Key Insights

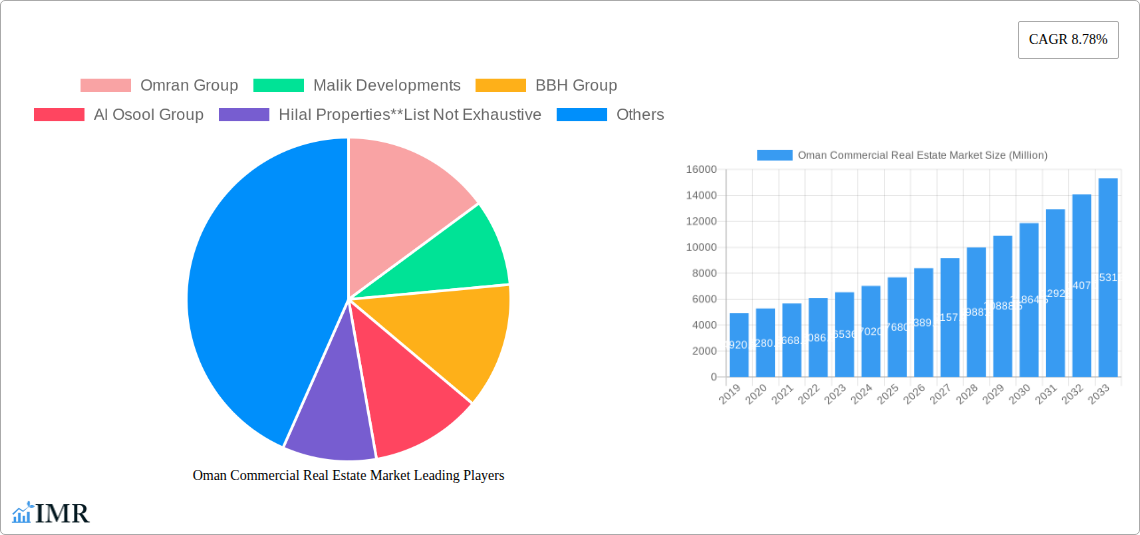

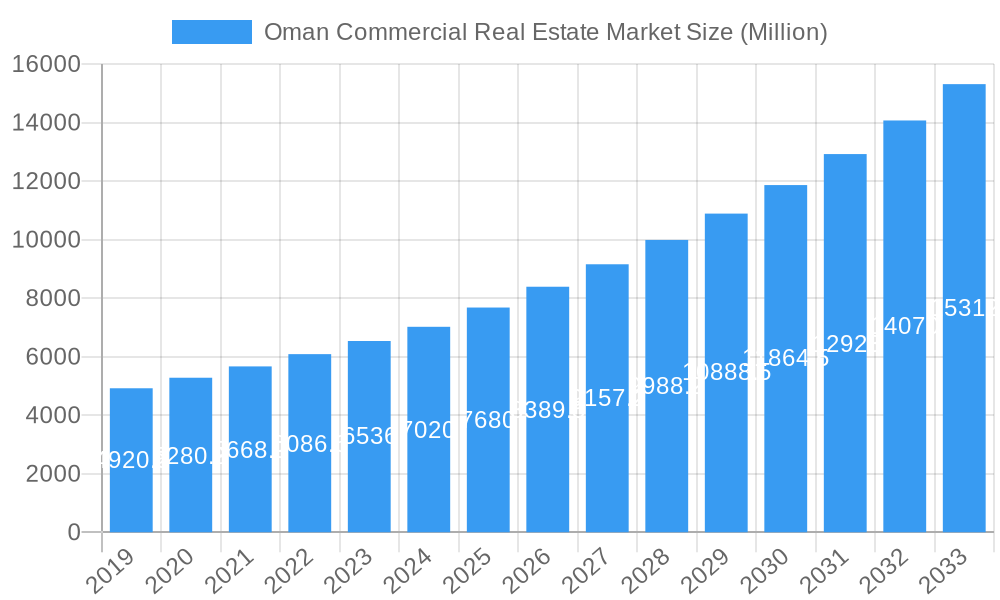

The Oman Commercial Real Estate Market is poised for substantial growth, projected to reach a market size of $7.68 billion by 2025. This robust expansion is driven by a compelling compound annual growth rate (CAGR) of 8.78% anticipated from 2019 to 2033. Key drivers fueling this surge include significant government investments in infrastructure development and diversification initiatives under Oman Vision 2040, aiming to reduce reliance on oil revenues. These initiatives are fostering a more dynamic economic landscape, attracting foreign direct investment and spurring demand across various commercial property segments. The ongoing development of key cities such as Muscat, Sohar, and Dhofar, with their burgeoning economic activities and tourism potential, will be central to this growth trajectory. Emerging trends like the increasing demand for modern office spaces, the expansion of the retail and logistics sectors to support e-commerce growth, and a growing interest in hospitality and multi-family residential properties are shaping the market's future.

Oman Commercial Real Estate Market Market Size (In Billion)

The market's dynamism is further underscored by the diverse range of players contributing to its evolution. Prominent companies like Omran Group, Malik Developments, BBH Group, and Al Osool Group are actively involved in developing and managing a variety of commercial properties, from large-scale integrated projects to specialized segments. While opportunities abound, potential restraints such as fluctuating global economic conditions and regional geopolitical uncertainties may present challenges. However, the underlying strong demand, coupled with proactive government policies supporting economic diversification and real estate development, is expected to mitigate these risks. The market's segmentation into Offices, Retail, Industrial, Logistics, Multi-family, and Hospitality sectors reflects a maturing and diversifying real estate ecosystem, catering to a broad spectrum of investor and tenant needs.

Oman Commercial Real Estate Market Company Market Share

Oman Commercial Real Estate Market Report: Strategic Insights, Growth Trends, and Key Players (2019–2033)

This comprehensive report provides an in-depth analysis of the Oman commercial real estate market, covering the historical period of 2019–2024, the base year of 2025, and a detailed forecast extending to 2033. We delve into market dynamics, growth trends, dominant regions, product landscape, key drivers, barriers, opportunities, accelerators, key players, and notable milestones. This report is tailored for industry professionals seeking actionable insights into the evolving Oman real estate investment, Oman property market, and GCC commercial property sectors.

Oman Commercial Real Estate Market Market Dynamics & Structure

The Oman commercial real estate market exhibits a developing concentration, with key players like Omran Group, Malik Developments, and BBH Group spearheading major projects. Technological innovation is driven by advancements in construction technology and smart building solutions, though adoption barriers persist due to initial investment costs. Regulatory frameworks, particularly those overseen by the Ministry of Housing and Urban Planning, are increasingly supportive of foreign investment and sustainable development, influencing market accessibility. Competitive product substitutes, while present, are largely differentiated by location, amenities, and developer reputation. End-user demographics are shifting towards a younger, more urbanized population seeking modern, flexible workspaces and a growing demand for integrated mixed-use developments. Mergers and acquisitions (M&A) trends are gradually emerging, with strategic alliances being formed to leverage expertise and capital for large-scale projects. The market is characterized by a strong emphasis on infrastructure development as a key determinant of future growth.

- Market Concentration: Emerging, with a few dominant developers leading significant projects.

- Technological Innovation Drivers: Smart building technologies, sustainable construction methods, and digital property management.

- Regulatory Frameworks: Supportive government policies promoting foreign investment and development, with evolving urban planning guidelines.

- Competitive Product Substitutes: Differentiated by location, quality of construction, and integrated amenities.

- End-User Demographics: Growing demand for modern, flexible office spaces, retail experiences, and residential options.

- M&A Trends: Nascent, with increasing potential for strategic partnerships and acquisitions.

Oman Commercial Real Estate Market Growth Trends & Insights

The Oman commercial real estate market is poised for robust growth, driven by strategic economic diversification initiatives and a burgeoning tourism sector. The market size is projected to expand significantly, with an estimated CAGR of XX% between 2025 and 2033. Adoption rates for innovative real estate technologies, such as proptech and sustainable building materials, are on an upward trajectory. Technological disruptions are largely focused on enhancing efficiency in construction, property management, and tenant experience, with an increasing integration of AI and IoT solutions. Consumer behavior shifts are evident, with a growing preference for mixed-use developments offering convenience and lifestyle amenities. Businesses are increasingly seeking flexible workspace solutions, driving demand for co-working spaces and adaptable office layouts. The retail segment is witnessing a transformation towards experiential shopping and omnichannel integration, while the logistics sector benefits from Oman's strategic geographical location and port infrastructure. Hospitality developments are capitalizing on the nation's tourism potential.

- Market Size Evolution: Significant projected expansion, driven by economic diversification and infrastructure development.

- Adoption Rates: Increasing adoption of proptech, smart building solutions, and sustainable practices.

- Technological Disruptions: Focus on efficiency, AI integration, and IoT in property management and construction.

- Consumer Behavior Shifts: Growing demand for mixed-use environments, flexible workspaces, and experiential retail.

- Market Penetration: Expanding penetration of international brands and modern development concepts.

Dominant Regions, Countries, or Segments in Oman Commercial Real Estate Market

The Muscat commercial real estate market stands as the dominant region driving growth within Oman. This capital city benefits from a concentrated economic activity, a well-established infrastructure, and a higher influx of foreign direct investment. Sohar is emerging as a significant industrial and logistics hub, attracting considerable investment due to its strategic port and industrial zone development. Dhofar, with its unique tourism potential and planned infrastructure upgrades, presents a substantial growth area for hospitality and mixed-use developments.

Within the segment breakdown, the Oman office market is experiencing steady demand, fueled by business expansion and the need for modern workspaces. The Oman retail real estate market is undergoing a transformation, with a shift towards modern retail parks and experiential centers. The Oman industrial and logistics real estate market is witnessing exponential growth, driven by Oman's role as a regional trade gateway and the government's focus on diversifying the economy beyond oil. The Oman multi-family real estate sector is seeing increased development to cater to a growing population and expatriate workforce. The Oman hospitality real estate sector is crucial for tourism growth, with ongoing investments in hotels and resorts.

- Dominant Region: Muscat, driven by economic concentration and infrastructure.

- Key Growth Cities:

- Muscat: Offices, Retail, Hospitality.

- Sohar: Industrial, Logistics.

- Dhofar: Hospitality, Mixed-use, Tourism-driven developments.

- Dominant Segments:

- Industrial & Logistics: Significant growth due to strategic location and trade focus.

- Hospitality: Capitalizing on tourism vision and diversification.

- Offices: Steady demand for modern and flexible workspaces.

- Market Share: Muscat commands the largest market share, followed by emerging growth in Sohar and Dhofar.

- Growth Potential: High potential in Industrial & Logistics due to infrastructure investments and in Hospitality due to tourism development.

Oman Commercial Real Estate Market Product Landscape

The Oman commercial real estate product landscape is characterized by an increasing emphasis on modern, sustainable, and mixed-use developments. Product innovations include the integration of smart building technologies for energy efficiency and enhanced tenant experience, such as automated climate control and smart security systems. Applications range from flexible co-working spaces designed to accommodate evolving work styles to high-street retail outlets and large-scale shopping malls catering to diverse consumer needs. Industrial and logistics properties are being developed with advanced features for efficient warehousing and distribution. Performance metrics are increasingly benchmarked against international standards for sustainability, functionality, and return on investment. Unique selling propositions often revolve around prime locations, high-quality construction, and integrated amenities that enhance the lifestyle and business operations of occupants. Technological advancements are central to offering energy-efficient buildings and digitally-enabled property management.

Key Drivers, Barriers & Challenges in Oman Commercial Real Estate Market

Key Drivers: The Oman commercial real estate market is propelled by several key drivers. Government initiatives, such as Vision 2040, are a significant catalyst, fostering economic diversification and attracting foreign investment. Infrastructure development, including new road networks and port expansions, enhances connectivity and accessibility, making the market more attractive. The growth of the tourism sector is a major driver for hospitality and retail real estate. Increased foreign direct investment is leading to greater demand for office spaces and commercial developments. Technological advancements in construction and property management are improving efficiency and sustainability.

Barriers & Challenges: Despite strong growth potential, the market faces several challenges. Perceived market saturation in certain segments and the need for more diversified product offerings can act as a restraint. Regulatory hurdles and the complexity of obtaining permits can slow down project development. Supply chain disruptions and rising construction costs can impact project feasibility and timelines. Competition from neighboring GCC markets, while also an opportunity, poses a challenge in attracting and retaining investment. The need for skilled labor in specialized construction and property management roles is also a consideration.

- Drivers: Vision 2040, Infrastructure development, Tourism growth, FDI, Technological advancements.

- Barriers & Challenges: Market saturation in specific segments, Regulatory complexities, Supply chain issues, Rising construction costs, Competition from regional markets, Skilled labor availability.

Emerging Opportunities in Oman Commercial Real Estate Market

Emerging opportunities in the Oman commercial real estate market lie in the development of sustainable and green buildings, aligning with global environmental trends and national sustainability goals. The growing demand for mixed-use developments that integrate residential, retail, and office spaces offers significant potential for creating vibrant community hubs. Untapped markets in emerging cities outside Muscat, particularly in areas benefiting from new infrastructure projects, present considerable growth prospects. Innovative applications in proptech, such as smart property management systems and virtual property tours, are gaining traction. Evolving consumer preferences for experiential retail and lifestyle-oriented hospitality venues create demand for unique and engaging commercial spaces. The development of specialized logistics facilities to support e-commerce and regional trade also presents a lucrative opportunity.

Growth Accelerators in the Oman Commercial Real Estate Market Industry

Several catalysts are accelerating the growth of the Oman commercial real estate industry. Strategic partnerships between government entities like the Oman Investment Authority (OIA) and private developers are crucial for undertaking large-scale, transformative projects. Technological breakthroughs in construction, such as modular building and advanced materials, are improving efficiency and reducing project timelines, thereby accelerating development. Market expansion strategies, including targeted international marketing campaigns to attract investors and businesses, are vital. The government's commitment to streamlining business processes and offering incentives for foreign investment further fuels growth. The development of integrated tourism and business hubs is expected to drive demand across multiple commercial real estate segments.

Key Players Shaping the Oman Commercial Real Estate Market Market

- Omran Group

- Malik Developments

- BBH Group

- Al Osool Group

- Hilal Properties

- Al Tamman Real Estate

- Alfardan Group

- WUJHA

- Shanfari Group

- Al-Taher Group

- Hamptons International & Partners LLC

- Diamonds Real Estate

Notable Milestones in Oman Commercial Real Estate Market Sector

- November 2023: The long-delayed Blue City project in Oman was relaunched under the auspices of the Grand Blue City Development Company, backed by the Oman Investment Authority (OIA). Known by the Arabic acronym (BAT), this relaunch signifies a renewed commitment to large-scale integrated development.

- July 2023: Oman Tourism Development Company (Omran) initiated the search for a multidisciplinary consultant to develop a concept masterplan for a significant site and a detailed masterplan and design guidelines for Madinat Al Irvine East. This mixed-use town center, anticipated to cover 175,000 square meters, aims to bolster Oman's position as a premier MICE and business tourism destination.

In-Depth Oman Commercial Real Estate Market Market Outlook

The Oman commercial real estate market outlook is exceptionally positive, fueled by ambitious national development plans and strategic investments. Growth accelerators such as the continued diversification of the economy beyond oil, coupled with substantial infrastructure upgrades, will foster sustained demand across all commercial segments. The strategic vision to position Oman as a regional hub for business, logistics, and tourism will drive significant opportunities in industrial, hospitality, and office spaces. Emerging trends like sustainable development and the integration of smart technologies will shape future projects, attracting environmentally conscious investors and occupiers. The market is well-positioned for robust growth, offering significant strategic opportunities for stakeholders seeking to capitalize on Oman's evolving economic landscape and attractive investment climate.

Oman Commercial Real Estate Market Segmentation

-

1. Type

- 1.1. Offices

- 1.2. Retail

- 1.3. Industrial

- 1.4. Logistics

- 1.5. Multi-family

- 1.6. Hospitality

-

2. Key Cities

- 2.1. Muscat

- 2.2. Sohar

- 2.3. Dhofar

Oman Commercial Real Estate Market Segmentation By Geography

- 1. Oman

Oman Commercial Real Estate Market Regional Market Share

Geographic Coverage of Oman Commercial Real Estate Market

Oman Commercial Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rise In Population4.; Foreign Investments

- 3.3. Market Restrains

- 3.3.1. 4.; High Cost

- 3.4. Market Trends

- 3.4.1. Hospitality sector witnessing lucrative growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Commercial Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Offices

- 5.1.2. Retail

- 5.1.3. Industrial

- 5.1.4. Logistics

- 5.1.5. Multi-family

- 5.1.6. Hospitality

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Muscat

- 5.2.2. Sohar

- 5.2.3. Dhofar

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Omran Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Malik Developments

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BBH Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Al Osool Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hilal Properties**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Al Tamman Real Estate

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Alfardan Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 WUJHA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shanfari Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Al-Taher Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hamptons International & Partners LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Diamonds Real Estate

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Omran Group

List of Figures

- Figure 1: Oman Commercial Real Estate Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Oman Commercial Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Oman Commercial Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Oman Commercial Real Estate Market Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 3: Oman Commercial Real Estate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Oman Commercial Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Oman Commercial Real Estate Market Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 6: Oman Commercial Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Commercial Real Estate Market?

The projected CAGR is approximately 8.78%.

2. Which companies are prominent players in the Oman Commercial Real Estate Market?

Key companies in the market include Omran Group, Malik Developments, BBH Group, Al Osool Group, Hilal Properties**List Not Exhaustive, Al Tamman Real Estate, Alfardan Group, WUJHA, Shanfari Group, Al-Taher Group, Hamptons International & Partners LLC, Diamonds Real Estate.

3. What are the main segments of the Oman Commercial Real Estate Market?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.68 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rise In Population4.; Foreign Investments.

6. What are the notable trends driving market growth?

Hospitality sector witnessing lucrative growth.

7. Are there any restraints impacting market growth?

4.; High Cost.

8. Can you provide examples of recent developments in the market?

November 2023: The long-delayed Blue City project in Oman was relaunched under the auspices of the Grand Blue City Development Company, which is backed by the sovereign wealth fund Oman Investment Authority (OIA). The project is also known by the Arabic acronym (BAT).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Commercial Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Commercial Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Commercial Real Estate Market?

To stay informed about further developments, trends, and reports in the Oman Commercial Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence