Key Insights

The Egypt natural gas market, valued at $3.6 billion in 2024, is poised for significant expansion with a projected Compound Annual Growth Rate (CAGR) of 6.5% from 2024 to 2033. This growth is propelled by escalating industrialization and urbanization, driving increased energy demand for both industrial and residential applications. Strategic government initiatives focused on diversifying the energy mix and reducing dependence on other fossil fuels further support market expansion. Investments in infrastructure, including pipelines and LNG facilities, are critical for efficient distribution and market development. Egypt's strategic geographic location as a regional energy hub and ongoing exploration of new gas reserves are also key growth accelerators. Major industry players such as Shell PLC, Exxon Mobil Corp, and BP PLC are actively contributing to production and market advancement.

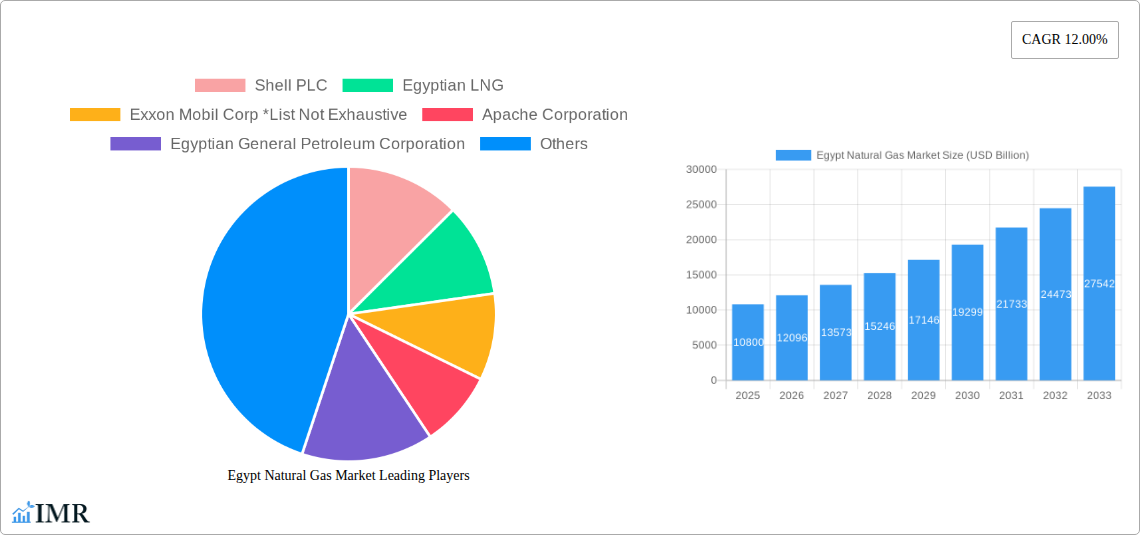

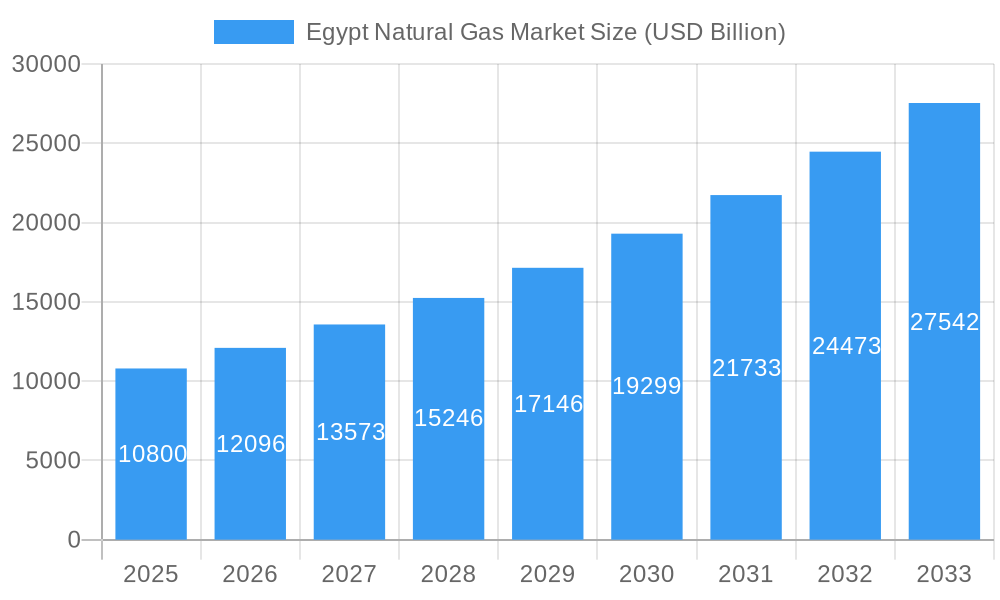

Egypt Natural Gas Market Market Size (In Billion)

Challenges include global energy price volatility, which can impact profitability and investment. Environmental considerations and potential regulatory restrictions necessitate investment in cleaner technologies and sustainable practices. Despite these challenges, the market outlook remains positive, underpinned by sustained government support, rising energy demands, and Egypt's advantageous regional positioning. The residential sector, driven by increasing household incomes and expanded gas connections, is anticipated to be a primary growth engine. The industrial sector, particularly manufacturing and petrochemicals, will continue to be a substantial consumer, reinforcing overall market expansion.

Egypt Natural Gas Market Company Market Share

Egypt Natural Gas Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Egypt Natural Gas Market, encompassing market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for industry professionals, investors, and strategic decision-makers. The report analyzes the parent market (Energy Market in Egypt) and the child market (Natural Gas Market within Egypt), providing a holistic view of this dynamic sector. The market size is projected to reach xx Billion USD by 2033.

Egypt Natural Gas Market Dynamics & Structure

The Egyptian natural gas market exhibits a moderately concentrated structure, with key players like Shell PLC, Exxon Mobil Corp, and BP PLC holding significant market share. However, the presence of state-owned entities like the Egyptian General Petroleum Corporation influences market dynamics. Technological innovation, primarily focused on enhancing extraction techniques and improving pipeline infrastructure, is a key driver. The regulatory framework, while supportive of investment, faces challenges in streamlining approvals. Competition from renewable energy sources is emerging, albeit gradually. M&A activity has been moderate, with several smaller acquisitions in recent years totaling approximately xx Billion USD in the historical period.

- Market Concentration: Moderately concentrated, with some dominance by international and national players.

- Technological Innovation: Focus on improved extraction and pipeline efficiency; challenges remain in adopting advanced technologies.

- Regulatory Framework: Supportive but faces challenges in streamlining approvals and promoting competition.

- Competitive Substitutes: Increasing competition from renewable energy sources.

- End-User Demographics: Industrial sector is the largest consumer, followed by power generation.

- M&A Trends: Moderate activity, with a total transaction value of approximately xx Billion USD during 2019-2024.

Egypt Natural Gas Market Growth Trends & Insights

The Egyptian natural gas market has witnessed fluctuating growth in recent years, primarily influenced by global energy prices and domestic demand. The historical period (2019-2024) showed a CAGR of xx%, while the forecast period (2025-2033) is projected to experience a CAGR of xx%, driven by rising industrialization, increasing power generation needs, and planned gas export initiatives. Technological disruptions in extraction and processing are improving efficiency and yield. Consumer behavior is shifting towards greater energy security and diversification, impacting demand patterns. The market size is expected to reach xx Billion USD in 2025 and xx Billion USD by 2033.

Dominant Regions, Countries, or Segments in Egypt Natural Gas Market

The industrial sector dominates the Egyptian natural gas market, accounting for approximately xx% of total consumption. This is driven by Egypt's expanding industrial base and its heavy reliance on natural gas for power generation. Key growth drivers include:

- Government Policies: Support for industrial development and infrastructure projects.

- Economic Growth: Increased industrial output fuels higher demand.

- Infrastructure Development: Expansion of gas pipelines and distribution networks.

While other segments like residential and commercial are growing, their consumption remains significantly lower than the industrial sector. The growth potential for these sectors is considerable, particularly with government initiatives to improve access and affordability.

Egypt Natural Gas Market Product Landscape

The Egyptian natural gas market primarily involves the production, processing, and distribution of natural gas. Recent technological advancements have focused on improved extraction technologies to enhance efficiency and reduce environmental impact. These advancements have also improved the quality and consistency of the delivered product. The key selling propositions are reliability of supply and relative cost-effectiveness compared to alternative energy sources.

Key Drivers, Barriers & Challenges in Egypt Natural Gas Market

Key Drivers:

- Increased industrial activity and power generation demand.

- Government support for domestic gas production and exploration.

- Strategic partnerships with international energy companies.

Key Challenges:

- Dependence on foreign investment and technology.

- Infrastructure limitations in gas distribution and transportation.

- Water scarcity in certain gas-producing areas.

- Fluctuations in global energy prices.

Emerging Opportunities in Egypt Natural Gas Market

- Expansion into new regional markets through export pipelines.

- Development of liquefied natural gas (LNG) facilities for export.

- Investment in renewable natural gas (RNG) projects for cleaner energy options.

- Growing demand in transport sector with conversion to CNG vehicles.

Growth Accelerators in the Egypt Natural Gas Market Industry

Long-term growth is fueled by continuous exploration and production, strategic partnerships with global players, and sustained government support for the energy sector. Further infrastructure development, particularly the expansion of pipeline networks, will also contribute to accelerating market growth. Investment in LNG facilities and regional export opportunities further bolster market expansion.

Key Players Shaping the Egypt Natural Gas Market Market

- Shell PLC

- Egyptian LNG

- Exxon Mobil Corp

- Apache Corporation

- Egyptian General Petroleum Corporation

- Chevron Corporation

- TotalEnergies SE

- Eni SpA

- Egyptian Natural Gas Co

- BP PLC

Notable Milestones in Egypt Natural Gas Market Sector

- January 2022: USD 506 million in new investments and a USD 67 million grant secured for oil and gas exploration and production in the Eastern and Western deserts, resulting in the drilling of 12 new wells. This significantly boosted exploration activity.

- January 2022: Agreement to export natural gas to Lebanon by February/March 2022, opening a new export market and enhancing Egypt's regional energy role. This significantly impacted export volumes and market dynamics.

In-Depth Egypt Natural Gas Market Market Outlook

The Egypt natural gas market shows strong potential for continued growth, driven by increasing domestic demand and expanding export opportunities. Strategic investments in infrastructure, technological advancements, and favorable government policies will further accelerate growth. The focus on regional energy cooperation and diversification creates long-term strategic opportunities for both domestic and international players.

Egypt Natural Gas Market Segmentation

-

1. End-user

- 1.1. Industrial

- 1.2. Commercial

- 1.3. Residential

- 1.4. Transport

Egypt Natural Gas Market Segmentation By Geography

- 1. Egypt

Egypt Natural Gas Market Regional Market Share

Geographic Coverage of Egypt Natural Gas Market

Egypt Natural Gas Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Power Demand4.; Increasing Penetration of Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Inadequate Infrastructure in the Country

- 3.4. Market Trends

- 3.4.1. Industrial Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Natural Gas Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 5.1.1. Industrial

- 5.1.2. Commercial

- 5.1.3. Residential

- 5.1.4. Transport

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Shell PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Egyptian LNG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Exxon Mobil Corp *List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Apache Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Egyptian General Petroleum Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Chevron Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TotalEnergies SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Eni SpA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Egyptian Natural Gas Co

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BP PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Shell PLC

List of Figures

- Figure 1: Egypt Natural Gas Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Egypt Natural Gas Market Share (%) by Company 2025

List of Tables

- Table 1: Egypt Natural Gas Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 2: Egypt Natural Gas Market Volume K Tons Forecast, by End-user 2020 & 2033

- Table 3: Egypt Natural Gas Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Egypt Natural Gas Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 5: Egypt Natural Gas Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 6: Egypt Natural Gas Market Volume K Tons Forecast, by End-user 2020 & 2033

- Table 7: Egypt Natural Gas Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Egypt Natural Gas Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Natural Gas Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Egypt Natural Gas Market?

Key companies in the market include Shell PLC, Egyptian LNG, Exxon Mobil Corp *List Not Exhaustive, Apache Corporation, Egyptian General Petroleum Corporation, Chevron Corporation, TotalEnergies SE, Eni SpA, Egyptian Natural Gas Co, BP PLC.

3. What are the main segments of the Egypt Natural Gas Market?

The market segments include End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.6 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Power Demand4.; Increasing Penetration of Renewable Energy.

6. What are the notable trends driving market growth?

Industrial Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Inadequate Infrastructure in the Country.

8. Can you provide examples of recent developments in the market?

January 2022: The Ministry of Petroleum and Mineral Resources signed two new agreements with the Canadian Transglobe and Pharos Energy for the exploration and production of oil and gas in the Eastern and Western deserts. It includes new investments of around USD 506 million and a signature grant of USD 67 million to drill 12 wells.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Natural Gas Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Natural Gas Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Natural Gas Market?

To stay informed about further developments, trends, and reports in the Egypt Natural Gas Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence