Key Insights

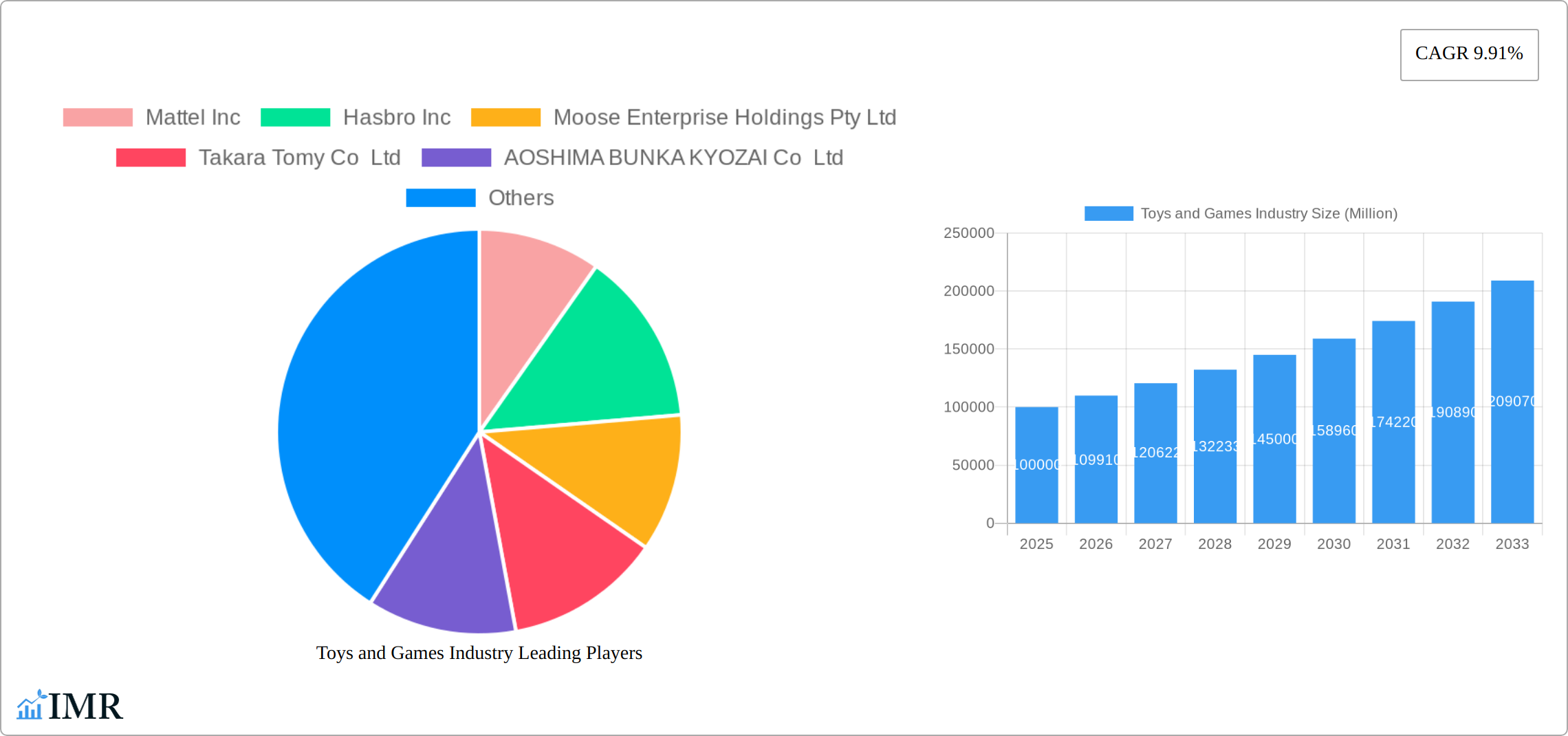

The global toys and games market, valued at approximately $1.7 billion in 2025, is poised for substantial expansion. Projected to grow at a Compound Annual Growth Rate (CAGR) of 0.7% from 2025 to 2033, the market is expected to reach an estimated $1.7 billion by 2033. This growth trajectory is attributed to increasing disposable incomes in emerging economies, growing urbanization influencing structured play, and continuous technological innovation in toy design and gaming. The integration of technology, especially in video games and interactive toys, is a significant driver, expanding audience reach and fostering innovation. Parental investment in educational toys and games further supports market growth. Conversely, potential market restraints include economic volatility and competition from alternative entertainment forms. Market segmentation spans distribution channels (online and offline) and product categories, with video games and construction toys leading, followed by dolls, accessories, and outdoor/sports toys. Key industry leaders, including Mattel, Hasbro, LEGO, and Bandai Namco, are actively pursuing innovation, strategic alliances, and expansion into new markets to leverage this growth.

Toys and Games Industry Market Size (In Billion)

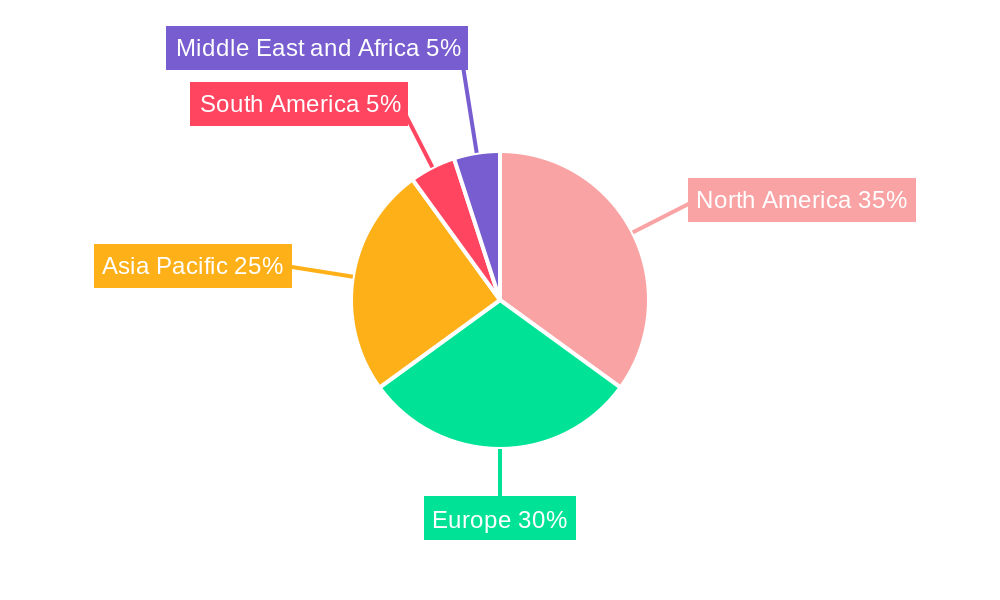

Geographically, North America and Europe currently hold dominant market shares. However, the Asia-Pacific region is anticipated to experience significant growth, fueled by rapid economic development and a substantial young population in countries such as China and India. Emerging markets in South America, the Middle East, and Africa also present considerable untapped potential. The competitive environment features both established multinational corporations and specialized niche providers, fostering innovation and diverse product portfolios. Future market success will depend on companies' ability to adapt to evolving consumer preferences, embrace technological advancements, and effectively engage diverse demographics through innovative marketing and enhanced e-commerce strategies.

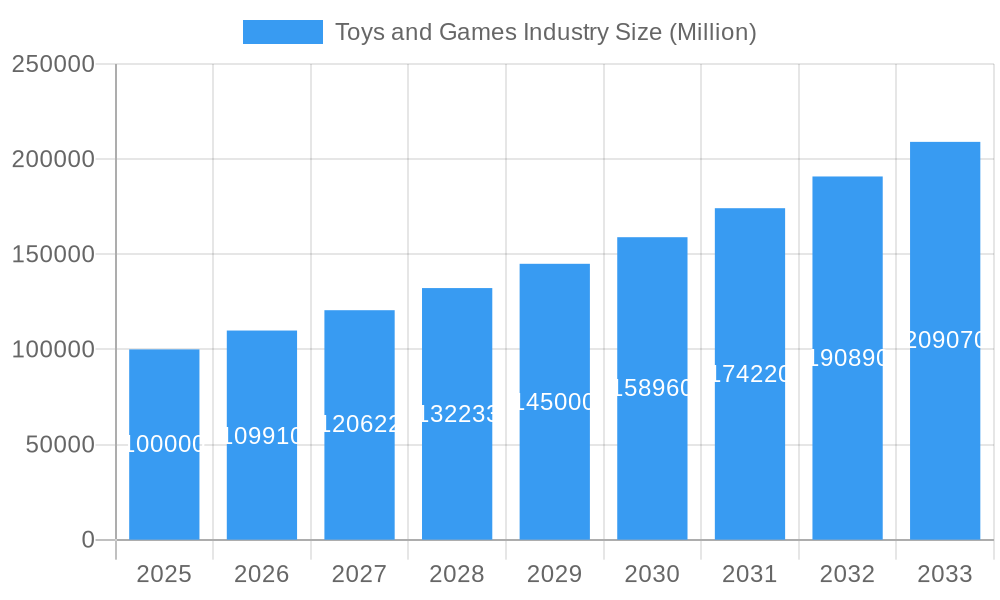

Toys and Games Industry Company Market Share

Toys and Games Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global Toys and Games industry, covering the period 2019-2033. It delves into market dynamics, growth trends, key players, and future opportunities, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report utilizes data from the historical period (2019-2024), with the base year set at 2025 and a forecast extending to 2033. Key segments analyzed include Online and Offline distribution channels, and product types such as Games & Puzzles, Video Games, Construction Toys, Dolls & Accessories, Outdoor & Sports Toys, and Other Product Types. Major players like Mattel Inc, Hasbro Inc, and Lego Group are profiled, alongside an analysis of industry developments. All values are presented in million units.

Toys and Games Industry Market Dynamics & Structure

The global toys and games market is characterized by moderate concentration, with a few dominant players holding significant market share. Mattel Inc., Hasbro Inc., and Lego Group, among others, contribute substantially to overall market value. However, a dynamic competitive landscape exists, fueled by smaller players and niche product offerings. Technological innovation, particularly in interactive gaming and augmented reality (AR) toys, significantly shapes market growth. Regulatory frameworks related to product safety and intellectual property rights influence market dynamics. The market also experiences competitive pressures from substitute products, such as digital entertainment and educational apps, impacting traditional toy sales. End-user demographics play a vital role, with shifts in age group preferences influencing product demand and market segmentation. Mergers and acquisitions (M&A) activity has been relatively stable in recent years, with xx deals recorded between 2019 and 2024, representing a xx% increase compared to the previous period. This indicates increasing consolidation and a trend toward larger players expanding their portfolio and market reach.

- Market Concentration: Highly concentrated with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: AR/VR integration, AI-powered toys, and connected gaming systems drive growth.

- Regulatory Framework: Stringent safety regulations (e.g., CPSIA in the US) influence manufacturing and distribution.

- Competitive Substitutes: Digital entertainment and mobile gaming pose significant competitive pressure.

- End-User Demographics: Shifting preferences of different age groups drive product diversification.

- M&A Activity: xx deals concluded between 2019-2024; indicative of consolidation and expansion strategies.

Toys and Games Industry Growth Trends & Insights

The global toys and games market demonstrated robust growth, with a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), reaching an estimated market size of xx million units in 2024. This expansion was propelled by a confluence of factors, including a noticeable increase in disposable incomes across emerging economies, a surging demand for educational, cognitive, and interactive toys that foster development, and continuous advancements in technology. The adoption of online channels for toy purchases saw a significant surge during this period, heavily influenced by the overall e-commerce boom and the enhancement of digital infrastructure. However, the industry also navigated challenges presented by technological disruptions, most notably the escalating popularity of digital entertainment platforms, which posed a competitive threat to traditional toy manufacturers. Furthermore, evolving consumer behaviors, with a growing preference for experience-based entertainment and a heightened awareness of sustainable and eco-friendly products, are increasingly shaping industry trends. The market is projected to sustain a healthy CAGR of xx% throughout the forecast period (2025-2033), with an anticipated market size of xx million units by 2033. The penetration of innovative product categories, such as highly interactive and connected toys, continues its upward trajectory.

Dominant Regions, Countries, or Segments in Toys and Games Industry

Historically, North America and Europe have been the leading regions in the global toys and games market, collectively representing xx% of the total market share in 2024. However, the Asia-Pacific region is exhibiting substantial growth momentum, fueled by increasing disposable incomes and a rapidly expanding middle-class population. Within product categories, construction toys (such as Lego) and dolls & accessories continue to command a significant market share. Concurrently, video games and interactive toys are experiencing accelerated growth. The online distribution channel is progressively gaining prominence, driven by the widespread expansion of e-commerce and consumers' increasing preference for convenience and accessibility.

- Dominant Regions: North America and Europe remain the established leaders.

- High-Growth Regions: Asia-Pacific, with a particular focus on China and India, is a key area for expansion.

- Dominant Product Types: Construction Toys (valued at xx million units in 2024) and Dolls & Accessories (valued at xx million units in 2024) hold substantial market positions.

- Fastest Growing Segments: Video Games and the Online Distribution Channel are identified as the quickest expanding segments.

- Key Drivers: The primary growth catalysts include rising disposable incomes, increasing urbanization, significant technological advancements, and evolving consumer preferences.

Toys and Games Industry Product Landscape

The toys and games market showcases a diverse range of products, from traditional board games and dolls to technologically advanced interactive toys and video games. Recent innovations include AR/VR-integrated toys, smart toys with AI capabilities, and educational games designed to enhance learning through play. These innovations offer unique selling propositions based on interactivity, personalization, and educational value. Technological advancements in manufacturing and design have led to improved product durability, safety features, and aesthetic appeal, all enhancing consumer satisfaction and market competitiveness.

Key Drivers, Barriers & Challenges in Toys and Games Industry

Key Drivers:

- A consistent rise in disposable incomes, particularly in emerging economies, is a significant growth engine.

- Technological advancements are continuously fostering the creation of innovative and engaging interactive toys.

- There is a growing consumer demand for educational and developmental toys that support children's learning and cognitive skills.

- The continuous expansion of e-commerce platforms and the optimization of online distribution channels are facilitating wider market reach and sales.

Challenges & Restraints:

- The industry faces intense competition from both established market leaders and agile new entrants.

- Fluctuations in raw material prices can significantly impact production costs and profit margins.

- Adherence to stringent safety standards and evolving regulatory frameworks presents ongoing compliance challenges.

- Supply chain disruptions, exacerbated by geopolitical instability and other global events, have led to increased operational complexities and costs, with a notable xx% increase in production costs reported in 2022.

Emerging Opportunities in Toys and Games Industry

The toys and games market presents several emerging opportunities, including:

- Expansion into untapped markets in developing countries.

- Development of sustainable and eco-friendly toys.

- Integration of educational content into toys and games.

- Personalized and customized toy experiences leveraging data analytics.

Growth Accelerators in the Toys and Games Industry

Long-term growth in the toys and games industry will be fueled by continuous technological innovation, strategic partnerships between toy manufacturers and technology companies, and successful expansion into new geographic markets. Investment in research and development (R&D) for creating innovative and interactive toys will play a pivotal role.

Key Players Shaping the Toys and Games Industry Market

- Mattel Inc.

- Hasbro Inc.

- Moose Enterprise Holdings Pty Ltd

- Takara Tomy Co Ltd.

- AOSHIMA BUNKA KYOZAI Co Ltd.

- Lego Group

- Simba-Dickie Group

- Tru Kids Inc.

- Spin Master Ltd.

- Bandai Namco Holdings Inc.

Notable Milestones in Toys and Games Industry Sector

- September 2022: Mattel introduced Bruno the Brake Car, the first autistic character within the beloved Thomas & Friends franchise, underscoring a commitment to inclusivity and promoting social awareness through play.

- September 2022: The Lego Group unveiled a new Lego Marvel Black Panther Set, strategically capitalizing on the immense popularity of Marvel characters to enhance brand appeal and product offerings.

- October 2022: The Lego Group announced the release of the Lego Marvel Studios Iron Man Hulkbuster set, further leveraging the success and broad appeal of the Marvel Cinematic Universe to drive sales and fan engagement.

In-Depth Toys and Games Industry Market Outlook

The future of the toys and games market appears bright, driven by technological advancements, evolving consumer preferences, and increasing disposable incomes globally. Strategic partnerships and collaborations among industry players will play a crucial role in driving innovation and shaping future trends. The market is poised for significant expansion, with opportunities for both established and new players to capitalize on emerging trends and unmet market needs. Continued growth is expected across various segments, with particular focus on interactive and educational toys, fueled by ongoing technological progress and enhanced consumer engagement.

Toys and Games Industry Segmentation

-

1. Product Type

- 1.1. Games and Puzzles

- 1.2. Video Games

- 1.3. Construction Toys

- 1.4. Dolls and Accessories

- 1.5. Outdoor and Sports Toys

- 1.6. Other Product Types

-

2. Distribution Channel

- 2.1. Online Channel

- 2.2. Offline Channel

Toys and Games Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Toys and Games Industry Regional Market Share

Geographic Coverage of Toys and Games Industry

Toys and Games Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Appeal for Multi-functional and Damage Control Hair Care Products; Prevalence of Different Hair Concerns Remains the Major Driving Force

- 3.3. Market Restrains

- 3.3.1. Growing Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Influence of Technology is Promoting Video Games

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Toys and Games Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Games and Puzzles

- 5.1.2. Video Games

- 5.1.3. Construction Toys

- 5.1.4. Dolls and Accessories

- 5.1.5. Outdoor and Sports Toys

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online Channel

- 5.2.2. Offline Channel

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Toys and Games Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Games and Puzzles

- 6.1.2. Video Games

- 6.1.3. Construction Toys

- 6.1.4. Dolls and Accessories

- 6.1.5. Outdoor and Sports Toys

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Online Channel

- 6.2.2. Offline Channel

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Toys and Games Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Games and Puzzles

- 7.1.2. Video Games

- 7.1.3. Construction Toys

- 7.1.4. Dolls and Accessories

- 7.1.5. Outdoor and Sports Toys

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Online Channel

- 7.2.2. Offline Channel

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Toys and Games Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Games and Puzzles

- 8.1.2. Video Games

- 8.1.3. Construction Toys

- 8.1.4. Dolls and Accessories

- 8.1.5. Outdoor and Sports Toys

- 8.1.6. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Online Channel

- 8.2.2. Offline Channel

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Toys and Games Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Games and Puzzles

- 9.1.2. Video Games

- 9.1.3. Construction Toys

- 9.1.4. Dolls and Accessories

- 9.1.5. Outdoor and Sports Toys

- 9.1.6. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Online Channel

- 9.2.2. Offline Channel

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Toys and Games Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Games and Puzzles

- 10.1.2. Video Games

- 10.1.3. Construction Toys

- 10.1.4. Dolls and Accessories

- 10.1.5. Outdoor and Sports Toys

- 10.1.6. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Online Channel

- 10.2.2. Offline Channel

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Mattel Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hasbro Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Moose Enterprise Holdings Pty Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Takara Tomy Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AOSHIMA BUNKA KYOZAI Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Lego Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Simba-Dickie Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tru Kids Inc *List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Spin Master Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bandai Namco Holdings Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Mattel Inc

List of Figures

- Figure 1: Global Toys and Games Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Toys and Games Industry Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America Toys and Games Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 4: North America Toys and Games Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 5: North America Toys and Games Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Toys and Games Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Toys and Games Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 8: North America Toys and Games Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 9: North America Toys and Games Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America Toys and Games Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: North America Toys and Games Industry Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Toys and Games Industry Volume (K Units), by Country 2025 & 2033

- Figure 13: North America Toys and Games Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Toys and Games Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Toys and Games Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 16: Europe Toys and Games Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 17: Europe Toys and Games Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe Toys and Games Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 19: Europe Toys and Games Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 20: Europe Toys and Games Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 21: Europe Toys and Games Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Europe Toys and Games Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 23: Europe Toys and Games Industry Revenue (billion), by Country 2025 & 2033

- Figure 24: Europe Toys and Games Industry Volume (K Units), by Country 2025 & 2033

- Figure 25: Europe Toys and Games Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Toys and Games Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Toys and Games Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Toys and Games Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 29: Asia Pacific Toys and Games Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Asia Pacific Toys and Games Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 31: Asia Pacific Toys and Games Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 32: Asia Pacific Toys and Games Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 33: Asia Pacific Toys and Games Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 34: Asia Pacific Toys and Games Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 35: Asia Pacific Toys and Games Industry Revenue (billion), by Country 2025 & 2033

- Figure 36: Asia Pacific Toys and Games Industry Volume (K Units), by Country 2025 & 2033

- Figure 37: Asia Pacific Toys and Games Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Toys and Games Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Toys and Games Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 40: South America Toys and Games Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 41: South America Toys and Games Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 42: South America Toys and Games Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 43: South America Toys and Games Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 44: South America Toys and Games Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 45: South America Toys and Games Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: South America Toys and Games Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: South America Toys and Games Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: South America Toys and Games Industry Volume (K Units), by Country 2025 & 2033

- Figure 49: South America Toys and Games Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Toys and Games Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Toys and Games Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 52: Middle East and Africa Toys and Games Industry Volume (K Units), by Product Type 2025 & 2033

- Figure 53: Middle East and Africa Toys and Games Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Middle East and Africa Toys and Games Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Middle East and Africa Toys and Games Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 56: Middle East and Africa Toys and Games Industry Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 57: Middle East and Africa Toys and Games Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Middle East and Africa Toys and Games Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: Middle East and Africa Toys and Games Industry Revenue (billion), by Country 2025 & 2033

- Figure 60: Middle East and Africa Toys and Games Industry Volume (K Units), by Country 2025 & 2033

- Figure 61: Middle East and Africa Toys and Games Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Toys and Games Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Toys and Games Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Toys and Games Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: Global Toys and Games Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Toys and Games Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Toys and Games Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Toys and Games Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Global Toys and Games Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Global Toys and Games Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 9: Global Toys and Games Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global Toys and Games Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global Toys and Games Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Toys and Games Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 13: United States Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 15: Canada Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 17: Mexico Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 19: Rest of North America Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of North America Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 21: Global Toys and Games Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Global Toys and Games Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 23: Global Toys and Games Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 24: Global Toys and Games Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 25: Global Toys and Games Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Global Toys and Games Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 27: Spain Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Spain Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 29: United Kingdom Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 31: Germany Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Germany Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 33: France Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: France Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 35: Italy Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Italy Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 37: Russia Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Russia Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Europe Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 41: Global Toys and Games Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 42: Global Toys and Games Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 43: Global Toys and Games Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 44: Global Toys and Games Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global Toys and Games Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 46: Global Toys and Games Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 47: China Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: China Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 49: Japan Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Japan Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 51: India Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: India Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 53: Australia Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Australia Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 55: Rest of Asia Pacific Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: Rest of Asia Pacific Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 57: Global Toys and Games Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 58: Global Toys and Games Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 59: Global Toys and Games Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 60: Global Toys and Games Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 61: Global Toys and Games Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 62: Global Toys and Games Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 63: Brazil Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: Brazil Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 65: Argentina Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: Argentina Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 67: Rest of South America Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 68: Rest of South America Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 69: Global Toys and Games Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 70: Global Toys and Games Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 71: Global Toys and Games Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 72: Global Toys and Games Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 73: Global Toys and Games Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 74: Global Toys and Games Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 75: South Africa Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: South Africa Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 77: Saudi Arabia Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 78: Saudi Arabia Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 79: Rest of Middle East and Africa Toys and Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 80: Rest of Middle East and Africa Toys and Games Industry Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Toys and Games Industry?

The projected CAGR is approximately 0.7%.

2. Which companies are prominent players in the Toys and Games Industry?

Key companies in the market include Mattel Inc, Hasbro Inc, Moose Enterprise Holdings Pty Ltd, Takara Tomy Co Ltd, AOSHIMA BUNKA KYOZAI Co Ltd, Lego Group, Simba-Dickie Group, Tru Kids Inc *List Not Exhaustive, Spin Master Ltd, Bandai Namco Holdings Inc.

3. What are the main segments of the Toys and Games Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Appeal for Multi-functional and Damage Control Hair Care Products; Prevalence of Different Hair Concerns Remains the Major Driving Force.

6. What are the notable trends driving market growth?

Influence of Technology is Promoting Video Games.

7. Are there any restraints impacting market growth?

Growing Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

October 2022: The Lego Group announced the Lego Marvel Studios Release, The Iron Man Hulkbuster set, featuring Iron Man as he appeared in Infinity Saga - Age of Ultron, a mega-hit film.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Toys and Games Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Toys and Games Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Toys and Games Industry?

To stay informed about further developments, trends, and reports in the Toys and Games Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence