Key Insights

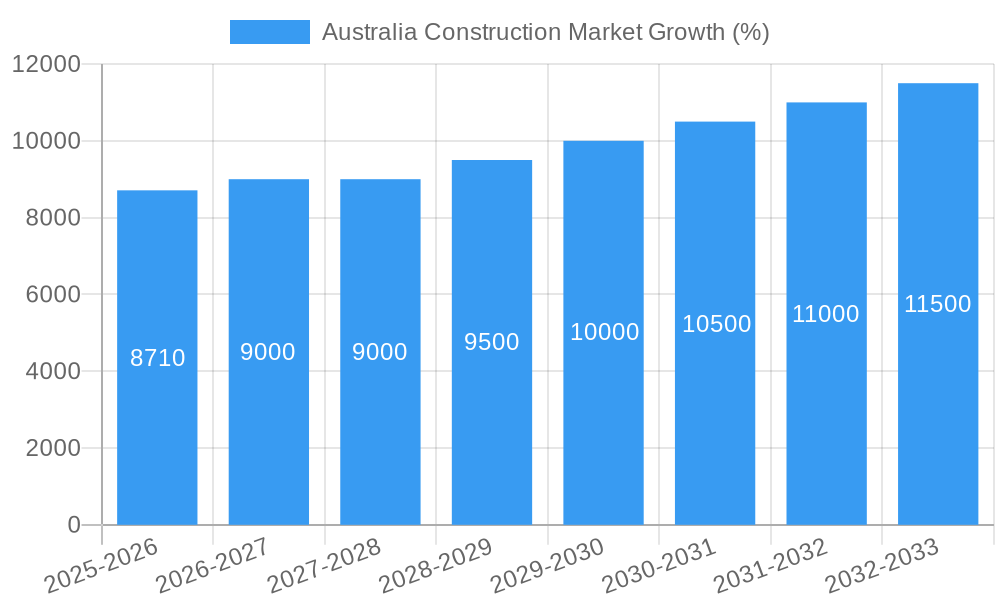

The Australian construction market, valued at $172.29 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.00% from 2025 to 2033. This expansion is fueled by several key drivers. Significant government investment in infrastructure projects, including transportation networks and renewable energy initiatives, is a major catalyst. Furthermore, a growing population and increasing urbanization are driving demand for residential and commercial construction. The residential sector is expected to remain a significant contributor, driven by population growth and increasing demand for housing in major cities. The commercial sector will benefit from sustained economic activity and expansion in key industries. While challenges such as material price fluctuations and skilled labor shortages exist, the long-term outlook remains positive, particularly with ongoing government support for infrastructure development and a focus on sustainable building practices.

The market is segmented across various sectors, including residential, commercial, industrial, infrastructure, and energy & utilities. While precise market share data for each segment is unavailable, a reasonable estimation based on industry trends suggests that infrastructure and residential construction will likely account for the largest portions of the market. Key players such as John Holland Group, Lendlease, and Cimic Group Limited are expected to maintain their leading positions, leveraging their experience and expertise to secure major projects. The increasing adoption of sustainable building technologies and practices represents a significant trend within the sector, influencing material selection and construction methodologies. This trend, combined with government initiatives promoting energy efficiency, will likely shape the market's trajectory in the coming years.

Australia Construction Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Australian construction market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report segments the market by sector (Residential, Commercial, Industrial, Infrastructure, Energy and Utilities), offering invaluable insights for investors, contractors, and industry professionals. The market size is projected to reach xx Million by 2033.

Australia Construction Market Dynamics & Structure

The Australian construction market is characterized by a moderately concentrated landscape, with several major players holding significant market share. Market concentration is influenced by factors like project scale, specialized expertise, and access to capital. Technological innovation, including Building Information Modeling (BIM), prefabrication, and robotics, is driving productivity gains and efficiency improvements. However, adoption rates vary across companies and project types. The regulatory framework, including building codes and environmental regulations, significantly impacts construction practices and costs. The market also faces competitive pressures from substitute materials and construction methods. End-user demographics, particularly population growth and urbanization trends in major cities, are key drivers of demand. M&A activity, while fluctuating, remains a strategic tool for expansion and diversification, with xx deals recorded between 2019 and 2024, totaling approximately xx Million in value.

- Market Concentration: Top 5 players account for approximately 35% of the market.

- Technological Innovation: BIM adoption rate is steadily increasing, with xx% of projects utilizing it in 2024.

- Regulatory Framework: Stringent environmental regulations are influencing material choices and construction methods.

- M&A Activity: Consolidation is expected to continue, particularly within the infrastructure sector.

Australia Construction Market Growth Trends & Insights

The Australian construction market experienced a period of growth from 2019 to 2024, followed by a slight slowdown in 2025 due to global economic factors. However, a robust rebound is anticipated, driven by infrastructure investments, residential construction, and resource sector projects. The market size in 2024 was estimated at xx Million, projected to grow at a CAGR of xx% from 2025 to 2033, reaching xx Million. Technological disruptions, particularly the increased use of automation and digital tools, are significantly influencing productivity and project timelines. Consumer preferences are shifting towards sustainable and technologically advanced building solutions.

- Market Size (2024): xx Million

- Projected Market Size (2033): xx Million

- CAGR (2025-2033): xx%

- Key Growth Drivers: Government infrastructure spending, population growth, and resource sector investments.

Dominant Regions, Countries, or Segments in Australia Construction Market

The infrastructure sector is currently the largest segment in the Australian construction market, accounting for approximately xx% of the total market value in 2024. Strong government spending on infrastructure projects, including transport networks and utilities, has fueled this growth. Major cities such as Sydney, Melbourne, and Brisbane are experiencing significant residential and commercial construction activity, driven by population growth and urbanization. The industrial sector is also expected to experience significant growth, driven by increasing manufacturing activity. The energy and utilities sector is also experiencing growth, driven by the increasing demand for renewable energy.

- Largest Segment (2024): Infrastructure (xx%)

- Key Growth Drivers:

- Government infrastructure programs (e.g., National Infrastructure Pipeline).

- Population growth and urbanization in major cities.

- Resource sector investments.

- Renewable energy initiatives.

Australia Construction Market Product Landscape

Product innovation is focused on improving efficiency, sustainability, and safety. This includes advancements in prefabrication techniques, sustainable building materials, and the integration of smart technologies. Unique selling propositions are centered around cost-effectiveness, reduced construction time, and enhanced building performance.

Key Drivers, Barriers & Challenges in Australia Construction Market

Key Drivers:

- Strong government investment in infrastructure.

- Population growth and urbanization.

- Demand for sustainable and resilient infrastructure.

- Technological advancements in construction methods and materials.

Key Challenges:

- Skill shortages and labor costs.

- Supply chain disruptions and material price volatility.

- Regulatory compliance and environmental concerns.

- Intense competition.

Emerging Opportunities in Australia Construction Market

- Sustainable building materials and green construction practices.

- Modular and prefabricated construction.

- Integration of smart technologies and IoT in buildings.

- Increased demand for affordable housing solutions.

Growth Accelerators in the Australia Construction Market Industry

Technological advancements, such as BIM and advanced robotics, are accelerating growth. Strategic partnerships and collaborations between construction companies and technology providers are enhancing efficiency and innovation. Expansion into new markets and diversification into related sectors are contributing to long-term market expansion.

Key Players Shaping the Australia Construction Market Market

- John Holland Group

- Hutchinson Builders

- Lendlease Corporation Limited

- Cimic Group Limited

- Adco Constructions

- Laing O'Rourke

- CPB Contractors

- UGL Limited

- Fulton Hogan

- Thiess Pty Ltd

List Not Exhaustive

Notable Milestones in Australia Construction Market Sector

- April 2022: Thiess, a CIMIC Group company, entered into a business cooperation agreement to provide mine design and engineering services to Tata Steel.

- July 2022: Laing O'Rourke partnered with Robotics Australia Group to explore robotics applications in construction.

- May 2023: Opening of the Indonesia-Australia partnership for Infrastructure (KIAT) office.

In-Depth Australia Construction Market Market Outlook

The Australian construction market is poised for continued growth, driven by sustained infrastructure investment, technological innovation, and a focus on sustainable development. Strategic opportunities exist for companies that embrace technological advancements, focus on sustainability, and effectively manage supply chain challenges. The market's future success hinges on addressing skill shortages, navigating regulatory complexities, and capitalizing on emerging opportunities in sectors like renewable energy and smart buildings.

Australia Construction Market Segmentation

-

1. Sector

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

- 1.4. Infrastructure

- 1.5. Energy and Utilities

Australia Construction Market Segmentation By Geography

- 1. Australia

Australia Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives is driving the market; Increase In Residential Sector

- 3.3. Market Restrains

- 3.3.1. Supply chain issues and rising material costs; Rising labor costs and labor shortages

- 3.4. Market Trends

- 3.4.1. Increase in Non-Residential and Infrastructure Construction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.1.4. Infrastructure

- 5.1.5. Energy and Utilities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 John Holland Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hutchinson Builders

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lendlease Corporation Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cimic Group Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Adco Constructions

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Laing O'rourke

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CPB Contractors

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ugl Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Fulton Hogan

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Thiess Pty Ltd**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 John Holland Group

List of Figures

- Figure 1: Australia Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Australia Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Australia Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Australia Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 6: Australia Construction Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Construction Market?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the Australia Construction Market?

Key companies in the market include John Holland Group, Hutchinson Builders, Lendlease Corporation Limited, Cimic Group Limited, Adco Constructions, Laing O'rourke, CPB Contractors, Ugl Limited, Fulton Hogan, Thiess Pty Ltd**List Not Exhaustive.

3. What are the main segments of the Australia Construction Market?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 172.29 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives is driving the market; Increase In Residential Sector.

6. What are the notable trends driving market growth?

Increase in Non-Residential and Infrastructure Construction.

7. Are there any restraints impacting market growth?

Supply chain issues and rising material costs; Rising labor costs and labor shortages.

8. Can you provide examples of recent developments in the market?

May 2023: New office of the Indonesia-Australia partnership for Infrastructure (KIAT) was opened by the Australian ambassador to Indonesia, Penny Williams (PSM), and minister of public works and housing of the Republic of Indonesia, Basuki Hidayat.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Construction Market?

To stay informed about further developments, trends, and reports in the Australia Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence