Key Insights

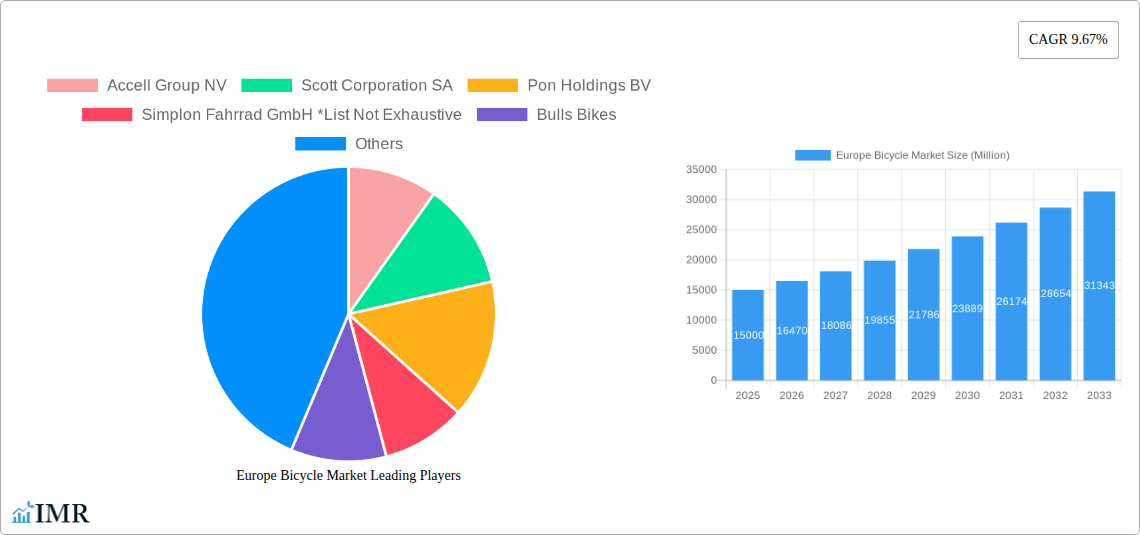

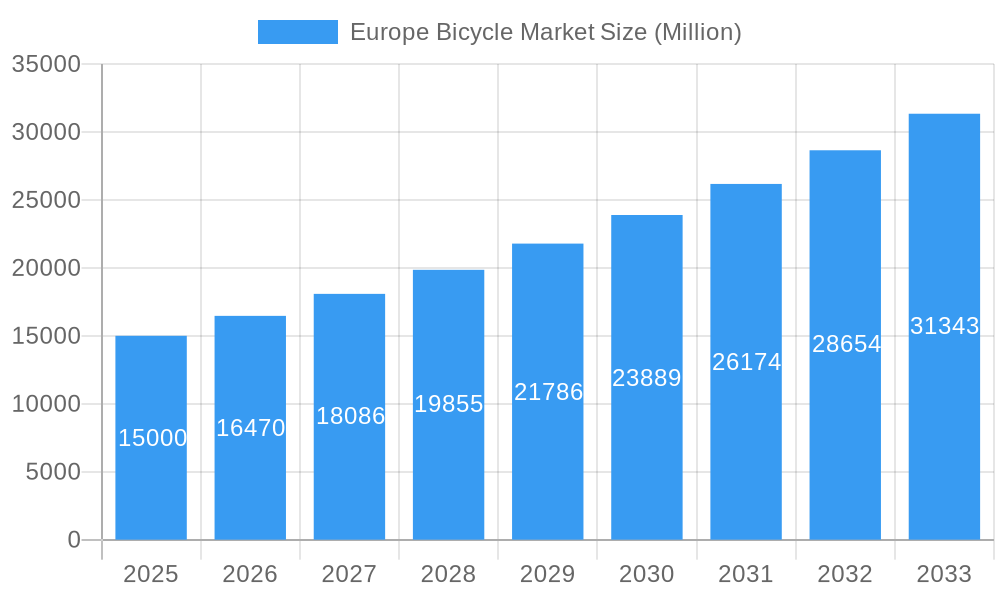

The European bicycle market, projected to reach $24406 million by 2025, is set for substantial growth with a Compound Annual Growth Rate (CAGR) of 11.4% from 2025 to 2033. This expansion is driven by increasing environmental consciousness and the widespread adoption of sustainable transportation methods, especially in urban centers. Government investments in cycling infrastructure and supportive policies further accelerate this trend. The burgeoning popularity of e-bikes, enhancing accessibility and user experience, is a key growth catalyst, broadening the market appeal across diverse demographics. Market segmentation shows strong performance across road, hybrid, and all-terrain bicycles, with e-bikes exhibiting exceptional growth. Online retail channels are increasingly complementing traditional brick-and-mortar stores. Prominent manufacturers like Accell Group NV, Giant Manufacturing Co Ltd, and Trek Bicycle Corporation are instrumental in shaping the market through innovation and strategic initiatives.

Europe Bicycle Market Market Size (In Billion)

Despite a positive growth trajectory, the European bicycle market encounters challenges including raw material price volatility and supply chain complexities. Intense competition necessitates ongoing product development and robust marketing. Seasonal demand fluctuations and potential economic downturns may also affect consumer spending. Nevertheless, the market's long-term outlook remains optimistic, bolstered by persistent environmental awareness, advancements in e-bike technology, and continued infrastructure development in key European markets such as Germany, France, the United Kingdom, and the Netherlands.

Europe Bicycle Market Company Market Share

Europe Bicycle Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe bicycle market, covering market dynamics, growth trends, dominant segments, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals seeking to understand and capitalize on the opportunities within this dynamic market. The report analyzes the parent market (Bicycle Market) and its child markets (Road Bicycles, E-Bicycles, Hybrid Bicycles, etc.) to provide a granular view of the landscape. The total market size is estimated at xx Million units in 2025.

Europe Bicycle Market Market Dynamics & Structure

The European bicycle market is characterized by a moderately concentrated structure, with several major players like Accell Group NV, Scott Corporation SA, Pon Holdings BV, and Giant Manufacturing Co Ltd holding significant market share. However, the market also features a number of smaller, specialized brands catering to niche segments. Technological innovation, particularly in e-bicycle technology and materials science, is a key driver of market growth. Stringent regulatory frameworks concerning product safety and environmental impact are shaping manufacturing and distribution practices. The market faces competition from substitute modes of transportation, such as electric scooters and public transport, particularly in urban areas. End-user demographics are diversifying, with increased participation from older age groups and a growing focus on cycling for fitness and leisure. The market has witnessed a moderate level of M&A activity in recent years, with strategic acquisitions aimed at expanding product portfolios and market reach.

- Market Concentration: Moderately concentrated, with top players holding approximately xx% of market share in 2025.

- Technological Innovation: Focus on lighter materials, improved battery technology for e-bikes, and smart bike features are driving innovation.

- Regulatory Framework: EU regulations on product safety and environmental sustainability are impacting manufacturing and distribution.

- Competitive Substitutes: Electric scooters, public transportation, and automobiles pose competition.

- End-User Demographics: Growing participation from older age groups and fitness enthusiasts.

- M&A Trends: Strategic acquisitions focusing on e-bike technology and market expansion. Estimated xx M&A deals between 2019-2024.

Europe Bicycle Market Growth Trends & Insights

The European bicycle market experienced significant growth during the historical period (2019-2024), driven by increased consumer interest in fitness, environmental awareness, and government initiatives promoting cycling as a sustainable mode of transportation. The market size expanded from xx Million units in 2019 to xx Million units in 2024, exhibiting a CAGR of xx%. The adoption rate of e-bicycles is particularly high, fuelled by technological advancements and government subsidies. Technological disruptions, including the development of advanced e-bike systems and smart bike technologies, are creating new market segments and driving demand. Consumer behavior shifts towards eco-conscious choices and health-focused lifestyles have further bolstered market growth. The forecast period (2025-2033) is expected to see continued growth, albeit at a slightly moderated pace, driven by the increasing popularity of cycling tourism and urban cycling initiatives. Market penetration is expected to reach xx% by 2033.

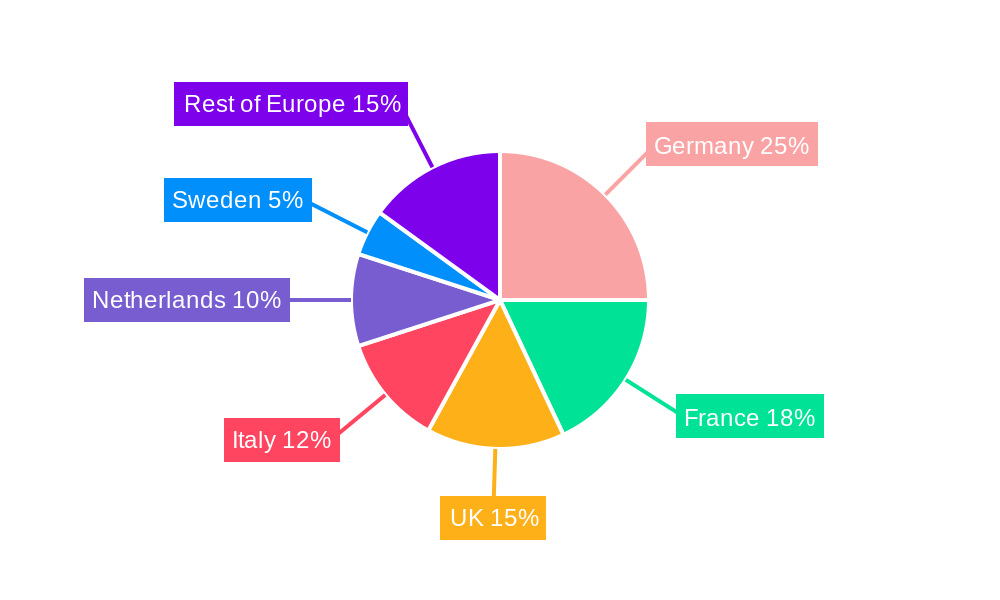

Dominant Regions, Countries, or Segments in Europe Bicycle Market

Germany, France, and the United Kingdom are the leading markets in Europe, driven by strong consumer demand, well-developed cycling infrastructure, and supportive government policies. The e-bicycle segment is experiencing the fastest growth across all regions, followed by hybrid bicycles. Offline retail stores remain the dominant distribution channel, although online sales are steadily increasing.

Key Drivers:

- Germany: Strong domestic manufacturing base, high disposable income, and well-established cycling culture.

- France: Growing popularity of cycling for commuting and leisure, supportive government initiatives.

- United Kingdom: Increased focus on urban cycling, government investment in cycling infrastructure.

- E-bike Segment: Technological advancements, government subsidies, and increasing consumer preference for e-bikes.

- Offline Retail: Established retail network, customer preference for in-person product experience.

Market Share & Growth Potential: Germany holds the largest market share, followed by France and the UK. Southern European countries offer significant growth potential due to increasing adoption of cycling.

Europe Bicycle Market Product Landscape

The European bicycle market offers a diverse range of products, from traditional road bicycles and mountain bikes to technologically advanced e-bicycles with integrated GPS and connectivity features. Manufacturers are increasingly focusing on lightweight materials, improved component design, and enhanced safety features to cater to diverse consumer preferences. Unique selling propositions include advanced suspension systems, integrated lighting, and customizable features. Technological advancements are primarily focused on battery technology, motor efficiency, and connectivity.

Key Drivers, Barriers & Challenges in Europe Bicycle Market

Key Drivers:

- Growing environmental awareness and the adoption of sustainable commuting options.

- Increased health consciousness and the popularity of cycling for fitness.

- Government initiatives promoting cycling infrastructure and e-bike adoption.

- Technological advancements leading to improved bicycle performance and features.

Key Challenges:

- Supply chain disruptions impacting component availability and production costs.

- Rising raw material prices impacting overall bicycle costs.

- Intense competition among established and emerging players.

- Regulatory hurdles and safety standards impacting product development and market access. (e.g., xx% increase in regulatory compliance costs since 2019).

Emerging Opportunities in Europe Bicycle Market

- Growing demand for specialized bicycles for specific activities like gravel cycling and urban commuting.

- Expansion of the bicycle-sharing and rental market.

- Integration of smart technologies into bicycles, including connectivity and data analytics.

- Development of innovative bicycle accessories and components.

Growth Accelerators in the Europe Bicycle Market Industry

Technological breakthroughs in e-bike battery technology and motor efficiency are driving market growth. Strategic partnerships between bicycle manufacturers and technology companies are fueling innovation and market expansion. Government initiatives to promote cycling as a sustainable mode of transportation, including subsidies and infrastructure development, are acting as strong catalysts. The expansion of bicycle tourism and the growing popularity of cycling events further boost market growth.

Key Players Shaping the Europe Bicycle Market Market

- Accell Group NV

- Scott Corporation SA

- Pon Holdings BV

- Simplon Fahrrad GmbH

- Bulls Bikes

- Merida Industry Co Ltd

- Giant Manufacturing Co Ltd

- Ribble Cycles

- Trek Bicycle Corporation

- Riese und Muller GmbH

Notable Milestones in Europe Bicycle Market Sector

- September 2022: Pon Bike acquired the Dutch e-bike brand Veloretti, expanding its presence in the European e-bike market.

- September 2022: The Accell Group's Haibike brand launched the Lyke eMTB, a new e-mountain bike with a removable battery, strengthening its position in the e-bike segment.

- October 2022: Pon Holdings' Cervélo launched the ZHT-5, a lightweight cross-country mountain bike designed for competitive racing, highlighting innovation in high-performance bicycles.

In-Depth Europe Bicycle Market Market Outlook

The European bicycle market is poised for continued growth driven by sustained demand for e-bikes, expansion of cycling infrastructure, and increasing consumer preference for sustainable and healthy transportation options. Strategic opportunities lie in leveraging technological advancements to develop innovative products, expanding into emerging markets, and focusing on sustainable manufacturing practices. The market is expected to witness a CAGR of xx% during the forecast period, driven by these factors, resulting in a market size of xx Million units by 2033.

Europe Bicycle Market Segmentation

-

1. Type

- 1.1. Road Bicycles

- 1.2. Hybrid Bicycles

- 1.3. All Terrain Bicycles

- 1.4. E-bicycles

- 1.5. Other Types

-

2. Distribution Channel

- 2.1. Offline Retail Stores

- 2.2. Online Retail Stores

Europe Bicycle Market Segmentation By Geography

- 1. Spain

- 2. United Kingdom

- 3. Germany

- 4. France

- 5. Italy

- 6. Netherlands

- 7. Rest of Europe

Europe Bicycle Market Regional Market Share

Geographic Coverage of Europe Bicycle Market

Europe Bicycle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Cycling Events; Growing Health Conscious and Environmentally Friendly Population

- 3.3. Market Restrains

- 3.3.1. Availability of Alternative Transport Solutions

- 3.4. Market Trends

- 3.4.1. Increasing Number of Cycling Events

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Bicycle Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Road Bicycles

- 5.1.2. Hybrid Bicycles

- 5.1.3. All Terrain Bicycles

- 5.1.4. E-bicycles

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline Retail Stores

- 5.2.2. Online Retail Stores

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.3.2. United Kingdom

- 5.3.3. Germany

- 5.3.4. France

- 5.3.5. Italy

- 5.3.6. Netherlands

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Spain Europe Bicycle Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Road Bicycles

- 6.1.2. Hybrid Bicycles

- 6.1.3. All Terrain Bicycles

- 6.1.4. E-bicycles

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Offline Retail Stores

- 6.2.2. Online Retail Stores

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Europe Bicycle Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Road Bicycles

- 7.1.2. Hybrid Bicycles

- 7.1.3. All Terrain Bicycles

- 7.1.4. E-bicycles

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Offline Retail Stores

- 7.2.2. Online Retail Stores

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Germany Europe Bicycle Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Road Bicycles

- 8.1.2. Hybrid Bicycles

- 8.1.3. All Terrain Bicycles

- 8.1.4. E-bicycles

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Offline Retail Stores

- 8.2.2. Online Retail Stores

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. France Europe Bicycle Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Road Bicycles

- 9.1.2. Hybrid Bicycles

- 9.1.3. All Terrain Bicycles

- 9.1.4. E-bicycles

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Offline Retail Stores

- 9.2.2. Online Retail Stores

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Italy Europe Bicycle Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Road Bicycles

- 10.1.2. Hybrid Bicycles

- 10.1.3. All Terrain Bicycles

- 10.1.4. E-bicycles

- 10.1.5. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Offline Retail Stores

- 10.2.2. Online Retail Stores

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Netherlands Europe Bicycle Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Road Bicycles

- 11.1.2. Hybrid Bicycles

- 11.1.3. All Terrain Bicycles

- 11.1.4. E-bicycles

- 11.1.5. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Offline Retail Stores

- 11.2.2. Online Retail Stores

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Europe Europe Bicycle Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Road Bicycles

- 12.1.2. Hybrid Bicycles

- 12.1.3. All Terrain Bicycles

- 12.1.4. E-bicycles

- 12.1.5. Other Types

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. Offline Retail Stores

- 12.2.2. Online Retail Stores

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Accell Group NV

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Scott Corporation SA

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Pon Holdings BV

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Simplon Fahrrad GmbH *List Not Exhaustive

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Bulls Bikes

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Merida Industry Co Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Giant Manufacturing Co Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Ribble Cycles

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Trek Bicycle Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Riese und Muller GmbH

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Accell Group NV

List of Figures

- Figure 1: Europe Bicycle Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Bicycle Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Bicycle Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Europe Bicycle Market Volume K Units Forecast, by Type 2020 & 2033

- Table 3: Europe Bicycle Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Europe Bicycle Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 5: Europe Bicycle Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Europe Bicycle Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Europe Bicycle Market Revenue million Forecast, by Type 2020 & 2033

- Table 8: Europe Bicycle Market Volume K Units Forecast, by Type 2020 & 2033

- Table 9: Europe Bicycle Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Europe Bicycle Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 11: Europe Bicycle Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: Europe Bicycle Market Volume K Units Forecast, by Country 2020 & 2033

- Table 13: Europe Bicycle Market Revenue million Forecast, by Type 2020 & 2033

- Table 14: Europe Bicycle Market Volume K Units Forecast, by Type 2020 & 2033

- Table 15: Europe Bicycle Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 16: Europe Bicycle Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 17: Europe Bicycle Market Revenue million Forecast, by Country 2020 & 2033

- Table 18: Europe Bicycle Market Volume K Units Forecast, by Country 2020 & 2033

- Table 19: Europe Bicycle Market Revenue million Forecast, by Type 2020 & 2033

- Table 20: Europe Bicycle Market Volume K Units Forecast, by Type 2020 & 2033

- Table 21: Europe Bicycle Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Europe Bicycle Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 23: Europe Bicycle Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: Europe Bicycle Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Europe Bicycle Market Revenue million Forecast, by Type 2020 & 2033

- Table 26: Europe Bicycle Market Volume K Units Forecast, by Type 2020 & 2033

- Table 27: Europe Bicycle Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 28: Europe Bicycle Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 29: Europe Bicycle Market Revenue million Forecast, by Country 2020 & 2033

- Table 30: Europe Bicycle Market Volume K Units Forecast, by Country 2020 & 2033

- Table 31: Europe Bicycle Market Revenue million Forecast, by Type 2020 & 2033

- Table 32: Europe Bicycle Market Volume K Units Forecast, by Type 2020 & 2033

- Table 33: Europe Bicycle Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Europe Bicycle Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 35: Europe Bicycle Market Revenue million Forecast, by Country 2020 & 2033

- Table 36: Europe Bicycle Market Volume K Units Forecast, by Country 2020 & 2033

- Table 37: Europe Bicycle Market Revenue million Forecast, by Type 2020 & 2033

- Table 38: Europe Bicycle Market Volume K Units Forecast, by Type 2020 & 2033

- Table 39: Europe Bicycle Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 40: Europe Bicycle Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 41: Europe Bicycle Market Revenue million Forecast, by Country 2020 & 2033

- Table 42: Europe Bicycle Market Volume K Units Forecast, by Country 2020 & 2033

- Table 43: Europe Bicycle Market Revenue million Forecast, by Type 2020 & 2033

- Table 44: Europe Bicycle Market Volume K Units Forecast, by Type 2020 & 2033

- Table 45: Europe Bicycle Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 46: Europe Bicycle Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 47: Europe Bicycle Market Revenue million Forecast, by Country 2020 & 2033

- Table 48: Europe Bicycle Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Bicycle Market?

The projected CAGR is approximately 11.4%.

2. Which companies are prominent players in the Europe Bicycle Market?

Key companies in the market include Accell Group NV, Scott Corporation SA, Pon Holdings BV, Simplon Fahrrad GmbH *List Not Exhaustive, Bulls Bikes, Merida Industry Co Ltd, Giant Manufacturing Co Ltd, Ribble Cycles, Trek Bicycle Corporation, Riese und Muller GmbH.

3. What are the main segments of the Europe Bicycle Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 24406 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Cycling Events; Growing Health Conscious and Environmentally Friendly Population.

6. What are the notable trends driving market growth?

Increasing Number of Cycling Events.

7. Are there any restraints impacting market growth?

Availability of Alternative Transport Solutions.

8. Can you provide examples of recent developments in the market?

October 2022: Pon Holdings' Cervélo launched ZHT-5, a cross-country mountain bike that prioritizes low weight and efficiency. Cervélo claimed that the ZHT-5 is 'purpose-built' for XC racing and will make its race debut at the first round of the XCO World Cups in Valkenburg, Netherlands.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Bicycle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Bicycle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Bicycle Market?

To stay informed about further developments, trends, and reports in the Europe Bicycle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence