Key Insights

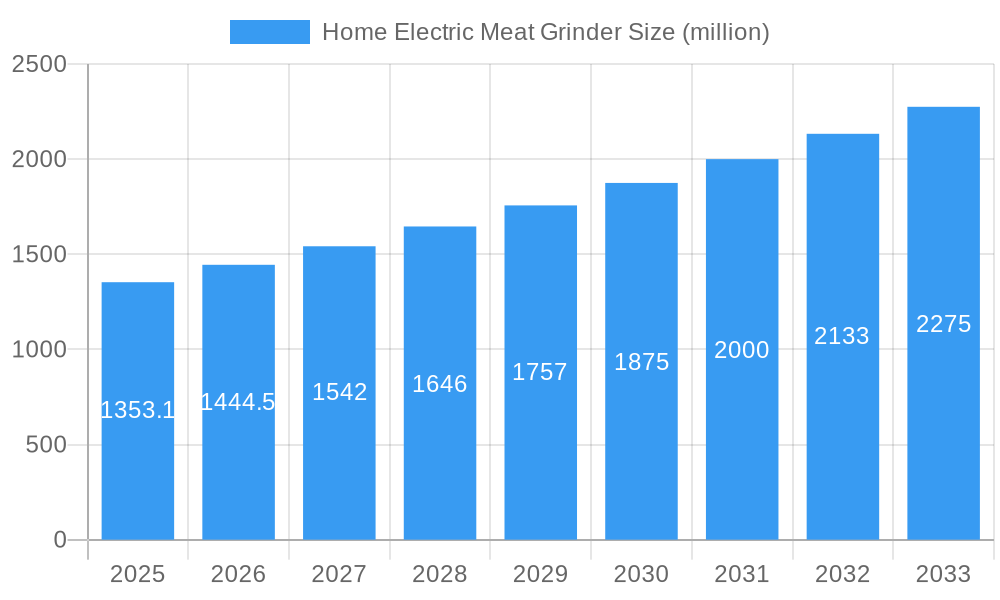

The global Home Electric Meat Grinder market is poised for significant expansion, projected to reach a valuation of 1353.1 million by 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 6.8% from 2019 to 2033, indicating sustained demand for convenient and efficient kitchen appliances. A key driver behind this upward trajectory is the increasing consumer preference for preparing fresh, homemade food, especially meat products, at home. This trend is fueled by heightened awareness regarding food safety and a desire for greater control over ingredients. Furthermore, the rising disposable incomes in emerging economies, coupled with a growing urban population, are contributing to greater accessibility and adoption of such specialized kitchen gadgets. The market is segmented into Online Sales and Offline Sales channels, with online platforms increasingly becoming a dominant force due to convenience and wider product availability. Integrated Type grinders, offering a streamlined user experience, are likely to witness higher adoption compared to Split Type models.

Home Electric Meat Grinder Market Size (In Billion)

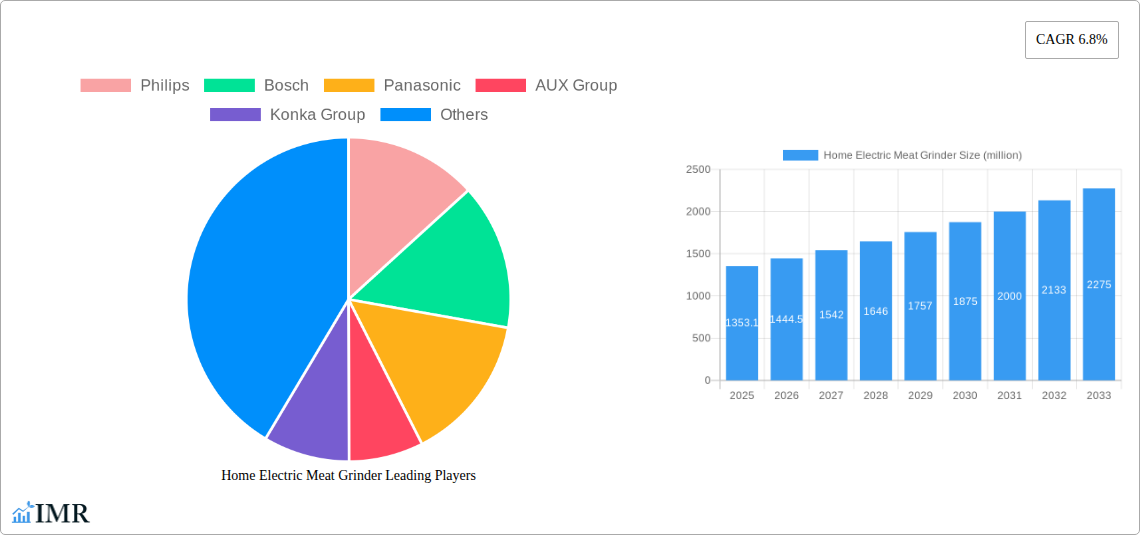

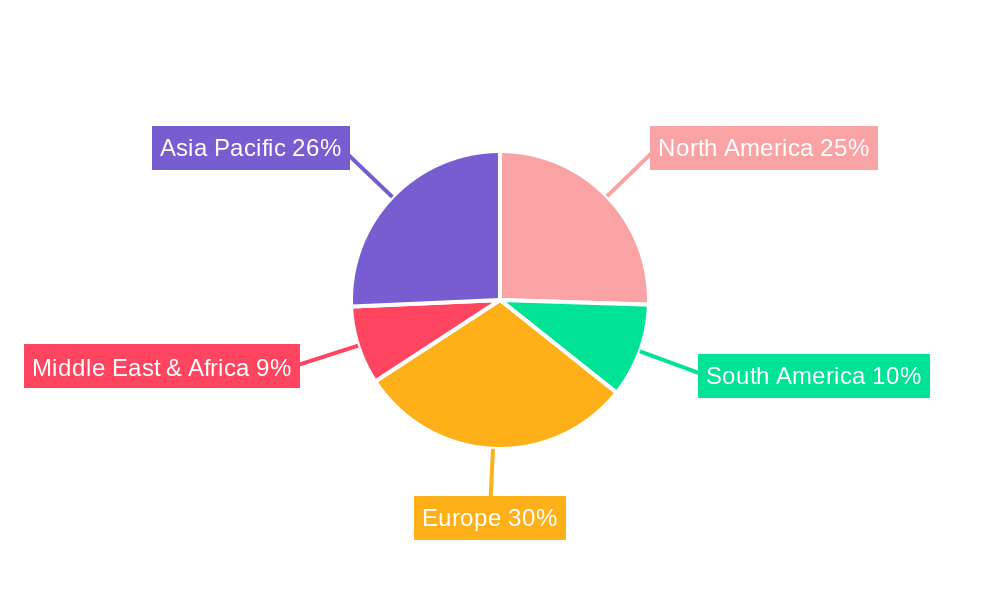

The competitive landscape features prominent players like Philips, Bosch, Panasonic, and Whirlpool, alongside established Chinese brands such as AUX Group and Konka Group, all vying for market share through product innovation and strategic market penetration. Geographically, the Asia Pacific region, particularly China and India, is expected to be a major growth engine, driven by a burgeoning middle class and an increasing interest in modern kitchen appliances. North America and Europe also represent mature yet substantial markets, with consumers seeking advanced features and premium brands. While the market benefits from strong demand drivers, potential restraints could include the initial cost of high-end models and the availability of multi-functional food processors that also offer grinding capabilities. However, the dedicated functionality and enhanced performance of specialized meat grinders are expected to maintain their appeal for a significant consumer base.

Home Electric Meat Grinder Company Market Share

Here's the SEO-optimized report description for the Home Electric Meat Grinder market:

Comprehensive Report: Home Electric Meat Grinder Market Dynamics, Growth Trends, and Future Outlook (2019–2033)

This in-depth market research report provides an exhaustive analysis of the global Home Electric Meat Grinder market, covering detailed dynamics, growth trajectories, regional dominance, product innovations, key drivers, barriers, opportunities, and a comprehensive player landscape. Leveraging extensive data and expert insights, this report is an indispensable resource for industry professionals, investors, and stakeholders seeking to understand and capitalize on the evolving market. The study encompasses the historical period from 2019 to 2024, the base year of 2025, and a detailed forecast period extending to 2033.

Home Electric Meat Grinder Market Dynamics & Structure

The Home Electric Meat Grinder market exhibits a moderately concentrated structure, with a blend of global conglomerates and specialized players vying for market share. Technological innovation is a significant driver, with manufacturers continuously refining motor power, blade efficiency, and ease of cleaning. Regulatory frameworks, particularly concerning food safety and appliance certifications, also shape product development and market entry. Competitive product substitutes, such as manual grinders and professional butchery services, exert some influence, though convenience and cost-effectiveness favor electric grinders for home use. End-user demographics reveal a growing interest among younger, urban households focused on healthy eating and home cooking. Mergers and acquisitions (M&A) trends indicate strategic consolidation to enhance product portfolios and expand market reach. For instance, the acquisition of smaller appliance brands by larger corporations aims to leverage economies of scale and distribution networks. The market share of leading players is estimated to be around xx% in the base year of 2025, with M&A deal volumes projected at xx units annually during the forecast period. Innovation barriers include the high cost of developing advanced features and the need to meet stringent international safety standards.

Home Electric Meat Grinder Growth Trends & Insights

The global Home Electric Meat Grinder market is poised for robust growth, projected to expand significantly from an estimated market size of $xx million units in 2025 to $xx million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. This expansion is fueled by increasing consumer interest in home-cooked meals, a rising emphasis on healthy eating and ingredient control, and the growing popularity of DIY food preparation. Adoption rates are steadily climbing, particularly in developed economies where disposable incomes are higher and consumer preferences lean towards convenience and customization. Technological disruptions, such as the integration of smarter features, quieter motor operation, and more durable materials, are enhancing product appeal and driving upgrades. Consumer behavior shifts, including a growing awareness of food sourcing and a desire to reduce reliance on processed foods, are directly translating into higher demand for home meat grinders. The market penetration is expected to increase from xx% in the base year to xx% by 2033. The surge in online sales channels, coupled with effective digital marketing campaigns highlighting product benefits and recipe ideas, is also a significant contributor to this growth trajectory.

Dominant Regions, Countries, or Segments in Home Electric Meat Grinder

North America currently holds a dominant position in the Home Electric Meat Grinder market, driven by a strong consumer culture around meat consumption, barbecue, and home entertainment. The United States, in particular, represents a significant market share of xx% in the base year of 2025, due to higher disposable incomes and a well-established retail infrastructure. Application: Online Sales is emerging as a critical growth driver, with its share projected to rise from xx% in 2025 to xx% by 2033, facilitated by the widespread adoption of e-commerce platforms and direct-to-consumer strategies by manufacturers. Key drivers in North America include favorable economic policies supporting consumer spending and robust logistics infrastructure that ensures efficient product distribution. The Type: Integrated Type segment accounts for the largest market share, estimated at xx% in 2025, owing to its user-friendly design and often higher power output compared to split types. Growth potential in emerging economies, particularly in Asia-Pacific, is substantial, with countries like China and India showing increasing adoption rates driven by a growing middle class and a rising interest in Western culinary trends. Economic policies in these regions are increasingly focused on boosting domestic manufacturing and consumer spending, further propelling market expansion. The market share of Offline Sales is expected to remain significant, especially in traditional retail markets and for consumers who prefer in-person shopping experiences, holding xx% in 2025.

Home Electric Meat Grinder Product Landscape

The Home Electric Meat Grinder product landscape is characterized by continuous innovation aimed at enhancing user experience and functionality. Key product advancements include more powerful motors for efficient grinding of various meats, improved blade designs for finer or coarser grinds, and enhanced safety features such as overload protection. Durability and ease of cleaning are paramount, with many models now featuring dishwasher-safe components. Applications extend beyond basic meat grinding to include sausage stuffing and making burger patties. Performance metrics like grinding speed (e.g., pounds per minute) and motor wattage are key differentiators. Unique selling propositions often revolve around compact designs for small kitchens, multi-functional attachments, and aesthetically pleasing finishes. Technological advancements are also focusing on noise reduction and energy efficiency. The market is seeing a rise in integrated type grinders with streamlined designs and split type grinders offering greater versatility.

Key Drivers, Barriers & Challenges in Home Electric Meat Grinder

Key Drivers:

- Growing Interest in Home Cooking: Consumers are increasingly opting for home-cooked meals for health, cost, and customization reasons.

- Health and Wellness Trends: A desire for control over ingredients and reduced consumption of processed foods drives demand for grinding fresh meat at home.

- Technological Advancements: Innovations in motor power, blade efficiency, and user-friendly features enhance product appeal.

- Online Retail Expansion: The convenience and accessibility of online sales channels make these appliances more readily available to a wider consumer base.

- Rising Disposable Incomes: Increased purchasing power in developing economies fuels demand for kitchen appliances.

Key Barriers & Challenges:

- Price Sensitivity: Higher-end models with advanced features can be prohibitively expensive for some consumer segments.

- Competition from Alternatives: Manual grinders and professional butchery services offer lower-cost or specialized alternatives.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of raw materials and finished products, estimated to increase production costs by xx% in the event of significant disruptions.

- Brand Loyalty and Perception: Established brands may face challenges in penetrating markets dominated by local or niche players.

- Product Lifespan and Replacement Cycles: The durable nature of these appliances can lead to longer replacement cycles, impacting sustained sales volume.

Emerging Opportunities in Home Electric Meat Grinder

Emerging opportunities in the Home Electric Meat Grinder market lie in tapping into niche culinary trends and expanding into underserved geographical regions. The growing popularity of artisanal sausage making and gourmet burger creation presents a fertile ground for specialized attachments and high-performance grinders. Furthermore, the increasing adoption of smart home technology opens avenues for connected grinders with app-based controls and recipe integration. Untapped markets in developing countries with rising middle classes and a growing interest in Western diets offer significant potential for market penetration. Evolving consumer preferences for sustainable and ethically sourced food also create opportunities for manufacturers to highlight the benefits of home grinding for controlling food quality and reducing waste.

Growth Accelerators in the Home Electric Meat Grinder Industry

Several catalysts are accelerating growth in the Home Electric Meat Grinder industry. Technological breakthroughs in energy-efficient motors and quieter operation are enhancing product appeal and user satisfaction, thus driving upgrades. Strategic partnerships between appliance manufacturers and food bloggers or culinary influencers are proving effective in creating brand awareness and driving consumer adoption. Market expansion strategies, particularly targeting emerging economies through localized marketing campaigns and product adaptations, are unlocking new revenue streams. The increasing emphasis on health and wellness, coupled with a desire for home-based food preparation, serves as a foundational growth accelerator.

Key Players Shaping the Home Electric Meat Grinder Market

- Philips

- Bosch

- Panasonic

- AUX Group

- Konka Group

- LEM Products

- NESCO

- Whirlpool

- Midea

- Joyoung

- SUPOR

- Little Bear Electric Appliance

- Fackelmann

- Cuisinart

- KitchenAid

Notable Milestones in Home Electric Meat Grinder Sector

- 2019: Philips launches its ProMix hand blender series with integrated meat grinding attachment, expanding its culinary appliance range.

- 2020: LEM Products introduces its Pro Series #22 electric meat grinder with enhanced motor power, catering to serious home butchers.

- 2021: Bosch unveils its new generation of kitchen machines featuring improved meat grinding capabilities and enhanced safety features.

- 2022: Midea strategically acquires a stake in a regional appliance manufacturer, aiming to strengthen its presence in emerging Asian markets.

- 2023: Cuisinart releases a compact and powerful electric meat grinder, focusing on ease of use and storage for urban dwellers.

- 2024: NESCO introduces an eco-friendly meat grinder with energy-saving motor technology, aligning with growing consumer demand for sustainable products.

- 2025 (Estimated): Anticipated product launches focusing on smart connectivity and advanced grinding customization features.

In-Depth Home Electric Meat Grinder Market Outlook

The future outlook for the Home Electric Meat Grinder market remains exceptionally bright, driven by sustained consumer interest in home cooking, health consciousness, and ongoing technological innovation. Growth accelerators such as smart kitchen integration and the increasing demand for DIY food preparation will continue to propel market expansion. Strategic partnerships and aggressive market penetration into developing economies will unlock significant untapped potential. The industry is well-positioned to benefit from evolving consumer preferences for quality ingredients and personalized culinary experiences, ensuring a robust and dynamic market trajectory for years to come.

Home Electric Meat Grinder Segmentation

-

1. Application

- 1.1. Online Sales

- 1.2. Offline Sales

-

2. Types

- 2.1. Integrated Type

- 2.2. Split Type

Home Electric Meat Grinder Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Home Electric Meat Grinder Regional Market Share

Geographic Coverage of Home Electric Meat Grinder

Home Electric Meat Grinder REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Home Electric Meat Grinder Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Sales

- 5.1.2. Offline Sales

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Integrated Type

- 5.2.2. Split Type

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Home Electric Meat Grinder Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Sales

- 6.1.2. Offline Sales

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Integrated Type

- 6.2.2. Split Type

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Home Electric Meat Grinder Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Sales

- 7.1.2. Offline Sales

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Integrated Type

- 7.2.2. Split Type

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Home Electric Meat Grinder Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Sales

- 8.1.2. Offline Sales

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Integrated Type

- 8.2.2. Split Type

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Home Electric Meat Grinder Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Sales

- 9.1.2. Offline Sales

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Integrated Type

- 9.2.2. Split Type

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Home Electric Meat Grinder Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Sales

- 10.1.2. Offline Sales

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Integrated Type

- 10.2.2. Split Type

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Philips

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bosch

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Panasonic

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 AUX Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Konka Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LEM Products

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 NESCO

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Whirlpool

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Midea

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Joyoung

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 SUPOR

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Little Bear Electric Appliance

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Fackelmann

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Cuisinart

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 KitchenAid

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Philips

List of Figures

- Figure 1: Global Home Electric Meat Grinder Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Home Electric Meat Grinder Revenue (million), by Application 2025 & 2033

- Figure 3: North America Home Electric Meat Grinder Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Home Electric Meat Grinder Revenue (million), by Types 2025 & 2033

- Figure 5: North America Home Electric Meat Grinder Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Home Electric Meat Grinder Revenue (million), by Country 2025 & 2033

- Figure 7: North America Home Electric Meat Grinder Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Home Electric Meat Grinder Revenue (million), by Application 2025 & 2033

- Figure 9: South America Home Electric Meat Grinder Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Home Electric Meat Grinder Revenue (million), by Types 2025 & 2033

- Figure 11: South America Home Electric Meat Grinder Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Home Electric Meat Grinder Revenue (million), by Country 2025 & 2033

- Figure 13: South America Home Electric Meat Grinder Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Home Electric Meat Grinder Revenue (million), by Application 2025 & 2033

- Figure 15: Europe Home Electric Meat Grinder Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Home Electric Meat Grinder Revenue (million), by Types 2025 & 2033

- Figure 17: Europe Home Electric Meat Grinder Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Home Electric Meat Grinder Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Home Electric Meat Grinder Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Home Electric Meat Grinder Revenue (million), by Application 2025 & 2033

- Figure 21: Middle East & Africa Home Electric Meat Grinder Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Home Electric Meat Grinder Revenue (million), by Types 2025 & 2033

- Figure 23: Middle East & Africa Home Electric Meat Grinder Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Home Electric Meat Grinder Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Home Electric Meat Grinder Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Home Electric Meat Grinder Revenue (million), by Application 2025 & 2033

- Figure 27: Asia Pacific Home Electric Meat Grinder Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Home Electric Meat Grinder Revenue (million), by Types 2025 & 2033

- Figure 29: Asia Pacific Home Electric Meat Grinder Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Home Electric Meat Grinder Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific Home Electric Meat Grinder Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Home Electric Meat Grinder Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Home Electric Meat Grinder Revenue million Forecast, by Types 2020 & 2033

- Table 3: Global Home Electric Meat Grinder Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Home Electric Meat Grinder Revenue million Forecast, by Application 2020 & 2033

- Table 5: Global Home Electric Meat Grinder Revenue million Forecast, by Types 2020 & 2033

- Table 6: Global Home Electric Meat Grinder Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Home Electric Meat Grinder Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Home Electric Meat Grinder Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Home Electric Meat Grinder Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Home Electric Meat Grinder Revenue million Forecast, by Application 2020 & 2033

- Table 11: Global Home Electric Meat Grinder Revenue million Forecast, by Types 2020 & 2033

- Table 12: Global Home Electric Meat Grinder Revenue million Forecast, by Country 2020 & 2033

- Table 13: Brazil Home Electric Meat Grinder Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Home Electric Meat Grinder Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Home Electric Meat Grinder Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global Home Electric Meat Grinder Revenue million Forecast, by Application 2020 & 2033

- Table 17: Global Home Electric Meat Grinder Revenue million Forecast, by Types 2020 & 2033

- Table 18: Global Home Electric Meat Grinder Revenue million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Home Electric Meat Grinder Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Germany Home Electric Meat Grinder Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: France Home Electric Meat Grinder Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Italy Home Electric Meat Grinder Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Spain Home Electric Meat Grinder Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Russia Home Electric Meat Grinder Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Home Electric Meat Grinder Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Home Electric Meat Grinder Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Home Electric Meat Grinder Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global Home Electric Meat Grinder Revenue million Forecast, by Application 2020 & 2033

- Table 29: Global Home Electric Meat Grinder Revenue million Forecast, by Types 2020 & 2033

- Table 30: Global Home Electric Meat Grinder Revenue million Forecast, by Country 2020 & 2033

- Table 31: Turkey Home Electric Meat Grinder Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Israel Home Electric Meat Grinder Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: GCC Home Electric Meat Grinder Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Home Electric Meat Grinder Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Home Electric Meat Grinder Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Home Electric Meat Grinder Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global Home Electric Meat Grinder Revenue million Forecast, by Application 2020 & 2033

- Table 38: Global Home Electric Meat Grinder Revenue million Forecast, by Types 2020 & 2033

- Table 39: Global Home Electric Meat Grinder Revenue million Forecast, by Country 2020 & 2033

- Table 40: China Home Electric Meat Grinder Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: India Home Electric Meat Grinder Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Japan Home Electric Meat Grinder Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Home Electric Meat Grinder Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Home Electric Meat Grinder Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Home Electric Meat Grinder Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Home Electric Meat Grinder Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Home Electric Meat Grinder?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the Home Electric Meat Grinder?

Key companies in the market include Philips, Bosch, Panasonic, AUX Group, Konka Group, LEM Products, NESCO, Whirlpool, Midea, Joyoung, SUPOR, Little Bear Electric Appliance, Fackelmann, Cuisinart, KitchenAid.

3. What are the main segments of the Home Electric Meat Grinder?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 1353.1 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Home Electric Meat Grinder," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Home Electric Meat Grinder report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Home Electric Meat Grinder?

To stay informed about further developments, trends, and reports in the Home Electric Meat Grinder, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence