Key Insights

The China energy storage battery market is poised for substantial expansion, with an estimated market size of $223.3 billion by 2033, driven by a robust Compound Annual Growth Rate (CAGR) of 25.4% from a base year of 2024. This growth is underpinned by China's ambitious renewable energy objectives, which require advanced energy storage to stabilize intermittent solar and wind power generation. Supportive government policies and incentives are further accelerating the adoption of energy storage solutions across residential, commercial, and industrial sectors. The burgeoning electric vehicle (EV) market also significantly boosts demand for sophisticated battery technologies. Continuous technological advancements, particularly in lithium-ion chemistries, are enhancing energy density, lifespan, and cost-effectiveness, stimulating market expansion. The market is segmented by battery type, including Pumped Hydro, Electrochemical, Molten Salt, Compressed Air, and Flywheel, and by application, such as Residential, Commercial, and Industrial. Electrochemical batteries currently lead the market due to their established technology and cost-competitiveness. Despite challenges like raw material price volatility and the need for improved recycling infrastructure, the outlook for the China energy storage battery market is exceptionally positive. China's manufacturing prowess positions it for continued leadership in this rapidly growing global sector, reflecting a commitment to sustainable energy solutions from both public and private entities.

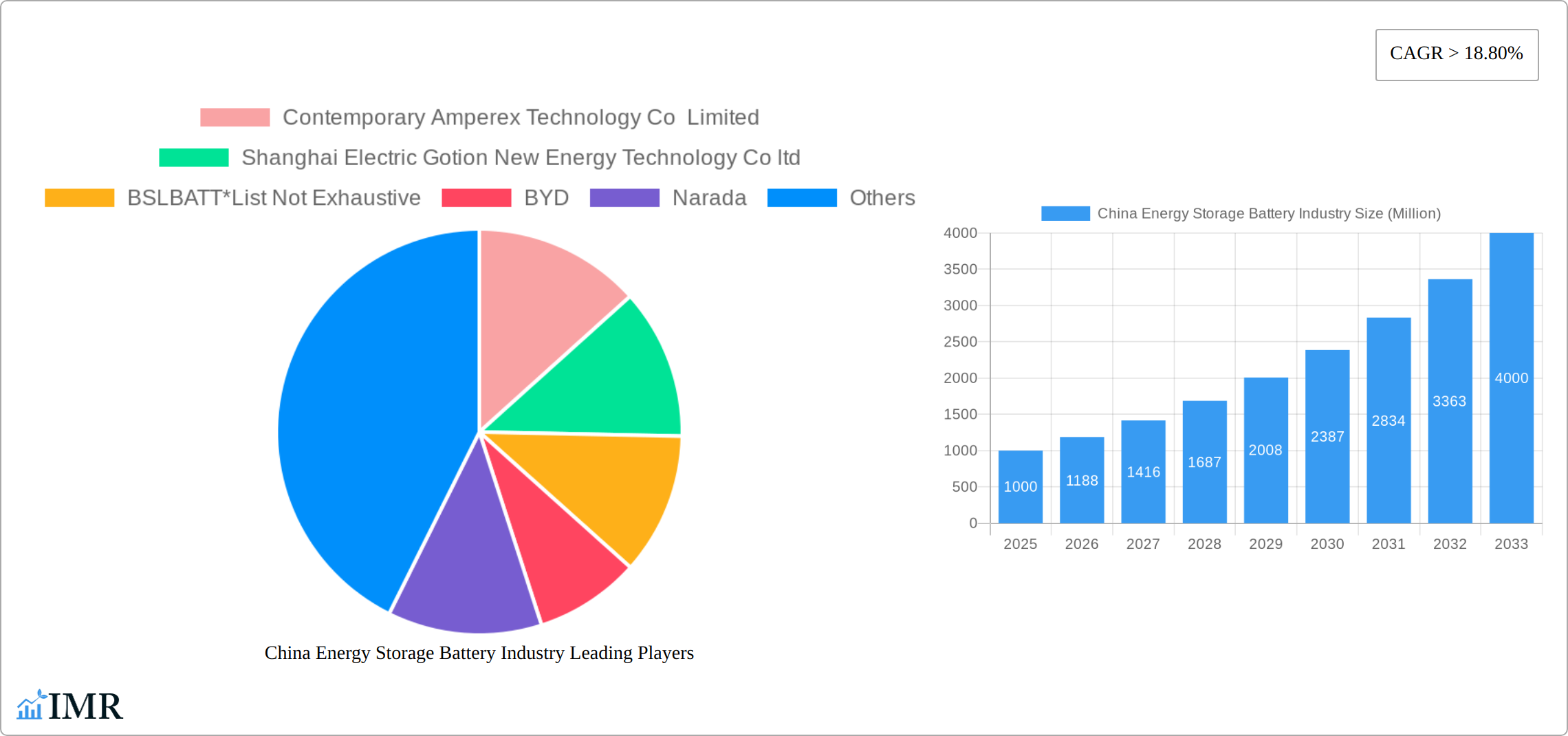

China Energy Storage Battery Industry Market Size (In Billion)

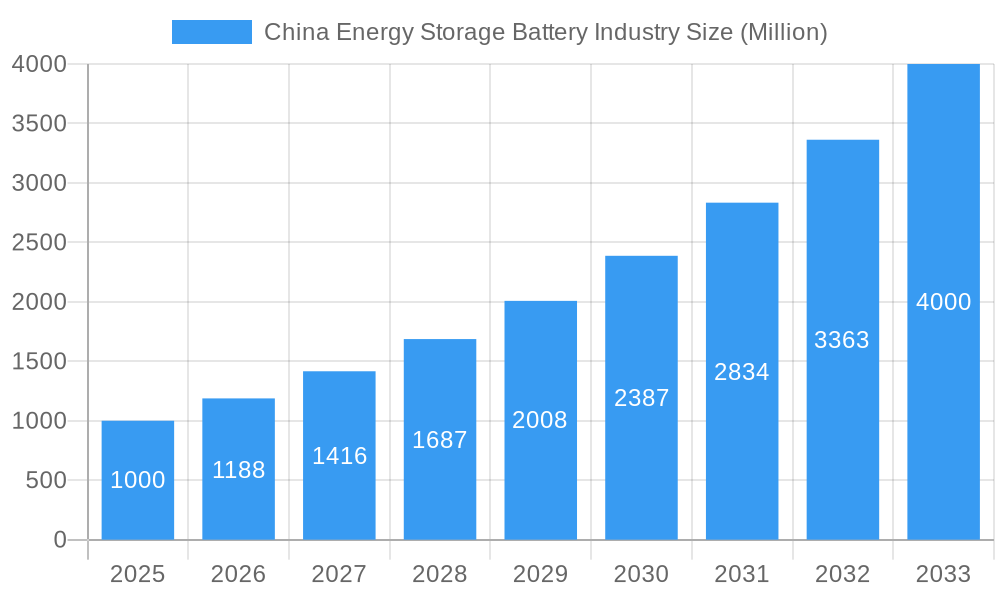

The competitive landscape is dominated by key players such as CATL, BYD, and Lishen Battery, who are actively investing in research and development to enhance battery performance and lower production costs. Strategic alliances between battery manufacturers and energy providers are also driving market growth. While the primary focus remains on the domestic market, international expansion opportunities are emerging due to increasing global demand for energy storage solutions. Innovative business models, including battery-as-a-service, are facilitating wider adoption. Considering the strong growth drivers and significant governmental backing, the long-term outlook for the China energy storage battery market is highly promising, offering substantial potential for both domestic and international expansion.

China Energy Storage Battery Industry Company Market Share

China Energy Storage Battery Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the burgeoning China energy storage battery industry, encompassing market dynamics, growth trends, key players, and future outlook. Focusing on both parent and child markets, the report offers invaluable insights for industry professionals, investors, and strategists seeking to navigate this rapidly evolving landscape. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Market values are presented in million units.

China Energy Storage Battery Industry Market Dynamics & Structure

The Chinese energy storage battery market is experiencing explosive growth, fueled by the nation's ambitious renewable energy targets and supportive government policies. This dynamic market is characterized by moderate concentration, with several leading domestic players vying for dominance alongside international competitors. Technological innovation, primarily in lithium-ion battery technology and advanced energy storage system (ESS) designs, remains a crucial driver. Stringent environmental regulations, coupled with substantial government incentives, are accelerating market expansion. While alternatives like pumped hydro storage exist, electrochemical batteries maintain a dominant position due to their scalability, flexibility, and adaptability to diverse applications. End-user demand spans residential, commercial, and industrial sectors, with industrial applications currently leading due to significant cost savings and efficiency gains. The market is also witnessing a surge in mergers and acquisitions (M&A) activity, signaling consolidation amongst major players and a drive towards economies of scale.

- Market Concentration: Moderate, with the top 5 players holding an estimated [Insert Percentage]% of the market share in 2024. This is expected to [Increase/Decrease/Remain Stable] in the coming years due to [Explain Reason, e.g., increased competition, M&A activity].

- Technological Innovation: Intense focus on enhancing energy density, extending lifespan, improving safety features, and reducing the cost-effectiveness of lithium-ion batteries, alongside exploration of next-generation battery technologies like solid-state batteries.

- Regulatory Framework: The Chinese government actively promotes renewable energy adoption and energy storage deployment through various policy initiatives, including subsidies, tax breaks, and supportive regulations. However, consistent regulatory clarity and standardization remain crucial for long-term market stability.

- Competitive Substitutes: Pumped hydro, compressed air energy storage (CAES), and flywheel energy storage systems offer alternatives, but their scalability and applicability are often limited compared to the versatility and cost-effectiveness of electrochemical batteries, especially in distributed energy storage scenarios.

- End-User Demographics: Industrial ([Insert Percentage]% ), Commercial ([Insert Percentage]% ), Residential ([Insert Percentage]% ). The industrial sector's dominance is anticipated to [Increase/Decrease/Remain Relatively Stable] based on [Explain trends, e.g., growth in renewable energy projects, industrial automation].

- M&A Trends: A significant increase in mergers and acquisitions, with [Insert Number] deals recorded in the past 5 years, reflects a trend of consolidation and strategic expansion by larger players to secure market share and enhance technological capabilities.

China Energy Storage Battery Industry Growth Trends & Insights

The Chinese energy storage battery market exhibits exceptionally robust growth, fueled by soaring demand for renewable energy integration, grid stabilization, and enhanced energy efficiency. Market size is projected to surge from [Insert 2024 Market Size] in 2024 to [Insert 2033 Market Size] by 2033, representing a Compound Annual Growth Rate (CAGR) of [Insert CAGR Percentage]%. Adoption rates are accelerating across all sectors, particularly in the industrial segment, driven by the substantial economic benefits of energy storage. Ongoing technological advancements, including breakthroughs in battery chemistry and ESS design, are steadily reducing costs and improving performance, accelerating market penetration. Furthermore, evolving consumer preferences towards sustainable energy solutions are providing a powerful tailwind to this expansion.

[Insert 600 words of detailed analysis leveraging data on market size, CAGR, penetration rates, key market segments, and regional variations. Include charts and graphs where applicable. Consider discussing factors such as government policies, technological advancements, and economic growth.]

Dominant Regions, Countries, or Segments in China Energy Storage Battery Industry

The electrochemical battery segment unequivocally dominates the Chinese energy storage battery market, propelled by continuous technological advancements, substantial cost reductions, and widespread applicability. Within the applications landscape, industrial energy storage commands the leading segment, driven by substantial energy demands and the potential for significant cost savings through optimized energy management. Key growth drivers are synergistic: government incentives strategically align with the expansion of renewable energy sources and the nation's ongoing industrialization. Geographically, coastal provinces, often characterized by high concentrations of renewable energy installations and robust power grids, are witnessing the most rapid growth. However, inland provinces are also experiencing increasing adoption, especially in regions focused on industrial development and urbanization.

- Type: Electrochemical (dominating due to superior cost-effectiveness and scalability)

- Application: Industrial (leading due to significant cost savings and substantial energy demands)

- Key Drivers:

- Government policies providing strong incentives for renewable energy integration and energy storage deployment.

- Significant infrastructure development actively supporting grid-scale energy storage projects.

- Continuous cost reduction in electrochemical battery technology, enhancing competitiveness.

- The ever-growing demand for enhanced energy security and greater grid stability.

- Expanding electric vehicle (EV) market, driving demand for advanced battery systems.

[Insert 600 words of detailed analysis, including detailed data illustrating market share and growth potential for each region/segment. Include regional breakdowns, provincial analysis, and discussion of emerging segments within the industrial sector. Use charts and graphs to visualize the data effectively.]

China Energy Storage Battery Industry Product Landscape

The Chinese energy storage battery market showcases a diverse product landscape, encompassing various battery chemistries (primarily lithium-ion), system designs, and power capacities. Recent innovations focus on enhancing energy density, lifespan, safety, and cost-effectiveness. Product applications span residential, commercial, and industrial sectors, with tailored solutions for grid-scale energy storage and microgrids. Unique selling propositions often center around advanced battery management systems, enhanced safety features, and improved cycle life. Technological advancements are continuous, driven by the pursuit of higher energy density and improved overall system performance.

Key Drivers, Barriers & Challenges in China Energy Storage Battery Industry

Key Drivers: Robust government support for renewable energy and the modernization of the power grid; a surge in demand for dependable and clean energy sources; the ongoing decline in battery production costs; and technological breakthroughs resulting in improved performance and enhanced safety features.

Challenges: Potential supply chain disruptions, particularly concerning raw materials like lithium, cobalt, and nickel; inherent safety risks associated with large-scale energy storage deployments, necessitating robust safety protocols and regulatory oversight; fierce competition from both domestic and international players, demanding innovation and efficiency; and the need for further standardization and regulatory clarity in certain areas of the industry. The rapid pace of technological advancement also poses challenges, requiring constant adaptation and investment in R&D.

Emerging Opportunities in China Energy Storage Battery Industry

Significant emerging opportunities are evident in exploring specialized niche applications, including electric vehicles (EVs), hybrid electric vehicles (HEVs), and portable power solutions tailored to specific needs. Expanding access to energy storage in rural areas with limited grid infrastructure presents substantial untapped potential. The development and commercialization of advanced battery chemistries—featuring higher energy density, superior safety profiles, and improved cycle life—will be crucial for sustained growth. Innovative business models, such as battery-as-a-service (BaaS), are gaining traction, offering new avenues for market penetration and sustainable revenue streams. The integration of energy storage into smart grids and the development of advanced energy management systems will further create opportunities for growth and innovation.

Growth Accelerators in the China Energy Storage Battery Industry Industry

Technological advancements in battery chemistry and energy management systems are key growth catalysts. Strategic partnerships between battery manufacturers, system integrators, and energy providers are facilitating faster market penetration. Government initiatives to promote renewable energy integration and grid modernization continue to fuel industry growth. The expansion of energy storage applications beyond grid-scale deployments into residential and transportation markets offers further growth potential.

Key Players Shaping the China Energy Storage Battery Industry Market

- Contemporary Amperex Technology Co Limited

- Shanghai Electric Gotion New Energy Technology Co ltd

- BSLBATT

- BYD

- Narada

- Ganfeng Battery

- CALB

- EVE Energy Co Ltd

- Higee Enegry

- Tianjin Lishen Battery Joint-Stock Co Ltd

Notable Milestones in China Energy Storage Battery Industry Sector

- April 2022: BSLBATT introduced the High Voltage Battery System (BSL-BOX-HV), a modular LFP battery system for solar energy storage, offering capacities from 15.36kWh to 35.84 kWh.

- March 2022: Construction began on China's first integrated flywheel and battery storage project in Shuozhou, with a budget of CNY 33.72 million.

In-Depth China Energy Storage Battery Industry Market Outlook

The China energy storage battery market is poised for sustained growth driven by ongoing technological innovations, favorable government policies, and increasing demand for clean energy solutions. Strategic partnerships and expansion into new application areas will be critical for success. The market presents attractive opportunities for both established players and new entrants, particularly those focusing on cost reduction, enhanced safety, and innovative business models. The long-term outlook remains exceptionally positive, with substantial growth potential across all market segments.

China Energy Storage Battery Industry Segmentation

-

1. Type

- 1.1. Pumped Hydro

- 1.2. Electrochemical

- 1.3. Molten Salt

- 1.4. Compressed Air

- 1.5. Flywheel

-

2. Application

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

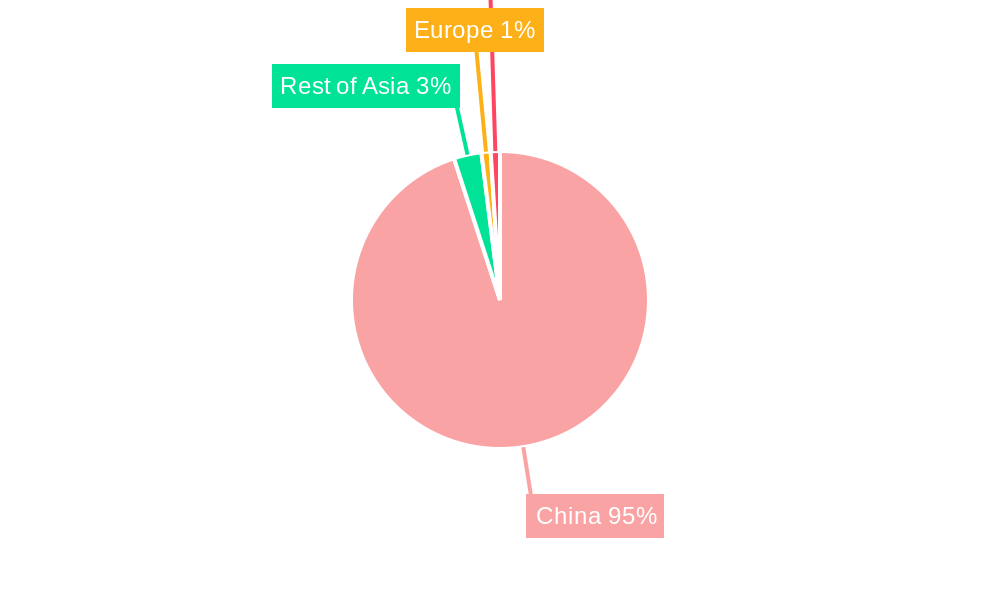

China Energy Storage Battery Industry Segmentation By Geography

- 1. China

China Energy Storage Battery Industry Regional Market Share

Geographic Coverage of China Energy Storage Battery Industry

China Energy Storage Battery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 25.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Petroleum Products Due to the Growth of the Local Economy4.; Government Initiatives to Boost the Production of Crude Oil and Natural Gas

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Electrochemical Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Energy Storage Battery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Pumped Hydro

- 5.1.2. Electrochemical

- 5.1.3. Molten Salt

- 5.1.4. Compressed Air

- 5.1.5. Flywheel

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Contemporary Amperex Technology Co Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Shanghai Electric Gotion New Energy Technology Co ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BSLBATT*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BYD

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Narada

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ganfeng Battery

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CALB

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 EVE Energy Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Higee Enegry

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tianjin Lishen Battery Joint-Stock Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Contemporary Amperex Technology Co Limited

List of Figures

- Figure 1: China Energy Storage Battery Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Energy Storage Battery Industry Share (%) by Company 2025

List of Tables

- Table 1: China Energy Storage Battery Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: China Energy Storage Battery Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: China Energy Storage Battery Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: China Energy Storage Battery Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: China Energy Storage Battery Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: China Energy Storage Battery Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: China Energy Storage Battery Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: China Energy Storage Battery Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 9: China Energy Storage Battery Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 10: China Energy Storage Battery Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 11: China Energy Storage Battery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: China Energy Storage Battery Industry Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Energy Storage Battery Industry?

The projected CAGR is approximately 25.4%.

2. Which companies are prominent players in the China Energy Storage Battery Industry?

Key companies in the market include Contemporary Amperex Technology Co Limited, Shanghai Electric Gotion New Energy Technology Co ltd, BSLBATT*List Not Exhaustive, BYD, Narada, Ganfeng Battery, CALB, EVE Energy Co Ltd, Higee Enegry, Tianjin Lishen Battery Joint-Stock Co Ltd.

3. What are the main segments of the China Energy Storage Battery Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 223.3 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Petroleum Products Due to the Growth of the Local Economy4.; Government Initiatives to Boost the Production of Crude Oil and Natural Gas.

6. What are the notable trends driving market growth?

Electrochemical Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Renewable Energy.

8. Can you provide examples of recent developments in the market?

On 9th April 2022, BSLBATT introduced the High Voltage Battery System (BSL-BOX-HV), and the system uses a lithium iron phosphate (LFP) battery. The BSL-BOX-HV is a high voltage battery system with a flexible modular design. The system does not have internal cables. The system is capable of stacking 3 to 7 battery modules. Furthermore, the system is available in various capacities ranging from 15.36kWh to 35.84 kWh and voltages from 153.6V to 358.4V. These battery systems have significant applications in solar energy storage.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Energy Storage Battery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Energy Storage Battery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Energy Storage Battery Industry?

To stay informed about further developments, trends, and reports in the China Energy Storage Battery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence