Key Insights

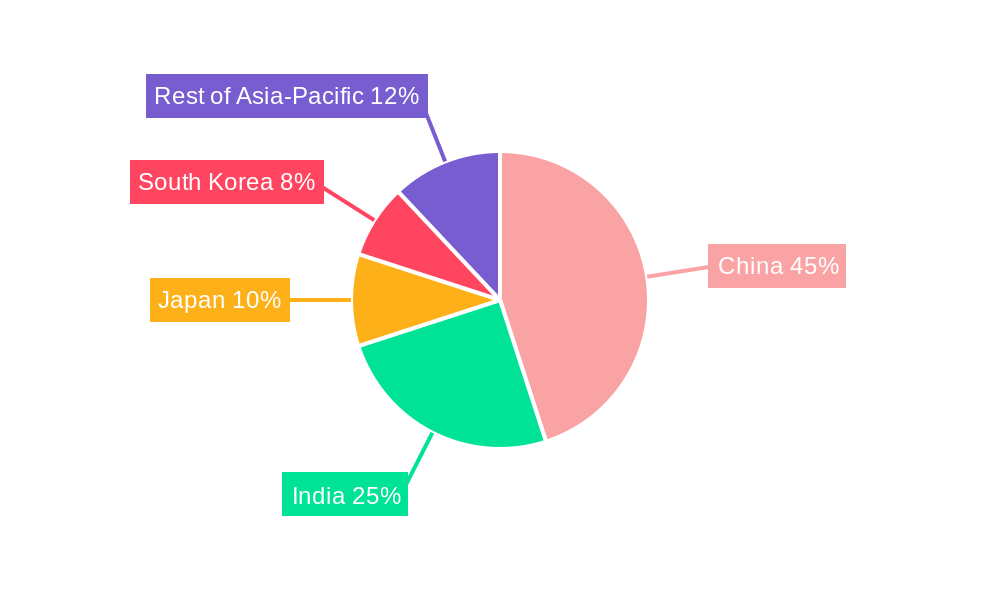

The Asia Pacific solar backsheet market is projected for significant expansion, driven by the region's increasing demand for renewable energy solutions. With an estimated market size of $1.8 billion and a projected CAGR of 7.2% from a base year of 2024, the sector is set for robust growth. China leads this expansion, supported by strong government policies for solar energy and a developed manufacturing base. India follows, aiming to meet its renewable energy targets and boost solar project investments. Mature markets like Japan and South Korea are contributing through ongoing technological advancements and a focus on high-efficiency solar modules. Emerging economies within the "Rest of Asia-Pacific," including Vietnam, Thailand, and the Philippines, are rapidly increasing their solar capacity, presenting a critical growth frontier.

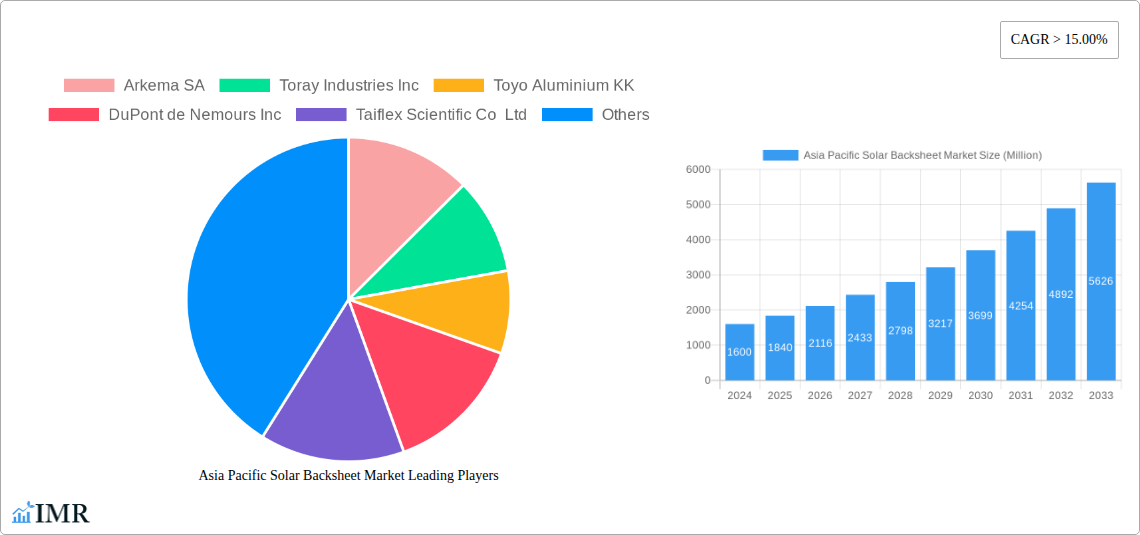

Asia Pacific Solar Backsheet Market Market Size (In Billion)

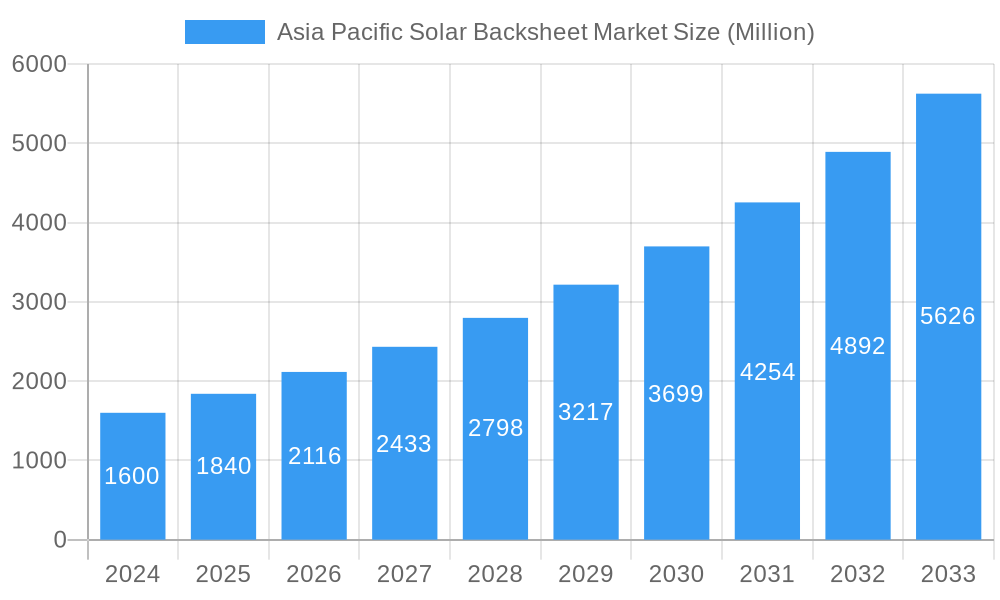

Key drivers for market growth include declining solar panel costs, supportive government incentives for solar installations, and the global imperative to reduce carbon emissions. Heightened consumer and corporate awareness of solar power's environmental and economic advantages further accelerates adoption. Technological innovations in backsheet materials, enhancing durability, electrical insulation, and weather resistance, are also critical factors. While Fluoropolymer-based backsheets dominate due to superior performance in challenging environments, Non-fluoropolymer alternatives are gaining traction for their cost-effectiveness in less demanding applications. Potential challenges include raw material supply chain volatilities and evolving regulatory frameworks in developing economies. Leading companies such as Arkema SA, DuPont de Nemours Inc., and Toray Industries Inc. are actively investing in R&D and expanding manufacturing to meet market demands.

Asia Pacific Solar Backsheet Market Company Market Share

Asia Pacific Solar Backsheet Market: Analysis & Forecast 2024-2033

This comprehensive report offers in-depth insights into the dynamic Asia Pacific Solar Backsheet Market. It analyzes market dynamics, growth trends, key regions, product landscape, and major players from 2024 to 2033. Understand the vital role of solar backsheets in optimizing photovoltaic module performance and longevity. This report is an essential resource for manufacturers, suppliers, investors, and stakeholders seeking to leverage opportunities in this expanding sector. It provides detailed quantitative and qualitative analysis segmented by Type (Fluoropolymer, Non-fluoropolymer) and Geography (China, India, Japan, South Korea, Rest of Asia-Pacific).

Keywords: Asia Pacific Solar Backsheet Market, Solar Backsheet Market Size, Solar Backsheet Market Share, Solar Photovoltaic Backsheet, Fluoropolymer Backsheet, Non-fluoropolymer Backsheet, China Solar Backsheet, India Solar Backsheet, Japan Solar Backsheet, South Korea Solar Backsheet, Rest of Asia-Pacific Solar Backsheet, Solar PV Module Materials, Renewable Energy Asia Pacific, Solar Energy Market Trends, Solar Backsheet Manufacturers, Solar Backsheet Technology, Solar Backsheet Market Forecast, Solar Backsheet Industry Analysis, PV Module Components, Encapsulation Materials, Arkema SA, Toray Industries Inc, DuPont de Nemours Inc, 3M Co, Hanwha Group, Segments: Type, Geography.

Asia Pacific Solar Backsheet Market Market Dynamics & Structure

The Asia Pacific solar backsheet market is characterized by a dynamic and evolving structure, driven by rapid technological advancements and increasing demand for renewable energy solutions. Market concentration is influenced by a few dominant global players alongside a growing number of regional manufacturers, particularly in China and India. Technological innovation is a key driver, with continuous research and development focused on improving the durability, efficiency, and cost-effectiveness of backsheet materials. Regulatory frameworks, including government incentives for solar energy deployment and manufacturing, significantly impact market growth and investment decisions. Competitive product substitutes exist, but specialized backsheet properties like UV resistance, electrical insulation, and moisture barrier capabilities maintain their importance. End-user demographics are shifting towards utility-scale solar projects, commercial installations, and a growing residential sector, each with distinct material requirements. Mergers and acquisitions (M&A) are a notable trend, as companies seek to expand their product portfolios, gain market share, and strengthen their supply chains.

- Market Concentration: Dominated by a blend of established global players and emerging regional manufacturers, especially in East and Southeast Asia.

- Technological Innovation Drivers: Focus on enhanced UV resistance, improved electrical insulation, increased mechanical strength, and reduced material costs.

- Regulatory Frameworks: Government subsidies, feed-in tariffs, and manufacturing incentives are crucial for market expansion.

- Competitive Product Substitutes: While alternatives exist, specific performance requirements of solar modules limit widespread adoption.

- End-User Demographics: Shifting from traditional utility-scale to diverse applications including rooftop solar, floating solar, and integrated building solutions.

- M&A Trends: Strategic acquisitions aimed at vertical integration, market access, and technological consolidation.

Asia Pacific Solar Backsheet Market Growth Trends & Insights

The Asia Pacific solar backsheet market is on a robust growth trajectory, fueled by an escalating global push towards sustainable energy and the region's significant role in solar manufacturing. Market size evolution is directly correlated with the expansion of solar photovoltaic (PV) installations across the continent. Adoption rates of advanced backsheet materials are steadily increasing as module manufacturers prioritize enhanced performance, extended warranty periods, and improved reliability in diverse environmental conditions. Technological disruptions, such as the development of thinner, more flexible, and higher-performance backsheet materials, are actively reshaping product offerings and manufacturing processes. Consumer behavior shifts are evident, with a growing awareness among end-users and investors regarding the importance of high-quality components for the long-term efficiency and safety of solar power systems. This heightened demand for reliability is driving the adoption of superior backsheet solutions.

The forecast period anticipates sustained, high single-digit to low double-digit Compound Annual Growth Rate (CAGR) for the Asia Pacific solar backsheet market. This growth will be propelled by several key factors: aggressive renewable energy targets set by governments across the region, particularly China, India, and Southeast Asian nations; a significant reduction in the levelized cost of electricity (LCOE) for solar power, making it increasingly competitive with conventional energy sources; and continued investment in solar manufacturing capacity. The market penetration of solar PV modules is expected to surge, directly translating into increased demand for essential components like solar backsheets. Innovations in material science, leading to backsheets with superior dielectric strength, reduced degradation rates, and enhanced fire resistance, will be crucial differentiators. Furthermore, the growing trend towards bifacial solar modules also necessitates specialized backsheet designs that optimize light reflection. The industry is witnessing a transition towards more sustainable and recyclable backsheet materials, aligning with global environmental initiatives. Market players are investing in R&D to develop solutions that not only meet stringent performance standards but also contribute to the circular economy. The interplay of supportive government policies, technological advancements, and evolving market demands creates a compelling growth narrative for the Asia Pacific solar backsheet sector.

Dominant Regions, Countries, or Segments in Asia Pacific Solar Backsheet Market

Within the Asia Pacific solar backsheet market, China stands out as the dominant region and country, significantly influencing growth, production, and innovation. Its unparalleled manufacturing capacity for solar PV modules translates directly into the largest demand for solar backsheets. The country's comprehensive industrial ecosystem, from raw material sourcing to finished product assembly, provides a distinct competitive advantage. China's aggressive renewable energy targets, coupled with substantial government support and investment in solar technology research and development, have positioned it as a global leader. The sheer scale of its domestic solar installations and its leading role in exporting solar components worldwide solidify its dominance.

- China's Dominance Factors:

- Unmatched Manufacturing Hub: Possesses the largest and most integrated solar manufacturing supply chain globally.

- Government Support & Policies: Extensive subsidies, incentives, and policy mandates favoring solar energy development.

- Scale of Domestic Market: Enormous internal demand for solar PV modules drives backsheet consumption.

- Export Prowess: A major global supplier of solar components, including backsheets, to international markets.

- Technological Advancement: Significant investment in R&D for higher efficiency and cost-effective materials.

Beyond China, India emerges as a rapidly growing market and a significant future contender. The Indian government's ambitious renewable energy goals, coupled with initiatives like the Production Linked Incentive (PLI) scheme for solar module manufacturing, are spurring substantial investment and capacity expansion. The country is actively working to reduce its reliance on imported solar components, fostering domestic production of materials like backsheets.

- India's Growth Potential:

- Ambitious Renewable Targets: Driven by a strong need for energy security and climate change mitigation.

- PLI Scheme Impact: Directly stimulates local manufacturing of solar PV components, including backsheets.

- Growing Domestic Installation Base: A rapidly expanding solar market requiring a consistent supply of modules and materials.

- Focus on Self-Reliance: Government emphasis on developing a strong domestic solar manufacturing ecosystem.

Japan and South Korea are key markets characterized by a focus on high-quality, advanced solar technology and significant R&D investments. While their market size is smaller than China's, they are influential in driving innovation and developing premium backsheet solutions, often catering to niche applications and high-efficiency modules. The "Rest of Asia-Pacific" encompasses a diverse range of countries with varying growth potentials, including Vietnam, Thailand, and the Philippines, all of which are increasingly investing in solar energy, creating localized demand for backsheets.

In terms of Type, the Non-fluoropolymer segment is currently dominant due to its cost-effectiveness and widespread adoption in standard solar modules. However, the Fluoropolymer segment is experiencing robust growth, driven by its superior performance characteristics such as exceptional weatherability, UV resistance, and dielectric properties, which are critical for long-duration, high-performance solar installations and demanding environmental conditions.

Asia Pacific Solar Backsheet Market Product Landscape

The Asia Pacific solar backsheet market's product landscape is characterized by a spectrum of innovations aimed at enhancing photovoltaic module durability, efficiency, and safety. Key product types include fluoropolymer-based backsheets (e.g., PVDF, ETFE) and non-fluoropolymer alternatives (e.g., PET, PEN). Fluoropolymer backsheets are recognized for their superior UV resistance, excellent dielectric strength, and long-term weatherability, making them ideal for demanding applications and extended warranty periods. Non-fluoropolymer backsheets offer a cost-effective solution for a broad range of solar modules, increasingly incorporating advanced coatings and structures to improve performance. Product innovations focus on thinner, lighter, and more flexible materials for ease of installation and integration, as well as improved fire retardancy and moisture barrier properties. The application spectrum spans residential rooftop solar, commercial and industrial installations, and utility-scale solar farms. Performance metrics such as tensile strength, elongation at break, UV degradation resistance, and electrical insulation are critical differentiators for manufacturers.

Key Drivers, Barriers & Challenges in Asia Pacific Solar Backsheet Market

Key Drivers:

The Asia Pacific solar backsheet market is primarily propelled by the escalating global demand for renewable energy, driven by climate change concerns and the pursuit of energy security. Supportive government policies, including subsidies, tax incentives, and renewable energy mandates across key nations like China and India, are significant growth catalysts. The declining cost of solar PV technology makes solar power increasingly competitive, leading to accelerated adoption and, consequently, higher demand for solar backsheets. Continuous technological advancements in backsheet materials, focusing on enhanced durability, performance, and cost-effectiveness, further stimulate market growth. The expansion of manufacturing capacity for solar PV modules within the region also directly fuels the demand for essential components like backsheets.

Barriers & Challenges:

Despite the strong growth outlook, the Asia Pacific solar backsheet market faces several challenges. Intense price competition among manufacturers, particularly for non-fluoropolymer backsheets, can erode profit margins. Supply chain disruptions, exacerbated by geopolitical factors and raw material price volatility, pose a significant risk to consistent production and pricing. Evolving technical standards and certification requirements across different countries can create compliance complexities for manufacturers. The development and adoption of new, higher-performance materials are often met with resistance due to the established manufacturing processes and the need for re-certification of solar modules. Furthermore, the increasing focus on sustainability and recyclability presents a challenge for manufacturers to adapt their product lines and manufacturing processes to meet these evolving environmental demands.

Emerging Opportunities in Asia Pacific Solar Backsheet Market

Emerging opportunities in the Asia Pacific solar backsheet market are centered around innovation and expanding applications. The growing demand for bifacial solar modules presents a significant opportunity for backsheet manufacturers to develop specialized products that enhance light reflection and module performance. Advancements in material science are opening doors for the development of ultra-thin, lightweight, and flexible backsheets, catering to the increasing popularity of building-integrated photovoltaics (BIPV) and portable solar solutions. The push towards sustainable manufacturing and a circular economy is creating opportunities for bio-based or highly recyclable backsheet materials. Furthermore, untapped markets in developing Southeast Asian countries, with their rapidly growing energy needs and increasing solar investments, offer substantial growth potential for backsheet suppliers.

Growth Accelerators in the Asia Pacific Solar Backsheet Market Industry

Several key catalysts are accelerating the long-term growth of the Asia Pacific solar backsheet industry. Technological breakthroughs in material science are continuously improving the performance, durability, and cost-efficiency of backsheets, making solar power more attractive. Strategic partnerships between backsheet manufacturers and solar module producers are crucial for co-developing innovative solutions and ensuring market adoption. Expanding manufacturing capacity within the region, driven by government incentives and increasing global demand for solar products, is a primary growth accelerator. Furthermore, market expansion strategies focused on emerging economies within Asia-Pacific, where solar energy adoption is rapidly increasing, will be vital for sustained growth. The ongoing trend of electrification and decarbonization across various sectors globally also contributes to the increasing demand for solar energy, thus indirectly boosting the solar backsheet market.

Key Players Shaping the Asia Pacific Solar Backsheet Market Market

- Arkema SA

- Toray Industries Inc

- Toyo Aluminium KK

- DuPont de Nemours Inc

- Taiflex Scientific Co Ltd

- Brij Encapsulants

- 3M Co

- ZTT International Limited

- Hanwha Group

- Hangzhou First Applied Material Co Ltd

Notable Milestones in Asia Pacific Solar Backsheet Market Sector

- September 2022: The government of India approved the second tranche of the performance-linked incentive (PLI) scheme to boost the manufacturing of solar photovoltaic (PV) modules in India. This scheme is expected to attract direct investment of approximately USD 11.35 billion and create manufacturing capacity for various materials, including EVA, solar glass, backsheet, etc. According to the government, the second tranche of the PLI scheme is expected to manufacture 65 GW per annum of fully integrated and partially integrated solar PV modules in the country.

- September 2022: Sharp, a Japanese company, unveiled a new version of the NU-JC410 solar panel, a half-cut monocrystalline PERC product with a 21% efficiency rating and 410 W power output. The lightweight NU-JC410B module has a white backsheet and a black frame that is suitable for short and long-frame side clamping and is ideal for residential, small-scale commercial, and industrial rooftop installations.

In-Depth Asia Pacific Solar Backsheet Market Market Outlook

The Asia Pacific solar backsheet market is poised for sustained and significant growth, driven by the region's pivotal role in the global renewable energy transition. Future market potential is amplified by the continuous expansion of solar PV installations, fueled by ambitious decarbonization targets and declining solar energy costs. Strategic opportunities lie in the development of advanced backsheet solutions for emerging technologies like bifacial and flexible solar modules, as well as in catering to the growing demand for sustainable and recyclable materials. The market's trajectory will be shaped by ongoing technological innovation, supportive government policies, and the increasing adoption of solar energy across diverse applications, solidifying the Asia Pacific's position as a critical hub for the solar backsheet industry.

Asia Pacific Solar Backsheet Market Segmentation

-

1. Type

- 1.1. Fluoropolymer

- 1.2. Non-fluoropolymer

-

2. Geography

- 2.1. China

- 2.2. India

- 2.3. Japan

- 2.4. South Korea

- 2.5. Rest of Asia-Pacific

Asia Pacific Solar Backsheet Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

Asia Pacific Solar Backsheet Market Regional Market Share

Geographic Coverage of Asia Pacific Solar Backsheet Market

Asia Pacific Solar Backsheet Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increased Government Regulations for Greenhouse Gas Emissions 4.; Encouraging Production and Consumption of Renewable Aviation Fuel

- 3.3. Market Restrains

- 3.3.1. 4.; The High Costs of Renewable Aviation Fuel

- 3.4. Market Trends

- 3.4.1. Fluoropolymer is Expected to Become a Significant Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Solar Backsheet Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fluoropolymer

- 5.1.2. Non-fluoropolymer

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Japan

- 5.2.4. South Korea

- 5.2.5. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia Pacific Solar Backsheet Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Fluoropolymer

- 6.1.2. Non-fluoropolymer

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. India

- 6.2.3. Japan

- 6.2.4. South Korea

- 6.2.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. India Asia Pacific Solar Backsheet Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Fluoropolymer

- 7.1.2. Non-fluoropolymer

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. India

- 7.2.3. Japan

- 7.2.4. South Korea

- 7.2.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Asia Pacific Solar Backsheet Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Fluoropolymer

- 8.1.2. Non-fluoropolymer

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Japan

- 8.2.4. South Korea

- 8.2.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South Korea Asia Pacific Solar Backsheet Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Fluoropolymer

- 9.1.2. Non-fluoropolymer

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. India

- 9.2.3. Japan

- 9.2.4. South Korea

- 9.2.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Asia Pacific Asia Pacific Solar Backsheet Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Fluoropolymer

- 10.1.2. Non-fluoropolymer

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. India

- 10.2.3. Japan

- 10.2.4. South Korea

- 10.2.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Arkema SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Toray Industries Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Toyo Aluminium KK

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DuPont de Nemours Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Taiflex Scientific Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Brij Encapsulants*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 3M Co

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ZTT International Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hanwha Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hangzhou First Applied Material Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Arkema SA

List of Figures

- Figure 1: Asia Pacific Solar Backsheet Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Solar Backsheet Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Solar Backsheet Market?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the Asia Pacific Solar Backsheet Market?

Key companies in the market include Arkema SA, Toray Industries Inc, Toyo Aluminium KK, DuPont de Nemours Inc, Taiflex Scientific Co Ltd, Brij Encapsulants*List Not Exhaustive, 3M Co, ZTT International Limited, Hanwha Group, Hangzhou First Applied Material Co Ltd.

3. What are the main segments of the Asia Pacific Solar Backsheet Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.8 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increased Government Regulations for Greenhouse Gas Emissions 4.; Encouraging Production and Consumption of Renewable Aviation Fuel.

6. What are the notable trends driving market growth?

Fluoropolymer is Expected to Become a Significant Segment.

7. Are there any restraints impacting market growth?

4.; The High Costs of Renewable Aviation Fuel.

8. Can you provide examples of recent developments in the market?

September 2022: The government of India approved the second tranche of the performance-linked incentive (PLI) scheme to boost the manufacturing of solar photovoltaic (PV) modules in India. This scheme is expected to attract direct investment of approximately USD 11.35 billion and create manufacturing capacity for various materials, including EVA, solar glass, backsheet, etc. According to the government, the second tranche of the PLI scheme is expected to manufacture 65 GW per annum of fully integrated and partially integrated solar PV modules in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Solar Backsheet Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Solar Backsheet Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Solar Backsheet Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Solar Backsheet Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence