Key Insights

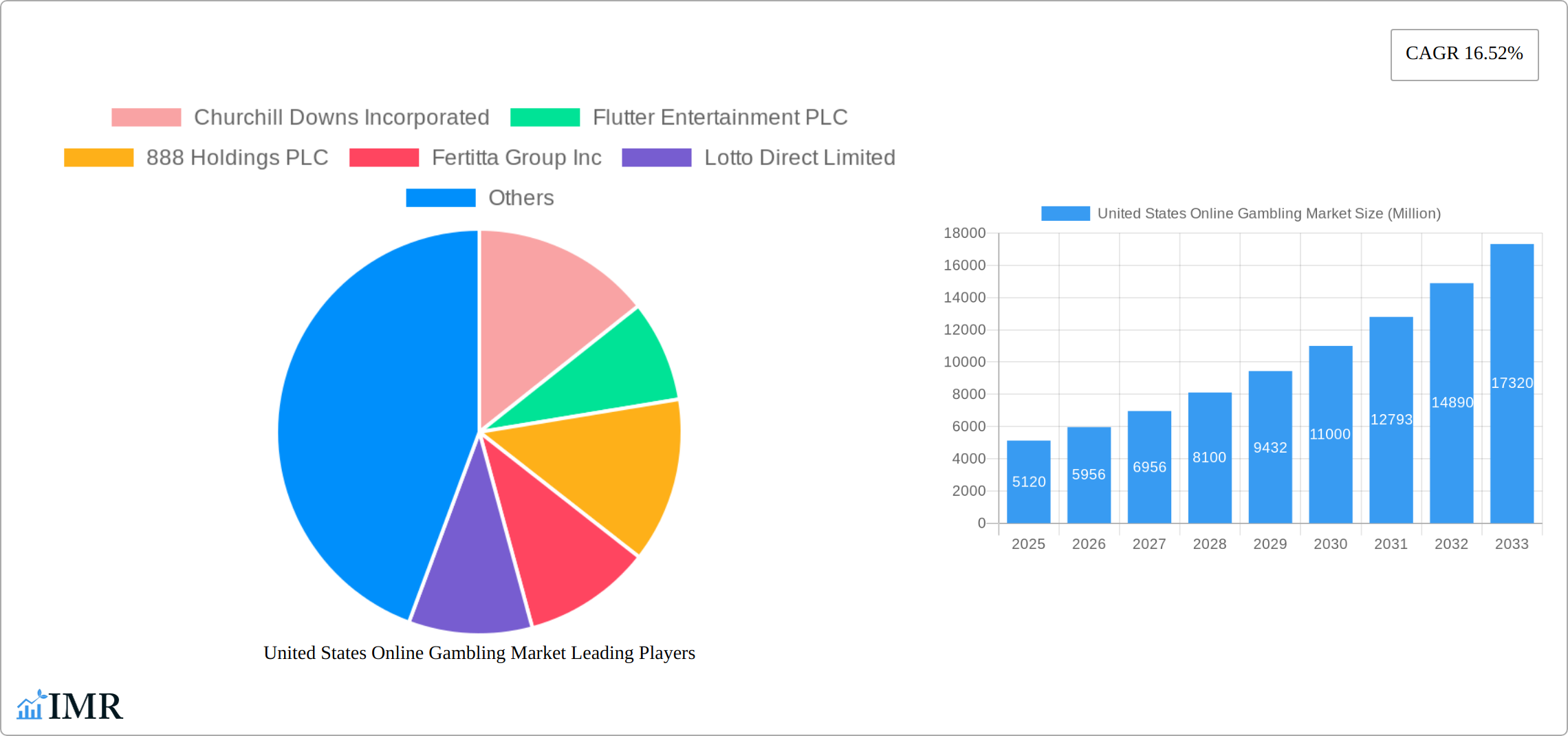

The United States online gambling market, currently valued at $5.12 billion in 2025, is experiencing robust growth, projected to expand significantly over the forecast period (2025-2033). A compound annual growth rate (CAGR) of 16.52% indicates substantial market expansion driven by several key factors. Increased smartphone penetration and readily available high-speed internet access are fueling the adoption of online gambling platforms. The rising popularity of fantasy sports and the legalization of online gambling in various states are further bolstering market growth. The market is segmented by end-user (desktop and mobile) and game type (sports betting, casino games, and other casino games). Sports betting, capitalizing on the growing popularity of professional and collegiate sports leagues, dominates the game type segment. Mobile gaming is rapidly gaining traction, surpassing desktop usage due to its convenience and accessibility. Major players like DraftKings, FanDuel, and Caesars Entertainment, along with established international operators like Flutter Entertainment and 888 Holdings, are fiercely competing for market share, leading to intense innovation in game offerings and marketing strategies. While regulatory hurdles and concerns about responsible gambling remain, the overall market trajectory points towards continued, significant expansion.

United States Online Gambling Market Market Size (In Billion)

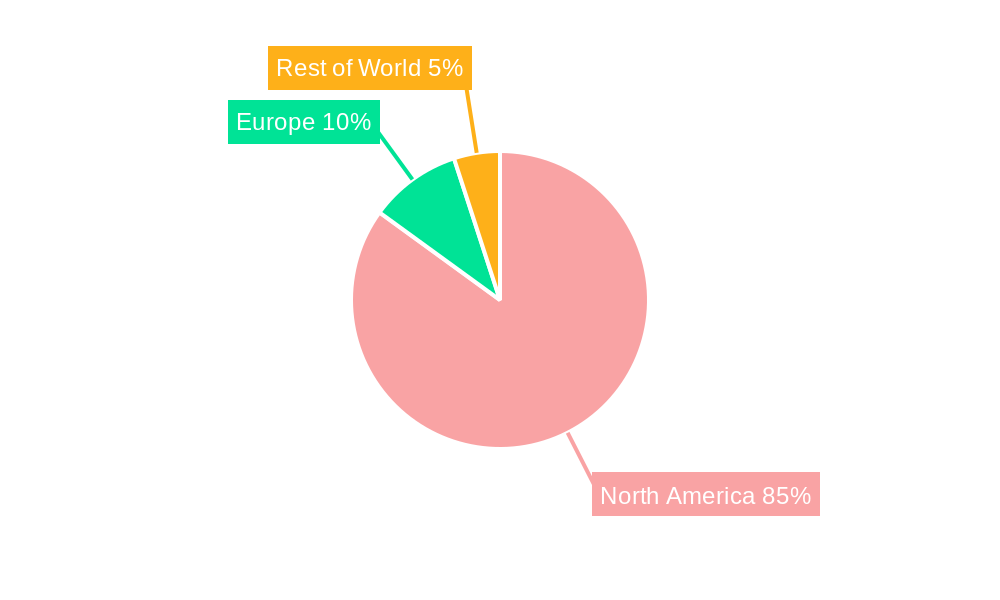

The North American region, specifically the United States, constitutes the largest share of this market due to the increasing legalization and acceptance of online gambling. However, the market’s growth is not without its challenges. Regulations vary widely across states, creating a fragmented landscape and posing operational complexities for companies. Furthermore, the industry faces scrutiny regarding potential social impacts, including problem gambling. Nevertheless, the market’s potential remains vast, driven by technological advancements, changing consumer preferences, and the continued expansion of legalized online gambling across more US states. The strategic investments in technological infrastructure, coupled with effective marketing strategies targeting specific demographics, will be crucial for companies aiming to succeed in this dynamic and rapidly evolving market.

United States Online Gambling Market Company Market Share

United States Online Gambling Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States online gambling market, covering its dynamic landscape, growth trends, key players, and future outlook. With a focus on both parent and child markets, this report is an essential resource for industry professionals, investors, and anyone seeking to understand this rapidly evolving sector. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The market size is presented in millions of US dollars.

United States Online Gambling Market Dynamics & Structure

This section analyzes the competitive structure, technological advancements, regulatory environment, and market trends within the US online gambling market. We delve into market concentration, examining the influence of key players and the prevalence of mergers and acquisitions (M&A). The report also explores the impact of technological innovations, regulatory frameworks (both federal and state-level), and the presence of substitute products. Finally, we examine end-user demographics and their evolving preferences, providing a nuanced understanding of the market's dynamic forces.

- Market Concentration: The US online gambling market shows a [xx]% concentration ratio in 2025, indicating [high/medium/low] competition. The top 5 players hold an estimated [xx]% market share.

- Technological Innovation: Key drivers include advancements in mobile technology, enhanced user interfaces, and the integration of artificial intelligence (AI) for personalized gaming experiences. Barriers to innovation include high development costs and stringent regulatory compliance.

- Regulatory Framework: State-level legalization and regulation are driving market growth, but inconsistencies across states create complexities for operators. The report details the impact of specific regulations on market expansion.

- M&A Activity: The report analyzes the volume and value of M&A deals from 2019 to 2024, providing insights into strategic consolidations and market share shifts. An estimated [xx] M&A deals occurred during this period, totaling [xx] million.

- End-User Demographics: [Detailed analysis of user demographics, including age, income, location, and gaming preferences].

United States Online Gambling Market Growth Trends & Insights

This section provides a detailed analysis of the US online gambling market's growth trajectory, utilizing historical data (2019-2024) and robust projections (2025-2033). We delve into market size evolution, adoption rates across diverse segments, the transformative impact of technological disruptions, and the dynamic shifts in consumer behaviors. Our analysis meticulously considers critical factors such as the escalating smartphone penetration, evolving consumer preferences, and the pervasive influence of sophisticated marketing and advertising strategies on sustained growth. Key performance indicators, including the Compound Annual Growth Rate (CAGR), market penetration rates, and user acquisition costs, are comprehensively presented to offer actionable insights.

The US online gambling market has witnessed substantial expansion, evolving from an estimated market size of approximately $X billion in 2019 to a projected $Y billion by the close of 2024. This growth is expected to accelerate, with the market anticipated to reach a staggering $Z billion by 2033. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at a strong A.B%. Adoption rates are climbing across all segments, with mobile gaming experiencing a particularly significant surge due to increased smartphone penetration and the development of user-friendly mobile applications. Consumer preferences are increasingly leaning towards dynamic and engaging game types, such as live dealer games and skill-based offerings. Technological disruptions, including advancements in AI for personalized recommendations and the development of more immersive gaming experiences, are continuously reshaping the landscape. The average market penetration rate is currently estimated at C.D% and is projected to reach E.F% by 2033. User acquisition costs, while variable, are being optimized through data-driven marketing campaigns and affiliate partnerships.

Dominant Regions, Countries, or Segments in United States Online Gambling Market

This section identifies the leading states/regions and segments (End User: Desktop, Mobile; Game Type: Sports Betting, Casino, Other Casino Games) driving market growth within the US. We analyze factors contributing to their dominance, including economic policies, infrastructure development, and regulatory environments. The analysis incorporates market share data and growth potential forecasts for each segment.

- Dominant Segment: [e.g., Mobile sports betting is the dominant segment, holding a [xx]% market share in 2025, projected to grow to [xx]% by 2033].

- Key Drivers: [Bullet points outlining key drivers for each dominant segment, such as favorable regulations, technological advancements, and consumer preferences.]

- Dominant States: [Analysis of states with the highest market share and growth rates, including discussion of factors such as population density, regulatory environment, and marketing strategies.]

[Detailed paragraph analysis supporting the findings above, including market share data and growth potential forecasts for each segment and state.]

United States Online Gambling Market Product Landscape

This section offers a comprehensive overview of the product innovations, diverse applications, and critical performance metrics within the dynamic US online gambling market. Our analysis spotlights unique selling propositions (USPs) and cutting-edge technological advancements that are actively shaping the competitive landscape. We emphasize the continuous evolution of gaming platforms, with a keen focus on features such as significantly enhanced user interfaces, deeply personalized player experiences, and the seamless integration of immersive technologies like virtual reality (VR) and augmented reality (AR).

Product innovations are revolutionizing the online gambling experience, with a notable trend towards the development of intuitive and visually appealing interfaces. Applications are expanding beyond traditional casino games to include sophisticated sports betting platforms, fantasy sports, and skill-based games. Performance metrics are being closely monitored and optimized, with average revenue per user (ARPU) showing a steady upward trend, driven by increased engagement and higher spending. Player retention rates are a key focus, with operators investing in loyalty programs and personalized promotions to foster long-term engagement. Unique selling propositions (USPs) increasingly revolve around exclusive game content, innovative bonus structures, and superior customer support. Technological advancements, such as AI-powered game recommendations that analyze player behavior to suggest tailored options, are becoming a standard feature, enhancing both user satisfaction and operator efficiency. The integration of blockchain technology for secure and transparent transactions is also emerging as a significant differentiator.

Key Drivers, Barriers & Challenges in United States Online Gambling Market

This section outlines the primary forces driving market growth and the key challenges and restraints hindering expansion.

Key Drivers:

- Increasing legalization and regulation across states.

- Growing adoption of mobile gaming and smartphones.

- Technological advancements enhancing user experience.

- Effective marketing and advertising strategies.

[Paragraph summarizing the key drivers and their impact on market growth]

Key Challenges & Restraints:

- Regulatory complexities and inconsistencies across states.

- Concerns around responsible gaming and addiction.

- Intense competition among established and emerging players.

- Potential for increased taxation and regulatory scrutiny.

[Paragraph summarizing the challenges and restraints and their quantifiable impact on market growth.]

Emerging Opportunities in United States Online Gambling Market

This section meticulously identifies emerging trends and lucrative opportunities, with a strategic focus on untapped markets, pioneering applications, and the ever-evolving spectrum of consumer preferences. These encompass the significant potential for strategic expansion into new states as legalization continues to progress, the burgeoning growth of esports betting as a distinct and rapidly expanding vertical, and the increasing consumer demand for highly personalized and interactive gaming experiences. The exploration of innovative payment processing technologies, such as blockchain and cryptocurrency, also represents a substantial area of opportunity for enhancing security, speed, and accessibility within the market.

The US online gambling market is ripe with emerging opportunities for growth and innovation. As more states legalize online gambling, there is a substantial market to be tapped, presenting a fertile ground for both established players and new entrants. The rise of esports betting, fueled by a growing global audience and the increasing professionalization of competitive gaming, offers a significant new revenue stream. Furthermore, the demand for personalized gaming experiences is driving the development of AI-driven platforms that can tailor game recommendations, bonuses, and even gameplay to individual player preferences. The integration of cryptocurrencies and blockchain technology promises to address concerns around transaction security, speed, and transparency, potentially attracting a new demographic of users. Innovations in social gaming integration and the development of immersive VR/AR gambling experiences also hold considerable promise for capturing the attention of a younger, tech-savvy audience.

Growth Accelerators in the United States Online Gambling Market Industry

Long-term growth in the US online gambling market will be driven by technological breakthroughs (e.g., VR/AR integration), strategic partnerships (e.g., collaborations between gaming companies and technology providers), and expansion into new states. The increasing sophistication of data analytics and the use of AI to personalize user experiences will play a critical role.

[Paragraph elaborating on the growth accelerators and their impact on long-term market expansion.]

Key Players Shaping the United States Online Gambling Market Market

- Churchill Downs Incorporated

- Flutter Entertainment PLC

- 888 Holdings PLC

- Fertitta Group Inc

- Lotto Direct Limited

- MGM Resorts International (Borgata Hotel Casino & Spa)

- DraftKings Inc

- Cherry Gold Casino

- El Royale Casino

- Caesars Entertainment Inc

Notable Milestones in United States Online Gambling Market Sector

- September 2022: Caesars Entertainment launched its advanced sports betting and iGaming platform, Caesars Sportsbook & Casino, significantly bolstering its presence in Pennsylvania.

- July 2022: EveryMatrix solidified its US market expansion by signing a strategic distribution agreement with 888casino, enhancing its reach and content offerings.

- January 2022: BetMGM marked a major expansion into a key market with the successful launch of its online sportsbook in New York.

- November 2023: FanDuel announced a groundbreaking partnership with an NFL team, integrating its brand deeper into the professional sports ecosystem.

- February 2024: DraftKings introduced a new suite of responsible gaming tools, underscoring the industry's commitment to player welfare.

In-Depth United States Online Gambling Market Market Outlook

The US online gambling market is poised for substantial and sustained future growth, propelled by relentless technological advancements, strategic industry partnerships, and the ongoing, dynamic process of state-level legalization. Significant strategic opportunities are readily available for companies that prioritize delivering personalized user experiences, pioneering innovative game offerings, and steadfastly adhering to robust responsible gaming practices. The market's projected trajectory presents highly attractive investment prospects for enterprises capable of adeptly navigating the intricate regulatory frameworks and intense competitive dynamics inherent in this rapidly evolving sector. The continued expansion into new states, coupled with the increasing sophistication and adoption of advanced gaming technologies, will undeniably serve as key drivers fueling further market growth in the years to come.

United States Online Gambling Market Segmentation

-

1. Game Type

- 1.1. Sports Betting

-

1.2. Casino

- 1.2.1. Live Casino

- 1.2.2. Slots

- 1.2.3. Baccarat

- 1.2.4. Blackjack

- 1.2.5. Poker

- 1.2.6. Other Casino Games

- 1.3. Other Game Types

-

2. End User

- 2.1. Desktop

- 2.2. Mobile

United States Online Gambling Market Segmentation By Geography

- 1. United States

United States Online Gambling Market Regional Market Share

Geographic Coverage of United States Online Gambling Market

United States Online Gambling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.52% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Popularity of Online Gambling; Advancement In Security

- 3.2.2 Encryption

- 3.2.3 and Streaming Technology

- 3.3. Market Restrains

- 3.3.1. Regulatory Uncertainty And Compliance

- 3.4. Market Trends

- 3.4.1. Consumer's Inclination Towards Gambling Culture

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Game Type

- 5.1.1. Sports Betting

- 5.1.2. Casino

- 5.1.2.1. Live Casino

- 5.1.2.2. Slots

- 5.1.2.3. Baccarat

- 5.1.2.4. Blackjack

- 5.1.2.5. Poker

- 5.1.2.6. Other Casino Games

- 5.1.3. Other Game Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Desktop

- 5.2.2. Mobile

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Game Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Churchill Downs Incorporated

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Flutter Entertainment PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 888 Holdings PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fertitta Group Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lotto Direct Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 MGM Resorts International (Borgata Hotel Casino & Spa)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DraftKings Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cherry Gold Casino

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 El Royale Casino*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Caesars Entertainment Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Churchill Downs Incorporated

List of Figures

- Figure 1: United States Online Gambling Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Online Gambling Market Share (%) by Company 2025

List of Tables

- Table 1: United States Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 2: United States Online Gambling Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: United States Online Gambling Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: United States Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 5: United States Online Gambling Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: United States Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Online Gambling Market?

The projected CAGR is approximately 16.52%.

2. Which companies are prominent players in the United States Online Gambling Market?

Key companies in the market include Churchill Downs Incorporated, Flutter Entertainment PLC, 888 Holdings PLC, Fertitta Group Inc, Lotto Direct Limited, MGM Resorts International (Borgata Hotel Casino & Spa), DraftKings Inc, Cherry Gold Casino, El Royale Casino*List Not Exhaustive, Caesars Entertainment Inc.

3. What are the main segments of the United States Online Gambling Market?

The market segments include Game Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Popularity of Online Gambling; Advancement In Security. Encryption. and Streaming Technology.

6. What are the notable trends driving market growth?

Consumer's Inclination Towards Gambling Culture.

7. Are there any restraints impacting market growth?

Regulatory Uncertainty And Compliance.

8. Can you provide examples of recent developments in the market?

In September 2022, Caesars Entertainment launched its most advanced sports betting and iGaming platform, Caesars Sportsbook & Casino in Pennsylvania. Featuring the introduction, the state will have access to a significantly improved, feature-rich version of the Caesars Sportsbook & Casino app with mobile sports betting and casino games befitting of a Caesar.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Online Gambling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Online Gambling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Online Gambling Market?

To stay informed about further developments, trends, and reports in the United States Online Gambling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence