Key Insights

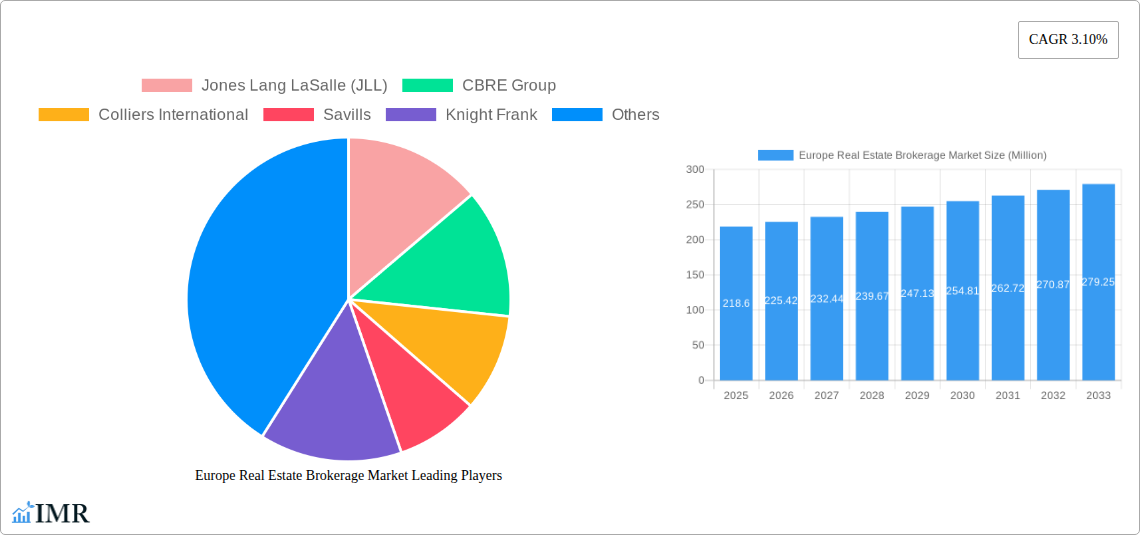

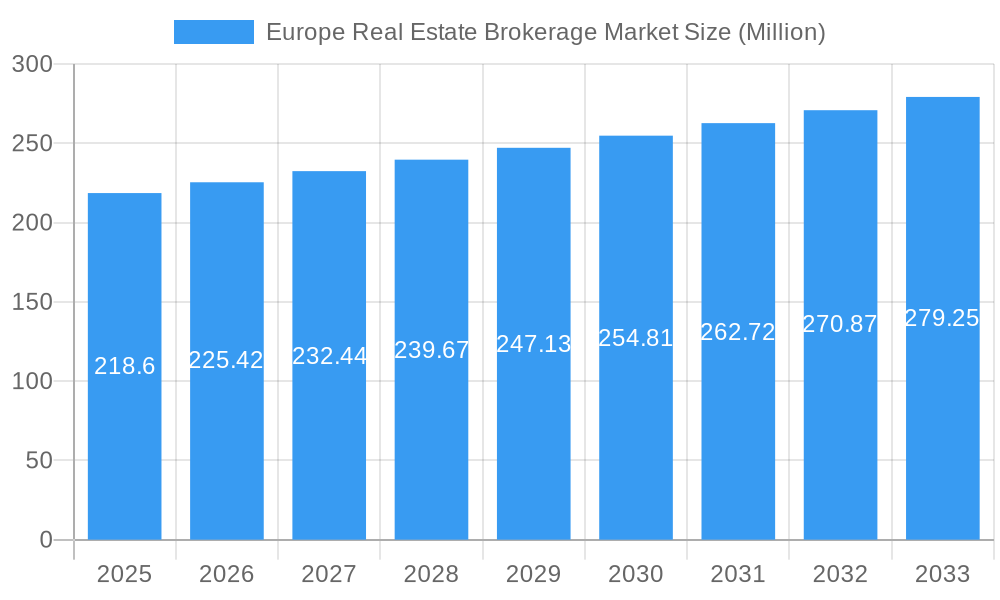

The European Real Estate Brokerage Market is poised for steady growth, projected to reach an estimated USD 218.60 million by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 3.10% through 2033. This robust expansion is fueled by a confluence of factors, including evolving urban development, increasing demand for both residential and non-residential properties, and a dynamic rental market. The sector is witnessing significant consolidation and innovation, with established global players like Jones Lang LaSalle (JLL), CBRE Group, and Colliers International dominating the landscape alongside emerging digital platforms and niche service providers. The brokerage services segment is largely driven by sales and rental transactions, with the residential sector historically representing a larger share, although the non-residential segment, encompassing commercial, industrial, and retail spaces, is gaining momentum due to strong investment flows and corporate expansion. The increasing professionalization of property management and the growing complexity of real estate transactions are further bolstering the need for expert brokerage services.

Europe Real Estate Brokerage Market Market Size (In Million)

The market's trajectory is also being shaped by emerging trends such as the integration of PropTech solutions, including AI-powered property search, virtual tours, and data analytics, which are enhancing efficiency and client experience. The growing emphasis on sustainable and green building certifications is also influencing market demand and brokerage strategies. However, the market faces certain restraints, including stringent regulatory environments in some European countries, fluctuating economic conditions, and increasing competition from direct-to-consumer online platforms. Geographically, the market is heavily concentrated within key European nations such as the United Kingdom, Germany, France, and Spain, which continue to be epicenters of real estate activity and investment. The forecast period, from 2025 to 2033, anticipates sustained growth driven by these underlying economic and technological shifts, with a continued emphasis on service specialization and digital integration to capture market share.

Europe Real Estate Brokerage Market Company Market Share

Europe Real Estate Brokerage Market: Comprehensive Outlook and Growth Projections (2019-2033)

Unlock unparalleled insights into the dynamic Europe Real Estate Brokerage Market with this definitive report. Covering the period from 2019 to 2033, with a detailed analysis of the base year 2025 and forecast period 2025-2033, this report provides a crucial understanding of market evolution, key players, and future trajectories. Targeting industry professionals, investors, and strategists, we leverage high-traffic keywords such as "European property sales," "real estate investment Europe," "luxury real estate brokerage," "commercial property deals," and "residential real estate services" to maximize search engine visibility. This report delves deep into both parent and child markets, offering a holistic view of this multi-billion Euro sector. All values are presented in Million units.

Europe Real Estate Brokerage Market Market Dynamics & Structure

The Europe Real Estate Brokerage Market is characterized by a moderately concentrated structure, with established global players coexisting alongside strong regional and niche operators. Technological innovation is a significant driver, with the adoption of AI-powered property valuation tools, virtual tours, and data analytics platforms transforming the way properties are marketed and transacted. Regulatory frameworks across European nations, while diverse, generally focus on consumer protection, transparency, and professional conduct, influencing operational standards and market entry barriers. Competitive product substitutes include direct sales by owners and nascent prop-tech platforms offering DIY solutions, though the comprehensive service offering of traditional brokerages remains a strong differentiator. End-user demographics are shifting, with an increasing demand for sustainable and smart homes, particularly among younger generations, and a growing interest in investment properties from institutional and high-net-worth individuals. Mergers and acquisitions (M&A) trends indicate a consolidation phase, driven by the pursuit of market share, technological integration, and geographic expansion. For instance, the acquisition of smaller, digitally-native agencies by larger firms is a recurring theme.

- Market Concentration: Top 5 players hold approximately XX% of the market share.

- Technological Innovation Drivers: Virtual Reality (VR) tours, AI-driven CRM, Big Data analytics for market insights.

- Regulatory Frameworks: EU-wide directives on property transactions, national licensing requirements.

- Competitive Product Substitutes: Online listing platforms without intermediary services, developer direct sales.

- End-User Demographics: Growing millennial and Gen Z buyer base, increasing demand for investment properties.

- M&A Trends: Strategic acquisitions to expand service offerings and market reach, particularly in emerging European markets.

Europe Real Estate Brokerage Market Growth Trends & Insights

The Europe Real Estate Brokerage Market has experienced robust growth over the historical period (2019-2024), driven by a combination of favorable economic conditions, increasing urbanization, and evolving consumer preferences. The market size is projected to witness a significant expansion, estimated at EUR XXX Million in the base year 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). Adoption rates of digital tools and online platforms have surged, transforming traditional brokerage models. Technological disruptions, such as the integration of blockchain for secure property transactions and the use of predictive analytics to identify prime investment opportunities, are reshaping the competitive landscape. Consumer behavior has shifted dramatically, with buyers and sellers increasingly expecting seamless online experiences, personalized service, and access to comprehensive market data. The demand for integrated property services, encompassing sales, rentals, and property management, is also on the rise.

- Market Size Evolution: Projected to reach EUR XXX Million by 2033.

- Adoption Rates: XX% increase in online property search and transaction initiation.

- Technological Disruptions: Impact of AI on property valuation and lead generation, growth of digital closing solutions.

- Consumer Behavior Shifts: Preference for hybrid (online and in-person) service models, demand for transparency and data-driven advice.

- Market Penetration: XX% of transactions facilitated by professional real estate brokerages.

Dominant Regions, Countries, or Segments in Europe Real Estate Brokerage Market

Within the Europe Real Estate Brokerage Market, the Residential segment currently dominates, driven by consistent demand for housing across the continent. However, the Non-residential segment, encompassing commercial properties such as office spaces, retail units, and industrial facilities, presents substantial growth potential, particularly in major economic hubs. The Sales service within this segment commands a larger market share compared to the Rental service, reflecting the primary function of brokerages in facilitating property ownership transfers.

Leading Countries and Key Drivers:

- United Kingdom: A mature market with a strong regulatory framework and a high volume of transactions, particularly in London’s prime residential and commercial sectors. Economic policies impacting stamp duty and mortgage rates significantly influence market activity.

- Germany: Characterized by a stable and growing economy, with consistent demand for both residential and commercial properties, especially in cities like Berlin, Munich, and Frankfurt. Strong emphasis on energy efficiency and sustainable building practices.

- France: Paris continues to be a global real estate hotspot, attracting both domestic and international buyers. Recent industry developments, like Newmark Group's expansion, highlight the increasing focus on capital markets and leasing. The luxury property market in regions like the French Riviera also contributes significantly.

- Spain: Experiencing a resurgence in property investment, particularly in tourist-driven coastal areas and major cities like Madrid and Barcelona. The luxury real estate initiative by eXp Realty expanding into Spain signifies growing international interest and broker participation.

- Netherlands: A dynamic market with a shortage of housing and strong demand for commercial spaces, especially logistics and tech-focused offices.

Dominance Factors:

- Economic Stability and Growth: Countries with robust economies and predictable growth trajectories attract higher investment and transaction volumes.

- Urbanization and Population Density: Major cities with growing populations and limited housing supply naturally fuel demand for brokerage services.

- Foreign Direct Investment (FDI): Openness to international investment significantly boosts both residential and commercial property markets.

- Infrastructure Development: Investment in transport and urban infrastructure enhances property desirability and market accessibility.

- Regulatory Environment: Clear and investor-friendly regulations foster confidence and encourage market participation.

Europe Real Estate Brokerage Market Product Landscape

The product landscape of the Europe Real Estate Brokerage Market is increasingly sophisticated, driven by technological advancements and evolving client expectations. Brokerages are offering integrated digital platforms that provide clients with access to comprehensive property listings, virtual tours, and detailed market analytics. Innovations include AI-powered matchmaking algorithms that connect buyers with properties tailored to their specific needs and preferences, and sophisticated CRM systems for enhanced client management. Furthermore, specialized services are emerging, such as ESG (Environmental, Social, and Governance) consulting for commercial properties, helping clients navigate sustainability regulations and investor demands. The performance metrics for these digital tools focus on lead conversion rates, client engagement duration, and the efficiency of transaction processing.

Key Drivers, Barriers & Challenges in Europe Real Estate Brokerage Market

Key Drivers:

- Economic Recovery and Growth: Sustained economic development across Europe fuels demand for both residential and commercial properties.

- Urbanization and Population Growth: Increasing urban populations create a consistent need for housing and commercial spaces.

- Foreign Investment Inflows: Attractive investment climates draw international capital into European real estate markets.

- Technological Advancements: Digital platforms enhance marketing, client engagement, and transaction efficiency.

- Growing Demand for Luxury and Niche Properties: Specialized segments like luxury real estate and sustainable properties offer significant growth avenues.

Key Barriers & Challenges:

- Regulatory Complexity and Fragmentation: Navigating diverse national and regional property laws presents a hurdle for cross-border operations.

- Economic Uncertainty and Inflation: Fluctuations in interest rates and inflation can impact buyer affordability and investor confidence.

- Talent Shortage: Attracting and retaining skilled real estate professionals with digital proficiency is a growing concern.

- Intensifying Competition: The rise of prop-tech solutions and direct-to-consumer platforms increases competitive pressure.

- Supply Chain Issues: Construction delays and material shortages can impact the availability of new properties.

Emerging Opportunities in Europe Real Estate Brokerage Market

Emerging opportunities in the Europe Real Estate Brokerage Market lie in the burgeoning demand for sustainable and energy-efficient properties, driven by both regulatory pressures and increasing consumer awareness. The digitalization of the entire property lifecycle, from initial search to final closing, presents a significant avenue for innovation, with AI and blockchain poised to revolutionize transaction processes. Furthermore, the growth of co-living and flexible workspace solutions catering to changing work patterns and lifestyles offers new market niches. Untapped markets in Eastern and Southern Europe, exhibiting strong economic growth and increasing foreign investment, also present considerable potential for expansion.

Growth Accelerators in the Europe Real Estate Brokerage Market Industry

Long-term growth in the Europe Real Estate Brokerage Market is being accelerated by significant technological breakthroughs, particularly in data analytics and artificial intelligence, which are enabling more precise market forecasting and personalized client services. Strategic partnerships between traditional brokerages and prop-tech firms are crucial for integrating innovative solutions and expanding service portfolios. Market expansion strategies, including entry into underserved regions and the development of specialized service offerings for niche segments like build-to-rent or senior living, are also acting as key growth accelerators. The increasing institutional investment in European real estate continues to drive demand for professional brokerage services.

Key Players Shaping the Europe Real Estate Brokerage Market Market

- Jones Lang LaSalle (JLL)

- CBRE Group

- Colliers International

- Savills

- Knight Frank

- Axel Springer SE

- Lloyds Property Group

- Foxtons

- Idealista

- Engel & Völkers

- 7 3 Other Companies

Notable Milestones in Europe Real Estate Brokerage Market Sector

- March 2024: Newmark Group Inc. inaugurated its flagship office in Paris, France, focusing on capital markets and leasing, bolstering its presence in the European commercial real estate sector.

- January 2024: eXp Realty extended its luxury real estate initiative, eXp Luxury, into key European markets including Portugal, Spain, France, Italy, Germany, and Greece, signifying an expansion of global luxury real estate services.

In-Depth Europe Real Estate Brokerage Market Market Outlook

The future outlook for the Europe Real Estate Brokerage Market is exceptionally positive, driven by a confluence of sustained economic recovery, increasing urbanization, and a persistent demand for both residential and commercial properties. Growth accelerators such as advanced prop-tech integration, strategic alliances, and a growing emphasis on sustainable real estate practices will further propel market expansion. The market is poised to witness a significant increase in transaction volumes and value, with opportunities for brokerages to diversify their service offerings and expand their geographical reach. Strategic foresight and adaptability to evolving market dynamics will be key for stakeholders to capitalize on the immense potential within this thriving sector.

Europe Real Estate Brokerage Market Segmentation

-

1. Type

- 1.1. Residential

- 1.2. Non-residential

-

2. Service

- 2.1. Sales

- 2.2. Rental

Europe Real Estate Brokerage Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Real Estate Brokerage Market Regional Market Share

Geographic Coverage of Europe Real Estate Brokerage Market

Europe Real Estate Brokerage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Economic Stability and Growth; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Economic Stability and Growth; Technological Advancements

- 3.4. Market Trends

- 3.4.1. Legislative Changes Drive a Surge in French Real Estate Interest Among British Buyers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Real Estate Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Residential

- 5.1.2. Non-residential

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Sales

- 5.2.2. Rental

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Jones Lang LaSalle (JLL)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CBRE Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Colliers International

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Savills

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Knight Frank

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Axel Springer SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Lloyds Property Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Foxtons

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Idealista

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Engel & Völkers**List Not Exhaustive 7 3 Other Companie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Jones Lang LaSalle (JLL)

List of Figures

- Figure 1: Europe Real Estate Brokerage Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Real Estate Brokerage Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Real Estate Brokerage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Real Estate Brokerage Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Europe Real Estate Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 4: Europe Real Estate Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 5: Europe Real Estate Brokerage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Real Estate Brokerage Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Europe Real Estate Brokerage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Europe Real Estate Brokerage Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Europe Real Estate Brokerage Market Revenue Million Forecast, by Service 2020 & 2033

- Table 10: Europe Real Estate Brokerage Market Volume Billion Forecast, by Service 2020 & 2033

- Table 11: Europe Real Estate Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Europe Real Estate Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Real Estate Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe Real Estate Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe Real Estate Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Real Estate Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: France Europe Real Estate Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Europe Real Estate Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Real Estate Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Real Estate Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Real Estate Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Real Estate Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Real Estate Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Real Estate Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Real Estate Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Real Estate Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Real Estate Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe Real Estate Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe Real Estate Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Real Estate Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Real Estate Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe Real Estate Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe Real Estate Brokerage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe Real Estate Brokerage Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Real Estate Brokerage Market?

The projected CAGR is approximately 3.10%.

2. Which companies are prominent players in the Europe Real Estate Brokerage Market?

Key companies in the market include Jones Lang LaSalle (JLL), CBRE Group, Colliers International, Savills, Knight Frank, Axel Springer SE, Lloyds Property Group, Foxtons, Idealista, Engel & Völkers**List Not Exhaustive 7 3 Other Companie.

3. What are the main segments of the Europe Real Estate Brokerage Market?

The market segments include Type, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 218.60 Million as of 2022.

5. What are some drivers contributing to market growth?

Economic Stability and Growth; Technological Advancements.

6. What are the notable trends driving market growth?

Legislative Changes Drive a Surge in French Real Estate Interest Among British Buyers.

7. Are there any restraints impacting market growth?

Economic Stability and Growth; Technological Advancements.

8. Can you provide examples of recent developments in the market?

March 2024: Newmark Group Inc., a commercial real estate advisor, inaugurated its flagship office in Paris, France. The company, known for its services to institutional investors, global corporations, and property owners, appointed industry veterans Francois Blin and Emmanuel Frénot to spearhead the Paris team. Situated at 32 Boulevard Haussmann 75009, in the 9th arrondissement, the office officially opened on March 11, 2024, and is expected to emphasize capital markets and leasing.January 2024: eXp Realty, a luxury real estate brokerage under eXp World Holdings Inc., unveiled the extension of its esteemed luxury real estate initiative, eXp Luxury, into critical European markets. These markets include Portugal, Spain, France, Italy, Germany, and Greece. This expansion is expected to bolster eXp Realty's international footprint and reaffirm its dedication to setting new global luxury real estate benchmarks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Real Estate Brokerage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Real Estate Brokerage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Real Estate Brokerage Market?

To stay informed about further developments, trends, and reports in the Europe Real Estate Brokerage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence