Key Insights

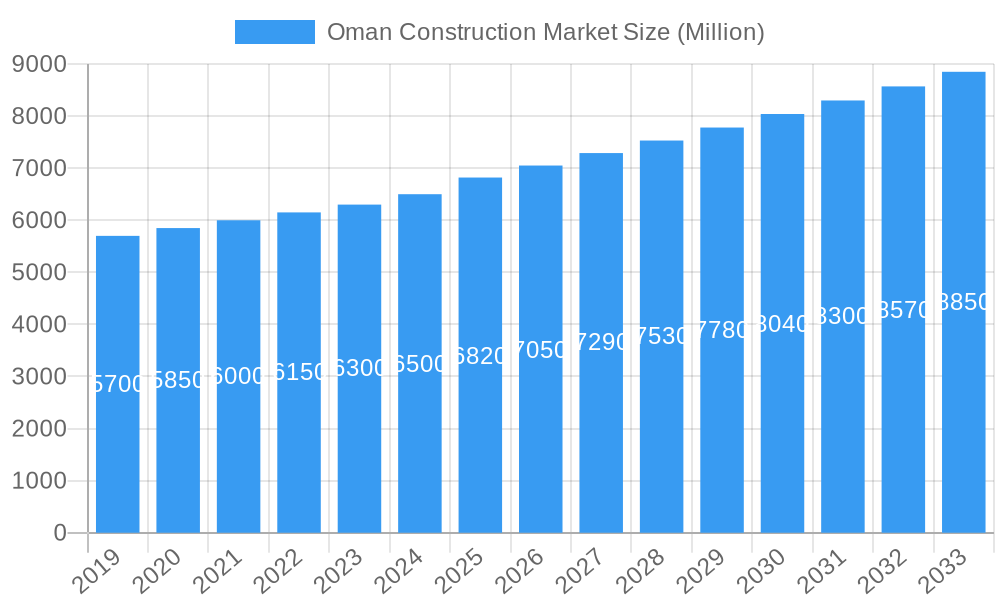

The Oman construction market is poised for steady growth, with an estimated market size of $6.82 million in 2025, projected to expand at a Compound Annual Growth Rate (CAGR) of 3.30% through 2033. This upward trajectory is primarily fueled by significant government investment in infrastructure development, aiming to diversify the nation's economy away from oil dependence and enhance its global connectivity. Key drivers include the ongoing development of transportation networks, such as new road projects and port expansions, alongside substantial investments in the energy and utility sectors, including renewable energy initiatives and enhanced oil and gas infrastructure. Furthermore, a growing focus on sustainable and smart city projects is stimulating demand for advanced construction techniques and materials, contributing to the market's overall expansion. The residential and commercial construction sectors are also expected to witness moderate growth, driven by an increasing population and a rising demand for modern housing and commercial spaces.

Oman Construction Market Market Size (In Billion)

The market's growth is strategically supported by various trends, including the increasing adoption of Building Information Modeling (BIM) for enhanced project efficiency and collaboration, and a growing emphasis on green building practices to meet environmental regulations and sustainability goals. Despite these positive indicators, the market faces certain restraints. Fluctuations in global oil prices can impact government spending and private sector investment, potentially leading to project delays or cancellations. Additionally, a shortage of skilled labor and the need for specialized expertise in emerging construction technologies present challenges. However, the Omani government's proactive approach to economic diversification and its commitment to developing robust infrastructure are expected to largely mitigate these restraints, ensuring a robust and dynamic construction landscape for the foreseeable future. Key players like Larsen and Toubro, VINCI, and Hyundai Engineering & Construction Co Ltd are actively participating in this evolving market.

Oman Construction Market Company Market Share

Oman Construction Market Report: Comprehensive Analysis & Future Outlook (2019-2033)

Unlock unparalleled insights into the dynamic Oman Construction Market with this definitive report. Spanning from 2019 to 2033, with a base year of 2025, this comprehensive study delves into market dynamics, growth trends, regional dominance, product landscape, key drivers, emerging opportunities, and the influential players shaping the Omani construction sector. Essential for construction firms, investors, policymakers, and material suppliers seeking to capitalize on the nation's burgeoning infrastructure and development projects.

Oman Construction Market Market Dynamics & Structure

The Oman construction market exhibits a moderately concentrated landscape, with a few dominant players alongside a significant number of smaller enterprises. Technological innovation is a key driver, particularly in areas like sustainable building materials, prefabrication, and smart construction technologies, aimed at enhancing efficiency and reducing environmental impact. Regulatory frameworks, including building codes, environmental regulations, and foreign investment policies, play a crucial role in shaping project feasibility and market access. Competitive product substitutes are emerging, especially in the realm of alternative building materials and energy-efficient solutions, pushing established players to innovate. End-user demographics are shifting, with increasing demand for diverse housing options, modern commercial spaces, and robust industrial facilities driven by population growth and economic diversification initiatives. Mergers and acquisitions (M&A) trends are on the rise as companies seek to consolidate market share, acquire new technologies, or expand their service offerings.

- Market Concentration: Dominated by a mix of large international contractors and established local firms.

- Technological Drivers: Focus on green building, modular construction, and digital project management.

- Regulatory Influence: Building codes, environmental standards, and government tenders significantly impact project pipelines.

- Substitute Products: Rise of eco-friendly materials and pre-engineered solutions.

- End-User Demographics: Growing demand for affordable housing, luxury residences, and specialized industrial facilities.

- M&A Trends: Strategic acquisitions to enhance capabilities and market presence.

Oman Construction Market Growth Trends & Insights

The Oman construction market is poised for substantial growth, driven by a confluence of factors including ambitious government infrastructure projects and a commitment to economic diversification under Oman Vision 2040. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period of 2025–2033, reflecting a robust recovery and expansion trajectory. Adoption rates for advanced construction technologies are accelerating, with increased interest in Building Information Modeling (BIM), drone technology for site surveying, and prefabrication techniques to improve project timelines and cost-efficiency. Technological disruptions are primarily focused on enhancing sustainability, improving safety standards, and optimizing resource management. Consumer behavior shifts are evident, with a growing preference for energy-efficient homes, smart buildings, and projects that align with environmental consciousness. Market penetration of specialized construction services, such as project management consultancy and sustainable design, is also on an upward trend. The historical period (2019–2024) saw fluctuations due to global economic conditions and initial phases of large-scale development, but the foundation for sustained growth has been firmly established. The base year of 2025 marks a critical inflection point, with significant investment anticipated across key sectors.

Dominant Regions, Countries, or Segments in Oman Construction Market

The Infrastructure (Transportation) Construction segment is identified as a primary growth driver within the Oman construction market. This dominance is underpinned by substantial government investment aimed at enhancing connectivity, facilitating trade, and supporting tourism. Key drivers for this segment's ascendance include ambitious projects like the expansion of road networks, modernization of airports, and development of port facilities, crucial for the nation's economic diversification strategy.

- Key Drivers for Infrastructure (Transportation) Construction:

- Oman Vision 2040 Initiatives: Direct alignment with national goals for economic diversification and improved logistics.

- Government Capital Expenditure: Significant allocation of funds towards transportation projects.

- Connectivity Enhancement: Focus on inter-city and international transport links.

- Tourism Development: Investment in airport and port infrastructure to support the growing tourism sector.

- Trade Facilitation: Development of logistics hubs and improved road networks to boost trade volumes.

The Energy and Utility Construction sector also plays a pivotal role, driven by ongoing investments in renewable energy projects, oil and gas infrastructure upgrades, and water desalination plants. Commercial construction is experiencing a resurgence with the development of new retail spaces, hotels, and mixed-use developments, catering to a growing population and a burgeoning tourism industry. Residential construction remains a vital segment, addressing the increasing demand for housing solutions across various income brackets, with a growing emphasis on sustainable and modern living. Industrial construction is also seeing activity, albeit at a more measured pace, focusing on the development of logistics centers and manufacturing facilities.

Oman Construction Market Product Landscape

The Oman construction market product landscape is evolving with a strong emphasis on sustainable and high-performance materials. Innovations include advanced concrete admixtures that enhance durability and reduce environmental impact, energy-efficient insulation materials, and prefabricated modular components that expedite construction timelines. Performance metrics are increasingly scrutinized, with a focus on longevity, thermal efficiency, and compliance with stringent environmental standards. Unique selling propositions lie in products that offer cost savings over the lifecycle of a building, reduce maintenance requirements, and contribute to LEED or other green building certifications. Technological advancements are driving the development of smart building materials that can adapt to environmental conditions, further optimizing energy consumption.

Key Drivers, Barriers & Challenges in Oman Construction Market

Key Drivers:

- Government Infrastructure Investment: Ambitious national development plans, particularly in transportation and energy.

- Economic Diversification: Shift away from oil reliance, stimulating growth in non-oil sectors requiring construction.

- Population Growth & Urbanization: Increasing demand for residential, commercial, and public facilities.

- Foreign Direct Investment (FDI): Influx of capital for large-scale projects, attracting international expertise.

- Technological Adoption: Growing interest in sustainable and efficient construction methods.

Barriers & Challenges:

- Skilled Labor Shortages: Difficulty in sourcing adequately trained construction professionals and technicians.

- Supply Chain Disruptions: Volatility in material prices and availability, impacting project costs and timelines.

- Regulatory Hurdles: Navigating complex permitting processes and adherence to evolving building codes.

- Financing & Payment Cycles: Extended payment terms and access to project financing can be challenging for smaller contractors.

- Competition: Intense competition among local and international players can exert downward pressure on margins.

Emerging Opportunities in Oman Construction Market

Emerging opportunities in the Oman construction market are concentrated in the renewable energy sector, with significant potential for solar and wind power projects. The development of smart cities and integrated urban planning presents avenues for innovative building solutions and sustainable infrastructure. Furthermore, the logistics and warehousing sector is experiencing a surge, driven by Oman's strategic geographical location and efforts to become a regional trade hub. There is also a growing niche for heritage restoration and adaptive reuse projects, capitalizing on Oman's rich cultural landscape.

Growth Accelerators in the Oman Construction Market Industry

Long-term growth in the Oman construction market is being catalyzed by a steadfast commitment to diversifying the national economy beyond oil and gas. This diversification translates into sustained public and private investment in non-oil sectors, requiring extensive infrastructure development. The strategic implementation of Oman Vision 2040 acts as a powerful roadmap, outlining specific targets and projects that will continue to stimulate construction activity for years to come. Technological breakthroughs in areas like sustainable construction materials and digital project management are also acting as growth accelerators, enabling more efficient, cost-effective, and environmentally responsible building practices, making projects more attractive and feasible.

Key Players Shaping the Oman Construction Market Market

- McDermott

- Bahwan Engineering Group

- Samsung Engineering Co Ltd

- Mohammed Abdulmohsin Al-Kharafi & Sons

- Daewoo Engineering & Construction Co Ltd

- Larsen and Toubro

- Galfar Engineering and Contracting SAOG

- United Engineering Services

- Hyundai Engineering & Construction Co Ltd

- Oman Gulf Company LLC

- Bouygues

- Petrofac Ltd

- VINCI

- Ray International Group

- Bechtel

- Khalid Bin Ahmed & Sons LLC

- SNC-Lavalin Inc

- Al Hassan Engineering Co SAOG

Notable Milestones in Oman Construction Market Sector

- May 2023: Sika acquired MBCC Group after receiving all necessary regulatory approvals. This highly complementary transaction strengthened Sika's footprint across all regions, reinforcing its product and service range across the entire construction life cycle and driving the sustainable transformation of the construction industry.

- April 2023: China-based Huaxin Cement acquired a 60% stake in Oman Cement. The group completed the transaction via Abra Holdings, a wholly-owned subsidiary incorporated in Mauritius. In a submission to the Hong Kong Exchange, Huaxin Cement stated the estimated purchase price for the stake as USD 193 million.

In-Depth Oman Construction Market Market Outlook

The Oman construction market is projected for robust and sustained growth, underpinned by visionary national development strategies and a proactive approach to economic diversification. Key growth accelerators include substantial government investment in infrastructure, a burgeoning tourism sector, and an increasing adoption of sustainable and digital construction technologies. Emerging opportunities in renewable energy, smart city development, and the logistics sector promise to further fuel market expansion. Companies that can demonstrate innovation, efficiency, and a commitment to sustainability will be best positioned to capitalize on the significant opportunities presented by the Omani construction landscape in the coming decade. The market is expected to witness increasing collaboration between local and international entities, fostering knowledge transfer and driving higher standards of project delivery.

Oman Construction Market Segmentation

-

1. Sector

- 1.1. Commercial Construction

- 1.2. Residential Construction

- 1.3. Industrial Construction

- 1.4. Infrastructure (Transportation) Construction

- 1.5. Energy and Utility Construction

Oman Construction Market Segmentation By Geography

- 1. Oman

Oman Construction Market Regional Market Share

Geographic Coverage of Oman Construction Market

Oman Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Governments Investments in Construction Projects4.; Urban Development Intiatives

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Cost of Raw Materials Affecting the Construction Industry4.; Decrease in Foreign Investment Affecting the Market

- 3.4. Market Trends

- 3.4.1. Economic Diversification Plan (Vision 2040) has Been a Key Growth Factor in the Construction Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Commercial Construction

- 5.1.2. Residential Construction

- 5.1.3. Industrial Construction

- 5.1.4. Infrastructure (Transportation) Construction

- 5.1.5. Energy and Utility Construction

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 McDermott

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bahwan Engineering Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Samsung Engineering Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mohammed Abdulmohsin Al-Kharafi & Sons

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Daewoo Engineering & Construction Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Larsen and Toubro

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Galfar Engineering and Contracting SAOG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 United Engineering Services

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hyundai Engineering & Construction Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Oman Gulf Company LLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Bouygues

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Petrofac Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 VINCI

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Ray International Group**List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Bechtel

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Khalid Bin Ahmed & Sons LLC

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 SNC-Lavalin Inc

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Al Hassan Engineering Co SAOG

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.1 McDermott

List of Figures

- Figure 1: Oman Construction Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Oman Construction Market Share (%) by Company 2025

List of Tables

- Table 1: Oman Construction Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 2: Oman Construction Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Oman Construction Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 4: Oman Construction Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Construction Market?

The projected CAGR is approximately 3.30%.

2. Which companies are prominent players in the Oman Construction Market?

Key companies in the market include McDermott, Bahwan Engineering Group, Samsung Engineering Co Ltd, Mohammed Abdulmohsin Al-Kharafi & Sons, Daewoo Engineering & Construction Co Ltd, Larsen and Toubro, Galfar Engineering and Contracting SAOG, United Engineering Services, Hyundai Engineering & Construction Co Ltd, Oman Gulf Company LLC, Bouygues, Petrofac Ltd, VINCI, Ray International Group**List Not Exhaustive, Bechtel, Khalid Bin Ahmed & Sons LLC, SNC-Lavalin Inc, Al Hassan Engineering Co SAOG.

3. What are the main segments of the Oman Construction Market?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.82 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Governments Investments in Construction Projects4.; Urban Development Intiatives.

6. What are the notable trends driving market growth?

Economic Diversification Plan (Vision 2040) has Been a Key Growth Factor in the Construction Sector.

7. Are there any restraints impacting market growth?

4.; Increasing Cost of Raw Materials Affecting the Construction Industry4.; Decrease in Foreign Investment Affecting the Market.

8. Can you provide examples of recent developments in the market?

May 2023: Sika acquired MBCC Group after receiving all necessary regulatory approvals. With this highly complementary transaction, Sika strengthened its footprint across all regions, reinforcing its range of products and services across the entire construction life cycle and driving the sustainable transformation of the construction industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Construction Market?

To stay informed about further developments, trends, and reports in the Oman Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence