Key Insights

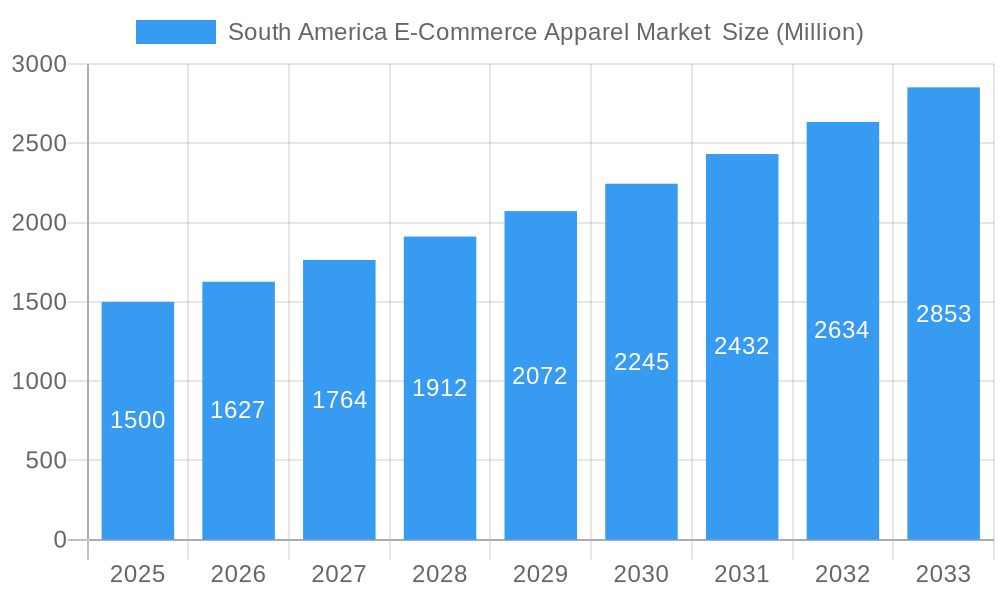

The South American e-commerce apparel market, projected to reach 8500.00 million by 2024, is poised for significant expansion, with a Compound Annual Growth Rate (CAGR) of 4.2% between 2024 and 2033. This growth is propelled by increasing internet and smartphone adoption across Brazil, Argentina, and other South American nations, expanding the online consumer base. A young, affluent demographic with a preference for convenient shopping further fuels demand. The proliferation of social commerce and influencer marketing, alongside enhanced payment gateways and logistics, are key contributors. While challenges like variable internet access and security concerns are being addressed through infrastructure and security investments, the market demonstrates strong potential across all apparel segments, particularly sportswear and casual wear, aligning with regional active lifestyles and evolving fashion consciousness. Major brands are actively capitalizing on this potential through strategic e-commerce and localized marketing.

South America E-Commerce Apparel Market Market Size (In Billion)

Market segmentation by platform highlights consumer demand for both third-party retailers and direct-to-consumer channels. Future growth will be driven by omnichannel strategies, integrating online and offline experiences to boost customer engagement. Intense competition will necessitate innovation in product development, logistics efficiency, and personalized marketing. Economic stability, supportive government policies, and evolving consumer behavior will shape the market's sustained growth. The South American e-commerce apparel market is set to become a vital component of the global fashion landscape.

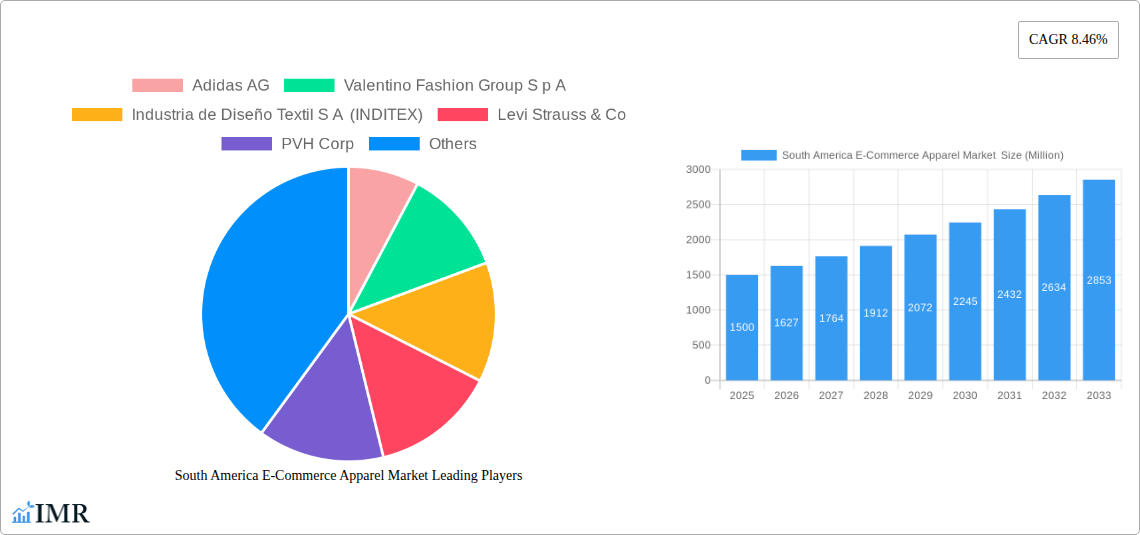

South America E-Commerce Apparel Market Company Market Share

South America E-Commerce Apparel Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South America e-commerce apparel market, covering market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals seeking to understand and capitalize on the opportunities within this rapidly evolving market. The report segments the market by platform type (Third Party Retailer, Company's Own Website), product type (Formal Wear, Casual Wear, Sportswear, Nightwear, Other Types), and end-user (Men, Women, Kids/Children). The total market size is projected to reach xx Million units by 2033.

South America E-Commerce Apparel Market Dynamics & Structure

The South American e-commerce apparel market is characterized by a moderately concentrated landscape, with key players like Adidas AG, Nike Inc, H & M Hennes & Mauritz AB, and INDITEX holding significant market share. However, the market is also witnessing the emergence of smaller, niche players. Technological innovation, particularly in areas like mobile commerce, personalized recommendations, and augmented reality (AR) try-ons, is a major growth driver. Regulatory frameworks related to data privacy and consumer protection are evolving, impacting market operations. Competitive product substitutes, such as secondhand apparel and fast fashion brands, also pose challenges.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Strong growth driver, fueled by mobile commerce and AR/VR technologies.

- Regulatory Frameworks: Evolving data privacy and consumer protection laws influence market practices.

- Competitive Substitutes: Secondhand apparel and fast fashion present competitive pressures.

- End-User Demographics: Growing young population and rising middle class fuel demand for online apparel.

- M&A Trends: xx M&A deals were recorded in the South American e-commerce apparel sector between 2019 and 2024, primarily focused on expanding market reach and product portfolios.

South America E-Commerce Apparel Market Growth Trends & Insights

The South American e-commerce apparel market experienced significant growth between 2019 and 2024, with a CAGR of xx%. This growth is attributed to several factors, including increasing internet and smartphone penetration, rising disposable incomes, and a shift in consumer preference towards online shopping. The market penetration of e-commerce in the apparel sector is estimated to be xx% in 2024, projected to reach xx% by 2033. Technological disruptions, such as the rise of social commerce and influencer marketing, have further accelerated market expansion. Changes in consumer behavior, including a preference for personalized experiences and convenient delivery options, are shaping market dynamics. The market is expected to continue its strong growth trajectory throughout the forecast period, driven by sustained technological advancements and changing consumer preferences. Specific growth segments include sportswear and casual wear, particularly among younger demographics.

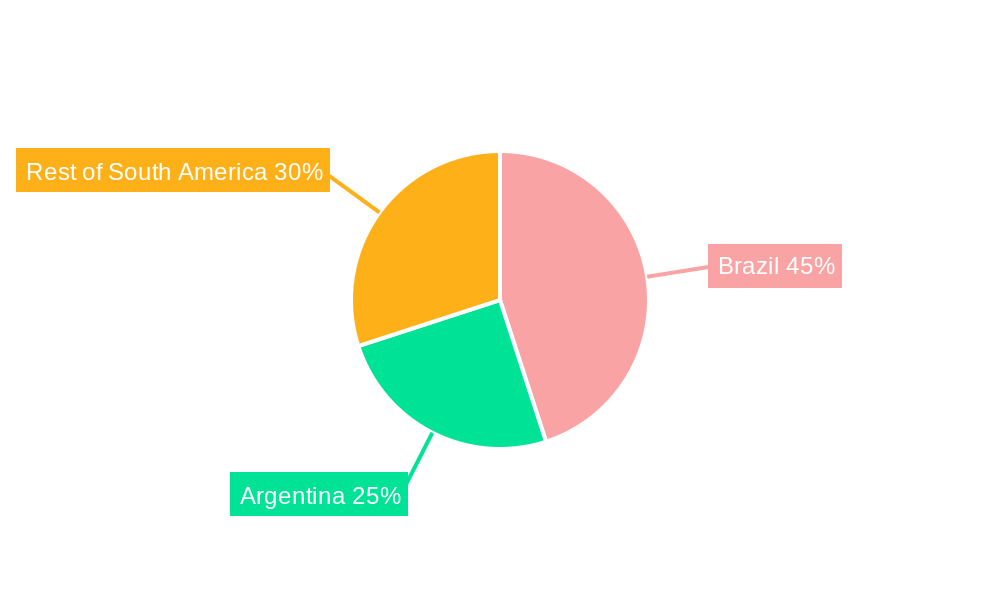

Dominant Regions, Countries, or Segments in South America E-Commerce Apparel Market

Brazil and Argentina currently dominate the South American e-commerce apparel market, accounting for approximately xx% and xx% of the total market value, respectively, in 2024. This dominance is driven by factors such as a larger consumer base, higher internet penetration, and a more developed e-commerce infrastructure compared to other South American countries. Within the market segmentation, casual wear currently holds the largest market share (approximately xx%), followed by sportswear (xx%). The "Company's Own Website" platform type holds a significant share, showcasing brand-building strategies.

- Key Drivers:

- Brazil & Argentina: Large consumer base, higher internet penetration, and developed e-commerce infrastructure.

- Casual Wear: High demand across various demographics and price points.

- Company's Own Website: Direct-to-consumer sales strategies are gaining popularity.

- Dominance Factors: Strong consumer base, established infrastructure, and brand recognition.

South America E-Commerce Apparel Market Product Landscape

The South American e-commerce apparel market features a diverse range of products, encompassing formal wear, casual wear, sportswear, nightwear, and other types of apparel. Product innovation focuses on incorporating sustainable materials, enhancing functionality, and improving online visual representations through high-quality photography and virtual try-on technologies. The most successful products are distinguished by their unique design, affordability, and quality and convenience of purchase via e-commerce. Technological advancements in manufacturing and supply chain management are improving efficiency and reducing production costs.

Key Drivers, Barriers & Challenges in South America E-Commerce Apparel Market

Key Drivers:

- Increasing internet and smartphone penetration.

- Rising disposable incomes and a growing middle class.

- Shifting consumer preferences towards online shopping.

- Growth of social commerce and influencer marketing.

Key Challenges:

- High logistics costs and delivery times.

- Lack of trust in online transactions.

- Competition from counterfeit products.

- Fluctuating currency exchange rates impacting imports.

Emerging Opportunities in South America E-Commerce Apparel Market

The market presents opportunities in several areas:

- Untapped Markets: Expanding into less-penetrated countries within South America.

- Sustainable Apparel: Growing demand for eco-friendly and ethically sourced apparel.

- Personalization: Leveraging data analytics to offer personalized shopping experiences.

- Mobile Commerce: Optimizing the shopping experience for mobile users.

Growth Accelerators in the South America E-Commerce Apparel Market Industry

Long-term growth will be fueled by continuous improvements in technology, particularly in logistics and payment systems. Strategic partnerships between e-commerce platforms and apparel brands will drive market expansion. The expansion into new markets and the integration of augmented reality and virtual reality technologies in online shopping experiences will create additional growth opportunities.

Key Players Shaping the South America E-Commerce Apparel Market Market

- Adidas AG

- Valentino Fashion Group S p A

- Industria de Diseño Textil S A (INDITEX)

- Levi Strauss & Co

- PVH Corp

- Puma SE

- LVMH Moët Hennessy Louis Vuitton

- Salvatore Ferragamo S p A

- Nike Inc

- H & M Hennes & Mauritz AB

Notable Milestones in South America E-Commerce Apparel Market Sector

- September 2021: Neymar Jr.'s partnership with Puma launched a successful lifestyle collection, boosting Puma's brand visibility and sales.

- August 2022: H&M's launch of its online store in Uruguay expanded its market reach and increased accessibility for Uruguayan consumers.

- February 2023: PVH Corp's Calvin Klein affiliate program enhanced e-commerce reach within Brazil's market.

In-Depth South America E-Commerce Apparel Market Market Outlook

The South American e-commerce apparel market is poised for continued robust growth, driven by increasing digitalization, favorable demographics, and ongoing technological advancements. Strategic partnerships and investments in infrastructure will be key to unlocking the market's full potential. The focus on personalization, sustainability, and seamless online experiences will be crucial for brands to thrive in this competitive landscape. The market is anticipated to reach xx Million units by 2033, presenting significant opportunities for both established and emerging players.

South America E-Commerce Apparel Market Segmentation

-

1. Product Type

- 1.1. Formal Wear

- 1.2. Casual Wear

- 1.3. Sportswear

- 1.4. Nightwear

- 1.5. Other Types

-

2. End User

- 2.1. Men

- 2.2. Women

- 2.3. Kids/Children

-

3. Platform Type

- 3.1. Third Party Retailer

- 3.2. Company's Own Website

-

4. Geography

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

South America E-Commerce Apparel Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America E-Commerce Apparel Market Regional Market Share

Geographic Coverage of South America E-Commerce Apparel Market

South America E-Commerce Apparel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Influence of Social Media and Aggressive Marketing; Growing Popularity of Athleisure Apparel Across E-commerce Channels

- 3.3. Market Restrains

- 3.3.1. Competition From Brick-and-Mortar Retail Channel

- 3.4. Market Trends

- 3.4.1. Increased Influence of Social Media and Aggressive Marketing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Formal Wear

- 5.1.2. Casual Wear

- 5.1.3. Sportswear

- 5.1.4. Nightwear

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Kids/Children

- 5.3. Market Analysis, Insights and Forecast - by Platform Type

- 5.3.1. Third Party Retailer

- 5.3.2. Company's Own Website

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.5.2. Argentina

- 5.5.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Formal Wear

- 6.1.2. Casual Wear

- 6.1.3. Sportswear

- 6.1.4. Nightwear

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Kids/Children

- 6.3. Market Analysis, Insights and Forecast - by Platform Type

- 6.3.1. Third Party Retailer

- 6.3.2. Company's Own Website

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Brazil

- 6.4.2. Argentina

- 6.4.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Argentina South America E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Formal Wear

- 7.1.2. Casual Wear

- 7.1.3. Sportswear

- 7.1.4. Nightwear

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Kids/Children

- 7.3. Market Analysis, Insights and Forecast - by Platform Type

- 7.3.1. Third Party Retailer

- 7.3.2. Company's Own Website

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Brazil

- 7.4.2. Argentina

- 7.4.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of South America South America E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Formal Wear

- 8.1.2. Casual Wear

- 8.1.3. Sportswear

- 8.1.4. Nightwear

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Kids/Children

- 8.3. Market Analysis, Insights and Forecast - by Platform Type

- 8.3.1. Third Party Retailer

- 8.3.2. Company's Own Website

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Brazil

- 8.4.2. Argentina

- 8.4.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Adidas AG

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Valentino Fashion Group S p A

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Industria de Diseño Textil S A (INDITEX)

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Levi Strauss & Co

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 PVH Corp

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Puma SE

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 LVMH Moët Hennessy Louis Vuitton

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Salvatore Ferragamo S p A *List Not Exhaustive

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Nike Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 H & M Hennes & Mauritz AB

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Adidas AG

List of Figures

- Figure 1: South America E-Commerce Apparel Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: South America E-Commerce Apparel Market Share (%) by Company 2025

List of Tables

- Table 1: South America E-Commerce Apparel Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: South America E-Commerce Apparel Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: South America E-Commerce Apparel Market Revenue million Forecast, by End User 2020 & 2033

- Table 4: South America E-Commerce Apparel Market Volume K Units Forecast, by End User 2020 & 2033

- Table 5: South America E-Commerce Apparel Market Revenue million Forecast, by Platform Type 2020 & 2033

- Table 6: South America E-Commerce Apparel Market Volume K Units Forecast, by Platform Type 2020 & 2033

- Table 7: South America E-Commerce Apparel Market Revenue million Forecast, by Geography 2020 & 2033

- Table 8: South America E-Commerce Apparel Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 9: South America E-Commerce Apparel Market Revenue million Forecast, by Region 2020 & 2033

- Table 10: South America E-Commerce Apparel Market Volume K Units Forecast, by Region 2020 & 2033

- Table 11: South America E-Commerce Apparel Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 12: South America E-Commerce Apparel Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 13: South America E-Commerce Apparel Market Revenue million Forecast, by End User 2020 & 2033

- Table 14: South America E-Commerce Apparel Market Volume K Units Forecast, by End User 2020 & 2033

- Table 15: South America E-Commerce Apparel Market Revenue million Forecast, by Platform Type 2020 & 2033

- Table 16: South America E-Commerce Apparel Market Volume K Units Forecast, by Platform Type 2020 & 2033

- Table 17: South America E-Commerce Apparel Market Revenue million Forecast, by Geography 2020 & 2033

- Table 18: South America E-Commerce Apparel Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 19: South America E-Commerce Apparel Market Revenue million Forecast, by Country 2020 & 2033

- Table 20: South America E-Commerce Apparel Market Volume K Units Forecast, by Country 2020 & 2033

- Table 21: South America E-Commerce Apparel Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 22: South America E-Commerce Apparel Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 23: South America E-Commerce Apparel Market Revenue million Forecast, by End User 2020 & 2033

- Table 24: South America E-Commerce Apparel Market Volume K Units Forecast, by End User 2020 & 2033

- Table 25: South America E-Commerce Apparel Market Revenue million Forecast, by Platform Type 2020 & 2033

- Table 26: South America E-Commerce Apparel Market Volume K Units Forecast, by Platform Type 2020 & 2033

- Table 27: South America E-Commerce Apparel Market Revenue million Forecast, by Geography 2020 & 2033

- Table 28: South America E-Commerce Apparel Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 29: South America E-Commerce Apparel Market Revenue million Forecast, by Country 2020 & 2033

- Table 30: South America E-Commerce Apparel Market Volume K Units Forecast, by Country 2020 & 2033

- Table 31: South America E-Commerce Apparel Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 32: South America E-Commerce Apparel Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 33: South America E-Commerce Apparel Market Revenue million Forecast, by End User 2020 & 2033

- Table 34: South America E-Commerce Apparel Market Volume K Units Forecast, by End User 2020 & 2033

- Table 35: South America E-Commerce Apparel Market Revenue million Forecast, by Platform Type 2020 & 2033

- Table 36: South America E-Commerce Apparel Market Volume K Units Forecast, by Platform Type 2020 & 2033

- Table 37: South America E-Commerce Apparel Market Revenue million Forecast, by Geography 2020 & 2033

- Table 38: South America E-Commerce Apparel Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 39: South America E-Commerce Apparel Market Revenue million Forecast, by Country 2020 & 2033

- Table 40: South America E-Commerce Apparel Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America E-Commerce Apparel Market ?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the South America E-Commerce Apparel Market ?

Key companies in the market include Adidas AG, Valentino Fashion Group S p A, Industria de Diseño Textil S A (INDITEX), Levi Strauss & Co, PVH Corp, Puma SE, LVMH Moët Hennessy Louis Vuitton, Salvatore Ferragamo S p A *List Not Exhaustive, Nike Inc, H & M Hennes & Mauritz AB.

3. What are the main segments of the South America E-Commerce Apparel Market ?

The market segments include Product Type, End User, Platform Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 7824.99 million as of 2022.

5. What are some drivers contributing to market growth?

Increased Influence of Social Media and Aggressive Marketing; Growing Popularity of Athleisure Apparel Across E-commerce Channels.

6. What are the notable trends driving market growth?

Increased Influence of Social Media and Aggressive Marketing.

7. Are there any restraints impacting market growth?

Competition From Brick-and-Mortar Retail Channel.

8. Can you provide examples of recent developments in the market?

February 2023: PVH Corp announced the launch of the Calvin Klein affiliate program, a popular e-commerce affiliate program. The company offers e-retailers across Brazil an offer to join the Calvin Klein Affiliate Marketing Campaign and claims that on joining the program, the visitors of the e-commerce sites have access to online stores in Brazil.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America E-Commerce Apparel Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America E-Commerce Apparel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America E-Commerce Apparel Market ?

To stay informed about further developments, trends, and reports in the South America E-Commerce Apparel Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence