Key Insights

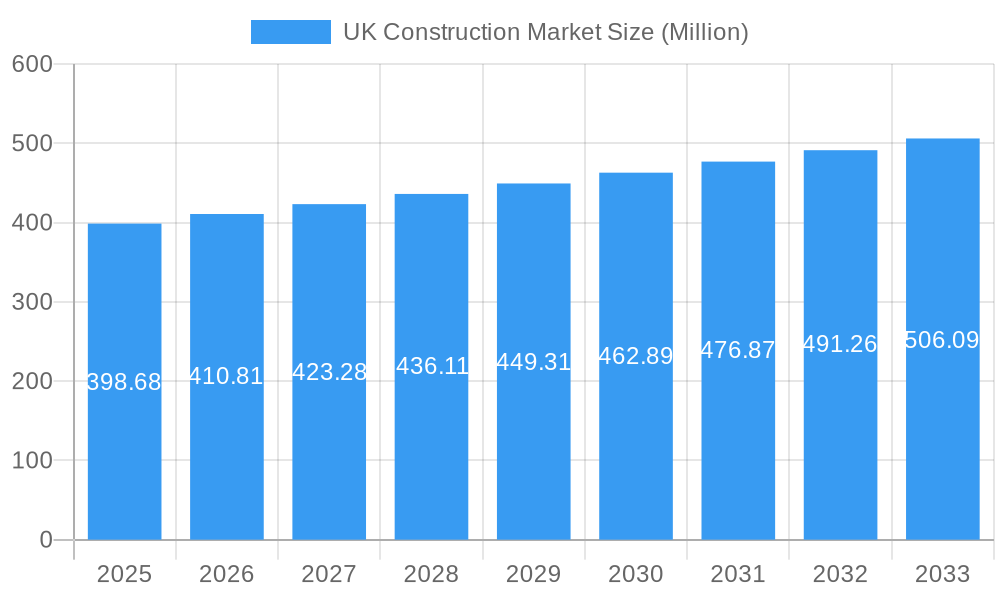

The UK construction market is projected to reach a substantial £398.68 million by 2025, demonstrating a steady growth trajectory. Driven by ongoing infrastructure development, particularly in transportation and energy, alongside a robust demand for residential and commercial properties, the sector is poised for continued expansion. Investments in sustainable building practices and the adoption of advanced technologies like Building Information Modeling (BIM) are key enablers. The industry is witnessing significant activity in urban regeneration projects and the expansion of renewable energy infrastructure, contributing to job creation and economic output. Despite global economic uncertainties, the foundational need for new and improved built environments, coupled with government initiatives aimed at boosting housing supply and green infrastructure, underpins the market's resilience.

UK Construction Market Market Size (In Million)

The market is forecast to experience a Compound Annual Growth Rate (CAGR) of 3.19% between 2025 and 2033. This growth will be propelled by a diverse range of projects, from large-scale infrastructure upgrades and commercial developments to the ongoing need for housing and the refurbishment of existing structures. The increasing focus on net-zero targets will further stimulate demand for energy-efficient buildings and retrofitting projects. While the market benefits from strong demand, it faces challenges such as rising material costs, labor shortages, and supply chain disruptions, which could temper the pace of growth. Key players are actively exploring innovation and strategic partnerships to navigate these complexities and capitalize on emerging opportunities within this dynamic sector.

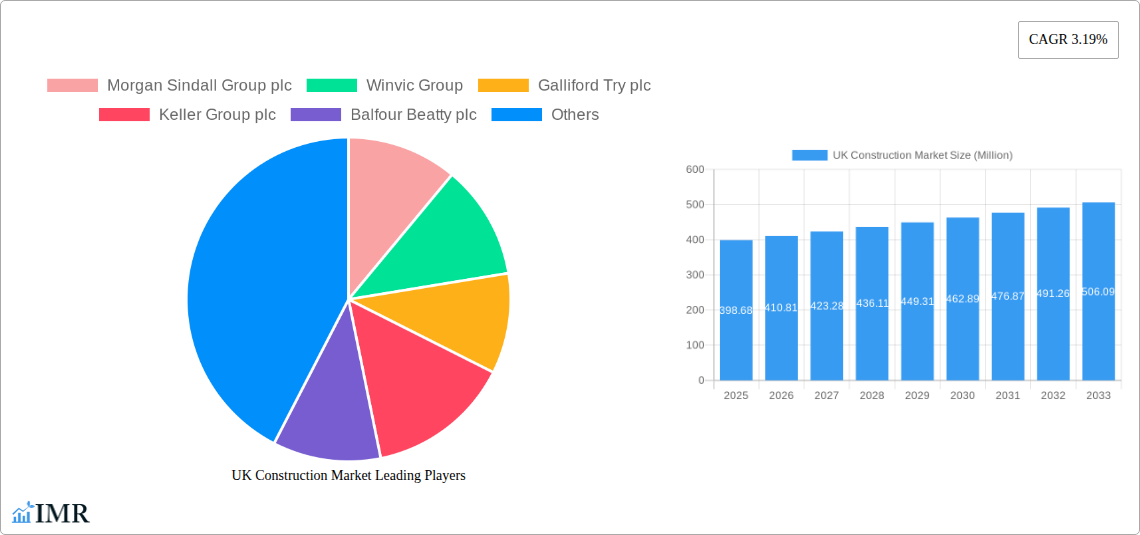

UK Construction Market Company Market Share

UK Construction Market Report: Dynamics, Growth, and Future Outlook (2024-2033)

This comprehensive report offers an in-depth analysis of the UK construction market, a vital sector experiencing dynamic shifts and offering significant investment opportunities. We delve into market structure, growth trajectories, dominant regions, product innovations, key drivers, emerging trends, and the influential players shaping the industry's future. This report is essential for construction firms, investors, policymakers, and industry professionals seeking to understand and capitalize on the evolving UK construction landscape. The report encompasses a study period from 2019–2033, with 2025 as the base and estimated year, and a forecast period of 2025–2033, building on historical data from 2019–2024. All values are presented in Million units for clear quantitative analysis.

UK Construction Market Market Dynamics & Structure

The UK construction market, a significant contributor to the national GDP, is characterized by a moderately concentrated structure with key players dominating specific segments. Technological innovation is a crucial driver, with advancements in Building Information Modeling (BIM), prefabrication, and sustainable building materials continually reshaping project delivery. Regulatory frameworks, including stringent building codes and environmental standards, influence market entry and operational practices. Competitive product substitutes are emerging, particularly in off-site construction and modular building solutions, challenging traditional on-site methods. End-user demographics are shifting, with increasing demand for energy-efficient, smart homes, and sustainable commercial and industrial spaces. Mergers and Acquisitions (M&A) trends reveal strategic consolidation, with larger firms acquiring specialized entities to expand capabilities and market reach. For instance, a significant M&A activity in December 2022 saw The Access Group acquire Construction Industry Solutions (COINS), bolstering its international software and services offerings.

- Market Concentration: Dominated by a mix of large, established firms and a robust SME sector, with top players holding significant market share in major infrastructure and commercial projects.

- Technological Innovation: Driven by digital transformation, including AI in project planning, drone technology for site surveys, and advanced materials research for enhanced sustainability and performance.

- Regulatory Frameworks: Governed by Building Regulations, Health and Safety Executive (HSE) standards, and increasingly, environmental legislation aimed at achieving net-zero targets.

- Competitive Product Substitutes: Rise of modular construction, 3D printed components, and alternative building materials offering faster deployment and reduced waste.

- End-User Demographics: Increasing demand for affordable housing, flexible commercial spaces, and resilient infrastructure, influenced by urbanisation and climate change adaptation.

- M&A Trends: Strategic acquisitions to gain market share, enhance technological capabilities, and vertical integration, as demonstrated by recent software acquisitions in the sector.

UK Construction Market Growth Trends & Insights

The UK construction market is poised for substantial growth, driven by ongoing infrastructure development, housing demand, and a sustained focus on sustainable building practices. The market size has demonstrated a steady upward trajectory throughout the historical period (2019-2024), with projections indicating a robust Compound Annual Growth Rate (CAGR) over the forecast period (2025-2033). Adoption rates for digital technologies such as BIM and prefabrication are accelerating, leading to increased efficiency, reduced project timelines, and improved cost management. Technological disruptions are a constant, with advancements in smart building technologies, renewable energy integration within structures, and the use of advanced analytics for project forecasting and risk mitigation profoundly impacting project execution. Consumer behavior shifts are evident, with a growing preference for energy-efficient homes, environmentally friendly materials, and flexible, adaptable spaces. The government's commitment to infrastructure investment, as highlighted by the Department of Transport's announcement of over £40 billion in capital investment across the next two financial years, is a significant catalyst for future growth, particularly in the infrastructure and transport sectors. The sector's resilience will also be tested and shaped by evolving economic conditions, labor market dynamics, and the ongoing drive towards net-zero construction.

Dominant Regions, Countries, or Segments in UK Construction Market

The UK construction market exhibits regional variations in growth and investment. While all sectors are experiencing development, the Infrastructure segment is emerging as a primary growth engine, propelled by substantial government investment and the critical need for modernizing national transport networks, energy grids, and digital connectivity. The Residential sector remains a cornerstone, driven by persistent housing shortages and government initiatives aimed at boosting homeownership. The Commercial sector is adapting to new working models and e-commerce trends, while the Industrial sector benefits from increased manufacturing and logistics demand. The Energy and Utilities sector is experiencing significant investment in renewable energy projects and grid upgrades to support decarbonization efforts. Key drivers for infrastructure dominance include:

- Economic Policies: Government commitment to infrastructure spending acts as a direct stimulus, creating a predictable pipeline of projects and fostering investor confidence.

- Infrastructure Investment: The £40 billion plus capital investment by the Department of Transport signifies a long-term commitment to improving national rail and road networks, directly benefiting the infrastructure segment. This investment translates into numerous large-scale projects for bridges, tunnels, highways, and rail upgrades.

- Decarbonization Targets: The UK's ambitious net-zero targets necessitate significant investment in energy infrastructure, including renewable energy generation, grid modernization, and carbon capture technologies, further bolstering the infrastructure segment.

- Urbanisation and Regeneration: Ongoing urban regeneration projects and the development of new housing estates across major conurbations require extensive supporting infrastructure, from utilities to transportation links.

- Digital Connectivity: The drive for universal high-speed broadband and 5G networks requires substantial investment in fibre optic deployment and tower infrastructure, adding to the infrastructure segment's growth.

The market share within the infrastructure segment is increasingly being captured by large-scale engineering and construction firms capable of managing complex, multi-billion-pound projects. Companies like Balfour Beatty plc, Kier Group plc, and Laing O'Rourke plc are at the forefront of these developments. The growth potential within this segment is immense, as the need for upgraded and expanded infrastructure is a long-term necessity for the UK's economic competitiveness and environmental sustainability.

UK Construction Market Product Landscape

The UK construction market is witnessing a surge in product innovations aimed at enhancing efficiency, sustainability, and performance. Advanced materials such as cross-laminated timber (CLT) and recycled aggregates are gaining traction for their environmental benefits and structural capabilities. Smart building technologies, including IoT-enabled sensors for energy management and automated building systems, are becoming integral to commercial and residential projects. Prefabricated and modular construction components offer faster on-site assembly, reduced waste, and improved quality control. These product advancements cater to evolving industry demands for greener, smarter, and more cost-effective building solutions.

Key Drivers, Barriers & Challenges in UK Construction Market

The UK construction market is propelled by several key drivers. Government investment in infrastructure, particularly transport and energy projects, provides a consistent pipeline of work. The increasing demand for housing, coupled with ambitious net-zero targets, encourages innovation in sustainable building solutions and energy-efficient technologies. Technological advancements, such as BIM and AI, are enhancing project efficiency and design capabilities.

However, the market faces significant barriers and challenges. Supply chain disruptions, exacerbated by global events, continue to impact material availability and costs. Labor shortages, particularly skilled tradespeople, pose a persistent threat to project timelines and budgets. Stringent regulatory compliance, while necessary, can also add complexity and cost. Competitive pressures among firms, especially for public sector contracts, can squeeze profit margins. Navigating these challenges requires robust project management, strategic sourcing, and continuous investment in workforce development.

Emerging Opportunities in UK Construction Market

Emerging opportunities in the UK construction market lie in the growing demand for retrofitting existing buildings for energy efficiency, a critical component of meeting net-zero goals. The expansion of renewable energy infrastructure, including offshore wind farms and solar power installations, presents substantial project potential. The development of smart cities and advanced digital infrastructure creates demand for innovative construction solutions. Furthermore, the increasing adoption of off-site construction and modular building techniques offers opportunities for specialized manufacturers and streamlined project delivery.

Growth Accelerators in the UK Construction Market Industry

Several catalysts are accelerating long-term growth in the UK construction market. Continuous technological breakthroughs in areas like AI-driven project management, robotics in construction, and advanced sustainable materials are boosting productivity and reducing environmental impact. Strategic partnerships between construction firms, technology providers, and material suppliers are fostering innovation and market expansion. The ongoing government commitment to infrastructure investment and housing development, coupled with the drive towards a green economy, provides a stable foundation and significant impetus for sustained market growth.

Key Players Shaping the UK Construction Market Market

- Morgan Sindall Group plc

- Winvic Group

- Galliford Try plc

- Keller Group plc

- Balfour Beatty plc

- ISG plc

- Bouygues UK

- Kier Group plc

- Laing O'Rourke plc

- Mace Ltd

Notable Milestones in UK Construction Market Sector

- December 2022: The Access Group successfully acquired Construction Industry Solutions (COINS), enhancing its capacity to offer international software and services to businesses engaged in the construction industry.

- March 2023: The Department of Transport, UK, announced over £40 billion of capital investment in transport across the next two financial years, driving significant improvements to rail and roads across the country.

In-Depth UK Construction Market Market Outlook

The future outlook for the UK construction market is exceptionally promising, underpinned by strong growth accelerators. Continued government investment in infrastructure and a national focus on achieving net-zero emissions will drive demand for sustainable building solutions and renewable energy projects. Technological advancements, from AI to modular construction, will continue to enhance efficiency and reduce environmental impact. Strategic collaborations and a focus on innovation will enable companies to navigate challenges and capitalize on emerging opportunities, solidifying the sector's vital role in the UK's economic recovery and future development.

UK Construction Market Segmentation

-

1. Sector

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

- 1.4. Infrastructure

- 1.5. Energy and Utilities

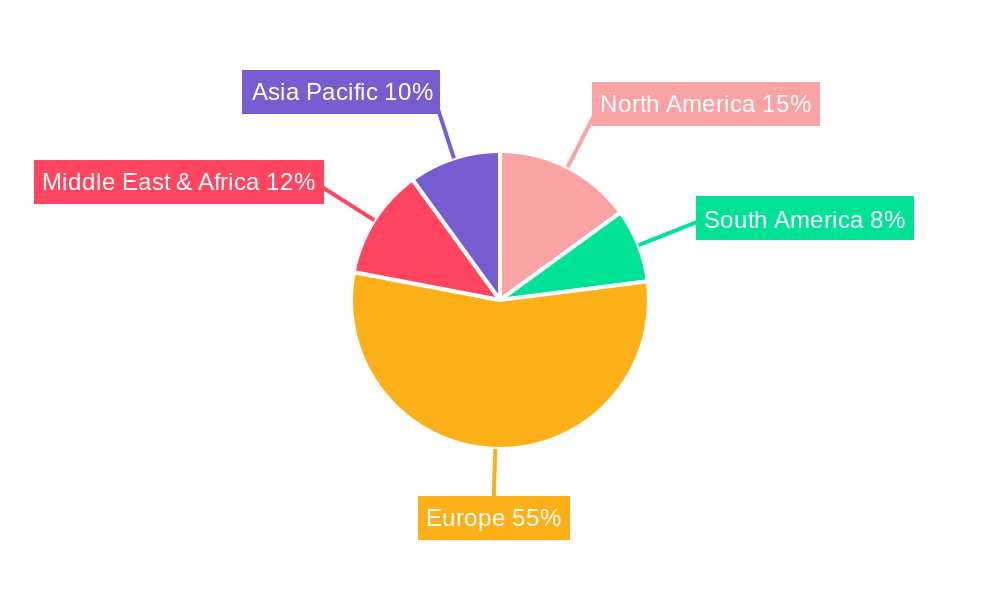

UK Construction Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Construction Market Regional Market Share

Geographic Coverage of UK Construction Market

UK Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Transport Infrstructure Investment

- 3.3. Market Restrains

- 3.3.1. Shortage of Skilled Labor

- 3.4. Market Trends

- 3.4.1. Increase in GVA of construction Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.1.4. Infrastructure

- 5.1.5. Energy and Utilities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. North America UK Construction Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.3. Industrial

- 6.1.4. Infrastructure

- 6.1.5. Energy and Utilities

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. South America UK Construction Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.3. Industrial

- 7.1.4. Infrastructure

- 7.1.5. Energy and Utilities

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Europe UK Construction Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.3. Industrial

- 8.1.4. Infrastructure

- 8.1.5. Energy and Utilities

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Middle East & Africa UK Construction Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.3. Industrial

- 9.1.4. Infrastructure

- 9.1.5. Energy and Utilities

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Asia Pacific UK Construction Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.3. Industrial

- 10.1.4. Infrastructure

- 10.1.5. Energy and Utilities

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Morgan Sindall Group plc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Winvic Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Galliford Try plc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Keller Group plc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Balfour Beatty plc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ISG plc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bouygues UK

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kier Group plc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Laing O'Rourke plc**List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mace Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Morgan Sindall Group plc

List of Figures

- Figure 1: Global UK Construction Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America UK Construction Market Revenue (Million), by Sector 2025 & 2033

- Figure 3: North America UK Construction Market Revenue Share (%), by Sector 2025 & 2033

- Figure 4: North America UK Construction Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America UK Construction Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America UK Construction Market Revenue (Million), by Sector 2025 & 2033

- Figure 7: South America UK Construction Market Revenue Share (%), by Sector 2025 & 2033

- Figure 8: South America UK Construction Market Revenue (Million), by Country 2025 & 2033

- Figure 9: South America UK Construction Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe UK Construction Market Revenue (Million), by Sector 2025 & 2033

- Figure 11: Europe UK Construction Market Revenue Share (%), by Sector 2025 & 2033

- Figure 12: Europe UK Construction Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe UK Construction Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa UK Construction Market Revenue (Million), by Sector 2025 & 2033

- Figure 15: Middle East & Africa UK Construction Market Revenue Share (%), by Sector 2025 & 2033

- Figure 16: Middle East & Africa UK Construction Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa UK Construction Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific UK Construction Market Revenue (Million), by Sector 2025 & 2033

- Figure 19: Asia Pacific UK Construction Market Revenue Share (%), by Sector 2025 & 2033

- Figure 20: Asia Pacific UK Construction Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific UK Construction Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Construction Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 2: Global UK Construction Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global UK Construction Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 4: Global UK Construction Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States UK Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada UK Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico UK Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global UK Construction Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 9: Global UK Construction Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil UK Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina UK Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America UK Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global UK Construction Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 14: Global UK Construction Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom UK Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany UK Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France UK Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy UK Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain UK Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia UK Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux UK Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics UK Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe UK Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global UK Construction Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 25: Global UK Construction Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey UK Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel UK Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC UK Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa UK Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa UK Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa UK Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global UK Construction Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 33: Global UK Construction Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China UK Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India UK Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan UK Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea UK Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN UK Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania UK Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific UK Construction Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Construction Market?

The projected CAGR is approximately 3.19%.

2. Which companies are prominent players in the UK Construction Market?

Key companies in the market include Morgan Sindall Group plc, Winvic Group, Galliford Try plc, Keller Group plc, Balfour Beatty plc, ISG plc, Bouygues UK, Kier Group plc, Laing O'Rourke plc**List Not Exhaustive, Mace Ltd.

3. What are the main segments of the UK Construction Market?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 398.68 Million as of 2022.

5. What are some drivers contributing to market growth?

Transport Infrstructure Investment.

6. What are the notable trends driving market growth?

Increase in GVA of construction Industry.

7. Are there any restraints impacting market growth?

Shortage of Skilled Labor.

8. Can you provide examples of recent developments in the market?

December 2022: The Access Group has announced that it has successfully acquired Construction Industry Solutions (COINS), enhancing its capacity to offer international software and services to businesses engaged in the construction industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Construction Market?

To stay informed about further developments, trends, and reports in the UK Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence