Key Insights

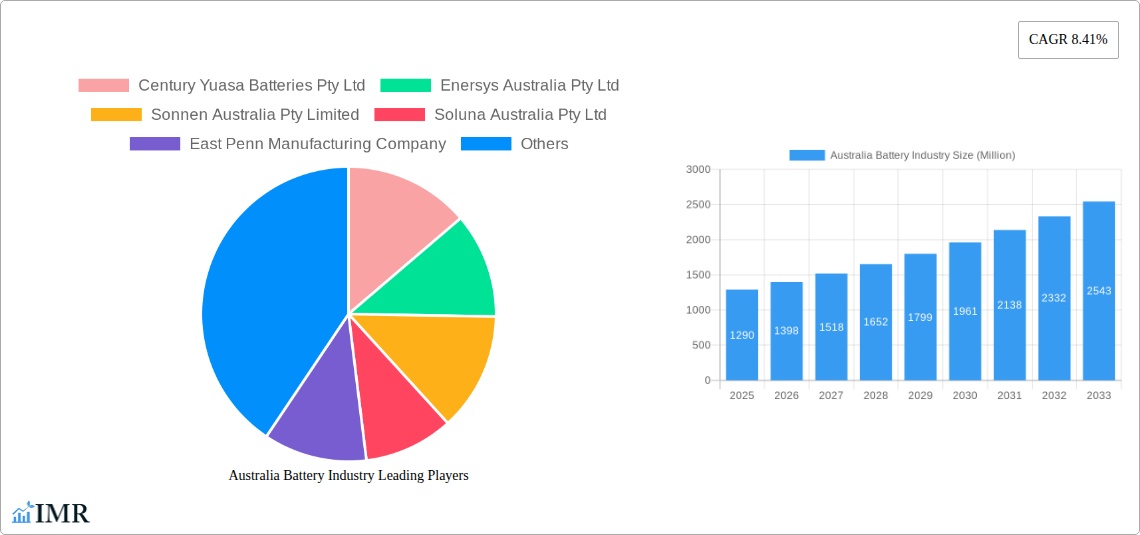

The Australian battery industry, valued at $1.29 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.41% from 2025 to 2033. This growth is fueled by several key factors. The increasing adoption of renewable energy sources like solar and wind power is driving demand for energy storage solutions, particularly in the stationary battery segment (including telecom, UPS, and Energy Storage Systems (ESS)). Furthermore, the burgeoning electric vehicle (EV) market in Australia is significantly boosting demand for automotive batteries, including HEV, PHEV, and EV batteries. The government's commitment to transitioning to cleaner energy and reducing carbon emissions further supports this market expansion. Li-ion batteries dominate the technology segment, owing to their higher energy density and longer lifespan compared to lead-acid batteries. However, lead-acid batteries continue to hold a significant market share, primarily in the SLI (Starting, Lighting, and Ignition) battery applications. The increasing focus on sustainable and environmentally friendly battery technologies is also shaping the industry landscape, with a gradual shift towards more recyclable and less environmentally damaging battery chemistries.

Australia Battery Industry Market Size (In Billion)

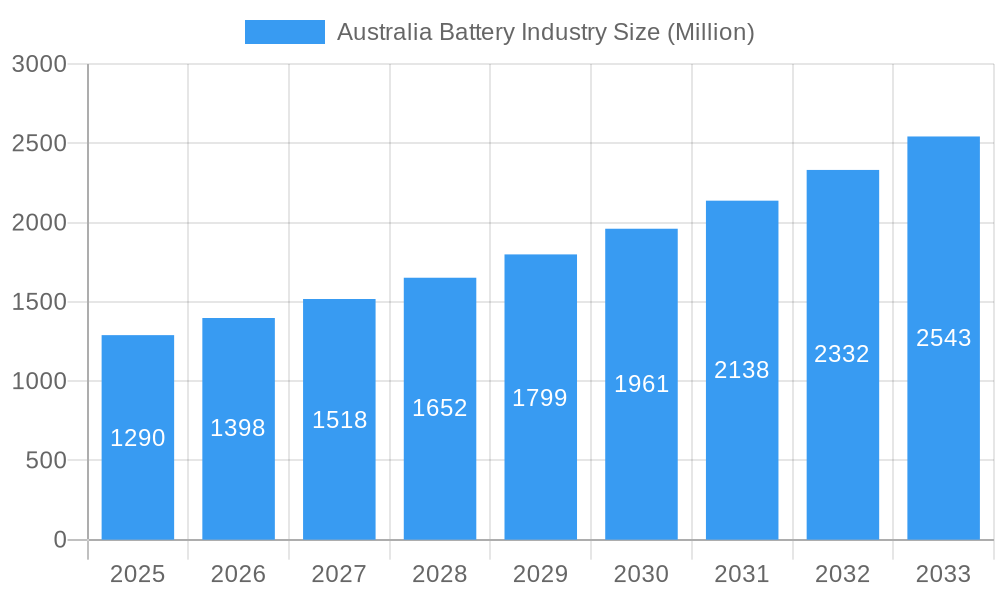

Despite the positive growth outlook, challenges remain. The high initial investment costs associated with battery technologies, especially for large-scale energy storage projects, could act as a restraint. Fluctuations in raw material prices, particularly for lithium, also pose a significant risk to industry profitability. Furthermore, the need for robust recycling infrastructure to manage end-of-life batteries is crucial for long-term sustainability. Key players in the Australian battery market, such as Century Yuasa Batteries Pty Ltd, Enersys Australia Pty Ltd, and Sonnen Australia Pty Ltd, are actively investing in research and development to overcome these challenges and capitalize on the expanding market opportunities. The competitive landscape is dynamic, with both established international players and emerging domestic companies vying for market share. The ongoing evolution of battery technologies, driven by advancements in energy density, charging speed, and cost-effectiveness, will further shape the future of the Australian battery industry.

Australia Battery Industry Company Market Share

Australia Battery Industry Market Report: 2019-2033

This comprehensive report delivers an in-depth analysis of the Australian battery industry, encompassing market dynamics, growth trends, key players, and future outlook. With a focus on both parent and child markets, this report is essential for industry professionals, investors, and anyone seeking to understand this rapidly evolving sector. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market size is presented in million units.

Australia Battery Industry Market Dynamics & Structure

The Australian battery market is characterized by a moderate level of concentration, with several multinational and domestic players competing across various segments. Technological innovation, driven primarily by the demand for renewable energy storage and electric vehicles (EVs), is a significant driver. Government regulations, including incentives for renewable energy adoption and stricter emission standards, are shaping market growth. Lead-acid batteries currently hold a significant market share in the SLI and industrial segments, while lithium-ion batteries are rapidly gaining traction in the ESS and EV sectors. Competitive substitutes include fuel cells and other energy storage technologies, but lithium-ion's energy density advantage is a strong barrier to entry. M&A activity has been moderate, with strategic acquisitions focusing on technology integration and market expansion.

- Market Concentration: Moderately concentrated, with several major players controlling xx% of the market in 2024.

- Technological Innovation: Strong focus on lithium-ion battery technology advancement and cost reduction. Lead-acid battery technology improvements focusing on lifespan and performance.

- Regulatory Framework: Government incentives for renewable energy and EV adoption are positive catalysts. xx% of the market growth is driven by this framework.

- Competitive Substitutes: Fuel cells and other energy storage solutions pose a long-term threat to xx%. However, lithium-ion dominates due to energy density.

- End-User Demographics: Growth is primarily driven by increasing electricity demand from residential and commercial sectors, as well as the EV industry.

- M&A Trends: Moderate activity, with strategic acquisitions of smaller technology firms and battery manufacturers. xx M&A deals observed between 2019-2024.

Australia Battery Industry Growth Trends & Insights

The Australian battery market exhibits robust growth, driven by a confluence of factors including increasing renewable energy adoption, government support for EVs, and the growing need for reliable energy storage solutions. The market size grew from xx million units in 2019 to xx million units in 2024, indicating a CAGR of xx%. Technological advancements, such as higher energy density lithium-ion batteries and improved battery management systems, are accelerating adoption. Consumer behavior is shifting towards more environmentally friendly options, further fueling demand for batteries in EVs and renewable energy storage applications. Market penetration for lithium-ion batteries in the ESS segment is expected to reach xx% by 2033. Increased adoption of ESS is further contributing to the market growth.

Dominant Regions, Countries, or Segments in Australia Battery Industry

The Australian battery market is geographically diverse, with significant growth in major urban centers and regions with high renewable energy penetration. The largest segment is Industrial Batteries, representing xx% of the market in 2024, followed by Automotive Batteries at xx%. Within technologies, lithium-ion batteries are expected to experience the highest growth, surpassing lead-acid batteries by 2030. Victoria and New South Wales are currently the leading states due to high EV adoption rates and renewable energy infrastructure development.

- Key Drivers: Government policies supporting renewable energy integration, increasing EV sales, and improving grid stability.

- Dominance Factors: High demand for ESS solutions in areas with intermittent renewable energy sources, robust industrial sector, and substantial investment in EV infrastructure.

- Market Share: Industrial batteries hold a xx% market share, driven by stationary energy storage and motive power applications. Automotive batteries are projected to reach xx% share by 2033.

Australia Battery Industry Product Landscape

The Australian battery market showcases a diverse range of products, encompassing lead-acid, lithium-ion, and other emerging technologies. Innovations focus on improving energy density, lifespan, safety, and cost-effectiveness. Lithium-ion batteries dominate the EV and ESS segments due to their higher energy density. Lead-acid batteries still maintain a significant presence in SLI and industrial applications, particularly those requiring lower cost and longer service life. Unique selling propositions include faster charging times, improved thermal management, and enhanced safety features.

Key Drivers, Barriers & Challenges in Australia Battery Industry

Key Drivers:

- Increasing demand for renewable energy storage.

- Government incentives for EV adoption.

- Growing industrial applications of batteries.

- Technological advancements in battery technology.

Key Barriers and Challenges:

- High initial cost of lithium-ion batteries.

- Supply chain constraints for raw materials.

- Lack of large-scale domestic manufacturing.

- Recycling and disposal challenges. The recycling infrastructure capacity is currently insufficient to handle xx% of the waste.

Emerging Opportunities in Australia Battery Industry

Emerging opportunities include growth in the microgrid and off-grid energy storage markets, increasing demand for second-life battery applications, and expansion into new industrial sectors. Furthermore, innovative business models focusing on battery-as-a-service are creating new market avenues. Development of advanced battery management systems and improved battery recycling technologies will further unlock new opportunities.

Growth Accelerators in the Australia Battery Industry

Technological breakthroughs in battery chemistry, particularly solid-state batteries, promise to significantly improve energy density and safety, unlocking new applications and driving market expansion. Strategic partnerships between battery manufacturers, energy companies, and automotive manufacturers are fostering innovation and accelerating market adoption. Expansion into new geographical markets and diversification into emerging applications, such as grid-scale energy storage and electric aviation, will further propel growth.

Key Players Shaping the Australia Battery Industry Market

- Century Yuasa Batteries Pty Ltd

- Enersys Australia Pty Ltd

- Sonnen Australia Pty Limited

- Soluna Australia Pty Ltd

- East Penn Manufacturing Company

- Robert Bosch (Australia) Pty Ltd

- PMB Defence

- R & J Batteries Pty Ltd

- Energy Renaissance Pty Ltd

- VARTA AG

- Crystal Solar Energy

- Battery Energy Power Solutions Pty

- Exide Technologies

Notable Milestones in Australia Battery Industry Sector

- June 2023: Commissioning of the Hazelwood big battery (150 MW), marking a significant milestone in large-scale battery storage deployment.

- January 2023: Announcement of plans to build a 30 GWh lithium-ion battery cell factory, signaling a major investment in domestic battery manufacturing.

In-Depth Australia Battery Industry Market Outlook

The Australian battery market is poised for significant growth, driven by the increasing demand for renewable energy integration, EV adoption, and industrial applications. Technological advancements, supportive government policies, and strategic partnerships will create a dynamic market landscape. Opportunities exist in both established and emerging segments, presenting attractive prospects for investors and industry players. The long-term outlook remains positive, with continued expansion in market size and technological innovation shaping the future of the Australian battery industry.

Australia Battery Industry Segmentation

-

1. Technology

- 1.1. Li-Ion Battery

- 1.2. Lead-acid Battery

- 1.3. Other Technologies

-

2. Application

- 2.1. SLI Batteries

- 2.2. Industri

- 2.3. Portable Batteries (Consumer Electronics, etc.)

- 2.4. Automotive Batteries (HEV, PHEV, EV)

- 2.5. Other Applications

Australia Battery Industry Segmentation By Geography

- 1. Australia

Australia Battery Industry Regional Market Share

Geographic Coverage of Australia Battery Industry

Australia Battery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand from EV Sector4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Development in Battery Production Supply Chain

- 3.4. Market Trends

- 3.4.1. SLI Battery Application to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Battery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Li-Ion Battery

- 5.1.2. Lead-acid Battery

- 5.1.3. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. SLI Batteries

- 5.2.2. Industri

- 5.2.3. Portable Batteries (Consumer Electronics, etc.)

- 5.2.4. Automotive Batteries (HEV, PHEV, EV)

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Century Yuasa Batteries Pty Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Enersys Australia Pty Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sonnen Australia Pty Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Soluna Australia Pty Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 East Penn Manufacturing Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Robert Bosch (Australia) Pty Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PMB Defence

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 R & J Batteries Pty Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Energy Renaissance Pty Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 VARTA AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Crystal Solar Energy*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Battery Energy Power Solutions Pty

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Exide Technologies

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Century Yuasa Batteries Pty Ltd

List of Figures

- Figure 1: Australia Battery Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Battery Industry Share (%) by Company 2025

List of Tables

- Table 1: Australia Battery Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Australia Battery Industry Volume Kiloton Forecast, by Technology 2020 & 2033

- Table 3: Australia Battery Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Australia Battery Industry Volume Kiloton Forecast, by Application 2020 & 2033

- Table 5: Australia Battery Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Australia Battery Industry Volume Kiloton Forecast, by Region 2020 & 2033

- Table 7: Australia Battery Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 8: Australia Battery Industry Volume Kiloton Forecast, by Technology 2020 & 2033

- Table 9: Australia Battery Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Australia Battery Industry Volume Kiloton Forecast, by Application 2020 & 2033

- Table 11: Australia Battery Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Australia Battery Industry Volume Kiloton Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Battery Industry?

The projected CAGR is approximately 8.41%.

2. Which companies are prominent players in the Australia Battery Industry?

Key companies in the market include Century Yuasa Batteries Pty Ltd, Enersys Australia Pty Ltd, Sonnen Australia Pty Limited, Soluna Australia Pty Ltd, East Penn Manufacturing Company, Robert Bosch (Australia) Pty Ltd, PMB Defence, R & J Batteries Pty Ltd, Energy Renaissance Pty Ltd, VARTA AG, Crystal Solar Energy*List Not Exhaustive, Battery Energy Power Solutions Pty, Exide Technologies.

3. What are the main segments of the Australia Battery Industry?

The market segments include Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.29 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand from EV Sector4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

SLI Battery Application to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Lack of Development in Battery Production Supply Chain.

8. Can you provide examples of recent developments in the market?

June 2023: Engie, Eku Energy, and Fluence commissioned the Hazelwood big battery, Australia's first large-scale battery project, at the former coal site of a power station in the state of Victoria. The 150 MW battery claims several Australian firsts in its design and operation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Battery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Battery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Battery Industry?

To stay informed about further developments, trends, and reports in the Australia Battery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence