Key Insights

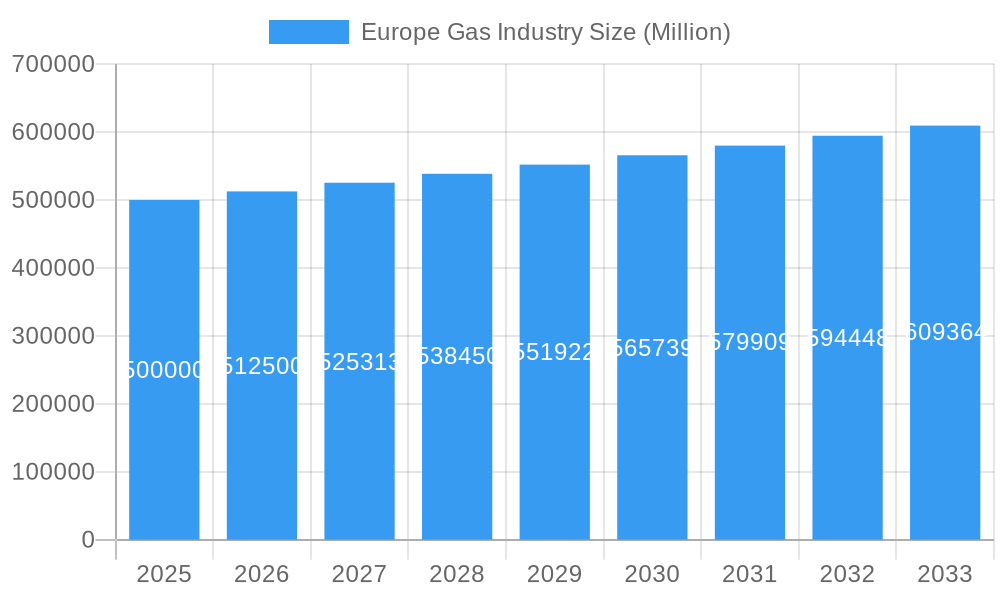

The European gas market, valued at approximately €1223.8 million in 2024, is projected to experience significant growth with a Compound Annual Growth Rate (CAGR) of 4.5% through 2033. Key growth drivers include escalating industrialization across Europe, fostering consistent demand for natural gas in manufacturing and power generation. The ongoing energy transition further bolsters demand, positioning natural gas as a critical bridge fuel in reducing coal dependency while renewable infrastructure matures. Government initiatives focused on energy security and diversification also stimulate market expansion through investments in gas infrastructure and exploration.

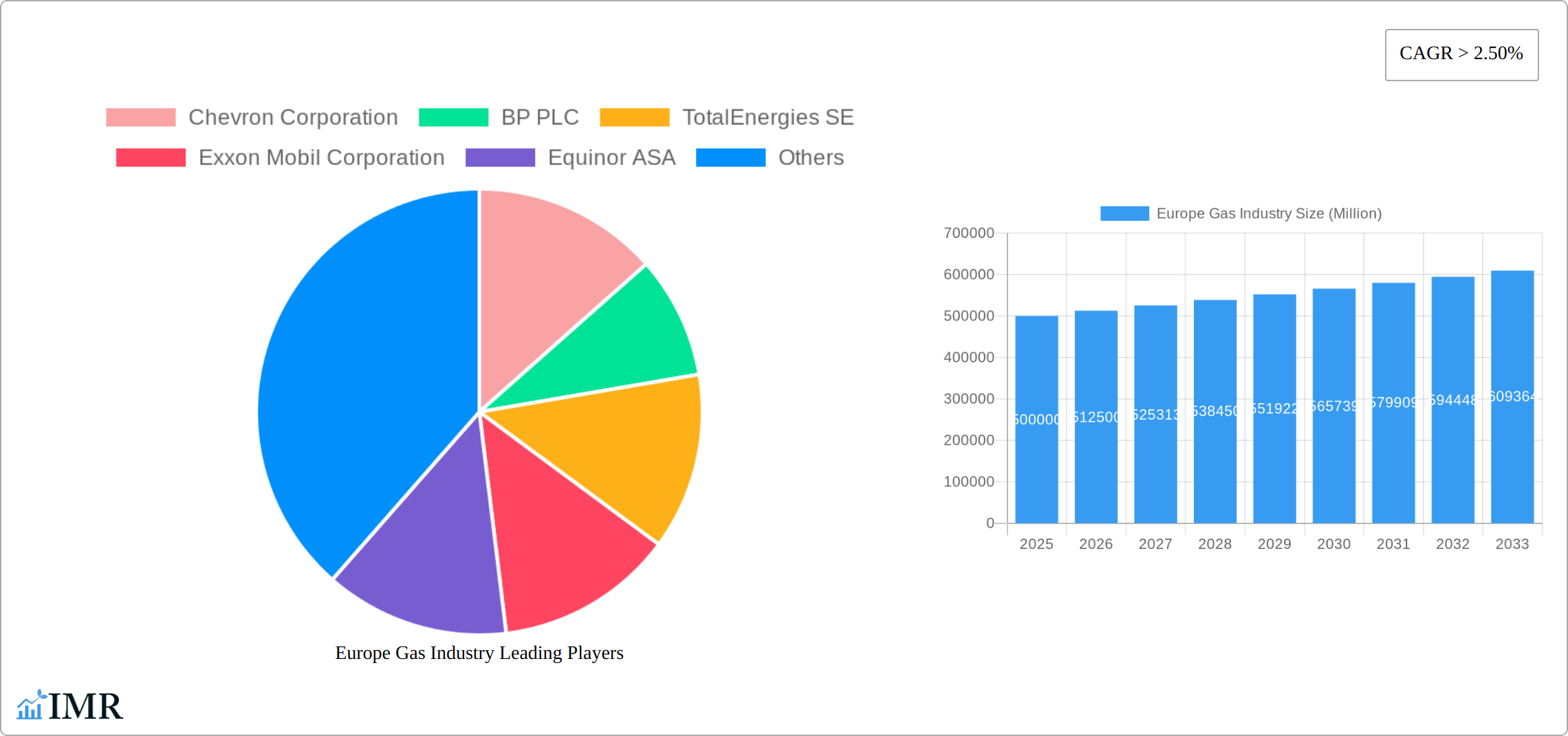

Europe Gas Industry Market Size (In Billion)

However, the market navigates challenges, including global supply chain fluctuations and geopolitical instability impacting gas price volatility. Stringent environmental regulations and the increasing adoption of renewable energy sources present long-term restraints on conventional gas consumption. The market is segmented by gas type (natural gas, LNG), end-use sectors (power generation, industrial, residential), and European regions. Leading participants such as Chevron Corporation, BP PLC, TotalEnergies SE, Exxon Mobil Corporation, and Equinor ASA compete through strategic alliances, acquisitions, and operational efficiency enhancements.

Europe Gas Industry Company Market Share

The competitive landscape features established international entities and regional energy firms. Differentiation strategies emphasize supply chain diversification, technological advancements in extraction and processing, and integrated energy solutions combining conventional gas with renewables. Future expansion hinges on advancements in gas-to-power technologies, enhanced gas utilization efficiency, and innovative carbon capture and storage solutions to address environmental concerns. Success will be defined by adaptability to evolving regulations, investment in sustainable practices, and responsiveness to changing European energy demands.

Europe Gas Industry Market Report: 2019-2033

This comprehensive report delivers an in-depth analysis of the European gas industry, providing crucial insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, growth trends, key players, and emerging opportunities within this vital energy sector. The report analyzes parent markets (Energy) and child markets (Natural Gas Production, Transportation, and Distribution) to offer a complete understanding of the industry landscape.

Europe Gas Industry Market Dynamics & Structure

This section analyzes the competitive landscape of the European gas industry, encompassing market concentration, technological innovation, regulatory frameworks, and market dynamics. We assess the impact of mergers and acquisitions (M&A) activity and the role of substitute products on market share.

Market Concentration: The European gas market exhibits a moderately concentrated structure, with major players holding significant shares. The combined market share of the top five companies (estimated at xx%) influences pricing and innovation.

Technological Innovation: Technological advancements such as improved pipeline infrastructure, advancements in liquefied natural gas (LNG) technologies, and exploration techniques are driving efficiency and expanding market access. However, the high capital expenditure required for such innovation acts as a barrier to entry for smaller players.

Regulatory Frameworks: EU energy policies, national regulations, and environmental concerns significantly shape the industry. These policies influence investment decisions, emissions targets, and market access.

Competitive Product Substitutes: Renewable energy sources (wind, solar) and other fossil fuels (coal) pose competitive challenges to natural gas. The rate of substitution depends on various factors, including government incentives and energy price fluctuations.

End-User Demographics: This section analyzes the distribution of gas consumption across various sectors, including residential, commercial, and industrial consumers, to identify key consumption patterns.

M&A Trends: The industry has witnessed significant M&A activity in recent years, with deal volumes totaling approximately xx Million in the period 2019-2024. These transactions reflect strategies for consolidation, geographic expansion, and resource acquisition.

Europe Gas Industry Growth Trends & Insights

This section delivers a comprehensive analysis of the European gas market's dynamic evolution, meticulously charting its growth trajectories and identifying the pivotal influencing factors. Leveraging proprietary data, robust industry benchmarks, and forward-looking projections, we illustrate not only the current market size and adoption rates but also a spectrum of significant emerging trends.

Historically, the European gas market has demonstrated robust expansion, achieving a Compound Annual Growth Rate (CAGR) of xx% between 2019 and 2024. This growth was significantly propelled by escalating energy demands and substantial infrastructural developments across the continent. However, the market's trajectory in the forthcoming forecast period (2025-2033) is anticipated to be shaped by a complex interplay of factors. Key among these is the accelerating adoption of renewable energy sources, the inherent volatility of economic cycles, and the ever-present influence of evolving geopolitical landscapes. Our projections indicate a market size of approximately xx Million for 2025, with an anticipated CAGR of xx% for the forecast period. Furthermore, evolving consumer behaviors, exemplified by a heightened focus on energy efficiency measures, are increasingly influencing demand projections. The industry is also on the cusp of transformation driven by technological disruptions, notably the advancement of smart grids and the pervasive integration of digitalization, which are poised to unlock significant efficiency gains and drive operational improvements.

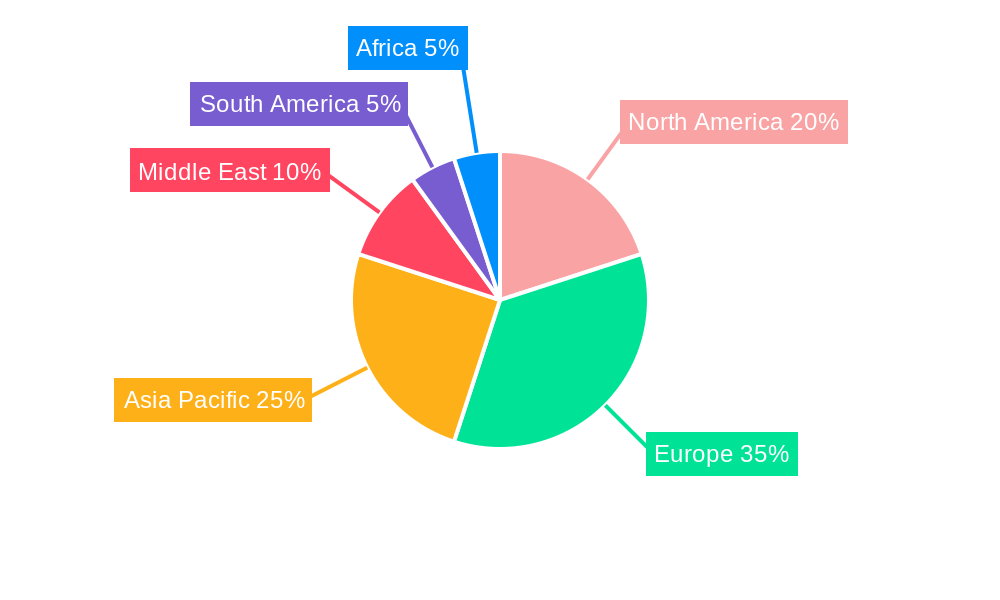

Dominant Regions, Countries, or Segments in Europe Gas Industry

This section identifies the leading regions, countries, and segments contributing most significantly to market growth. Factors such as robust energy policies, readily available infrastructure, and strategic geographic locations are analyzed for their influence on growth.

Leading Regions: [Insert leading region(s) with a detailed explanation and analysis. Quantify with market share percentages and growth projections.]

Key Countries: [Include analysis of leading countries, providing data on market size, growth rates, and key drivers. Examples could include Norway, Netherlands, UK, etc.]

Dominant Segments: [Analyze segments like upstream, midstream, and downstream with details on growth rates and market share.]

The dominance of specific regions and countries can be attributed to factors such as established infrastructure, favorable government policies supporting gas exploration and production, and proximity to major markets.

Europe Gas Industry Product Landscape

This section provides a concise overview of the product landscape, encompassing product innovations, applications, and key performance metrics. The unique selling propositions of various gas products, along with significant technological improvements, are also explored. The market offers various natural gas products, including pipeline gas, LNG, and compressed natural gas (CNG), each catering to specific end-user needs and applications. Technological advancements in extraction, processing, and distribution are optimizing efficiency and reducing environmental impact.

Key Drivers, Barriers & Challenges in Europe Gas Industry

This section delves into a granular identification of the primary forces propelling the European gas market forward, alongside a critical assessment of the obstacles and challenges that could potentially impede its progress. Our analysis incorporates quantifiable impacts wherever robust data is available, offering a clear perspective on the scale of these influences.

Key Drivers:

- Sustained and growing energy demand across a diverse range of industrial, commercial, and residential sectors.

- Robust government support and strategic investments in the development and modernization of gas infrastructure projects.

- Continued and essential reliance on natural gas as a crucial component for electricity generation, particularly for grid stability and peak demand management.

- The role of natural gas as a transition fuel, bridging the gap towards a fully decarbonized energy system.

Challenges and Restraints:

- Heightened geopolitical instability, which poses significant risks to supply security and contributes to considerable price volatility, with an estimated impact of xx Million.

- The intensifying environmental discourse and escalating pressure from regulatory bodies and public opinion to accelerate the transition towards a greater reliance on renewable energy sources.

- Navigating and complying with increasingly stringent regulatory frameworks, which can impose significant operational costs, estimated at xx Million.

- Growing competitive pressure from rapidly advancing renewable energy technologies, which may lead to a projected reduction in market share by as much as xx% by 2033.

Emerging Opportunities in Europe Gas Industry

This section highlights promising avenues for market growth, including untapped markets, innovative applications, and evolving consumer preferences.

- Growth in LNG imports: Increasing reliance on LNG imports to diversify energy supplies and reduce dependence on pipeline gas presents significant opportunities.

- Technological advancements in gas storage and transportation: Innovations in gas storage facilities and pipeline technologies can improve efficiency and security.

- Expansion into emerging markets: Growth in emerging economies provides potential for gas market expansion.

Growth Accelerators in the Europe Gas Industry Industry

This section highlights the principal elements that are actively contributing to and are poised to significantly enhance the long-term growth trajectory of the European gas industry.

Key among these accelerators are pioneering technological innovations, encompassing advancements in efficient extraction techniques, the development of more robust and smarter pipeline infrastructure, and innovative storage solutions, all of which contribute to enhancing operational efficiency and reducing costs. Furthermore, the forging of strategic partnerships between leading energy companies and cutting-edge technology providers is crucial for accelerating the widespread adoption of these new technologies. The active pursuit of expansion into new geographical markets and the strategic diversification of energy sources, including exploring opportunities in cleaner gas alternatives like hydrogen blending and biomethane, also present significant avenues for future growth and market penetration. The development and deployment of advanced analytics and AI for predictive maintenance and grid optimization are also key growth enablers.

Key Players Shaping the Europe Gas Industry Market

- Chevron Corporation

- BP PLC

- TotalEnergies SE

- Exxon Mobil Corporation

- Equinor ASA

- NK Lukoil PAO

- Gazprom PJSC ADR

- Rosneft Oil Co PJSC

- Eni S.p.A.

- Shell plc

- Repsol S.A.

- OMV AG

This list is indicative and not exhaustive; many other vital contributors are actively shaping the market.

Notable Milestones in Europe Gas Industry Sector

- September 2022: Russia's Gazprom announced shipping 42.4 million cubic meters (mcm) of natural gas to Europe via Ukraine, reducing its reliance on the US dollar. This event highlighted geopolitical tensions' impact on gas supply.

- September 2022: The Baltic Pipe inauguration in Goleniów, Poland, facilitated annual gas imports of up to 10 billion cubic meters (bcm) from Norway to Poland and 3 bcm from Poland to Denmark. This milestone significantly enhanced gas supply diversity for the region.

In-Depth Europe Gas Industry Market Outlook

The European gas industry stands on the precipice of significant and sustained growth in the coming years, primarily fueled by an unyielding demand for energy to power economies and maintain stability, coupled with continuous, substantial investments in upgrading and expanding essential infrastructure. While the global energy landscape is undeniably shifting towards renewable sources, natural gas is set to retain its critical role as a cornerstone of the energy mix for the foreseeable future. Its inherent flexibility and reliability make it indispensable for balancing intermittent renewable generation and meeting peak demand. Strategic alliances and collaborations, coupled with relentless technological advancements and the implementation of agile and efficient regulatory frameworks, will be paramount in dictating future market dynamics and unlocking new avenues for expansion. The market, with its evolving complexities and opportunities, presents lucrative prospects for forward-thinking companies that prioritize innovation, operational efficiency, and a steadfast commitment to sustainable practices, particularly in the context of developing and integrating lower-carbon gas solutions.

Europe Gas Industry Segmentation

-

1. Application

- 1.1. Utilities

- 1.2. Industrial

- 1.3. Commercial

Europe Gas Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

Europe Gas Industry Regional Market Share

Geographic Coverage of Europe Gas Industry

Europe Gas Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1 Utility Sector (i.e.

- 3.4.2 Power Generation) Sector Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Europe Gas Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Utilities

- 5.1.2. Industrial

- 5.1.3. Commercial

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.2.2. United Kingdom

- 5.2.3. France

- 5.2.4. Italy

- 5.2.5. Spain

- 5.2.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Germany Europe Gas Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Utilities

- 6.1.2. Industrial

- 6.1.3. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. United Kingdom Europe Gas Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Utilities

- 7.1.2. Industrial

- 7.1.3. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. France Europe Gas Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Utilities

- 8.1.2. Industrial

- 8.1.3. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Italy Europe Gas Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Utilities

- 9.1.2. Industrial

- 9.1.3. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Spain Europe Gas Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Utilities

- 10.1.2. Industrial

- 10.1.3. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Rest of Europe Europe Gas Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Utilities

- 11.1.2. Industrial

- 11.1.3. Commercial

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Chevron Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 BP PLC

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 TotalEnergies SE

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Exxon Mobil Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Equinor ASA

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 NK Lukoil PAO

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Gazprom PJSC ADR

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Rosneft Oil Co PJSC*List Not Exhaustive

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Chevron Corporation

List of Figures

- Figure 1: Global Europe Gas Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Germany Europe Gas Industry Revenue (million), by Application 2025 & 2033

- Figure 3: Germany Europe Gas Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: Germany Europe Gas Industry Revenue (million), by Country 2025 & 2033

- Figure 5: Germany Europe Gas Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: United Kingdom Europe Gas Industry Revenue (million), by Application 2025 & 2033

- Figure 7: United Kingdom Europe Gas Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: United Kingdom Europe Gas Industry Revenue (million), by Country 2025 & 2033

- Figure 9: United Kingdom Europe Gas Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: France Europe Gas Industry Revenue (million), by Application 2025 & 2033

- Figure 11: France Europe Gas Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: France Europe Gas Industry Revenue (million), by Country 2025 & 2033

- Figure 13: France Europe Gas Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Italy Europe Gas Industry Revenue (million), by Application 2025 & 2033

- Figure 15: Italy Europe Gas Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Italy Europe Gas Industry Revenue (million), by Country 2025 & 2033

- Figure 17: Italy Europe Gas Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Spain Europe Gas Industry Revenue (million), by Application 2025 & 2033

- Figure 19: Spain Europe Gas Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: Spain Europe Gas Industry Revenue (million), by Country 2025 & 2033

- Figure 21: Spain Europe Gas Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Rest of Europe Europe Gas Industry Revenue (million), by Application 2025 & 2033

- Figure 23: Rest of Europe Europe Gas Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Rest of Europe Europe Gas Industry Revenue (million), by Country 2025 & 2033

- Figure 25: Rest of Europe Europe Gas Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Europe Gas Industry Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Europe Gas Industry Revenue million Forecast, by Region 2020 & 2033

- Table 3: Global Europe Gas Industry Revenue million Forecast, by Application 2020 & 2033

- Table 4: Global Europe Gas Industry Revenue million Forecast, by Country 2020 & 2033

- Table 5: Global Europe Gas Industry Revenue million Forecast, by Application 2020 & 2033

- Table 6: Global Europe Gas Industry Revenue million Forecast, by Country 2020 & 2033

- Table 7: Global Europe Gas Industry Revenue million Forecast, by Application 2020 & 2033

- Table 8: Global Europe Gas Industry Revenue million Forecast, by Country 2020 & 2033

- Table 9: Global Europe Gas Industry Revenue million Forecast, by Application 2020 & 2033

- Table 10: Global Europe Gas Industry Revenue million Forecast, by Country 2020 & 2033

- Table 11: Global Europe Gas Industry Revenue million Forecast, by Application 2020 & 2033

- Table 12: Global Europe Gas Industry Revenue million Forecast, by Country 2020 & 2033

- Table 13: Global Europe Gas Industry Revenue million Forecast, by Application 2020 & 2033

- Table 14: Global Europe Gas Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Gas Industry?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Europe Gas Industry?

Key companies in the market include Chevron Corporation, BP PLC, TotalEnergies SE, Exxon Mobil Corporation, Equinor ASA, NK Lukoil PAO, Gazprom PJSC ADR, Rosneft Oil Co PJSC*List Not Exhaustive.

3. What are the main segments of the Europe Gas Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1223.8 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Utility Sector (i.e.. Power Generation) Sector Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

September 2022: Russia's Gazprom announced shipping 42.4 million cubic meters (mcm) of natural gas to Europe via Ukraine. The shift was part of a push by Russia to reduce its reliance on the US dollar.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Gas Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Gas Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Gas Industry?

To stay informed about further developments, trends, and reports in the Europe Gas Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence