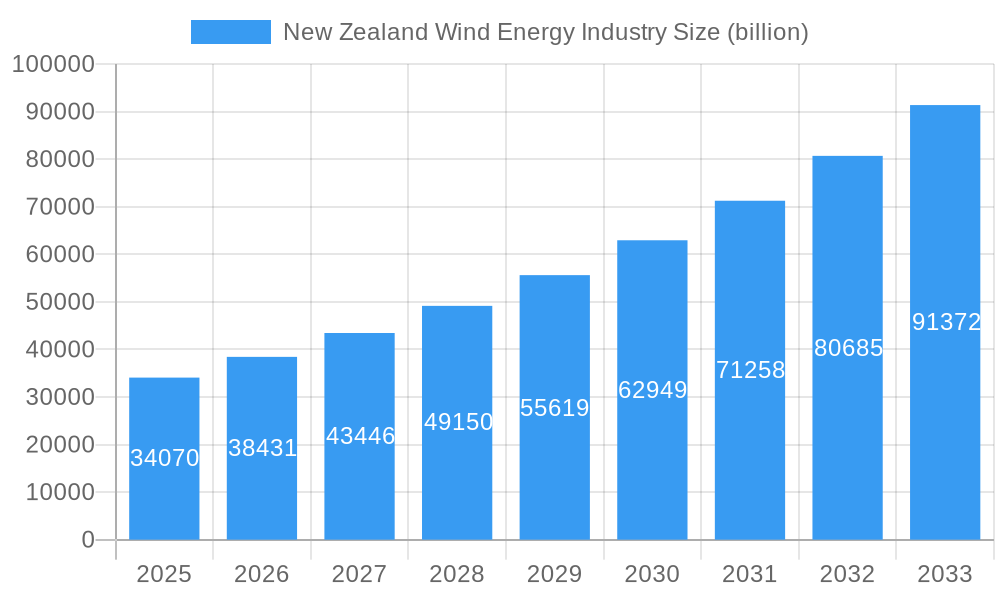

New Zealand Wind Energy Industry Company Market Share

Here's the SEO-optimized report description for the New Zealand Wind Energy Industry, designed for maximum visibility and engagement:

This comprehensive report provides an in-depth analysis of the New Zealand wind energy industry, offering critical insights for stakeholders, investors, and industry professionals. Covering the historical period of 2019-2024, base year 2025, and extending to a detailed forecast period of 2025-2033, this study delves into market dynamics, growth trends, regional dominance, product landscape, and key players. Understand the evolving renewable energy market in New Zealand, wind power investment opportunities, and the future of clean energy in Oceania. With a focus on both parent and child market segments, this report equips you with actionable intelligence to navigate the burgeoning New Zealand green energy sector.

New Zealand Wind Energy Industry Market Dynamics & Structure

The New Zealand wind energy industry is characterized by a dynamic market structure influenced by a combination of robust technological innovation, evolving regulatory frameworks, and increasing environmental consciousness among end-users. Market concentration is moderately high, with a few key players dominating the landscape, driven by the capital-intensive nature of large-scale wind farm development. Technological innovation remains a primary driver, focusing on enhancing turbine efficiency, optimizing energy storage solutions, and integrating advanced grid management systems. The regulatory environment, spearheaded by governmental policies promoting renewable energy targets, plays a crucial role in shaping investment decisions and project approvals. Competitive product substitutes, such as solar energy and other renewable sources, are present but are often complementary rather than direct replacements due to geographical and operational advantages of wind power in specific regions. End-user demographics are shifting towards a greater demand for clean and sustainable energy solutions from both commercial and residential sectors. Mergers and acquisitions (M&A) trends are indicative of strategic consolidation and expansion within the industry, as companies seek to leverage economies of scale and technological expertise.

- Market Concentration: Dominated by a few key developers and technology providers.

- Technological Innovation Drivers: Focus on efficiency, storage, and grid integration.

- Regulatory Frameworks: Government policies supporting renewable energy targets and incentives.

- Competitive Product Substitutes: Solar energy, hydroelectricity, and other renewables.

- End-User Demographics: Growing demand for sustainable and green energy.

- M&A Trends: Strategic consolidation and partnerships for market expansion.

New Zealand Wind Energy Industry Growth Trends & Insights

The New Zealand wind energy industry is poised for significant expansion, driven by a confluence of favorable market conditions and a global shift towards decarbonization. The market size evolution indicates a consistent upward trajectory, with strong growth anticipated throughout the forecast period. Adoption rates for wind energy are accelerating, fueled by increasing cost-competitiveness of wind power technologies and supportive government policies aimed at achieving ambitious renewable energy targets. Technological disruptions, such as the development of more efficient wind turbine designs, advancements in battery storage integration, and sophisticated predictive maintenance technologies, are further bolstering the industry's growth prospects. Consumer behavior shifts are playing a pivotal role, with a growing public and corporate demand for electricity generated from clean and sustainable sources. This heightened environmental awareness is translating into increased investment in wind energy projects and a stronger preference for utilities and businesses that prioritize renewable energy procurement. The industry is expected to witness a substantial Compound Annual Growth Rate (CAGR), surpassing xx% in the coming years. Market penetration of wind energy within New Zealand's overall energy mix is projected to rise significantly, contributing substantially to the nation's energy security and climate objectives. Furthermore, the integration of smart grid technologies and the development of offshore wind potential represent key areas that will drive future market penetration and sustainability.

Dominant Regions, Countries, or Segments in New Zealand Wind Energy Industry

The New Zealand wind energy industry's dominance is primarily dictated by regions offering optimal wind resources, supportive infrastructure, and favorable economic policies. From a Production Analysis: perspective, the South Island, particularly the Taranaki and Canterbury regions, has historically been a dominant force due to its consistent and strong wind speeds. These regions benefit from well-established grid connectivity and a history of significant wind farm development. The Consumption Analysis: for wind energy is broadly distributed across the nation, with major industrial and urban centers driving demand. However, the trend towards decentralized energy generation and the increasing adoption of electric vehicles in both the North and South Islands are creating a more evenly spread consumption pattern.

The Import Market Analysis (Value & Volume): for wind energy in New Zealand is substantial, driven by the need for advanced turbine components, specialized equipment, and potentially outsourced expertise. Key import markets often include countries with established wind energy manufacturing capabilities. The value of imports is projected to reach approximately $xx billion in 2025, with volumes expected to increase as more large-scale projects are commissioned.

Conversely, the Export Market Analysis (Value & Volume): for New Zealand's wind energy sector is currently nascent, primarily focused on the export of renewable energy expertise, consulting services, and potentially the development of wind projects in neighboring Pacific nations. The value of such exports is estimated at around $xx billion in 2025, with potential for growth as New Zealand's reputation in renewable energy development solidifies.

The Price Trend Analysis: for wind energy in New Zealand shows a generally decreasing trend over the historical period, attributed to technological advancements and economies of scale. However, fluctuations in global supply chains and raw material costs can introduce short-term volatility. The average price per MWh is expected to hover around $xx in 2025, with a projected decline in the long term.

Several factors contribute to the dominance of certain regions and segments. Economic policies that incentivize renewable energy development, such as tax credits and feed-in tariffs, play a crucial role in attracting investment. Infrastructure development, including grid upgrades and transportation networks capable of handling large turbine components, is essential for facilitating large-scale projects. The market share of wind energy in New Zealand's total electricity generation is steadily increasing, projected to reach xx% by 2025.

- Dominant Production Regions: Taranaki, Canterbury (South Island).

- Key Consumption Drivers: Industrial hubs, urban centers, and growing EV adoption.

- Major Import Sources: Countries with advanced wind turbine manufacturing.

- Emerging Export Focus: Renewable energy expertise and project development services.

- Price Trend Drivers: Technological efficiency, economies of scale, and supply chain dynamics.

New Zealand Wind Energy Industry Product Landscape

The product landscape in the New Zealand wind energy industry is defined by sophisticated wind turbine technologies, advanced energy storage solutions, and integrated grid management systems. Manufacturers are continuously innovating to enhance turbine performance, increase energy capture efficiency, and reduce operational costs. This includes the development of larger rotor diameters, taller towers, and advanced blade designs optimized for specific wind conditions. Applications range from utility-scale wind farms powering national grids to smaller distributed wind systems for industrial or community use. Performance metrics such as capacity factor, power curve efficiency, and lifecycle maintenance costs are key differentiators. Unique selling propositions often lie in the reliability, scalability, and environmental credentials of these solutions, with a growing emphasis on sustainability throughout the product lifecycle. Technological advancements are also focused on improving the integration of wind power with other renewable sources and enhancing grid stability through smart controls and forecasting.

Key Drivers, Barriers & Challenges in New Zealand Wind Energy Industry

Key Drivers:

The New Zealand wind energy industry is propelled by a strong commitment to renewable energy targets, driving significant investment and policy support. Technological advancements in turbine efficiency and cost reduction make wind power increasingly competitive. Growing environmental awareness and public demand for clean energy also serve as powerful catalysts. Furthermore, the potential for energy independence and security through domestic renewable resources is a key economic driver.

Barriers & Challenges:

Despite the positive outlook, the industry faces several barriers and challenges. The high upfront capital investment required for wind farm development remains a significant hurdle. Grid integration issues, particularly the intermittency of wind power and the need for robust storage solutions, present ongoing challenges. Stringent environmental regulations and consenting processes can lead to project delays. Supply chain disruptions and the availability of skilled labor for installation and maintenance can also impact project timelines and costs. Competitive pressures from other renewable energy sources and the evolving electricity market dynamics require continuous adaptation.

Emerging Opportunities in New Zealand Wind Energy Industry

Emerging opportunities in the New Zealand wind energy industry are diverse and promising. The development of offshore wind farms presents a significant untapped market with immense potential for large-scale energy generation. Advancements in energy storage technologies, including battery and hydrogen storage, are opening avenues for improved grid stability and the dispatchability of wind power. The growing demand for green hydrogen produced from renewable electricity offers a new pathway for decarbonizing hard-to-abate sectors. Furthermore, opportunities exist in repowering older wind farms with more efficient turbines and in developing distributed wind energy solutions for rural and industrial applications, catering to evolving consumer preferences for localized and sustainable energy.

Growth Accelerators in the New Zealand Wind Energy Industry Industry

Several catalysts are accelerating the long-term growth of the New Zealand wind energy industry. Significant technological breakthroughs in turbine design, such as enhanced aerodynamics and materials science, are leading to higher energy yields and lower costs. Strategic partnerships between international technology providers and local developers are fostering innovation and facilitating project execution. Market expansion strategies, including government incentives and a clear regulatory roadmap, are encouraging further investment. The development of robust energy storage solutions is crucial for overcoming intermittency challenges and ensuring reliable power supply, acting as a major growth accelerator.

Key Players Shaping the New Zealand Wind Energy Industry Market

- Vestas Wind Systems A/S

- Siemens Gamesa Renewable Energy SA

- Goldwind International Holdings Ltd

- Contact Energy Limited

- Tilt Renewables Ltd

- General Electric Company

- Genesis Energy LP

Notable Milestones in New Zealand Wind Energy Industry Sector

- 2019: Commissioning of significant wind farm expansions, increasing installed capacity.

- 2020: Government announces ambitious renewable energy targets, boosting industry confidence.

- 2021: Major investment in grid upgrades to accommodate increased renewable energy flow.

- 2022: Launch of feasibility studies for potential offshore wind projects.

- 2023: Introduction of new policy incentives for energy storage solutions.

- 2024: First major deployment of advanced battery storage integrated with a wind farm.

In-Depth New Zealand Wind Energy Industry Market Outlook

The outlook for the New Zealand wind energy industry is exceptionally bright, driven by a strong commitment to sustainability and a supportive policy environment. Growth accelerators such as advancements in turbine technology, expanding energy storage capabilities, and the exploration of offshore wind potential are set to significantly increase the industry's contribution to the national energy mix. Strategic partnerships and ongoing investment in grid infrastructure will further bolster reliability and efficiency. The increasing demand for clean energy solutions and the potential for green hydrogen production position New Zealand as a key player in the global renewable energy transition, presenting substantial opportunities for continued growth and innovation in the coming years.

New Zealand Wind Energy Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

New Zealand Wind Energy Industry Segmentation By Geography

- 1. New Zealand

New Zealand Wind Energy Industry Regional Market Share

Geographic Coverage of New Zealand Wind Energy Industry

New Zealand Wind Energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Adoption Of Solar And Wind Energy4.; Supportive Government Policies And Ambitious Targets

- 3.3. Market Restrains

- 3.3.1. 4.; Integrating Renewables into the Main Electricity Grid

- 3.4. Market Trends

- 3.4.1. Wind Energy Growing as Major Source of Renewable Energy

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. New Zealand Wind Energy Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. New Zealand

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Vestas Wind Systems A/S

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Siemens Gamesa Renewable Energy SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Goldwind International Holdings Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Contact Energy Limited*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tilt Renewables Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 General Electric Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Genesis Energy LP

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Vestas Wind Systems A/S

List of Figures

- Figure 1: New Zealand Wind Energy Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: New Zealand Wind Energy Industry Share (%) by Company 2025

List of Tables

- Table 1: New Zealand Wind Energy Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: New Zealand Wind Energy Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: New Zealand Wind Energy Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: New Zealand Wind Energy Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: New Zealand Wind Energy Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: New Zealand Wind Energy Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: New Zealand Wind Energy Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: New Zealand Wind Energy Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: New Zealand Wind Energy Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: New Zealand Wind Energy Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: New Zealand Wind Energy Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: New Zealand Wind Energy Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the New Zealand Wind Energy Industry?

The projected CAGR is approximately 13.1%.

2. Which companies are prominent players in the New Zealand Wind Energy Industry?

Key companies in the market include Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy SA, Goldwind International Holdings Ltd, Contact Energy Limited*List Not Exhaustive, Tilt Renewables Ltd, General Electric Company, Genesis Energy LP.

3. What are the main segments of the New Zealand Wind Energy Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 34.07 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Adoption Of Solar And Wind Energy4.; Supportive Government Policies And Ambitious Targets.

6. What are the notable trends driving market growth?

Wind Energy Growing as Major Source of Renewable Energy.

7. Are there any restraints impacting market growth?

4.; Integrating Renewables into the Main Electricity Grid.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "New Zealand Wind Energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the New Zealand Wind Energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the New Zealand Wind Energy Industry?

To stay informed about further developments, trends, and reports in the New Zealand Wind Energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence