Key Insights

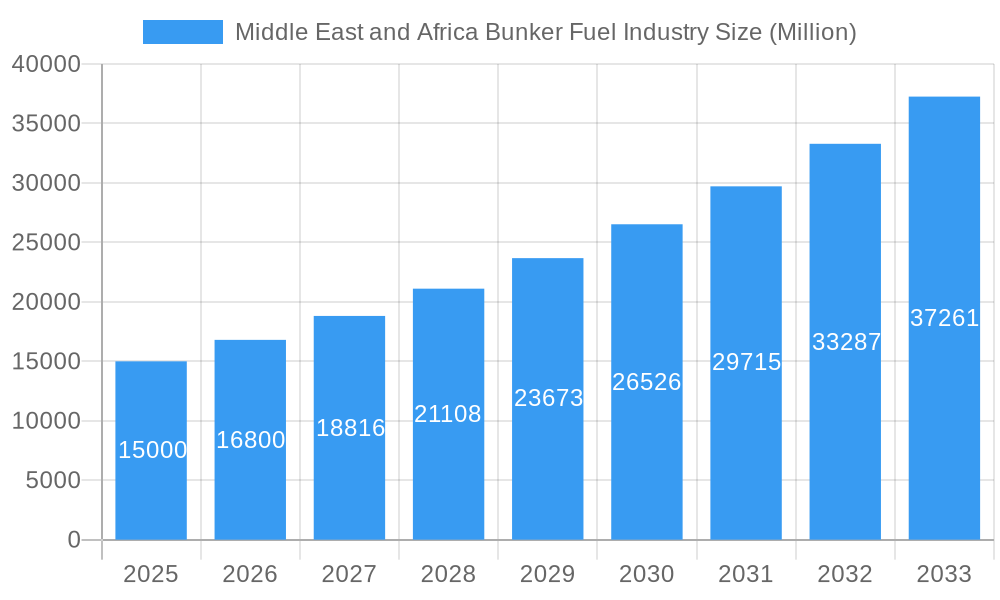

The Middle East and Africa Bunker Fuel market, valued at approximately $172.5 billion in 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.6% from 2025 to 2033. This robust expansion is primarily fueled by escalating global trade volumes, particularly through critical maritime routes like the Suez Canal, which drives demand for bunker fuels for container ships, tankers, and other vessels. Concurrently, economic growth in East Africa is stimulating infrastructural development and port expansion, further increasing fuel requirements. The industry is also witnessing a shift towards cleaner fuel alternatives such as LNG and VLSFO, presenting significant opportunities, although adoption is influenced by price differentials and infrastructure availability. Challenges include price volatility stemming from fluctuating crude oil prices and increased compliance costs associated with stringent environmental regulations. Market segmentation by fuel type (HSFO, VLSFO, MGO, LNG, Others) and vessel type (Containers, Tankers, General Cargo, Bulk Carriers, Others) highlights specific growth areas, with VLSFO and LNG expected to see substantial increases driven by environmental mandates.

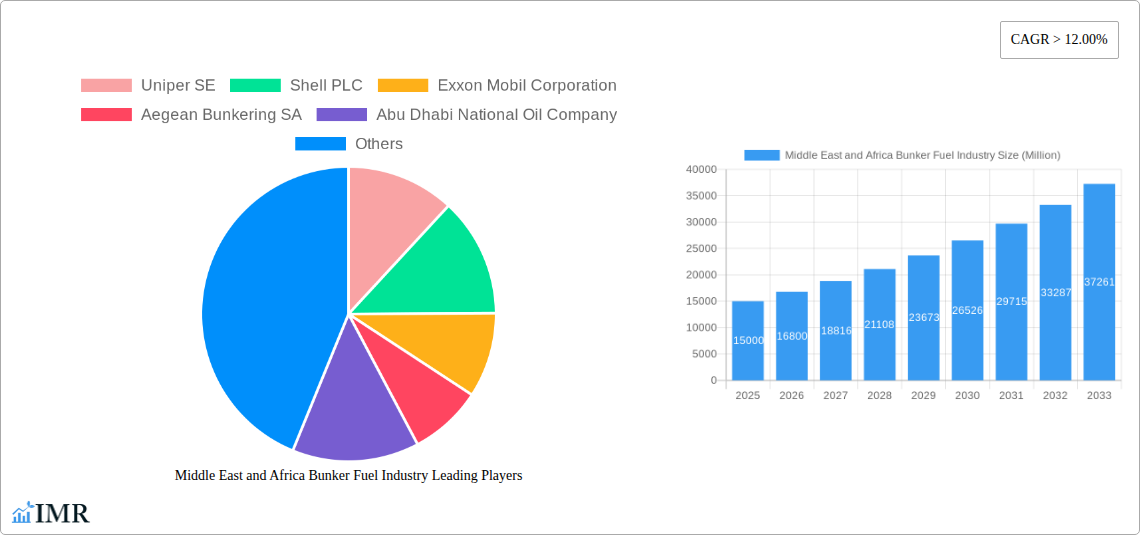

Middle East and Africa Bunker Fuel Industry Market Size (In Billion)

Country-specific analysis reveals varied growth patterns across the Middle East and Africa. Nations like Kenya, Tanzania, and South Africa demonstrate higher growth potential due to their expanding port infrastructure and maritime trade. Established hubs such as the UAE and South Africa serve as pivotal bunker fuel supply centers, impacting regional pricing and market competition. Leading market players, including Uniper SE, Shell PLC, and Exxon Mobil Corporation, are strategically investing in infrastructure, logistics, and fuel diversification to leverage these growth prospects and shape the market's future. Sustainable growth hinges on balancing economic development, environmental responsibility, and price stability.

Middle East and Africa Bunker Fuel Industry Company Market Share

Middle East & Africa Bunker Fuel Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East and Africa bunker fuel industry, encompassing market dynamics, growth trends, dominant segments, and key players. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is invaluable for industry professionals, investors, and strategic decision-makers seeking a clear understanding of this dynamic market.

Middle East and Africa Bunker Fuel Industry Market Dynamics & Structure

The Middle East and Africa bunker fuel market is characterized by a moderately concentrated structure, with major players like Shell PLC, Exxon Mobil Corporation, and TotalEnergies SE holding significant market share (estimated at xx% collectively in 2025). Market dynamics are shaped by several factors:

- Technological Innovation: The shift towards cleaner fuels, driven by stricter environmental regulations (e.g., IMO 2020), is a primary driver, with increasing adoption of VLSFO and LNG. However, high upfront investment costs and limited infrastructure pose challenges to wider LNG adoption.

- Regulatory Frameworks: Varying regulations across different countries in the region impact fuel choices and pricing. Harmonization efforts and the implementation of stricter emission standards are reshaping the market.

- Competitive Product Substitutes: The emergence of alternative fuels, such as biofuels and hydrogen, presents both opportunities and challenges for traditional bunker fuel suppliers. Competition is also fierce among existing players.

- End-User Demographics: The growth of container shipping and the expansion of port infrastructure significantly influence bunker fuel demand. Regional economic growth and trade patterns directly impact consumption.

- M&A Trends: The past five years have witnessed xx M&A deals in the region (2019-2024), primarily focused on expanding geographical reach and optimizing supply chains. Further consolidation is anticipated.

Middle East and Africa Bunker Fuel Industry Growth Trends & Insights

The MEA bunker fuel market exhibited a CAGR of xx% during the historical period (2019-2024), reaching a market size of xx million units in 2024. Driven by increased maritime trade, port development, and economic growth in several key countries, the market is projected to continue its expansion. The forecast period (2025-2033) anticipates a CAGR of xx%, reaching xx million units by 2033. This growth is heavily influenced by increasing demand for VLSFO, fueled by stricter environmental regulations and the growing preference for cleaner fuels. However, economic downturns and global trade fluctuations can impact growth trajectories. Technological disruptions, such as the widespread adoption of LNG and alternative fuels, will significantly shape the industry's future. Consumer behavior shifts towards sustainable shipping practices also influence the choice of bunker fuels. Market penetration of LNG is expected to grow from xx% in 2025 to xx% by 2033.

Dominant Regions, Countries, or Segments in Middle East and Africa Bunker Fuel Industry

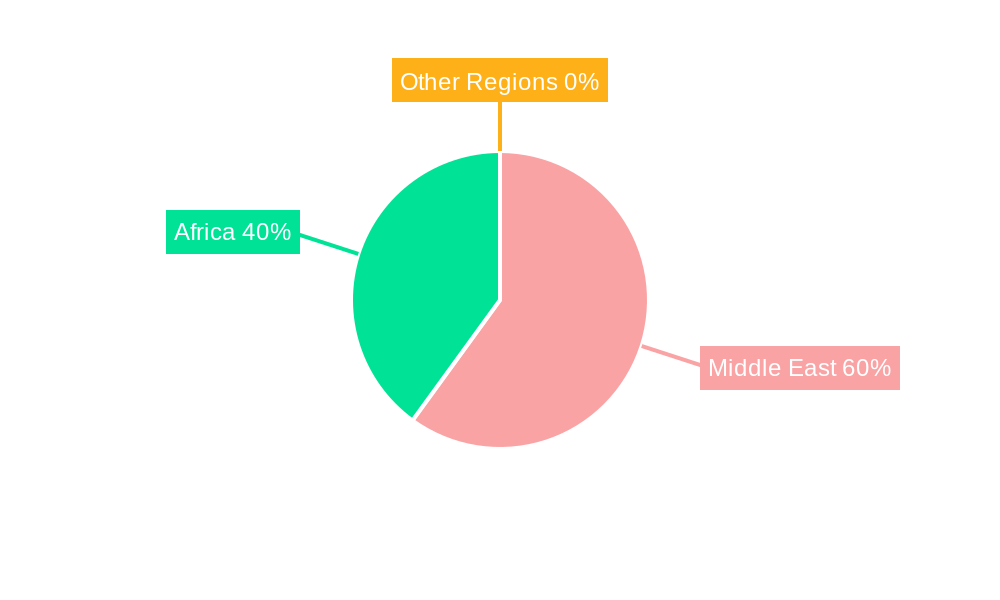

The Middle East region, particularly the Strait of Hormuz, remains the dominant area for bunker fuel consumption due to its strategic location as a major shipping route. Within the fuel type segment, VLSFO is experiencing the fastest growth, surpassing HSFO in market share.

Key Drivers:

- Economic Growth: Continued economic expansion in several MEA countries stimulates trade and shipping activity.

- Infrastructure Development: Investments in port infrastructure and expansion are vital for increasing bunker fuel demand.

- Government Policies: Supportive regulatory frameworks and investments in sustainable shipping initiatives contribute to market growth.

Dominant Segments:

- Fuel Type: VLSFO is experiencing significant growth driven by environmental regulations.

- Vessel Type: Container ships and tankers represent the largest share of bunker fuel consumption.

The growth potential is substantial in East Africa, due to planned infrastructure upgrades and increasing economic activity.

Middle East and Africa Bunker Fuel Industry Product Landscape

The bunker fuel market offers a range of products catering to various vessel types and environmental regulations. Product innovation focuses on improving fuel efficiency, reducing emissions, and enhancing performance. VLSFO and LNG are leading the way, with advancements in fuel additives and blending technologies designed to optimize engine performance and reduce harmful emissions. Unique selling propositions emphasize fuel quality, reliability of supply, and competitive pricing.

Key Drivers, Barriers & Challenges in Middle East and Africa Bunker Fuel Industry

Key Drivers: Increased global trade, economic growth in several MEA countries, and investments in port infrastructure are key growth drivers. Stricter environmental regulations promote the adoption of cleaner fuels like VLSFO and LNG.

Challenges: Fluctuations in crude oil prices, geopolitical instability in certain regions, and the high upfront costs associated with LNG infrastructure development pose significant challenges. Supply chain disruptions and regulatory inconsistencies across different countries also hinder market growth. The competitive landscape, with several major international players, can intensify pricing pressures.

Emerging Opportunities in Middle East and Africa Bunker Fuel Industry

Emerging opportunities exist in the growing adoption of LNG as a marine fuel, particularly in regions with supportive infrastructure. Expanding into underserved markets in East Africa presents significant potential. The development of sustainable and alternative bunker fuels offers long-term growth prospects.

Growth Accelerators in the Middle East and Africa Bunker Fuel Industry Industry

Strategic partnerships between fuel suppliers and port authorities can accelerate market growth by improving infrastructure and streamlining logistics. Technological advancements in fuel blending and emissions reduction technologies further enhance the market's attractiveness. Continued investments in port infrastructure and the expansion of shipping routes within the region will drive long-term growth.

Key Players Shaping the Middle East and Africa Bunker Fuel Industry Market

- Uniper SE

- Shell PLC

- Exxon Mobil Corporation

- Aegean Bunkering SA

- Abu Dhabi National Oil Company

- Gulf Agency Company Ltd

- Chevron Corporation

- TotalEnergies SE

Notable Milestones in Middle East and Africa Bunker Fuel Industry Sector

- May 2022: EBRD provided a USD 41.6 million loan, supplemented by a USD 5.7 million GEF grant, for Moroccan port development, boosting infrastructure for bunker fuel handling.

- December 2022: A USD 6 billion agreement was signed for a new port and economic zone in Sudan, signifying potential for future bunker fuel demand growth.

In-Depth Middle East and Africa Bunker Fuel Industry Market Outlook

The future of the MEA bunker fuel market is bright, driven by ongoing infrastructure development, economic growth, and the transition to cleaner fuels. Strategic investments in LNG infrastructure and the exploration of alternative fuels present significant opportunities for growth. Companies that can adapt to stricter environmental regulations and offer innovative solutions will be best positioned for success. The market's long-term potential is substantial, particularly in rapidly developing regions.

Middle East and Africa Bunker Fuel Industry Segmentation

-

1. Fuel Type

- 1.1. High Sulfur Fuel Oil (HSFO)

- 1.2. Very-Low Sulfur Fuel Oil (VLSFO)

- 1.3. Marine Gas Oil (MGO)

- 1.4. Liquefied Natural Gas (LNG)

- 1.5. Other Fuel Types

-

2. Vessel Type

- 2.1. Containers

- 2.2. Tankers

- 2.3. General Cargo

- 2.4. Bulk Carrier

- 2.5. Other Vessel Types

-

3. Geography

- 3.1. The United Arab Emirates

- 3.2. Saudi Arabia

- 3.3. Nigeria

- 3.4. Rest of the Middle-East and Africa

Middle East and Africa Bunker Fuel Industry Segmentation By Geography

- 1. The United Arab Emirates

- 2. Saudi Arabia

- 3. Nigeria

- 4. Rest of the Middle East and Africa

Middle East and Africa Bunker Fuel Industry Regional Market Share

Geographic Coverage of Middle East and Africa Bunker Fuel Industry

Middle East and Africa Bunker Fuel Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Cost of Solar PV Installations4.; Supportive Government Policies For Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Penetration of Other Energy Sources

- 3.4. Market Trends

- 3.4.1. VLSFO to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Bunker Fuel Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. High Sulfur Fuel Oil (HSFO)

- 5.1.2. Very-Low Sulfur Fuel Oil (VLSFO)

- 5.1.3. Marine Gas Oil (MGO)

- 5.1.4. Liquefied Natural Gas (LNG)

- 5.1.5. Other Fuel Types

- 5.2. Market Analysis, Insights and Forecast - by Vessel Type

- 5.2.1. Containers

- 5.2.2. Tankers

- 5.2.3. General Cargo

- 5.2.4. Bulk Carrier

- 5.2.5. Other Vessel Types

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. The United Arab Emirates

- 5.3.2. Saudi Arabia

- 5.3.3. Nigeria

- 5.3.4. Rest of the Middle-East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. The United Arab Emirates

- 5.4.2. Saudi Arabia

- 5.4.3. Nigeria

- 5.4.4. Rest of the Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. The United Arab Emirates Middle East and Africa Bunker Fuel Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6.1.1. High Sulfur Fuel Oil (HSFO)

- 6.1.2. Very-Low Sulfur Fuel Oil (VLSFO)

- 6.1.3. Marine Gas Oil (MGO)

- 6.1.4. Liquefied Natural Gas (LNG)

- 6.1.5. Other Fuel Types

- 6.2. Market Analysis, Insights and Forecast - by Vessel Type

- 6.2.1. Containers

- 6.2.2. Tankers

- 6.2.3. General Cargo

- 6.2.4. Bulk Carrier

- 6.2.5. Other Vessel Types

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. The United Arab Emirates

- 6.3.2. Saudi Arabia

- 6.3.3. Nigeria

- 6.3.4. Rest of the Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7. Saudi Arabia Middle East and Africa Bunker Fuel Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7.1.1. High Sulfur Fuel Oil (HSFO)

- 7.1.2. Very-Low Sulfur Fuel Oil (VLSFO)

- 7.1.3. Marine Gas Oil (MGO)

- 7.1.4. Liquefied Natural Gas (LNG)

- 7.1.5. Other Fuel Types

- 7.2. Market Analysis, Insights and Forecast - by Vessel Type

- 7.2.1. Containers

- 7.2.2. Tankers

- 7.2.3. General Cargo

- 7.2.4. Bulk Carrier

- 7.2.5. Other Vessel Types

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. The United Arab Emirates

- 7.3.2. Saudi Arabia

- 7.3.3. Nigeria

- 7.3.4. Rest of the Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8. Nigeria Middle East and Africa Bunker Fuel Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8.1.1. High Sulfur Fuel Oil (HSFO)

- 8.1.2. Very-Low Sulfur Fuel Oil (VLSFO)

- 8.1.3. Marine Gas Oil (MGO)

- 8.1.4. Liquefied Natural Gas (LNG)

- 8.1.5. Other Fuel Types

- 8.2. Market Analysis, Insights and Forecast - by Vessel Type

- 8.2.1. Containers

- 8.2.2. Tankers

- 8.2.3. General Cargo

- 8.2.4. Bulk Carrier

- 8.2.5. Other Vessel Types

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. The United Arab Emirates

- 8.3.2. Saudi Arabia

- 8.3.3. Nigeria

- 8.3.4. Rest of the Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9. Rest of the Middle East and Africa Middle East and Africa Bunker Fuel Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9.1.1. High Sulfur Fuel Oil (HSFO)

- 9.1.2. Very-Low Sulfur Fuel Oil (VLSFO)

- 9.1.3. Marine Gas Oil (MGO)

- 9.1.4. Liquefied Natural Gas (LNG)

- 9.1.5. Other Fuel Types

- 9.2. Market Analysis, Insights and Forecast - by Vessel Type

- 9.2.1. Containers

- 9.2.2. Tankers

- 9.2.3. General Cargo

- 9.2.4. Bulk Carrier

- 9.2.5. Other Vessel Types

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. The United Arab Emirates

- 9.3.2. Saudi Arabia

- 9.3.3. Nigeria

- 9.3.4. Rest of the Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Fuel Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Uniper SE

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Shell PLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Exxon Mobil Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Aegean Bunkering SA

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Abu Dhabi National Oil Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Gulf Agency Company Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Chevron Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 TotalEnergies SE

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Uniper SE

List of Figures

- Figure 1: Middle East and Africa Bunker Fuel Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Bunker Fuel Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 2: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Fuel Type 2020 & 2033

- Table 3: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Vessel Type 2020 & 2033

- Table 4: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Vessel Type 2020 & 2033

- Table 5: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Geography 2020 & 2033

- Table 7: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Region 2020 & 2033

- Table 9: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 10: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Fuel Type 2020 & 2033

- Table 11: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Vessel Type 2020 & 2033

- Table 12: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Vessel Type 2020 & 2033

- Table 13: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Geography 2020 & 2033

- Table 15: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Country 2020 & 2033

- Table 17: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 18: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Fuel Type 2020 & 2033

- Table 19: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Vessel Type 2020 & 2033

- Table 20: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Vessel Type 2020 & 2033

- Table 21: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Geography 2020 & 2033

- Table 23: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Country 2020 & 2033

- Table 25: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 26: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Fuel Type 2020 & 2033

- Table 27: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Vessel Type 2020 & 2033

- Table 28: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Vessel Type 2020 & 2033

- Table 29: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Geography 2020 & 2033

- Table 31: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Country 2020 & 2033

- Table 33: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 34: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Fuel Type 2020 & 2033

- Table 35: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Vessel Type 2020 & 2033

- Table 36: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Vessel Type 2020 & 2033

- Table 37: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Geography 2020 & 2033

- Table 39: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Bunker Fuel Industry?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the Middle East and Africa Bunker Fuel Industry?

Key companies in the market include Uniper SE, Shell PLC, Exxon Mobil Corporation, Aegean Bunkering SA, Abu Dhabi National Oil Company, Gulf Agency Company Ltd, Chevron Corporation, TotalEnergies SE.

3. What are the main segments of the Middle East and Africa Bunker Fuel Industry?

The market segments include Fuel Type, Vessel Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 172.5 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Cost of Solar PV Installations4.; Supportive Government Policies For Renewable Energy.

6. What are the notable trends driving market growth?

VLSFO to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Penetration of Other Energy Sources.

8. Can you provide examples of recent developments in the market?

May 2022: European Bank for Reconstruction and Development (EBRD) provided a USD 41.6 million loan to Agence Nationale des Ports (ANP) for the development of Moroccan ports. The loan will be supplemented by an investment grant of USD 5.7 million from the Global Environment Facility (GEF).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in metric tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Bunker Fuel Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Bunker Fuel Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Bunker Fuel Industry?

To stay informed about further developments, trends, and reports in the Middle East and Africa Bunker Fuel Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence