Key Insights

The global office space market is projected to reach $3300.85 billion by 2025, driven by a Compound Annual Growth Rate (CAGR) of 5.2% through 2033. Key growth drivers include the increasing adoption of flexible workspace solutions and the demand for modern, strategically located office environments. The widespread adoption of hybrid work models has fundamentally reshaped business operations, boosting demand for adaptable and co-working spaces. Companies are prioritizing agility and cost-effectiveness, making flexible office solutions more attractive than traditional long-term leases. This trend is particularly evident in the "Retrofits" segment, where established companies are reconfiguring existing spaces to support hybrid workforces and enhance employee experience. The "New Buildings" segment reflects ongoing development of innovative office designs focused on sustainability, technology integration, and employee well-being to meet the future needs of a dynamic workforce.

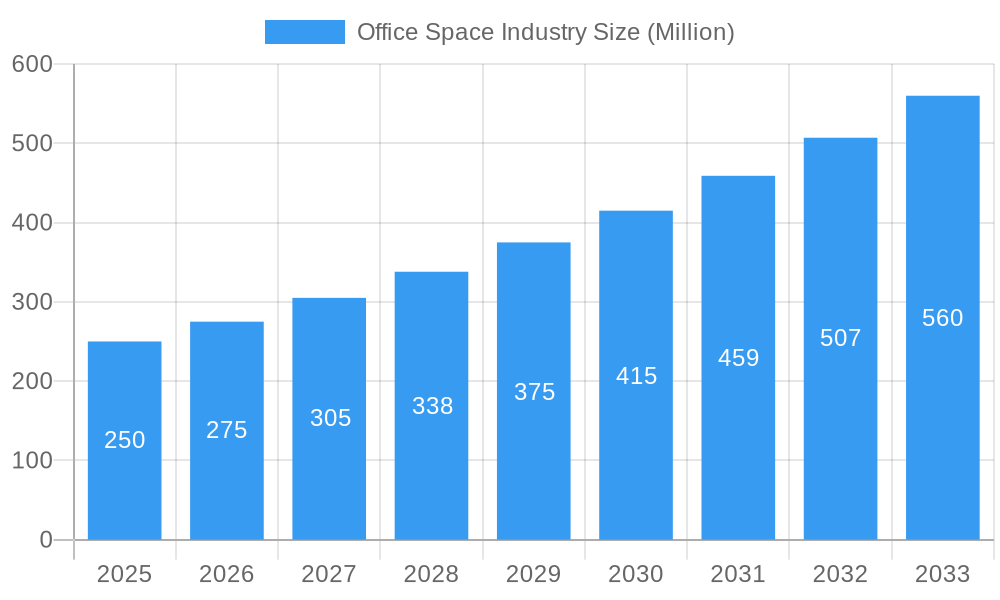

Office Space Industry Market Size (In Million)

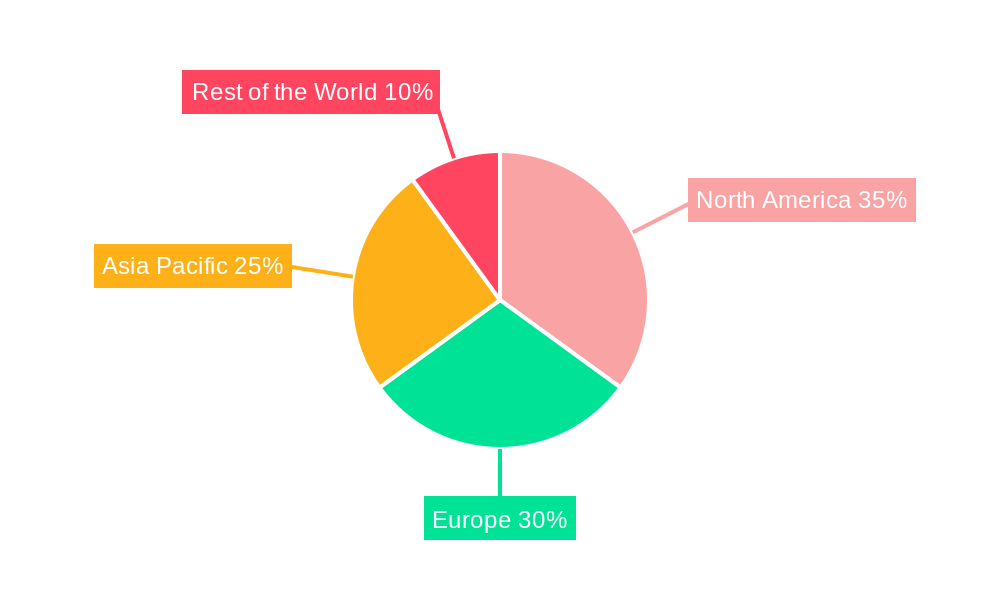

The IT and Telecommunications, and Media and Entertainment sectors are identified as primary end-users accelerating market growth. These industries, characterized by rapid evolution and a focus on collaboration and innovation, are seeking dynamic office environments that foster creativity and attract top talent. The Retail and Consumer Goods sector also contributes to market growth as businesses integrate their physical presence strategies with online operations, often utilizing flexible office spaces for project teams and regional hubs. Geographically, North America and Europe are expected to lead market share due to established economies and early adoption of flexible work trends. The Asia Pacific region demonstrates significant growth potential, driven by rapid urbanization, technological advancements, and a burgeoning startup ecosystem. Potential restraints, such as escalating rental costs in prime locations and economic downturns, are being effectively addressed by the inherent flexibility and cost-efficiency of modern office space solutions.

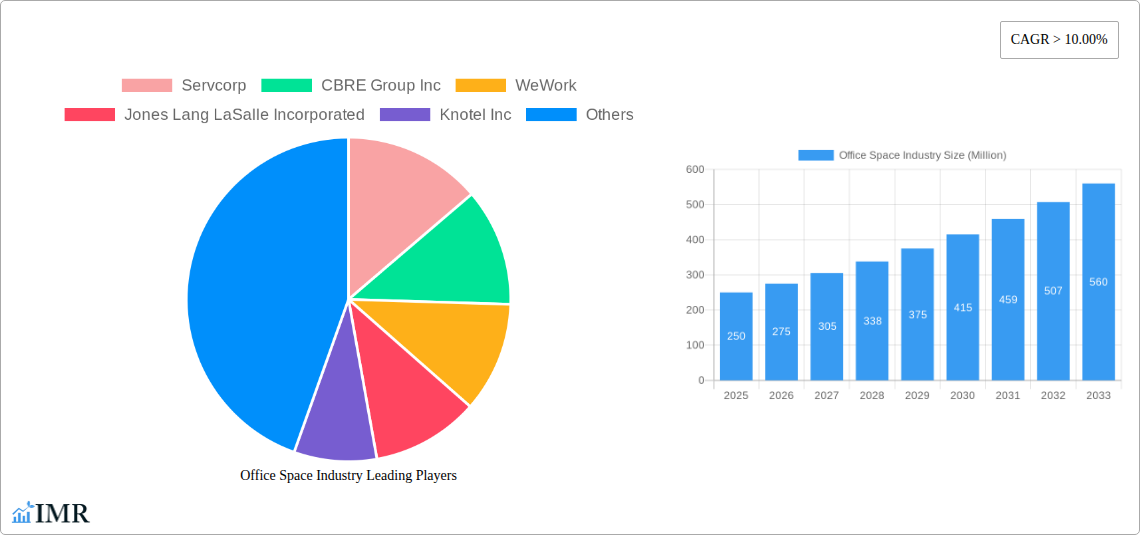

Office Space Industry Company Market Share

Office Space Industry Report Description

This comprehensive report provides an in-depth analysis of the global Office Space Industry, meticulously examining market dynamics, growth trends, regional dominance, product innovations, and the strategic landscape. Leveraging extensive data from the Historical Period (2019–2024), Base Year (2025), and a robust Forecast Period (2025–2033), this study offers unparalleled insights for industry professionals, investors, and strategic planners. We dissect the intricate interplay of parent and child markets, shedding light on critical segments like Building Type (Retrofits, New Buildings) and End User (IT and Telecommunications, Media and Entertainment, Retail and Consumer Goods), and exploring vital industry developments. All monetary values are presented in Million Units for clarity and comparability.

Office Space Industry Market Dynamics & Structure

The global Office Space Industry is characterized by a dynamic and evolving market structure, shaped by technological innovation, evolving end-user demands, and a complex regulatory environment. Market concentration varies significantly across regions, with larger, established players like CBRE Group Inc. and Jones Lang LaSalle Incorporated dominating established markets, while agile disruptors such as WeWork and Knotel Inc. have redefined flexible workspace models. Technological advancements are primarily driven by the demand for smart buildings, sustainable energy solutions, and integrated technology platforms that enhance productivity and employee well-being. Regulatory frameworks, including zoning laws, building codes, and sustainability mandates, play a crucial role in shaping development and operational standards. Competitive product substitutes, ranging from traditional leased spaces to co-working solutions and remote work policies, are continually pressuring established models. End-user demographics are shifting, with a growing emphasis on attracting and retaining talent through flexible, collaborative, and amenity-rich office environments. Mergers and acquisitions (M&A) activity remains a key strategic lever for companies seeking to expand their geographic reach, diversify their service offerings, or consolidate market share. For instance, the Historical Period (2019–2024) witnessed an estimated XX M&A deals in the commercial real estate sector, with an estimated value of $XXX Million.

- Market Concentration: A dualistic landscape with established REITs and brokerage firms alongside agile co-working providers.

- Technological Innovation Drivers: Smart building technology, AI-powered space optimization, sustainable materials, and integrated IoT solutions.

- Regulatory Frameworks: Evolving building codes, ESG mandates, and urban planning regulations influencing new construction and retrofits.

- Competitive Product Substitutes: Traditional leases, flexible office spaces, serviced offices, remote work infrastructure, and hybrid models.

- End-User Demographics: Increasing demand for collaborative zones, wellness amenities, and flexible work arrangements from diverse industries.

- M&A Trends: Consolidation within the co-working sector, strategic acquisitions of proptech firms, and portfolio diversification.

Office Space Industry Growth Trends & Insights

The Office Space Industry is poised for significant expansion, driven by a confluence of economic recovery, evolving work philosophies, and technological integration. The Base Year (2025) is estimated to witness a global market size of $XXX,XXX Million, with a projected Compound Annual Growth Rate (CAGR) of XX% over the Forecast Period (2025–2033). This growth trajectory is underpinned by increasing adoption rates of flexible workspace solutions, which are rapidly gaining traction across various industries. Technological disruptions, such as the proliferation of AI-driven space management platforms and the development of smart building technologies, are not only optimizing operational efficiency but also enhancing the employee experience, thereby influencing consumer behavior shifts towards more agile and adaptable office environments.

The aftermath of global events has accelerated the adoption of hybrid work models, prompting businesses to re-evaluate their real estate footprints. This has led to a surge in demand for well-designed, amenity-rich office spaces that foster collaboration, innovation, and employee well-being. The IT and Telecommunications sector, a significant end-user segment, continues to drive demand for cutting-edge office facilities that can accommodate rapid growth and evolving technological needs. Similarly, the Media and Entertainment industry is seeking dynamic spaces that inspire creativity and facilitate seamless production workflows. The Retail and Consumer Goods sector is also adapting, with a focus on creating centralized hubs for management, design, and marketing, while embracing more decentralized models for physical retail operations.

The market penetration of flexible workspace solutions is expected to rise from XX% in the Base Year (2025) to an estimated XX% by 2033. This evolution in office space utilization signifies a fundamental shift from fixed, long-term leases to more adaptable, service-oriented offerings. Companies are increasingly prioritizing spaces that offer a blend of dedicated areas and shared collaborative zones, reflecting a need for both focused work and spontaneous interaction. The integration of smart building technologies, including advanced HVAC systems, intelligent lighting, and occupancy sensors, is becoming a standard expectation, contributing to operational cost savings and improved sustainability. Furthermore, the growing emphasis on environmental, social, and governance (ESG) factors is compelling developers and occupiers to invest in green building certifications and sustainable materials. The Office Space Industry is thus transforming into a more dynamic and responsive ecosystem, aligning with the evolving needs of the modern workforce and the broader societal push towards sustainability and efficiency.

Dominant Regions, Countries, or Segments in Office Space Industry

The Office Space Industry is experiencing robust growth, with specific regions, countries, and segments demonstrating exceptional dynamism. North America, particularly the United States, consistently emerges as a dominant force, driven by its large economy, technological innovation hubs, and a mature commercial real estate market. The IT and Telecommunications sector in the US, with its high concentration of tech giants and startups, remains a primary driver of demand for state-of-the-art office spaces, especially in key tech corridors like Silicon Valley and Seattle. The country's high adoption rate of flexible workspace solutions, spearheaded by companies like WeWork and Knotel Inc., further solidifies its leadership. Market share within the US office space sector is estimated at XX% in 2025, with a projected CAGR of XX% over the Forecast Period (2025–2033).

Asia Pacific, led by countries like Japan and Singapore, is another significant growth engine. Japan's Office Space Industry, influenced by major corporations such as Mitsui Fudosan Co Ltd., is witnessing a resurgence in demand for premium office spaces, particularly in Tokyo. Singapore, a hub for regional headquarters, benefits from favorable government policies and a thriving business ecosystem, attracting multinational corporations across various sectors, including Media and Entertainment. The segment of New Buildings in these developed Asian markets is experiencing substantial investment, focusing on intelligent, sustainable, and amenity-rich developments that cater to the evolving needs of their sophisticated tenant base.

Within the Building Type segment, Retrofits are gaining significant traction globally. This trend is propelled by increasing environmental consciousness and the desire to upgrade older buildings to meet modern standards for energy efficiency, technology integration, and employee well-being. Cities worldwide are implementing stringent ESG regulations, making retrofitting a more cost-effective and sustainable option than new construction in many cases. For instance, in Europe, cities like London and Amsterdam are leading the charge in retrofitting initiatives, driven by strong government incentives and corporate sustainability goals. The Retrofits segment is projected to grow at a CAGR of XX% from 2025 to 2033, capturing an estimated XX% of the total market value.

The End User segment of IT and Telecommunications is expected to continue its dominance, driven by the rapid digital transformation across all industries. Companies in this sector require flexible, scalable, and technologically advanced spaces to foster innovation and attract top talent. The Media and Entertainment sector is also a key contributor, with a growing demand for collaborative spaces that facilitate creative processes and content creation. The Retail and Consumer Goods sector, while undergoing significant shifts, is still investing in premium office spaces for their corporate headquarters, R&D, and marketing functions, especially in urban centers.

- Dominant Region: North America, with the United States leading in market size and adoption of flexible workspaces.

- Key Country: Japan, witnessing demand for premium office spaces and significant investment from companies like Mitsui Fudosan Co Ltd.

- Dominant Segment (Building Type): Retrofits, driven by ESG mandates and the need for sustainable upgrades.

- Dominant Segment (End User): IT and Telecommunications, fueled by digital transformation and talent acquisition needs.

- Growth Potential: Asia Pacific, particularly Singapore, is exhibiting strong growth due to favorable business environments and multinational presence.

Office Space Industry Product Landscape

The Office Space Industry product landscape is increasingly defined by innovation in flexible, technology-enabled, and sustainable workspace solutions. Companies like Servcorp and Regus (part of IWG PLC) are at the forefront of offering premium serviced office solutions, providing businesses with fully furnished, equipped, and managed office spaces that reduce overhead and offer scalability. WeWork and The Office Group are expanding their co-working offerings, emphasizing community building, flexible membership plans, and a diverse range of amenities designed to enhance productivity and employee satisfaction. Knotel Inc. is focusing on bespoke private office solutions tailored to the specific needs of growing companies, offering agility and branding control. The integration of smart building technologies, including advanced access control, environmental monitoring, and space utilization analytics, is becoming a standard feature, enhancing operational efficiency and tenant experience. These innovations are not merely about physical space but about creating ecosystems that support modern work paradigms, from hybrid models to hot-desking and collaborative project zones.

Key Drivers, Barriers & Challenges in Office Space Industry

Key Drivers: The Office Space Industry is propelled by several critical drivers. The ongoing digital transformation necessitates flexible and adaptable workspaces that can accommodate evolving technological needs and workforce structures, particularly within the IT and Telecommunications and Media and Entertainment sectors. The increasing adoption of hybrid work models is creating demand for high-quality, amenity-rich office environments that foster collaboration and employee engagement. Furthermore, a growing global emphasis on sustainability and ESG compliance is driving demand for energy-efficient buildings and green certifications, benefiting Retrofits and new sustainable constructions. Government incentives for urban regeneration and business development also play a crucial role.

Barriers & Challenges: Despite robust growth, the industry faces significant challenges. The Office Space Industry is susceptible to economic downturns and fluctuations in business confidence, which can impact leasing activity and investment. Supply chain disruptions and rising construction costs can hinder the development of new buildings and the completion of retrofits, leading to project delays and increased capital expenditure. Intense competition from established players and emerging co-working providers, coupled with the increasing prevalence of remote work, puts pressure on rental rates and occupancy levels. Navigating complex and evolving regulatory landscapes across different jurisdictions also presents a considerable hurdle. The Historical Period (2019–2024) saw an estimated XX% increase in construction material costs, impacting project viability.

Emerging Opportunities in Office Space Industry

Emerging opportunities in the Office Space Industry lie in the development of highly flexible and adaptable workspace solutions that cater to the specific needs of a diverse clientele. The rise of niche co-working spaces targeting specific industries, such as creative professionals or tech startups, presents a significant untapped market. The integration of advanced proptech, including AI-powered space management, smart building IoT solutions, and virtual reality for property tours, offers opportunities for enhanced efficiency and tenant experience. There is also a growing demand for hybrid office models that seamlessly blend physical and remote work, leading to opportunities in designing flexible layouts and supporting technologies. Furthermore, the focus on employee well-being and mental health is creating demand for biophilic design, wellness amenities, and flexible benefit packages integrated into office leases. The Office Space Industry is also seeing opportunities in repurposing underutilized commercial spaces into mixed-use developments that incorporate residential, retail, and community elements, thereby creating vibrant urban hubs.

Growth Accelerators in the Office Space Industry Industry

Several factors are acting as growth accelerators for the Office Space Industry. Technological breakthroughs in smart building management systems and AI-driven space optimization are enhancing operational efficiency and tenant satisfaction, making offices more attractive and cost-effective. Strategic partnerships between real estate developers, technology providers, and flexible workspace operators are leading to the creation of innovative and integrated office solutions. Market expansion strategies, including global reach and diversification of service offerings by key players like IWG PLC, are tapping into new geographic markets and catering to a wider range of business needs. The increasing focus on ESG compliance is also a significant accelerator, driving investment in sustainable building practices and retrofits, aligning with corporate responsibility goals. The growing understanding of the importance of office space as a tool for talent attraction and retention is further fueling demand for high-quality, collaborative, and flexible environments.

Key Players Shaping the Office Space Industry Market

- Servcorp

- CBRE Group Inc.

- WeWork

- Jones Lang LaSalle Incorporated

- Knotel Inc.

- IWG PLC

- Mitsui Fudosan Co Ltd.

- The Office Group

- Regus

- WOJO

- 7 3 Other Companies

Notable Milestones in Office Space Industry Sector

- 2019: Significant expansion of co-working spaces globally, with increased investment in proptech solutions.

- 2020: Widespread adoption of remote work policies, leading to a temporary decline in office occupancy but a surge in demand for flexible solutions.

- 2021: Resurgence of hybrid work models; increased focus on ESG initiatives and sustainable office designs.

- 2022: Growing M&A activity as larger players consolidate and acquire innovative proptech firms; notable investments in smart building technology.

- 2023: Rise in demand for amenity-rich, collaborative office spaces designed to foster employee engagement and well-being.

- 2024 (Expected): Continued growth in the retrofitting market to meet evolving sustainability standards; further integration of AI in space management.

In-Depth Office Space Industry Market Outlook

The Office Space Industry outlook is highly positive, driven by continued economic recovery and the permanent shift towards hybrid and flexible work arrangements. Growth accelerators such as technological advancements in smart building technology and AI-driven space optimization will continue to enhance efficiency and tenant experience. Strategic partnerships between real estate firms and tech providers will foster innovation, leading to more integrated and user-friendly office solutions. Market expansion strategies by key players will tap into emerging economies and cater to evolving business needs. The strong emphasis on ESG compliance will fuel further investment in sustainable retrofits and new green buildings, aligning with global climate goals. The Office Space Industry is set to transform, offering dynamic, collaborative, and employee-centric environments that are crucial for talent attraction and business success in the coming years.

Office Space Industry Segmentation

-

1. Building Type

- 1.1. Retrofits

- 1.2. New Buildings

-

2. End User

- 2.1. IT and Telecommunications

- 2.2. Media and Entertainment

- 2.3. Retail and Consumer Goods

Office Space Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Office Space Industry Regional Market Share

Geographic Coverage of Office Space Industry

Office Space Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increase in Aging Population Driving the Market4.; Healthcare and Long-term Care Needs Driving the Market

- 3.3. Market Restrains

- 3.3.1. 4.; High Affordability and Cost of Care Affecting the Market4.; Staffing and Workforce Challenges Affecting the Market

- 3.4. Market Trends

- 3.4.1. Increase in Office Space Vacancy Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Office Space Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Building Type

- 5.1.1. Retrofits

- 5.1.2. New Buildings

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. IT and Telecommunications

- 5.2.2. Media and Entertainment

- 5.2.3. Retail and Consumer Goods

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Building Type

- 6. North America Office Space Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Building Type

- 6.1.1. Retrofits

- 6.1.2. New Buildings

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. IT and Telecommunications

- 6.2.2. Media and Entertainment

- 6.2.3. Retail and Consumer Goods

- 6.1. Market Analysis, Insights and Forecast - by Building Type

- 7. Europe Office Space Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Building Type

- 7.1.1. Retrofits

- 7.1.2. New Buildings

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. IT and Telecommunications

- 7.2.2. Media and Entertainment

- 7.2.3. Retail and Consumer Goods

- 7.1. Market Analysis, Insights and Forecast - by Building Type

- 8. Asia Pacific Office Space Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Building Type

- 8.1.1. Retrofits

- 8.1.2. New Buildings

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. IT and Telecommunications

- 8.2.2. Media and Entertainment

- 8.2.3. Retail and Consumer Goods

- 8.1. Market Analysis, Insights and Forecast - by Building Type

- 9. Rest of the World Office Space Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Building Type

- 9.1.1. Retrofits

- 9.1.2. New Buildings

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. IT and Telecommunications

- 9.2.2. Media and Entertainment

- 9.2.3. Retail and Consumer Goods

- 9.1. Market Analysis, Insights and Forecast - by Building Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Servcorp

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 CBRE Group Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 WeWork

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Jones Lang LaSalle Incorporated

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Knotel Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 IWG PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Mitsui Fudosan Co Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 The Office Group

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Regus

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 WOJO**List Not Exhaustive 7 3 Other Companie

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Servcorp

List of Figures

- Figure 1: Global Office Space Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Office Space Industry Revenue (billion), by Building Type 2025 & 2033

- Figure 3: North America Office Space Industry Revenue Share (%), by Building Type 2025 & 2033

- Figure 4: North America Office Space Industry Revenue (billion), by End User 2025 & 2033

- Figure 5: North America Office Space Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Office Space Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Office Space Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Office Space Industry Revenue (billion), by Building Type 2025 & 2033

- Figure 9: Europe Office Space Industry Revenue Share (%), by Building Type 2025 & 2033

- Figure 10: Europe Office Space Industry Revenue (billion), by End User 2025 & 2033

- Figure 11: Europe Office Space Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Office Space Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Office Space Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Office Space Industry Revenue (billion), by Building Type 2025 & 2033

- Figure 15: Asia Pacific Office Space Industry Revenue Share (%), by Building Type 2025 & 2033

- Figure 16: Asia Pacific Office Space Industry Revenue (billion), by End User 2025 & 2033

- Figure 17: Asia Pacific Office Space Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Office Space Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Office Space Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Office Space Industry Revenue (billion), by Building Type 2025 & 2033

- Figure 21: Rest of the World Office Space Industry Revenue Share (%), by Building Type 2025 & 2033

- Figure 22: Rest of the World Office Space Industry Revenue (billion), by End User 2025 & 2033

- Figure 23: Rest of the World Office Space Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Rest of the World Office Space Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Office Space Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Office Space Industry Revenue billion Forecast, by Building Type 2020 & 2033

- Table 2: Global Office Space Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Global Office Space Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Office Space Industry Revenue billion Forecast, by Building Type 2020 & 2033

- Table 5: Global Office Space Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Global Office Space Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Office Space Industry Revenue billion Forecast, by Building Type 2020 & 2033

- Table 8: Global Office Space Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 9: Global Office Space Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Office Space Industry Revenue billion Forecast, by Building Type 2020 & 2033

- Table 11: Global Office Space Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 12: Global Office Space Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Office Space Industry Revenue billion Forecast, by Building Type 2020 & 2033

- Table 14: Global Office Space Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 15: Global Office Space Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Office Space Industry?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Office Space Industry?

Key companies in the market include Servcorp, CBRE Group Inc, WeWork, Jones Lang LaSalle Incorporated, Knotel Inc, IWG PLC, Mitsui Fudosan Co Ltd, The Office Group, Regus, WOJO**List Not Exhaustive 7 3 Other Companie.

3. What are the main segments of the Office Space Industry?

The market segments include Building Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3300.85 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increase in Aging Population Driving the Market4.; Healthcare and Long-term Care Needs Driving the Market.

6. What are the notable trends driving market growth?

Increase in Office Space Vacancy Rate.

7. Are there any restraints impacting market growth?

4.; High Affordability and Cost of Care Affecting the Market4.; Staffing and Workforce Challenges Affecting the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Office Space Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Office Space Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Office Space Industry?

To stay informed about further developments, trends, and reports in the Office Space Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence