Key Insights

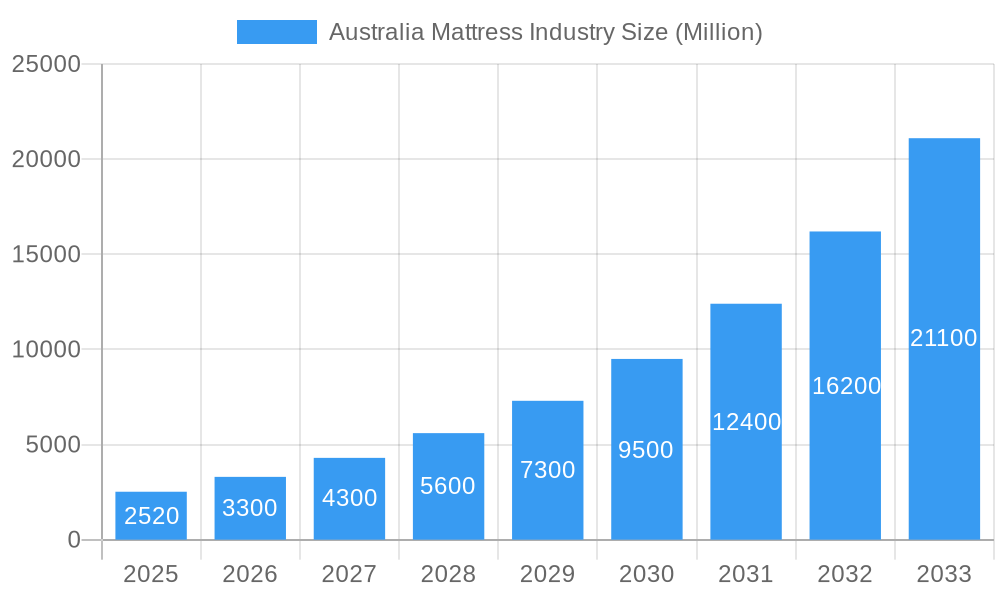

The global fuel cell market, valued at $2.52 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 31.01% from 2025 to 2033. This expansion is driven by increasing demand for clean energy solutions across various sectors, particularly in transportation and portable power applications. The rising adoption of electric vehicles (EVs) and the need for reliable backup power in remote locations are key factors fueling market growth. Technological advancements, such as improvements in fuel cell efficiency and durability, are further contributing to market expansion. While high initial investment costs and limited infrastructure remain restraints, government initiatives promoting renewable energy and stricter emission regulations are expected to mitigate these challenges. The market is segmented by application (portable, stationary, transportation) and fuel cell technology (PEMFC, SOFC, others). Major players like Ceres Power, AFC Energy, and Ballard Power Systems are driving innovation and competition within the market, focusing on enhancing performance, reducing costs, and expanding their market reach. The European market, particularly Germany, the UK, and France, is a significant contributor to global fuel cell demand due to strong government support for clean technologies and a well-established renewable energy infrastructure.

Australia Mattress Industry Market Size (In Billion)

The forecast period of 2025-2033 presents significant opportunities for growth within the fuel cell market. The increasing focus on decarbonization globally will continue to drive demand, particularly in the transportation sector. Continued research and development efforts are expected to lead to more efficient and cost-effective fuel cell technologies, further expanding market penetration. However, challenges remain in scaling up manufacturing to meet growing demand and addressing the complexities of fuel storage and distribution. Strategic partnerships between fuel cell manufacturers, energy companies, and government agencies will be crucial in accelerating market adoption and overcoming existing limitations. The market's segmentation offers various entry points for new players, particularly those focusing on niche applications or innovative fuel cell technologies.

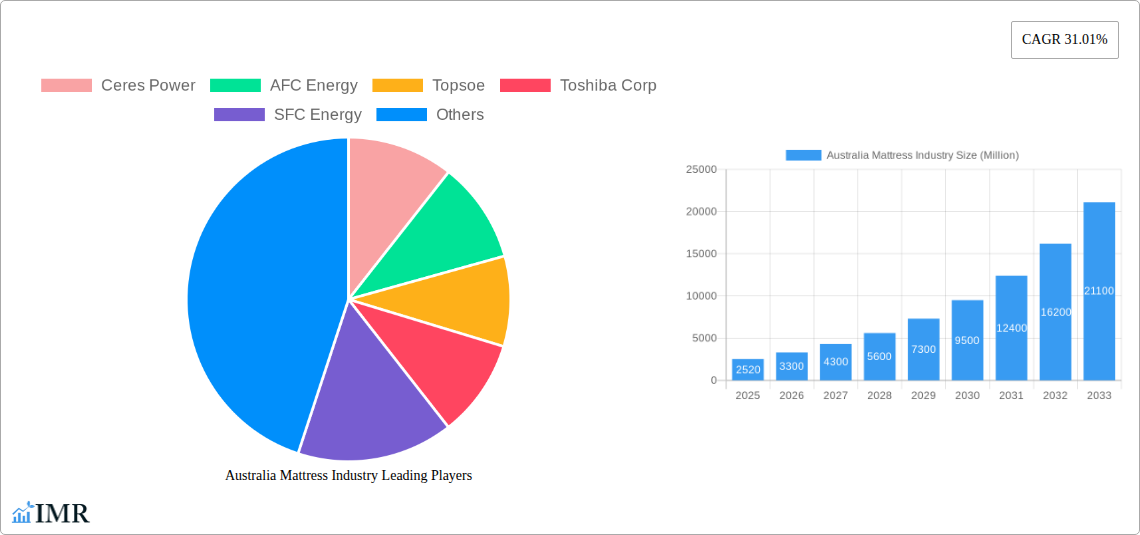

Australia Mattress Industry Company Market Share

Australia Mattress Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Australian mattress industry, covering market dynamics, growth trends, key players, and future outlook. The report utilizes a robust methodology, combining qualitative insights with quantitative data to deliver actionable intelligence for industry professionals, investors, and strategic decision-makers. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. This report is essential for understanding the current state and future trajectory of the Australian mattress market.

Australia Mattress Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, and regulatory environment of the Australian mattress industry. We delve into market concentration, identifying major players and their respective market shares. The report also examines technological innovation drivers, such as advancements in materials science and manufacturing processes. Further analysis includes an evaluation of regulatory frameworks affecting the industry, including product safety standards and environmental regulations. The influence of competitive product substitutes, like airbeds and other sleep solutions, is also considered. Finally, the report explores end-user demographics (age, income, lifestyle) and their impact on purchasing decisions, alongside an examination of recent mergers and acquisitions (M&A) activity within the sector.

- Market Concentration: xx% of the market is dominated by the top 5 players.

- Technological Innovation: Focus on eco-friendly materials and smart sleep technologies is driving innovation.

- Regulatory Framework: Stringent safety and quality standards are in place.

- Competitive Substitutes: Growing popularity of alternative sleep solutions poses a challenge.

- End-User Demographics: Millennials and Gen Z are driving demand for technologically advanced mattresses.

- M&A Activity: xx M&A deals were recorded between 2019-2024, indicating a consolidating market.

Australia Mattress Industry Growth Trends & Insights

This section provides a detailed analysis of the Australian mattress market's growth trajectory using historical and projected data. We examine market size evolution, tracking the growth in both units sold and overall revenue. The analysis incorporates adoption rates of different mattress types (e.g., innerspring, memory foam, latex), identifying consumer preferences and trends. The impact of technological disruptions, like the introduction of smart mattresses, is assessed, along with shifts in consumer behavior, such as increasing preference for online purchases and personalized sleep solutions. Specific metrics such as compound annual growth rate (CAGR) and market penetration rates are provided for a comprehensive understanding of market growth.

- Market Size Evolution (Million Units): 2019: xx; 2024: xx; 2025: xx; 2033: xx

- CAGR (2025-2033): xx%

- Market Penetration of Smart Mattresses: xx% in 2024, projected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Australia Mattress Industry

This section identifies the key regions and segments within the Australian mattress market driving growth. We analyze the market share and growth potential of various segments based on application (e.g., residential, hospitality) and product type (e.g., innerspring, memory foam, hybrid). Key drivers, such as economic policies, infrastructure development, and consumer preferences, are highlighted. The analysis also delves into factors influencing regional dominance, including population density, income levels, and consumer preferences.

- Leading Segment: Residential segment dominates with xx% market share.

- Key Drivers: Rising disposable incomes and preference for better sleep quality.

- Regional Variations: Growth is relatively higher in metropolitan areas compared to rural regions.

Australia Mattress Industry Product Landscape

This section details the range of mattress products available in the Australian market. We discuss product innovations, such as the introduction of new materials and technologies, and analyze their performance metrics. The unique selling propositions of different products are highlighted, focusing on factors such as comfort, durability, and health benefits. Technological advancements impacting product development are also explored.

- Product Innovation: Focus on eco-friendly materials, improved comfort technologies, and smart features.

Key Drivers, Barriers & Challenges in Australia Mattress Industry

This section identifies the key factors driving market growth and the challenges hindering its expansion.

Key Drivers:

- Rising disposable incomes

- Increasing awareness of sleep hygiene and its importance for health

- Technological advancements leading to innovative products

- Growing online sales channels

Key Barriers and Challenges:

- Intense competition from both domestic and international players

- Fluctuations in raw material prices impacting production costs

- Stringent regulatory compliance requirements

- Economic downturns affecting consumer spending

Emerging Opportunities in Australia Mattress Industry

This section highlights emerging trends and untapped opportunities within the Australian mattress market.

- Growth in the online mattress market

- Increasing demand for personalized sleep solutions

- Growing adoption of smart home technologies

- Expansion into niche markets (e.g., eco-friendly mattresses)

Growth Accelerators in the Australia Mattress Industry Industry

Technological breakthroughs, strategic partnerships, and expanding market reach are discussed as key factors propelling long-term growth in the Australian mattress industry. The analysis emphasizes the potential of sustainable manufacturing practices and innovative product development to further accelerate this growth.

Key Players Shaping the Australia Mattress Industry Market

- Ceres Power

- AFC Energy

- Topsoe

- Toshiba Corp

- SFC Energy

- Cummins Inc

- Ballard Power System Inc

- Plug Power Inc

- Fuelcell Energy Inc

- Nuvera Fuel Cells LLC

Notable Milestones in Australia Mattress Industry Sector

- July 2022: The European Commission's approval of USD 5.47 billion for the IPCEI Hy2Tech project signifies a major push towards hydrogen technology, indirectly impacting the broader energy sector and potentially influencing the materials used in mattress manufacturing in the long term.

- February 2022: Ballard Power Systems and MAHLE Group's collaboration on fuel cell systems for long-haul trucks showcases advancements in transportation technology, potentially impacting the development of more sustainable materials for mattresses.

In-Depth Australia Mattress Industry Market Outlook

The Australian mattress industry is poised for sustained growth, driven by rising disposable incomes, increasing awareness of sleep quality, and ongoing technological advancements. Strategic opportunities exist in developing innovative, eco-friendly products and expanding into niche market segments. The market is expected to continue its consolidation, with larger players acquiring smaller companies to increase their market share. The long-term outlook remains positive, suggesting a robust and dynamic market with significant potential for growth and innovation.

Australia Mattress Industry Segmentation

-

1. Application

- 1.1. Portable

- 1.2. Stationary

- 1.3. Transportation

-

2. Fuel Cell Technology

- 2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 2.2. Solid Oxide Fuel Cell (SOFC)

- 2.3. Other Fuel Cell Technologies

Australia Mattress Industry Segmentation By Geography

- 1. Germany

- 2. France

- 3. Italy

- 4. United Kingdom

- 5. Russia

- 6. NORDIC

- 7. Spain

- 8. Rest of Europe

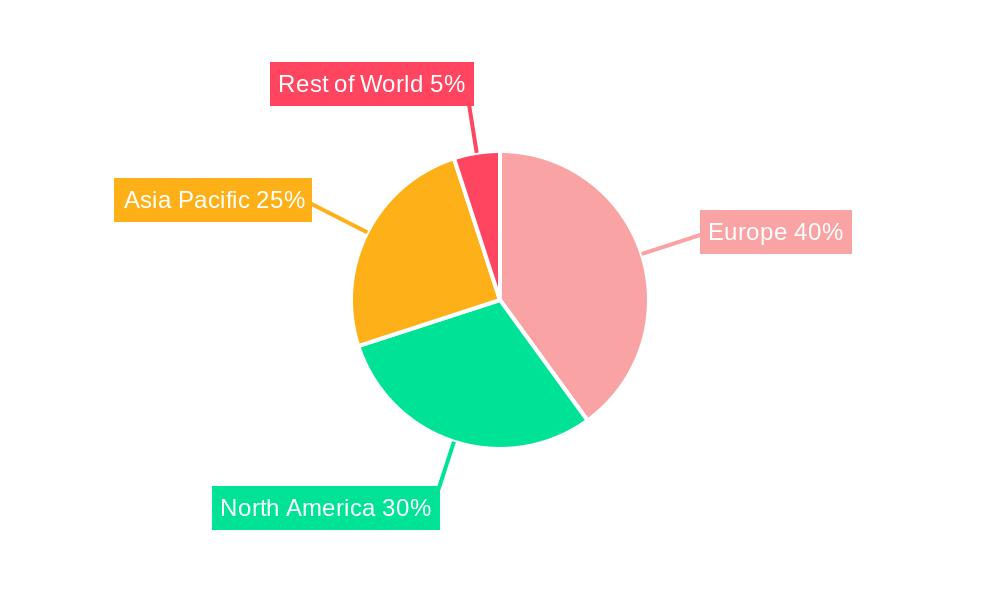

Australia Mattress Industry Regional Market Share

Geographic Coverage of Australia Mattress Industry

Australia Mattress Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 31.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Government Supportive Policies and Incentives4.; Renewable Energy Integration

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Costs

- 3.4. Market Trends

- 3.4.1. Transportation Sector Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Portable

- 5.1.2. Stationary

- 5.1.3. Transportation

- 5.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 5.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 5.2.2. Solid Oxide Fuel Cell (SOFC)

- 5.2.3. Other Fuel Cell Technologies

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. France

- 5.3.3. Italy

- 5.3.4. United Kingdom

- 5.3.5. Russia

- 5.3.6. NORDIC

- 5.3.7. Spain

- 5.3.8. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Germany Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Portable

- 6.1.2. Stationary

- 6.1.3. Transportation

- 6.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 6.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 6.2.2. Solid Oxide Fuel Cell (SOFC)

- 6.2.3. Other Fuel Cell Technologies

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. France Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Portable

- 7.1.2. Stationary

- 7.1.3. Transportation

- 7.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 7.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 7.2.2. Solid Oxide Fuel Cell (SOFC)

- 7.2.3. Other Fuel Cell Technologies

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Italy Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Portable

- 8.1.2. Stationary

- 8.1.3. Transportation

- 8.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 8.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 8.2.2. Solid Oxide Fuel Cell (SOFC)

- 8.2.3. Other Fuel Cell Technologies

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. United Kingdom Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Portable

- 9.1.2. Stationary

- 9.1.3. Transportation

- 9.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 9.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 9.2.2. Solid Oxide Fuel Cell (SOFC)

- 9.2.3. Other Fuel Cell Technologies

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Russia Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Portable

- 10.1.2. Stationary

- 10.1.3. Transportation

- 10.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 10.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 10.2.2. Solid Oxide Fuel Cell (SOFC)

- 10.2.3. Other Fuel Cell Technologies

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. NORDIC Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Portable

- 11.1.2. Stationary

- 11.1.3. Transportation

- 11.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 11.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 11.2.2. Solid Oxide Fuel Cell (SOFC)

- 11.2.3. Other Fuel Cell Technologies

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Spain Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Application

- 12.1.1. Portable

- 12.1.2. Stationary

- 12.1.3. Transportation

- 12.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 12.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 12.2.2. Solid Oxide Fuel Cell (SOFC)

- 12.2.3. Other Fuel Cell Technologies

- 12.1. Market Analysis, Insights and Forecast - by Application

- 13. Rest of Europe Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Application

- 13.1.1. Portable

- 13.1.2. Stationary

- 13.1.3. Transportation

- 13.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 13.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 13.2.2. Solid Oxide Fuel Cell (SOFC)

- 13.2.3. Other Fuel Cell Technologies

- 13.1. Market Analysis, Insights and Forecast - by Application

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 Ceres Power

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 AFC Energy

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Topsoe

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Toshiba Corp

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 SFC Energy

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Cummins Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Ballard Power System Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Plug Power Inc

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Fuelcell Energy Inc

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Nuvera Fuel Cells LLC

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Ceres Power

List of Figures

- Figure 1: Australia Mattress Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Mattress Industry Share (%) by Company 2025

List of Tables

- Table 1: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 3: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 4: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 5: Australia Mattress Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Australia Mattress Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 9: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 10: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 11: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 15: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 16: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 17: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 21: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 22: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 23: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 26: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 27: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 28: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 29: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 32: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 33: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 34: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 35: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 38: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 39: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 40: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 41: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 44: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 45: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 46: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 47: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 49: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 50: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 51: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 52: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 53: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 54: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Mattress Industry?

The projected CAGR is approximately 31.01%.

2. Which companies are prominent players in the Australia Mattress Industry?

Key companies in the market include Ceres Power, AFC Energy, Topsoe, Toshiba Corp, SFC Energy, Cummins Inc , Ballard Power System Inc, Plug Power Inc, Fuelcell Energy Inc, Nuvera Fuel Cells LLC.

3. What are the main segments of the Australia Mattress Industry?

The market segments include Application, Fuel Cell Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.52 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Government Supportive Policies and Incentives4.; Renewable Energy Integration.

6. What are the notable trends driving market growth?

Transportation Sector Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Costs.

8. Can you provide examples of recent developments in the market?

July 2022: the European Commission approved USD 5.47 billion in public funding for the IPCEI Hy2Tech project was jointly prepared and notified by fifteen Member States to support research, innovation, and the first industrial development in the hydrogen technology value chain. Hydrogen was expected to become one of the leading options for power generation, further expected to drive the fuel cell market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Mattress Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Mattress Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Mattress Industry?

To stay informed about further developments, trends, and reports in the Australia Mattress Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence