Key Insights

The Asia-Pacific Coal Market is poised for significant expansion, projecting a Compound Annual Growth Rate (CAGR) of 1.6% from 2025 to 2033. This growth is propelled by escalating energy requirements in rapidly industrializing economies across China, India, and Southeast Asia. The power sector, particularly thermal coal power plants, remains the primary consumer, underscoring the continued reliance on coal for electricity generation amidst growing renewable energy adoption. Coking coal, vital for steel production driven by regional construction and infrastructure development, also significantly fuels market expansion. However, stringent environmental regulations targeting carbon emission reduction and the rise of cleaner energy alternatives like solar and wind power present market constraints. These regulatory pressures and the global emphasis on climate change mitigation are expected to moderate market growth in the latter forecast years. Key industry leaders, including JERA Co Inc, Datang International Power Generation, and Adani Power Ltd, are strategically adapting their operations to comply with environmental standards while securing market share. The competitive arena features a mix of large state-owned and private enterprises, fostering intense competition and continuous investment in operational efficiency and technological innovation.

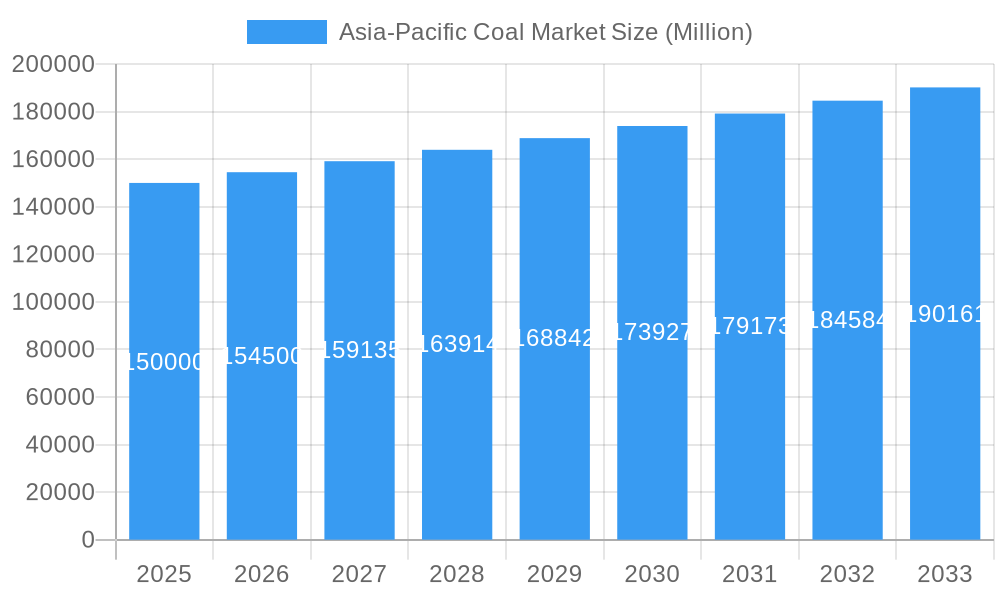

Asia-Pacific Coal Market Market Size (In Billion)

Market segmentation highlights the substantial influence of power generation (thermal coal) and steel production (coking coal) end-users. While other applications exist, these two segments predominantly shape market dynamics. Significant regional variations are evident, with China, India, and Japan leading national markets due to high energy consumption and steel output. Ongoing infrastructure development, especially in emerging economies, is anticipated to boost coking coal demand. Conversely, the increasing adoption of renewable energy and stricter environmental policies in countries like Japan and South Korea will likely dampen overall coal market growth, potentially resulting in a slower CAGR toward the forecast's conclusion. A comprehensive understanding of both growth drivers and limitations is therefore essential for accurate future market trajectory assessment. The current market size is valued at 8811.34 million as of the base year 2025.

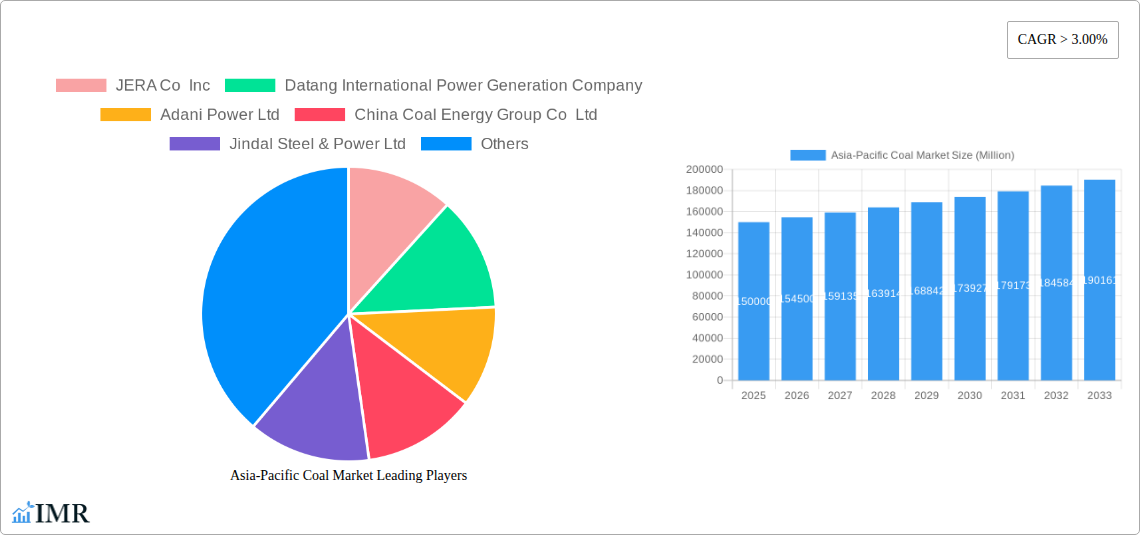

Asia-Pacific Coal Market Company Market Share

Asia-Pacific Coal Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific coal market, covering market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report is essential for industry professionals, investors, and policymakers seeking to understand this dynamic and crucial energy sector. The report segments the market by end-user: Power Station (Thermal Coal), Coking Feedstock (Coking Coal), and Others. Key players analyzed include JERA Co Inc, Datang International Power Generation Company, Adani Power Ltd, China Coal Energy Group Co Ltd, Jindal Steel & Power Ltd, China Shenhua Energy Co Ltd, Huadian Power International Corporation, NTPC Ltd, and Shenergy Group Company Limited (list not exhaustive). The market value is presented in million units.

Asia-Pacific Coal Market Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Asia-Pacific coal market. We delve into market concentration, examining the market share held by major players and identifying any dominant firms. The influence of technological innovations, including improved mining techniques and coal utilization technologies, is assessed alongside the impact of regulatory frameworks and environmental policies on market growth. The role of substitute fuels, such as natural gas and renewables, in shaping market dynamics is also considered. Finally, the report explores mergers and acquisitions (M&A) activity within the sector, quantifying deal volumes and analyzing their impact on market structure.

- Market Concentration: xx% market share held by top 5 players in 2024. Expected to slightly decrease to xx% by 2033 due to increased competition and new entrants.

- Technological Innovation: Focus on improving extraction efficiency and reducing emissions. Barriers include high capital investment and regulatory uncertainty.

- Regulatory Frameworks: Vary significantly across countries, influencing mining operations and emission standards. Stringent regulations in some areas are leading to increased costs and reduced production.

- Competitive Product Substitutes: Growing adoption of renewable energy sources (solar, wind) poses a significant challenge to coal's market share. Natural gas also presents competition, particularly in power generation.

- End-User Demographics: Predominantly driven by power generation, with significant demand from developing economies experiencing rapid industrialization.

- M&A Trends: xx M&A deals recorded between 2019-2024. A consolidation trend is predicted, with larger companies acquiring smaller players to gain market share and resources.

Asia-Pacific Coal Market Growth Trends & Insights

This section provides a detailed analysis of the Asia-Pacific coal market's growth trajectory from 2019 to 2033. We examine market size evolution, analyzing historical data and projecting future growth based on various factors, including economic growth rates, energy demand, and policy changes. Adoption rates of coal across different end-user segments are assessed, revealing regional variations and driving forces behind coal consumption. The impact of technological disruptions, such as advancements in coal mining and utilization technologies, on market growth is explored. Finally, we investigate shifts in consumer behavior and their influence on coal demand.

The market is expected to experience a CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx Million units by 2033. Market penetration in key regions is expected to remain high, though gradually declining due to the increasing adoption of renewable energy sources. Technological advancements in coal-fired power plant efficiency are expected to moderate the decline.

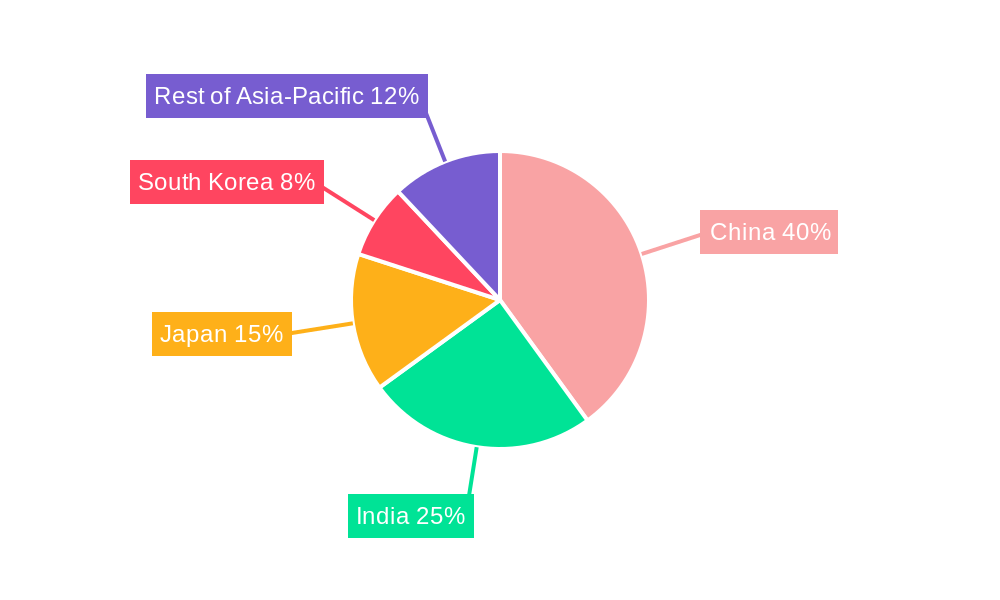

Dominant Regions, Countries, or Segments in Asia-Pacific Coal Market

This section pinpoints the leading regions, countries, and end-user segments driving market growth within the Asia-Pacific coal market. We analyze the factors contributing to their dominance, such as economic policies, infrastructure development, and industrial activity. Market share and growth potential of each leading region and segment are quantitatively assessed.

- China: Remains the dominant market, driven by its large industrial base and ongoing infrastructure projects. Its market share is expected to remain around xx% throughout the forecast period.

- India: Shows significant growth potential due to increasing energy demand and industrial expansion. Expected to surpass xx Million units by 2033.

- Power Station (Thermal Coal): This segment dominates the market, accounting for xx% of total consumption, driven by the high reliance on coal-fired power plants for electricity generation.

- Coking Feedstock (Coking Coal): This segment experiences strong demand from the steel industry, particularly in countries with significant steel production capabilities, accounting for xx% of consumption.

Asia-Pacific Coal Market Product Landscape

The Asia-Pacific coal market offers a variety of coal types, each with specific applications and performance characteristics. Technological advancements in coal mining and processing have led to the development of higher-quality coals with improved energy content and reduced impurities. These improvements enhance efficiency in power generation and other industrial applications. The market also sees innovation in coal utilization technologies, aiming to reduce emissions and improve environmental performance. This includes advancements in carbon capture and storage (CCS) technologies and cleaner coal combustion methods.

Key Drivers, Barriers & Challenges in Asia-Pacific Coal Market

Key Drivers:

- Growing energy demand from rapidly developing economies.

- Relatively low cost of coal compared to other energy sources.

- Existing infrastructure for coal mining, transportation, and utilization.

- Government support for coal-based power generation in some regions.

Key Barriers and Challenges:

- Increasing environmental concerns and stricter regulations on emissions.

- Competition from renewable energy sources and natural gas.

- Fluctuations in global coal prices and supply chain disruptions.

- Health and safety concerns related to coal mining and usage.

Emerging Opportunities in Asia-Pacific Coal Market

Emerging opportunities include advancements in coal gasification and liquefaction technologies, opening up new applications for coal in the chemical and transportation sectors. There's also potential in developing improved CCS technologies to mitigate environmental impacts. Furthermore, focusing on sustainable mining practices and community engagement can unlock greater acceptance and social license to operate.

Growth Accelerators in the Asia-Pacific Coal Market Industry

Long-term growth will be fueled by technological breakthroughs in cleaner coal technologies, strategic partnerships between coal producers and power companies, and expansion into new markets with high energy demands. Continued investment in infrastructure and upgrading existing coal-fired power plants to enhance efficiency will also play a significant role.

Key Players Shaping the Asia-Pacific Coal Market Market

- JERA Co Inc

- Datang International Power Generation Company

- Adani Power Ltd

- China Coal Energy Group Co Ltd

- Jindal Steel & Power Ltd

- China Shenhua Energy Co Ltd

- Huadian Power International Corporation

- NTPC Ltd

- Shenergy Group Company Limited

Notable Milestones in Asia-Pacific Coal Market Sector

- 2020: Implementation of stricter emission standards in several countries.

- 2022: Significant investment in new coal mining projects in [Country X].

- 2023: Launch of a new ultra-supercritical coal-fired power plant in [Country Y].

In-Depth Asia-Pacific Coal Market Market Outlook

The Asia-Pacific coal market faces a complex future. While demand will likely decline due to environmental concerns and the rise of renewable energy, coal will continue to play a significant role in the energy mix for the foreseeable future, particularly in developing nations. Strategic opportunities lie in investing in technologies that reduce emissions and improve efficiency, as well as focusing on sustainable mining practices and responsible resource management. The market is poised for a period of transition, with those players adapting to stricter regulations and the shift towards cleaner energy sources expected to fare best.

Asia-Pacific Coal Market Segmentation

-

1. End-User

- 1.1. Power Station (Thermal Coal)

- 1.2. Coking Feedstock (Coking Coal)

- 1.3. Others

-

2. Geography

- 2.1. China

- 2.2. India

- 2.3. Indonesia

- 2.4. Rest of Asia-Pacific

Asia-Pacific Coal Market Segmentation By Geography

- 1. China

- 2. India

- 3. Indonesia

- 4. Rest of Asia Pacific

Asia-Pacific Coal Market Regional Market Share

Geographic Coverage of Asia-Pacific Coal Market

Asia-Pacific Coal Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Oil and Gas4.; Presence of Proven Oil and Gas Reserves

- 3.3. Market Restrains

- 3.3.1. 4.; Volatile Oil and Gas Prices

- 3.4. Market Trends

- 3.4.1. Power Stations Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Coal Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Power Station (Thermal Coal)

- 5.1.2. Coking Feedstock (Coking Coal)

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Indonesia

- 5.2.4. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Indonesia

- 5.3.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. China Asia-Pacific Coal Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 6.1.1. Power Station (Thermal Coal)

- 6.1.2. Coking Feedstock (Coking Coal)

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. India

- 6.2.3. Indonesia

- 6.2.4. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 7. India Asia-Pacific Coal Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 7.1.1. Power Station (Thermal Coal)

- 7.1.2. Coking Feedstock (Coking Coal)

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. India

- 7.2.3. Indonesia

- 7.2.4. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 8. Indonesia Asia-Pacific Coal Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 8.1.1. Power Station (Thermal Coal)

- 8.1.2. Coking Feedstock (Coking Coal)

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Indonesia

- 8.2.4. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 9. Rest of Asia Pacific Asia-Pacific Coal Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-User

- 9.1.1. Power Station (Thermal Coal)

- 9.1.2. Coking Feedstock (Coking Coal)

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. India

- 9.2.3. Indonesia

- 9.2.4. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by End-User

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 JERA Co Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Datang International Power Generation Company

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Adani Power Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 China Coal Energy Group Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Jindal Steel & Power Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 China Shenhua Energy Co Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Huadian Power International Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 NTPC Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Shenergy Group Company Limited*List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 JERA Co Inc

List of Figures

- Figure 1: Asia-Pacific Coal Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Coal Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Coal Market Revenue million Forecast, by End-User 2020 & 2033

- Table 2: Asia-Pacific Coal Market Volume Tonnes Forecast, by End-User 2020 & 2033

- Table 3: Asia-Pacific Coal Market Revenue million Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Coal Market Volume Tonnes Forecast, by Geography 2020 & 2033

- Table 5: Asia-Pacific Coal Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Coal Market Volume Tonnes Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Coal Market Revenue million Forecast, by End-User 2020 & 2033

- Table 8: Asia-Pacific Coal Market Volume Tonnes Forecast, by End-User 2020 & 2033

- Table 9: Asia-Pacific Coal Market Revenue million Forecast, by Geography 2020 & 2033

- Table 10: Asia-Pacific Coal Market Volume Tonnes Forecast, by Geography 2020 & 2033

- Table 11: Asia-Pacific Coal Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: Asia-Pacific Coal Market Volume Tonnes Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Coal Market Revenue million Forecast, by End-User 2020 & 2033

- Table 14: Asia-Pacific Coal Market Volume Tonnes Forecast, by End-User 2020 & 2033

- Table 15: Asia-Pacific Coal Market Revenue million Forecast, by Geography 2020 & 2033

- Table 16: Asia-Pacific Coal Market Volume Tonnes Forecast, by Geography 2020 & 2033

- Table 17: Asia-Pacific Coal Market Revenue million Forecast, by Country 2020 & 2033

- Table 18: Asia-Pacific Coal Market Volume Tonnes Forecast, by Country 2020 & 2033

- Table 19: Asia-Pacific Coal Market Revenue million Forecast, by End-User 2020 & 2033

- Table 20: Asia-Pacific Coal Market Volume Tonnes Forecast, by End-User 2020 & 2033

- Table 21: Asia-Pacific Coal Market Revenue million Forecast, by Geography 2020 & 2033

- Table 22: Asia-Pacific Coal Market Volume Tonnes Forecast, by Geography 2020 & 2033

- Table 23: Asia-Pacific Coal Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: Asia-Pacific Coal Market Volume Tonnes Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Coal Market Revenue million Forecast, by End-User 2020 & 2033

- Table 26: Asia-Pacific Coal Market Volume Tonnes Forecast, by End-User 2020 & 2033

- Table 27: Asia-Pacific Coal Market Revenue million Forecast, by Geography 2020 & 2033

- Table 28: Asia-Pacific Coal Market Volume Tonnes Forecast, by Geography 2020 & 2033

- Table 29: Asia-Pacific Coal Market Revenue million Forecast, by Country 2020 & 2033

- Table 30: Asia-Pacific Coal Market Volume Tonnes Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Coal Market?

The projected CAGR is approximately 1.6%.

2. Which companies are prominent players in the Asia-Pacific Coal Market?

Key companies in the market include JERA Co Inc, Datang International Power Generation Company, Adani Power Ltd, China Coal Energy Group Co Ltd, Jindal Steel & Power Ltd, China Shenhua Energy Co Ltd, Huadian Power International Corporation, NTPC Ltd, Shenergy Group Company Limited*List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Coal Market?

The market segments include End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 8811.34 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Oil and Gas4.; Presence of Proven Oil and Gas Reserves.

6. What are the notable trends driving market growth?

Power Stations Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Volatile Oil and Gas Prices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in Tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Coal Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Coal Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Coal Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Coal Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence