Key Insights

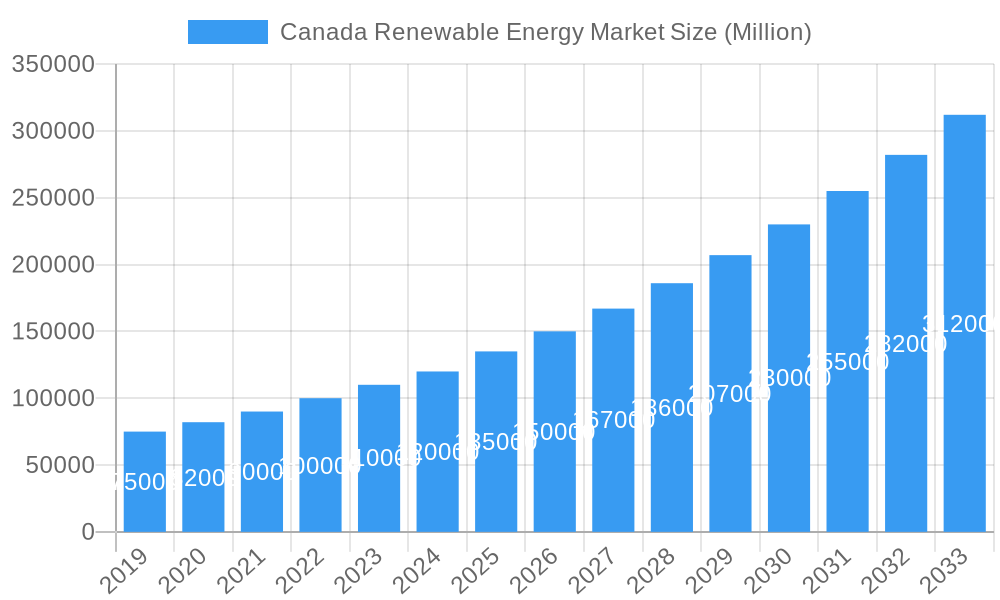

The Canadian renewable energy sector is set for substantial growth, with an estimated market size of $39.1 billion by the base year 2025. The market is projected to expand at a Compound Annual Growth Rate (CAGR) of 1.9% from 2025 to 2033. This upward trend is driven by supportive government decarbonization policies, increasing demand for sustainable energy solutions across all sectors, and technological advancements enhancing efficiency and cost-effectiveness. Canada's commitment to climate action and energy security is a key catalyst for investment in green energy. Major trends include significant expansion of utility-scale solar and wind projects, alongside growing adoption of distributed generation and energy storage for grid stability. Emerging opportunities in bioenergy from waste and tidal energy are also notable.

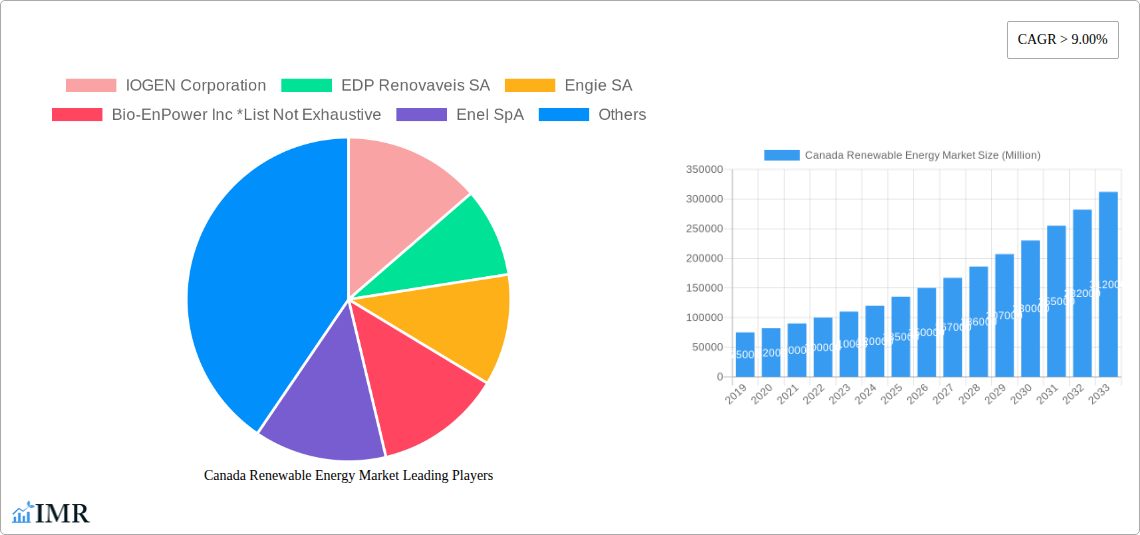

Canada Renewable Energy Market Market Size (In Billion)

Potential challenges to market expansion include high initial capital investments, the need for extensive infrastructure upgrades for intermittent renewables, and regulatory complexities. Land availability and local opposition can also pose obstacles. However, the significant economic and environmental advantages, coupled with ongoing technological improvements and cost reductions, are expected to mitigate these restraints. The market is segmented by energy source, with Hydro, Wind, and Solar currently leading, while Bioenergy and Tidal show strong growth potential. End-user segments include Residential, Commercial & Industrial, and Transportation, all seeking cleaner energy. Key industry players such as IOGEN Corporation, EDP Renovaveis SA, Engie SA, and Siemens Gamesa Renewable Energy SA are instrumental in driving innovation and deployment.

Canada Renewable Energy Market Company Market Share

Canada Renewable Energy Market Report: Unlocking a Sustainable Future

This comprehensive report provides an in-depth analysis of the Canada Renewable Energy Market, encompassing the historical period from 2019 to 2024 and projecting robust growth through 2033. Leveraging cutting-edge data and expert insights, we dissect key market dynamics, growth trends, regional dominance, product landscapes, and the competitive environment. This report is essential for industry professionals, investors, and policymakers seeking to understand and capitalize on the burgeoning opportunities within Canada's clean energy sector. We explore parent and child market segments across Hydro Energy, Wind Energy, Solar Energy, Bioenergy, and Tidal Energy, with a detailed breakdown of end-user adoption in Residential, Commercial and Industrial, Transportation, and Industry sectors.

Canada Renewable Energy Market Market Dynamics & Structure

The Canada Renewable Energy Market is characterized by a dynamic interplay of technological innovation, evolving regulatory frameworks, and increasing end-user demand. Market concentration varies across segments, with established players in hydro energy contrasting with the rapid expansion of solar and wind power. Technological innovation is a key driver, fueled by significant R&D investments and a government commitment to decarbonization targets. Regulatory frameworks, including federal and provincial incentives, carbon pricing mechanisms, and grid modernization initiatives, are instrumental in shaping investment decisions and project development. Competitive product substitutes, primarily from fossil fuels, are steadily being eroded by the declining costs and improving efficiency of renewable technologies. End-user demographics are shifting, with a growing preference for sustainable energy solutions across residential, commercial, and industrial sectors. Merger and acquisition (M&A) trends indicate a consolidation within mature segments and strategic investments in emerging technologies and project pipelines.

- Market Concentration: Highly concentrated in hydro energy, with increasing fragmentation and competition in solar and wind power.

- Technological Innovation Drivers: Driven by government R&D funding, private sector innovation, and the pursuit of cost-effective clean energy solutions.

- Regulatory Frameworks: Supportive federal policies and provincial targets are crucial for market expansion.

- Competitive Product Substitutes: Fossil fuels remain a substitute, but cost parity and environmental concerns are diminishing their appeal.

- End-User Demographics: Growing demand from residential consumers, corporate sustainability initiatives, and industrial decarbonization efforts.

- M&A Trends: Active M&A activity focused on acquiring project pipelines and consolidating market share in key renewable segments.

Canada Renewable Energy Market Growth Trends & Insights

The Canada Renewable Energy Market is poised for significant expansion, driven by a confluence of favorable economic, environmental, and policy factors. The market size is projected to grow at an impressive Compound Annual Growth Rate (CAGR) of approximately 7.5% over the forecast period (2025-2033), reaching an estimated value of $125,000 million units by 2033. This growth is underpinned by accelerating adoption rates of solar and wind energy, spurred by declining technology costs and supportive government incentives. Technological disruptions, such as advancements in battery storage and smart grid technologies, are further enhancing the reliability and integration of intermittent renewable sources. Consumer behavior is shifting, with an increasing awareness of climate change and a growing demand for clean energy solutions, translating into higher market penetration across residential and commercial sectors. The foundational year of 2025 is estimated to see the market reach $75,000 million units, indicating substantial growth from the historical period (2019-2024).

Dominant Regions, Countries, or Segments in Canada Renewable Energy Market

Within the Canada Renewable Energy Market, Hydro Energy continues to be a dominant segment, historically contributing the largest share of renewable electricity generation. This dominance is attributed to Canada's vast water resources and established infrastructure. However, Wind Energy and Solar Energy are experiencing the most rapid growth and are projected to significantly increase their market share over the forecast period.

- Hydro Energy:

- Dominance Factors: Abundant natural resources, long-standing infrastructure, and a stable baseload power provider.

- Market Share: Historically holds the largest share, estimated at 55% in the base year 2025.

- Growth Potential: Moderate growth, primarily driven by upgrades and expansion of existing facilities.

- Wind Energy:

- Key Drivers: Declining turbine costs, favorable provincial policies, and growing corporate demand for renewable power purchase agreements.

- Market Share: Projected to reach 30% by 2033, a significant increase from its historical presence.

- Growth Potential: High, with substantial untapped onshore wind resources.

- Solar Energy:

- Key Drivers: Rapidly falling solar panel costs, increasing utility-scale project development, and growing rooftop solar adoption.

- Market Share: Expected to capture 12% of the market by 2033, demonstrating a strong upward trajectory.

- Growth Potential: Very high, particularly in regions with high solar irradiance.

- End-User Dominance: The Commercial and Industrial (C&I) sector is the leading end-user segment, driven by corporate sustainability goals and the pursuit of cost savings through on-site generation and power purchase agreements. Residential adoption is steadily increasing, while the Transportation sector is beginning to see growth with the electrification of fleets.

Canada Renewable Energy Market Product Landscape

The Canada Renewable Energy Market is defined by a landscape of increasingly efficient and cost-effective technologies. Innovations in wind turbine design, including larger rotor diameters and advanced aerodynamic features, are maximizing energy capture. Solar energy advancements are characterized by higher efficiency photovoltaic panels, bifacial modules, and integrated energy storage solutions. Bioenergy technologies are evolving to include more efficient conversion processes and the utilization of diverse biomass feedstocks. Emerging tidal energy technologies are showing promise for localized, predictable power generation. These product innovations are directly impacting performance metrics, with significant improvements in capacity factors for wind and solar, and reduced levelized cost of energy (LCOE) across the board.

Key Drivers, Barriers & Challenges in Canada Renewable Energy Market

Key Drivers:

- Government Policy & Incentives: Federal and provincial targets for emissions reductions and renewable energy deployment, coupled with financial incentives and tax credits.

- Declining Technology Costs: Continuous reduction in the cost of solar panels, wind turbines, and battery storage systems.

- Corporate Sustainability Initiatives: Increasing commitment from businesses to reduce their carbon footprint and procure renewable energy.

- Energy Security & Independence: Desire to reduce reliance on fossil fuels and diversify energy sources.

Barriers & Challenges:

- Grid Intermittency & Integration: Managing the variability of solar and wind power requires significant grid modernization and energy storage solutions.

- Supply Chain Constraints: Potential for disruptions in the global supply chain for critical components.

- Regulatory Hurdles & Permitting: Navigating complex permitting processes and obtaining regulatory approvals can cause project delays.

- Public Perception & Land Use: Addressing concerns related to visual impact, noise pollution, and land acquisition for large-scale projects.

Emerging Opportunities in Canada Renewable Energy Market

Emerging opportunities in the Canada Renewable Energy Market lie in the development of advanced energy storage solutions to complement intermittent renewables, particularly in regions with high solar and wind penetration. The expansion of green hydrogen production, powered by renewable electricity, presents a significant opportunity for decarbonizing heavy industry and transportation. Untapped potential exists in offshore wind development, especially along Canada's coastlines, and in the further commercialization of geothermal and advanced bioenergy technologies. Evolving consumer preferences for distributed energy resources and microgrids also create opportunities for innovative business models and localized energy solutions.

Growth Accelerators in the Canada Renewable Energy Market Industry

Long-term growth in the Canada Renewable Energy Market will be significantly accelerated by continued technological breakthroughs in areas such as next-generation solar cells, advanced battery chemistries for longer duration storage, and more efficient wind turbine designs. Strategic partnerships between renewable energy developers, utility companies, and industrial consumers will be crucial for scaling up projects and ensuring grid stability. Market expansion strategies, including the development of new transmission infrastructure to connect remote renewable resources to demand centers, and policy frameworks that incentivize long-term investment certainty, will further propel growth. The ongoing electrification of transportation and industrial processes will also serve as a major growth accelerator.

Key Players Shaping the Canada Renewable Energy Market Market

- IOGEN Corporation

- EDP Renovaveis SA

- Engie SA

- Bio-EnPower Inc

- Enel SpA

- Siemens Gamesa Renewable Energy SA

- Electricite de France SA (EDF Renewables)

- Canadian Solar Inc

- Vestas Wind Systems AS

- Acciona SA

Notable Milestones in Canada Renewable Energy Market Sector

- January 2022: Canada planned a new utility-scale solar power project, Fox Coulee Solar Project, in Alberta. The 85.6-MW solar PV power project, developed by Aura Power Developments and Subra GP, is expected to be in service by 2023.

- April 2021: Bimbo Canada entered two Virtual Power Purchase Agreements (VPPAs) with RES Canada to secure 50 MW of electricity from upcoming wind and solar power plants, demonstrating strong corporate commitment to renewable energy sourcing by the end of 2022.

In-Depth Canada Renewable Energy Market Market Outlook

The future outlook for the Canada Renewable Energy Market is exceptionally positive, driven by a clear trajectory towards decarbonization and energy independence. Growth accelerators include significant advancements in energy storage technologies, which will alleviate intermittency concerns and unlock greater grid capacity for renewables. The burgeoning green hydrogen sector, powered by abundant renewable electricity, promises to revolutionize heavy industry and transportation. Continued investment in offshore wind and the exploration of underutilized geothermal resources will diversify the renewable energy mix. Strategic collaborations and supportive policy environments are essential for realizing this potential, ensuring Canada’s leadership in the global transition to clean energy and creating substantial economic and environmental benefits.

Canada Renewable Energy Market Segmentation

-

1. Type

- 1.1. Hydro Energy

- 1.2. Wind Energy

- 1.3. Solar Energy

- 1.4. Bioenergy

- 1.5. Tidal Energy

-

2. End User

- 2.1. Residential

- 2.2. Commercial and Industrial

- 2.3. Transportation

Canada Renewable Energy Market Segmentation By Geography

- 1. Canada

Canada Renewable Energy Market Regional Market Share

Geographic Coverage of Canada Renewable Energy Market

Canada Renewable Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Solar Energy Demand4.; Declining Cost of Solar PV Systems

- 3.3. Market Restrains

- 3.3.1. 4.; Strong Dependence on Prevailing Weather Condition

- 3.4. Market Trends

- 3.4.1. Wind Energy Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Renewable Energy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hydro Energy

- 5.1.2. Wind Energy

- 5.1.3. Solar Energy

- 5.1.4. Bioenergy

- 5.1.5. Tidal Energy

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial and Industrial

- 5.2.3. Transportation

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 IOGEN Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 EDP Renovaveis SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Engie SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bio-EnPower Inc *List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Enel SpA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Siemens Gamesa Renewable Energy SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Electricite de France SA (EDF Renewables)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Canadian Solar Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Vestas Wind Systems AS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Acciona SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 IOGEN Corporation

List of Figures

- Figure 1: Canada Renewable Energy Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Renewable Energy Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Renewable Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Canada Renewable Energy Market Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Canada Renewable Energy Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Canada Renewable Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Canada Renewable Energy Market Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Canada Renewable Energy Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Renewable Energy Market?

The projected CAGR is approximately 1.9%.

2. Which companies are prominent players in the Canada Renewable Energy Market?

Key companies in the market include IOGEN Corporation, EDP Renovaveis SA, Engie SA, Bio-EnPower Inc *List Not Exhaustive, Enel SpA, Siemens Gamesa Renewable Energy SA, Electricite de France SA (EDF Renewables), Canadian Solar Inc, Vestas Wind Systems AS, Acciona SA.

3. What are the main segments of the Canada Renewable Energy Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 39.1 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Solar Energy Demand4.; Declining Cost of Solar PV Systems.

6. What are the notable trends driving market growth?

Wind Energy Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Strong Dependence on Prevailing Weather Condition.

8. Can you provide examples of recent developments in the market?

In January 2022, Canada planned a new utility-scale solar power project, Fox Coulee Solar Project, in Alberta. The 85.6-MW solar PV power project will be developed by two companies, Aura Power Developments and Subra GP, in a single phase. Its construction will be started in 2022 and is expected to be in service by 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Renewable Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Renewable Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Renewable Energy Market?

To stay informed about further developments, trends, and reports in the Canada Renewable Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence