Key Insights

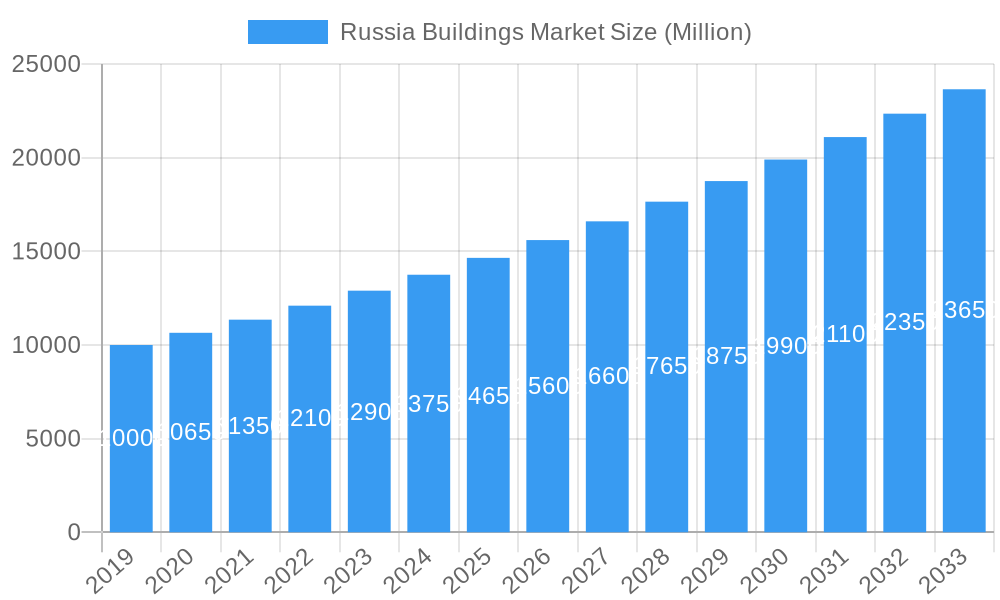

The Russian buildings market is projected for significant expansion, reaching an estimated market size of 184.43 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 3.09% through 2033. This growth is propelled by favorable economic conditions and strategic initiatives focused on improving the nation's built environment. Key drivers include substantial government investment in infrastructure, particularly in urban areas, and increasing demand for contemporary residential and commercial spaces. The residential segment is experiencing robust growth due to population increase, urbanization, and supportive mortgage policies. The commercial sector is benefiting from expansion in retail, office, and hospitality, attracting both domestic and international investment. Technological advancements in construction, such as prefabrication and sustainable materials, are enhancing efficiency and reducing project timelines. Growing emphasis on energy-efficient and green building solutions aligns with global sustainability goals and local environmental regulations.

Russia Buildings Market Market Size (In Billion)

The market is segmented by material type, with Concrete, Glass, and Timber being dominant due to their widespread application and durability. The Residential sector leads in application, driven by housing needs and rising disposable incomes. The Commercial sector also holds a significant share, fueled by new business parks, retail complexes, and hospitality venues. Potential restraints include fluctuating material costs and skilled labor availability. However, the presence of prominent construction companies such as LSR Group, Segezha Group, and PIK Group indicates a competitive landscape capable of addressing challenges and fostering innovation. These companies are instrumental in shaping the Russian construction industry's future, prioritizing quality, sustainability, and efficient project delivery to meet evolving market demands.

Russia Buildings Market Company Market Share

Russia Buildings Market: Comprehensive Analysis and Future Outlook (2019-2033)

This report delivers an in-depth analysis of the dynamic Russia Buildings Market, encompassing a detailed study from 2019 to 2033, with a base and estimated year of 2025, and a forecast period of 2025-2033. We examine parent and child market segments, providing critical insights into market size, growth drivers, technological advancements, and competitive landscape. Leveraging high-traffic keywords and precise data, this report is an essential resource for industry professionals seeking to navigate and capitalize on the evolving Russian construction sector. All values are presented in Million units.

Russia Buildings Market Market Dynamics & Structure

The Russia Buildings Market is characterized by a moderate to high degree of concentration, with key players increasingly focusing on innovation and strategic acquisitions to expand their market share. Technological advancements, particularly in prefabrication and modular construction, are significant drivers, reducing build times and costs. Regulatory frameworks, while evolving, aim to support sustainable development and modern construction practices. Competitive product substitutes are emerging, especially in alternative materials and energy-efficient designs, pushing established players to differentiate. End-user demographics are shifting, with an increasing demand for diverse housing options and technologically advanced commercial spaces. Mergers and acquisitions (M&A) are a prevalent trend, exemplified by significant deals that consolidate market power and integrate new technologies.

- Market Concentration: Dominated by a few large integrated developers and construction companies, with increasing consolidation through M&A.

- Technological Innovation: Focus on modular construction, prefabrication, smart building technologies, and sustainable materials.

- Regulatory Frameworks: Evolving building codes, safety standards, and incentives for green construction.

- Competitive Product Substitutes: Growing interest in engineered wood, advanced insulation, and smart home systems.

- End-User Demographics: Demand for affordable housing, modern urban developments, and energy-efficient commercial spaces.

- M&A Trends: Strategic acquisitions aimed at gaining market share, technological capabilities, and project pipelines. The Etalon Group's acquisition of YIT Corporation (RUB 4,597 million) exemplifies this trend.

Russia Buildings Market Growth Trends & Insights

The Russia Buildings Market is poised for significant growth, driven by robust demand across residential, commercial, and infrastructure sectors. The market size is projected to expand at a healthy Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period (2025-2033). Adoption rates for advanced construction technologies, such as modular and pre-fabricated building solutions, are accelerating due to their efficiency and cost-effectiveness. Technological disruptions are fundamentally reshaping construction methodologies, with a growing emphasis on digitalization, BIM (Building Information Modeling), and the use of sustainable and recycled materials. Consumer behavior is shifting towards prioritizing energy efficiency, smart home integration, and aesthetically pleasing, functional living and working spaces. The market penetration of modern construction techniques is expected to increase as developers recognize the competitive advantages they offer. The historical period (2019-2024) saw initial recovery and adaptation, setting the stage for more ambitious growth in the coming years, fueled by government initiatives and a growing middle class.

Dominant Regions, Countries, or Segments in Russia Buildings Market

The Residential segment is currently the dominant force driving growth within the Russia Buildings Market, accounting for an estimated 60% of the total market value in 2025. This dominance is fueled by a persistent demand for housing, particularly in major urban centers and surrounding agglomerations. Economic policies aimed at stimulating domestic demand and supporting mortgage lending have further bolstered the residential sector.

- Key Drivers for Residential Dominance:

- Urbanization and Population Growth: Continued migration to cities creates sustained demand for new housing units.

- Government Housing Programs: Initiatives promoting affordable housing and mortgage subsidies are key catalysts.

- Rising Disposable Incomes: A growing middle class can afford to invest in better quality and larger living spaces.

- Technological Integration: Increasing adoption of smart home features and energy-efficient designs in new residential constructions.

- Market Share and Growth Potential: The residential segment is expected to maintain its leading position, with a projected CAGR of 6.2% from 2025-2033. The demand for diverse housing types, from single-family homes to multi-story apartment complexes, ensures a broad market base.

While the residential segment leads, the Commercial segment is a significant contributor and exhibits strong growth potential, particularly in sectors like retail, office spaces, and logistics.

- Key Drivers for Commercial Growth:

- Economic Recovery and Business Expansion: Growth in various industries necessitates new commercial infrastructure.

- E-commerce Boom: Driving demand for modern warehousing and logistics facilities.

- Investment in Modern Office Spaces: Companies are seeking smart, sustainable, and flexible workspaces.

- Infrastructure Development: Government investment in transportation and urban development indirectly supports commercial construction.

- Market Share and Growth Potential: The commercial segment is projected to grow at a CAGR of 5.1% during the forecast period, with market share estimated at 30% in 2025.

The Other Applications segment, encompassing industrial buildings, public facilities, and infrastructure projects, also plays a crucial role, though its market share is smaller.

- Key Drivers for Other Applications:

- Industrial Modernization: Investments in upgrading manufacturing and processing facilities.

- Infrastructure Projects: Government spending on roads, bridges, power plants, and utilities.

- Healthcare and Education Facilities: Ongoing development and modernization of public services.

- Market Share and Growth Potential: This segment is expected to witness a CAGR of 4.5%, with a market share of approximately 10% in 2025.

Among Material Types, Concrete remains the most dominant material, constituting an estimated 55% of the market value in 2025, due to its versatility, affordability, and widespread availability. However, Metal (expected 20% market share) and Glass (expected 15% market share) are experiencing significant growth due to their use in modern architectural designs and industrial applications. Timber (expected 5% market share) is gaining traction with the rise of sustainable construction and modular housing.

Russia Buildings Market Product Landscape

The Russia Buildings Market is witnessing a surge in product innovations driven by the demand for efficiency, sustainability, and enhanced functionality. Concrete remains a cornerstone, with advancements in high-performance formulations and precast elements streamlining construction. Glass is increasingly being utilized in advanced curtain wall systems and energy-efficient glazing, contributing to modern aesthetics and thermal performance. Metal structures, including steel and aluminum, are favored for their strength, durability, and design flexibility in commercial and industrial projects. Timber, particularly engineered wood products like glulam and CLT (Cross-Laminated Timber), is gaining prominence for its eco-friendly credentials and rapid assembly capabilities in residential and low-rise commercial applications. Other material types, such as advanced composites and recycled materials, are emerging as niche solutions offering specific performance benefits. The integration of smart building technologies, from automated climate control to intelligent lighting systems, is becoming a standard feature, enhancing user experience and operational efficiency across various applications.

Key Drivers, Barriers & Challenges in Russia Buildings Market

Key Drivers:

- Technological Advancements: The adoption of modular construction, prefabrication, and digital building technologies significantly enhances efficiency and reduces project timelines.

- Government Support: Housing programs, urban development initiatives, and incentives for green construction stimulate market activity.

- Urbanization & Demand: Continuous migration to cities fuels demand for new residential and commercial properties.

- Economic Stability & Investment: A stable economic environment encourages both domestic and foreign investment in the construction sector.

- Sustainable Building Practices: Growing awareness and regulatory push for energy-efficient and environmentally friendly construction solutions.

Barriers & Challenges:

- Supply Chain Disruptions: Global and domestic supply chain issues can lead to material shortages and price volatility.

- Regulatory Hurdles: Complex permitting processes and evolving building codes can cause project delays.

- Skilled Labor Shortage: A lack of adequately trained construction workers can impact project quality and speed.

- Financing & Investment Risks: Interest rate fluctuations and economic uncertainties can affect project financing and investor confidence.

- Geopolitical Factors: External geopolitical events can influence material costs, international trade, and overall market sentiment. The impact of supply chain disruptions on key materials like steel and imported components is estimated to cause project cost increases of up to 15-20% in some instances.

Emerging Opportunities in Russia Buildings Market

Emerging opportunities in the Russia Buildings Market lie in the increasing demand for sustainable and energy-efficient buildings, driven by both consumer preference and regulatory push. The development of smart cities and integrated urban infrastructure presents significant potential for large-scale projects incorporating innovative technologies. The renovation and retrofitting of existing building stock to improve energy performance and modernize facilities is another untapped market. Furthermore, the growth of e-commerce is creating a robust demand for advanced logistics and warehousing facilities. Niche applications, such as modular healthcare facilities and specialized industrial buildings, also offer promising avenues for growth. The growing interest in prefabricated and modular construction solutions for faster, more cost-effective housing development also presents a substantial opportunity for market players.

Growth Accelerators in the Russia Buildings Market Industry

Several key catalysts are accelerating growth in the Russia Buildings Market industry. Technological breakthroughs in materials science are leading to the development of lighter, stronger, and more sustainable building components, reducing construction time and environmental impact. Strategic partnerships between developers, technology providers, and material suppliers are fostering innovation and creating integrated solutions. The increasing adoption of Building Information Modeling (BIM) and digital construction platforms streamlines project management, enhances collaboration, and improves overall efficiency. Government initiatives promoting urban renewal and the development of new residential areas, coupled with supportive financing mechanisms, are directly stimulating construction activity. Moreover, a growing emphasis on ESG (Environmental, Social, and Governance) factors is pushing companies to adopt greener construction practices, creating a competitive advantage and attracting investment.

Key Players Shaping the Russia Buildings Market Market

- LSR group St Petersburg

- Atlaca Group

- Segezha Group

- AECON

- PIK Group of Companies

- K Modul

- Setl Group St Petersburg

- Renaissance Construction

- INSI Holding

- Story House

- Pallada Eco

Notable Milestones in Russia Buildings Market Sector

- April 2022: Etalon Group acquired YIT Corporation for a maximum consideration of RUB 4,597 million (USD 65.53 million), reinforcing its position as a leading developer. This strategic move highlights the trend of consolidation and integration of construction technologies. Etalon Group's focus on ready-to-assemble modular multi-story buildings using on-site prefabrication technology signals a significant shift towards more efficient construction methods.

- January 2022: Dubldom designed the TOPOL 27 modular house, a fully furnished, easily transportable unit made from natural materials like oak wood, black metal, and stone. This innovation demonstrates the growing market for compact, sustainable, and convenient modular housing solutions, catering to a specific demand for ready-to-live-in structures.

In-Depth Russia Buildings Market Market Outlook

The Russia Buildings Market outlook remains highly positive, driven by sustained demand for diverse construction projects and an increasing embrace of advanced technologies. Growth accelerators such as innovative material solutions, digital construction platforms, and strategic industry collaborations will continue to propel the market forward. The focus on sustainable development and energy efficiency is creating a strong demand for green building solutions and retrofitting services. Government support for housing and infrastructure development, coupled with a maturing construction sector, provides a stable foundation for long-term expansion. Emerging opportunities in smart city development, modular construction, and the renovation of existing building stock offer significant potential for market players to diversify and innovate, ensuring robust growth throughout the forecast period.

Russia Buildings Market Segmentation

-

1. Material Type

- 1.1. Concrete

- 1.2. Glass

- 1.3. Metal

- 1.4. Timber

- 1.5. Other Material Types

-

2. Application

- 2.1. Residential

- 2.2. Commercial

- 2.3. Other Ap

Russia Buildings Market Segmentation By Geography

- 1. Russia

Russia Buildings Market Regional Market Share

Geographic Coverage of Russia Buildings Market

Russia Buildings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.09% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing construction spending by governments; Growing popularity of interior design and architecture is likely to increase the demand for polymer sheets

- 3.3. Market Restrains

- 3.3.1. Shortage of Raw Materials

- 3.4. Market Trends

- 3.4.1. The Demand for Prefabricated Building is Increasing in Russia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Buildings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Concrete

- 5.1.2. Glass

- 5.1.3. Metal

- 5.1.4. Timber

- 5.1.5. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Other Ap

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LSR group St Petersburg

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Atlaca Group **List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Segezha Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AECON

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PIK Group of Companies

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 K Modul

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Setl Group St Petersburg

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Renaissance Construction

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 INSI Holding

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Story House

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Pallada Eco

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 LSR group St Petersburg

List of Figures

- Figure 1: Russia Buildings Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Russia Buildings Market Share (%) by Company 2025

List of Tables

- Table 1: Russia Buildings Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: Russia Buildings Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Russia Buildings Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Russia Buildings Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 5: Russia Buildings Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Russia Buildings Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Buildings Market?

The projected CAGR is approximately 3.09%.

2. Which companies are prominent players in the Russia Buildings Market?

Key companies in the market include LSR group St Petersburg, Atlaca Group **List Not Exhaustive, Segezha Group, AECON, PIK Group of Companies, K Modul, Setl Group St Petersburg, Renaissance Construction, INSI Holding, Story House, Pallada Eco.

3. What are the main segments of the Russia Buildings Market?

The market segments include Material Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 184.43 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing construction spending by governments; Growing popularity of interior design and architecture is likely to increase the demand for polymer sheets.

6. What are the notable trends driving market growth?

The Demand for Prefabricated Building is Increasing in Russia.

7. Are there any restraints impacting market growth?

Shortage of Raw Materials.

8. Can you provide examples of recent developments in the market?

April 2022: Etalon Group (one of Russia's largest and longest-established development and construction companies) acquired YIT Corporation (a construction company) for a maximum consideration of RUB 4,597 million (USD 65.53 million). In terms of the development of construction technologies, the Etalon company's priority is the construction of ready-to-assemble modular multi-story buildings using on-site prefabrication technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Buildings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Buildings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Buildings Market?

To stay informed about further developments, trends, and reports in the Russia Buildings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence