Key Insights

The European home fitness equipment market, valued at approximately $11.44 billion in 2025, is projected to grow at a CAGR of 4.49% from 2025 to 2033. This growth is driven by increasing health consciousness and a preference for convenient home workout solutions. The proliferation of smart fitness technology, including connected equipment and digital workout platforms, is enhancing user engagement and market appeal. The ease of access and flexibility offered by home fitness are particularly attractive to busy individuals. However, potential constraints include the high initial cost of premium equipment and consumer price sensitivity. Competition from affordable alternatives and economic volatility also present challenges.

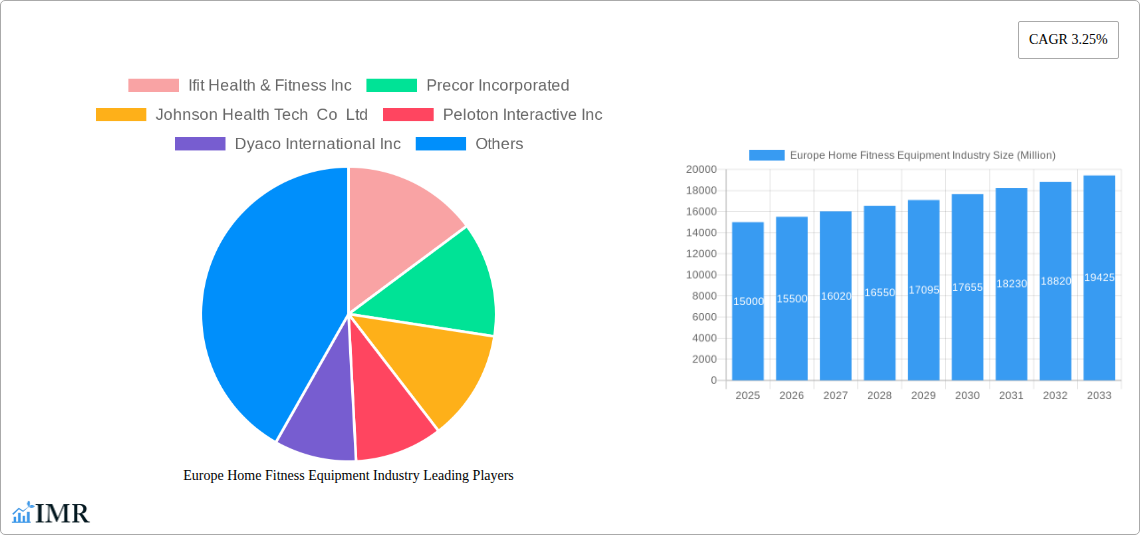

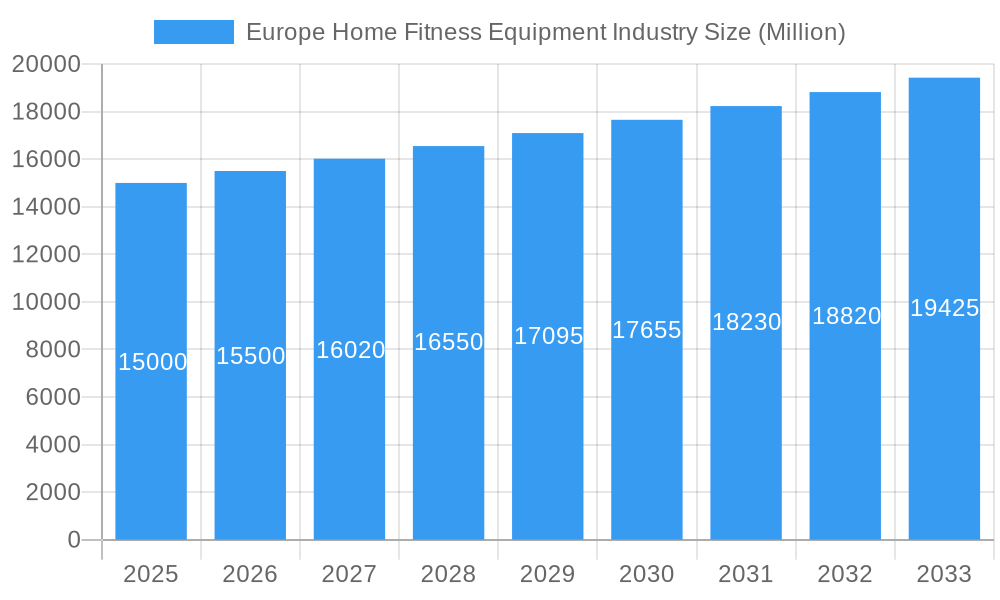

Europe Home Fitness Equipment Industry Market Size (In Billion)

The market is segmented by product type (treadmills, ellipticals, stationary cycles, rowing machines, strength training equipment, and others) and distribution channel (offline retail, online retail, and direct selling). Leading companies such as Peloton and Life Fitness are actively innovating and forming strategic alliances. Germany, the UK, and France are key regional markets. Continued emphasis on health and wellness, coupled with technological advancements, points to sustained market growth, notwithstanding economic uncertainties.

Europe Home Fitness Equipment Industry Company Market Share

Online retail channels are expected to dominate, offering enhanced convenience and product variety. Product innovation, especially in fitness tracking and personalized training, will be critical. Companies providing value-added services like online coaching and virtual classes will likely capture significant market share. Hybrid business models integrating online and offline strategies will be essential for maximizing reach and customer satisfaction. Market expansion will be influenced by macroeconomic trends, health policies, and effective marketing of home fitness benefits. The strength training equipment segment is anticipated to experience substantial growth due to a heightened awareness of comprehensive fitness.

Europe Home Fitness Equipment Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Europe home fitness equipment market, covering the period 2019-2033. It examines market dynamics, growth trends, key players, and future opportunities within the parent market of sporting goods and the child market of home fitness equipment. The report utilizes data from 2019-2024 (historical period) as a base for projecting market trends up to 2033 (forecast period), with 2025 serving as the base and estimated year. The market size is presented in million units.

Europe Home Fitness Equipment Industry Market Dynamics & Structure

This section analyzes the competitive landscape of the European home fitness equipment market, exploring market concentration, technological advancements, regulatory impacts, substitute products, consumer demographics, and mergers & acquisitions (M&A) activity. The market is characterized by a mix of established international players and regional brands.

- Market Concentration: The market exhibits moderate concentration, with a few major players holding significant market share (estimated at xx%), while numerous smaller companies cater to niche segments.

- Technological Innovation: Continuous innovation in areas like connected fitness, AI-powered training programs, and improved ergonomics drives market growth. However, high R&D costs and integration complexities present barriers to innovation for smaller players.

- Regulatory Framework: EU regulations concerning product safety and consumer protection significantly impact market operations. Compliance requirements influence manufacturing processes and product development.

- Competitive Substitutes: Activities like outdoor sports, gym memberships, and online fitness classes represent alternative options for consumers, impacting market penetration.

- End-User Demographics: The primary consumer demographic consists of health-conscious individuals aged 25-55, with increasing interest from older age groups due to aging populations and focus on wellness.

- M&A Trends: The past five years have seen xx M&A deals in the European home fitness equipment industry, reflecting consolidation efforts among players to expand market reach and product portfolios.

Europe Home Fitness Equipment Industry Growth Trends & Insights

The European home fitness equipment market experienced significant growth during the historical period (2019-2024), driven by factors including rising health awareness, increasing disposable incomes, and the impact of the COVID-19 pandemic. The market size, expressed in million units, showed a CAGR of xx% during this period. The adoption rate of home fitness equipment is expected to remain high as remote work trends persist and demand for convenient workout options grow. The continued integration of smart technology and digital fitness platforms is expected to fuel further market expansion. The market is expected to reach xx million units by 2025 and xx million units by 2033. Consumer behavior shifts toward personalized fitness experiences, demand for high-quality, durable products, and seamless online purchase experiences are key factors driving market growth.

Dominant Regions, Countries, or Segments in Europe Home Fitness Equipment Industry

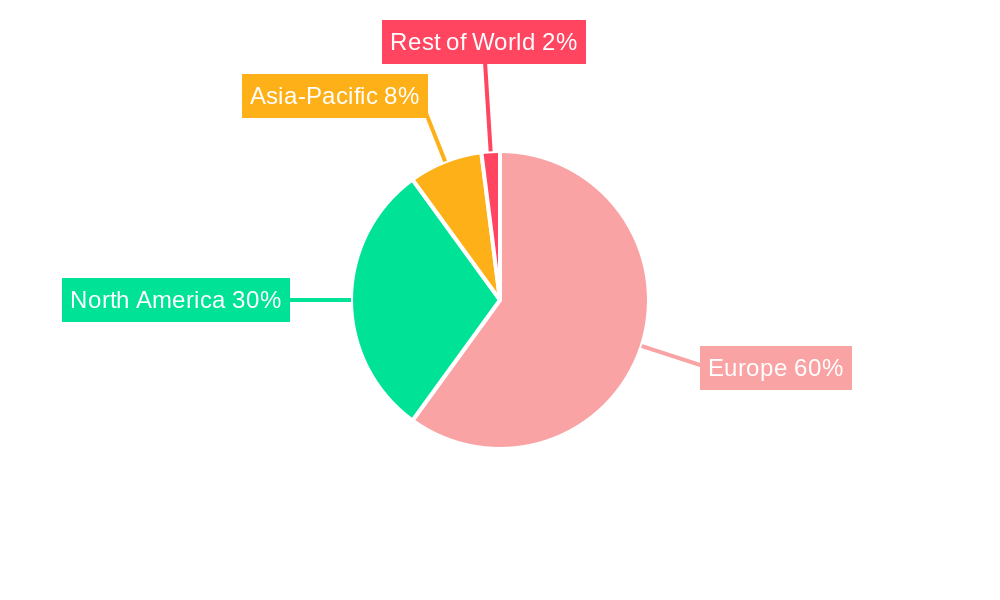

Germany, United Kingdom, and France represent the largest markets within Europe, driving significant growth in the industry. The online retail channel is experiencing rapid expansion, surpassing traditional offline retail stores. Among product types, treadmills maintain the largest market share, followed closely by stationary cycles and strength training equipment.

Key Drivers:

- Strong consumer demand for convenient at-home workout solutions.

- Increasing adoption of connected fitness and digital training.

- Government initiatives promoting healthy lifestyles.

- Growing e-commerce penetration.

Dominance Factors:

- High disposable incomes in key European markets.

- Well-established retail infrastructure.

- Strong focus on health and wellness amongst consumers.

- Extensive technological advancement within the sector.

Europe Home Fitness Equipment Industry Product Landscape

The market offers a wide range of products, from basic treadmills and stationary bikes to advanced, connected fitness solutions. Innovation focuses on user experience improvements, integration of wearables, and personalized training programs using AI and machine learning. Key features include heart rate monitoring, virtual workout experiences, and data tracking capabilities.

Key Drivers, Barriers & Challenges in Europe Home Fitness Equipment Industry

Key Drivers:

- Rising health consciousness and focus on wellness.

- Growing preference for at-home fitness solutions.

- Technological advancements in connected fitness.

- Increasing disposable incomes across key markets.

Key Challenges:

- Intense competition from established and emerging brands.

- High initial investment costs for advanced equipment.

- Potential for supply chain disruptions.

- Ongoing regulatory changes in product safety and consumer protection.

Emerging Opportunities in Europe Home Fitness Equipment Industry

- Expansion into underserved markets within Europe.

- Development of specialized equipment for niche fitness activities.

- Integration of virtual reality and augmented reality technologies.

- Partnerships with fitness apps and digital platforms to enhance user engagement.

Growth Accelerators in the Europe Home Fitness Equipment Industry Industry

Technological innovations, strategic partnerships among brands and fitness apps, and expansion into new markets and product categories are major growth drivers. The increasing focus on virtual and personalized fitness experiences provides further impetus to market expansion. The rise of subscription-based models for connected fitness equipment is also a significant growth accelerator.

Key Players Shaping the Europe Home Fitness Equipment Industry Market

- iFIT Health & Fitness Inc

- Precor Incorporated

- Johnson Health Tech Co Ltd

- Peloton Interactive Inc

- Dyaco International Inc

- Exigo

- Decathlon S A

- Life Fitness

- Nautilus Inc

- Echelon Fitness

- BFT Fitness

- Sprintex Trainingsgeraete GmbH

- Anta Sports Products Limited

Notable Milestones in Europe Home Fitness Equipment Industry Sector

- October 2021: iFIT partnered with major city marathons, expanding its digital content reach.

- July 2022: Sprintex launched the Callis PRO slat-belt treadmill, featuring enhanced performance and biofeedback data.

- November 2022: Peloton partnered with Amazon UK to expand its online sales.

In-Depth Europe Home Fitness Equipment Industry Market Outlook

The European home fitness equipment market exhibits robust growth potential, driven by continuous technological advancements, increasing health awareness, and the enduring popularity of home workouts. Strategic partnerships, product diversification, and expansion into untapped segments will present significant opportunities for companies seeking to thrive in this dynamic market. The continued integration of AI, VR, and personalized fitness programs will further drive market expansion and innovation.

Europe Home Fitness Equipment Industry Segmentation

-

1. Product Type

- 1.1. Treadmills

- 1.2. Elliptical Machines

- 1.3. Stationary Cycles

- 1.4. Rowing Machines

- 1.5. Strength Training Equipment

- 1.6. Other Product Types

-

2. Distribution Channel

- 2.1. Offline Retail Stores

- 2.2. Online Retail Stores

- 2.3. Direct Selling

Europe Home Fitness Equipment Industry Segmentation By Geography

- 1. Spain

- 2. United Kingdom

- 3. France

- 4. Germany

- 5. Russia

- 6. Italy

- 7. Rest of Europe

Europe Home Fitness Equipment Industry Regional Market Share

Geographic Coverage of Europe Home Fitness Equipment Industry

Europe Home Fitness Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.49% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations Leading to Ban on Smokeless Tobacco

- 3.4. Market Trends

- 3.4.1. Consumers Interest in Customized Workout Regimes

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Home Fitness Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Treadmills

- 5.1.2. Elliptical Machines

- 5.1.3. Stationary Cycles

- 5.1.4. Rowing Machines

- 5.1.5. Strength Training Equipment

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline Retail Stores

- 5.2.2. Online Retail Stores

- 5.2.3. Direct Selling

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Germany

- 5.3.5. Russia

- 5.3.6. Italy

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Spain Europe Home Fitness Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Treadmills

- 6.1.2. Elliptical Machines

- 6.1.3. Stationary Cycles

- 6.1.4. Rowing Machines

- 6.1.5. Strength Training Equipment

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Offline Retail Stores

- 6.2.2. Online Retail Stores

- 6.2.3. Direct Selling

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Kingdom Europe Home Fitness Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Treadmills

- 7.1.2. Elliptical Machines

- 7.1.3. Stationary Cycles

- 7.1.4. Rowing Machines

- 7.1.5. Strength Training Equipment

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Offline Retail Stores

- 7.2.2. Online Retail Stores

- 7.2.3. Direct Selling

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France Europe Home Fitness Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Treadmills

- 8.1.2. Elliptical Machines

- 8.1.3. Stationary Cycles

- 8.1.4. Rowing Machines

- 8.1.5. Strength Training Equipment

- 8.1.6. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Offline Retail Stores

- 8.2.2. Online Retail Stores

- 8.2.3. Direct Selling

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Germany Europe Home Fitness Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Treadmills

- 9.1.2. Elliptical Machines

- 9.1.3. Stationary Cycles

- 9.1.4. Rowing Machines

- 9.1.5. Strength Training Equipment

- 9.1.6. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Offline Retail Stores

- 9.2.2. Online Retail Stores

- 9.2.3. Direct Selling

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Russia Europe Home Fitness Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Treadmills

- 10.1.2. Elliptical Machines

- 10.1.3. Stationary Cycles

- 10.1.4. Rowing Machines

- 10.1.5. Strength Training Equipment

- 10.1.6. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Offline Retail Stores

- 10.2.2. Online Retail Stores

- 10.2.3. Direct Selling

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Italy Europe Home Fitness Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Treadmills

- 11.1.2. Elliptical Machines

- 11.1.3. Stationary Cycles

- 11.1.4. Rowing Machines

- 11.1.5. Strength Training Equipment

- 11.1.6. Other Product Types

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Offline Retail Stores

- 11.2.2. Online Retail Stores

- 11.2.3. Direct Selling

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe Europe Home Fitness Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Treadmills

- 12.1.2. Elliptical Machines

- 12.1.3. Stationary Cycles

- 12.1.4. Rowing Machines

- 12.1.5. Strength Training Equipment

- 12.1.6. Other Product Types

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. Offline Retail Stores

- 12.2.2. Online Retail Stores

- 12.2.3. Direct Selling

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Ifit Health & Fitness Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Precor Incorporated

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Johnson Health Tech Co Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Peloton Interactive Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Dyaco International Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Exigo

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Decathlon S A *List Not Exhaustive

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Life Fitness

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Nautilus Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Echelon Fitness

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 BFT Fitness

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Sprintex Trainingsgeraete GmbH

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Anta Sports Products Limited

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.1 Ifit Health & Fitness Inc

List of Figures

- Figure 1: Europe Home Fitness Equipment Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Home Fitness Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Home Fitness Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Europe Home Fitness Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Europe Home Fitness Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Home Fitness Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Europe Home Fitness Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Europe Home Fitness Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Europe Home Fitness Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Europe Home Fitness Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 9: Europe Home Fitness Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Europe Home Fitness Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 11: Europe Home Fitness Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: Europe Home Fitness Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Home Fitness Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Europe Home Fitness Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Europe Home Fitness Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Home Fitness Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 17: Europe Home Fitness Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 18: Europe Home Fitness Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Europe Home Fitness Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: Europe Home Fitness Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 21: Europe Home Fitness Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Europe Home Fitness Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 23: Europe Home Fitness Equipment Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 24: Europe Home Fitness Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Home Fitness Equipment Industry?

The projected CAGR is approximately 4.49%.

2. Which companies are prominent players in the Europe Home Fitness Equipment Industry?

Key companies in the market include Ifit Health & Fitness Inc, Precor Incorporated, Johnson Health Tech Co Ltd, Peloton Interactive Inc, Dyaco International Inc, Exigo, Decathlon S A *List Not Exhaustive, Life Fitness, Nautilus Inc, Echelon Fitness, BFT Fitness, Sprintex Trainingsgeraete GmbH, Anta Sports Products Limited.

3. What are the main segments of the Europe Home Fitness Equipment Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.44 billion as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco.

6. What are the notable trends driving market growth?

Consumers Interest in Customized Workout Regimes.

7. Are there any restraints impacting market growth?

Stringent Government Regulations Leading to Ban on Smokeless Tobacco.

8. Can you provide examples of recent developments in the market?

In November 2022, Peloton Interactive Inc. partnered with Amazon Inc., United Kingdom, to sell its fitness equipment, such as exercise bikes and other accessories, online through Amazon to boost its demand in the region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Home Fitness Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Home Fitness Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Home Fitness Equipment Industry?

To stay informed about further developments, trends, and reports in the Europe Home Fitness Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence