Key Insights

The global tobacco market, estimated at $1058.2 billion in 2025, is projected to grow at a compound annual growth rate (CAGR) of 2.53% from 2025 to 2033. While developed markets like North America and Europe face headwinds from health concerns and regulations, expansion in Asia and Africa, driven by economic growth and population increase, will be key growth drivers. The market is segmented by product (cigarettes, cigars, smokeless devices, waterpipes) and distribution (supermarkets, convenience stores, specialty stores). Cigarettes remain dominant, though smokeless alternatives like e-cigarettes and vaping devices are gaining traction. Online sales and e-commerce are also transforming distribution. Major players include Philip Morris International, British American Tobacco, and ITC Limited, alongside significant regional competitors. The industry confronts ongoing challenges from anti-smoking initiatives, taxation, and shifting consumer preferences. Strategic diversification, innovation, and emerging market expansion are vital for sustained profitability.

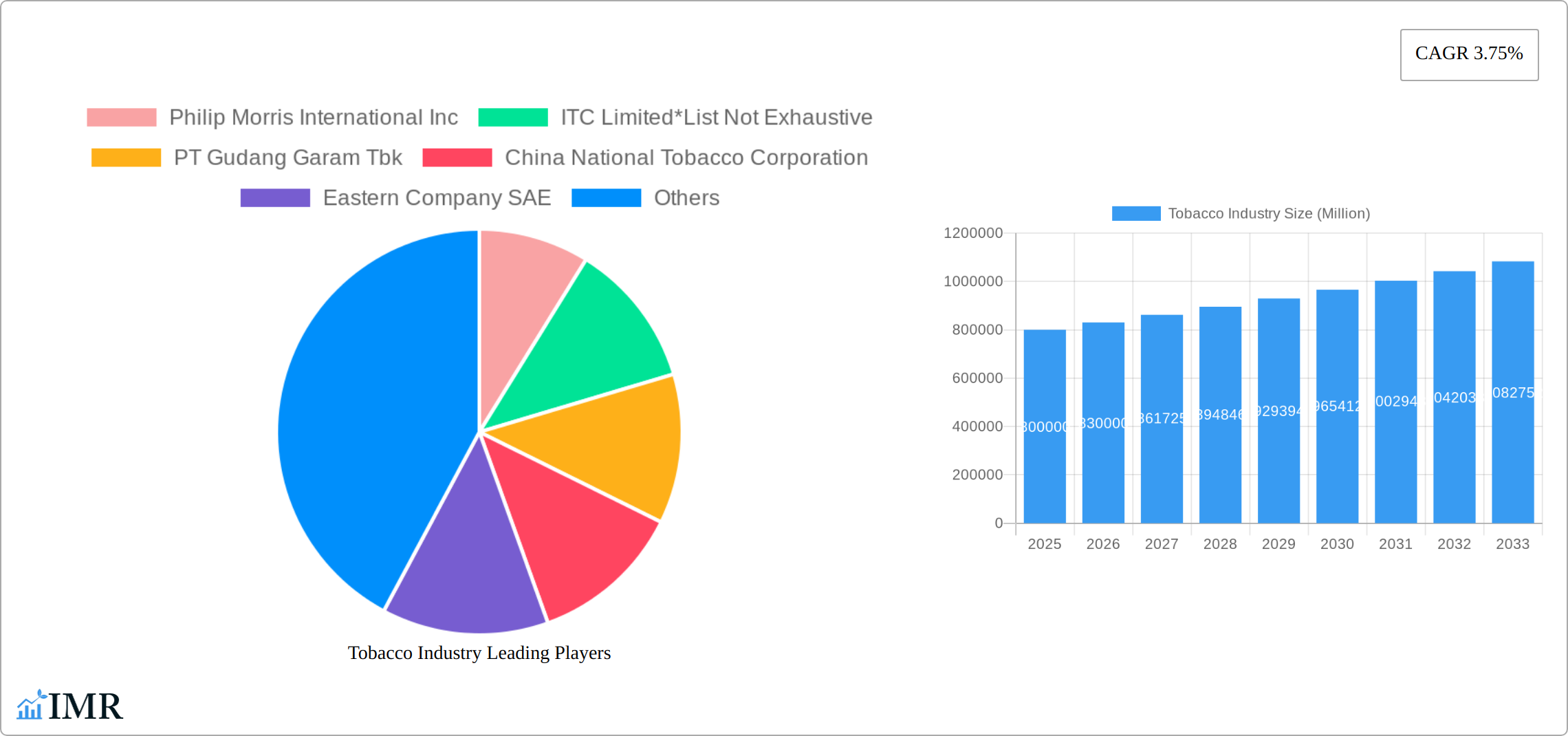

Tobacco Industry Market Size (In Million)

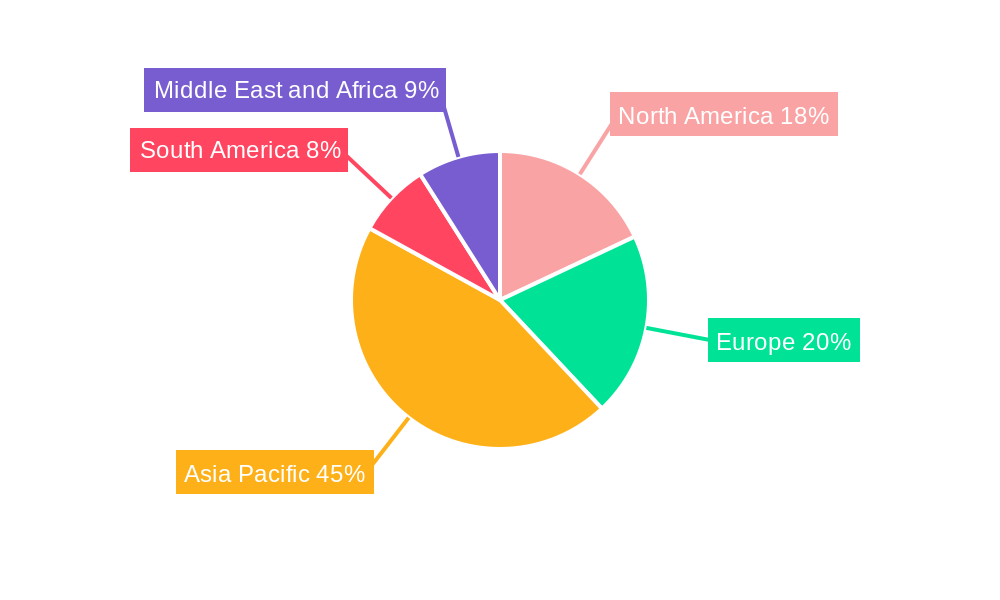

Future growth hinges on industry adaptation to evolving consumer behavior. This necessitates investment in R&D for reduced-harm products and targeted marketing strategies. The Asia Pacific region is expected to lead market share due to population growth and rising consumption. North America and Europe may see stagnant or declining sales due to health awareness and regulatory pressures. South America and the Middle East & Africa are anticipated to experience moderate growth. Regulatory scrutiny and changing consumer preferences demand a flexible business approach.

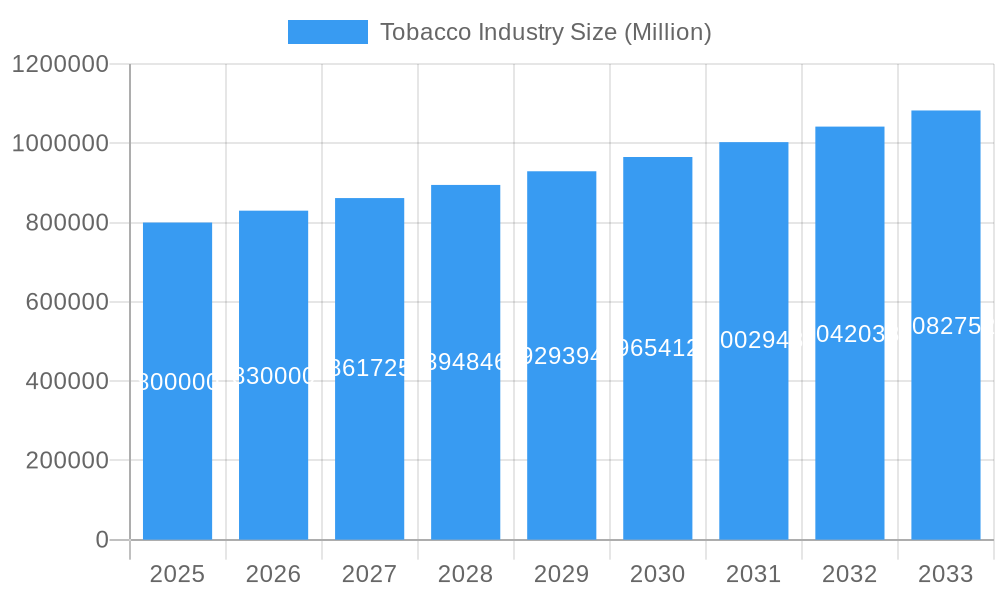

Tobacco Industry Company Market Share

This report offers a comprehensive analysis of the global tobacco industry, including market dynamics, growth trends, key segments, product landscape, challenges, and opportunities. The study period spans 2019-2033, with 2025 serving as the base year. It provides actionable intelligence for industry professionals, investors, and stakeholders, with detailed analysis of the parent market (Tobacco) and its sub-segments (Cigarettes, Cigars and Cigarillos, Waterpipes, Smokeless Devices).

Tobacco Industry Market Dynamics & Structure

This section analyzes the global tobacco market's competitive landscape, technological advancements, regulatory environment, and market consolidation trends from 2019 to 2024. The market exhibits high concentration with a few dominant players controlling a significant share. Technological innovation is driven by the need to create less harmful alternatives to traditional cigarettes. Stringent regulatory frameworks significantly impact product development and marketing strategies. The emergence of heated tobacco products and e-cigarettes poses a considerable challenge to traditional cigarette manufacturers. Consumer demographics are shifting towards healthier alternatives, while M&A activities reshape market dynamics.

- Market Concentration: xx% controlled by top 5 players (2024).

- Technological Innovation: Focus on heated tobacco products and smokeless alternatives.

- Regulatory Landscape: Stringent regulations on advertising, product labeling, and taxation.

- Competitive Substitutes: E-cigarettes, heated tobacco products, vaping devices.

- End-User Demographics: Shifting consumer preferences towards reduced-risk products.

- M&A Activity: xx deals recorded between 2019 and 2024 (estimated value: xx Million). Significant consolidation predicted for the forecast period.

Tobacco Industry Growth Trends & Insights

This section offers a comprehensive analysis of the tobacco industry's growth trajectory, market size evolution (in million units), and key factors influencing market expansion from 2019 to 2033. The report meticulously examines adoption rates of various tobacco products, exploring shifts in consumer behavior and technological advancements that are fundamentally reshaping the industry landscape. Our analysis utilizes a robust blend of quantitative metrics (e.g., CAGR, market penetration, market share) and qualitative factors to provide a holistic understanding of market evolution. Specific market sizes for individual product segments are detailed, highlighting growth and decline across various categories. The impact of regulatory changes, evolving health concerns, and dynamic consumer preferences on market growth is extensively analyzed, considering both global and regional variations. Further, we delve into the competitive dynamics within the industry, exploring the strategies employed by key players to maintain market share and drive growth.

- Market Size (2024): [Insert Updated Market Size in Million Units] projected to reach [Insert Updated Projected Market Size in Million Units] (2033).

- CAGR (2025-2033): [Insert Updated CAGR Percentage]

- Market Penetration: Detailed analysis illustrating variations across different product types and key geographic regions is included in the full report.

- Technological Disruptions: The introduction and market acceptance of heated tobacco products (HTPs), e-cigarettes, and other emerging nicotine delivery systems are analyzed in detail, including their impact on consumer preference and market segmentation.

- Consumer Behavior Shifts: A deep dive into shifting consumer preferences, including the growing demand for reduced-risk products and the impact of health awareness campaigns, is provided.

- Regulatory Landscape: An in-depth analysis of the evolving regulatory environment and its influence on product innovation, market access, and overall industry growth.

Dominant Regions, Countries, or Segments in Tobacco Industry

This section identifies the leading geographical regions, countries, and product segments driving growth within the tobacco industry. Asia accounts for the largest market share, followed by North America and Europe. Within product types, cigarettes dominate the market, while the smokeless tobacco segment is experiencing the fastest growth. Convenience stores represent the leading distribution channel. The analysis examines the factors contributing to the dominance of these regions and segments, incorporating economic policies, infrastructure development, and consumer preferences.

- Leading Region: Asia (xx% market share in 2024).

- Leading Country: China (xx% market share in 2024).

- Leading Product Segment: Cigarettes (xx% market share in 2024).

- Leading Distribution Channel: Convenience Stores (xx% market share in 2024).

- Key Drivers: High population density in Asia, established distribution networks, and favorable economic conditions.

Tobacco Industry Product Landscape

The tobacco industry's product landscape is characterized by continuous innovation, with a focus on reduced-risk products. Manufacturers are investing heavily in developing heated tobacco devices, e-cigarettes, and other alternatives to conventional cigarettes. These products often boast unique selling propositions such as improved taste, reduced harmful emissions, and enhanced user experience. The report provides an overview of these product innovations, highlighting their key features and performance metrics.

Key Drivers, Barriers & Challenges in Tobacco Industry

The tobacco industry's growth is driven by factors such as rising disposable incomes, particularly in developing economies, and the established presence of strong distribution networks. However, the industry faces numerous challenges, including stringent regulations, increasing health consciousness among consumers, and the emergence of potent substitutes like vaping products. Supply chain disruptions also affect the market significantly, along with intense competition and pricing pressures.

Key Drivers:

- Rising disposable incomes in emerging markets.

- Well-established distribution networks.

Key Challenges:

- Stringent government regulations.

- Growing health concerns among consumers.

- Intense competition from substitute products.

- Supply chain disruptions causing xx% impact on production (estimated).

Emerging Opportunities in Tobacco Industry

Significant emerging opportunities exist in the development and marketing of reduced-risk products (RRPs), particularly within untapped markets exhibiting rapid economic growth. The escalating global demand for alternatives to conventional cigarettes presents a substantial opportunity for companies capable of effectively meeting this demand while adhering to rigorous regulatory standards. Further opportunities reside in exploring innovative product formats, personalized marketing strategies, and the development of novel nicotine delivery systems to cater to the evolving preferences and needs of diverse consumer segments. Strategic partnerships and investments in research and development will be crucial for capitalizing on these opportunities.

Growth Accelerators in the Tobacco Industry Industry

Long-term growth in the tobacco industry will be driven by technological advancements in product development, strategic partnerships to expand market reach, and aggressive penetration of new markets. Companies that can successfully adapt to the changing regulatory landscape and consumer preferences while developing and marketing less harmful alternatives will be best positioned to capitalize on future growth opportunities.

Key Players Shaping the Tobacco Industry Market

- Philip Morris International Inc

- ITC Limited

- PT Gudang Garam Tbk

- China National Tobacco Corporation

- Eastern Company SAE

- Japan Tobacco Inc

- KT&G Corp

- British American Tobacco plc

- Altria Group Inc

- Imperial Brands plc

Notable Milestones in Tobacco Industry Sector

- November 2022: Philip Morris International Inc. launched BONDS by IQOS, a heat-not-burn tobacco heating system, highlighting continued innovation in reduced-risk product offerings.

- July 2022: BAT launched glo™ hyper X2, a heated tobacco product in Tokyo, Japan, demonstrating expansion efforts in key Asian markets.

- August 2021: JT Group launched Ploom X, a next-generation heated tobacco device in Japan, showcasing the ongoing race for technological advancement in the reduced-risk product category.

- [Add more recent milestones with brief descriptions]

In-Depth Tobacco Industry Market Outlook

The future of the tobacco industry hinges on the successful development and adoption of reduced-risk products. Strategic partnerships, technological innovations, and aggressive market expansion strategies will play pivotal roles in shaping future growth. Companies demonstrating agility and a commitment to innovation will be best positioned to thrive in this dynamic and evolving market. The predicted growth in the heated tobacco and smokeless segment holds significant potential for market expansion.

Tobacco Industry Segmentation

-

1. Product Type

- 1.1. Cigarettes

- 1.2. Cigars and Cigarillos

- 1.3. Waterpipes

- 1.4. Smokeless Devices

-

2. Distribution Channel

- 2.1. Supermarket/Hypermarket

- 2.2. Convenience Stores

- 2.3. Specialty Stores

- 2.4. Other Distribution Channels

Tobacco Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Russia

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Tobacco Industry Regional Market Share

Geographic Coverage of Tobacco Industry

Tobacco Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.53% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fast Fashion Trend; Inflating Income Level of Individuals

- 3.3. Market Restrains

- 3.3.1. The Presence Of Counterfeit Products

- 3.4. Market Trends

- 3.4.1 Rising Popularity for Low Tar

- 3.4.2 Nicotine Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tobacco Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cigarettes

- 5.1.2. Cigars and Cigarillos

- 5.1.3. Waterpipes

- 5.1.4. Smokeless Devices

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarket/Hypermarket

- 5.2.2. Convenience Stores

- 5.2.3. Specialty Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Tobacco Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Cigarettes

- 6.1.2. Cigars and Cigarillos

- 6.1.3. Waterpipes

- 6.1.4. Smokeless Devices

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarket/Hypermarket

- 6.2.2. Convenience Stores

- 6.2.3. Specialty Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Tobacco Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Cigarettes

- 7.1.2. Cigars and Cigarillos

- 7.1.3. Waterpipes

- 7.1.4. Smokeless Devices

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarket/Hypermarket

- 7.2.2. Convenience Stores

- 7.2.3. Specialty Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Tobacco Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Cigarettes

- 8.1.2. Cigars and Cigarillos

- 8.1.3. Waterpipes

- 8.1.4. Smokeless Devices

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarket/Hypermarket

- 8.2.2. Convenience Stores

- 8.2.3. Specialty Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Tobacco Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Cigarettes

- 9.1.2. Cigars and Cigarillos

- 9.1.3. Waterpipes

- 9.1.4. Smokeless Devices

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarket/Hypermarket

- 9.2.2. Convenience Stores

- 9.2.3. Specialty Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Tobacco Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Cigarettes

- 10.1.2. Cigars and Cigarillos

- 10.1.3. Waterpipes

- 10.1.4. Smokeless Devices

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarket/Hypermarket

- 10.2.2. Convenience Stores

- 10.2.3. Specialty Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Philip Morris International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ITC Limited*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PT Gudang Garam Tbk

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 China National Tobacco Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Eastern Company SAE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Japan Tobacco Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 KT&G Corp

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 British American Tobacco plc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Altria Group Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Imperial Brands plc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Philip Morris International Inc

List of Figures

- Figure 1: Global Tobacco Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Tobacco Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Tobacco Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Tobacco Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Tobacco Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Tobacco Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Tobacco Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Tobacco Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 9: Europe Tobacco Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Tobacco Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: Europe Tobacco Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Tobacco Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Tobacco Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Tobacco Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Tobacco Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Tobacco Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Tobacco Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Tobacco Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Tobacco Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Tobacco Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 21: South America Tobacco Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Tobacco Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: South America Tobacco Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Tobacco Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Tobacco Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Tobacco Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Tobacco Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Tobacco Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Tobacco Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Tobacco Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Tobacco Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Tobacco Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Tobacco Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Tobacco Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Tobacco Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Tobacco Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Tobacco Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Tobacco Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Global Tobacco Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Tobacco Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Germany Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: France Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Italy Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Russia Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Tobacco Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Global Tobacco Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Tobacco Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: China Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: India Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Australia Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Tobacco Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 30: Global Tobacco Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Tobacco Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Brazil Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Argentina Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Global Tobacco Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 36: Global Tobacco Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Tobacco Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 38: South Africa Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Tobacco Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tobacco Industry?

The projected CAGR is approximately 2.53%.

2. Which companies are prominent players in the Tobacco Industry?

Key companies in the market include Philip Morris International Inc, ITC Limited*List Not Exhaustive, PT Gudang Garam Tbk, China National Tobacco Corporation, Eastern Company SAE, Japan Tobacco Inc, KT&G Corp, British American Tobacco plc, Altria Group Inc, Imperial Brands plc.

3. What are the main segments of the Tobacco Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1058.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Fast Fashion Trend; Inflating Income Level of Individuals.

6. What are the notable trends driving market growth?

Rising Popularity for Low Tar. Nicotine Products.

7. Are there any restraints impacting market growth?

The Presence Of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In November 2022, With its mix of specially designed tobacco sticks, BLENDS, Philip Morris International Inc. launched its latest heat-not-burn tobacco heating system, BONDS by IQOS.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tobacco Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tobacco Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tobacco Industry?

To stay informed about further developments, trends, and reports in the Tobacco Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence