Key Insights

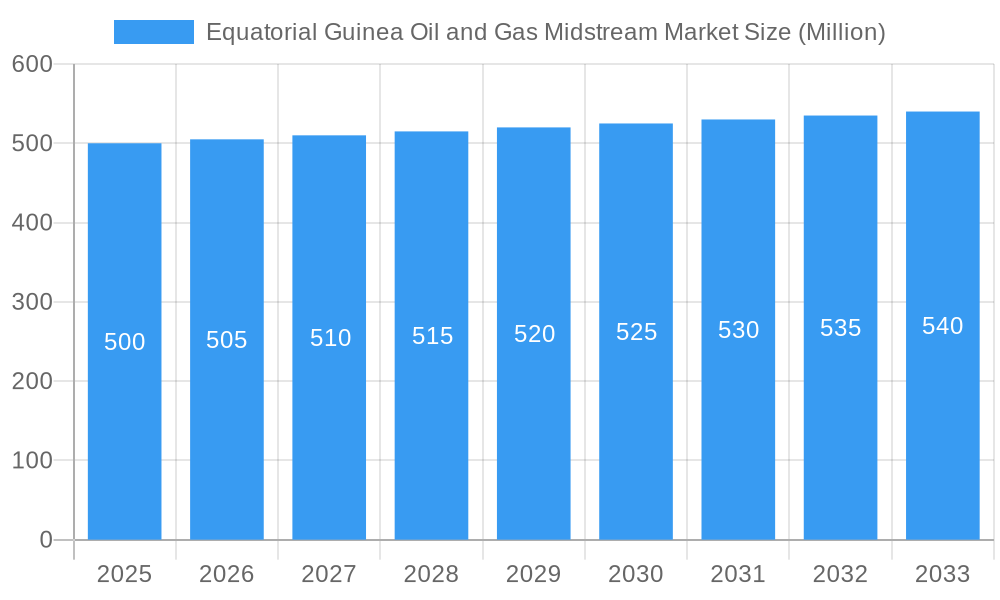

The Equatorial Guinea Oil and Gas Midstream Market is poised for significant expansion, driven by substantial investments in infrastructure development and a growing demand for efficient energy transportation and storage. With a projected market size estimated at $500 million in 2025, the market is expected to witness robust growth, exceeding a CAGR of 0.42% through 2033. This growth trajectory is primarily fueled by the strategic imperative to enhance the nation's oil and gas handling capabilities, encompassing transportation networks, sophisticated storage solutions, and advanced LNG terminal facilities. The existing infrastructure, while foundational, is undergoing continuous upgrades and expansion, with numerous projects in the pipeline and on the horizon, designed to optimize the flow of hydrocarbons from extraction sites to export terminals and domestic consumption points. Key drivers include government initiatives to boost oil and gas production, attract foreign investment, and diversify its energy portfolio.

Equatorial Guinea Oil and Gas Midstream Market Market Size (In Million)

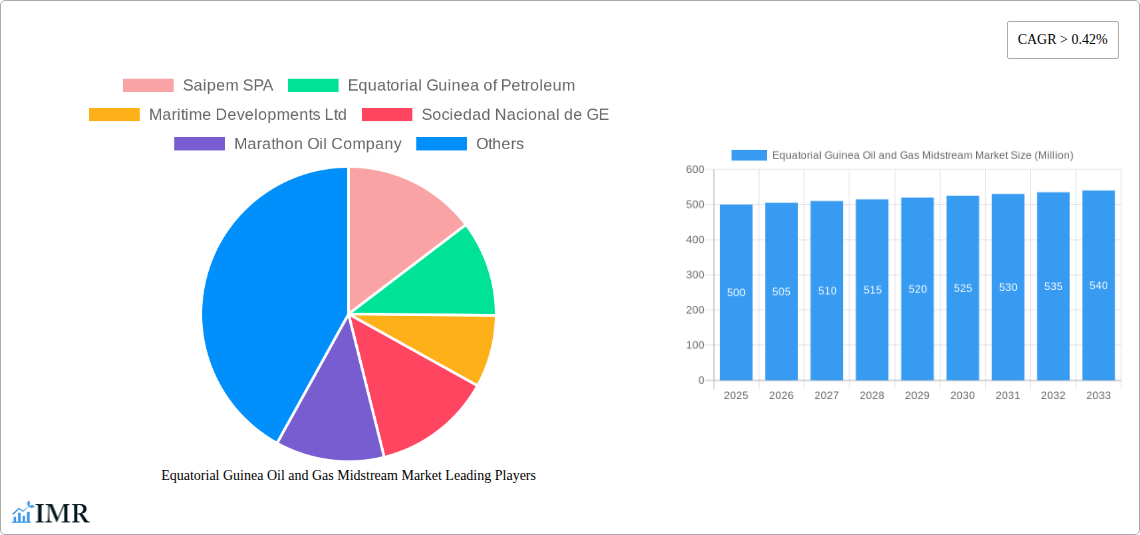

Emerging trends are shaping the midstream sector, with a focus on technological innovation for improved operational efficiency and safety, alongside an increasing emphasis on environmental sustainability in infrastructure development. Companies like Saipem SPA, Equatorial Guinea of Petroleum, Maritime Developments Ltd, Sociedad Nacional de GE, and Marathon Oil Company are at the forefront of these developments, investing in and operating critical midstream assets. However, the market faces certain restraints, including the complexities of regulatory frameworks, potential geopolitical instability, and the high capital expenditure required for developing world-class midstream infrastructure. Despite these challenges, the outlook remains positive, with segmented growth anticipated across transportation, storage, and LNG terminals, each playing a vital role in bolstering Equatorial Guinea's position as a key player in the African oil and gas landscape. The projected value unit is in millions, underscoring the substantial financial commitments involved.

Equatorial Guinea Oil and Gas Midstream Market Company Market Share

Here is the SEO-optimized report description for the Equatorial Guinea Oil and Gas Midstream Market, designed for maximum visibility and industry engagement:

Dive into the dynamic Equatorial Guinea Oil and Gas Midstream Market with our in-depth report. This comprehensive analysis covers the crucial Transportation, Storage, and LNG Terminals segments, offering unparalleled insights into existing infrastructure, projects in pipeline, and upcoming developments. Uncover market dynamics, growth trends, dominant regions, product landscape, key drivers, challenges, emerging opportunities, and growth accelerators. Featuring key players like Saipem SPA, Equatorial Guinea of Petroleum, Maritime Developments Ltd, Sociedad Nacional de GE, and Marathon Oil Company, this report is essential for stakeholders seeking to capitalize on the evolving energy landscape.

Equatorial Guinea Oil and Gas Midstream Market Market Dynamics & Structure

The Equatorial Guinea Oil and Gas Midstream Market is characterized by a moderately concentrated structure, with major international and national oil companies playing a pivotal role. Technological innovation is a significant driver, particularly in enhancing efficiency and safety in oil and gas transportation and storage solutions. Regulatory frameworks, overseen by bodies like the Ministry of Mines and Hydrocarbons, are continuously evolving to attract foreign investment while ensuring national benefit. Competitive product substitutes are limited within the midstream sector, with infrastructure development being the primary form of competition. End-user demographics are largely driven by the demand for refined products and natural gas for domestic consumption and export. Mergers and acquisitions (M&A) trends are influenced by the consolidation of energy assets and the pursuit of vertical integration. Recent M&A activities have seen significant deal volumes, aiming to optimize operational synergies. Barriers to innovation include high capital expenditure requirements and the complex geological conditions present in offshore operations.

- Market Concentration: Dominated by a few key players, with increasing involvement of national entities.

- Technological Innovation Drivers: Focus on pipeline integrity, advanced storage technologies, and efficient LNG processing.

- Regulatory Frameworks: Evolving policies aimed at attracting investment and ensuring local content development.

- Competitive Product Substitutes: Limited in core midstream infrastructure; competition is primarily through infrastructure enhancement.

- End-User Demographics: Primarily industrial and export-oriented, with growing domestic energy needs.

- M&A Trends: Driven by asset consolidation and strategic partnerships for project development.

- Innovation Barriers: High upfront investment costs, complex logistical challenges.

Equatorial Guinea Oil and Gas Midstream Market Growth Trends & Insights

The Equatorial Guinea Oil and Gas Midstream Market is projected to experience robust growth, with an estimated market size of $1,500 Million in the base year 2025. This growth is underpinned by increasing upstream production and a strategic focus on developing and expanding midstream infrastructure to monetize these resources effectively. The adoption rates for advanced oil and gas storage technologies and high-capacity LNG terminals are expected to accelerate as the nation aims to become a significant regional energy hub. Technological disruptions, such as the implementation of digital twin technology for pipeline monitoring and predictive maintenance, are poised to enhance operational efficiency and safety. Consumer behavior shifts are largely influenced by global energy demand and Equatorial Guinea's commitment to meeting these demands through reliable supply chains. The market penetration of specialized midstream services is steadily increasing, driven by the need for integrated solutions from exploration to export. The Compound Annual Growth Rate (CAGR) is estimated at 7.2% over the forecast period (2025-2033), signifying a strong upward trajectory.

- Market Size Evolution: Expected to grow from $1,350 Million in 2024 to exceed $2,500 Million by 2033.

- Adoption Rates: Increasing demand for technologically advanced LNG liquefaction and regasification facilities.

- Technological Disruptions: Integration of AI and IoT for enhanced pipeline monitoring and efficiency.

- Consumer Behavior Shifts: Growing preference for reliable and secure energy supply chains.

- Market Penetration: Expansion of specialized services for offshore and onshore midstream operations.

- CAGR: Projected at 7.2% for the forecast period.

Dominant Regions, Countries, or Segments in Equatorial Guinea Oil and Gas Midstream Market

The Transportation segment is currently the dominant force within the Equatorial Guinea Oil and Gas Midstream Market, driven by extensive existing infrastructure and ambitious projects in the pipeline. This dominance is further amplified by the nation's geographical position, making efficient crude oil and natural gas transportation critical for both domestic distribution and international export.

Existing Infrastructure in the transportation segment includes a network of offshore pipelines connecting production platforms to onshore processing facilities and terminals. There are also onshore pipeline networks facilitating the movement of crude oil and refined products to storage and export points. The estimated value of existing transportation infrastructure is approximately $800 Million.

Projects in Pipeline within the transportation segment are focused on expanding capacity and improving connectivity. These include proposals for new subsea pipelines to access newly discovered reserves and the expansion of existing onshore networks to accommodate increased production volumes. Investments in these projects are estimated to reach $500 Million.

Upcoming Projects are strategically designed to enhance the reach and efficiency of the midstream network. This includes initiatives aimed at integrating newly developed fields into the national grid and potentially developing cross-border transportation links. The potential investment in upcoming transportation projects is significant, estimated at $700 Million, highlighting its continued importance.

The Storage segment is also a vital contributor, with existing infrastructure comprising onshore tank farms for crude oil and refined products, as well as subsea storage facilities. The estimated value of existing storage infrastructure is around $300 Million. Projects in the pipeline and upcoming projects in this segment are geared towards increasing storage capacity to meet export demands and ensure supply security, with an estimated investment of $200 Million for pipeline projects and $250 Million for upcoming projects.

The LNG Terminals segment, while currently smaller in its existing infrastructure value (estimated at $400 Million), holds immense growth potential. Projects in the pipeline and upcoming projects are heavily focused on expanding LNG export capabilities, including the development of new liquefaction trains and associated onshore and offshore infrastructure. The estimated investment in LNG terminal projects in the pipeline and upcoming projects is $600 Million and $850 Million, respectively, reflecting a strong push towards natural gas monetization.

The dominance of the Transportation segment is a direct result of the upstream oil and gas industry's foundational need for efficient product movement. However, the substantial investments planned for the LNG Terminals segment indicate a strategic shift towards greater natural gas utilization and export, which could see this segment’s influence grow significantly in the coming years.

- Transportation Segment Dominance: Driven by extensive existing pipelines and ongoing expansion projects.

- Existing Transportation Infrastructure: Estimated value of $800 Million.

- Projects in Pipeline (Transportation): Estimated investment of $500 Million.

- Upcoming Projects (Transportation): Potential investment of $700 Million.

- Storage Segment Contribution: Existing infrastructure valued at $300 Million, with $450 Million in pipeline and upcoming projects.

- LNG Terminals Segment Potential: Existing infrastructure valued at $400 Million, with substantial investments of $1,450 Million in pipeline and upcoming projects.

Equatorial Guinea Oil and Gas Midstream Market Product Landscape

The Equatorial Guinea Oil and Gas Midstream Market product landscape is centered on the robust infrastructure required for the efficient movement, processing, and storage of hydrocarbons. This includes the development and maintenance of extensive pipeline networks for crude oil and natural gas, designed to withstand harsh offshore and onshore environments. Advanced oil storage tanks and terminals with sophisticated containment systems are crucial for managing inventory and ensuring product integrity. Furthermore, the market is increasingly focused on the expansion and modernization of LNG terminals, encompassing liquefaction plants, regasification facilities, and associated loading infrastructure. Technological advancements in areas like inline inspection (ILI) tools for pipelines and automated inventory management systems for storage facilities are enhancing operational efficiency and safety. Unique selling propositions in this market revolve around reliability, scalability, and adherence to stringent international safety and environmental standards.

Key Drivers, Barriers & Challenges in Equatorial Guinea Oil and Gas Midstream Market

Key Drivers:

- Increasing Upstream Production: New discoveries and enhanced recovery efforts in oil and gas fields are a primary driver for midstream infrastructure expansion.

- Government Support and Investment: Favorable government policies and direct investment in energy infrastructure projects are crucial.

- Growing Global Energy Demand: The international demand for crude oil, natural gas, and LNG creates export opportunities.

- Technological Advancements: Adoption of efficient and safer technologies in pipeline construction, storage, and LNG handling.

Barriers & Challenges:

- High Capital Expenditure: The significant upfront investment required for midstream infrastructure development.

- Regulatory Hurdles: Complex permitting processes and evolving environmental regulations can cause delays.

- Logistical Complexities: The remote locations of some offshore fields and the logistical challenges of large-scale infrastructure deployment.

- Geopolitical Instability: Regional political and economic factors can impact investment and operational continuity.

- Skilled Workforce Shortage: A limited pool of experienced personnel for specialized midstream operations.

- Market Volatility: Fluctuations in global oil and gas prices can affect project viability and investment decisions.

Emerging Opportunities in Equatorial Guinea Oil and Gas Midstream Market

Emerging opportunities in the Equatorial Guinea Oil and Gas Midstream Market lie in the development of integrated logistics solutions, particularly for natural gas monetization. There is a significant opportunity in expanding LNG export capacity to meet rising global demand. Furthermore, the development of smaller-scale floating LNG (FLNG) facilities presents an avenue for monetizing marginal gas fields. Investment in digital infrastructure for real-time monitoring and optimization of pipelines and storage facilities also offers considerable potential. The growing emphasis on environmental, social, and governance (ESG) factors creates opportunities for developing and implementing sustainable midstream practices, including carbon capture and utilization technologies.

Growth Accelerators in the Equatorial Guinea Oil and Gas Midstream Market Industry

Long-term growth in the Equatorial Guinea Oil and Gas Midstream Market is being accelerated by strategic partnerships between national oil companies and international energy majors, fostering knowledge transfer and access to capital. Technological breakthroughs in subsea pipeline laying and advanced gas liquefaction techniques are crucial catalysts. Market expansion strategies, including the development of new export terminals and the exploration of regional pipeline interconnections, are poised to drive sustained growth. The government's commitment to diversifying the economy through value-added processing of hydrocarbons also acts as a significant growth accelerator, encouraging investment in facilities that go beyond simple transportation and storage.

Key Players Shaping the Equatorial Guinea Oil and Gas Midstream Market Market

- Saipem SPA

- Equatorial Guinea of Petroleum

- Maritime Developments Ltd

- Sociedad Nacional de GE

- Marathon Oil Company

Notable Milestones in Equatorial Guinea Oil and Gas Midstream Market Sector

- 2019: Commencement of feasibility studies for the expansion of existing LNG export facilities.

- 2020: Marathon Oil Company announces discovery of new hydrocarbon reserves, prompting midstream infrastructure planning.

- 2021: Saipem SPA secures contracts for offshore pipeline upgrades and maintenance.

- 2022: Equatorial Guinea of Petroleum outlines a strategic vision for enhanced domestic gas utilization.

- 2023: Maritime Developments Ltd involved in a joint venture for novel offshore storage solutions.

- 2024: Sociedad Nacional de GE leads initiatives for improving national oil product distribution networks.

In-Depth Equatorial Guinea Oil and Gas Midstream Market Market Outlook

The future of the Equatorial Guinea Oil and Gas Midstream Market is bright, driven by strategic investments in expanding LNG infrastructure and enhancing oil and gas transportation networks. Growth accelerators such as technological innovation in liquefaction and pipeline integrity management, coupled with strategic international partnerships, will fuel expansion. The market outlook is highly positive, with a strong focus on leveraging the nation's vast hydrocarbon resources to become a more significant player in the global energy market. Opportunities for integrated logistics and sustainable midstream solutions will continue to shape the market landscape.

Equatorial Guinea Oil and Gas Midstream Market Segmentation

-

1. Transportation

-

1.1. Overview

- 1.1.1. Existing Infrastructure

- 1.1.2. Projects in Pipeline

- 1.1.3. Upcoming Projects

-

1.1. Overview

-

2. Storage

-

2.1. Overview

- 2.1.1. Existing Infrastructure

- 2.1.2. Projects in Pipeline

- 2.1.3. Upcoming Projects

-

2.1. Overview

-

3. LNG Terminals

-

3.1. Overview

- 3.1.1. Existing Infrastructure

- 3.1.2. Projects in Pipeline

- 3.1.3. Upcoming Projects

-

3.1. Overview

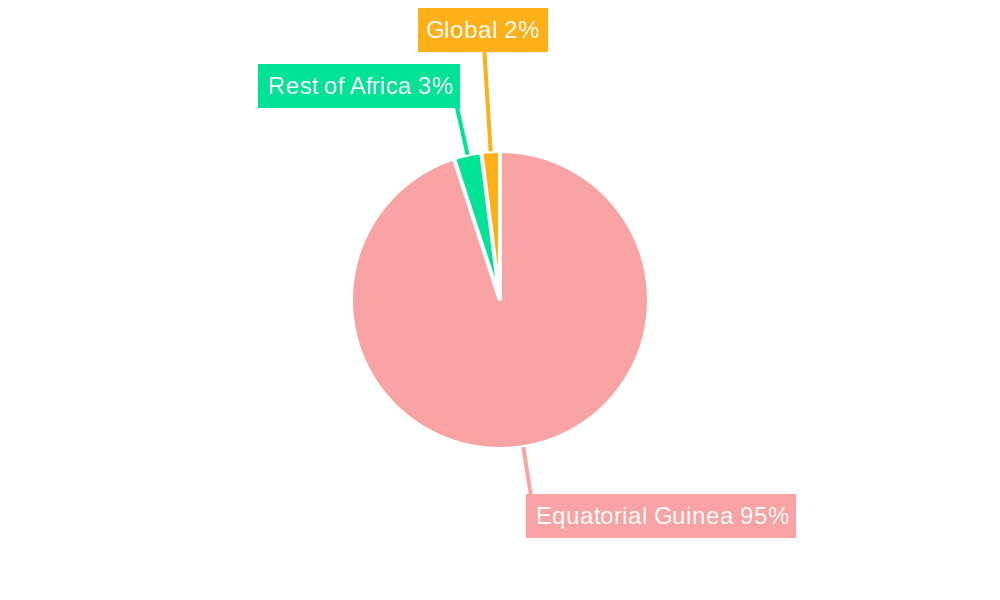

Equatorial Guinea Oil and Gas Midstream Market Segmentation By Geography

- 1. Equatorial Guinea

Equatorial Guinea Oil and Gas Midstream Market Regional Market Share

Geographic Coverage of Equatorial Guinea Oil and Gas Midstream Market

Equatorial Guinea Oil and Gas Midstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 0.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in the Tidal Energy Sector and Upcoming Projects

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Alternative Clean Power Source

- 3.4. Market Trends

- 3.4.1. Pipeline Sector to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Equatorial Guinea Oil and Gas Midstream Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Transportation

- 5.1.1. Overview

- 5.1.1.1. Existing Infrastructure

- 5.1.1.2. Projects in Pipeline

- 5.1.1.3. Upcoming Projects

- 5.1.1. Overview

- 5.2. Market Analysis, Insights and Forecast - by Storage

- 5.2.1. Overview

- 5.2.1.1. Existing Infrastructure

- 5.2.1.2. Projects in Pipeline

- 5.2.1.3. Upcoming Projects

- 5.2.1. Overview

- 5.3. Market Analysis, Insights and Forecast - by LNG Terminals

- 5.3.1. Overview

- 5.3.1.1. Existing Infrastructure

- 5.3.1.2. Projects in Pipeline

- 5.3.1.3. Upcoming Projects

- 5.3.1. Overview

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Equatorial Guinea

- 5.1. Market Analysis, Insights and Forecast - by Transportation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Saipem SPA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Equatorial Guinea of Petroleum

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Maritime Developments Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sociedad Nacional de GE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Marathon Oil Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Saipem SPA

List of Figures

- Figure 1: Equatorial Guinea Oil and Gas Midstream Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Equatorial Guinea Oil and Gas Midstream Market Share (%) by Company 2025

List of Tables

- Table 1: Equatorial Guinea Oil and Gas Midstream Market Revenue Million Forecast, by Transportation 2020 & 2033

- Table 2: Equatorial Guinea Oil and Gas Midstream Market Volume Million Forecast, by Transportation 2020 & 2033

- Table 3: Equatorial Guinea Oil and Gas Midstream Market Revenue Million Forecast, by Storage 2020 & 2033

- Table 4: Equatorial Guinea Oil and Gas Midstream Market Volume Million Forecast, by Storage 2020 & 2033

- Table 5: Equatorial Guinea Oil and Gas Midstream Market Revenue Million Forecast, by LNG Terminals 2020 & 2033

- Table 6: Equatorial Guinea Oil and Gas Midstream Market Volume Million Forecast, by LNG Terminals 2020 & 2033

- Table 7: Equatorial Guinea Oil and Gas Midstream Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Equatorial Guinea Oil and Gas Midstream Market Volume Million Forecast, by Region 2020 & 2033

- Table 9: Equatorial Guinea Oil and Gas Midstream Market Revenue Million Forecast, by Transportation 2020 & 2033

- Table 10: Equatorial Guinea Oil and Gas Midstream Market Volume Million Forecast, by Transportation 2020 & 2033

- Table 11: Equatorial Guinea Oil and Gas Midstream Market Revenue Million Forecast, by Storage 2020 & 2033

- Table 12: Equatorial Guinea Oil and Gas Midstream Market Volume Million Forecast, by Storage 2020 & 2033

- Table 13: Equatorial Guinea Oil and Gas Midstream Market Revenue Million Forecast, by LNG Terminals 2020 & 2033

- Table 14: Equatorial Guinea Oil and Gas Midstream Market Volume Million Forecast, by LNG Terminals 2020 & 2033

- Table 15: Equatorial Guinea Oil and Gas Midstream Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Equatorial Guinea Oil and Gas Midstream Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Equatorial Guinea Oil and Gas Midstream Market?

The projected CAGR is approximately > 0.42%.

2. Which companies are prominent players in the Equatorial Guinea Oil and Gas Midstream Market?

Key companies in the market include Saipem SPA, Equatorial Guinea of Petroleum, Maritime Developments Ltd, Sociedad Nacional de GE, Marathon Oil Company.

3. What are the main segments of the Equatorial Guinea Oil and Gas Midstream Market?

The market segments include Transportation, Storage, LNG Terminals.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in the Tidal Energy Sector and Upcoming Projects.

6. What are the notable trends driving market growth?

Pipeline Sector to Witness Growth.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Alternative Clean Power Source.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Equatorial Guinea Oil and Gas Midstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Equatorial Guinea Oil and Gas Midstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Equatorial Guinea Oil and Gas Midstream Market?

To stay informed about further developments, trends, and reports in the Equatorial Guinea Oil and Gas Midstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence