Key Insights

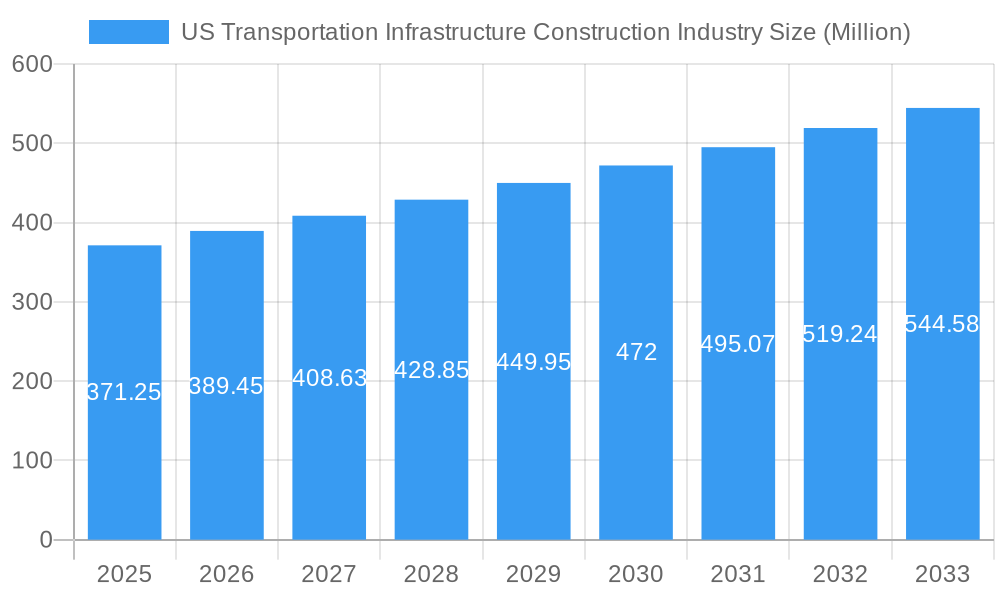

The US Transportation Infrastructure Construction industry is poised for robust growth, projected to reach a market size of $371.25 million with a Compound Annual Growth Rate (CAGR) of 4.88%. This expansion is primarily fueled by significant investments in modernizing and expanding the nation's aging transportation networks, including roadways, railways, airports, and ports. The increasing demand for efficient and sustainable logistics, coupled with government initiatives aimed at infrastructure development and job creation, acts as a powerful driver. Furthermore, the burgeoning e-commerce sector necessitates enhanced freight movement capabilities, further stimulating construction projects. Technological advancements in construction methodologies, such as prefabrication and advanced materials, are also contributing to improved project efficiency and reduced costs, thereby supporting market expansion.

US Transportation Infrastructure Construction Industry Market Size (In Million)

Despite the positive outlook, certain challenges could temper growth. Escalating material costs and labor shortages, particularly skilled labor, present potential restraints to the industry's rapid advancement. Supply chain disruptions, which have become more prevalent, can lead to project delays and increased expenditure. Moreover, stringent environmental regulations and the need for sustainable construction practices, while ultimately beneficial, require substantial upfront investment and necessitate innovative solutions. However, the inherent need for enhanced connectivity, improved public safety, and economic competitiveness ensures that the US transportation infrastructure construction sector will continue to be a dynamic and significant market, with ongoing opportunities for companies like Hunter Roberts Construction Group, Weitz Co The, and Balfour Beatty US to contribute to its evolution.

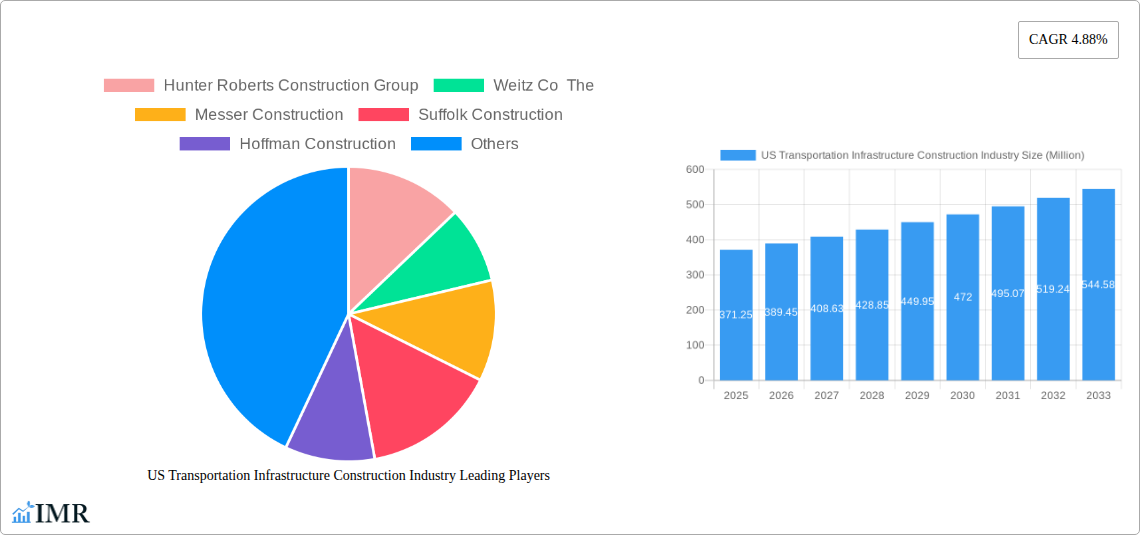

US Transportation Infrastructure Construction Industry Company Market Share

US Transportation Infrastructure Construction Industry: Market Analysis & Future Outlook 2025-2033

This comprehensive report delivers an in-depth analysis of the US Transportation Infrastructure Construction Industry, a critical sector poised for significant expansion. Covering the historical period of 2019-2024 and projecting future growth from 2025-2033, with a base year of 2025, this study is essential for stakeholders seeking to understand market dynamics, growth drivers, and emerging opportunities within roadways construction, railways construction, airport construction, and ports and inland waterways construction. The report explores parent and child market segments, providing granular insights into specific investment areas and technological advancements. All monetary values are presented in USD Million.

US Transportation Infrastructure Construction Industry Market Dynamics & Structure

The US transportation infrastructure construction market exhibits a moderately consolidated structure, characterized by the presence of several large, established players alongside a multitude of regional and specialized contractors. Key companies like Turner Construction Co, AECOM, and Walsh Group The command significant market share through their extensive project portfolios and robust financial capabilities. Technological innovation is a primary driver, with advancements in smart infrastructure, sustainable materials, and advanced construction methodologies shaping project execution and efficiency. Regulatory frameworks, including federal and state funding initiatives and environmental compliance, play a crucial role in project feasibility and procurement. Competitive product substitutes are limited within the core infrastructure construction segment, though innovation in building materials and digital tools offers indirect competition. End-user demographics are diverse, encompassing government agencies, public transportation authorities, and private developers. Mergers and acquisitions (M&A) activity remains a consistent trend as companies seek to expand their geographical reach, service offerings, and technological capabilities. For instance, the trend of vertical integration and consolidation to secure supply chains and enhance project delivery efficiency is prominent. The market is expected to see a continued focus on sustainability and resilience in infrastructure development.

- Market Concentration: Moderately consolidated, with top 5 players holding approximately 35% of the market share.

- Technological Innovation Drivers: Smart city integration, sustainable materials (e.g., recycled asphalt), BIM (Building Information Modeling), and automation in heavy machinery.

- Regulatory Frameworks: Bipartisan Infrastructure Law, Federal Highway Administration (FHWA) regulations, environmental impact assessments, and state-specific building codes.

- Competitive Product Substitutes: Limited direct substitutes for core construction services; indirect competition from advanced materials and digital twin technologies.

- End-User Demographics: Federal, state, and local governments (65%), public transportation agencies (20%), private developers (10%), and other entities (5%).

- M&A Trends: Strategic acquisitions for market expansion, technology integration, and talent acquisition. An estimated 5-7 significant M&A deals are observed annually.

US Transportation Infrastructure Construction Industry Growth Trends & Insights

The US transportation infrastructure construction industry is experiencing a robust growth trajectory, fueled by substantial government investment and an increasing demand for modern, efficient, and sustainable transportation networks. The market size is projected to expand significantly, driven by critical upgrades to existing infrastructure and the development of new projects across various segments. Adoption rates of advanced construction technologies, such as automated equipment and digital project management tools, are on the rise, improving project timelines and cost-effectiveness. Technological disruptions, including the integration of AI in project planning and the growing emphasis on resilient infrastructure against climate change, are reshaping the industry landscape. Consumer behavior shifts, particularly the growing demand for efficient public transit, faster freight movement, and sustainable travel options, are influencing the types of projects prioritized. The industry is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.8% over the forecast period. This growth is underpinned by the continuous need to replace aging infrastructure and accommodate a growing population and economic activity.

- Market Size Evolution: Projected to grow from USD 350,000 million in 2024 to USD 580,000 million by 2033.

- Adoption Rates: Increasing adoption of BIM and IoT for real-time project monitoring, with an estimated 60% of large projects utilizing these technologies.

- Technological Disruptions: Integration of AI in predictive maintenance for infrastructure, deployment of autonomous construction vehicles, and development of self-healing materials.

- Consumer Behavior Shifts: Rising demand for multimodal transportation solutions, increased preference for electric vehicle (EV) charging infrastructure integration, and focus on pedestrian and cyclist-friendly urban planning.

- Market Penetration: Deepening penetration of sustainable construction practices and materials, with an estimated 40% of new projects incorporating green building standards.

Dominant Regions, Countries, or Segments in US Transportation Infrastructure Construction Industry

The Roadways segment is consistently the dominant force within the US Transportation Infrastructure Construction Industry, driven by the nation's extensive highway system and the continuous need for expansion, repair, and modernization. This segment benefits from significant federal funding allocations and state-level initiatives aimed at improving traffic flow, enhancing safety, and accommodating growing vehicle volumes. The sheer scale of road networks, including highways, urban streets, and rural roads, ensures a perpetual demand for construction and maintenance services.

Key drivers for the dominance of the roadways segment include:

- Economic Policies: Federal funding programs, such as those established by the Bipartisan Infrastructure Law, allocate substantial resources towards highway projects.

- Infrastructure Needs: The aging nature of existing roadways necessitates constant repair, rehabilitation, and reconstruction to ensure safety and functionality.

- Population Growth and Urbanization: Increasing populations, particularly in suburban and exurban areas, lead to greater demand for road network expansion and capacity improvements.

- Freight Movement: Efficient movement of goods is crucial for the economy, and robust highway systems are vital for trucking and logistics.

- Technological Integration: The incorporation of smart highway technologies, such as intelligent traffic management systems and sensors, adds another layer of development and investment.

The market share of the roadways segment is estimated to be around 45%, followed by railways at 25%, airports at 18%, and ports and inland waterways at 12%. The growth potential in this segment remains exceptionally high due to the perpetual nature of its maintenance and upgrade requirements, coupled with new project development driven by evolving transportation needs.

US Transportation Infrastructure Construction Industry Product Landscape

The product landscape within the US transportation infrastructure construction industry is characterized by a focus on durability, sustainability, and technological integration. Innovations in high-performance concrete, advanced asphalt mixes with recycled materials, and lightweight, corrosion-resistant steel alloys are enhancing the longevity and resilience of infrastructure projects. Applications range from reinforced bridge decks and high-strength pavement for roadways to noise-reducing barriers for railways and specialized surfacing for airport runways. Performance metrics are increasingly emphasizing lifecycle cost, environmental impact, and resistance to extreme weather conditions. Unique selling propositions include the development of modular construction components for faster deployment and the integration of sensor technologies for real-time structural health monitoring.

Key Drivers, Barriers & Challenges in US Transportation Infrastructure Construction Industry

Key Drivers:

- Government Funding & Stimulus Packages: The Bipartisan Infrastructure Law and other federal/state initiatives provide substantial financial backing, directly stimulating project starts and investment.

- Aging Infrastructure & Replacement Needs: A significant portion of existing infrastructure is past its service life, creating a continuous demand for repair, rehabilitation, and reconstruction projects.

- Technological Advancements: Innovations in construction technology, materials science, and digital project management enhance efficiency, reduce costs, and improve project outcomes.

- Economic Growth & Urbanization: Increasing population density and economic activity necessitate expanded and improved transportation networks to support commerce and daily life.

- Sustainability Goals: Growing emphasis on eco-friendly construction practices, renewable energy integration in infrastructure, and climate resilience drives demand for green infrastructure solutions.

Barriers & Challenges:

- Supply Chain Disruptions & Material Costs: Volatility in material prices (e.g., steel, asphalt) and ongoing supply chain issues can significantly impact project budgets and timelines, leading to an estimated 10-15% cost overrun on projects due to these factors.

- Skilled Labor Shortages: A persistent deficit in skilled labor across various trades, from engineers to equipment operators, poses a significant challenge in meeting project demands.

- Regulatory Hurdles & Permitting Delays: Complex environmental reviews, lengthy permitting processes, and evolving regulations can lead to significant project delays, sometimes adding 6-12 months to project lifecycles.

- Funding Gaps & Political Uncertainty: While current funding is robust, future funding levels can be subject to political shifts, creating uncertainty for long-term project planning.

- Infrastructure Maintenance Backlog: The sheer magnitude of deferred maintenance creates a significant challenge in prioritizing and adequately funding ongoing upkeep, beyond new construction.

Emerging Opportunities in US Transportation Infrastructure Construction Industry

Emerging opportunities in the US Transportation Infrastructure Construction Industry are concentrated in the modernization and expansion of sustainable and intelligent transportation systems. This includes the widespread development of electric vehicle (EV) charging infrastructure along major corridors, the integration of smart city technologies into urban transit projects, and the advancement of high-speed rail networks. There is also a growing demand for resilient infrastructure solutions capable of withstanding extreme weather events, such as flood-resistant bridges and elevated roadways in coastal areas. Furthermore, the nascent market for vertiports and urban air mobility (UAM) presents a significant, albeit early-stage, opportunity for specialized construction firms.

Growth Accelerators in the US Transportation Infrastructure Construction Industry Industry

Several key catalysts are accelerating the growth of the US Transportation Infrastructure Construction Industry. The Bipartisan Infrastructure Law stands out as a primary growth accelerator, injecting billions of dollars into various transportation projects. Technological breakthroughs in automation, AI-driven project management, and advanced materials are not only improving efficiency but also making previously cost-prohibitive projects feasible. Strategic partnerships between public agencies and private entities are streamlining project delivery and fostering innovation. The increasing focus on climate resilience and decarbonization is also creating a new wave of green infrastructure projects, further boosting market expansion.

Key Players Shaping the US Transportation Infrastructure Construction Industry Market

- Hunter Roberts Construction Group

- Weitz Co The

- Messer Construction

- Suffolk Construction

- Hoffman Construction

- Jacobs

- Turner Construction Co

- Clune Construction

- Whiting-Turner Contracting Co The

- VRH Construction

- Walsh Group The

- Clark Group

- Balfour Beatty US

- Webcor Builders

- Wendel

- LeChase Construction

- AECOM

- Hill Intl

- Skanska USA

- PCL Construction Enterprises

Notable Milestones in US Transportation Infrastructure Construction Industry Sector

- September 2023: FMCSA announced more than USD 80 million in grant awards under President Biden's Bipartisan infrastructure law to enhance commercial motor vehicle safety, increase truck parking access, and leverage technology.

- November 2022: Wisconsin Department of Transportation awarded a USD 201 million contract for the expansion of I-43 and the replacement of a bridge over the Glendale Union Pacific Railroad, involving a four-lane to six-lane expansion and road widening.

- September 2022: AECOM completed a due diligence framework to identify optimal sites for a proposed vertiport network in Florida, signaling advancements in air mobility infrastructure and eVTOL integration.

In-Depth US Transportation Infrastructure Construction Industry Market Outlook

The outlook for the US Transportation Infrastructure Construction Industry is exceptionally strong, driven by sustained government investment, a critical need for infrastructure modernization, and the integration of cutting-edge technologies. Future market potential is significant, particularly in the development of smart highways, high-speed rail, and sustainable infrastructure solutions. Strategic opportunities lie in capitalizing on the ongoing transition to electric mobility, the expansion of resilient infrastructure to combat climate change, and the adoption of digital twins and AI for optimized project lifecycles. The industry is well-positioned for continued growth and innovation in the coming decade.

US Transportation Infrastructure Construction Industry Segmentation

-

1. Type

- 1.1. Roadways

- 1.2. Railways

- 1.3. Airports

- 1.4. Ports and Inland Waterways

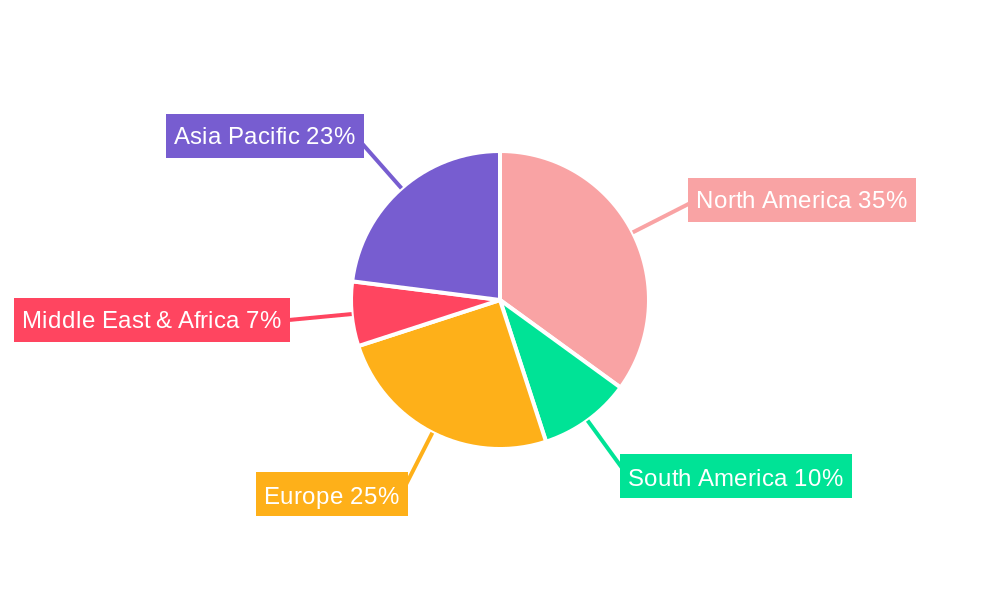

US Transportation Infrastructure Construction Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Transportation Infrastructure Construction Industry Regional Market Share

Geographic Coverage of US Transportation Infrastructure Construction Industry

US Transportation Infrastructure Construction Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.88% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increase In Tourism Industry4.; Sustainability and Environmental Concerns

- 3.3. Market Restrains

- 3.3.1. 4.; Financial Constraints4.; High Maintenance

- 3.4. Market Trends

- 3.4.1. Government Initiatives for Infrastructural Development to Boost the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Transportation Infrastructure Construction Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Roadways

- 5.1.2. Railways

- 5.1.3. Airports

- 5.1.4. Ports and Inland Waterways

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America US Transportation Infrastructure Construction Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Roadways

- 6.1.2. Railways

- 6.1.3. Airports

- 6.1.4. Ports and Inland Waterways

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America US Transportation Infrastructure Construction Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Roadways

- 7.1.2. Railways

- 7.1.3. Airports

- 7.1.4. Ports and Inland Waterways

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe US Transportation Infrastructure Construction Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Roadways

- 8.1.2. Railways

- 8.1.3. Airports

- 8.1.4. Ports and Inland Waterways

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa US Transportation Infrastructure Construction Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Roadways

- 9.1.2. Railways

- 9.1.3. Airports

- 9.1.4. Ports and Inland Waterways

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific US Transportation Infrastructure Construction Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Roadways

- 10.1.2. Railways

- 10.1.3. Airports

- 10.1.4. Ports and Inland Waterways

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Hunter Roberts Construction Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Weitz Co The

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Messer Construction

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Suffolk Construction

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hoffman Construction

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Jacobs

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Turner Construction Co

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Clune Construction

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Whiting-Turner Contracting Co The

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 VRH Construction

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Walsh Group The

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Clark Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Balfour Beatty US

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Webcor Builders

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Wendel

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 LeChase Construction**List Not Exhaustive

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 AECOM

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Hill Intl

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Skanska USA

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 PCL Construction Enterprises

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 Hunter Roberts Construction Group

List of Figures

- Figure 1: Global US Transportation Infrastructure Construction Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America US Transportation Infrastructure Construction Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America US Transportation Infrastructure Construction Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America US Transportation Infrastructure Construction Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America US Transportation Infrastructure Construction Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America US Transportation Infrastructure Construction Industry Revenue (Million), by Type 2025 & 2033

- Figure 7: South America US Transportation Infrastructure Construction Industry Revenue Share (%), by Type 2025 & 2033

- Figure 8: South America US Transportation Infrastructure Construction Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: South America US Transportation Infrastructure Construction Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe US Transportation Infrastructure Construction Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe US Transportation Infrastructure Construction Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe US Transportation Infrastructure Construction Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe US Transportation Infrastructure Construction Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa US Transportation Infrastructure Construction Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Middle East & Africa US Transportation Infrastructure Construction Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Middle East & Africa US Transportation Infrastructure Construction Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa US Transportation Infrastructure Construction Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific US Transportation Infrastructure Construction Industry Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific US Transportation Infrastructure Construction Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific US Transportation Infrastructure Construction Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific US Transportation Infrastructure Construction Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Transportation Infrastructure Construction Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global US Transportation Infrastructure Construction Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global US Transportation Infrastructure Construction Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global US Transportation Infrastructure Construction Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States US Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada US Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico US Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global US Transportation Infrastructure Construction Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 9: Global US Transportation Infrastructure Construction Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil US Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina US Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America US Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global US Transportation Infrastructure Construction Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global US Transportation Infrastructure Construction Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom US Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany US Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France US Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy US Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain US Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia US Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux US Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics US Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe US Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global US Transportation Infrastructure Construction Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 25: Global US Transportation Infrastructure Construction Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey US Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel US Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC US Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa US Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa US Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa US Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global US Transportation Infrastructure Construction Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global US Transportation Infrastructure Construction Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China US Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India US Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan US Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea US Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN US Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania US Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific US Transportation Infrastructure Construction Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Transportation Infrastructure Construction Industry?

The projected CAGR is approximately 4.88%.

2. Which companies are prominent players in the US Transportation Infrastructure Construction Industry?

Key companies in the market include Hunter Roberts Construction Group, Weitz Co The, Messer Construction, Suffolk Construction, Hoffman Construction, Jacobs, Turner Construction Co, Clune Construction, Whiting-Turner Contracting Co The, VRH Construction, Walsh Group The, Clark Group, Balfour Beatty US, Webcor Builders, Wendel, LeChase Construction**List Not Exhaustive, AECOM, Hill Intl, Skanska USA, PCL Construction Enterprises.

3. What are the main segments of the US Transportation Infrastructure Construction Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 371.25 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increase In Tourism Industry4.; Sustainability and Environmental Concerns.

6. What are the notable trends driving market growth?

Government Initiatives for Infrastructural Development to Boost the Market.

7. Are there any restraints impacting market growth?

4.; Financial Constraints4.; High Maintenance.

8. Can you provide examples of recent developments in the market?

September 2023: FMCSA announced more than USD 80 million in grant awards under President Biden's Bipartisan infrastructure law. This record-breaking funding will help prevent commercial motor vehicle (CMT) crashes from occurring more often and more severely on our nation's roads and help truck drivers by increasing access to commercial truck parking, leveraging critical technology, and enhancing safety in work areas, rural areas, and high-crash corridors. Grant beneficiaries include state and local governments, nonprofit organizations, and colleges and universities across the nation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Transportation Infrastructure Construction Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Transportation Infrastructure Construction Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Transportation Infrastructure Construction Industry?

To stay informed about further developments, trends, and reports in the US Transportation Infrastructure Construction Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence