Key Insights

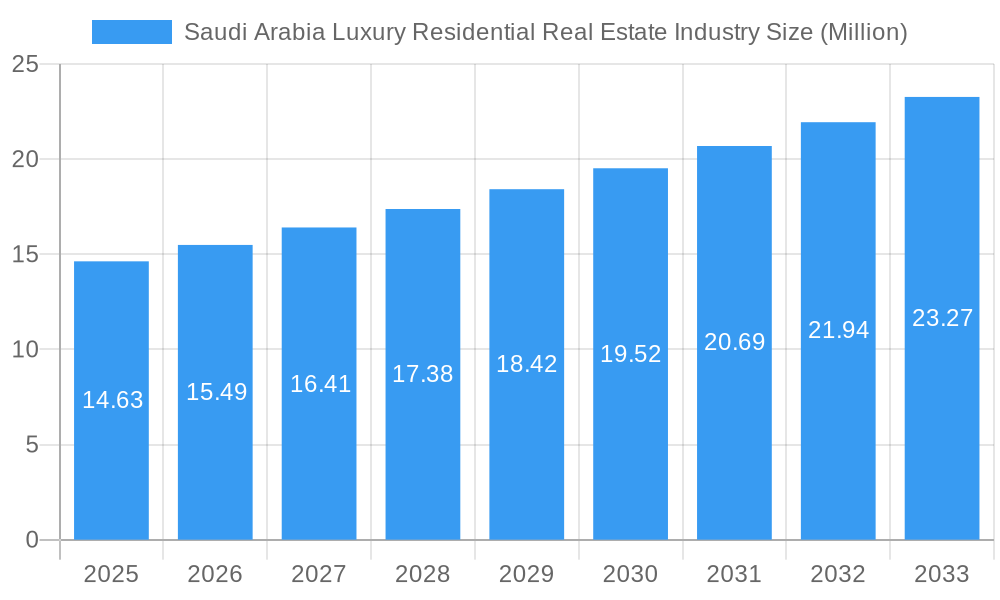

The Saudi Arabia Luxury Residential Real Estate Industry is poised for substantial growth, projected to reach approximately $14.63 million by 2025. This robust expansion is driven by a confluence of factors, notably the burgeoning economic diversification initiatives under Saudi Vision 2030, which are attracting significant foreign investment and a growing expatriate professional class. Increased disposable incomes among affluent Saudi citizens, coupled with a desire for premium living spaces that offer enhanced amenities and privacy, are further fueling demand. The market is experiencing a notable shift towards modern, technologically integrated homes and compounds, aligning with global luxury real estate trends. Furthermore, government-led urban development projects, particularly in key cities like Riyadh, Jeddah, and Dammam, are creating new, high-value residential opportunities. The development of world-class leisure and entertainment destinations is also indirectly boosting the attractiveness of luxury residential properties in these areas.

Saudi Arabia Luxury Residential Real Estate Industry Market Size (In Million)

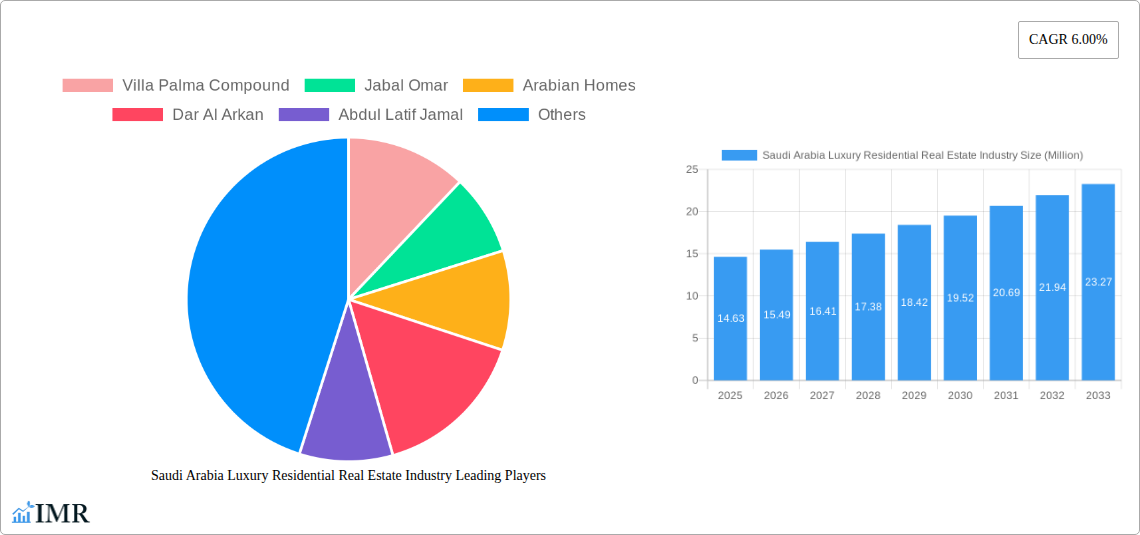

The industry's growth trajectory is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 6.00%, indicating sustained and predictable expansion throughout the forecast period from 2025 to 2033. Key market drivers include government support for real estate development, an increasing focus on creating integrated communities with lifestyle facilities, and the aspirational purchasing power of the affluent demographic. While the market is largely characterized by positive sentiment and strong demand, potential restraints could emerge from fluctuating global economic conditions or shifts in regulatory policies impacting foreign ownership. However, the inherent resilience of the luxury segment, coupled with continuous innovation in property development by prominent players like Dar Al Arkan and Jabal Omar, suggests a promising outlook. The segment is diverse, encompassing luxury apartments and condominiums, as well as exclusive villas and landed houses, catering to a wide spectrum of high-net-worth individuals and families. The strategic focus on major metropolitan areas ensures continued demand, with potential for growth in secondary cities as infrastructure and amenities improve.

Saudi Arabia Luxury Residential Real Estate Industry Company Market Share

Saudi Arabia Luxury Residential Real Estate Industry Report: Market Dynamics, Growth, and Opportunities

This comprehensive report provides an in-depth analysis of the Saudi Arabia Luxury Residential Real Estate Industry, encompassing market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, emerging opportunities, growth accelerators, and a detailed outlook. Leveraging extensive data from the historical period (2019–2024), base year (2025), and forecast period (2025–2033), this report is essential for industry professionals seeking to understand the current market structure and future potential.

Saudi Arabia Luxury Residential Real Estate Industry Market Dynamics & Structure

The Saudi Arabia luxury residential real estate market is characterized by a moderate to high concentration of key players, with a few prominent developers holding significant market share. Technological innovation is a critical driver, particularly in smart home integration, sustainable building practices, and advanced property management systems. Regulatory frameworks, guided by Vision 2030, are increasingly favorable, encouraging foreign investment and streamlining development processes. Competitive product substitutes include high-end serviced apartments and fractional ownership models, though traditional luxury villas and penthouses remain dominant. End-user demographics are shifting, with a growing affluent Saudi population and expatriate professionals seeking premium living spaces. Mergers and acquisitions (M&A) are an emerging trend, driven by the desire for market consolidation and portfolio expansion, with an estimated deal volume of xx million units in the past year. Barriers to innovation include high upfront costs for adopting new technologies and a sometimes-conservative approach to untested construction methods.

- Market Concentration: Dominated by a few large-scale developers, but with increasing participation from niche luxury providers.

- Technological Innovation: Focus on smart home integration, energy efficiency, and premium construction materials.

- Regulatory Frameworks: Supportive government policies under Vision 2030, encouraging foreign direct investment.

- Competitive Substitutes: Serviced apartments, branded residences, and off-plan luxury units.

- End-User Demographics: High-net-worth individuals (HNWIs), expatriates, and young affluent families.

- M&A Trends: Increasing activity aimed at portfolio expansion and market consolidation.

Saudi Arabia Luxury Residential Real Estate Industry Growth Trends & Insights

The Saudi Arabia luxury residential real estate market is poised for significant expansion, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033. This growth trajectory is fueled by a burgeoning affluent population, ambitious government initiatives like Vision 2030, and a strategic focus on diversifying the economy beyond oil. The market size is expected to evolve from approximately $xx billion in 2025 to over $xx billion by 2033. Adoption rates for sustainable building practices and smart home technologies are steadily increasing as developers and buyers prioritize comfort, efficiency, and environmental responsibility. Technological disruptions, such as the integration of AI in property management and virtual reality tours, are enhancing the buyer experience. Consumer behavior is shifting towards a preference for integrated communities offering a holistic lifestyle, including leisure facilities, retail outlets, and world-class amenities. Market penetration for luxury residential properties is estimated to reach xx% by 2033, driven by increased disposable incomes and a growing desire for high-quality, secure, and aesthetically pleasing living environments.

- Market Size Evolution: Projected to grow from $xx billion (2025) to over $xx billion (2033).

- CAGR: Estimated at xx% for the forecast period.

- Adoption Rates: Increasing for sustainable construction and smart home technologies.

- Technological Disruptions: AI in property management, VR property tours, and advanced construction techniques.

- Consumer Behavior Shifts: Preference for integrated lifestyle communities and experiential living.

- Market Penetration: Expected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Saudi Arabia Luxury Residential Real Estate Industry

Within the Saudi Arabia luxury residential real estate industry, the Riyadh region stands out as the dominant force driving market growth. Its status as the capital city, a major economic and administrative hub, and a focal point for Vision 2030 mega-projects attracts significant investment and a high concentration of affluent individuals and expatriates. The city's robust infrastructure development, including new transportation networks and commercial centers, further enhances its appeal for luxury residential projects.

- Riyadh: Leading city in terms of market size, transaction volumes, and new project launches.

- Economic Policies: Benefiting from government incentives and major investment in infrastructure.

- Infrastructure Development: Rapid expansion of transportation, entertainment, and commercial facilities.

- End-User Demand: High concentration of HNWIs, expatriate professionals, and government officials.

- Market Share: Estimated to hold xx% of the luxury residential market.

- Growth Potential: Strong growth prospects driven by ongoing mega-projects and population influx.

The Dammam Metropolitan Area is emerging as a significant contender, driven by its industrial importance, port facilities, and ongoing urban development initiatives. Jeddah, with its coastal appeal and established economic activity, also plays a crucial role, attracting a discerning clientele.

Dammam Metropolitan Area: Growing importance due to industrial strength and strategic location.

- Industrial Hub: Drives demand from a skilled workforce and corporate executives.

- Urban Redevelopment: Focus on modernizing infrastructure and creating desirable living spaces.

- Market Share: Estimated at xx%.

Jeddah: Coastal appeal and established economic base contribute to its luxury market.

- Tourism and Commerce: Attracts affluent residents and investors.

- Lifestyle Appeal: Waterfront properties and access to amenities.

- Market Share: Estimated at xx%.

In terms of property types, Villas and Landed Houses continue to command a substantial segment of the luxury market, appealing to families seeking space, privacy, and exclusivity. However, Apartments and Condominiums are gaining traction, particularly in prime urban locations, offering modern amenities, security, and convenience for professionals and smaller households.

Saudi Arabia Luxury Residential Real Estate Industry Product Landscape

The product landscape in the Saudi Arabia luxury residential real estate industry is characterized by a strong emphasis on exclusivity, bespoke design, and integrated amenities. Developers are increasingly incorporating smart home technology for enhanced convenience and security, alongside sustainable building practices to meet growing environmental consciousness. Properties often feature high-end finishes, premium materials, and innovative architectural designs that reflect a sophisticated lifestyle. Applications range from ultra-luxury penthouses with panoramic city views to expansive villas within gated communities offering unparalleled privacy and bespoke services. Unique selling propositions often include access to private amenities like golf courses, marinas, and exclusive clubhouses. Technological advancements are evident in the seamless integration of building management systems, advanced climate control, and personalized lighting solutions, all aimed at delivering an elevated living experience.

Key Drivers, Barriers & Challenges in Saudi Arabia Luxury Residential Real Estate Industry

Key drivers propelling the Saudi Arabia luxury residential real estate industry include the ambitious Vision 2030 initiative, fostering economic diversification and attracting foreign investment. Government support for infrastructure development and the creation of entertainment and lifestyle destinations are creating a more appealing environment for premium living. A growing affluent population with increasing disposable incomes and a desire for high-quality housing further fuels demand. Technological advancements in construction and smart home integration are also key motivators.

- Drivers:

- Vision 2030 initiatives for economic diversification.

- Government investment in infrastructure and urban development.

- Rising disposable incomes of the affluent population.

- Increasing demand for smart homes and sustainable living.

Key challenges and restraints include the high cost of land acquisition and construction, which can impact affordability. Regulatory hurdles, though improving, can still present complexities for new entrants and large-scale developments. Supply chain disruptions for specialized luxury materials and skilled labor shortages can also pose challenges. Furthermore, intense competition among developers and the need to continually innovate to meet evolving consumer expectations add to the market's complexities, with potential impacts on profit margins estimated at xx%.

- Barriers & Challenges:

- High land acquisition and construction costs.

- Potential regulatory complexities and approval processes.

- Supply chain disruptions for premium materials.

- Shortage of specialized skilled labor.

- Intense competition and evolving consumer demands.

Emerging Opportunities in Saudi Arabia Luxury Residential Real Estate Industry

Emerging opportunities in the Saudi Arabia luxury residential real estate industry lie in the development of branded residences associated with international luxury hotel chains, catering to a discerning clientele seeking familiar standards of service and quality. The growing demand for sustainable and eco-friendly luxury properties presents a significant niche, with opportunities for developers focusing on green building certifications and energy-efficient designs. Furthermore, the expansion of luxury tourism is creating demand for high-end vacation homes and serviced apartments in prime tourist destinations. The development of integrated communities that offer a blend of residential, retail, and entertainment options is another significant opportunity, catering to evolving lifestyle preferences.

Growth Accelerators in the Saudi Arabia Luxury Residential Real Estate Industry Industry

Growth accelerators in the Saudi Arabia luxury residential real estate industry are primarily driven by strategic partnerships between local developers and international luxury brands, enhancing project credibility and market appeal. The ongoing influx of foreign direct investment, facilitated by Vision 2030, is a significant catalyst, bringing capital and expertise to the sector. The continuous development of world-class infrastructure and mega-projects, such as NEOM and the Red Sea Project, is creating new hubs of economic activity and attracting a wealthy demographic, thereby expanding the market for luxury residential properties. Furthermore, innovative financing models and mortgage solutions tailored for the luxury segment are making these properties more accessible.

Key Players Shaping the Saudi Arabia Luxury Residential Real Estate Industry Market

- Villa Palma Compound

- Jabal Omar

- Arabian Homes

- Dar AI Arkan

- Abdul Latif Jamal

- AL Nassar

- AI Sedan

- Rafal Real Estate Development Company

- Sedco Development

- Alfirah United Company for Real Estate

- Saudi Real Estate Company (Al Akaria)

Notable Milestones in Saudi Arabia Luxury Residential Real Estate Industry Sector

- May 2023: Sedco Development partnered with Hamad M.AlMousa Real Estate Co. to develop a new 1.9 million square meter land development in Al-Qadisiyah, Riyadh. This project underscores SEDCO's strategy to position Riyadh as a key business, commercial, and residential hub.

- April 2023: Dar Al Arkan launched its new residential project "Ai Masyuf" in Riyadh, offering diverse housing options including villas, townships, and apartments, indicating a focus on expanding residential offerings in the capital.

In-Depth Saudi Arabia Luxury Residential Real Estate Industry Market Outlook

The future market potential for the Saudi Arabia luxury residential real estate industry is exceptionally bright, fueled by a confluence of favorable economic policies, sustained government investment in mega-projects, and a growing affluent demographic. The ongoing diversification of the Saudi economy is creating new wealth and attracting a global talent pool, directly translating into increased demand for premium residential spaces. Strategic partnerships between local developers and international luxury brands are expected to further elevate the quality and desirability of offerings, attracting both domestic and international buyers. The market is poised for continued expansion, with a strong emphasis on creating integrated, sustainable, and technologically advanced living environments that cater to the evolving preferences of high-net-worth individuals seeking an unparalleled lifestyle.

Saudi Arabia Luxury Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Villas and Landed Houses

-

2. City

- 2.1. Riyadh

- 2.2. Jeddah

- 2.3. Dammam Metropolitan Area

- 2.4. Other Cities

Saudi Arabia Luxury Residential Real Estate Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Luxury Residential Real Estate Industry Regional Market Share

Geographic Coverage of Saudi Arabia Luxury Residential Real Estate Industry

Saudi Arabia Luxury Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Disposable Incomes4.; Government Initiatives4.; Growing Expatriate Population

- 3.3. Market Restrains

- 3.3.1. 4.; Regulatory Framework4.; The Risk of Oversupply

- 3.4. Market Trends

- 3.4.1. Demand for Apartments remains High due to Cultural Preferences in Saudi Arabia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Luxury Residential Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by City

- 5.2.1. Riyadh

- 5.2.2. Jeddah

- 5.2.3. Dammam Metropolitan Area

- 5.2.4. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Villa Palma Compound

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Jabal Omar

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Arabian Homes

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dar AI Arkan

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Abdul Latif Jamal

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AL Nassar**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AI Sedan

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rafal Real Estate Development Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sedco Development

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Alfirah United Company for Real Estate

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Saudi Real Estate Company (Al Akaria)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Villa Palma Compound

List of Figures

- Figure 1: Saudi Arabia Luxury Residential Real Estate Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Luxury Residential Real Estate Industry Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Luxury Residential Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Saudi Arabia Luxury Residential Real Estate Industry Revenue Million Forecast, by City 2020 & 2033

- Table 3: Saudi Arabia Luxury Residential Real Estate Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia Luxury Residential Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Saudi Arabia Luxury Residential Real Estate Industry Revenue Million Forecast, by City 2020 & 2033

- Table 6: Saudi Arabia Luxury Residential Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Luxury Residential Real Estate Industry?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the Saudi Arabia Luxury Residential Real Estate Industry?

Key companies in the market include Villa Palma Compound, Jabal Omar, Arabian Homes, Dar AI Arkan, Abdul Latif Jamal, AL Nassar**List Not Exhaustive, AI Sedan, Rafal Real Estate Development Company, Sedco Development, Alfirah United Company for Real Estate, Saudi Real Estate Company (Al Akaria).

3. What are the main segments of the Saudi Arabia Luxury Residential Real Estate Industry?

The market segments include Type, City.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.63 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Disposable Incomes4.; Government Initiatives4.; Growing Expatriate Population.

6. What are the notable trends driving market growth?

Demand for Apartments remains High due to Cultural Preferences in Saudi Arabia.

7. Are there any restraints impacting market growth?

4.; Regulatory Framework4.; The Risk of Oversupply.

8. Can you provide examples of recent developments in the market?

May 2023: Sedco Development has partnered with Hamad M.AlMousa Real Estate Co. to develop a new 1.9 million square meter land development in Al-Qadisiyah, Riyadh. The project is part of SEDCO'S real estate strategy to make Riyadh a key business, commercial, and residential hub.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Luxury Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Luxury Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Luxury Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Luxury Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence