Key Insights

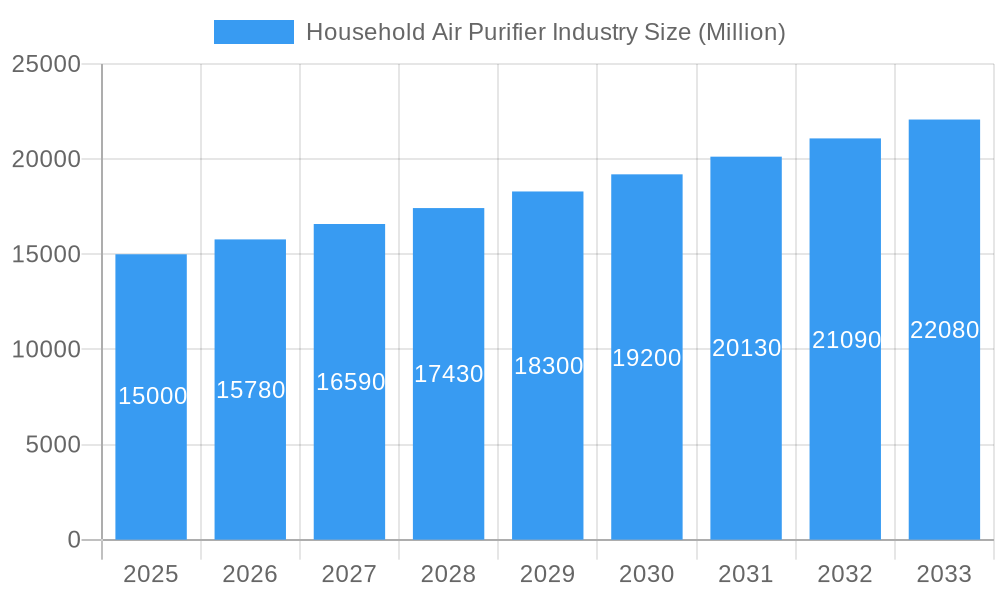

The global Household Air Purifier Industry is poised for robust growth, projecting a substantial market size of XX million in 2025 and expanding at a Compound Annual Growth Rate (CAGR) of 5.38% through 2033. This upward trajectory is primarily propelled by escalating consumer awareness regarding the detrimental health impacts of indoor air pollution. Growing concerns about allergies, respiratory ailments, and the general well-being of families are compelling households worldwide to invest in advanced air purification solutions. The increasing prevalence of airborne contaminants, including dust mites, pollen, pet dander, mold spores, and volatile organic compounds (VOCs) emitted from everyday household products, further fuels this demand. Moreover, the growing trend of urbanization and the subsequent increase in population density in urban areas contribute to poorer indoor air quality, making air purifiers an essential home appliance. Technological advancements, particularly in filtration technologies like High-efficiency Particulate Air (HEPA) filters, which are highly effective in capturing microscopic particles, are also a significant driver. The introduction of smart features and connectivity options, aligning with the smart home ecosystem, is enhancing user convenience and driving adoption.

Household Air Purifier Industry Market Size (In Billion)

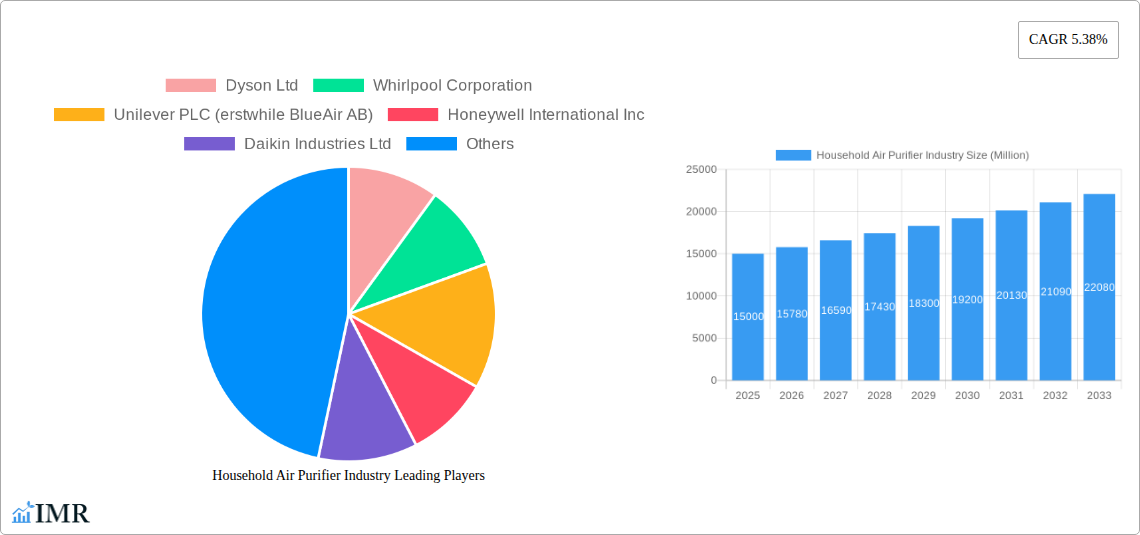

The market dynamics are further shaped by evolving consumer preferences and an increasing focus on health and wellness. The drivers of this market include heightened health consciousness, rising disposable incomes in emerging economies, stringent government regulations promoting indoor air quality, and the increasing incidence of respiratory diseases. The trends observed are the growing popularity of portable and compact air purifiers, the integration of IoT and AI for intelligent air quality monitoring and control, and a surge in demand for purifiers with advanced features like activated carbon filters for odor removal and UV-C light for germicidal action. However, certain restrains such as the initial high cost of premium air purifiers and ongoing maintenance expenses, including filter replacements, might pose challenges for widespread adoption in price-sensitive markets. Despite these challenges, the continuous innovation in product design and functionality, coupled with increasing affordability of mid-range models, is expected to mitigate these limitations and ensure sustained market expansion. The segments of the market, including Stand-alone and In-duct types, and the dominance of HEPA filtration technology, highlight the diverse product offerings catering to varied consumer needs. Leading companies like Dyson, Whirlpool, Unilever (BlueAir), and Honeywell are at the forefront of this innovation, introducing cutting-edge products that resonate with modern consumers.

Household Air Purifier Industry Company Market Share

This in-depth household air purifier market report provides a panoramic view of the global industry, offering critical insights into air purification technology, HEPA filter adoption, and smart home integration. Designed for industry professionals, investors, and manufacturers, this report analyzes the stand-alone air purifier market and the in-duct air purifier segment, detailing market size in million units from the historical period (2019-2024) through the forecast period (2025-2033), with a base year of 2025. Navigate the complex landscape of indoor air quality solutions and identify lucrative growth avenues.

Household Air Purifier Industry Market Dynamics & Structure

The household air purifier industry is characterized by a moderate to high market concentration, with key players like Dyson Ltd, Whirlpool Corporation, and Unilever PLC (erstwhile BlueAir AB) holding significant shares. Technological innovation, particularly in HEPA filtration and the integration of smart features, is a primary driver, pushing the adoption of advanced air cleaning devices. Regulatory frameworks, increasingly focused on indoor air quality standards and energy efficiency, are shaping product development and market entry. Competitive product substitutes include HVAC systems with advanced filtration and natural air purification methods, though dedicated air purifiers offer superior performance. End-user demographics are expanding beyond allergy sufferers to include health-conscious individuals, pet owners, and urban dwellers concerned about pollution. Mergers and acquisitions (M&A) are playing a vital role in market consolidation and technological advancement, with notable recent activity indicating a drive for expanded product portfolios and market reach. For instance, the acquisition of Aeris Cleantec AG by iRobot Corporation signals a trend towards integrating air purification into broader smart home ecosystems.

- Market Concentration: Moderately to highly concentrated, with a few dominant global players.

- Technological Innovation Drivers: Advancements in HEPA filtration, activated carbon, UV-C sterilization, and smart connectivity.

- Regulatory Frameworks: Growing emphasis on indoor air pollution standards, energy efficiency certifications, and product safety.

- Competitive Product Substitutes: Advanced HVAC filters, dehumidifiers, humidifiers, and natural ventilation.

- End-User Demographics: Households with allergies, asthma, respiratory issues, pet owners, urban residents, and health-conscious consumers.

- M&A Trends: Strategic acquisitions to gain market share, acquire new technologies, and expand product offerings.

Household Air Purifier Industry Growth Trends & Insights

The global household air purifier market size is projected for robust expansion, driven by escalating concerns over indoor air pollution, rising prevalence of respiratory ailments, and increasing consumer awareness regarding the health benefits of clean air. The adoption rate of home air purifiers is steadily increasing, particularly in urban centers with higher pollution levels and in regions with a growing middle class. Technological disruptions are continuously reshaping the landscape, with the integration of AI-powered sensors for real-time air quality monitoring, advanced multi-stage filtration systems, and ultra-quiet operation becoming standard. Consumer behavior shifts are evident, with a growing preference for aesthetically pleasing, energy-efficient, and smart-enabled devices that seamlessly integrate into the connected home environment. The market penetration of HEPA air purifiers continues to dominate due to their proven effectiveness against particulate matter. The overall market is anticipated to witness a healthy Compound Annual Growth Rate (CAGR) during the forecast period, indicating sustained demand and investment opportunities in the air purification solutions sector.

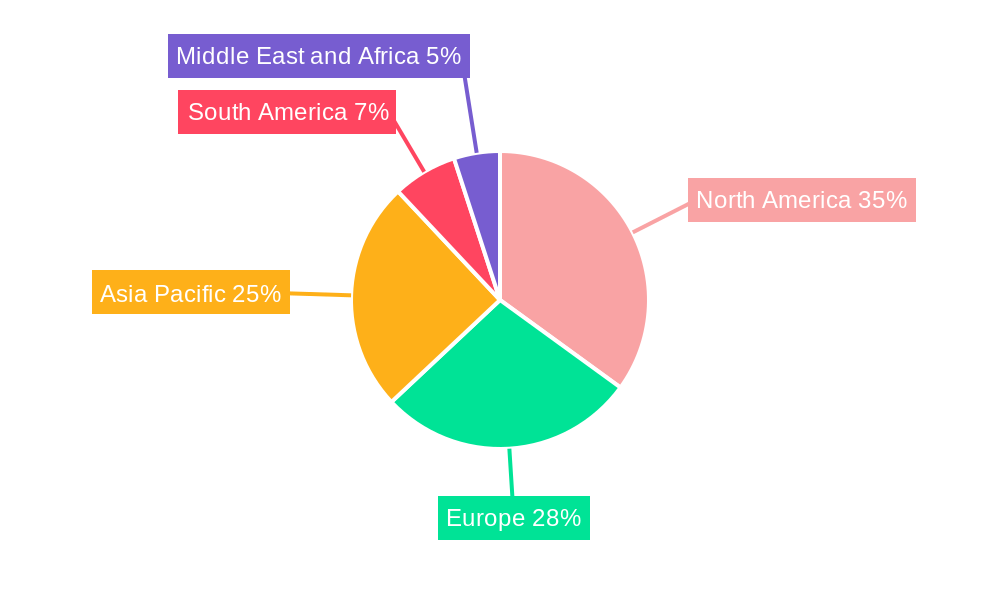

Dominant Regions, Countries, or Segments in Household Air Purifier Industry

The stand-alone air purifier segment, particularly those equipped with High-efficiency Particulate Air (HEPA) filters, is currently the dominant force driving the global household air purifier market. This dominance is fueled by their widespread appeal, versatility, and proven efficacy in removing airborne contaminants such as dust, pollen, pet dander, and mold spores. North America and Europe currently represent the leading regions, characterized by high consumer awareness of indoor air quality issues, stringent environmental regulations, and a well-established market for home appliances. In these regions, economic policies supporting health and wellness initiatives, coupled with a strong infrastructure for retail and e-commerce distribution of air cleaning appliances, further bolster sales.

However, the Asia-Pacific region is emerging as the fastest-growing market. Rapid urbanization, increasing disposable incomes, and growing concerns about severe outdoor and indoor air pollution in countries like China and India are creating a surge in demand for residential air purifiers. Government initiatives to improve air quality and rising health consciousness among the populace are key growth drivers. The in-duct air purifier segment is also gaining traction, especially in new constructions and for consumers seeking a more integrated and discreet solution for whole-house air purification. Technological advancements in filtration media and smart control systems are enhancing the appeal of both stand-alone and in-duct models, ensuring continued growth across key geographical markets.

- Dominant Segment: Stand-alone Air Purifiers with HEPA Filtration.

- Key Drivers in Leading Regions (North America & Europe):

- High consumer awareness of indoor air quality.

- Stringent environmental and health regulations.

- Developed retail and e-commerce infrastructure.

- Strong purchasing power and preference for premium air purification technology.

- Fastest Growing Region: Asia-Pacific.

- Drivers in Asia-Pacific:

- Rapid urbanization and increasing pollution levels.

- Rising disposable incomes and health consciousness.

- Government initiatives for air quality improvement.

- Emerging Segment: In-duct Air Purifiers, gaining popularity for whole-house solutions.

Household Air Purifier Industry Product Landscape

The household air purifier industry is witnessing a rapid evolution in its product landscape, driven by continuous innovation in air purification technology. Leading manufacturers are focusing on enhancing filtration efficiency, with advanced HEPA filters now commonly incorporating additional layers like activated carbon for odor removal and pre-filters for larger particles. Product designs are becoming more consumer-centric, emphasizing sleek aesthetics, compact footprints, and whisper-quiet operation to seamlessly blend into home environments. Smart capabilities are increasingly integrated, allowing for remote control via smartphone apps, real-time air quality monitoring, automatic mode adjustments based on sensor data, and voice assistant compatibility. Performance metrics such as CADR (Clean Air Delivery Rate) are becoming crucial differentiators, highlighting the speed and effectiveness of air cleaning devices. Unique selling propositions often revolve around specialized features like allergen-specific filtration, UV-C sterilization for germ elimination, and ionizers for enhanced air purification.

Key Drivers, Barriers & Challenges in Household Air Purifier Industry

The household air purifier market is propelled by several key drivers, primarily the escalating global concern over indoor air pollution, heightened awareness of respiratory health issues like asthma and allergies, and the increasing trend towards pet ownership, which contributes to airborne allergens. The growing integration of smart home technology also acts as a significant driver, making connected air purifiers more appealing.

Conversely, several barriers and challenges restrain market growth. The initial cost of purchasing high-quality air purifiers, especially those with advanced HEPA filtration, can be a deterrent for price-sensitive consumers. Ongoing operational costs, including filter replacements, also contribute to this challenge. Additionally, a lack of widespread consumer education regarding the specific benefits and types of air cleaning devices can lead to underestimation of their necessity. Intense competition and market saturation in certain regions can also put pressure on profit margins.

Emerging Opportunities in Household Air Purifier Industry

Emerging opportunities within the household air purifier industry lie in the development of more energy-efficient models that appeal to environmentally conscious consumers. The growing trend of smart home integration presents a significant avenue, with opportunities for developing advanced, AI-powered air purifiers that offer personalized air quality management and seamless connectivity. Untapped markets in developing economies, where awareness of indoor air quality is growing but penetration is low, offer substantial growth potential. Furthermore, innovative applications such as portable personal air purifiers for use in vehicles or small spaces, and the development of multi-functional devices that combine air purification with humidification or dehumidification, are poised to capture evolving consumer preferences.

Growth Accelerators in the Household Air Purifier Industry Industry

Technological breakthroughs in air purification technology, such as advancements in photocatalytic oxidation and electrostatic precipitation, are key growth accelerators for the household air purifier market. Strategic partnerships between air purifier manufacturers and smart home technology providers are facilitating the development of integrated ecosystems, enhancing user convenience and market appeal. Market expansion strategies targeting underserved regions with increasing awareness of indoor air quality are also crucial. Furthermore, the growing demand for specialized air cleaning devices catering to specific needs, like those designed for nurseries or for individuals with severe respiratory conditions, will fuel sustained growth. The increasing focus on preventive healthcare and wellness will continue to drive demand for residential air purifiers.

Key Players Shaping the Household Air Purifier Industry Market

- Dyson Ltd

- Whirlpool Corporation

- Unilever PLC (erstwhile BlueAir AB)

- Honeywell International Inc

- Daikin Industries Ltd

- LG Electronics Inc

- Samsung Electronics Co Ltd

- AllerAir Industries Inc

- Koninklijke Philips NV

- Xiaomi Corp

- Sharp Corporation

- WINIX Inc

- Panasonic Corporation

- IQAir

Notable Milestones in Household Air Purifier Industry Sector

- February 2022: Panasonic announced the new WhisperAir Repair Spot Air Purifier, a maintenance-free and easy-to-install, lightweight device designed to keep indoor air clean and fresh.

- November 2021: iRobot Corporation, a prominent company in consumer robotics, acquired Aeris Cleantec AG, a leading provider of premium air purifiers headquartered in Cham, Switzerland.

In-Depth Household Air Purifier Industry Market Outlook

The household air purifier industry is poised for continued expansion, driven by persistent global concerns over indoor air pollution and a growing emphasis on health and wellness. Future market potential is immense, particularly in emerging economies and in niche segments like smart-enabled and highly specialized air cleaning devices. Strategic opportunities abound for companies that can innovate in areas of energy efficiency, user-centric design, and seamless smart home integration. The increasing adoption of HEPA air purifiers and advancements in air purification technology will remain core to market growth, while evolving consumer preferences for healthier living environments will further accelerate demand for effective indoor air quality solutions.

Household Air Purifier Industry Segmentation

-

1. Filtration Technology

- 1.1. High-efficiency Particulate Air (HEPA)

- 1.2. Other Te

-

2. Type

- 2.1. Stand-alone

- 2.2. In-duct

Household Air Purifier Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Household Air Purifier Industry Regional Market Share

Geographic Coverage of Household Air Purifier Industry

Household Air Purifier Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Number of Automobiles4.; The Government Policy Regarding Pollution Emission Control Parameters

- 3.3. Market Restrains

- 3.3.1. 4.; The Technological Limitations of Air Filters

- 3.4. Market Trends

- 3.4.1. High-efficiency Particulate Air (HEPA) Filtration Technology to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Household Air Purifier Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 5.1.1. High-efficiency Particulate Air (HEPA)

- 5.1.2. Other Te

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Stand-alone

- 5.2.2. In-duct

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 6. North America Household Air Purifier Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 6.1.1. High-efficiency Particulate Air (HEPA)

- 6.1.2. Other Te

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Stand-alone

- 6.2.2. In-duct

- 6.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 7. Europe Household Air Purifier Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 7.1.1. High-efficiency Particulate Air (HEPA)

- 7.1.2. Other Te

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Stand-alone

- 7.2.2. In-duct

- 7.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 8. Asia Pacific Household Air Purifier Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 8.1.1. High-efficiency Particulate Air (HEPA)

- 8.1.2. Other Te

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Stand-alone

- 8.2.2. In-duct

- 8.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 9. South America Household Air Purifier Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 9.1.1. High-efficiency Particulate Air (HEPA)

- 9.1.2. Other Te

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Stand-alone

- 9.2.2. In-duct

- 9.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 10. Middle East and Africa Household Air Purifier Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 10.1.1. High-efficiency Particulate Air (HEPA)

- 10.1.2. Other Te

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Stand-alone

- 10.2.2. In-duct

- 10.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Dyson Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Whirlpool Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Unilever PLC (erstwhile BlueAir AB)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Honeywell International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Daikin Industries Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LG Electronics Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Samsung Electronics Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AllerAir Industries Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Koninklijke Philips NV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Xiaomi Corp *List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sharp Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 WINIX Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Panasonic Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 IQAir

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Dyson Ltd

List of Figures

- Figure 1: Global Household Air Purifier Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Household Air Purifier Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Household Air Purifier Industry Revenue (undefined), by Filtration Technology 2025 & 2033

- Figure 4: North America Household Air Purifier Industry Volume (K Unit), by Filtration Technology 2025 & 2033

- Figure 5: North America Household Air Purifier Industry Revenue Share (%), by Filtration Technology 2025 & 2033

- Figure 6: North America Household Air Purifier Industry Volume Share (%), by Filtration Technology 2025 & 2033

- Figure 7: North America Household Air Purifier Industry Revenue (undefined), by Type 2025 & 2033

- Figure 8: North America Household Air Purifier Industry Volume (K Unit), by Type 2025 & 2033

- Figure 9: North America Household Air Purifier Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Household Air Purifier Industry Volume Share (%), by Type 2025 & 2033

- Figure 11: North America Household Air Purifier Industry Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America Household Air Purifier Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Household Air Purifier Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Household Air Purifier Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Household Air Purifier Industry Revenue (undefined), by Filtration Technology 2025 & 2033

- Figure 16: Europe Household Air Purifier Industry Volume (K Unit), by Filtration Technology 2025 & 2033

- Figure 17: Europe Household Air Purifier Industry Revenue Share (%), by Filtration Technology 2025 & 2033

- Figure 18: Europe Household Air Purifier Industry Volume Share (%), by Filtration Technology 2025 & 2033

- Figure 19: Europe Household Air Purifier Industry Revenue (undefined), by Type 2025 & 2033

- Figure 20: Europe Household Air Purifier Industry Volume (K Unit), by Type 2025 & 2033

- Figure 21: Europe Household Air Purifier Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Household Air Purifier Industry Volume Share (%), by Type 2025 & 2033

- Figure 23: Europe Household Air Purifier Industry Revenue (undefined), by Country 2025 & 2033

- Figure 24: Europe Household Air Purifier Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Household Air Purifier Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Household Air Purifier Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Household Air Purifier Industry Revenue (undefined), by Filtration Technology 2025 & 2033

- Figure 28: Asia Pacific Household Air Purifier Industry Volume (K Unit), by Filtration Technology 2025 & 2033

- Figure 29: Asia Pacific Household Air Purifier Industry Revenue Share (%), by Filtration Technology 2025 & 2033

- Figure 30: Asia Pacific Household Air Purifier Industry Volume Share (%), by Filtration Technology 2025 & 2033

- Figure 31: Asia Pacific Household Air Purifier Industry Revenue (undefined), by Type 2025 & 2033

- Figure 32: Asia Pacific Household Air Purifier Industry Volume (K Unit), by Type 2025 & 2033

- Figure 33: Asia Pacific Household Air Purifier Industry Revenue Share (%), by Type 2025 & 2033

- Figure 34: Asia Pacific Household Air Purifier Industry Volume Share (%), by Type 2025 & 2033

- Figure 35: Asia Pacific Household Air Purifier Industry Revenue (undefined), by Country 2025 & 2033

- Figure 36: Asia Pacific Household Air Purifier Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Household Air Purifier Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Household Air Purifier Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Household Air Purifier Industry Revenue (undefined), by Filtration Technology 2025 & 2033

- Figure 40: South America Household Air Purifier Industry Volume (K Unit), by Filtration Technology 2025 & 2033

- Figure 41: South America Household Air Purifier Industry Revenue Share (%), by Filtration Technology 2025 & 2033

- Figure 42: South America Household Air Purifier Industry Volume Share (%), by Filtration Technology 2025 & 2033

- Figure 43: South America Household Air Purifier Industry Revenue (undefined), by Type 2025 & 2033

- Figure 44: South America Household Air Purifier Industry Volume (K Unit), by Type 2025 & 2033

- Figure 45: South America Household Air Purifier Industry Revenue Share (%), by Type 2025 & 2033

- Figure 46: South America Household Air Purifier Industry Volume Share (%), by Type 2025 & 2033

- Figure 47: South America Household Air Purifier Industry Revenue (undefined), by Country 2025 & 2033

- Figure 48: South America Household Air Purifier Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: South America Household Air Purifier Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Household Air Purifier Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Household Air Purifier Industry Revenue (undefined), by Filtration Technology 2025 & 2033

- Figure 52: Middle East and Africa Household Air Purifier Industry Volume (K Unit), by Filtration Technology 2025 & 2033

- Figure 53: Middle East and Africa Household Air Purifier Industry Revenue Share (%), by Filtration Technology 2025 & 2033

- Figure 54: Middle East and Africa Household Air Purifier Industry Volume Share (%), by Filtration Technology 2025 & 2033

- Figure 55: Middle East and Africa Household Air Purifier Industry Revenue (undefined), by Type 2025 & 2033

- Figure 56: Middle East and Africa Household Air Purifier Industry Volume (K Unit), by Type 2025 & 2033

- Figure 57: Middle East and Africa Household Air Purifier Industry Revenue Share (%), by Type 2025 & 2033

- Figure 58: Middle East and Africa Household Air Purifier Industry Volume Share (%), by Type 2025 & 2033

- Figure 59: Middle East and Africa Household Air Purifier Industry Revenue (undefined), by Country 2025 & 2033

- Figure 60: Middle East and Africa Household Air Purifier Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: Middle East and Africa Household Air Purifier Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Household Air Purifier Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Household Air Purifier Industry Revenue undefined Forecast, by Filtration Technology 2020 & 2033

- Table 2: Global Household Air Purifier Industry Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 3: Global Household Air Purifier Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 4: Global Household Air Purifier Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 5: Global Household Air Purifier Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Household Air Purifier Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Household Air Purifier Industry Revenue undefined Forecast, by Filtration Technology 2020 & 2033

- Table 8: Global Household Air Purifier Industry Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 9: Global Household Air Purifier Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Global Household Air Purifier Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: Global Household Air Purifier Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Household Air Purifier Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global Household Air Purifier Industry Revenue undefined Forecast, by Filtration Technology 2020 & 2033

- Table 14: Global Household Air Purifier Industry Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 15: Global Household Air Purifier Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 16: Global Household Air Purifier Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 17: Global Household Air Purifier Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: Global Household Air Purifier Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Global Household Air Purifier Industry Revenue undefined Forecast, by Filtration Technology 2020 & 2033

- Table 20: Global Household Air Purifier Industry Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 21: Global Household Air Purifier Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: Global Household Air Purifier Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 23: Global Household Air Purifier Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Household Air Purifier Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Household Air Purifier Industry Revenue undefined Forecast, by Filtration Technology 2020 & 2033

- Table 26: Global Household Air Purifier Industry Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 27: Global Household Air Purifier Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 28: Global Household Air Purifier Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 29: Global Household Air Purifier Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: Global Household Air Purifier Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Global Household Air Purifier Industry Revenue undefined Forecast, by Filtration Technology 2020 & 2033

- Table 32: Global Household Air Purifier Industry Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 33: Global Household Air Purifier Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 34: Global Household Air Purifier Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 35: Global Household Air Purifier Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Global Household Air Purifier Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Household Air Purifier Industry?

The projected CAGR is approximately 6.6%.

2. Which companies are prominent players in the Household Air Purifier Industry?

Key companies in the market include Dyson Ltd, Whirlpool Corporation, Unilever PLC (erstwhile BlueAir AB), Honeywell International Inc, Daikin Industries Ltd, LG Electronics Inc, Samsung Electronics Co Ltd, AllerAir Industries Inc, Koninklijke Philips NV, Xiaomi Corp *List Not Exhaustive, Sharp Corporation, WINIX Inc, Panasonic Corporation, IQAir.

3. What are the main segments of the Household Air Purifier Industry?

The market segments include Filtration Technology, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Number of Automobiles4.; The Government Policy Regarding Pollution Emission Control Parameters.

6. What are the notable trends driving market growth?

High-efficiency Particulate Air (HEPA) Filtration Technology to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Technological Limitations of Air Filters.

8. Can you provide examples of recent developments in the market?

In February 2022, Panasonic announced the new WhisperAir Repair Spot Air Purifier. The device is maintenance-free and easy to install. The WhisperAir Repair is lightweight and designed to keep indoor air clean and fresh.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Household Air Purifier Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Household Air Purifier Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Household Air Purifier Industry?

To stay informed about further developments, trends, and reports in the Household Air Purifier Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence