Key Insights

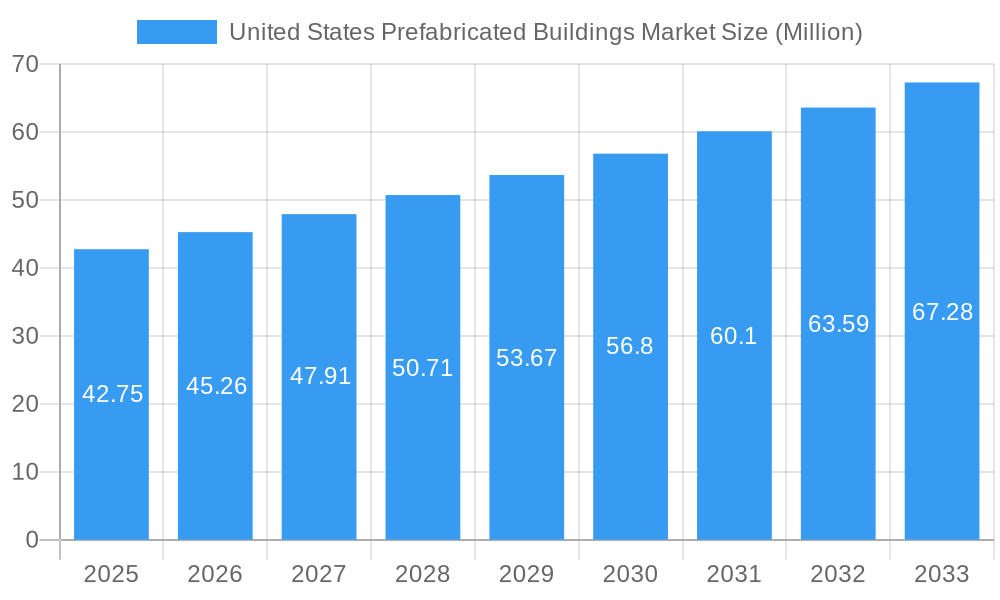

The United States prefabricated buildings market is poised for robust expansion, currently valued at approximately $40.91 billion. This impressive figure is underpinned by a compound annual growth rate (CAGR) of 5.94%, signaling a sustained upward trajectory through 2033. A significant driver for this growth is the increasing demand for efficient and cost-effective construction solutions across both residential and commercial sectors. The prefab industry is adept at addressing labor shortages, project timelines, and budget constraints, making it an attractive alternative to traditional building methods. Furthermore, advancements in manufacturing technologies, including greater customization options and improved aesthetics, are breaking down previous perceptions of modular construction. The market's segmentation reflects this broad applicability, with concrete, glass, and timber emerging as key material types, while residential and commercial applications lead the demand. Companies like American Buildings Company, Morton Buildings Inc., and Skyline Champion Corporation are at the forefront, innovating and scaling to meet this burgeoning market.

United States Prefabricated Buildings Market Market Size (In Million)

The prefabricated buildings market in the United States is also influenced by evolving consumer preferences and regulatory support. The emphasis on sustainability is a notable trend, with many prefab manufacturers incorporating eco-friendly materials and energy-efficient designs into their offerings. This aligns with broader environmental initiatives and appeals to a growing segment of environmentally conscious buyers. While the market enjoys strong tailwinds, potential restraints include initial perception challenges regarding quality and durability, though these are rapidly diminishing with improved quality control and showcase projects. Supply chain disruptions and fluctuating material costs could also present temporary hurdles. However, the inherent advantages of speed, predictability, and reduced waste in prefabricated construction are expected to outweigh these challenges, ensuring continued market dominance and innovation in the coming years. The United States is a leading region, and its market dynamics will significantly shape global trends in modular and off-site construction.

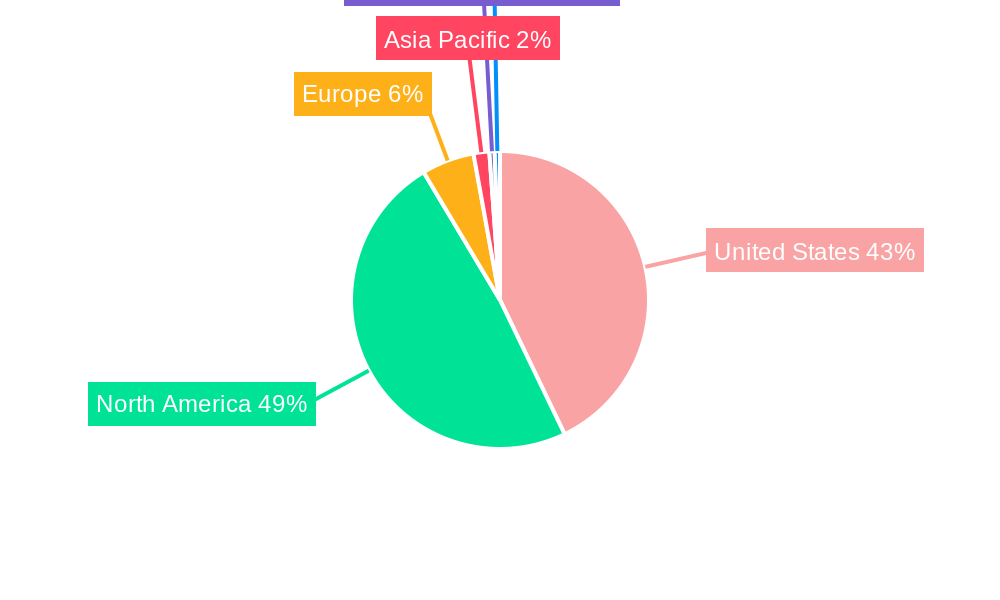

United States Prefabricated Buildings Market Company Market Share

United States Prefabricated Buildings Market: Comprehensive Market Analysis & Forecast 2019–2033

This in-depth report provides a definitive analysis of the United States prefabricated buildings market, offering critical insights into its dynamics, growth trends, and future trajectory. With a detailed study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period of 2025–2033, this report equips industry professionals with the data and strategic perspectives needed to navigate this rapidly evolving sector. We delve into parent and child market segments, explore material innovations, and highlight key industry developments, making this report an indispensable resource for manufacturers, suppliers, developers, and investors in the U.S. prefabricated construction landscape. All values are presented in Million units.

United States Prefabricated Buildings Market Market Dynamics & Structure

The United States prefabricated buildings market is characterized by a moderately concentrated structure, with a few key players holding significant market share, yet fostering a competitive environment driven by technological innovation and evolving consumer demands. Technological advancements in design software, manufacturing automation, and sustainable material integration are continuously reshaping the industry, leading to increased efficiency and reduced construction times. Regulatory frameworks, while providing a baseline for safety and quality, can also present barriers to entry for novel technologies and designs, requiring stringent adherence to building codes and standards. The market also faces pressure from competitive product substitutes, such as traditional site-built construction and other modular solutions, necessitating continuous differentiation through cost-effectiveness, quality, and speed. End-user demographics are shifting, with a growing preference for eco-friendly and cost-efficient housing solutions driving residential adoption, while commercial sectors increasingly leverage prefabricated structures for their speed of deployment and scalability. Mergers and acquisitions (M&A) trends are evident as larger companies seek to expand their capabilities, geographical reach, and product portfolios, consolidating market power and fostering greater integration within the supply chain.

- Market Concentration: Dominated by a blend of large established firms and agile niche players.

- Technological Innovation Drivers: Advancements in BIM, robotics in manufacturing, and development of sustainable materials.

- Regulatory Frameworks: Stringent building codes and zoning laws influencing design and deployment.

- Competitive Product Substitutes: Traditional construction, other modular building types.

- End-User Demographics: Growing demand from millennials for affordable housing, increasing adoption by businesses for operational flexibility.

- M&A Trends: Strategic acquisitions aimed at market consolidation and capability enhancement.

United States Prefabricated Buildings Market Growth Trends & Insights

The United States prefabricated buildings market is on a robust growth trajectory, propelled by a confluence of economic, technological, and societal factors. The market size is anticipated to witness significant expansion throughout the forecast period, driven by increasing adoption rates across diverse applications. Technological disruptions, such as the integration of smart building technologies and advanced manufacturing techniques, are enhancing the appeal of prefabricated solutions by improving quality, customization, and sustainability. Consumer behavior shifts are pivotal, with a growing preference for faster construction timelines, cost predictability, and environmentally conscious building practices. The inherent benefits of prefabricated construction, including reduced on-site waste, improved quality control, and minimized weather-related delays, are resonating strongly with both residential and commercial clients. Furthermore, government initiatives promoting affordable housing and sustainable development indirectly bolster the demand for prefabricated structures.

The market penetration of prefabricated buildings is steadily increasing as awareness of its advantages grows. Innovations in materials like cross-laminated timber (CLT) and high-performance concrete are expanding the design possibilities and structural integrity of prefabricated modules. The digitalization of the construction industry, encompassing Building Information Modeling (BIM) and advanced project management software, further streamlines the design, manufacturing, and assembly processes, leading to greater accuracy and efficiency. The evolving workforce dynamics also play a role, with prefabricated construction offering a more controlled and safer work environment compared to traditional on-site building. As the industry matures, we can expect to see a greater emphasis on circular economy principles, with prefabricated components designed for disassembly and reuse. This report leverages comprehensive market data and expert analysis to provide a detailed understanding of these growth trends and their implications for market participants.

Dominant Regions, Countries, or Segments in United States Prefabricated Buildings Market

The United States prefabricated buildings market's dominance is a multifaceted landscape, with specific regions, countries, and segments exhibiting significant growth drivers. Among the Material Types, Metal prefabricated buildings consistently lead due to their durability, cost-effectiveness, and versatility, finding widespread application in commercial and industrial sectors. The Timber segment is experiencing a notable surge, particularly in residential applications, driven by a growing demand for sustainable and aesthetically pleasing structures. Concrete prefabricated buildings remain a strong contender, especially for larger infrastructure projects and commercial developments requiring robust structural integrity. The Residential application segment is a primary growth engine, fueled by the persistent demand for affordable housing solutions and the inherent speed and efficiency of modular construction for single-family homes and multi-unit dwellings. The Commercial application segment also shows robust growth, with businesses increasingly opting for prefabricated structures for offices, retail spaces, and hospitality facilities due to rapid deployment capabilities and cost advantages.

Key drivers for dominance include a combination of economic policies, infrastructure development, and evolving consumer preferences. Regions with robust economic activity and a strong construction pipeline tend to exhibit higher adoption rates. For instance, areas experiencing population growth and subsequent housing shortages often see a significant uptake in prefabricated residential units. Furthermore, proactive government policies aimed at stimulating construction and promoting sustainable building practices can significantly influence regional market performance. The growing awareness and preference for green building solutions are particularly benefiting the timber and other sustainable material segments. The adaptability of prefabricated structures to various climatic conditions and architectural styles also contributes to their widespread adoption across different geographical areas. Understanding these regional and segment-specific dynamics is crucial for strategic market planning and investment.

- Leading Material Type: Metal, followed by a strong resurgence in Timber and continued strength in Concrete.

- Dominant Application: Residential applications are outpacing Commercial, though both show significant growth.

- Key Growth Drivers:

- Affordable housing initiatives and demand.

- Need for rapid construction in commercial sectors.

- Growing preference for sustainable building materials.

- Technological advancements improving quality and design.

- Favorable economic conditions in key regions.

United States Prefabricated Buildings Market Product Landscape

The product landscape within the United States prefabricated buildings market is characterized by continuous innovation and an expanding array of applications. Manufacturers are increasingly focusing on offering customizable designs that cater to diverse aesthetic preferences and functional requirements. Advanced manufacturing techniques, including precision robotics and sophisticated assembly lines, ensure high-quality finishes and structural integrity. Product performance metrics are being redefined by advancements in insulation, energy efficiency, and durability. Innovations in materials, such as self-healing concrete and advanced composite panels, are pushing the boundaries of what prefabricated structures can achieve. The integration of smart building technologies, enabling features like automated climate control and energy monitoring, is also becoming a significant differentiator. This evolution in product offerings is key to meeting the increasingly sophisticated demands of the market.

Key Drivers, Barriers & Challenges in United States Prefabricated Buildings Market

The United States prefabricated buildings market is propelled by several key drivers, including the ever-growing demand for affordable housing, the need for faster construction timelines, and increasing environmental consciousness. Technological advancements in manufacturing processes and materials are significantly enhancing the quality, efficiency, and sustainability of prefabricated structures. Government incentives and supportive policies aimed at promoting construction and sustainable development also play a crucial role.

However, the market faces notable barriers and challenges. Stiff competition from traditional construction methods, perceived limitations in design flexibility (though rapidly diminishing), and the need for widespread public and industry education about the benefits of modular construction remain significant hurdles. Supply chain disruptions, particularly concerning raw material availability and logistics, can impact production schedules and costs. Navigating complex and sometimes inconsistent local zoning regulations and building codes across different municipalities can also present a challenge for widespread adoption.

Emerging Opportunities in United States Prefabricated Buildings Market

Emerging opportunities in the United States prefabricated buildings market are largely centered around untapped potential in specialized sectors and evolving consumer preferences. The increasing demand for sustainable and energy-efficient buildings presents a significant avenue for growth, particularly for prefabricated structures utilizing eco-friendly materials like timber and recycled components. The burgeoning need for flexible and adaptable spaces, such as co-living units, temporary medical facilities, and rapid deployment commercial spaces, also offers substantial untapped potential. Furthermore, advancements in off-site manufacturing techniques are enabling the production of more complex and architecturally diverse prefabricated buildings, opening up new markets previously dominated by site-built construction. The growing acceptance of prefabricated solutions for higher-end residential and commercial projects signals a shift in market perception and a fertile ground for innovation.

Growth Accelerators in the United States Prefabricated Buildings Market Industry

Several catalysts are accelerating growth within the United States prefabricated buildings market. The continuous technological breakthroughs in automation and 3D printing are leading to more efficient manufacturing processes, reduced costs, and enhanced design capabilities. Strategic partnerships between prefabricated builders, material suppliers, and technology providers are fostering innovation and expanding market reach. The increasing adoption of Building Information Modeling (BIM) and other digital tools is streamlining the entire construction lifecycle, from design to installation, improving accuracy and reducing waste. Furthermore, a growing number of companies are recognizing the long-term benefits of prefabricated construction, including faster ROI and enhanced sustainability, leading to increased investment and market expansion strategies.

Key Players Shaping the United States Prefabricated Buildings Market Market

- American Buildings Company

- Morton Buildings Inc

- The High Construction Company

- Homette Corporation List Not Exhaustive

- SG Modular

- Plant Prefab

- Skyline Champion Corporation

- Westchester Modular Homes Inc

- Varco Pruden

- Affinity Building Systems

- Z Modular

Notable Milestones in United States Prefabricated Buildings Market Sector

- May 2023: Morton Buildings expanded its business with a new 67,429-square-foot manufacturing plant in Pocatello Regional Airport Business Park. This facility, Morton's eighth, will enhance their ability to serve projects in Idaho, Montana, Washington, Wyoming, Colorado, Utah, and surrounding areas, meeting current and future building demands.

- May 2023: WillScot Mobile Mini announced the acquisitions of US-based Hallwood Modular Buildings and Canada-based BRT Structures. These strategic purchases are aimed at expanding their specialty modular fleet and solidifying their position as a leader in blast-resistant modules across North America.

In-Depth United States Prefabricated Buildings Market Market Outlook

The future outlook for the United States prefabricated buildings market is exceptionally promising, driven by a powerful combination of evolving market demands and continuous technological advancements. Growth accelerators, including the increasing urgency for sustainable construction practices and the persistent need for affordable and rapidly deployable housing solutions, will continue to fuel market expansion. Innovations in materials science and off-site manufacturing are enabling the creation of more sophisticated, aesthetically diverse, and high-performance prefabricated structures, breaking down previous design limitations. Strategic collaborations and an increasing investment in digital construction technologies will further optimize efficiency and reduce costs, making prefabricated options even more competitive. This positive trajectory indicates significant future potential and highlights the strategic importance of embracing innovation and adaptability within this dynamic market.

United States Prefabricated Buildings Market Segmentation

-

1. Material Type

- 1.1. Concrete

- 1.2. Glass

- 1.3. Metal

- 1.4. Timber

- 1.5. Other Material Types

-

2. Application

- 2.1. Residential

- 2.2. Commercial

- 2.3. Other Ap

United States Prefabricated Buildings Market Segmentation By Geography

- 1. United States

United States Prefabricated Buildings Market Regional Market Share

Geographic Coverage of United States Prefabricated Buildings Market

United States Prefabricated Buildings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for prefab buildings; Surge in demand from residential segment

- 3.3. Market Restrains

- 3.3.1. Lack of knowledge about modular building; Unreliability of modular building in earthquake-prone areas

- 3.4. Market Trends

- 3.4.1. The Trend of BIM in the Prefab Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Prefabricated Buildings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Concrete

- 5.1.2. Glass

- 5.1.3. Metal

- 5.1.4. Timber

- 5.1.5. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Other Ap

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 American Buildings Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Morton Buildings Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The High Construction Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Homette Corporation **List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SG Modular

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Plant Prefab

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Skyline Champion Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Westchester Modular Homes Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Varco Pruden

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Affinity Building Systems

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Z Modular

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 American Buildings Company

List of Figures

- Figure 1: United States Prefabricated Buildings Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Prefabricated Buildings Market Share (%) by Company 2025

List of Tables

- Table 1: United States Prefabricated Buildings Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: United States Prefabricated Buildings Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: United States Prefabricated Buildings Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: United States Prefabricated Buildings Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 5: United States Prefabricated Buildings Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: United States Prefabricated Buildings Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Prefabricated Buildings Market?

The projected CAGR is approximately 5.94%.

2. Which companies are prominent players in the United States Prefabricated Buildings Market?

Key companies in the market include American Buildings Company, Morton Buildings Inc, The High Construction Company, Homette Corporation **List Not Exhaustive, SG Modular, Plant Prefab, Skyline Champion Corporation, Westchester Modular Homes Inc, Varco Pruden, Affinity Building Systems, Z Modular.

3. What are the main segments of the United States Prefabricated Buildings Market?

The market segments include Material Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 40.91 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for prefab buildings; Surge in demand from residential segment.

6. What are the notable trends driving market growth?

The Trend of BIM in the Prefab Sector.

7. Are there any restraints impacting market growth?

Lack of knowledge about modular building; Unreliability of modular building in earthquake-prone areas.

8. Can you provide examples of recent developments in the market?

May 2023: Morton Buildings has expanded its business in a new 67,429-square-foot manufacturing plant in Pocatello Regional Airport Business Park. The facility in Pocatello is Morton’s eighth manufacturing plant. It will stock the business’s construction projects in Idaho, Montana, Washington, Wyoming, Colorado, Utah, and other surrounding areas so that current and future building needs are met.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Prefabricated Buildings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Prefabricated Buildings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Prefabricated Buildings Market?

To stay informed about further developments, trends, and reports in the United States Prefabricated Buildings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence