Key Insights

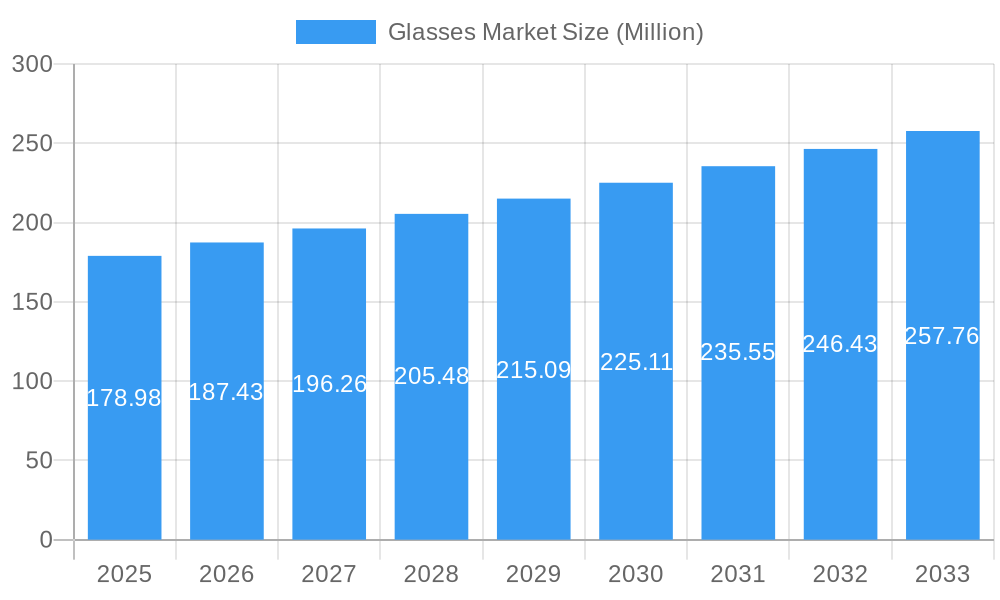

The global glasses market, valued at $178.98 million in 2025, is projected to experience robust growth, driven by several key factors. Increasing myopia rates globally, particularly among younger populations, fuel significant demand for corrective eyewear. The rising adoption of fashionable eyewear, transcending mere corrective needs to become a significant fashion accessory, further boosts market expansion. Technological advancements in lens technology, including progressive lenses and specialized coatings offering improved UV protection and blue light filtering, cater to evolving consumer preferences and health concerns. The growth is further supported by the expanding e-commerce sector, offering increased accessibility and convenience to consumers. While the market faces potential restraints such as fluctuating raw material prices and intense competition, particularly from private label brands, the overall market trajectory remains positive.

Glasses Market Market Size (In Million)

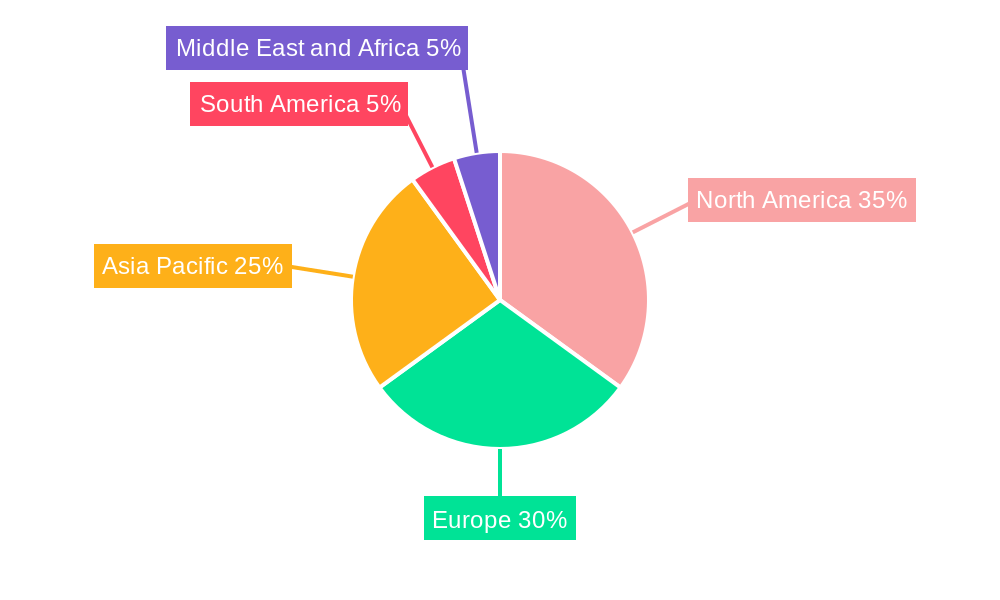

The market segmentation reveals significant opportunities within specific product types and distribution channels. The online channel is experiencing rapid growth, driven by the convenience and wider selection it provides. Within product types, spectacles remain the dominant segment, although sunglasses and contact lenses also contribute significantly. Geographical analysis suggests North America and Europe currently hold substantial market share, while Asia-Pacific presents a high-growth potential region, fueled by increasing disposable incomes and rising awareness of eye health. Companies such as EssilorLuxottica, Johnson & Johnson, and others are actively competing through innovation, strategic acquisitions, and expansion into emerging markets, leading to ongoing market consolidation and diversification of product offerings. The forecast period (2025-2033) anticipates continued expansion driven by the synergistic interplay of these factors.

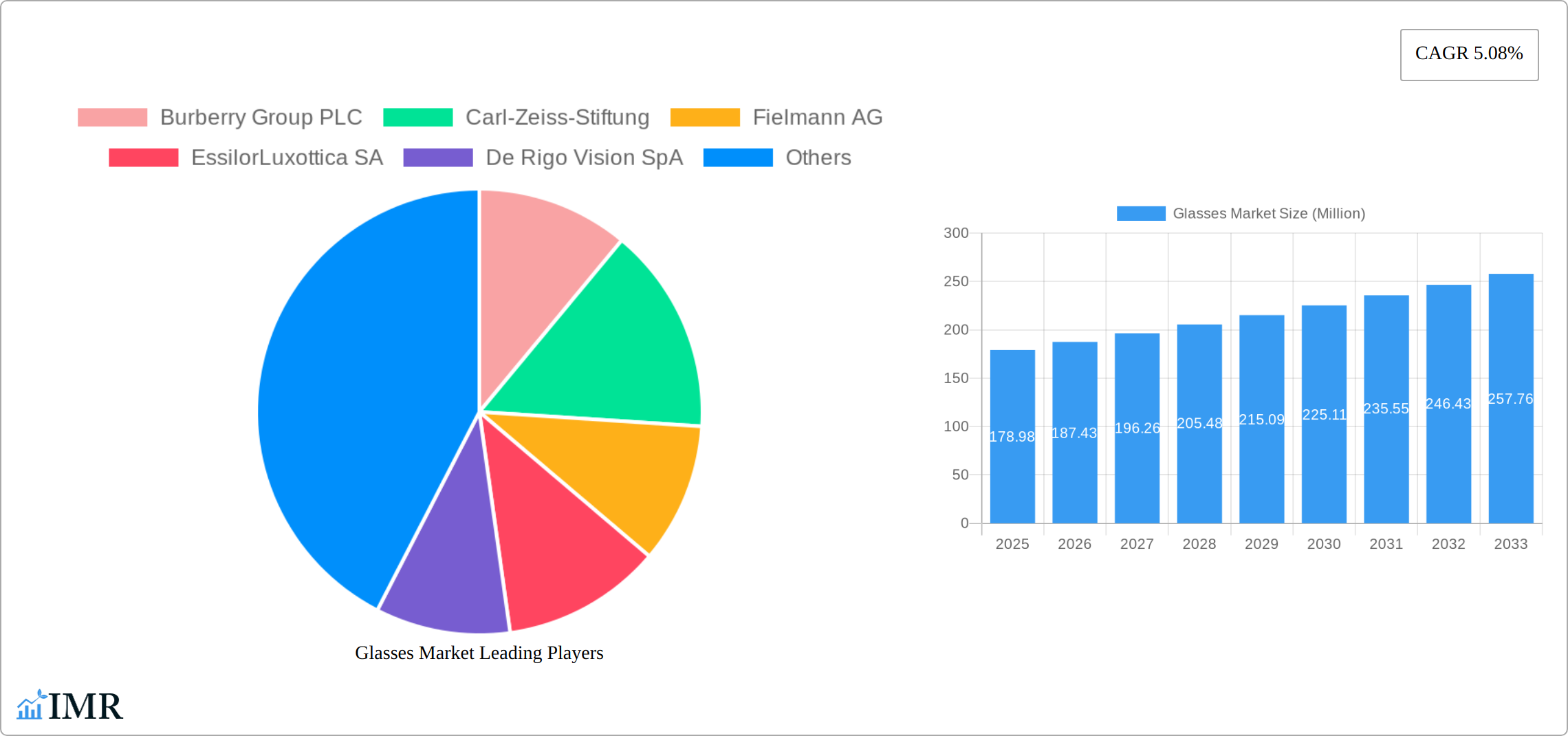

Glasses Market Company Market Share

Glasses Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global Glasses Market, encompassing its current dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is invaluable for industry professionals, investors, and anyone seeking a detailed understanding of this dynamic market. The market is segmented by distribution channel (offline and online) and product type (spectacles, sunglasses, contact lenses, and other product types). The total market size is predicted to reach xx Million units by 2033.

Glasses Market Dynamics & Structure

The global glasses market is characterized by a moderately concentrated structure with key players like EssilorLuxottica SA and Johnson & Johnson Services Inc. holding significant market share. Technological innovation, particularly in lens technology and frame materials, is a major driver, while regulatory frameworks related to safety and prescription accuracy influence market dynamics. Competitive substitutes, such as LASIK surgery, exert pressure, impacting market growth. Consumer demographics, particularly the aging population and increasing awareness of eye health, play a crucial role. The market has witnessed several mergers and acquisitions (M&A) in recent years, with an estimated xx deals completed between 2019 and 2024, primarily driven by expansion strategies and technological synergy.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2024.

- Technological Innovation: Focus on lightweight materials, customizable lenses, and smart glasses technology.

- Regulatory Frameworks: Stringent regulations regarding lens prescription and safety standards.

- Competitive Substitutes: LASIK surgery and other vision correction procedures.

- End-User Demographics: Aging population driving demand for reading glasses and corrective lenses.

- M&A Trends: Strategic acquisitions to expand market reach and product portfolio. xx M&A deals in 2019-2024.

Glasses Market Growth Trends & Insights

The global glasses market is experiencing a period of robust and sustained growth, propelled by a confluence of significant trends. A primary driver is the escalating global prevalence of refractive errors, necessitating corrective eyewear for a larger segment of the population. Simultaneously, rising disposable incomes, particularly in burgeoning developing economies, are empowering consumers to invest in vision correction and fashion-forward eyewear. Furthermore, there's a palpable increase in consumer awareness regarding the importance of comprehensive eye health and regular check-ups, directly translating to higher demand for eyewear products. The market size, estimated at XX Million units in 2025, is forecasted to expand at an impressive Compound Annual Growth Rate (CAGR) of XX% throughout the forecast period, spanning from 2025 to 2033. Market penetration is notably accelerating in emerging markets, where the adoption of both prescription spectacles and stylish sunglasses is on an upward trajectory. The advent and rapid advancement of smart glasses, coupled with a growing consumer appetite for personalized and custom-fit eyewear solutions, are further acting as powerful catalysts for market expansion. Consumer purchasing behaviors are also undergoing a significant transformation, with a pronounced shift towards convenient online retail channels, a strong preference for unique and personalized designs, and an increasing interest in technologically advanced eyewear that offers enhanced functionality and features.

Dominant Regions, Countries, or Segments in Glasses Market

The North American region is currently the dominant market for glasses, driven by high per capita income, widespread availability of eye care facilities, and strong consumer preference for branded eyewear. Within the product types, spectacles dominate with xx% market share in 2024, followed by sunglasses at xx%. The online channel is growing rapidly, with xx% of sales in 2024.

- North America: High per capita income, advanced eye care infrastructure, and strong consumer demand for branded products.

- Europe: Established market with significant demand for prescription glasses and sunglasses.

- Asia Pacific: Rapid growth potential due to rising disposable incomes and expanding middle class.

- Spectacles: Highest market share due to widespread need for vision correction.

- Online Channel: Growing rapidly due to convenience and wider product selection.

Glasses Market Product Landscape

The glasses market showcases continuous product innovation with advancements in lens technology, including progressive lenses, anti-reflective coatings, and blue light filtering. Frame materials are evolving towards lighter, more durable materials like titanium and high-quality plastics. Smart glasses, integrating technology with eyewear, represent a significant emerging segment. Unique selling propositions include customizability, fashionable designs, and enhanced functionality.

Key Drivers, Barriers & Challenges in Glasses Market

Key Drivers: Rising prevalence of refractive errors, increasing disposable incomes, growing awareness of eye health, technological advancements, and favorable government regulations.

Challenges: Intense competition, price sensitivity in some regions, availability of substitutes like LASIK surgery, and supply chain disruptions impacting raw material availability. These factors contribute to a xx% reduction in projected sales in certain regions (e.g., xx).

Emerging Opportunities in Glasses Market

The dynamic glasses market is ripe with untapped potential, presenting a wealth of emerging opportunities. Significant growth avenues lie within underserved developing economies, where a rapidly expanding middle class is increasingly seeking quality eyewear solutions. Product innovation remains a key differentiator, with substantial opportunities in the development of advanced personalized lens technologies that cater to individual vision needs, the burgeoning segment of augmented reality (AR) glasses promising immersive experiences, and the growing demand for sustainable and eco-friendly materials in frame and lens manufacturing. The continued dominance and expansion of online retail platforms further amplify these opportunities, offering broader market reach and direct consumer engagement for brands.

Growth Accelerators in the Glasses Market Industry

The long-term trajectory of the glasses market is poised for significant acceleration, underpinned by several key growth drivers. Foremost among these are continuous technological breakthroughs in sophisticated lens materials and innovative designs, leading to superior optical performance and enhanced comfort. Strategic collaborations and partnerships between established eyewear brands and pioneering technology companies are crucial for the successful launch and widespread adoption of next-generation smart eyewear. Moreover, aggressive expansion into strategically identified emerging markets, with their vast and growing consumer bases, will be instrumental in driving overall market growth and capturing new market share.

Key Players Shaping the Glasses Market Market

- Burberry Group PLC

- Carl-Zeiss-Stiftung

- Fielmann AG

- EssilorLuxottica SA

- De Rigo Vision SpA

- Bausch Health Companies Inc

- Johnson & Johnson Services Inc

- Alcon Laboratories Inc

- Charmant Group

- Safilo Group SpA

- The Cooper Companies Inc

Notable Milestones in Glasses Market Sector

- September 2023: Ray-Ban and EssilorLuxottica launch Ray-Ban Meta smart glasses.

- January 2024: Pair Eyewear partners with National Vision Inc.

- March 2022: Web Eyewear launches new sunglasses collection.

In-Depth Glasses Market Market Outlook

The outlook for the glasses market is exceptionally promising, driven by an unyielding commitment to continuous innovation, the strategic expansion into diverse and growing global markets, and a consistently escalating consumer demand for eyewear that is both highly functional and aesthetically appealing. The proactive forging of strategic alliances and significant investments in cutting-edge technologies are poised to further accelerate market expansion, creating a landscape replete with lucrative opportunities for all industry participants. The ongoing integration of sophisticated smart technologies, coupled with the increasing emphasis on delivering personalized solutions tailored to individual consumer needs, will continue to fundamentally reshape the market's landscape, fostering an environment conducive to differentiation, sustained growth, and unparalleled expansion.

Glasses Market Segmentation

-

1. Product Type

- 1.1. Spectacles

- 1.2. Sunglasses

- 1.3. Contact Lenses

- 1.4. Other Product Types

-

2. End User

- 2.1. Men

- 2.2. Women

- 2.3. Unisex

-

3. Distribution Channel

- 3.1. Offline Channel

- 3.2. Online Channel

Glasses Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Glasses Market Regional Market Share

Geographic Coverage of Glasses Market

Glasses Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.08% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Toward Vegan and Cruelty-free Products; Influence of Social Media on Young Adults

- 3.3. Market Restrains

- 3.3.1. Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Growing Popularity of Sports Sunglasses

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Glasses Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Spectacles

- 5.1.2. Sunglasses

- 5.1.3. Contact Lenses

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Unisex

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Offline Channel

- 5.3.2. Online Channel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Glasses Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Spectacles

- 6.1.2. Sunglasses

- 6.1.3. Contact Lenses

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Unisex

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Offline Channel

- 6.3.2. Online Channel

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Glasses Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Spectacles

- 7.1.2. Sunglasses

- 7.1.3. Contact Lenses

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Unisex

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Offline Channel

- 7.3.2. Online Channel

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Glasses Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Spectacles

- 8.1.2. Sunglasses

- 8.1.3. Contact Lenses

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Unisex

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Offline Channel

- 8.3.2. Online Channel

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Glasses Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Spectacles

- 9.1.2. Sunglasses

- 9.1.3. Contact Lenses

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Men

- 9.2.2. Women

- 9.2.3. Unisex

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Offline Channel

- 9.3.2. Online Channel

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Glasses Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Spectacles

- 10.1.2. Sunglasses

- 10.1.3. Contact Lenses

- 10.1.4. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Men

- 10.2.2. Women

- 10.2.3. Unisex

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Offline Channel

- 10.3.2. Online Channel

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Burberry Group PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Carl-Zeiss-Stiftung

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fielmann AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 EssilorLuxottica SA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 De Rigo Vision SpA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bausch Health Companies Inc *List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Johnson & Johnson Services Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Alcon Laboratories Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Charmant Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Safilo Group SpA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 The Cooper Companies Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Burberry Group PLC

List of Figures

- Figure 1: Global Glasses Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Glasses Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Glasses Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Glasses Market Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Glasses Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Glasses Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: North America Glasses Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Glasses Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Glasses Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Glasses Market Revenue (Million), by Product Type 2025 & 2033

- Figure 11: Europe Glasses Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Glasses Market Revenue (Million), by End User 2025 & 2033

- Figure 13: Europe Glasses Market Revenue Share (%), by End User 2025 & 2033

- Figure 14: Europe Glasses Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: Europe Glasses Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: Europe Glasses Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Glasses Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Glasses Market Revenue (Million), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Glasses Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Glasses Market Revenue (Million), by End User 2025 & 2033

- Figure 21: Asia Pacific Glasses Market Revenue Share (%), by End User 2025 & 2033

- Figure 22: Asia Pacific Glasses Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Asia Pacific Glasses Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Asia Pacific Glasses Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Glasses Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Glasses Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: South America Glasses Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: South America Glasses Market Revenue (Million), by End User 2025 & 2033

- Figure 29: South America Glasses Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: South America Glasses Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 31: South America Glasses Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: South America Glasses Market Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Glasses Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Glasses Market Revenue (Million), by Product Type 2025 & 2033

- Figure 35: Middle East and Africa Glasses Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Middle East and Africa Glasses Market Revenue (Million), by End User 2025 & 2033

- Figure 37: Middle East and Africa Glasses Market Revenue Share (%), by End User 2025 & 2033

- Figure 38: Middle East and Africa Glasses Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Middle East and Africa Glasses Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Middle East and Africa Glasses Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Glasses Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Glasses Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Glasses Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Glasses Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Glasses Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Glasses Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Glasses Market Revenue Million Forecast, by End User 2020 & 2033

- Table 7: Global Glasses Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Glasses Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Glasses Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Glasses Market Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global Glasses Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 16: Global Glasses Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Spain Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Germany Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: France Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Italy Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Russia Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Glasses Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 25: Global Glasses Market Revenue Million Forecast, by End User 2020 & 2033

- Table 26: Global Glasses Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 27: Global Glasses Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: China Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Japan Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: India Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Australia Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Asia Pacific Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Glasses Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 34: Global Glasses Market Revenue Million Forecast, by End User 2020 & 2033

- Table 35: Global Glasses Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 36: Global Glasses Market Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Brazil Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Argentina Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Glasses Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 41: Global Glasses Market Revenue Million Forecast, by End User 2020 & 2033

- Table 42: Global Glasses Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 43: Global Glasses Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: South Africa Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Saudi Arabia Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East and Africa Glasses Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Glasses Market?

The projected CAGR is approximately 5.08%.

2. Which companies are prominent players in the Glasses Market?

Key companies in the market include Burberry Group PLC, Carl-Zeiss-Stiftung, Fielmann AG, EssilorLuxottica SA, De Rigo Vision SpA, Bausch Health Companies Inc *List Not Exhaustive, Johnson & Johnson Services Inc, Alcon Laboratories Inc, Charmant Group, Safilo Group SpA, The Cooper Companies Inc.

3. What are the main segments of the Glasses Market?

The market segments include Product Type, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 178.98 Million as of 2022.

5. What are some drivers contributing to market growth?

Inclination Toward Vegan and Cruelty-free Products; Influence of Social Media on Young Adults.

6. What are the notable trends driving market growth?

Growing Popularity of Sports Sunglasses.

7. Are there any restraints impacting market growth?

Counterfeit Products.

8. Can you provide examples of recent developments in the market?

January 2024: Pair Eyewear, the direct-to-consumer customizable eyewear brand, unveiled a new partnership with National Vision Inc., the second-largest optical retailer in America. The brand stated that this partnership helps introduce affordable bundles, including Pair’s customizable, stylish, and accessible eyewear.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Glasses Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Glasses Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Glasses Market?

To stay informed about further developments, trends, and reports in the Glasses Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence