Key Insights

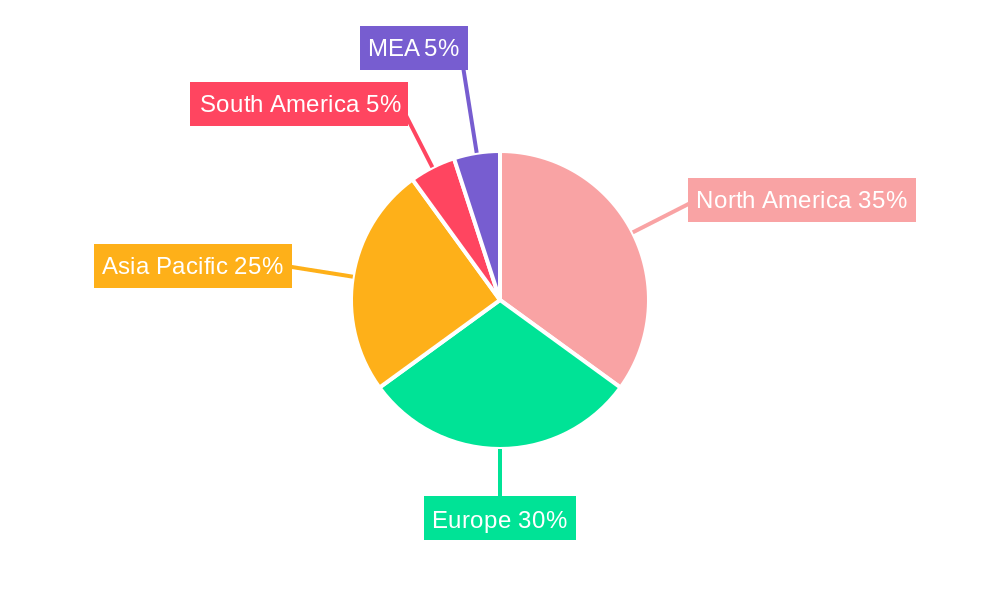

The global e-cigarette market is projected for substantial expansion, driven by an increasing focus on smoking cessation and the perceived lower health risks associated with vaping compared to traditional tobacco. Innovations in product design, including advanced battery technology and diverse flavor options, alongside the rising popularity of disposable and personalized vaporizers, are key growth catalysts. Despite these advancements, stringent regulatory frameworks and ongoing health concerns present significant market challenges. The market, segmented by battery mode and product type, sees the disposable e-cigarette segment leading in growth due to its convenience and affordability. Leading industry players are actively engaged in innovation and market expansion. While North America and Europe currently lead, the Asia Pacific region is anticipated to experience significant future growth, fueled by rising disposable incomes and evolving consumer preferences in key markets like China and India.

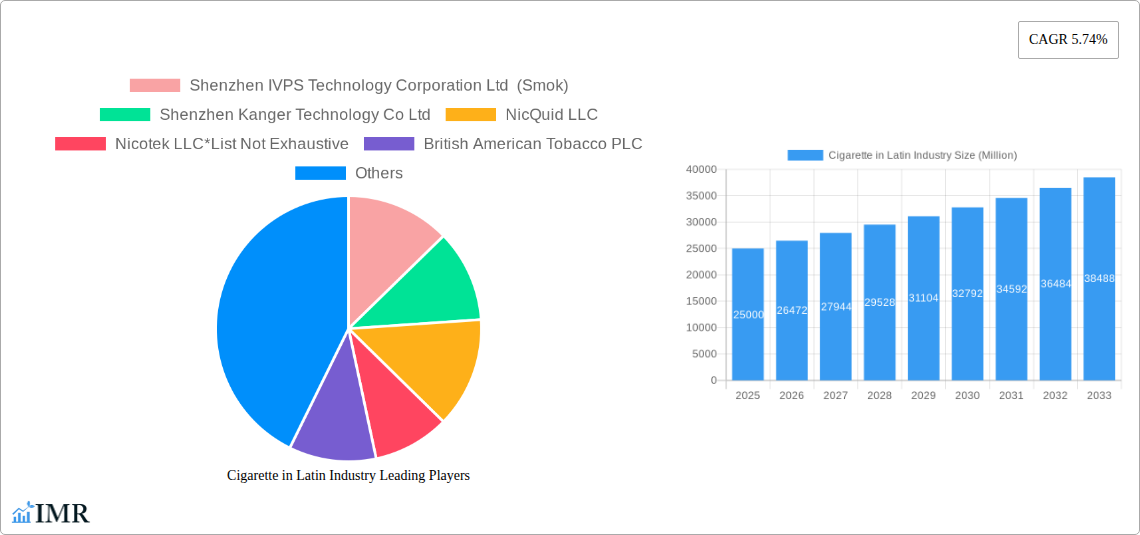

Cigarette in Latin Industry Market Size (In Billion)

The competitive environment features a blend of established corporations and agile startups, each contributing distinct strengths to the market. Future market development will be shaped by evolving regulations, continuous technological progress, and persistent consumer demand for alternatives to conventional smoking. Achieving sustainable growth necessitates a careful balance between innovation, regulatory adherence, and responsible consumer engagement, addressing public health considerations while meeting market demand.

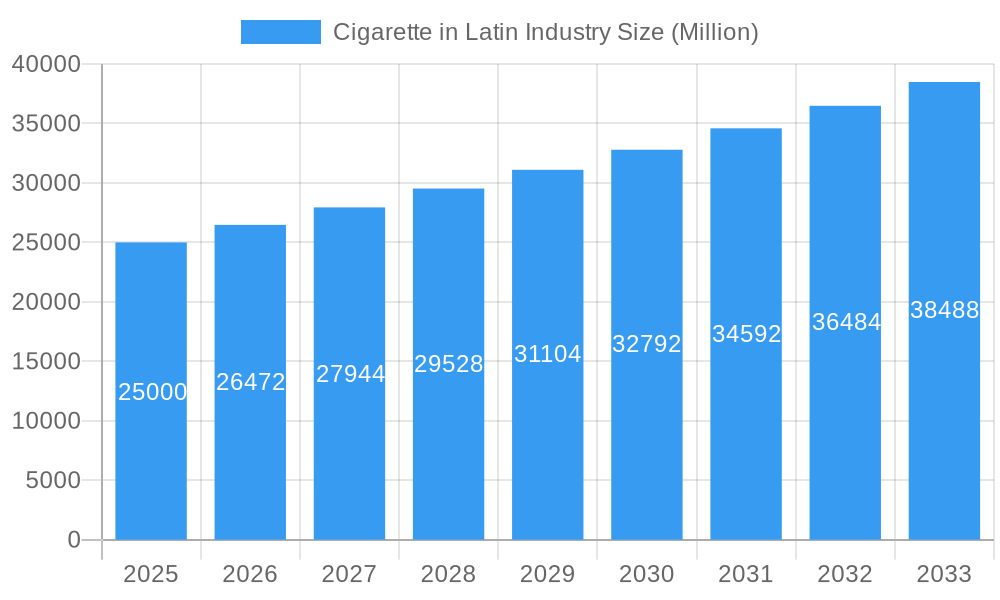

Cigarette in Latin Industry Company Market Share

Cigarette in Latin America Industry Market Report: 2019-2033

This comprehensive report provides a deep dive into the dynamic Cigarette in Latin America Industry, analyzing market trends, competitive landscape, and future growth prospects from 2019 to 2033. The report leverages extensive market research to deliver actionable insights for industry professionals, investors, and strategic decision-makers. With a focus on key segments including Automatic and Manual E-cigarettes, and product types like Completely Disposable Models, Rechargeable but Disposable Cartomizers, and Personalized Vaporizers, this report offers a granular understanding of this evolving market. The Base Year is 2025, with the Forecast Period spanning 2025-2033 and the Historical Period covering 2019-2024. Market values are presented in Million units.

Cigarette in Latin America Industry Market Dynamics & Structure

The Latin American e-cigarette market exhibits a moderately concentrated structure, with key players such as Shenzhen IVPS Technology Corporation Ltd (Smok), Shenzhen Kanger Technology Co Ltd, NicQuid LLC, Nicotek LLC, British American Tobacco PLC, Innokin Technology, Philip Morris International Inc, Japan Tobacco Inc, NJOY Inc, and International Vapor Group holding significant market shares. However, the entry of new players and technological innovations contribute to a dynamic competitive environment.

- Market Concentration: xx% held by top 5 players in 2024, expected to decrease to xx% by 2033 due to increased competition.

- Technological Innovation: Significant advancements in battery technology, e-liquid formulations, and device design drive market growth. However, barriers to innovation exist due to regulatory uncertainties and high R&D costs.

- Regulatory Frameworks: Varying regulatory landscapes across Latin American countries present both opportunities and challenges for market expansion. Stringent regulations in some nations hinder growth, while lax regulations in others fuel market expansion.

- Competitive Product Substitutes: Traditional cigarettes remain a significant competitive threat, although the growing awareness of e-cigarettes' potential harm reduction benefits is shifting consumer preferences.

- End-User Demographics: Primarily young adults (18-35) and former smokers constitute the main consumer base, with evolving preferences towards disposables and personalized vaping experiences.

- M&A Trends: A moderate level of M&A activity is observed, primarily focused on expanding market reach and acquiring innovative technologies. xx M&A deals were recorded in 2024, with a projected increase to xx by 2033.

Cigarette in Latin America Industry Growth Trends & Insights

The Latin American e-cigarette market is experiencing substantial growth, driven by increasing consumer awareness, shifting consumer preferences towards harm reduction alternatives, and technological advancements. The market size expanded from xx million units in 2019 to xx million units in 2024, exhibiting a CAGR of xx%. The market is expected to reach xx million units by 2033, with a projected CAGR of xx% during the forecast period. Technological disruptions, such as the introduction of water-based vaporizers and induction-heating systems, are reshaping consumer preferences and driving product innovation. Consumer behavior shifts towards disposables and personalized vaping experiences further fuel market growth. Market penetration remains relatively low compared to developed markets, indicating significant untapped potential.

Dominant Regions, Countries, or Segments in Cigarette in Latin America Industry

Brazil and Mexico are currently the leading markets in Latin America, driven by high population density, relatively high disposable incomes, and a burgeoning vaping culture. The Automatic E-cigarette segment holds a larger market share (xx%) compared to Manual E-cigarettes (xx%), reflecting consumer preference for ease of use. The Completely Disposable Model segment dominates the product type category (xx%), owing to its affordability and convenience.

- Key Drivers in Brazil: Favorable regulatory environment (relatively less restrictive), high disposable income in urban areas, and strong marketing campaigns by major players.

- Key Drivers in Mexico: Growing awareness of e-cigarettes as harm reduction alternatives, increasing adoption among young adults, and a large potential consumer base.

- Segment Dominance: The dominance of Automatic E-cigarettes and Completely Disposable Models is driven by ease of use and affordability, appealing to a broader consumer base. Personalized Vaporizers are also gaining traction among tech-savvy consumers.

Cigarette in Latin America Industry Product Landscape

The e-cigarette product landscape is characterized by a wide range of devices, catering to diverse consumer preferences. Product innovations focus on improved battery life, enhanced flavor delivery, and personalized vaping experiences. The emergence of water-based vaporizers and induction-heating systems signifies significant technological advancements. Unique selling propositions include sleek designs, advanced temperature control, and innovative e-liquid formulations. Performance metrics, such as battery capacity, vapor production, and flavor intensity, are key factors influencing consumer choices.

Key Drivers, Barriers & Challenges in Cigarette in Latin America Industry

Key Drivers:

- Growing awareness of e-cigarettes as a less harmful alternative to traditional cigarettes.

- Technological advancements leading to improved device functionality and user experience.

- Favorable regulatory environments in some Latin American countries.

Key Challenges and Restraints:

- Stringent regulations in certain countries hindering market expansion. (xx% decrease in sales projected in Country X due to new regulations)

- Concerns over the long-term health effects of vaping.

- Competition from traditional cigarettes and other nicotine products.

- Supply chain disruptions affecting the availability of raw materials and finished products.

Emerging Opportunities in Cigarette in Latin America Industry

- Untapped markets in smaller Latin American countries with less stringent regulations.

- Growing demand for personalized vaporizers and customized e-liquids.

- Expansion of water-based and other innovative e-liquid formulations.

- Potential for partnerships with public health organizations to promote harm reduction.

Growth Accelerators in the Cigarette in Latin America Industry Industry

Technological breakthroughs, such as advanced battery technologies, and improved e-liquid formulations continue to drive market growth. Strategic partnerships between established players and new entrants, focusing on product development and market expansion, are also key accelerators. Increased investment in marketing and consumer education will play a crucial role in boosting market penetration.

Key Players Shaping the Cigarette in Latin America Market

- Shenzhen IVPS Technology Corporation Ltd (Smok)

- Shenzhen Kanger Technology Co Ltd

- NicQuid LLC

- Nicotek LLC

- British American Tobacco PLC

- Innokin Technology

- Philip Morris International Inc

- Japan Tobacco Inc

- NJOY Inc

- International Vapor Group

Notable Milestones in Cigarette in Latin America Sector

- August 2022: SMOK launches the SOLUS 2 series, enhancing vaping experiences and cost-effectiveness.

- May 2022: Innokin Technology and Aquios Labs launch the water-based vaporizer 'Lota'.

- August 2021: Philip Morris International Inc launches IQOS ILUMA, a bladeless tobacco-heating system.

In-Depth Cigarette in Latin America Industry Market Outlook

The Latin American e-cigarette market holds significant long-term growth potential, driven by increasing consumer awareness, technological advancements, and expanding market penetration. Strategic opportunities lie in developing innovative products tailored to specific consumer needs, forging strategic partnerships, and navigating the evolving regulatory landscape. By capitalizing on these opportunities and mitigating potential challenges, industry players can achieve significant growth in this dynamic market.

Cigarette in Latin Industry Segmentation

-

1. Product Type

- 1.1. Completely Disposable Model

- 1.2. Rechargeable but Disposable Cartomizer

- 1.3. Personalized Vaporizer

-

2. Battery Mode

- 2.1. Automatic E-cigarette

- 2.2. Manual E-cigarette

-

3. Geography

- 3.1. Chile

- 3.2. Ecuador

- 3.3. Honduras

- 3.4. Paraguay

- 3.5. Costa Rica

- 3.6. Rest of Latin America

Cigarette in Latin Industry Segmentation By Geography

- 1. Chile

- 2. Ecuador

- 3. Honduras

- 4. Paraguay

- 5. Costa Rica

- 6. Rest of Latin America

Cigarette in Latin Industry Regional Market Share

Geographic Coverage of Cigarette in Latin Industry

Cigarette in Latin Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Toward Healthy Lifestyle; Strategic Expansion by Health & Fitness Clubs

- 3.3. Market Restrains

- 3.3.1. Rise in Popularity of Outdoor Activities

- 3.4. Market Trends

- 3.4.1. Rising Prevalence of Smoking among Young Population

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cigarette in Latin Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Completely Disposable Model

- 5.1.2. Rechargeable but Disposable Cartomizer

- 5.1.3. Personalized Vaporizer

- 5.2. Market Analysis, Insights and Forecast - by Battery Mode

- 5.2.1. Automatic E-cigarette

- 5.2.2. Manual E-cigarette

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Chile

- 5.3.2. Ecuador

- 5.3.3. Honduras

- 5.3.4. Paraguay

- 5.3.5. Costa Rica

- 5.3.6. Rest of Latin America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Chile

- 5.4.2. Ecuador

- 5.4.3. Honduras

- 5.4.4. Paraguay

- 5.4.5. Costa Rica

- 5.4.6. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Chile Cigarette in Latin Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Completely Disposable Model

- 6.1.2. Rechargeable but Disposable Cartomizer

- 6.1.3. Personalized Vaporizer

- 6.2. Market Analysis, Insights and Forecast - by Battery Mode

- 6.2.1. Automatic E-cigarette

- 6.2.2. Manual E-cigarette

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Chile

- 6.3.2. Ecuador

- 6.3.3. Honduras

- 6.3.4. Paraguay

- 6.3.5. Costa Rica

- 6.3.6. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Ecuador Cigarette in Latin Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Completely Disposable Model

- 7.1.2. Rechargeable but Disposable Cartomizer

- 7.1.3. Personalized Vaporizer

- 7.2. Market Analysis, Insights and Forecast - by Battery Mode

- 7.2.1. Automatic E-cigarette

- 7.2.2. Manual E-cigarette

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Chile

- 7.3.2. Ecuador

- 7.3.3. Honduras

- 7.3.4. Paraguay

- 7.3.5. Costa Rica

- 7.3.6. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Honduras Cigarette in Latin Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Completely Disposable Model

- 8.1.2. Rechargeable but Disposable Cartomizer

- 8.1.3. Personalized Vaporizer

- 8.2. Market Analysis, Insights and Forecast - by Battery Mode

- 8.2.1. Automatic E-cigarette

- 8.2.2. Manual E-cigarette

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Chile

- 8.3.2. Ecuador

- 8.3.3. Honduras

- 8.3.4. Paraguay

- 8.3.5. Costa Rica

- 8.3.6. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Paraguay Cigarette in Latin Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Completely Disposable Model

- 9.1.2. Rechargeable but Disposable Cartomizer

- 9.1.3. Personalized Vaporizer

- 9.2. Market Analysis, Insights and Forecast - by Battery Mode

- 9.2.1. Automatic E-cigarette

- 9.2.2. Manual E-cigarette

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Chile

- 9.3.2. Ecuador

- 9.3.3. Honduras

- 9.3.4. Paraguay

- 9.3.5. Costa Rica

- 9.3.6. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Costa Rica Cigarette in Latin Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Completely Disposable Model

- 10.1.2. Rechargeable but Disposable Cartomizer

- 10.1.3. Personalized Vaporizer

- 10.2. Market Analysis, Insights and Forecast - by Battery Mode

- 10.2.1. Automatic E-cigarette

- 10.2.2. Manual E-cigarette

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Chile

- 10.3.2. Ecuador

- 10.3.3. Honduras

- 10.3.4. Paraguay

- 10.3.5. Costa Rica

- 10.3.6. Rest of Latin America

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Rest of Latin America Cigarette in Latin Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Completely Disposable Model

- 11.1.2. Rechargeable but Disposable Cartomizer

- 11.1.3. Personalized Vaporizer

- 11.2. Market Analysis, Insights and Forecast - by Battery Mode

- 11.2.1. Automatic E-cigarette

- 11.2.2. Manual E-cigarette

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. Chile

- 11.3.2. Ecuador

- 11.3.3. Honduras

- 11.3.4. Paraguay

- 11.3.5. Costa Rica

- 11.3.6. Rest of Latin America

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Shenzhen IVPS Technology Corporation Ltd (Smok)

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Shenzhen Kanger Technology Co Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 NicQuid LLC

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Nicotek LLC*List Not Exhaustive

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 British American Tobacco PLC

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Innokin Technology

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Philip Morris International Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Japan Tobacco Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 NJOY Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 International Vapor Group

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Shenzhen IVPS Technology Corporation Ltd (Smok)

List of Figures

- Figure 1: Global Cigarette in Latin Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Chile Cigarette in Latin Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: Chile Cigarette in Latin Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Chile Cigarette in Latin Industry Revenue (billion), by Battery Mode 2025 & 2033

- Figure 5: Chile Cigarette in Latin Industry Revenue Share (%), by Battery Mode 2025 & 2033

- Figure 6: Chile Cigarette in Latin Industry Revenue (billion), by Geography 2025 & 2033

- Figure 7: Chile Cigarette in Latin Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 8: Chile Cigarette in Latin Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Chile Cigarette in Latin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Ecuador Cigarette in Latin Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 11: Ecuador Cigarette in Latin Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Ecuador Cigarette in Latin Industry Revenue (billion), by Battery Mode 2025 & 2033

- Figure 13: Ecuador Cigarette in Latin Industry Revenue Share (%), by Battery Mode 2025 & 2033

- Figure 14: Ecuador Cigarette in Latin Industry Revenue (billion), by Geography 2025 & 2033

- Figure 15: Ecuador Cigarette in Latin Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Ecuador Cigarette in Latin Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Ecuador Cigarette in Latin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Honduras Cigarette in Latin Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 19: Honduras Cigarette in Latin Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Honduras Cigarette in Latin Industry Revenue (billion), by Battery Mode 2025 & 2033

- Figure 21: Honduras Cigarette in Latin Industry Revenue Share (%), by Battery Mode 2025 & 2033

- Figure 22: Honduras Cigarette in Latin Industry Revenue (billion), by Geography 2025 & 2033

- Figure 23: Honduras Cigarette in Latin Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Honduras Cigarette in Latin Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Honduras Cigarette in Latin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Paraguay Cigarette in Latin Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Paraguay Cigarette in Latin Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Paraguay Cigarette in Latin Industry Revenue (billion), by Battery Mode 2025 & 2033

- Figure 29: Paraguay Cigarette in Latin Industry Revenue Share (%), by Battery Mode 2025 & 2033

- Figure 30: Paraguay Cigarette in Latin Industry Revenue (billion), by Geography 2025 & 2033

- Figure 31: Paraguay Cigarette in Latin Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Paraguay Cigarette in Latin Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Paraguay Cigarette in Latin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Costa Rica Cigarette in Latin Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 35: Costa Rica Cigarette in Latin Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Costa Rica Cigarette in Latin Industry Revenue (billion), by Battery Mode 2025 & 2033

- Figure 37: Costa Rica Cigarette in Latin Industry Revenue Share (%), by Battery Mode 2025 & 2033

- Figure 38: Costa Rica Cigarette in Latin Industry Revenue (billion), by Geography 2025 & 2033

- Figure 39: Costa Rica Cigarette in Latin Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Costa Rica Cigarette in Latin Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Costa Rica Cigarette in Latin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Rest of Latin America Cigarette in Latin Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 43: Rest of Latin America Cigarette in Latin Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 44: Rest of Latin America Cigarette in Latin Industry Revenue (billion), by Battery Mode 2025 & 2033

- Figure 45: Rest of Latin America Cigarette in Latin Industry Revenue Share (%), by Battery Mode 2025 & 2033

- Figure 46: Rest of Latin America Cigarette in Latin Industry Revenue (billion), by Geography 2025 & 2033

- Figure 47: Rest of Latin America Cigarette in Latin Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 48: Rest of Latin America Cigarette in Latin Industry Revenue (billion), by Country 2025 & 2033

- Figure 49: Rest of Latin America Cigarette in Latin Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cigarette in Latin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Cigarette in Latin Industry Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 3: Global Cigarette in Latin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Global Cigarette in Latin Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Cigarette in Latin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global Cigarette in Latin Industry Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 7: Global Cigarette in Latin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Global Cigarette in Latin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Cigarette in Latin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: Global Cigarette in Latin Industry Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 11: Global Cigarette in Latin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global Cigarette in Latin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Cigarette in Latin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Global Cigarette in Latin Industry Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 15: Global Cigarette in Latin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Global Cigarette in Latin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Cigarette in Latin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Global Cigarette in Latin Industry Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 19: Global Cigarette in Latin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Global Cigarette in Latin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Cigarette in Latin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Global Cigarette in Latin Industry Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 23: Global Cigarette in Latin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Global Cigarette in Latin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Global Cigarette in Latin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: Global Cigarette in Latin Industry Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 27: Global Cigarette in Latin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Global Cigarette in Latin Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cigarette in Latin Industry?

The projected CAGR is approximately 2.6%.

2. Which companies are prominent players in the Cigarette in Latin Industry?

Key companies in the market include Shenzhen IVPS Technology Corporation Ltd (Smok), Shenzhen Kanger Technology Co Ltd, NicQuid LLC, Nicotek LLC*List Not Exhaustive, British American Tobacco PLC, Innokin Technology, Philip Morris International Inc, Japan Tobacco Inc, NJOY Inc, International Vapor Group.

3. What are the main segments of the Cigarette in Latin Industry?

The market segments include Product Type, Battery Mode, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 988.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Inclination Toward Healthy Lifestyle; Strategic Expansion by Health & Fitness Clubs.

6. What are the notable trends driving market growth?

Rising Prevalence of Smoking among Young Population.

7. Are there any restraints impacting market growth?

Rise in Popularity of Outdoor Activities.

8. Can you provide examples of recent developments in the market?

August 2022: SMOK, the brand from Shenzhen IVPS Technology, which specializes in the research, development, production, and sale of e-cigarettes, launched its new SOLUS 2 series. After nearly 200 days in development, the SOLUS 2 has come to represent improved vaping experiences and cost-effectiveness for vapers worldwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cigarette in Latin Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cigarette in Latin Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cigarette in Latin Industry?

To stay informed about further developments, trends, and reports in the Cigarette in Latin Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence