Key Insights

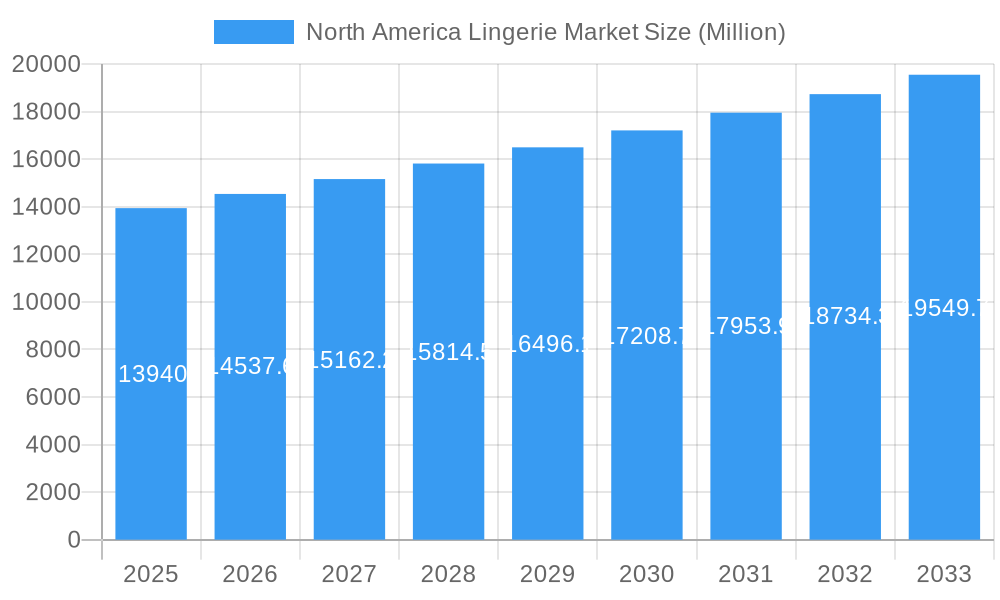

The North American lingerie market, valued at $13.94 billion in 2025, is projected to experience steady growth, with a Compound Annual Growth Rate (CAGR) of 4.29% from 2025 to 2033. This growth is fueled by several key factors. Increasing disposable incomes, particularly among millennial and Gen Z consumers, are driving demand for premium and comfortable lingerie options. The rising awareness of body positivity and inclusivity is pushing brands to offer wider ranges of sizes, styles, and fabrics catering to diverse body types, further expanding the market. E-commerce's continued expansion provides convenient access to a wider variety of products, boosting sales. Furthermore, the increasing adoption of sustainable and ethically sourced materials resonates with environmentally conscious consumers, influencing purchasing decisions. However, economic downturns and fluctuating raw material prices could pose challenges to market growth.

North America Lingerie Market Market Size (In Billion)

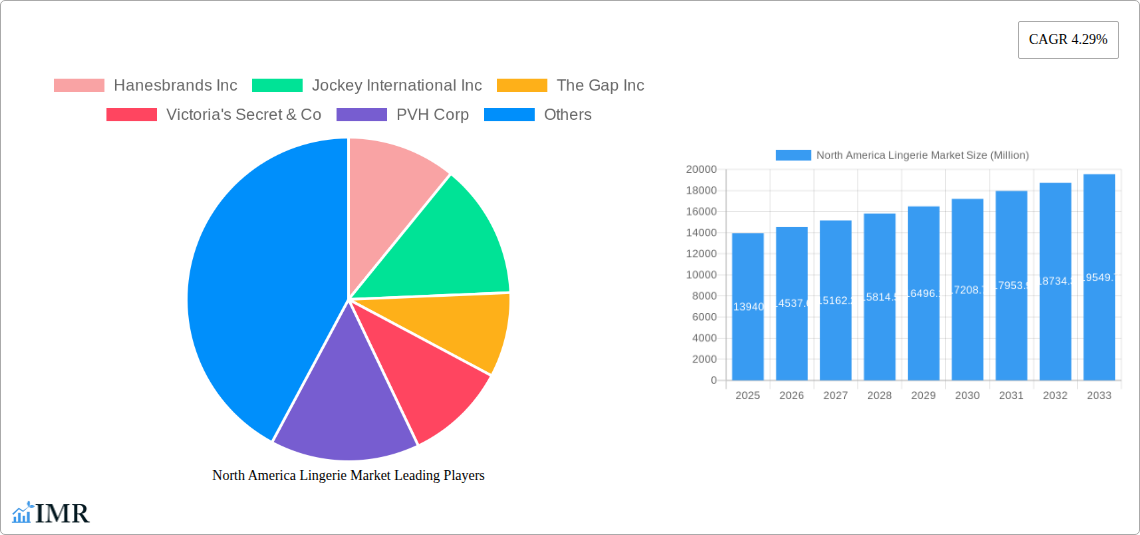

The market is segmented by product type (brassieres, briefs, and other products) and distribution channel (supermarkets/hypermarkets, specialty stores, and online retail stores). Brassieres and briefs constitute the largest segments, driven by consistent demand. Online retail is experiencing significant growth, driven by convenience and increased product visibility. Major players like Hanesbrands Inc, Jockey International Inc, Victoria's Secret & Co, and PVH Corp are shaping market dynamics through innovative product launches, strategic partnerships, and effective marketing campaigns. Regional variations exist, with the United States representing the largest market within North America. The market's future depends on adapting to evolving consumer preferences, including embracing body positivity, sustainability, and technological advancements in product design and marketing.

North America Lingerie Market Company Market Share

North America Lingerie Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America lingerie market, covering market dynamics, growth trends, dominant segments, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report is crucial for lingerie brands, investors, and market analysts seeking a complete understanding of this evolving sector. The market size is projected to reach xx Million units by 2033.

Keywords: North America Lingerie Market, Lingerie Market Size, Lingerie Market Trends, Brassiere Market, Briefs Market, Online Lingerie Retail, Lingerie Market Analysis, Lingerie Industry, Victoria's Secret, Hanesbrands, Jockey International, AI-Fitted Bras, Lingerie Market Growth, North America Lingerie Sales.

North America Lingerie Market Dynamics & Structure

The North America lingerie market is characterized by a moderately concentrated landscape, with key players like Hanesbrands Inc, Jockey International Inc, The Gap Inc, Victoria's Secret & Co, PVH Corp, and others holding significant market share. However, the rise of smaller, specialized brands and direct-to-consumer (DTC) companies is increasing competition. Technological innovation, particularly in areas like AI-powered fitting and personalized recommendations, is a key driver of growth. Regulatory frameworks concerning labeling, material safety, and advertising influence market practices. Competitive product substitutes, such as shapewear and comfortable everyday apparel, pose a challenge. End-user demographics are diverse, with varying preferences across age groups, body types, and lifestyles. The market has witnessed a moderate level of M&A activity in recent years, with larger companies seeking to expand their product portfolios and market reach.

- Market Concentration: Moderately concentrated, with top players holding approximately xx% of the market share in 2025.

- Technological Innovation: AI-powered fitting, personalized recommendations, and sustainable materials are key innovation drivers.

- Regulatory Framework: Regulations concerning labeling, material safety, and advertising influence market practices.

- Competitive Substitutes: Shapewear, comfortable everyday apparel.

- End-User Demographics: Diverse, with varying preferences across age, body type, and lifestyle.

- M&A Trends: Moderate activity in recent years, driven by expansion strategies. Approximate number of M&A deals in the past 5 years: xx.

North America Lingerie Market Growth Trends & Insights

The North America lingerie market experienced a CAGR of xx% during the historical period (2019-2024). Market size is estimated at xx Million units in 2025 and is projected to reach xx Million units by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by factors such as increasing disposable incomes, changing consumer preferences towards comfort and body positivity, and the expansion of e-commerce. Technological disruptions, such as the introduction of AI-powered fitting technologies, are transforming the shopping experience and driving market penetration. Consumer behavior is shifting towards seeking more personalized and inclusive products, with a growing emphasis on sustainability and ethical sourcing. The market penetration of online retail channels is also significantly contributing to the market's expansion.

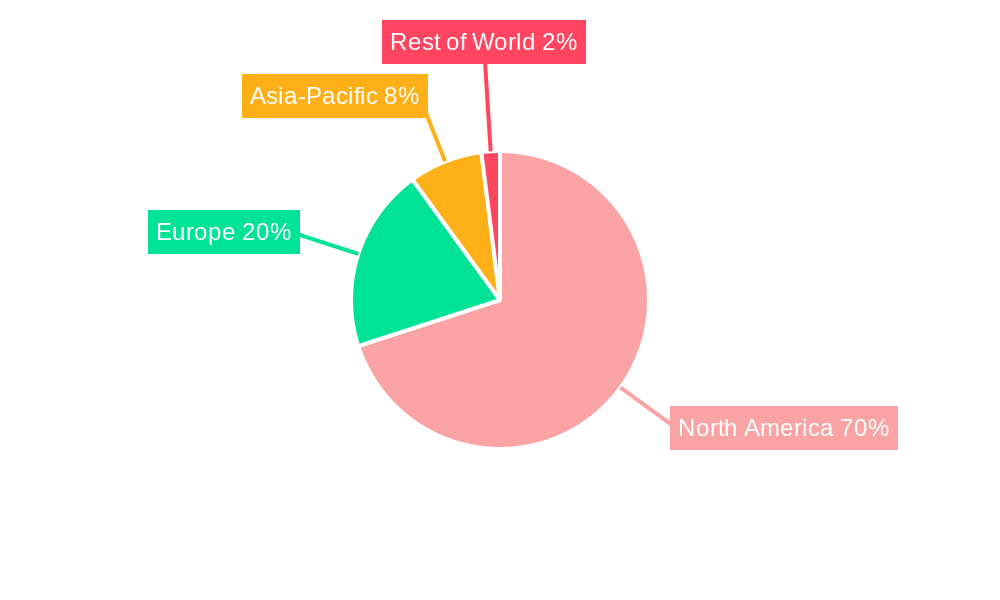

Dominant Regions, Countries, or Segments in North America Lingerie Market

The United States dominates the North America lingerie market, accounting for approximately xx% of the total market value in 2025. This dominance is driven by a larger consumer base, higher disposable incomes, and a well-established retail infrastructure. Within product types, brassieres hold the largest market share, followed by briefs and other product types. Online retail stores are experiencing rapid growth and are expected to become a significant distribution channel in the coming years.

- By Product Type: Brassieres (xx Million units), Briefs (xx Million units), Other Product Types (xx Million units)

- By Distribution Channel: Online Retail Stores (xx Million units), Specialty Stores (xx Million units), Supermarkets/Hypermarkets (xx Million units), Other Distribution Channels (xx Million units)

- Key Growth Drivers (US): High disposable incomes, established retail infrastructure, strong e-commerce adoption.

North America Lingerie Market Product Landscape

The North America lingerie market showcases a diverse range of products, from basic everyday bras and briefs to high-end luxury lingerie and specialized items like shapewear and sports bras. Recent innovations focus on comfort, fit, and sustainability, with materials like organic cotton, recycled fabrics, and innovative designs gaining traction. Brands are increasingly incorporating technological advancements, such as AI-powered fitting tools and personalized recommendation engines, to enhance the customer experience. Unique selling propositions often center on superior comfort, innovative designs, and body-positive messaging.

Key Drivers, Barriers & Challenges in North America Lingerie Market

Key Drivers:

- Increasing disposable incomes and consumer spending.

- Growing awareness of body positivity and self-acceptance.

- Rise of e-commerce and online shopping.

- Technological advancements in product design and fitting.

Key Challenges:

- Intense competition from established and emerging brands.

- Supply chain disruptions and fluctuations in raw material prices.

- Maintaining ethical and sustainable sourcing practices.

- Meeting diverse consumer needs and preferences across various demographics.

Emerging Opportunities in North America Lingerie Market

- Growing demand for plus-size and inclusive lingerie.

- Expansion into niche markets, such as sustainable and eco-friendly lingerie.

- Leveraging technological advancements to personalize the shopping experience.

- Increasing focus on promoting body positivity and self-love.

Growth Accelerators in the North America Lingerie Market Industry

Technological breakthroughs in AI-powered fitting, personalized recommendations, and sustainable material development are key growth catalysts. Strategic partnerships between established brands and innovative technology companies are also driving market expansion. Furthermore, market expansion strategies focusing on underserved demographics and untapped markets, along with aggressive e-commerce initiatives, are accelerating growth.

Key Players Shaping the North America Lingerie Market Market

- Hanesbrands Inc

- Jockey International Inc

- The Gap Inc

- Victoria's Secret & Co

- PVH Corp

- The Natori Company Incorporated

- Fullbeauty Brands

- AEO Inc

- Nike Inc

- La Perla

Notable Milestones in North America Lingerie Market Sector

- January 2024: Victoria's Secret & Co. partners with Google Cloud to leverage AI for personalized online shopping experiences.

- March 2024: ThirdLove partners with Neiman Marcus to expand its reach to luxury shoppers.

- March 2024: DOUBL launches the first AI-fitted bra, allowing for at-home measurements and customized bra creation.

In-Depth North America Lingerie Market Market Outlook

The North America lingerie market exhibits strong growth potential driven by ongoing technological advancements, the rise of e-commerce, and the increasing focus on inclusivity and sustainability. Strategic partnerships, targeted marketing campaigns, and the expansion into new product categories and markets will further fuel growth in the coming years. The market is poised for continued expansion, offering significant opportunities for established players and new entrants alike.

North America Lingerie Market Segmentation

-

1. Product Type

- 1.1. Brassiere

- 1.2. Briefs

- 1.3. Other Product Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Specialty Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Lingerie Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Lingerie Market Regional Market Share

Geographic Coverage of North America Lingerie Market

North America Lingerie Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Influence of Endorsements and Aggressive Marketing; Inclination Toward Healthy Lifestyle and Athleisure

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Influence of Endorsements and Aggressive Marketing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Lingerie Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Brassiere

- 5.1.2. Briefs

- 5.1.3. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Lingerie Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Brassiere

- 6.1.2. Briefs

- 6.1.3. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Specialty Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Lingerie Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Brassiere

- 7.1.2. Briefs

- 7.1.3. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Specialty Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Lingerie Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Brassiere

- 8.1.2. Briefs

- 8.1.3. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Specialty Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North America Lingerie Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Brassiere

- 9.1.2. Briefs

- 9.1.3. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Specialty Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Hanesbrands Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Jockey International Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 The Gap Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Victoria's Secret & Co

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 PVH Corp

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 The Natori Company Incorporated

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Fullbeauty Brands *List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 AEO Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Nike Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 La Perla

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Hanesbrands Inc

List of Figures

- Figure 1: North America Lingerie Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Lingerie Market Share (%) by Company 2025

List of Tables

- Table 1: North America Lingerie Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: North America Lingerie Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: North America Lingerie Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: North America Lingerie Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Lingerie Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: North America Lingerie Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 7: North America Lingerie Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: North America Lingerie Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: North America Lingerie Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: North America Lingerie Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 11: North America Lingerie Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: North America Lingerie Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: North America Lingerie Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: North America Lingerie Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: North America Lingerie Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: North America Lingerie Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: North America Lingerie Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 18: North America Lingerie Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 19: North America Lingerie Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: North America Lingerie Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Lingerie Market?

The projected CAGR is approximately 4.29%.

2. Which companies are prominent players in the North America Lingerie Market?

Key companies in the market include Hanesbrands Inc, Jockey International Inc, The Gap Inc, Victoria's Secret & Co, PVH Corp, The Natori Company Incorporated, Fullbeauty Brands *List Not Exhaustive, AEO Inc, Nike Inc, La Perla.

3. What are the main segments of the North America Lingerie Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Influence of Endorsements and Aggressive Marketing; Inclination Toward Healthy Lifestyle and Athleisure.

6. What are the notable trends driving market growth?

Influence of Endorsements and Aggressive Marketing.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

March 2024: ThirdLove partnered with Neiman Marcus to expand its reach and gain access to luxury shoppers through the department store across America.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Lingerie Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Lingerie Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Lingerie Market?

To stay informed about further developments, trends, and reports in the North America Lingerie Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence