Key Insights

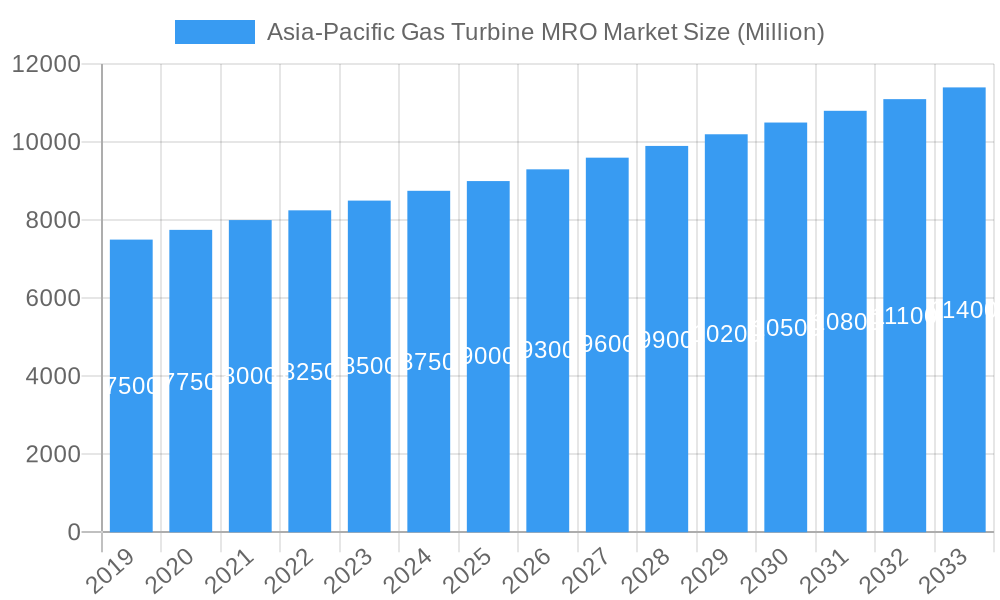

The Asia-Pacific Gas Turbine MRO market is projected for substantial growth, anticipating a market size of 8.68 billion by 2025. This robust expansion reflects the indispensable role of gas turbines in fueling the region's dynamic economies, supporting industrial operations and electricity generation. With a Compound Annual Growth Rate (CAGR) of 5.28%, the market is forecast to reach an estimated 13.25 billion by 2033. This upward trajectory is primarily attributed to the escalating demand for dependable and efficient power solutions to address the increasing energy requirements across diverse geographies.

Asia-Pacific Gas Turbine MRO Market Market Size (In Billion)

Key growth catalysts include ongoing industrialization and urbanization in major economies such as China, India, and South Korea, driving the need for consistent power supply. Furthermore, the aging gas turbine fleet necessitates continuous and advanced MRO services for sustained operational integrity and peak performance. Emerging trends, including the integration of advanced diagnostics, predictive maintenance, and asset lifespan extension strategies, are further invigorating market dynamics. While these factors propel growth, potential challenges may arise from the high costs associated with specialized MRO and stringent regulatory frameworks, particularly for aviation-specific turbine maintenance. The market encompasses service segments like maintenance, repair, and overhaul, with Original Equipment Manufacturers (OEMs) holding a significant share, alongside a growing presence of independent service providers and in-house capabilities.

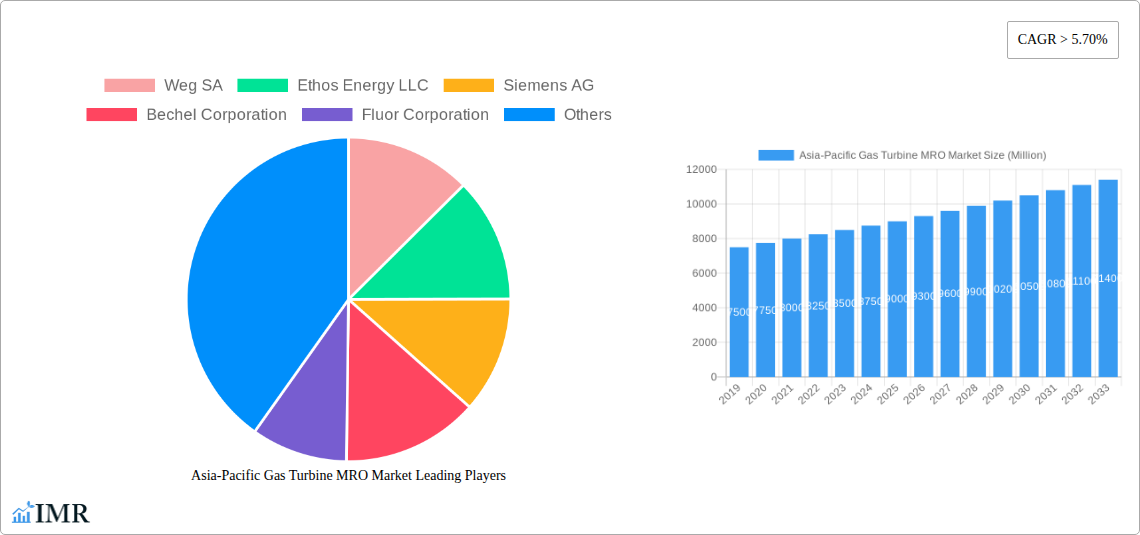

Asia-Pacific Gas Turbine MRO Market Company Market Share

Unlocking the Potential: Asia-Pacific Gas Turbine MRO Market Analysis 2019-2033

This comprehensive report delivers an in-depth analysis of the Asia-Pacific Gas Turbine MRO (Maintenance, Repair, and Overhaul) market, offering critical insights for stakeholders navigating this dynamic sector. Covering the study period of 2019–2033, with a base year of 2025, this report meticulously examines market size, growth drivers, competitive landscape, and future opportunities. We provide detailed segmentation by Service Type (Maintenance, Repair, Overhaul) and Service Provider (OEMs, Independent Service Providers, In-house), alongside a granular geographical breakdown including China, Japan, India, South Korea, and the Rest of Asia-Pacific. Gain unparalleled understanding of the gas turbine MRO market size in million units, essential for strategic planning and investment decisions.

Asia-Pacific Gas Turbine MRO Market Market Dynamics & Structure

The Asia-Pacific Gas Turbine MRO market is characterized by a moderate to high market concentration, with Original Equipment Manufacturers (OEMs) like General Electric Company, Siemens AG, and Mitsubishi Heavy Industries Ltd holding significant sway. However, the growing influence of Independent Service Providers such as Ethos Energy LLC, John Wood Group PLC, and Sulzer AG is fostering a more competitive environment. Technological innovation is a key driver, with advancements in predictive maintenance, digitalization, and advanced repair techniques enhancing efficiency and reducing downtime. Regulatory frameworks, particularly concerning emissions and safety standards, are increasingly shaping MRO practices, pushing for more sustainable and compliant operations. Competitive product substitutes, while limited for core gas turbine components, exist in the form of advanced diagnostic tools and alternative energy sources that could indirectly impact long-term demand. End-user demographics are diverse, spanning power generation, oil & gas, and aviation sectors, each with unique MRO needs. Mergers & Acquisitions (M&A) trends indicate a strategic consolidation of capabilities and market reach, with companies like Fluor Corporation and Babcock & Wilcox Enterprises Inc actively participating in the ecosystem.

- Market Concentration: Dominated by OEMs with increasing competition from Independent Service Providers.

- Technological Innovation Drivers: Predictive maintenance, AI-powered diagnostics, digital twins, additive manufacturing for spare parts.

- Regulatory Frameworks: Stringent emissions standards, safety certifications, and environmental compliance mandates.

- Competitive Product Substitutes: Advanced diagnostic software, alternative fuel technologies impacting long-term demand.

- End-User Demographics: Power generation (peaking and baseload), oil & gas exploration and production, aviation, industrial applications.

- M&A Trends: Strategic acquisitions to enhance service portfolios, geographic reach, and technological capabilities.

Asia-Pacific Gas Turbine MRO Market Growth Trends & Insights

The Asia-Pacific Gas Turbine MRO market is poised for substantial growth, driven by a confluence of factors including increasing energy demand, aging gas turbine fleets, and a growing emphasis on operational efficiency and reliability. The estimated market size in 2025 is projected to be USD 12,500 Million, with a robust CAGR of 6.8% anticipated during the forecast period of 2025–2033. This growth trajectory is fueled by escalating investments in power infrastructure across developing economies, particularly in China and India, where substantial additions to installed gas turbine capacity are underway. The adoption rate of advanced MRO techniques, such as remote monitoring and digital diagnostics, is rapidly increasing, enabling proactive identification and resolution of potential issues, thereby minimizing unscheduled downtime and extending the lifespan of critical assets. Technological disruptions, including the integration of AI and machine learning for predictive maintenance, are revolutionizing MRO strategies, shifting from reactive repairs to proactive interventions. Consumer behavior is evolving towards seeking integrated service solutions and long-term maintenance contracts, offering greater cost predictability and assured asset performance. The repair segment is expected to witness the highest growth, driven by the need to optimize existing assets and mitigate the impact of supply chain disruptions on new equipment procurement. Overhaul services will also see sustained demand as older turbines reach critical maintenance milestones. The focus on extending the operational life of existing gas turbines, coupled with stringent environmental regulations, is encouraging significant investment in specialized MRO services. The increasing complexity of modern gas turbine technology necessitates highly skilled technicians and advanced diagnostic capabilities, further bolstering the demand for specialized MRO providers.

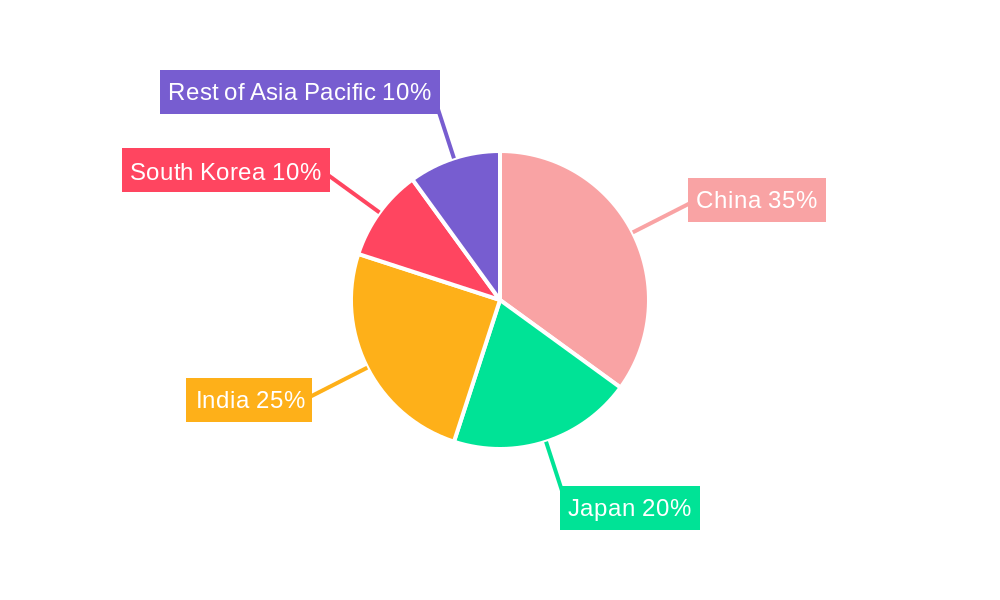

Dominant Regions, Countries, or Segments in Asia-Pacific Gas Turbine MRO Market

China stands as the dominant region within the Asia-Pacific Gas Turbine MRO market, driven by its massive industrial base, significant investments in power generation, and a rapidly expanding fleet of gas turbines. The country's commitment to modernizing its energy infrastructure, coupled with ambitious renewable energy targets that often require stable baseload power from gas turbines as a backup, positions it as a key growth engine. The estimated market share for China in 2025 is 35%, representing a market value of USD 4,375 Million.

- Dominant Country: China

- Key Drivers:

- Massive installed base of gas turbines across power generation and industrial sectors.

- Government initiatives promoting energy security and diversification, leading to increased gas turbine deployment.

- Rapid urbanization and industrialization driving energy demand.

- Growing adoption of advanced MRO technologies to ensure asset reliability.

- Presence of major domestic and international MRO service providers.

- Market Share (Estimated 2025): 35%

- Key Drivers:

India emerges as the second-largest and fastest-growing market, with a projected market share of 25% in 2025, translating to USD 3,125 Million. Its burgeoning economy, increasing power deficit, and focus on natural gas as a cleaner fuel source are propelling demand for gas turbine MRO services.

- Dominant Country: India

- Key Drivers:

- Significant capacity additions in gas-based power plants to meet rising energy needs.

- Government's push for cleaner energy sources and infrastructure development.

- Aging gas turbine fleet requiring extensive maintenance and repair.

- Increasing attractiveness of Independent Service Providers offering cost-effective solutions.

- Market Share (Estimated 2025): 25%

- Key Drivers:

Japan and South Korea, while more mature markets, continue to represent significant segments due to their advanced industrial capabilities and reliance on gas turbines for baseload power and critical industrial processes. Their focus on technological innovation and lifecycle management of existing assets ensures a steady demand for high-quality MRO services. The Rest of Asia-Pacific segment, encompassing countries like Indonesia, Vietnam, and the Philippines, is experiencing rapid growth driven by expanding economies and increasing energy infrastructure development.

Within Service Type, Maintenance and Repair are the most significant segments due to the continuous operational needs of gas turbines.

- Dominant Segment: Maintenance & Repair

- Key Drivers:

- Routine servicing to ensure optimal performance and prevent breakdowns.

- On-demand repair services to address unexpected issues.

- Cost-effectiveness of repair over replacement.

- Extension of asset lifespan.

- Key Drivers:

In terms of Service Provider, OEMs continue to hold a substantial market share due to their specialized knowledge and access to proprietary parts and technology. However, Independent Service Providers are rapidly gaining traction by offering competitive pricing, flexible service agreements, and specialized expertise.

- Dominant Segment: OEMs (with growing influence of Independent Service Providers)

- Key Drivers for OEMs:

- Original equipment expertise and proprietary technologies.

- Established brand reputation and customer trust.

- Comprehensive service portfolios covering the entire lifecycle.

- Key Drivers for Independent Service Providers:

- Competitive pricing and cost-saving solutions.

- Agility and customized service offerings.

- Specialized niche expertise.

- Key Drivers for OEMs:

Asia-Pacific Gas Turbine MRO Market Product Landscape

The product landscape in the Asia-Pacific Gas Turbine MRO market is characterized by continuous innovation focused on enhancing turbine performance, extending component life, and improving operational efficiency. Advanced diagnostic tools, remote monitoring systems, and digital twin technologies are becoming integral, enabling predictive maintenance and proactive issue resolution. Innovations in materials science and additive manufacturing are leading to the development of more durable and cost-effective replacement parts, particularly for aging fleets. Enhanced repair techniques, such as advanced coating technologies and robotic welding, are also crucial in restoring worn components to near-OEM specifications. The application of AI and machine learning in analyzing vast amounts of operational data is revolutionizing troubleshooting and predictive analytics, leading to significant reductions in unplanned downtime and maintenance costs.

Key Drivers, Barriers & Challenges in Asia-Pacific Gas Turbine MRO Market

The Asia-Pacific Gas Turbine MRO market is propelled by several key drivers. Increasing energy demand across the region, fueled by economic growth and industrialization, necessitates a robust and reliable gas turbine fleet, driving MRO needs. Aging gas turbine infrastructure in established markets requires ongoing maintenance and refurbishment to ensure operational longevity. Technological advancements in predictive maintenance, digital twins, and advanced repair techniques enhance efficiency and reduce costs. Favorable government policies promoting energy security and cleaner fuel adoption also act as significant catalysts.

However, the market faces several barriers and challenges. High initial investment costs for advanced MRO technologies can be a hurdle for smaller players. Shortage of skilled workforce and specialized technicians poses a significant operational constraint. Stringent regulatory compliance for emissions and safety standards requires continuous investment in upgrades and adherence to evolving protocols. Supply chain disruptions, exacerbated by geopolitical events, can impact the availability of critical spare parts, leading to delays and increased costs. Intense competition among OEMs and independent service providers can also put pressure on profit margins.

Emerging Opportunities in Asia-Pacific Gas Turbine MRO Market

Emerging opportunities in the Asia-Pacific Gas Turbine MRO market lie in the growing demand for integrated digital MRO solutions, encompassing AI-powered predictive analytics, remote monitoring, and blockchain for supply chain transparency. The increasing adoption of hybrid power plants and the integration of gas turbines with renewable energy sources present new MRO requirements and service models. Furthermore, the circular economy approach, focusing on remanufacturing and sustainable MRO practices, is gaining traction, creating opportunities for specialized service providers. Untapped markets in Southeast Asia and the Pacific Islands offer significant growth potential as these regions invest in expanding their energy infrastructure.

Growth Accelerators in the Asia-Pacific Gas Turbine MRO Market Industry

Several catalysts are accelerating long-term growth in the Asia-Pacific Gas Turbine MRO industry. Technological breakthroughs in areas like advanced robotics for inspections, drone-based assessments, and AI for performance optimization are continuously improving efficiency and accuracy. Strategic partnerships between OEMs, independent service providers, and technology firms are fostering innovation and expanding service capabilities. Market expansion strategies by key players into emerging economies, coupled with localized MRO solutions, are crucial for capturing new market share. The increasing emphasis on asset lifecycle management and the growing trend of outsourcing MRO services to specialized providers are also significant growth accelerators.

Key Players Shaping the Asia-Pacific Gas Turbine MRO Market Market

- Weg SA

- Ethos Energy LLC

- Siemens AG

- Bechel Corporation

- Fluor Corporation

- Babcock & Wilcox Enterprises Inc

- John Wood Group PLC

- Sulzer AG

- General Electric Company

- Mitsubishi Heavy Industries Ltd

Notable Milestones in Asia-Pacific Gas Turbine MRO Market Sector

- February 2022: Siemens AG, in collaboration with ZEISS, launched MakerVerse, a one-stop-shop on-demand 3D printing fulfillment platform, enhancing MRO capabilities through rapid prototyping and spare part production.

- February 2022: India inaugurated a significant bio-CNG plant in Indore, processing wet municipal waste, symbolizing innovative waste-to-energy initiatives that may indirectly influence demand for associated gas turbine MRO techniques for waste-to-energy plants.

In-Depth Asia-Pacific Gas Turbine MRO Market Market Outlook

The outlook for the Asia-Pacific Gas Turbine MRO market is exceptionally positive, driven by sustained energy demand, technological advancements, and evolving service models. Growth accelerators such as the integration of digital technologies for predictive maintenance, the expansion of independent service providers offering cost-effective solutions, and strategic partnerships will continue to fuel market expansion. The focus on extending the lifespan of existing gas turbine assets, coupled with the gradual integration of gas turbines into a more diversified energy mix, including hydrogen-ready turbines, presents significant long-term potential. Strategic investments in specialized training and talent development will be crucial to meet the growing demand for skilled MRO professionals, ensuring the continued reliability and efficiency of critical energy infrastructure across the region.

Asia-Pacific Gas Turbine MRO Market Segmentation

-

1. Service Type

- 1.1. Maintenane

- 1.2. Repair

- 1.3. Overhaul

-

2. Service Provider

- 2.1. OEMs

- 2.2. Independent Service Providers

- 2.3. In-house

-

3. Geography

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia-Pacific

Asia-Pacific Gas Turbine MRO Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. South Korea

- 5. Rest of Asia Pacific

Asia-Pacific Gas Turbine MRO Market Regional Market Share

Geographic Coverage of Asia-Pacific Gas Turbine MRO Market

Asia-Pacific Gas Turbine MRO Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Supportive Government Policies and Incentives4.; Environmental Concerns

- 3.3. Market Restrains

- 3.3.1. Fossil Fuel Subsidies

- 3.4. Market Trends

- 3.4.1. The Maintenance Segment Expected to Witness Significant Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Gas Turbine MRO Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Maintenane

- 5.1.2. Repair

- 5.1.3. Overhaul

- 5.2. Market Analysis, Insights and Forecast - by Service Provider

- 5.2.1. OEMs

- 5.2.2. Independent Service Providers

- 5.2.3. In-house

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. South Korea

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. South Korea

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. China Asia-Pacific Gas Turbine MRO Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Maintenane

- 6.1.2. Repair

- 6.1.3. Overhaul

- 6.2. Market Analysis, Insights and Forecast - by Service Provider

- 6.2.1. OEMs

- 6.2.2. Independent Service Providers

- 6.2.3. In-house

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. Japan

- 6.3.3. India

- 6.3.4. South Korea

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Japan Asia-Pacific Gas Turbine MRO Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Maintenane

- 7.1.2. Repair

- 7.1.3. Overhaul

- 7.2. Market Analysis, Insights and Forecast - by Service Provider

- 7.2.1. OEMs

- 7.2.2. Independent Service Providers

- 7.2.3. In-house

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. Japan

- 7.3.3. India

- 7.3.4. South Korea

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. India Asia-Pacific Gas Turbine MRO Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Maintenane

- 8.1.2. Repair

- 8.1.3. Overhaul

- 8.2. Market Analysis, Insights and Forecast - by Service Provider

- 8.2.1. OEMs

- 8.2.2. Independent Service Providers

- 8.2.3. In-house

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. Japan

- 8.3.3. India

- 8.3.4. South Korea

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. South Korea Asia-Pacific Gas Turbine MRO Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Maintenane

- 9.1.2. Repair

- 9.1.3. Overhaul

- 9.2. Market Analysis, Insights and Forecast - by Service Provider

- 9.2.1. OEMs

- 9.2.2. Independent Service Providers

- 9.2.3. In-house

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. Japan

- 9.3.3. India

- 9.3.4. South Korea

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Rest of Asia Pacific Asia-Pacific Gas Turbine MRO Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Maintenane

- 10.1.2. Repair

- 10.1.3. Overhaul

- 10.2. Market Analysis, Insights and Forecast - by Service Provider

- 10.2.1. OEMs

- 10.2.2. Independent Service Providers

- 10.2.3. In-house

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. Japan

- 10.3.3. India

- 10.3.4. South Korea

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Weg SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ethos Energy LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Siemens AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bechel Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fluor Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Babcock & Wilcox Enterprises Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 John Wood Group PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sulzer AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 General Electric Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mitsubishi Heavy Industries Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Weg SA

List of Figures

- Figure 1: Asia-Pacific Gas Turbine MRO Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Gas Turbine MRO Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Gas Turbine MRO Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 2: Asia-Pacific Gas Turbine MRO Market Revenue billion Forecast, by Service Provider 2020 & 2033

- Table 3: Asia-Pacific Gas Turbine MRO Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Gas Turbine MRO Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Gas Turbine MRO Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 6: Asia-Pacific Gas Turbine MRO Market Revenue billion Forecast, by Service Provider 2020 & 2033

- Table 7: Asia-Pacific Gas Turbine MRO Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Gas Turbine MRO Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Asia-Pacific Gas Turbine MRO Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 10: Asia-Pacific Gas Turbine MRO Market Revenue billion Forecast, by Service Provider 2020 & 2033

- Table 11: Asia-Pacific Gas Turbine MRO Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Gas Turbine MRO Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Gas Turbine MRO Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 14: Asia-Pacific Gas Turbine MRO Market Revenue billion Forecast, by Service Provider 2020 & 2033

- Table 15: Asia-Pacific Gas Turbine MRO Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Asia-Pacific Gas Turbine MRO Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Gas Turbine MRO Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 18: Asia-Pacific Gas Turbine MRO Market Revenue billion Forecast, by Service Provider 2020 & 2033

- Table 19: Asia-Pacific Gas Turbine MRO Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Gas Turbine MRO Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Gas Turbine MRO Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 22: Asia-Pacific Gas Turbine MRO Market Revenue billion Forecast, by Service Provider 2020 & 2033

- Table 23: Asia-Pacific Gas Turbine MRO Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific Gas Turbine MRO Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Gas Turbine MRO Market?

The projected CAGR is approximately 5.28%.

2. Which companies are prominent players in the Asia-Pacific Gas Turbine MRO Market?

Key companies in the market include Weg SA, Ethos Energy LLC, Siemens AG, Bechel Corporation, Fluor Corporation, Babcock & Wilcox Enterprises Inc, John Wood Group PLC, Sulzer AG, General Electric Company, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Asia-Pacific Gas Turbine MRO Market?

The market segments include Service Type, Service Provider, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.68 billion as of 2022.

5. What are some drivers contributing to market growth?

Supportive Government Policies and Incentives4.; Environmental Concerns.

6. What are the notable trends driving market growth?

The Maintenance Segment Expected to Witness Significant Market Growth.

7. Are there any restraints impacting market growth?

Fossil Fuel Subsidies.

8. Can you provide examples of recent developments in the market?

In February 2022, the energy technology firm Siemens AG entered a joint venture initiative with metrology device manufacturer ZEISS to launch a one-stop-shop on-demand 3D printing fulfillment platform called MakerVerse. This is expected to aid the company in MRO development.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Gas Turbine MRO Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Gas Turbine MRO Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Gas Turbine MRO Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Gas Turbine MRO Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence