Key Insights

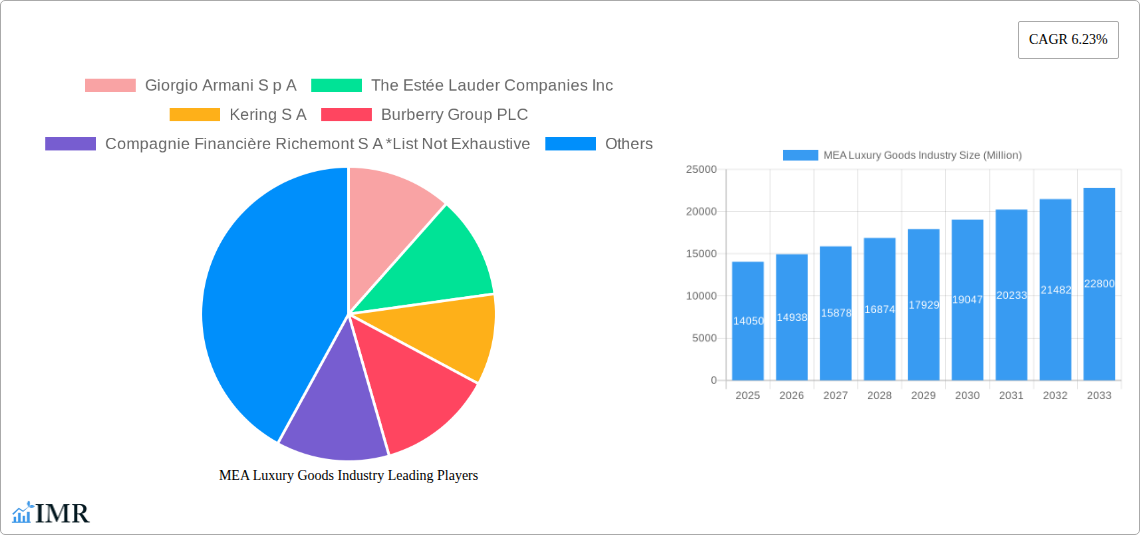

The Middle East and Africa (MEA) luxury goods market, valued at $14.05 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.23% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, a burgeoning affluent population across the region, particularly in the UAE and Saudi Arabia, is driving increased demand for high-end products. The rising disposable incomes and a growing aspirational middle class contribute significantly to this trend. Secondly, the MEA region is witnessing a surge in luxury tourism, with international visitors contributing substantially to luxury goods sales. Furthermore, the increasing popularity of e-commerce platforms and the expansion of omnichannel retail strategies are facilitating greater accessibility and convenience for luxury consumers. Finally, strategic marketing campaigns by luxury brands, coupled with innovative product offerings and personalized experiences, further enhance market growth.

MEA Luxury Goods Industry Market Size (In Billion)

However, the market isn't without challenges. Economic volatility in certain parts of the region poses a risk, and fluctuating currency exchange rates can impact import costs and consumer spending. Furthermore, the rise of counterfeit luxury goods presents a significant threat, potentially eroding consumer trust and impacting the profitability of legitimate brands. Despite these restraints, the long-term outlook for the MEA luxury goods market remains positive, with continued growth expected across various segments including clothing and apparel, footwear, jewelry, and watches. The strong presence of established luxury brands, coupled with the emergence of local and regional players, signifies a dynamic and competitive market landscape. Successful brands are likely to be those that effectively adapt to evolving consumer preferences, leverage digital channels effectively, and navigate the inherent economic complexities of the region.

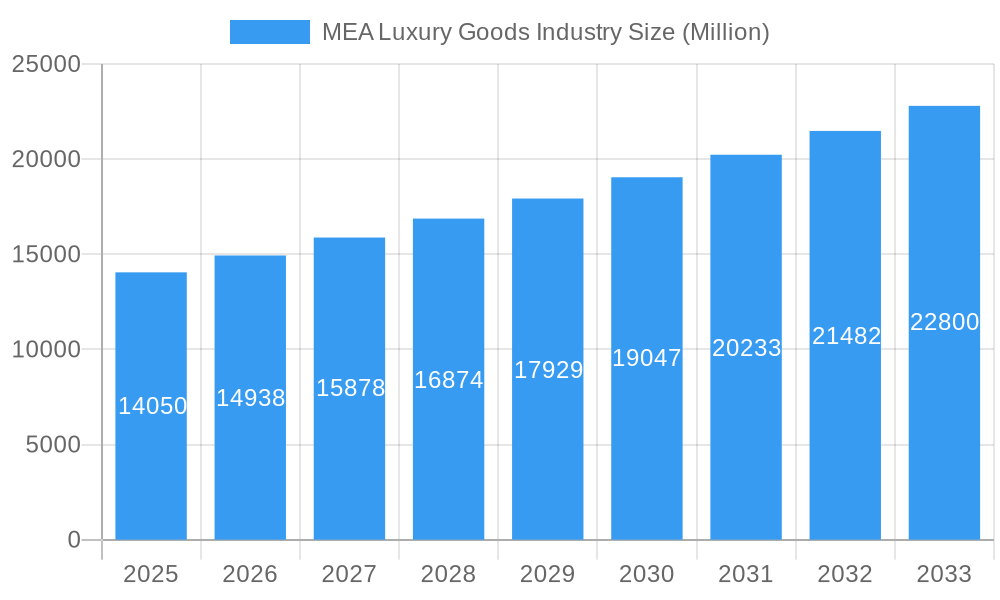

MEA Luxury Goods Industry Company Market Share

MEA Luxury Goods Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Middle East and Africa (MEA) luxury goods market, encompassing historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). It delves into market dynamics, growth trends, key players, and emerging opportunities within this lucrative sector. The report is essential for industry professionals, investors, and strategists seeking to understand and capitalize on the evolving MEA luxury landscape. The report covers key product types (Clothing and Apparel, Footwear, Bags, Jewelry, Watches, Other Accessories) and distribution channels (Single-branded Stores, Multi-brand Stores, Online Retail Stores, Other Distribution Channels) within the parent market of Luxury Goods and the child market of high-end fashion and accessories.

MEA Luxury Goods Industry Market Dynamics & Structure

The MEA luxury goods market is characterized by a dynamic interplay of global giants and a burgeoning local scene. While behemoths like LVMH Moët Hennessy Louis Vuitton, Kering SA, and Richemont continue to command substantial market share, the landscape is increasingly enriched by a diverse array of established international brands and innovative, emerging local players. Technological advancement, particularly the seamless integration of e-commerce and hyper-personalized digital experiences, acts as a primary engine for growth. Simultaneously, navigating intricate regulatory frameworks governing import/export and robust consumer protection mandates significantly shapes market operations. The ascendant wave of conscious consumerism, coupled with the growing accessibility of premium goods and sophisticated alternatives, is actively reshaping the competitive contours. Mergers and acquisitions (M&A) remain a vibrant component, with both strategic acquisitions and consolidation efforts contributing to the market's ongoing evolution and maturity.

- Market Concentration: LVMH, Kering, and Richemont collectively hold an estimated 65-70% market share in 2025.

- Technological Innovation: Advanced e-commerce platforms and hyper-personalized digital marketing are key growth drivers, with the integration of the metaverse and AI-powered clienteling emerging as transformative trends.

- Regulatory Framework: Import duties, varying excise taxes, and stringent regulations impacting product distribution and advertising significantly influence pricing strategies, product accessibility, and overall market entry.

- Competitive Substitutes: The increasing popularity of accessible luxury brands, premium diffusion lines, and meticulously curated pre-owned luxury markets creates sustained competitive pressure and demands nuanced brand positioning.

- End-User Demographics: The rapidly expanding affluent middle class, coupled with a youthful, digitally native, and increasingly discerning consumer base, is a primary engine of demand, with a growing appetite for experiential luxury.

- M&A Trends: An average of 8-10 M&A deals per year were recorded in the historical period (2019-2024), primarily focused on strategic expansion into new territories, vertical integration, and acquiring innovative technology or design capabilities.

MEA Luxury Goods Industry Growth Trends & Insights

The MEA luxury goods market experienced robust growth in the historical period (2019-2024), with a CAGR of xx%. This growth is primarily driven by increasing disposable incomes, a rising affluent population, and a growing preference for luxury goods among consumers in the region. The market is witnessing a notable shift towards online retail, driven by increasing internet penetration and convenience. Technological advancements, such as personalized shopping experiences and augmented reality applications, are further enhancing consumer engagement and driving sales. Consumer behavior is also evolving, with increased focus on sustainability and ethical sourcing influencing purchasing decisions. The forecast period (2025-2033) anticipates continued strong growth, albeit at a slightly moderated pace, driven by sustained economic growth and evolving consumer preferences. Market penetration is expected to reach xx% by 2033.

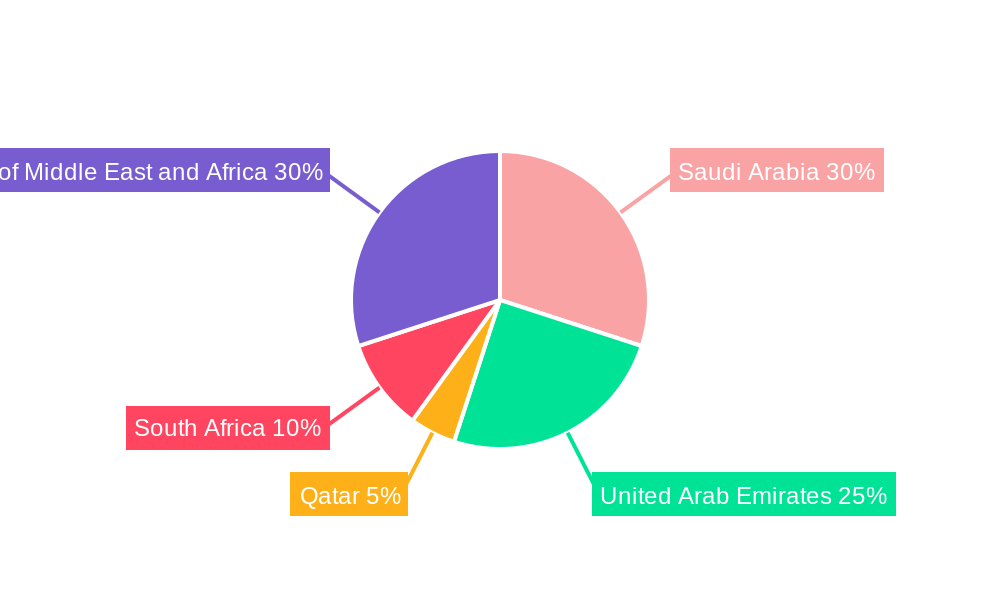

Dominant Regions, Countries, or Segments in MEA Luxury Goods Industry

The UAE (United Arab Emirates), Saudi Arabia, and Qatar are leading the MEA luxury goods market, fueled by their strong economic growth, high disposable incomes, and established tourism infrastructure. Within product types, Watches and Jewelry consistently demonstrate strong performance, while the Clothing and Apparel segment shows significant potential for expansion. Single-branded stores remain the dominant distribution channel, although online retail is rapidly gaining traction.

- Key Drivers:

- Strong economic growth in key markets.

- High tourist arrivals.

- Development of luxury shopping malls and retail infrastructure.

- Growing e-commerce adoption.

- Dominant Segments:

- Product Type: Watches and Jewelry command the highest market share, with xx million units estimated for 2025.

- Distribution Channel: Single-branded stores hold the largest market share, estimated at xx million units in 2025.

MEA Luxury Goods Industry Product Landscape

The MEA luxury goods market presents a rich and varied product spectrum, artfully blending global luxury trends with the distinct cultural nuances and preferences of the region. A significant innovation trend revolves around the adoption of sustainable and ethically sourced materials, appealing to an increasingly environmentally conscious clientele. Technological integration is becoming more sophisticated, evident in advanced functionalities within high-end watches and accessories, including next-generation smartwatches and connected devices. Personalization and bespoke customization options are paramount, allowing consumers to imbue their purchases with individual significance. Brands are strategically emphasizing unique selling propositions rooted in rich heritage, unparalleled craftsmanship, and exclusive, limited-edition designs to captivate and retain a discerning customer base. Furthermore, ongoing technological advancements are not only enhancing product quality and functionality but also elevating the overall customer journey and engagement.

Key Drivers, Barriers & Challenges in MEA Luxury Goods Industry

Key Drivers: A confluence of factors fuels the MEA luxury goods market, including sustained growth in disposable incomes, the expanding affluent middle class, a significant surge in inbound tourism, and continuous technological advancements revolutionizing e-commerce and personalized clienteling. Complementary government initiatives aimed at bolstering tourism infrastructure and retail development further catalyze market expansion.

Key Challenges: The market navigates a landscape marked by inherent economic volatility, fluctuating currency exchange rates, and persistent geopolitical uncertainties that can temper consumer spending power. Supply chain complexities and escalating input costs present ongoing operational hurdles. The pervasive issue of counterfeit goods and the imperative for robust brand protection remain critical concerns, directly impacting brand equity and profitability. Moreover, the market contends with intense and evolving competition, exerting pressure on established pricing structures and profit margins. Collectively, these challenges are estimated to temper the market's growth trajectory by approximately 3-5% annually.

Emerging Opportunities in MEA Luxury Goods Industry

Untapped markets in smaller MEA countries present significant growth potential. The increasing adoption of e-commerce and social commerce offers opportunities for expansion and reaching new customers. Focus on personalization, customization, and sustainability will resonate with an increasingly conscious consumer base. Opportunities exist to create luxury experiences integrated with local culture and heritage.

Growth Accelerators in the MEA Luxury Goods Industry

Strategic alliances and collaborative ventures between established international luxury houses and burgeoning local brands are proving instrumental in enhancing market penetration, fostering deeper brand resonance, and cultivating authentic regional appeal. The widespread adoption of cutting-edge technologies such as Augmented Reality (AR) and Virtual Reality (VR) applications, facilitating immersive virtual try-ons and highly personalized digital shopping experiences, is significantly accelerating growth. Furthermore, strategic market expansion into previously underserved geographical areas within the MEA region, coupled with meticulously crafted and culturally relevant targeted marketing campaigns, are pivotal for achieving sustainable long-term success and unlocking untapped potential.

Key Players Shaping the MEA Luxury Goods Industry Market

- Giorgio Armani S p A

- The Estée Lauder Companies Inc

- Kering S A

- Burberry Group PLC

- Compagnie Financière Richemont S A

- Alshaya franchise group (Tribe of 6 Aerie)

- Dolce & Gabbana Luxembourg S À R L

- Rolex SA

- Prada S P A

- Roberto Cavalli S P A

- Chanel S A

- LVMH Moët Hennessy Louis Vuitton

- Chopard Group

Notable Milestones in MEA Luxury Goods Industry Sector

- May 2021: Opening of a new Rolex Boutique at the Galleria Al Maryah Island in Abu Dhabi, signifying brand expansion and commitment to the market.

- May 2022: PRADA Tropico's pop-up boutique launch in Dubai Mall showcases innovative retail experiences and market engagement.

- November 2022: Cartier's launch of the Santos de Cartier jewelry collection highlights product innovation and brand evolution in the luxury jewelry segment.

In-Depth MEA Luxury Goods Industry Market Outlook

The MEA luxury goods market is fundamentally positioned for sustained and robust expansion, propelled by a synergistic combination of consistent economic development, the rapid evolution of consumer preferences, and the transformative impact of technological advancements. Strategic investments in sophisticated e-commerce infrastructure, deeply personalized customer experiences, and a steadfast commitment to sustainable and ethical practices will be critical determinants in capturing future market share and solidifying brand leadership. A proactive approach to identifying and penetrating nascent markets, alongside the deliberate cultivation of profound brand loyalty through exceptional service and product offerings, will be indispensable for achieving enduring success. The market is projected to reach a significant value of $45-55 billion in sales volume by 2033, presenting unparalleled opportunities for both established global players and agile new entrants to thrive and innovate.

MEA Luxury Goods Industry Segmentation

-

1. Product Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Jewelry

- 1.5. Watches

- 1.6. Other Accessories

-

2. Distribution Channel

- 2.1. Single-branded Stores

- 2.2. Multi-brand Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. United Arab Emirates

- 3.3. Qatar

- 3.4. South Africa

- 3.5. Rest of Middle East and Africa

MEA Luxury Goods Industry Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Qatar

- 4. South Africa

- 5. Rest of Middle East and Africa

MEA Luxury Goods Industry Regional Market Share

Geographic Coverage of MEA Luxury Goods Industry

MEA Luxury Goods Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Tourism Expected to Drive the Market; Robust Luxury Market Infrastructure

- 3.3. Market Restrains

- 3.3.1. Counterfeit Goods Restricting the Market Growth

- 3.4. Market Trends

- 3.4.1. Rise in Tourism Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. MEA Luxury Goods Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Jewelry

- 5.1.5. Watches

- 5.1.6. Other Accessories

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Single-branded Stores

- 5.2.2. Multi-brand Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. Qatar

- 5.3.4. South Africa

- 5.3.5. Rest of Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. Qatar

- 5.4.4. South Africa

- 5.4.5. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Saudi Arabia MEA Luxury Goods Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Clothing and Apparel

- 6.1.2. Footwear

- 6.1.3. Bags

- 6.1.4. Jewelry

- 6.1.5. Watches

- 6.1.6. Other Accessories

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Single-branded Stores

- 6.2.2. Multi-brand Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. United Arab Emirates

- 6.3.3. Qatar

- 6.3.4. South Africa

- 6.3.5. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Arab Emirates MEA Luxury Goods Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Clothing and Apparel

- 7.1.2. Footwear

- 7.1.3. Bags

- 7.1.4. Jewelry

- 7.1.5. Watches

- 7.1.6. Other Accessories

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Single-branded Stores

- 7.2.2. Multi-brand Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. United Arab Emirates

- 7.3.3. Qatar

- 7.3.4. South Africa

- 7.3.5. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Qatar MEA Luxury Goods Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Clothing and Apparel

- 8.1.2. Footwear

- 8.1.3. Bags

- 8.1.4. Jewelry

- 8.1.5. Watches

- 8.1.6. Other Accessories

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Single-branded Stores

- 8.2.2. Multi-brand Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. United Arab Emirates

- 8.3.3. Qatar

- 8.3.4. South Africa

- 8.3.5. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South Africa MEA Luxury Goods Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Clothing and Apparel

- 9.1.2. Footwear

- 9.1.3. Bags

- 9.1.4. Jewelry

- 9.1.5. Watches

- 9.1.6. Other Accessories

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Single-branded Stores

- 9.2.2. Multi-brand Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. United Arab Emirates

- 9.3.3. Qatar

- 9.3.4. South Africa

- 9.3.5. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of Middle East and Africa MEA Luxury Goods Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Clothing and Apparel

- 10.1.2. Footwear

- 10.1.3. Bags

- 10.1.4. Jewelry

- 10.1.5. Watches

- 10.1.6. Other Accessories

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Single-branded Stores

- 10.2.2. Multi-brand Stores

- 10.2.3. Online Retail Stores

- 10.2.4. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Saudi Arabia

- 10.3.2. United Arab Emirates

- 10.3.3. Qatar

- 10.3.4. South Africa

- 10.3.5. Rest of Middle East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Giorgio Armani S p A

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Estée Lauder Companies Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kering S A

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Burberry Group PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Compagnie Financière Richemont S A *List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Alshaya franchise group (Tribe of 6 Aerie)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dolce & Gabbana Luxembourg S À R L

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Rolex SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Prada S P A

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Roberto Cavalli S P A

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Chanel S A

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 LVMH Moët Hennessy Louis Vuitton

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Chopard Group

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Giorgio Armani S p A

List of Figures

- Figure 1: MEA Luxury Goods Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: MEA Luxury Goods Industry Share (%) by Company 2025

List of Tables

- Table 1: MEA Luxury Goods Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: MEA Luxury Goods Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: MEA Luxury Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: MEA Luxury Goods Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: MEA Luxury Goods Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: MEA Luxury Goods Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 7: MEA Luxury Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: MEA Luxury Goods Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: MEA Luxury Goods Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: MEA Luxury Goods Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 11: MEA Luxury Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: MEA Luxury Goods Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: MEA Luxury Goods Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: MEA Luxury Goods Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: MEA Luxury Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: MEA Luxury Goods Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: MEA Luxury Goods Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 18: MEA Luxury Goods Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 19: MEA Luxury Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: MEA Luxury Goods Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: MEA Luxury Goods Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: MEA Luxury Goods Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 23: MEA Luxury Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: MEA Luxury Goods Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Luxury Goods Industry?

The projected CAGR is approximately 6.23%.

2. Which companies are prominent players in the MEA Luxury Goods Industry?

Key companies in the market include Giorgio Armani S p A, The Estée Lauder Companies Inc, Kering S A, Burberry Group PLC, Compagnie Financière Richemont S A *List Not Exhaustive, Alshaya franchise group (Tribe of 6 Aerie), Dolce & Gabbana Luxembourg S À R L, Rolex SA, Prada S P A, Roberto Cavalli S P A, Chanel S A, LVMH Moët Hennessy Louis Vuitton, Chopard Group.

3. What are the main segments of the MEA Luxury Goods Industry?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.05 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Tourism Expected to Drive the Market; Robust Luxury Market Infrastructure.

6. What are the notable trends driving market growth?

Rise in Tourism Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Counterfeit Goods Restricting the Market Growth.

8. Can you provide examples of recent developments in the market?

November 2022: Santos de Cartier launched new series of jewelry collections that consists of rings, bracelets, and necklaces. The collection consists of a gold chain in two colors, mounted with a single or double row of coffee beans decorated with diamonds of various sizes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Luxury Goods Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Luxury Goods Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Luxury Goods Industry?

To stay informed about further developments, trends, and reports in the MEA Luxury Goods Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence