Key Insights

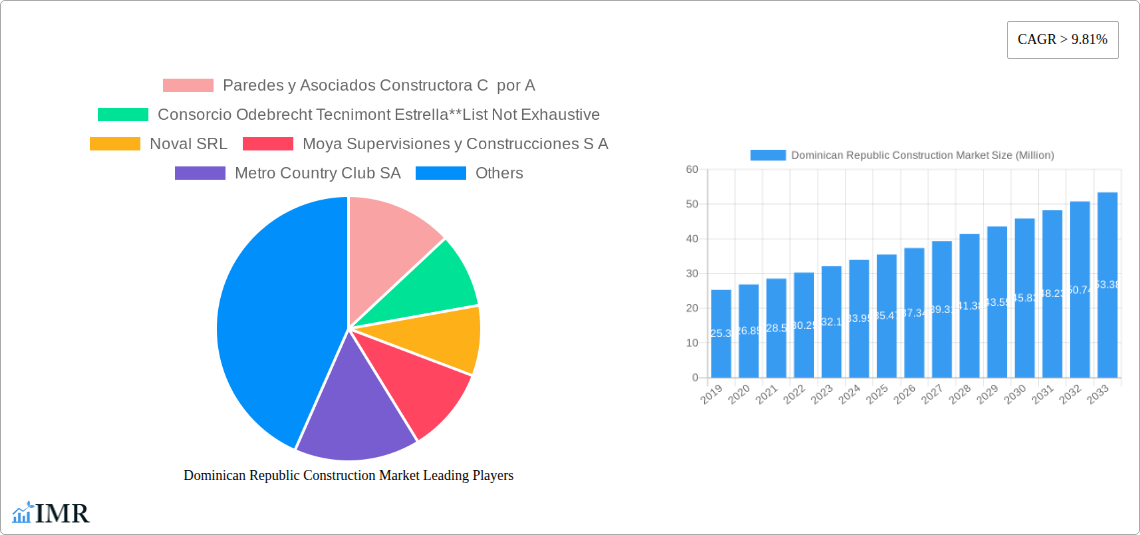

The Dominican Republic construction market is poised for significant expansion, projected to reach a substantial value by 2033. Valued at an estimated USD 35.47 million in 2025, the market is anticipated to experience a robust Compound Annual Growth Rate (CAGR) exceeding 9.81% throughout the forecast period of 2025-2033. This impressive growth trajectory is fueled by a confluence of factors, including escalating investments in infrastructure development, particularly within the transportation sector, and a burgeoning demand from both residential and commercial segments. The nation's ongoing economic development, coupled with increasing foreign direct investment, is creating a favorable environment for construction activities. Furthermore, government initiatives aimed at modernizing urban centers and enhancing connectivity are acting as powerful catalysts, driving demand for new construction projects and renovations across various applications.

Dominican Republic Construction Market Market Size (In Million)

Key trends shaping the Dominican Republic construction landscape include a notable shift towards sustainable building practices, driven by environmental consciousness and regulatory pressures. The adoption of innovative construction technologies and materials is also gaining momentum, promising increased efficiency and reduced project timelines. The residential sector, in particular, is witnessing strong demand, supported by a growing middle class and favorable housing policies. The industrial and commercial segments are also showing promising signs of recovery and growth, influenced by expanding tourism, manufacturing, and service industries. While the market presents immense opportunities, potential restraints such as fluctuating raw material costs and the availability of skilled labor could pose challenges. Nevertheless, the overarching positive outlook, driven by robust economic fundamentals and strategic development plans, indicates a dynamic and promising future for the Dominican Republic construction market.

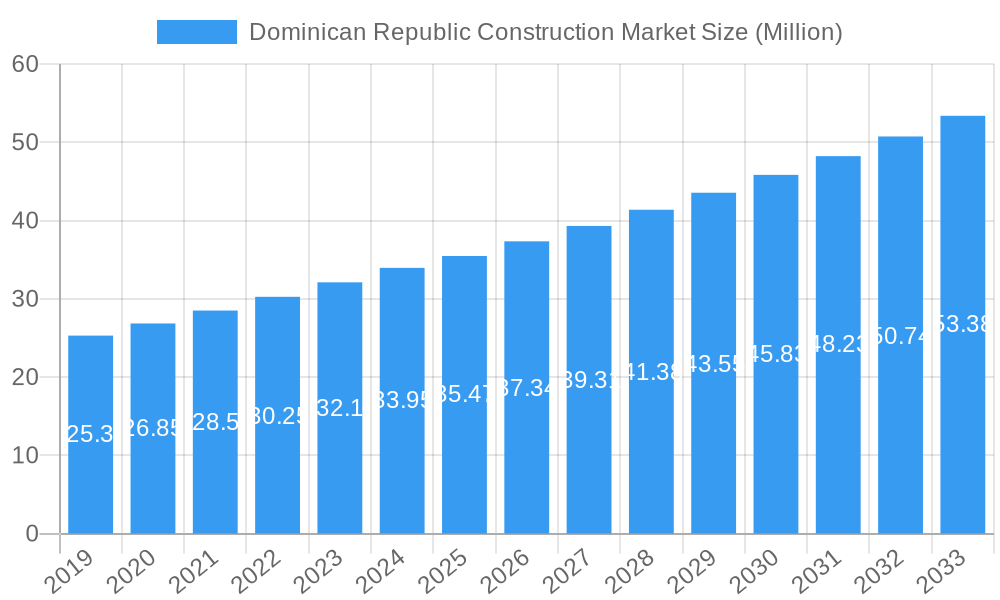

Dominican Republic Construction Market Company Market Share

This in-depth report provides an exhaustive analysis of the Dominican Republic construction market, covering its current state and projecting its trajectory through 2033. With a focus on market dynamics, growth trends, dominant segments, and key players, this report is an indispensable resource for industry stakeholders seeking to capitalize on emerging opportunities in this vibrant Latin American market. Our analysis integrates high-traffic keywords such as "Dominican Republic construction," "Caribbean infrastructure," "real estate development DR," and "PPP projects Dominican Republic" to ensure maximum search engine visibility and relevance for industry professionals.

Dominican Republic Construction Market Market Dynamics & Structure

The Dominican Republic construction market is characterized by a moderately concentrated structure, with a few large domestic and international players holding significant market share. Technological innovation is driven by the increasing adoption of BIM (Building Information Modeling) and prefabrication techniques, aimed at improving efficiency and reducing project timelines. The regulatory framework, overseen by entities like the Ministry of Public Works and Communications (MOPC) and the National Council of Public and Private Alliances (MAPPRE), is evolving to attract foreign investment and streamline project approvals, particularly for large-scale infrastructure and energy projects. Competitive product substitutes are emerging in materials science, with a growing demand for sustainable and cost-effective building solutions. End-user demographics are shifting, with an expanding middle class fueling demand for residential and commercial properties, while tourism growth continues to spur hospitality and retail construction. Mergers and acquisitions (M&A) trends are notable, with consortia forming for major infrastructure bids and international firms acquiring local expertise.

- Market Concentration: Dominated by a mix of established domestic firms and international joint ventures.

- Technological Innovation: Growing adoption of BIM, sustainable building materials, and advanced construction machinery.

- Regulatory Framework: Streamlining of permits and incentives for foreign direct investment in construction.

- Competitive Landscape: Increasing competition from companies offering modular and prefabricated solutions.

- End-User Demographics: Rising demand for affordable housing and modern commercial spaces driven by urbanization and tourism.

- M&A Trends: Formation of strategic alliances for mega-projects and consolidation within specific construction sub-sectors.

Dominican Republic Construction Market Growth Trends & Insights

The Dominican Republic construction market is poised for robust growth, driven by sustained economic expansion, government investment in infrastructure, and a booming tourism sector. The market size is projected to witness a significant expansion from an estimated USD 6,500 Million in 2025 to over USD 10,000 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 6.5%. Adoption rates of advanced construction technologies are accelerating, with an increasing focus on digitalization and sustainability. Technological disruptions, such as the integration of AI in project management and the use of drones for site monitoring, are set to revolutionize project execution. Consumer behavior is shifting towards demand for energy-efficient buildings, smart homes, and integrated community developments. The influx of foreign direct investment, particularly in real estate and tourism-related infrastructure, further bolsters market penetration for innovative construction solutions.

- Market Size Evolution: Projected to grow substantially from an estimated USD 6,500 Million in 2025 to over USD 10,000 Million by 2033.

- CAGR: Anticipated to be approximately 6.5% over the forecast period.

- Adoption Rates: Increasing uptake of BIM, sustainable construction practices, and smart building technologies.

- Technological Disruptions: Integration of AI, IoT, and advanced robotics in construction processes.

- Consumer Behavior Shifts: Growing preference for eco-friendly, technologically advanced, and amenity-rich properties.

- Market Penetration: Expansion driven by both domestic demand and significant foreign investment in key sectors.

Dominant Regions, Countries, or Segments in Dominican Republic Construction Market

The Infrastructure (Transportation) segment is projected to be the dominant force driving growth in the Dominican Republic construction market, projected to account for approximately 35% of the total market value by 2025. This dominance is fueled by substantial government investment in modernizing the nation's transportation network, including highways, airports, and ports, essential for facilitating trade and tourism. The Residential sector is a close second, driven by a growing population and an expanding middle class demanding better housing solutions. The Commercial segment, particularly retail and hospitality, is also experiencing significant growth due to the thriving tourism industry.

- Dominant Segment: Infrastructure (Transportation), representing an estimated 35% market share in 2025.

- Key Drivers: Government focus on connectivity, expansion of road networks, airport upgrades, and port modernization projects.

- Growth Potential: High due to ongoing and planned public-private partnerships (PPPs) for national development.

- Secondary Segment: Residential Construction, contributing an estimated 28% market share in 2025.

- Key Drivers: Urbanization, demand for affordable housing, and an expanding middle class.

- Growth Potential: Strong, with continuous development of new housing projects across the country.

- Tertiary Segment: Commercial Construction, holding an estimated 22% market share in 2025.

- Key Drivers: Tourism growth, expansion of retail outlets, hotels, and mixed-use developments.

- Growth Potential: Steadily increasing, aligning with the nation's economic diversification.

- Other Segments: Industrial and Energy & Utilities also contribute to market growth, with specific projects driving demand.

Dominican Republic Construction Market Product Landscape

The product landscape within the Dominican Republic construction market is evolving rapidly, with a strong emphasis on innovative building materials and sustainable solutions. Demand for high-performance concrete, energy-efficient insulation, and advanced roofing systems is on the rise. Prefabricated components, modular construction elements, and smart home technologies are gaining traction, offering quicker installation times and improved building performance. Unique selling propositions often revolve around durability, cost-effectiveness, and environmental credentials. Technological advancements in materials science are leading to products that enhance structural integrity, thermal efficiency, and aesthetic appeal.

Key Drivers, Barriers & Challenges in Dominican Republic Construction Market

Key Drivers:

- Government Infrastructure Investment: Significant public spending on transportation, energy, and utilities.

- Tourism Sector Growth: Driving demand for hotels, resorts, and related infrastructure.

- Foreign Direct Investment (FDI): Influx of capital for real estate and development projects.

- Urbanization and Population Growth: Increasing demand for residential and commercial spaces.

- Public-Private Partnerships (PPPs): Facilitating large-scale projects and attracting private capital.

Barriers & Challenges:

- Supply Chain Volatility: Global disruptions impacting material availability and costs.

- Skilled Labor Shortages: A consistent challenge in the construction industry.

- Regulatory Complexities: Navigating permitting processes and environmental regulations.

- Financing Accessibility: Securing adequate funding for projects, particularly for smaller developers.

- Inflationary Pressures: Rising costs of raw materials and labor impacting project budgets.

Emerging Opportunities in the Dominican Republic Construction Market Industry

Emerging opportunities in the Dominican Republic construction market are concentrated in sustainable and green building initiatives, driven by global environmental concerns and increasing local awareness. The development of renewable energy infrastructure, particularly solar and wind power projects, presents significant growth potential. Furthermore, the demand for smart city solutions and resilient infrastructure capable of withstanding climate change impacts is creating new avenues for innovation. The expansion of the logistics and industrial sectors, supported by government initiatives to attract manufacturing, also opens up opportunities for specialized construction services.

Growth Accelerators in the Dominican Republic Construction Market Industry

Several catalysts are accelerating long-term growth in the Dominican Republic construction market. Technological breakthroughs in modular construction and digital project management are enhancing efficiency and reducing costs, making projects more viable. Strategic partnerships between local developers and international construction firms are bringing in expertise, capital, and advanced methodologies. The government's commitment to improving ease of doing business and its proactive stance on infrastructure development are crucial for sustained market expansion. Furthermore, the increasing focus on eco-tourism and sustainable development policies encourages investment in green building practices and infrastructure.

Key Players Shaping the Dominican Republic Construction Market Market

- Paredes y Asociados Constructora C por A

- Consorcio Odebrecht Tecnimont Estrella

- Noval SRL

- Moya Supervisiones y Construcciones S A

- Metro Country Club SA

- Constructora Rizek y Asociados SRL

- Abi Karram Morilla Ingenieros Arquitectos S A

- Constructora Samredo S A

- Therrestra SAS

- Contratistas Civiles y Mecanicos SA

Notable Milestones in Dominican Republic Construction Market Sector

- August 2023: Guyana signed a memorandum of understanding (MoU) with the Dominican Republic to explore the construction of a 50,000 barrel per day (bpd) refinery in Guyana. The Dominican Republic Government could own at least a 51% stake in the refinery project.

- May 2023: The Dominican Republic’s PPP agency DGAPP launched the process to award construction and operation of the DOP 21.5 billion (USD 391 million) Ámbar divided highway. It will connect Santiago de los Caballeros and Puerto Plata on the north coast.

- March 2023: Grupo Estrella subsidiary Cemento PANAM plans to execute a 1.23 Mt/yr grinding plant project in the Dominican Republic. China-based Sinoma Construction won a contract to deliver the project.

In-Depth Dominican Republic Construction Market Market Outlook

The Dominican Republic construction market is set for a period of sustained and dynamic growth, fueled by strategic government initiatives, robust economic performance, and a thriving tourism sector. Future market potential lies in the continued expansion of infrastructure, particularly in transportation and renewable energy, creating significant opportunities for both local and international players. Strategic opportunities also exist in the development of resilient and sustainable urban environments, catering to the evolving needs of its population and the global push for climate action. The market is expected to witness increased adoption of advanced construction technologies, fostering greater efficiency and environmental responsibility.

Dominican Republic Construction Market Segmentation

-

1. Sector

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

- 1.4. Infrastructure (Transportation)

- 1.5. Energy and Utilities

Dominican Republic Construction Market Segmentation By Geography

- 1. Dominica

Dominican Republic Construction Market Regional Market Share

Geographic Coverage of Dominican Republic Construction Market

Dominican Republic Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 9.81% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in GDP contribution from Construction Industry; Increase in Number of Building Permits

- 3.3. Market Restrains

- 3.3.1. High Initial Investments

- 3.4. Market Trends

- 3.4.1. Rise in commercial construction projects

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Dominican Republic Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.1.4. Infrastructure (Transportation)

- 5.1.5. Energy and Utilities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Dominica

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Paredes y Asociados Constructora C por A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Consorcio Odebrecht Tecnimont Estrella**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Noval SRL

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Moya Supervisiones y Construcciones S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Metro Country Club SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Constructora Rizek y Asociados SRL

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Abi Karram Morilla Ingenieros Arquitectos S A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Constructora Samredo S A

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Therrestra SAS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Contratistas Civiles y Mecanicos SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Paredes y Asociados Constructora C por A

List of Figures

- Figure 1: Dominican Republic Construction Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Dominican Republic Construction Market Share (%) by Company 2025

List of Tables

- Table 1: Dominican Republic Construction Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 2: Dominican Republic Construction Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Dominican Republic Construction Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 4: Dominican Republic Construction Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dominican Republic Construction Market?

The projected CAGR is approximately > 9.81%.

2. Which companies are prominent players in the Dominican Republic Construction Market?

Key companies in the market include Paredes y Asociados Constructora C por A, Consorcio Odebrecht Tecnimont Estrella**List Not Exhaustive, Noval SRL, Moya Supervisiones y Construcciones S A, Metro Country Club SA, Constructora Rizek y Asociados SRL, Abi Karram Morilla Ingenieros Arquitectos S A, Constructora Samredo S A, Therrestra SAS, Contratistas Civiles y Mecanicos SA.

3. What are the main segments of the Dominican Republic Construction Market?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 35.47 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in GDP contribution from Construction Industry; Increase in Number of Building Permits.

6. What are the notable trends driving market growth?

Rise in commercial construction projects.

7. Are there any restraints impacting market growth?

High Initial Investments.

8. Can you provide examples of recent developments in the market?

August 2023: Guyana signed a memorandum of understanding (MoU) with the Dominican Republic to explore the construction of a 50,000 barrel per day (bpd) refinery in Guyana. As per the terms of the agreement, the Dominican Republic Government could own at least a 51% stake in the refinery project.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dominican Republic Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dominican Republic Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dominican Republic Construction Market?

To stay informed about further developments, trends, and reports in the Dominican Republic Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence