Key Insights

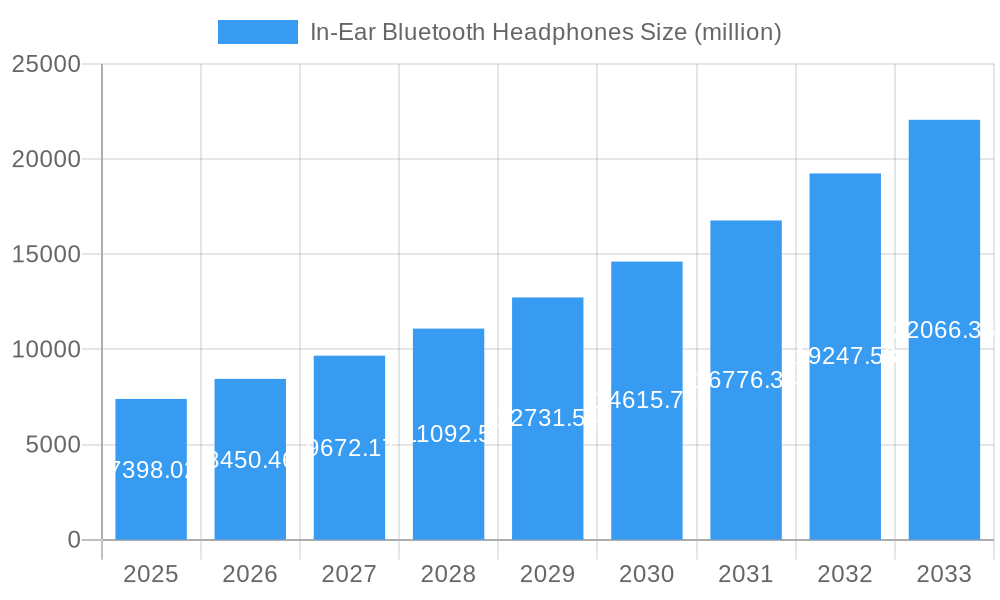

The global In-Ear Bluetooth Headphones market is poised for significant expansion, projected to reach a substantial $7,398.02 million by 2025, driven by an impressive compound annual growth rate (CAGR) of 14.2% during the forecast period. This robust growth is primarily fueled by the increasing demand for wireless audio solutions across diverse applications, including sports, work, and entertainment. The widespread adoption of smartphones and other portable devices, coupled with a growing consumer preference for convenience and immersive audio experiences, are key accelerators for this market. Furthermore, technological advancements in audio quality, battery life, and noise-cancellation features are continuously enhancing the product appeal, encouraging higher adoption rates. The "wearable tech" revolution, where in-ear Bluetooth headphones are an integral component, is witnessing a surge in innovation and consumer interest, solidifying its position as a dominant segment in the personal audio landscape.

In-Ear Bluetooth Headphones Market Size (In Billion)

The market's upward trajectory is further supported by emerging trends such as the integration of advanced AI features, biometric sensors for health tracking, and enhanced connectivity options. While the market demonstrates immense potential, certain factors can influence its growth trajectory. The competitive landscape is dynamic, with a multitude of established players and emerging brands vying for market share. Intense price competition, coupled with the need for continuous innovation to stay ahead, presents a challenge. However, the expanding consumer base, particularly in developing economies where smartphone penetration is rapidly increasing, offers substantial untapped potential. The development of more affordable yet feature-rich models is expected to democratize access to this technology, further propelling market growth throughout the forecast period.

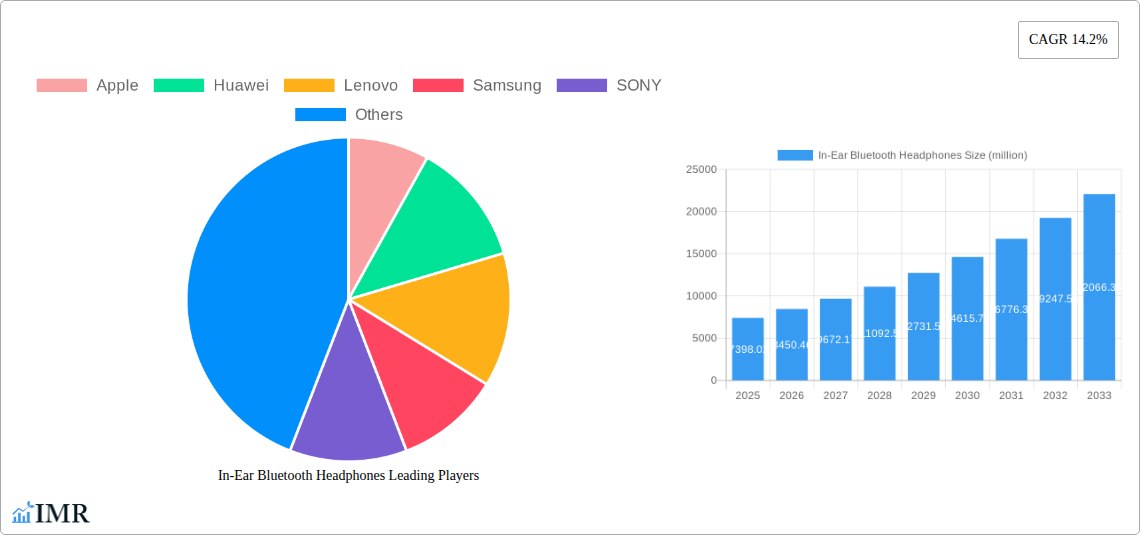

In-Ear Bluetooth Headphones Company Market Share

This comprehensive report offers an in-depth analysis of the global In-Ear Bluetooth Headphones market, a rapidly expanding segment within the broader consumer electronics and personal audio industry. With a focus on the period from 2019 to 2033, including a detailed base year of 2025 and a forecast period extending to 2033, this report provides actionable insights for industry professionals, investors, and strategists. We delve into market dynamics, growth trends, regional dominance, product innovation, key players, and emerging opportunities, all presented with robust quantitative data and qualitative analysis. This report is essential for understanding the trajectory of wireless audio technology and its profound impact across various applications and demographics.

In-Ear Bluetooth Headphones Market Dynamics & Structure

The In-Ear Bluetooth Headphones market exhibits a dynamic and evolving structure, influenced by a confluence of technological advancements, evolving consumer preferences, and a competitive landscape dominated by key players. Market concentration is moderate to high, with established giants like Apple, Samsung, and Sony holding significant sway, particularly in the premium segment. However, the rise of agile competitors such as Anker, iKF, and Shokz, coupled with increasing penetration from Chinese brands like Huawei, Lenovo, OPPO, and vivo, injects significant dynamism. Technological innovation serves as a primary growth driver, with continuous improvements in battery life, audio quality, noise cancellation, and seamless connectivity fueling adoption. Regulatory frameworks, while generally supportive of technological integration, can influence market entry and product compliance. Competitive product substitutes, including traditional wired headphones and other wearable audio devices, are present but increasingly challenged by the convenience and feature set of Bluetooth in-ear models. End-user demographics are broadening, extending beyond early adopters to mass-market consumers across all age groups, driven by affordability and diverse use cases. Mergers and acquisitions (M&A) activity, though not as rampant as in some other tech sectors, plays a role in consolidating market share and acquiring innovative technologies, with an estimated 3-5 significant M&A deals in the historical period (2019-2024). Barriers to innovation primarily stem from the miniaturization challenges in achieving superior audio fidelity and extended battery life within compact form factors, alongside the constant pressure to differentiate in a crowded marketplace.

- Market Concentration: Moderate to High, with a blend of established global brands and emerging regional players.

- Technological Innovation Drivers: Enhanced ANC, longer battery life, improved Bluetooth codecs, AI integration for personalized audio.

- Regulatory Frameworks: Primarily focused on Bluetooth certification, audio quality standards, and data privacy.

- Competitive Product Substitutes: Wired in-ear headphones, over-ear Bluetooth headphones, smart speakers.

- End-User Demographics: Broadening appeal across age groups, professions, and lifestyle segments.

- M&A Trends: Strategic acquisitions for technology enhancement and market consolidation, with approximately 4 M&A deals observed between 2019-2024.

In-Ear Bluetooth Headphones Growth Trends & Insights

The global In-Ear Bluetooth Headphones market is projected for substantial growth, fueled by relentless technological innovation, shifting consumer behaviors, and the expanding utility of wireless audio across diverse applications. The market size is estimated to reach xx million units in the base year 2025, with a Compound Annual Growth Rate (CAGR) of approximately 12% projected over the forecast period 2025–2033. This robust expansion is underpinned by increasing consumer demand for convenience, portability, and enhanced audio experiences. Adoption rates are soaring, driven by the democratization of advanced features like active noise cancellation (ANC) and transparency modes, which are no longer confined to premium offerings. Technological disruptions, including advancements in low-power Bluetooth connectivity, miniaturized battery technology, and sophisticated audio processing algorithms, are continually pushing the boundaries of what in-ear headphones can deliver. Consumer behavior shifts are evident, with a growing preference for seamless integration into daily routines, whether for immersive entertainment, focused work, or active lifestyles. The "always-on" connectivity facilitated by these devices, coupled with their role as conduits for voice assistants and smart notifications, further solidifies their indispensable nature. The market penetration is expected to climb from an estimated 45% in 2024 to over 65% by 2033 in developed economies, with emerging markets showing even steeper growth trajectories. The increasing integration of health and fitness tracking features within earbuds is also a significant trend, appealing to a health-conscious demographic. The historical period (2019–2024) witnessed an average market size of around 250 million units, with a CAGR of roughly 10%. The estimated market size for 2025 stands at xx million units.

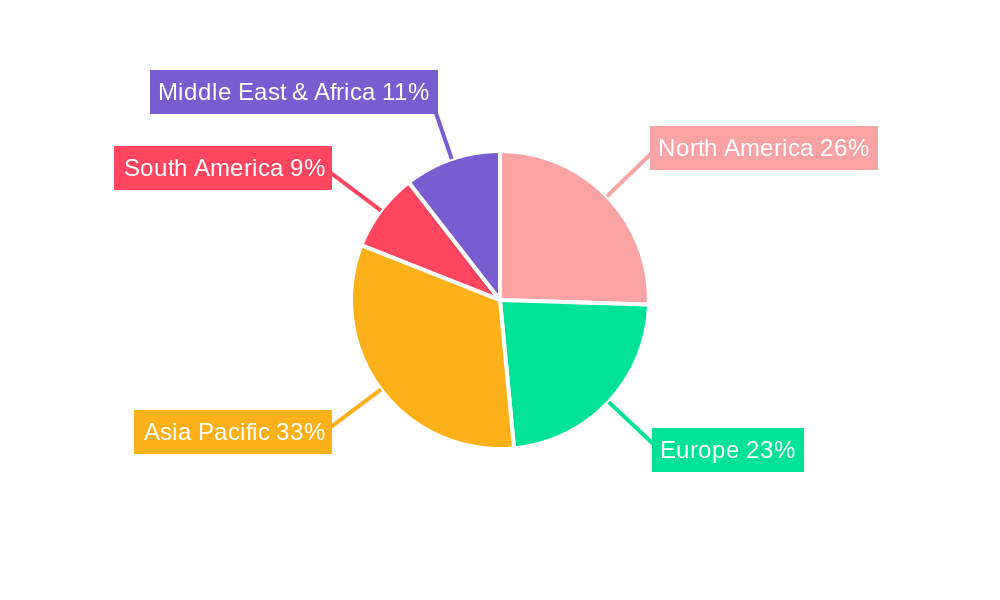

Dominant Regions, Countries, or Segments in In-Ear Bluetooth Headphones

The In-Ear Bluetooth Headphones market exhibits strong growth across several key regions and application segments, with North America and Europe currently leading in terms of market share, driven by high disposable incomes and early adoption of advanced technologies. However, the Asia-Pacific region, particularly China, is emerging as a powerhouse, not only in production but also in burgeoning consumer demand, projected to outpace other regions in growth rate by 2028. Within application segments, Entertainment continues to hold a dominant position, accounting for an estimated 40% of the market share in 2025, owing to the universal appeal of music, podcasts, and video consumption. The Sports segment is experiencing the most rapid expansion, with a projected CAGR of 15% over the forecast period. This surge is attributed to the increasing popularity of fitness activities, the development of ruggedized and sweat-proof headphone designs, and the integration of health-monitoring features. Countries like the United States, Germany, the UK, Japan, and South Korea are key markets within their respective continents, characterized by robust economies, high consumer spending, and a strong presence of major technology brands. Infrastructure development, including widespread internet and smartphone penetration, acts as a crucial enabler for the adoption of Bluetooth headphones. Government initiatives promoting digital literacy and consumer electronics adoption further bolster market growth in developing economies. The Earbuds Type segment overwhelmingly dominates the Halter Neck type, representing over 85% of the market share in 2025. This dominance is driven by the superior portability, discreetness, and comfort offered by earbuds for a wide range of activities. The market size for the Sports application is projected to reach xx million units by 2025, while Entertainment remains the largest segment at xx million units.

- Leading Region: North America, followed closely by Europe, with Asia-Pacific exhibiting the highest growth potential.

- Dominant Application Segment: Entertainment, projected at xx million units in 2025.

- Fastest Growing Application Segment: Sports, with a projected CAGR of 15%.

- Dominant Product Type: Earbuds Type, accounting for over 85% market share in 2025.

- Key Country Markets: United States, China, Germany, Japan, South Korea.

- Growth Drivers: High disposable income, smartphone penetration, government digital initiatives, and growing health consciousness.

In-Ear Bluetooth Headphones Product Landscape

The product landscape for In-Ear Bluetooth Headphones is characterized by relentless innovation, focusing on enhancing user experience and expanding functionalities. Key advancements include the integration of advanced Active Noise Cancellation (ANC) technologies with adaptive modes, superior sound fidelity through advanced audio codecs, and extended battery life, with many models now offering over 8 hours of playback on a single charge, and charging cases providing multiple recharges for a total of 30+ hours. The proliferation of true wireless stereo (TWS) earbuds has revolutionized portability and convenience. Unique selling propositions often revolve around specialized features such as enhanced water and sweat resistance for sports enthusiasts, crystal-clear microphone quality for seamless calls in noisy environments, and AI-driven personalized sound profiles. Technological advancements are also seen in areas like low-latency audio transmission for gaming and immersive spatial audio experiences, pushing the boundaries of mobile entertainment.

Key Drivers, Barriers & Challenges in In-Ear Bluetooth Headphones

The In-Ear Bluetooth Headphones market is propelled by several key drivers, including the increasing ubiquity of smartphones, the growing demand for wireless convenience, and the continuous evolution of audio technology. The integration of smart features, such as AI-powered voice assistants and health monitoring capabilities, further fuels consumer interest. Furthermore, the expanding adoption of these headphones in professional settings for remote work and virtual meetings is a significant growth accelerator.

Conversely, the market faces several barriers and challenges. The high cost of premium features like advanced ANC and superior audio codecs can be a deterrent for price-sensitive consumers. Supply chain disruptions, particularly those affecting semiconductor availability, pose a significant risk to production volumes and lead times. Intense competition among numerous brands leads to rapid price erosion and necessitates continuous innovation to maintain market share. Regulatory hurdles related to Bluetooth certification and varying audio quality standards across regions can also present challenges. The estimated impact of supply chain issues on market growth is approximately 5-7% in the short term.

Emerging Opportunities in In-Ear Bluetooth Headphones

Emerging opportunities in the In-Ear Bluetooth Headphones sector lie in the untapped potential of emerging markets, where smartphone penetration is rapidly increasing, creating a vast new consumer base. Innovative applications such as advanced hearables that integrate augmented reality (AR) audio experiences, real-time language translation capabilities, and sophisticated health and wellness tracking features present significant growth avenues. Evolving consumer preferences for personalized audio experiences, driven by AI algorithms that adapt sound to individual hearing profiles, also offer a promising frontier. The demand for eco-friendly and sustainable headphone designs is also gaining traction, presenting an opportunity for brands to differentiate themselves.

Growth Accelerators in the In-Ear Bluetooth Headphones Industry

Several catalysts are accelerating the long-term growth of the In-Ear Bluetooth Headphones industry. Technological breakthroughs in battery energy density, enabling significantly longer playback times and faster charging, are a major driver. The ongoing development of advanced Bluetooth standards, offering higher bandwidth and lower latency, enhances the overall user experience for various applications, from gaming to immersive audio. Strategic partnerships between headphone manufacturers and smartphone or chip makers streamline product development and integration. Furthermore, market expansion strategies targeting underserved demographics and geographical regions, coupled with the increasing integration of headphones into broader smart ecosystems, are crucial growth accelerators.

Key Players Shaping the In-Ear Bluetooth Headphones Market

- Apple

- Huawei

- Lenovo

- Samsung

- SONY

- JBL

- OPPO

- vivo

- Bose

- Beats

- Anker

- iKF

- Shokz

- NANK

Notable Milestones in In-Ear Bluetooth Headphones Sector

- 2019: Introduction of advanced Active Noise Cancellation (ANC) in mainstream true wireless earbuds by multiple brands.

- 2020: Increased adoption of Bluetooth 5.0 and 5.1, offering improved connectivity and power efficiency.

- 2021: Surge in demand for true wireless earbuds for remote work and fitness, leading to a market size of over 300 million units.

- 2022: Introduction of spatial audio and personalized sound features, enhancing immersive listening experiences.

- 2023: Significant advancements in battery technology leading to longer playback times and faster charging capabilities.

- Q1 2024: Increased focus on sustainable materials and eco-friendly packaging by key manufacturers.

- Q2 2024: Emergence of hearables with integrated health monitoring features, beyond basic fitness tracking.

In-Depth In-Ear Bluetooth Headphones Market Outlook

The In-Ear Bluetooth Headphones market is poised for sustained and robust growth, driven by an optimistic outlook fueled by continuous technological innovation and evolving consumer demands. Future market potential is immense, with increasing integration of artificial intelligence for personalized audio experiences and enhanced user interaction. Strategic opportunities abound in catering to specialized niche markets, such as professional audio users, gamers seeking ultra-low latency, and individuals requiring advanced assistive listening capabilities. The expansion of smart city initiatives and the increasing reliance on connected devices will further solidify the position of in-ear Bluetooth headphones as indispensable personal audio companions. The market is expected to reach xx million units by 2033, demonstrating a significant upward trajectory driven by these growth accelerators.

In-Ear Bluetooth Headphones Segmentation

-

1. Application

- 1.1. Sports

- 1.2. Work

- 1.3. Entertainment

- 1.4. Others

-

2. Types

- 2.1. Halter Neck

- 2.2. Earbuds Type

In-Ear Bluetooth Headphones Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

In-Ear Bluetooth Headphones Regional Market Share

Geographic Coverage of In-Ear Bluetooth Headphones

In-Ear Bluetooth Headphones REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global In-Ear Bluetooth Headphones Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Sports

- 5.1.2. Work

- 5.1.3. Entertainment

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Halter Neck

- 5.2.2. Earbuds Type

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America In-Ear Bluetooth Headphones Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Sports

- 6.1.2. Work

- 6.1.3. Entertainment

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Halter Neck

- 6.2.2. Earbuds Type

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America In-Ear Bluetooth Headphones Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Sports

- 7.1.2. Work

- 7.1.3. Entertainment

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Halter Neck

- 7.2.2. Earbuds Type

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe In-Ear Bluetooth Headphones Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Sports

- 8.1.2. Work

- 8.1.3. Entertainment

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Halter Neck

- 8.2.2. Earbuds Type

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa In-Ear Bluetooth Headphones Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Sports

- 9.1.2. Work

- 9.1.3. Entertainment

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Halter Neck

- 9.2.2. Earbuds Type

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific In-Ear Bluetooth Headphones Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Sports

- 10.1.2. Work

- 10.1.3. Entertainment

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Halter Neck

- 10.2.2. Earbuds Type

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Apple

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Huawei

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lenovo

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Samsung

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SONY

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 JBL

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 OPPO

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 vivo

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bose

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Google

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Beats

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Anker

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 iKF

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Shokz

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 NANK

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Apple

List of Figures

- Figure 1: Global In-Ear Bluetooth Headphones Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America In-Ear Bluetooth Headphones Revenue (million), by Application 2025 & 2033

- Figure 3: North America In-Ear Bluetooth Headphones Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America In-Ear Bluetooth Headphones Revenue (million), by Types 2025 & 2033

- Figure 5: North America In-Ear Bluetooth Headphones Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America In-Ear Bluetooth Headphones Revenue (million), by Country 2025 & 2033

- Figure 7: North America In-Ear Bluetooth Headphones Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America In-Ear Bluetooth Headphones Revenue (million), by Application 2025 & 2033

- Figure 9: South America In-Ear Bluetooth Headphones Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America In-Ear Bluetooth Headphones Revenue (million), by Types 2025 & 2033

- Figure 11: South America In-Ear Bluetooth Headphones Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America In-Ear Bluetooth Headphones Revenue (million), by Country 2025 & 2033

- Figure 13: South America In-Ear Bluetooth Headphones Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe In-Ear Bluetooth Headphones Revenue (million), by Application 2025 & 2033

- Figure 15: Europe In-Ear Bluetooth Headphones Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe In-Ear Bluetooth Headphones Revenue (million), by Types 2025 & 2033

- Figure 17: Europe In-Ear Bluetooth Headphones Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe In-Ear Bluetooth Headphones Revenue (million), by Country 2025 & 2033

- Figure 19: Europe In-Ear Bluetooth Headphones Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa In-Ear Bluetooth Headphones Revenue (million), by Application 2025 & 2033

- Figure 21: Middle East & Africa In-Ear Bluetooth Headphones Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa In-Ear Bluetooth Headphones Revenue (million), by Types 2025 & 2033

- Figure 23: Middle East & Africa In-Ear Bluetooth Headphones Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa In-Ear Bluetooth Headphones Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa In-Ear Bluetooth Headphones Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific In-Ear Bluetooth Headphones Revenue (million), by Application 2025 & 2033

- Figure 27: Asia Pacific In-Ear Bluetooth Headphones Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific In-Ear Bluetooth Headphones Revenue (million), by Types 2025 & 2033

- Figure 29: Asia Pacific In-Ear Bluetooth Headphones Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific In-Ear Bluetooth Headphones Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific In-Ear Bluetooth Headphones Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Types 2020 & 2033

- Table 3: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Application 2020 & 2033

- Table 5: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Types 2020 & 2033

- Table 6: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Application 2020 & 2033

- Table 11: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Types 2020 & 2033

- Table 12: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Country 2020 & 2033

- Table 13: Brazil In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Argentina In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Application 2020 & 2033

- Table 17: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Types 2020 & 2033

- Table 18: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Germany In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: France In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Italy In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Spain In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Russia In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Benelux In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Nordics In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Application 2020 & 2033

- Table 29: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Types 2020 & 2033

- Table 30: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Country 2020 & 2033

- Table 31: Turkey In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Israel In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: GCC In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: North Africa In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: South Africa In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Application 2020 & 2033

- Table 38: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Types 2020 & 2033

- Table 39: Global In-Ear Bluetooth Headphones Revenue million Forecast, by Country 2020 & 2033

- Table 40: China In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: India In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Japan In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: South Korea In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Oceania In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific In-Ear Bluetooth Headphones Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the In-Ear Bluetooth Headphones?

The projected CAGR is approximately 14.2%.

2. Which companies are prominent players in the In-Ear Bluetooth Headphones?

Key companies in the market include Apple, Huawei, Lenovo, Samsung, SONY, JBL, OPPO, vivo, Bose, Google, Beats, Anker, iKF, Shokz, NANK.

3. What are the main segments of the In-Ear Bluetooth Headphones?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 7398.02 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "In-Ear Bluetooth Headphones," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the In-Ear Bluetooth Headphones report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the In-Ear Bluetooth Headphones?

To stay informed about further developments, trends, and reports in the In-Ear Bluetooth Headphones, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence