Key Insights

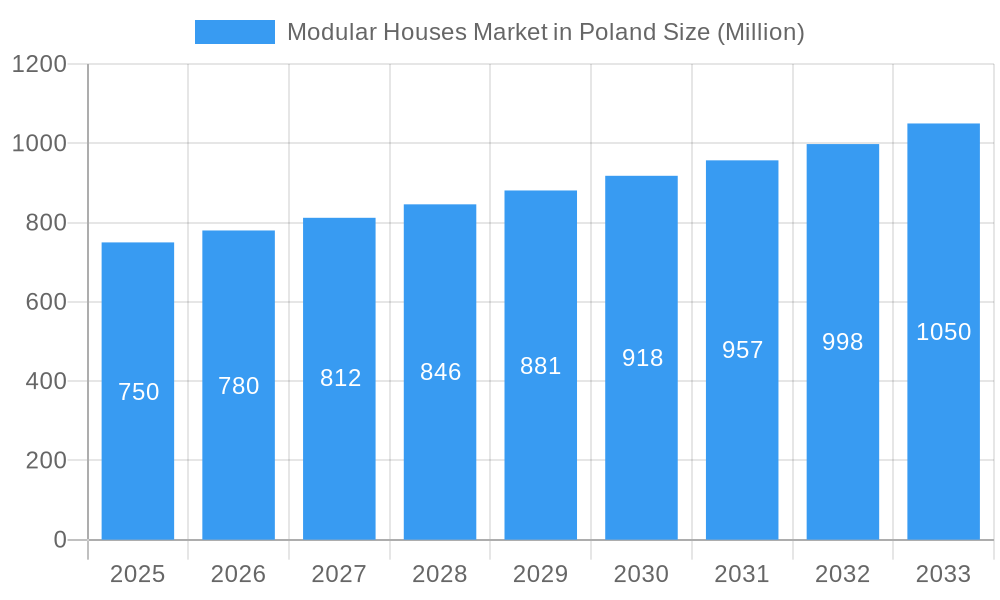

Poland's Modular Homes Market is set for substantial growth, driven by increasing demand for sustainable and cost-effective housing. The market is projected to reach $2.63 billion by 2033, expanding at a Compound Annual Growth Rate (CAGR) of 6.5% from a base year of 2025. This expansion is fueled by the need for rapid construction solutions to address housing shortages and promote efficient building methods. The adoption of advanced manufacturing and growing environmental awareness, highlighting reduced waste and lower carbon emissions, are key growth factors. Government support for the construction sector and sustainable practices further enhances market potential.

Modular Houses Market in Poland Market Size (In Billion)

The residential sector currently leads the Polish modular housing market, representing approximately 65% of the share. The commercial sector is expected to experience faster growth due to increased investment in modular offices, retail, and hospitality. Emerging material types, including advanced composites and eco-friendly alternatives, are gaining traction. Leading companies are focusing on innovation to expand product offerings. Addressing challenges such as building code standardization and evolving perceptions of modular construction will be crucial for continued rapid expansion. The market is forecast to reach an estimated $2.63 billion by 2033.

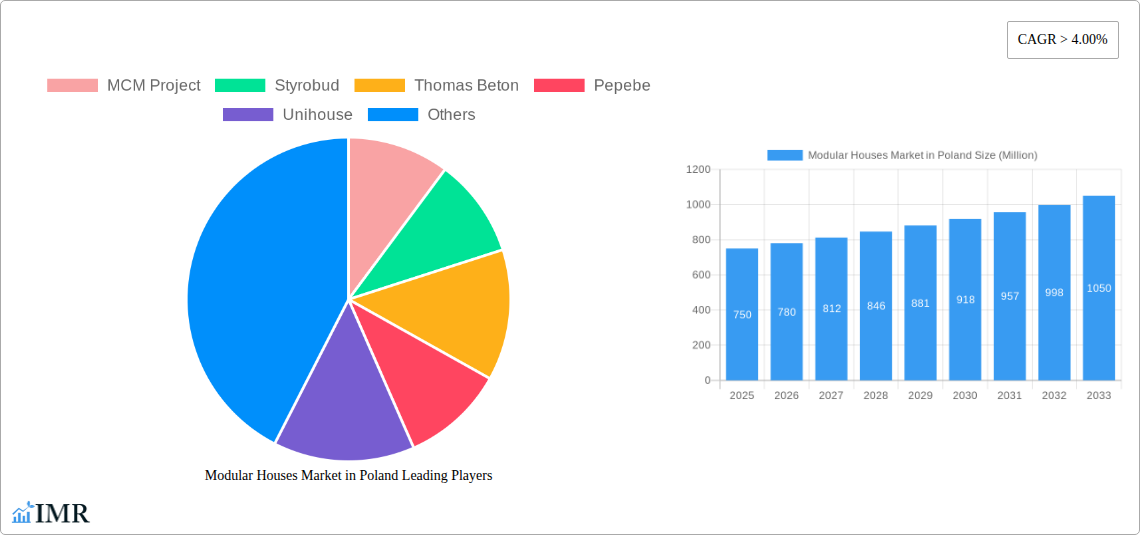

Modular Houses Market in Poland Company Market Share

Modular Houses Market in Poland: Strategic Analysis and Future Outlook (2019-2033)

Report Description:

Delve into the dynamic modular houses market in Poland with this comprehensive, SEO-optimized report. Covering the study period of 2019 to 2033, with a base and estimated year of 2025, this analysis provides unparalleled insights into the growth trajectory, market structure, and key players shaping Poland's prefabricated construction sector. Discover critical market dynamics, dominant regional and segmental trends, technological innovations, and strategic opportunities within the residential modular construction and commercial modular building segments. This report is an essential resource for investors, developers, manufacturers, and policymakers seeking to understand the evolving landscape of Poland's modular homes, offsite construction, and prefabricated housing solutions.

Modular Houses Market in Poland Market Dynamics & Structure

The modular houses market in Poland exhibits a moderately concentrated structure, with key players investing heavily in technological advancements and expanding their production capacities. Innovation drivers are primarily fueled by the demand for sustainable building materials, faster construction timelines, and cost-effective housing solutions. Regulatory frameworks are evolving to accommodate modern construction methods, with a growing emphasis on energy efficiency and safety standards for modular buildings. Competitive product substitutes, such as traditional construction methods and other prefabricated systems, remain, but the distinct advantages of modularity in terms of speed and reduced waste are increasingly recognized. End-user demographics are diverse, ranging from young families seeking affordable housing to businesses requiring rapid deployment of commercial spaces. Mergers and acquisitions (M&A) trends are anticipated to accelerate as larger construction firms seek to integrate modular capabilities and smaller specialized companies aim for market consolidation, further influencing market concentration. The Polish modular construction industry is poised for significant expansion.

- Market Concentration: Moderately concentrated, with strategic investments by established players.

- Technological Innovation Drivers: Sustainability, speed of construction, cost-effectiveness, energy efficiency.

- Regulatory Frameworks: Evolving to support modular construction standards and sustainability goals.

- Competitive Product Substitutes: Traditional construction, other prefabricated systems.

- End-User Demographics: Diverse, including residential buyers and commercial enterprises.

- M&A Trends: Anticipated acceleration for market consolidation and capability integration.

Modular Houses Market in Poland Growth Trends & Insights

The modular houses market in Poland is experiencing robust growth, driven by an increasing adoption rate of prefabricated housing solutions across both residential and commercial applications. The market size evolution is marked by a significant upward trend, supported by technological disruptions that enhance the quality, customization, and sustainability of modular homes. Consumer behavior shifts are evident, with a growing preference for faster, more predictable construction processes and environmentally conscious building options. The offsite construction market in Poland is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 9.5% during the forecast period of 2025–2033. Market penetration is steadily increasing as awareness of the benefits of modular construction gains traction among developers and end-users. Innovations in material science and digital design tools are further accelerating the adoption of these advanced building systems. The integration of smart technologies within modular buildings is also a key trend, enhancing their appeal and functionality for modern living and working environments. The Poland modular building market is set for sustained expansion.

Dominant Regions, Countries, or Segments in Modular Houses Market in Poland

The residential application segment is currently the dominant force driving the modular houses market in Poland, showcasing significant growth potential and widespread adoption. This dominance is fueled by a persistent demand for affordable and rapidly deployable housing solutions across the country. Timber as a material type is also experiencing a surge in popularity within this segment, owing to its sustainable properties, excellent insulation capabilities, and aesthetic appeal, making it a preferred choice for modular homes. Key drivers include favorable government initiatives promoting housing construction, rising disposable incomes, and a growing awareness of the environmental benefits associated with sustainable building. Economic policies supporting affordable housing development and infrastructure improvements in surrounding regions further bolster the demand for residential modular construction. The commercial application segment, while currently smaller, is showing promising growth, particularly in the development of modular offices, retail spaces, and temporary facilities, driven by businesses seeking flexible and quick expansion solutions.

- Dominant Segment: Residential Application.

- Key Material Type Driver: Timber.

- Primary Growth Drivers:

- Affordable housing demand.

- Rapid deployment requirements.

- Sustainable building awareness.

- Favorable government housing initiatives.

- Rising disposable incomes.

- Infrastructure development.

- Emerging Segment: Commercial Application (offices, retail, temporary facilities).

Modular Houses Market in Poland Product Landscape

The modular houses market in Poland is characterized by continuous product innovation, focusing on enhanced design flexibility, superior energy efficiency, and faster assembly times. Manufacturers are increasingly offering customizable solutions, allowing clients to personalize layouts and finishes for both residential modular homes and commercial modular buildings. Performance metrics are being optimized through the use of advanced materials like high-performance insulation and durable metal framing, contributing to lower lifecycle costs and reduced environmental impact. Key product innovations include integrated smart home technologies, advanced ventilation systems, and the use of recycled or sustainably sourced materials. The offsite construction sector is witnessing the development of larger, more complex modular units capable of accommodating diverse architectural designs and functional requirements.

Key Drivers, Barriers & Challenges in Modular Houses Market in Poland

Key Drivers:

- Speed and Efficiency: Modular construction significantly reduces build times compared to traditional methods.

- Cost-Effectiveness: Predictable pricing and reduced labor costs contribute to overall affordability.

- Sustainability: Reduced waste, controlled factory environments, and energy-efficient designs align with environmental goals.

- Government Support: Initiatives promoting housing and construction innovation are driving adoption.

- Technological Advancements: Improved design software, automation, and material science enhance product quality.

Barriers & Challenges:

- Perception and Awareness: Overcoming traditional construction mindsets and educating the market about modular benefits.

- Supply Chain Logistics: Ensuring consistent availability and timely delivery of specialized modular components.

- Regulatory Hurdles: Navigating building codes and standards that may not be fully adapted to modular construction.

- Financing: Securing mortgages and financing for non-traditional housing solutions can sometimes be challenging.

- Skilled Labor Shortage: A potential deficit in skilled labor for factory production and on-site assembly.

Emerging Opportunities in Modular Houses Market in Poland

Emerging opportunities within the modular houses market in Poland lie in the expansion of modular solutions for multi-story residential buildings and specialized commercial applications such as modular healthcare facilities and educational institutions. The increasing focus on sustainable development presents a significant opportunity for manufacturers utilizing eco-friendly materials like timber and advanced energy-efficient technologies. Untapped markets in rural and underserved areas, where rapid housing solutions are crucial, offer substantial growth potential. Evolving consumer preferences for smart homes and flexible living spaces are driving demand for technologically integrated and adaptable modular units. The export potential to neighboring European markets also presents a lucrative avenue for Polish modular construction companies.

Growth Accelerators in the Modular Houses Market in Poland Industry

Growth accelerators in the modular houses market in Poland industry are predominantly driven by ongoing technological breakthroughs in 3D printing, advanced robotics for factory automation, and sophisticated building information modeling (BIM) integration. Strategic partnerships between manufacturers, material suppliers, and technology providers are crucial for fostering innovation and enhancing product offerings. Market expansion strategies, including diversification into new application sectors and geographic regions, will significantly boost growth. The increasing emphasis on circular economy principles and the development of modular systems designed for disassembly and reuse will also act as powerful growth catalysts, aligning with global sustainability trends.

Key Players Shaping the Modular Houses Market in Poland Market

- MCM Project

- Styrobud

- Thomas Beton

- Pepebe

- Unihouse

- Unimex

- Mabudo

- Prologis

- Budizol

- Containex

Notable Milestones in Modular Houses Market in Poland Sector

- March 2023: European Company iQ Module Bets The Future on Shared Tech, Tools, and Partnerships. iQ Module, based out of Gdansk, Poland, has grown exponentially with offices in Germany and Denmark. The company has embarked on an ongoing joint venture and partnership with Roger Krulak of FullStack Modular for projects in the U.S. and around the globe.

- March 2023: HOLCIM acquired HM Factory, a provider of precast concrete solutions with net sales of CHF18 million. HM Factory offers solutions for walls, staircases, and balconies, well-positioned to capitalize on growth in industrial and residential construction. The company supplies Polish construction projects and exports to Scandinavian markets.

In-Depth Modular Houses Market in Poland Market Outlook

The modular houses market in Poland is on an upward trajectory, propelled by a confluence of factors including advancements in offsite construction technologies, a growing demand for sustainable and efficient building solutions, and supportive economic policies. Future market potential is immense, particularly within the residential modular construction segment, driven by housing shortages and evolving lifestyle preferences. Strategic opportunities abound for companies focusing on innovation in materials, digital integration, and circular economy principles. The Polish market is poised to become a significant hub for modular construction in Europe, offering scalable and cost-effective building solutions that address contemporary challenges and cater to future demands.

Modular Houses Market in Poland Segmentation

-

1. Material Type

- 1.1. Concrete

- 1.2. Glass

- 1.3. Metal

- 1.4. Timber

- 1.5. Other Material Types

-

2. Application

- 2.1. Residential

- 2.2. Commercial

- 2.3. Other Ap

Modular Houses Market in Poland Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

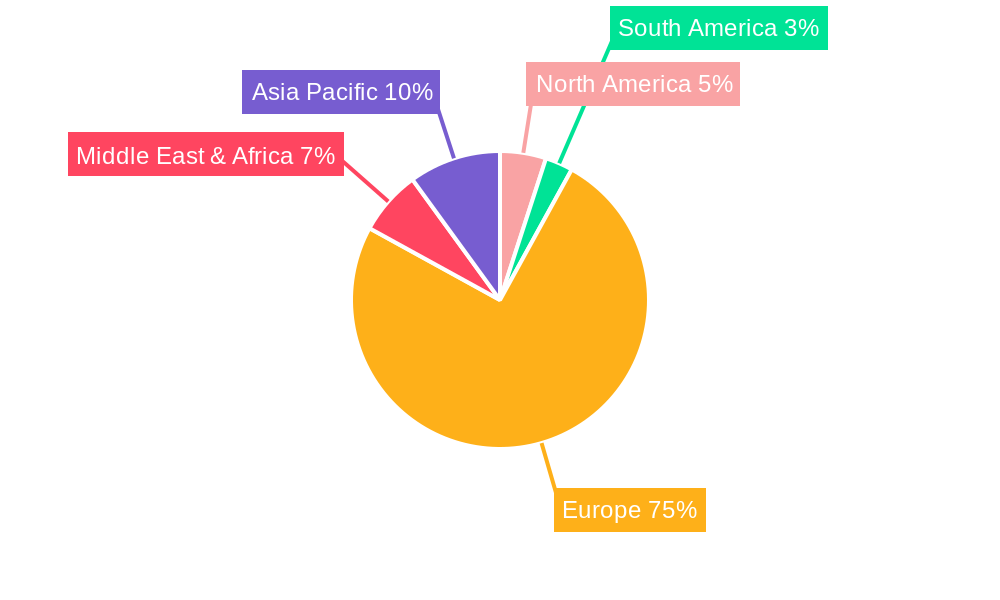

Modular Houses Market in Poland Regional Market Share

Geographic Coverage of Modular Houses Market in Poland

Modular Houses Market in Poland REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in GDP contribution from Construction Industry; Increase in Number of Building Permits

- 3.3. Market Restrains

- 3.3.1. High Initial Investments

- 3.4. Market Trends

- 3.4.1. The Rising Demand for Prefabricated Houses in Poland is Notably Driving Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Modular Houses Market in Poland Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Concrete

- 5.1.2. Glass

- 5.1.3. Metal

- 5.1.4. Timber

- 5.1.5. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Other Ap

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. North America Modular Houses Market in Poland Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Concrete

- 6.1.2. Glass

- 6.1.3. Metal

- 6.1.4. Timber

- 6.1.5. Other Material Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.2.3. Other Ap

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. South America Modular Houses Market in Poland Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Concrete

- 7.1.2. Glass

- 7.1.3. Metal

- 7.1.4. Timber

- 7.1.5. Other Material Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.2.3. Other Ap

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Europe Modular Houses Market in Poland Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Concrete

- 8.1.2. Glass

- 8.1.3. Metal

- 8.1.4. Timber

- 8.1.5. Other Material Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.2.3. Other Ap

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Middle East & Africa Modular Houses Market in Poland Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. Concrete

- 9.1.2. Glass

- 9.1.3. Metal

- 9.1.4. Timber

- 9.1.5. Other Material Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.2.3. Other Ap

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. Asia Pacific Modular Houses Market in Poland Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 10.1.1. Concrete

- 10.1.2. Glass

- 10.1.3. Metal

- 10.1.4. Timber

- 10.1.5. Other Material Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.2.3. Other Ap

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 MCM Project

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Styrobud

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Thomas Beton

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pepebe

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Unihouse

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Unimex

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mabudo**List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Prologis

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Budizol

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Containex

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 MCM Project

List of Figures

- Figure 1: Global Modular Houses Market in Poland Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Modular Houses Market in Poland Revenue (billion), by Material Type 2025 & 2033

- Figure 3: North America Modular Houses Market in Poland Revenue Share (%), by Material Type 2025 & 2033

- Figure 4: North America Modular Houses Market in Poland Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Modular Houses Market in Poland Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Modular Houses Market in Poland Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Modular Houses Market in Poland Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Modular Houses Market in Poland Revenue (billion), by Material Type 2025 & 2033

- Figure 9: South America Modular Houses Market in Poland Revenue Share (%), by Material Type 2025 & 2033

- Figure 10: South America Modular Houses Market in Poland Revenue (billion), by Application 2025 & 2033

- Figure 11: South America Modular Houses Market in Poland Revenue Share (%), by Application 2025 & 2033

- Figure 12: South America Modular Houses Market in Poland Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Modular Houses Market in Poland Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Modular Houses Market in Poland Revenue (billion), by Material Type 2025 & 2033

- Figure 15: Europe Modular Houses Market in Poland Revenue Share (%), by Material Type 2025 & 2033

- Figure 16: Europe Modular Houses Market in Poland Revenue (billion), by Application 2025 & 2033

- Figure 17: Europe Modular Houses Market in Poland Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Modular Houses Market in Poland Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Modular Houses Market in Poland Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Modular Houses Market in Poland Revenue (billion), by Material Type 2025 & 2033

- Figure 21: Middle East & Africa Modular Houses Market in Poland Revenue Share (%), by Material Type 2025 & 2033

- Figure 22: Middle East & Africa Modular Houses Market in Poland Revenue (billion), by Application 2025 & 2033

- Figure 23: Middle East & Africa Modular Houses Market in Poland Revenue Share (%), by Application 2025 & 2033

- Figure 24: Middle East & Africa Modular Houses Market in Poland Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Modular Houses Market in Poland Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Modular Houses Market in Poland Revenue (billion), by Material Type 2025 & 2033

- Figure 27: Asia Pacific Modular Houses Market in Poland Revenue Share (%), by Material Type 2025 & 2033

- Figure 28: Asia Pacific Modular Houses Market in Poland Revenue (billion), by Application 2025 & 2033

- Figure 29: Asia Pacific Modular Houses Market in Poland Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Pacific Modular Houses Market in Poland Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Modular Houses Market in Poland Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Modular Houses Market in Poland Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: Global Modular Houses Market in Poland Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Modular Houses Market in Poland Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Modular Houses Market in Poland Revenue billion Forecast, by Material Type 2020 & 2033

- Table 5: Global Modular Houses Market in Poland Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Modular Houses Market in Poland Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Modular Houses Market in Poland Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Modular Houses Market in Poland Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Modular Houses Market in Poland Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Modular Houses Market in Poland Revenue billion Forecast, by Material Type 2020 & 2033

- Table 11: Global Modular Houses Market in Poland Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Modular Houses Market in Poland Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Modular Houses Market in Poland Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Modular Houses Market in Poland Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Modular Houses Market in Poland Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Modular Houses Market in Poland Revenue billion Forecast, by Material Type 2020 & 2033

- Table 17: Global Modular Houses Market in Poland Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Global Modular Houses Market in Poland Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Modular Houses Market in Poland Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Modular Houses Market in Poland Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Modular Houses Market in Poland Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Modular Houses Market in Poland Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Modular Houses Market in Poland Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Modular Houses Market in Poland Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Modular Houses Market in Poland Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Modular Houses Market in Poland Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Modular Houses Market in Poland Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Modular Houses Market in Poland Revenue billion Forecast, by Material Type 2020 & 2033

- Table 29: Global Modular Houses Market in Poland Revenue billion Forecast, by Application 2020 & 2033

- Table 30: Global Modular Houses Market in Poland Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Modular Houses Market in Poland Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Modular Houses Market in Poland Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Modular Houses Market in Poland Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Modular Houses Market in Poland Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Modular Houses Market in Poland Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Modular Houses Market in Poland Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Modular Houses Market in Poland Revenue billion Forecast, by Material Type 2020 & 2033

- Table 38: Global Modular Houses Market in Poland Revenue billion Forecast, by Application 2020 & 2033

- Table 39: Global Modular Houses Market in Poland Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Modular Houses Market in Poland Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Modular Houses Market in Poland Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Modular Houses Market in Poland Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Modular Houses Market in Poland Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Modular Houses Market in Poland Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Modular Houses Market in Poland Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Modular Houses Market in Poland Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Modular Houses Market in Poland?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Modular Houses Market in Poland?

Key companies in the market include MCM Project, Styrobud, Thomas Beton, Pepebe, Unihouse, Unimex, Mabudo**List Not Exhaustive, Prologis, Budizol, Containex.

3. What are the main segments of the Modular Houses Market in Poland?

The market segments include Material Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.63 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in GDP contribution from Construction Industry; Increase in Number of Building Permits.

6. What are the notable trends driving market growth?

The Rising Demand for Prefabricated Houses in Poland is Notably Driving Market Growth.

7. Are there any restraints impacting market growth?

High Initial Investments.

8. Can you provide examples of recent developments in the market?

March 2023: European Company iQ Module Bets The Future on Shared Tech, Tools, and Partnerships. iQ Module-based out of Gdansk, Poland-has grown exponentially as a company, with offices in Germany and Denmark. The company has also embarked on an ongoing joint venture and partnership with Roger Krulak of FullStack Modular for projects in the U.S. and around the globe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Modular Houses Market in Poland," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Modular Houses Market in Poland report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Modular Houses Market in Poland?

To stay informed about further developments, trends, and reports in the Modular Houses Market in Poland, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence