Key Insights

The Brazil offshore energy market is a significant growth area, anticipated to expand at a Compound Annual Growth Rate (CAGR) of 9.45% from 2025 to 2033. This expansion is underpinned by Brazil's vast oil and gas resources and a strengthened focus on renewable energy sources, including wind and wave power. Substantial investments in offshore infrastructure, particularly for deep-water exploration and production, are key growth drivers. Government support for sustainable energy development and diversification from fossil fuels further enhances the market's potential for renewable offshore energy projects. Despite potential regulatory and environmental challenges, the market outlook is positive, driven by rising energy demand and advancements in offshore energy technologies. Leading companies such as Petrobras, Vestas Wind Systems, and Siemens Gamesa Renewable Energy are strategically positioned to leverage this growth, fostering innovation and competition.

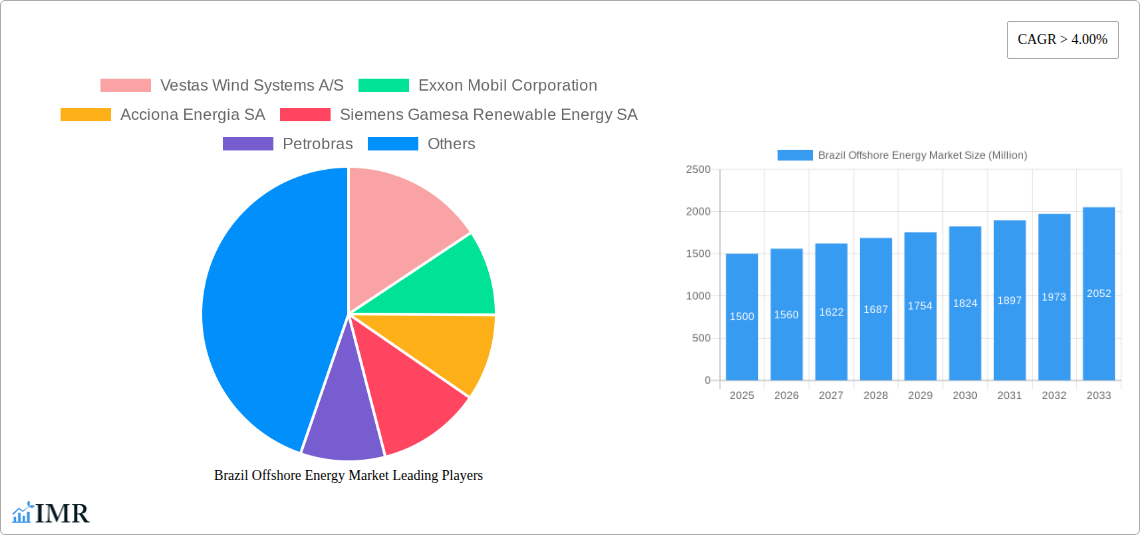

Brazil Offshore Energy Market Market Size (In Billion)

Renewable energy presents substantial opportunities, with offshore wind power poised for significant growth owing to Brazil's extensive coastline and favorable wind patterns. Innovations in wave energy technology may also unlock future potential. The oil and gas sector, while facing sustainability pressures, will remain a vital contributor due to Brazil's considerable reserves and ongoing exploration. A balanced strategy integrating fossil fuels and renewables is essential for Brazil's long-term energy security. Market success hinges on continued technological innovation, supportive government policies, and effective environmental mitigation.

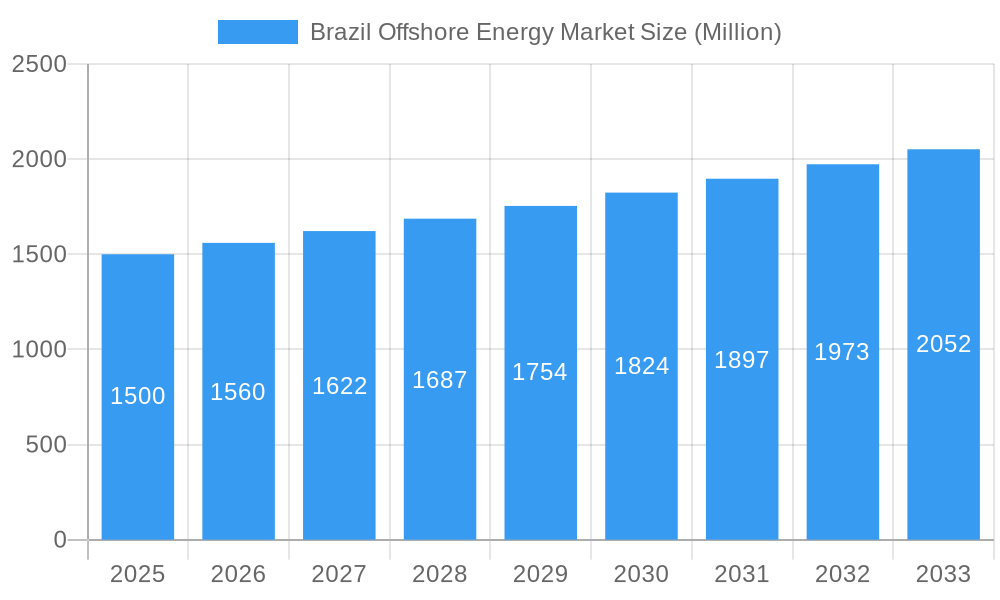

Brazil Offshore Energy Market Company Market Share

Brazil Offshore Energy Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning Brazil offshore energy market, encompassing its dynamic landscape, growth trajectories, key players, and future prospects. With a focus on wind, oil and gas, and wave energy segments, this study offers invaluable insights for industry professionals, investors, and policymakers seeking to navigate this rapidly evolving sector. The report covers the period 2019-2033, with 2025 as the base and estimated year.

Brazil Offshore Energy Market Dynamics & Structure

The Brazilian offshore energy market is characterized by a complex interplay of factors influencing its growth and structure. Market concentration is relatively low, with several international and domestic players vying for market share. However, significant mergers and acquisitions (M&A) activity, particularly in the wind energy segment, is shaping the competitive landscape. The report estimates that M&A deal volume increased by xx% between 2021 and 2022, driven by the country’s significant offshore wind potential. Technological innovation is a key driver, especially in offshore wind technology, with advancements in turbine design and installation methods leading to increased efficiency and cost reductions. However, challenges remain regarding the development and deployment of innovative wave energy technologies in Brazil.

- Market Concentration: Moderately fragmented, with increasing consolidation.

- Technological Innovation: Significant advancements in wind energy, limited progress in wave.

- Regulatory Framework: Evolving regulatory policies are key to supporting industry growth.

- Competitive Substitutes: Hydropower and onshore renewables pose some competition.

- End-User Demographics: Primarily driven by large energy companies and the government.

- M&A Trends: Significant activity observed across all segments, but primarily focused on wind energy.

Brazil Offshore Energy Market Growth Trends & Insights

The Brazilian offshore energy market is experiencing substantial growth, driven primarily by the country's vast offshore resources, supportive government policies, and increasing demand for renewable energy. The market size, valued at xx Million in 2024, is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is largely attributed to the rapid expansion of the offshore wind sector. Adoption rates are increasing significantly, particularly in the southeast region due to favorable wind resources and infrastructure development. However, technological challenges, such as the development of suitable wave energy conversion technologies and the need for specialized skills in offshore operations, will have to be overcome to unlock the full potential of all offshore energy segments.

Dominant Regions, Countries, or Segments in Brazil Offshore Energy Market

The southeast region of Brazil is currently the dominant region for offshore energy development, particularly for wind energy. This dominance is largely attributed to the availability of favorable wind resources, existing port infrastructure, and government initiatives to promote renewable energy development in the area. The offshore wind segment is the fastest-growing sector, driven by substantial investment in new projects and supportive government policies, The oil and gas sector remains significant, while the wave energy sector is still in its nascent stage, with limited commercial projects.

- Key Drivers (Southeast Region):

- Abundant wind resources

- Existing port infrastructure

- Government incentives for renewable energy

- Dominance Factors:

- High resource availability

- Supportive regulatory environment

- Significant investments in infrastructure

- Growth Potential: The southeast region has significant untapped potential, particularly in offshore wind.

Brazil Offshore Energy Market Product Landscape

The Brazilian offshore energy market features a diverse range of products, including advanced wind turbines, specialized oil and gas extraction platforms, and innovative wave energy converters. Continuous technological advancements are driving the development of more efficient and cost-effective solutions. Notably, floating offshore wind turbines are gaining traction due to their ability to access deeper water resources. Furthermore, the integration of smart technologies, such as sensors and data analytics, is improving performance and optimizing operations.

Key Drivers, Barriers & Challenges in Brazil Offshore Energy Market

Key Drivers:

- Government support: Incentive programs and regulatory frameworks designed to attract investments.

- Renewable energy targets: ambitious goals to increase renewable energy contribution to the energy mix.

- Technological advancements: Continuous improvements in wind and wave energy technologies.

Challenges & Restraints:

- High capital costs: Significant upfront investments are required to develop offshore energy projects, particularly for offshore wind farms. This creates a barrier to entry for smaller players.

- Regulatory hurdles: Navigating the complex regulatory landscape and securing permits poses a challenge for companies.

- Supply chain limitations: Developing a robust and efficient supply chain is crucial for the industry's growth.

Emerging Opportunities in Brazil Offshore Energy Market

- Untapped potential in the Northeast region: Exploration of offshore wind resources in under-developed areas.

- Hybrid projects: Combining offshore wind and wave energy technologies to optimize resource utilization.

- Floating offshore wind technology: Expansion into deeper waters to access larger resource potentials.

Growth Accelerators in the Brazil Offshore Energy Market Industry

Technological innovation, strategic partnerships, and market expansion initiatives are key growth accelerators for the Brazilian offshore energy sector. The adoption of innovative floating offshore wind technologies will unlock access to deeper water resources, significantly increasing the potential of the wind segment. Strategic collaborations between international and domestic companies are vital to facilitating knowledge transfer and technology adoption.

Key Players Shaping the Brazil Offshore Energy Market Market

Notable Milestones in Brazil Offshore Energy Market Sector

- June 2022: Corio Generation plans to develop five offshore wind projects (5 GW+) in partnership with Servtec.

- May 2022: Petrobras and Equinor assess the feasibility of a 4 GW offshore wind farm near Aracatu.

In-Depth Brazil Offshore Energy Market Market Outlook

The future of the Brazilian offshore energy market is exceptionally promising. Continuous technological advancements, coupled with supportive government policies and increasing investor interest, are poised to drive substantial growth across all segments. The exploration of untapped resources, particularly in offshore wind, presents significant opportunities for market expansion and the creation of a sustainable energy future for Brazil. Strategic partnerships and a robust regulatory framework will be crucial in harnessing this potential.

Brazil Offshore Energy Market Segmentation

-

1. Type

- 1.1. Wind

- 1.2. Oil and Gas

- 1.3. Wave

Brazil Offshore Energy Market Segmentation By Geography

- 1. Brazil

Brazil Offshore Energy Market Regional Market Share

Geographic Coverage of Brazil Offshore Energy Market

Brazil Offshore Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in Demand of Refined Petroleum Products4.; Need for Sustainable Refined Petroleum Products

- 3.3. Market Restrains

- 3.3.1. Increase in Adoption of Alternative Fuel Vehicles

- 3.4. Market Trends

- 3.4.1. The Oil and Gas Segment is Expected to Dominate the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Offshore Energy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wind

- 5.1.2. Oil and Gas

- 5.1.3. Wave

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Vestas Wind Systems A/S

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Exxon Mobil Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Acciona Energia SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Siemens Gamesa Renewable Energy SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Petrobras

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Chevron Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Eco Wave Power Global

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Enel Green Power SpA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Repsol SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 General Electric Company*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Vestas Wind Systems A/S

List of Figures

- Figure 1: Brazil Offshore Energy Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Brazil Offshore Energy Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Offshore Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Brazil Offshore Energy Market Volume gigawatts Forecast, by Type 2020 & 2033

- Table 3: Brazil Offshore Energy Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Brazil Offshore Energy Market Volume gigawatts Forecast, by Region 2020 & 2033

- Table 5: Brazil Offshore Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Brazil Offshore Energy Market Volume gigawatts Forecast, by Type 2020 & 2033

- Table 7: Brazil Offshore Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Brazil Offshore Energy Market Volume gigawatts Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Offshore Energy Market?

The projected CAGR is approximately 9.45%.

2. Which companies are prominent players in the Brazil Offshore Energy Market?

Key companies in the market include Vestas Wind Systems A/S, Exxon Mobil Corporation, Acciona Energia SA, Siemens Gamesa Renewable Energy SA, Petrobras, Chevron Corporation, Eco Wave Power Global, Enel Green Power SpA, Repsol SA, General Electric Company*List Not Exhaustive.

3. What are the main segments of the Brazil Offshore Energy Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Surge in Demand of Refined Petroleum Products4.; Need for Sustainable Refined Petroleum Products.

6. What are the notable trends driving market growth?

The Oil and Gas Segment is Expected to Dominate the market.

7. Are there any restraints impacting market growth?

Increase in Adoption of Alternative Fuel Vehicles.

8. Can you provide examples of recent developments in the market?

June 2022: Corio Generation intended to develop five offshore wind projects in Brazil with a combined capacity of more than 5 GW. Servtec, a Brazilian power generation company, will develop the five projects with Corio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in gigawatts.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Offshore Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Offshore Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Offshore Energy Market?

To stay informed about further developments, trends, and reports in the Brazil Offshore Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence