Key Insights

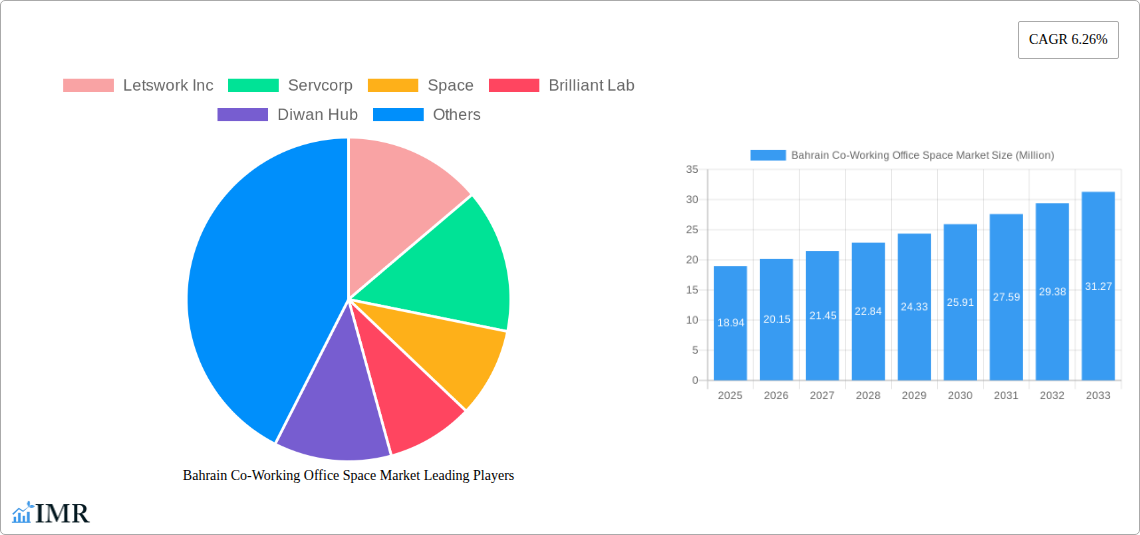

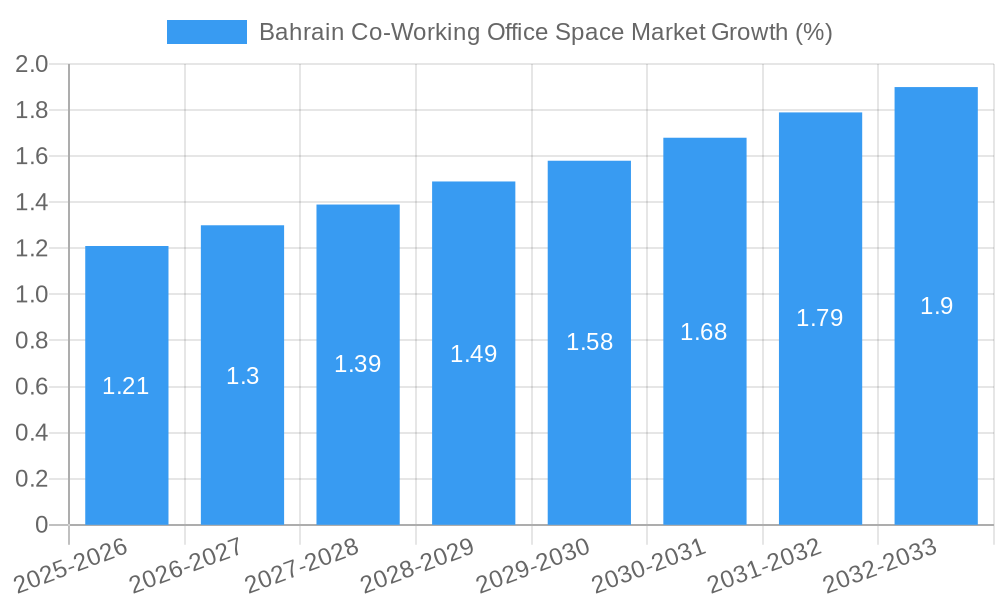

The Bahrain co-working office space market exhibits robust growth potential, projected to reach $18.94 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 6.26% from 2025 to 2033. This expansion is driven by several factors. The increasing number of startups and small-to-medium-sized enterprises (SMEs) in Bahrain seeking flexible and cost-effective workspace solutions significantly fuels demand. Furthermore, the burgeoning IT and ITES sectors, coupled with growth in legal services and the BFSI (Banking, Financial Services, and Insurance) industries, are key contributors. The preference for flexible managed offices and serviced offices over traditional leases reflects a shift towards agile work models and reduced overhead costs. While specific data on market restraints are unavailable, potential challenges could include competition from established traditional office spaces and the fluctuating economic conditions impacting business expansion in the region. However, the strong government support for entrepreneurship and innovation within Bahrain suggests that these challenges will be mitigated by the overall positive business environment.

The market segmentation reveals a diverse landscape. While precise market share figures for each segment (personal users, SMEs, large-scale companies, etc.) are unavailable, the dominance of SMEs and the IT/ITES sectors is likely significant given the current economic trends in Bahrain. The serviced office segment probably holds a larger share than flexible managed offices due to the wider range of services they often offer. Key players such as Letswork Inc, Servcorp, Space, and Regus are shaping the market through their established presence and service offerings, further fostering competition and innovation. This competitive landscape, combined with sustained economic growth and government initiatives, ensures continued expansion of the Bahrain co-working space sector.

Bahrain Co-Working Office Space Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Bahrain co-working office space market, covering market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for investors, businesses, and industry professionals seeking to understand and capitalize on opportunities within this dynamic sector. The parent market is the broader Bahrain commercial real estate market, while the child market is specifically the co-working space segment.

Bahrain Co-Working Office Space Market Dynamics & Structure

The Bahrain co-working office space market is characterized by a moderately concentrated landscape, with key players such as Letswork Inc, Servcorp, Space, Brilliant Lab, Diwan Hub, Spire Hub, Regus, The Startup Factory, Brinc Batelco IoT Hub, Prime Instant Offices, and others competing for market share. The market size in 2025 is estimated at XX Million. Market concentration is approximately xx%, indicating a competitive environment with opportunities for both established and emerging players. Technological innovation, particularly in areas like smart office technology and booking platforms, is a significant driver. The regulatory framework, while generally supportive of business growth, may present minor hurdles regarding licensing and zoning. Competitive substitutes include traditional leased office spaces and virtual offices. End-user demographics show a growing preference for flexible work arrangements, particularly among small and medium-sized enterprises (SMEs). M&A activity in the sector remains relatively low, with an estimated xx deals in the past five years.

- Market Concentration: xx% in 2025

- M&A Deals (2020-2024): xx

- Key Technological Drivers: Smart office tech, booking platforms

- Regulatory Landscape: Generally supportive, minor licensing hurdles

Bahrain Co-Working Office Space Market Growth Trends & Insights

The Bahrain co-working office space market has experienced significant growth in recent years, driven by factors such as the increasing preference for flexible workspaces among startups, SMEs, and freelancers. The market size grew from XX Million in 2019 to an estimated XX Million in 2024, reflecting a CAGR of xx%. This growth is expected to continue, with the market projected to reach XX Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as the rise of virtual offices and remote work tools, have also influenced market dynamics. Changing consumer behavior, particularly the increasing demand for collaborative workspaces and community-driven environments, further fuels the sector's expansion. Market penetration among businesses has increased from xx% in 2019 to xx% in 2024, and this is expected to increase significantly during the forecast period.

Dominant Regions, Countries, or Segments in Bahrain Co-Working Office Space Market

The Bahrain co-working office space market is primarily concentrated in major urban centers, with Manama expected to hold the largest market share. By end-user segment, small-scale companies represent the largest segment, driven by their demand for cost-effective and flexible office solutions. The serviced office type dominates the market, offering comprehensive amenities and support services. Within applications, the Information Technology (IT and ITES) sector exhibits substantial growth, owing to the burgeoning tech industry in Bahrain.

- Dominant Region: Manama

- Largest End-User Segment: Small-Scale Companies

- Dominant Office Type: Serviced Office

- Fastest-Growing Application: Information Technology (IT and ITES)

- Key Growth Drivers: Government initiatives supporting entrepreneurship, rising number of SMEs, foreign investment.

Bahrain Co-Working Office Space Market Product Landscape

The co-working office space market in Bahrain offers a range of products, from basic hot desks to fully equipped private offices. Innovations include smart office technology integrating access control, booking systems, and environmental controls. Performance metrics focus on occupancy rates, customer satisfaction, and revenue generation. Unique selling propositions often include community building events, networking opportunities, and access to business support services. Technological advancements are driving greater flexibility and customization of workspace solutions.

Key Drivers, Barriers & Challenges in Bahrain Co-Working Office Space Market

Key Drivers:

- Growing number of startups and SMEs

- Increasing demand for flexible workspaces

- Government initiatives promoting entrepreneurship

- Foreign direct investment in the technology sector

Key Challenges:

- Competition from traditional office spaces

- High real estate costs in prime locations

- Potential regulatory hurdles (xx%)

- Fluctuations in oil prices impacting the overall economy.

Emerging Opportunities in Bahrain Co-Working Office Space Market

Opportunities exist in expanding into underserved markets, such as suburban areas. Innovative applications, like specialized co-working spaces for specific industries (e.g., creative arts, healthcare), represent significant potential. Evolving consumer preferences towards sustainability and wellness are driving demand for eco-friendly and health-conscious workspace designs.

Growth Accelerators in the Bahrain Co-Working Office Space Market Industry

Long-term growth will be driven by technological advancements in workspace management systems and the expansion of high-speed internet infrastructure. Strategic partnerships between co-working operators and technology providers can unlock significant synergies. Government initiatives aimed at diversifying the economy and attracting foreign talent will also boost market expansion.

Key Players Shaping the Bahrain Co-Working Office Space Market

- Letswork Inc

- Servcorp

- Space

- Brilliant Lab

- Diwan Hub

- Spire Hub

- Regus

- The Startup Factory

- Brinc Batelco IoT Hub

- Prime Instant Offices

Notable Milestones in Bahrain Co-Working Office Space Market Sector

- June 2023: Launch of 'HQ' co-working space by Hope Ventures and Seef Properties.

- June 2022: GOMYCODE's USD 8M funding round for expansion in the Middle East and Africa, including Bahrain.

In-Depth Bahrain Co-Working Office Space Market Outlook

The Bahrain co-working office space market is poised for sustained growth, driven by the ongoing trend towards flexible work arrangements and the increasing adoption of technology-enabled workspace solutions. Strategic partnerships, expansion into new markets, and the development of specialized co-working spaces will shape future market dynamics. The market presents significant opportunities for both established players and new entrants to capitalize on the growing demand for innovative and adaptable workspace solutions.

Bahrain Co-Working Office Space Market Segmentation

-

1. End User

- 1.1. Personal User

- 1.2. Small Scale Company

- 1.3. Large Scale Company

- 1.4. Other End Users

-

2. Type

- 2.1. Flexible Managed Office

- 2.2. Serviced Office

-

3. Application

- 3.1. Information Technology (IT and ITES)

- 3.2. Legal Services

- 3.3. BFSI (Banking, Financial Services and Insurance)

- 3.4. Consulting

- 3.5. Other Applications

Bahrain Co-Working Office Space Market Segmentation By Geography

- 1. Bahrain

Bahrain Co-Working Office Space Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.26% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing number of startups

- 3.3. Market Restrains

- 3.3.1. Low Awareness and Privacy Issues

- 3.4. Market Trends

- 3.4.1. Increase in Foreign Investment to Boost the Economy

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bahrain Co-Working Office Space Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Personal User

- 5.1.2. Small Scale Company

- 5.1.3. Large Scale Company

- 5.1.4. Other End Users

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Flexible Managed Office

- 5.2.2. Serviced Office

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Information Technology (IT and ITES)

- 5.3.2. Legal Services

- 5.3.3. BFSI (Banking, Financial Services and Insurance)

- 5.3.4. Consulting

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Bahrain

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Letswork Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Servcorp

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Space

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Brilliant Lab

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Diwan Hub

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Spire Hub

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Regus

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Startup Factory

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Brinc Batelco IoT Hub**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Prime Instant Offices

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Letswork Inc

List of Figures

- Figure 1: Bahrain Co-Working Office Space Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Bahrain Co-Working Office Space Market Share (%) by Company 2024

List of Tables

- Table 1: Bahrain Co-Working Office Space Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Bahrain Co-Working Office Space Market Revenue Million Forecast, by End User 2019 & 2032

- Table 3: Bahrain Co-Working Office Space Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Bahrain Co-Working Office Space Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Bahrain Co-Working Office Space Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Bahrain Co-Working Office Space Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Bahrain Co-Working Office Space Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Bahrain Co-Working Office Space Market Revenue Million Forecast, by Type 2019 & 2032

- Table 9: Bahrain Co-Working Office Space Market Revenue Million Forecast, by Application 2019 & 2032

- Table 10: Bahrain Co-Working Office Space Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bahrain Co-Working Office Space Market?

The projected CAGR is approximately 6.26%.

2. Which companies are prominent players in the Bahrain Co-Working Office Space Market?

Key companies in the market include Letswork Inc, Servcorp, Space, Brilliant Lab, Diwan Hub, Spire Hub, Regus, The Startup Factory, Brinc Batelco IoT Hub**List Not Exhaustive, Prime Instant Offices.

3. What are the main segments of the Bahrain Co-Working Office Space Market?

The market segments include End User, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing number of startups.

6. What are the notable trends driving market growth?

Increase in Foreign Investment to Boost the Economy.

7. Are there any restraints impacting market growth?

Low Awareness and Privacy Issues.

8. Can you provide examples of recent developments in the market?

June 2023: Hope Ventures, the investment arm of Bahrain-based Hope Fund, has joined hands with Seef Properties to launch its co-working space 'HQ' in the kingdom. The HQ, which is spread over a 1,085 sq m area at Seef Mall, is pipelined to officially welcome its tenants starting from this September. It will act as the actual headquarters that brings together entrepreneurs, investors, partners, legislators, and government representatives all in one space, thus creating a network and community that boosts opportunity facilitation in Bahrain.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bahrain Co-Working Office Space Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bahrain Co-Working Office Space Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bahrain Co-Working Office Space Market?

To stay informed about further developments, trends, and reports in the Bahrain Co-Working Office Space Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence