Key Insights

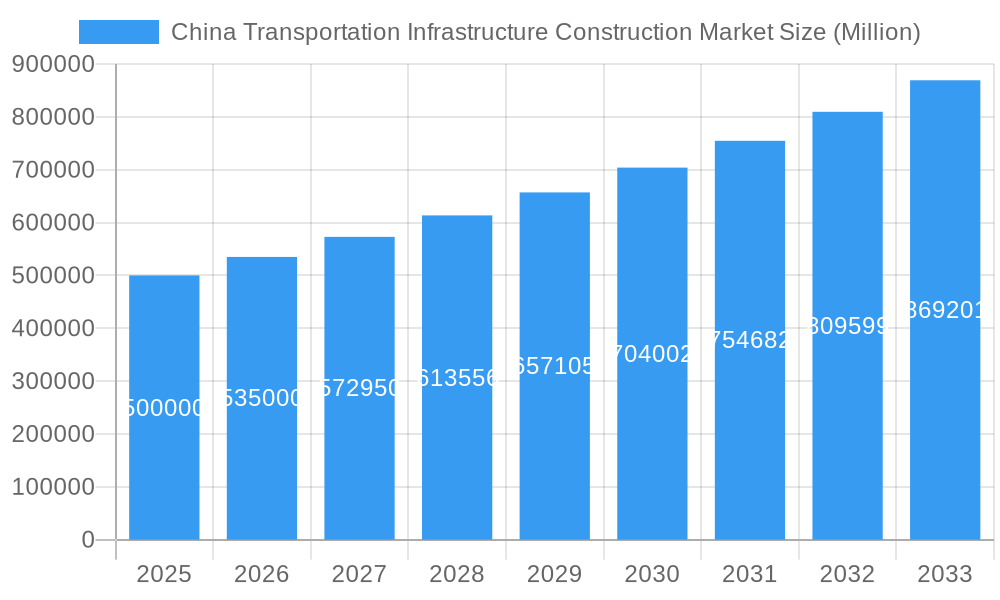

The China Transportation Infrastructure Construction Market is projected for significant expansion, driven by strategic government investments and a robust economy. Expected to reach approximately $3654.96 billion by the base year 2025, the market anticipates a Compound Annual Growth Rate (CAGR) of 6.32% through 2033. This growth is underpinned by ongoing initiatives to enhance national connectivity and modernize logistics networks, including the Belt and Road Initiative and accelerated urbanization. Key development areas encompass high-speed rail, expressways, and airport expansions, supported by technological advancements and a focus on sustainable infrastructure. The market's comprehensive approach to developing roadways, railways, airports, ports, and inland waterways ensures a resilient and efficient transportation system.

China Transportation Infrastructure Construction Market Market Size (In Million)

Challenges within the market include the substantial capital required for projects, environmental impact considerations necessitating stringent regulations, and evolving land acquisition policies. However, these are being mitigated through innovative financing and the adoption of green construction practices. The market is highly competitive, featuring major players such as China State Construction Engineering, China Communications Construction Company, and China Railway Group, all actively contributing to large-scale national and regional development projects. The government's commitment to balanced economic growth and improved accessibility across China further strengthens the market's future outlook.

China Transportation Infrastructure Construction Market Company Market Share

This report delivers a critical analysis of the China transportation infrastructure construction market, a key enabler of national economic growth and connectivity. Covering the period 2019-2033, with 2025 as the base year, this study provides actionable insights for stakeholders and investors. We explore the intricate dynamics of parent and child markets, examining the interdependencies between various transportation modes and their construction demands. This analysis is optimized for search engines with relevant keywords such as "China infrastructure development," "transportation construction China," "railway construction China," "highway construction China," "airport expansion China," and "port development China."

China Transportation Infrastructure Construction Market Market Dynamics & Structure

The China transportation infrastructure construction market is characterized by a highly consolidated structure, with a few dominant state-owned enterprises holding significant market share. Technological innovation is a key driver, with advancements in smart construction techniques, high-speed rail technology, and sustainable building materials rapidly being adopted. Regulatory frameworks, primarily driven by government initiatives like the Belt and Road Initiative (BRI) and urban development plans, significantly influence project approvals and investment flows. While direct competitive product substitutes are limited within specific infrastructure categories, inter-modal competition, such as the shift from road freight to rail or waterways, influences demand. End-user demographics are increasingly urbanized, demanding more efficient and integrated public transportation networks. Mergers and acquisitions (M&A) trends, though less frequent in the state-dominated sector, do occur, particularly in specialized construction segments, aiming to consolidate expertise and expand capabilities.

- Market Concentration: Dominated by state-owned enterprises, with limited private sector penetration in large-scale projects.

- Technological Innovation: Focus on BIM (Building Information Modeling), AI-driven project management, and advanced materials for enhanced durability and efficiency.

- Regulatory Frameworks: Government policies heavily influence project pipelines, funding mechanisms, and environmental standards.

- End-User Demographics: Growing demand for multimodal transport solutions driven by urbanization and economic activity.

- M&A Trends: Strategic acquisitions aimed at technology integration and market expansion within niche segments.

China Transportation Infrastructure Construction Market Growth Trends & Insights

The China transportation infrastructure construction market is poised for sustained robust growth, fueled by the nation's unwavering commitment to enhancing its multimodal transportation network. The market size is projected to witness a significant expansion, with an estimated Compound Annual Growth Rate (CAGR) of approximately 7.5% over the forecast period (2025-2033). This growth is underpinned by continuous government investment in upgrading and expanding existing infrastructure, alongside the development of new, state-of-the-art facilities. Adoption rates for advanced construction technologies, including prefabrication and digital twin modeling, are steadily increasing, leading to more efficient project execution and reduced costs. Technological disruptions, such as the integration of smart city concepts into transportation hubs and the increasing use of autonomous vehicles, are also shaping the future of infrastructure development. Consumer behavior shifts towards seeking seamless travel experiences and efficient logistics are further influencing project prioritization, with a growing emphasis on intermodal connectivity and last-mile solutions. The market penetration of sustainable construction practices is also on an upward trajectory, driven by environmental regulations and a growing corporate social responsibility focus.

Dominant Regions, Countries, or Segments in China Transportation Infrastructure Construction Market

The roadways segment is a dominant force within the China transportation infrastructure construction market, consistently driving growth and investment. This dominance is fueled by several key factors, including China's vast geographical expanse, the need for efficient freight movement, and the ongoing urbanization that necessitates extensive highway networks connecting cities and economic zones. Government policies prioritizing rural road development and the expansion of expressways to alleviate congestion have further bolstered this segment. Market share within roadways is substantial, with major construction firms heavily invested in projects like expressways, national highways, and urban road networks.

- Key Drivers for Roadways Dominance:

- Economic Policies: Continued focus on domestic consumption and supply chain efficiency necessitates robust road networks.

- Urbanization: Expansion of cities and suburban areas requires extensive road infrastructure for connectivity.

- Rural Development: Government initiatives to connect rural areas to economic centers.

- Logistics Demands: Growing e-commerce and manufacturing sectors rely heavily on efficient road freight.

- Technological Integration: Adoption of smart traffic management systems and intelligent transportation systems (ITS) in new road projects.

The growth potential within the roadways segment remains significant, with ongoing projects aimed at improving road quality, increasing capacity, and integrating digital technologies for enhanced traffic flow and safety. While other segments like railways and airports are also experiencing substantial growth, the sheer scale and ongoing necessity of road infrastructure development solidify its leading position in the China transportation infrastructure construction market.

China Transportation Infrastructure Construction Market Product Landscape

The China transportation infrastructure construction market showcases a product landscape defined by scale, innovation, and sustainability. Major construction projects involve the deployment of advanced materials such as high-strength concrete, durable asphalt mixes, and specialized steel alloys for bridges and tunnels. Unique selling propositions often lie in the ability to construct complex and challenging infrastructure, such as elevated expressways, deep-sea ports, and high-speed railway lines under stringent timelines. Technological advancements are evident in the integration of smart sensors for structural health monitoring, energy-efficient lighting systems for roadways and tunnels, and noise reduction barriers. The application of Building Information Modeling (BIM) and prefabrication techniques are also becoming standard, enhancing precision and reducing construction waste.

Key Drivers, Barriers & Challenges in China Transportation Infrastructure Construction Market

Key Drivers: The China transportation infrastructure construction market is propelled by sustained government investment in national connectivity and economic development, driven by initiatives like the Belt and Road Initiative (BRI). Technological advancements in construction methods and materials, coupled with increasing demand for multimodal transport solutions due to urbanization and a growing middle class, are significant growth accelerators.

Barriers & Challenges: Supply chain disruptions, particularly for specialized materials and equipment, can lead to project delays and cost overruns. Stringent environmental regulations and the need for sustainable construction practices present both a challenge and an opportunity. Intense competition among major players, while fostering innovation, can also put pressure on profit margins. Navigating complex land acquisition processes and ensuring equitable community impact are ongoing challenges.

Emerging Opportunities in China Transportation Infrastructure Construction Market

Emerging opportunities in the China transportation infrastructure construction market lie in the development of smart transportation hubs that integrate various modes of transit with digital services. The expansion of high-speed rail networks, particularly in less developed regions, presents significant growth potential. Furthermore, the increasing focus on green infrastructure development, including the construction of charging stations for electric vehicles and the adoption of renewable energy sources for transportation facilities, offers a burgeoning market. The ongoing digitalization of infrastructure management and maintenance presents opportunities for innovative solutions and services.

Growth Accelerators in the China Transportation Infrastructure Construction Market Industry

Several growth accelerators are shaping the long-term trajectory of the China transportation infrastructure construction market. These include continued government commitment to infrastructure spending as a key pillar of economic stimulus and national development. Technological breakthroughs in construction automation, AI-powered project management, and the use of advanced composites are enabling faster, more efficient, and cost-effective project delivery. Strategic partnerships between Chinese construction giants and international technology providers are also fostering innovation and knowledge transfer, further accelerating growth. Market expansion into emerging inland regions and the development of integrated logistics networks are also crucial catalysts.

Key Players Shaping the China Transportation Infrastructure Construction Market Market

- China State Construction Engineering

- China Communications Construction Company

- China Railway Group

- China Railway Construction

- Yunnan Construction and Investment Holding Group

- Shanghai Construction Group (SCG)

- China Wu Yi co Ltd

- Power Construction Corporation of China

- Beijing Construction Engineering Group

- Sichuan Road and Bridge Group

Notable Milestones in China Transportation Infrastructure Construction Market Sector

- 2019: Completion of the Hong Kong-Zhuhai-Macau Bridge, showcasing world-class engineering and connectivity.

- 2020: Significant expansion of the high-speed rail network, connecting more cities and improving travel efficiency.

- 2021: Launch of major airport expansion projects, including Terminal 3 at Beijing Capital International Airport, to accommodate growing air travel demand.

- 2022: Accelerated development of inland waterway transportation infrastructure, enhancing freight logistics and regional connectivity.

- 2023: Increased investment in smart transportation technologies, including the deployment of 5G networks and AI for traffic management.

- 2024 (Projected): Further integration of renewable energy sources in infrastructure projects, with a focus on sustainability and carbon reduction.

In-Depth China Transportation Infrastructure Construction Market Market Outlook

The China transportation infrastructure construction market is set for a future characterized by continued expansion and technological sophistication. Growth accelerators such as ongoing government investment, innovation in construction technologies, and the increasing demand for integrated multimodal transportation systems will sustain market momentum. Opportunities in smart infrastructure, green construction, and the development of high-speed rail networks in emerging regions will be key drivers. The market outlook remains exceptionally strong, promising significant returns for stakeholders invested in China's transformative infrastructure development.

China Transportation Infrastructure Construction Market Segmentation

-

1. Mode

- 1.1. Roadways

- 1.2. Railways

- 1.3. Airports

- 1.4. Ports and Inland Waterways

China Transportation Infrastructure Construction Market Segmentation By Geography

- 1. China

China Transportation Infrastructure Construction Market Regional Market Share

Geographic Coverage of China Transportation Infrastructure Construction Market

China Transportation Infrastructure Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Infrastructure Spending; Urbanization and Increasing Disposable Incomes

- 3.3. Market Restrains

- 3.3.1. Oversupply in the Real Estate; Labor Shortages

- 3.4. Market Trends

- 3.4.1. Government Initiatives Driving Transport Infrastructure Construction Market in China

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Transportation Infrastructure Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 5.1.1. Roadways

- 5.1.2. Railways

- 5.1.3. Airports

- 5.1.4. Ports and Inland Waterways

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 China State Construction Engineering

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 China Communications Construction Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China Railway Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China Railway Construction

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Yunnan Construction and Investment Holding Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Shanghai Construction Group (SCG)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 China Wu Yi co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Power Construction Corporation of China

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Beijing Construction Engineering Group**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sichuan Road and Bridge Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 China State Construction Engineering

List of Figures

- Figure 1: China Transportation Infrastructure Construction Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Transportation Infrastructure Construction Market Share (%) by Company 2025

List of Tables

- Table 1: China Transportation Infrastructure Construction Market Revenue billion Forecast, by Mode 2020 & 2033

- Table 2: China Transportation Infrastructure Construction Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: China Transportation Infrastructure Construction Market Revenue billion Forecast, by Mode 2020 & 2033

- Table 4: China Transportation Infrastructure Construction Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Transportation Infrastructure Construction Market?

The projected CAGR is approximately 6.32%.

2. Which companies are prominent players in the China Transportation Infrastructure Construction Market?

Key companies in the market include China State Construction Engineering, China Communications Construction Company, China Railway Group, China Railway Construction, Yunnan Construction and Investment Holding Group, Shanghai Construction Group (SCG), China Wu Yi co Ltd, Power Construction Corporation of China, Beijing Construction Engineering Group**List Not Exhaustive, Sichuan Road and Bridge Group.

3. What are the main segments of the China Transportation Infrastructure Construction Market?

The market segments include Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 3654.96 billion as of 2022.

5. What are some drivers contributing to market growth?

Government Infrastructure Spending; Urbanization and Increasing Disposable Incomes.

6. What are the notable trends driving market growth?

Government Initiatives Driving Transport Infrastructure Construction Market in China.

7. Are there any restraints impacting market growth?

Oversupply in the Real Estate; Labor Shortages.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Transportation Infrastructure Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Transportation Infrastructure Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Transportation Infrastructure Construction Market?

To stay informed about further developments, trends, and reports in the China Transportation Infrastructure Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence