Key Insights

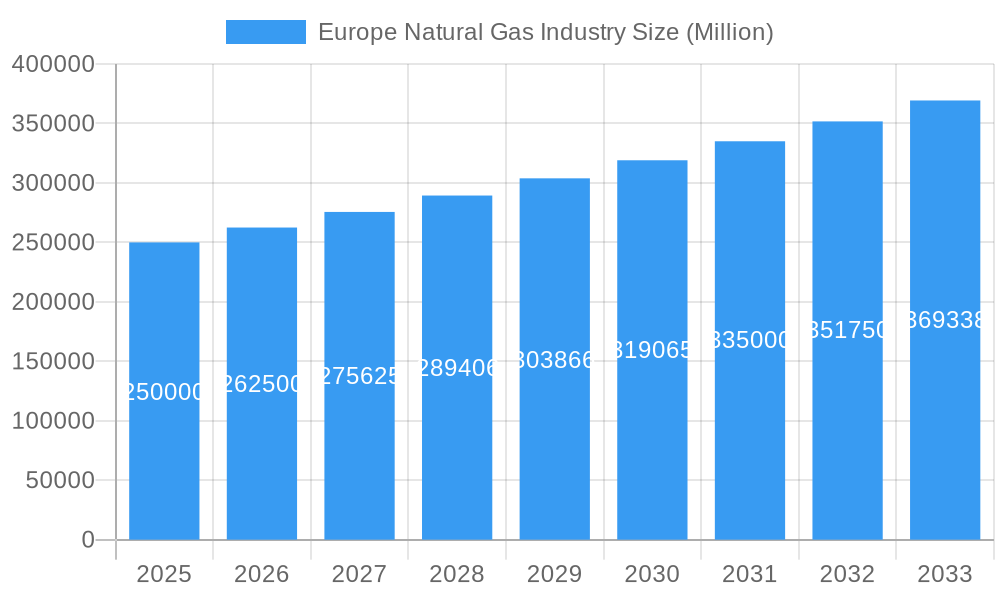

The European natural gas market is projected to reach €401.9 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 1.4% through 2033. This growth is propelled by the ongoing energy transition, positioning natural gas as a crucial bridging fuel for power generation and industrial applications. Enhanced energy security mandates are also stimulating demand for diversified supply and robust storage solutions. Growing industrial output across key sectors further bolsters this demand.

Europe Natural Gas Industry Market Size (In Billion)

Key challenges include stringent environmental regulations targeting greenhouse gas reduction, necessitating cleaner technologies and a shift towards renewables. Volatile global energy prices and potential supply chain disruptions also present significant market headwinds. The market is segmented by production methods, distribution channels, and end-use sectors including power generation, industrial, and residential applications.

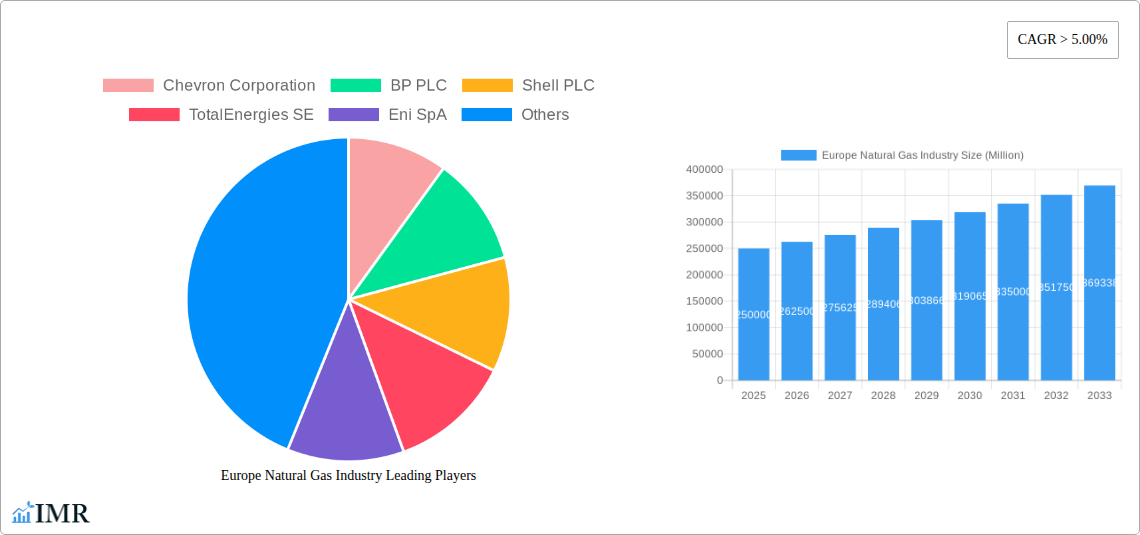

Europe Natural Gas Industry Company Market Share

Major industry participants such as Chevron Corporation, BP PLC, Shell PLC, and TotalEnergies SE are strategically navigating increased demand, regulatory pressures, and geopolitical complexities. Their strategies encompass infrastructure modernization, exploration of new reserves, investment in advanced technologies like carbon capture and storage, and supply chain diversification. Regional market dynamics are influenced by industrial concentration, population density, and climate variations. The forecast period (2025-2033) anticipates sustained growth, with a potential moderation as renewable energy adoption accelerates, leading to an innovative and sustainability-focused market environment characterized by strategic collaborations.

Europe Natural Gas Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the European natural gas industry, encompassing market dynamics, growth trends, regional performance, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for industry professionals, investors, and policymakers seeking a comprehensive understanding of this dynamic market. The report analyzes both the parent market (European Energy Market) and child market (European Natural Gas Market) to provide a holistic view.

Europe Natural Gas Industry Market Dynamics & Structure

The European natural gas market is characterized by a complex interplay of factors influencing its structure and dynamics. Market concentration is relatively high, with a few major multinational companies holding significant market share. Technological innovation, driven by the need for efficiency and sustainability, is a key driver, although regulatory frameworks and the availability of funding can create barriers. The presence of competitive substitutes, such as renewable energy sources, is impacting the market's trajectory. Furthermore, the end-user demographic—primarily power generation, industrial sectors, and residential consumers—significantly impacts demand patterns. M&A activity has been substantial, with deals worth xx Million in the last five years, reflecting consolidation and strategic positioning within the evolving landscape.

- Market Concentration: High, with top 5 players holding approximately xx% market share.

- Technological Innovation: Driven by efficiency gains and emission reduction targets. Barriers include high initial investment costs and regulatory uncertainty.

- Regulatory Frameworks: Differ across European nations, impacting investment decisions and market access.

- Competitive Substitutes: Renewable energy sources (solar, wind) and LNG imports are posing increasing competition.

- End-User Demographics: Primarily power generation (xx Million units), industrial (xx Million units), and residential (xx Million units).

- M&A Trends: Significant consolidation activity in recent years, with xx major deals completed since 2019.

Europe Natural Gas Industry Growth Trends & Insights

The European natural gas market experienced significant volatility in recent years, largely due to geopolitical factors and energy transition initiatives. The market size, valued at xx Million units in 2024, is projected to reach xx Million units by 2033, exhibiting a CAGR of xx%. Adoption rates vary across regions, with higher penetration observed in countries with established gas infrastructure. Technological disruptions, such as advancements in LNG import technologies and pipeline infrastructure upgrades, are impacting growth trends. Shifts in consumer behavior, influenced by rising energy prices and environmental concerns, are also altering demand patterns. Increased focus on energy security and diversification of supply sources is expected to influence market growth in the forecast period.

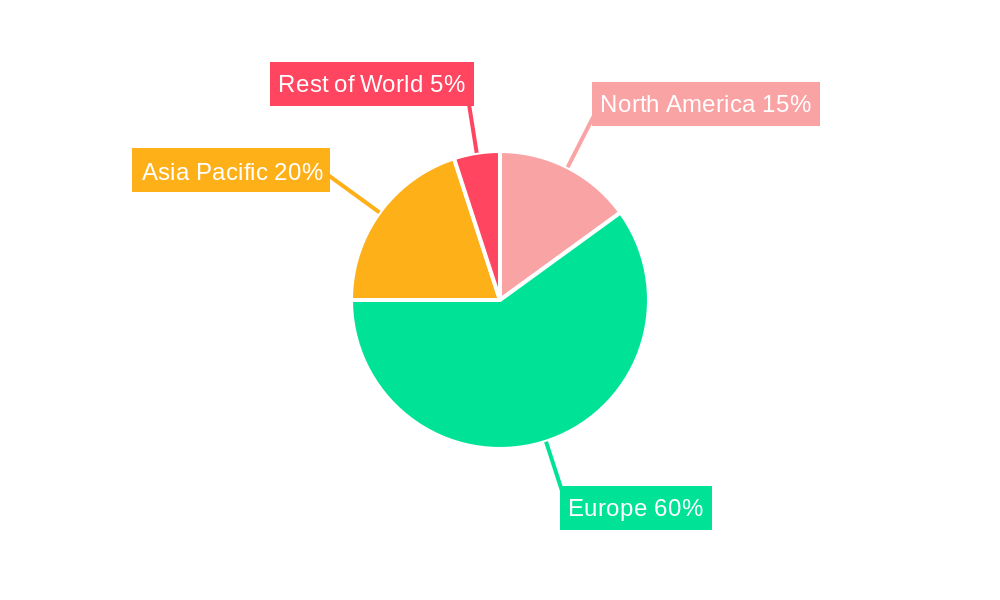

Dominant Regions, Countries, or Segments in Europe Natural Gas Industry

While numerous European nations are involved in the natural gas sector, some regions exhibit significantly stronger market growth and influence. Northwestern Europe (especially Norway and the UK) maintains a dominant position due to significant reserves and established infrastructure. Germany is a major consumer and importer, while Eastern Europe is experiencing varied dynamics influenced by geopolitical events. The power generation segment is the largest consumer, followed by the industrial sector and residential consumers.

- Key Drivers: Strong economic growth in certain regions, existing gas infrastructure, supportive government policies.

- Dominance Factors: Abundant reserves (Norway), strong industrial demand (Germany), established pipelines and import facilities (UK, Netherlands).

- Growth Potential: High in countries with developing infrastructure and increasing energy demand.

Europe Natural Gas Industry Product Landscape

The European natural gas industry encompasses various product types, including natural gas, LNG, and associated services. Recent innovations focus on improving efficiency, safety, and sustainability. The development of more efficient LNG import terminals is increasing the access to global supplies while advancements in gas storage technologies and grid modernization are improving the market stability.

Key Drivers, Barriers & Challenges in Europe Natural Gas Industry

Key Drivers: The need to meet growing energy demands across Europe, the availability of established gas infrastructure in some regions, and government support for energy security are key drivers. Strategic investments in LNG import facilities are also significantly contributing.

Key Challenges: Geopolitical instability, particularly concerning Russian gas supplies, poses a significant challenge. The transition towards renewable energy sources and the rising cost of gas extraction and transportation impact market stability. Moreover, regulatory uncertainty and environmental concerns are further hurdles to overcome. The ongoing energy crisis and resulting price volatility remain major challenges.

Emerging Opportunities in Europe Natural Gas Industry

Emerging opportunities in the European natural gas industry include developing advanced gas storage facilities to increase energy security. The transition towards low-carbon and sustainable alternatives requires significant investments in pipeline infrastructure, including Carbon Capture Utilization and Storage (CCUS) technologies. The development of innovative business models that facilitate the integration of renewable energy sources and gas represents a significant area of growth.

Growth Accelerators in the Europe Natural Gas Industry Industry

Long-term growth will be fueled by sustained investments in LNG import terminals, pipeline infrastructure upgrades, and diversification of supply sources. Technological advancements in gas exploration and extraction, coupled with strategic collaborations amongst energy companies and policymakers, will facilitate market expansion. A focus on energy efficiency and the development of carbon capture and storage (CCS) technologies will also contribute to long-term growth and sustainability.

Key Players Shaping the Europe Natural Gas Industry Market

Notable Milestones in Europe Natural Gas Industry Sector

- September 2022: The German government announced a USD 65 billion plan to mitigate soaring energy prices, highlighting the impact of the energy crisis.

- March 2022: Equinor announced plans to increase gas supply to Europe, signifying efforts to address supply disruptions stemming from the Ukraine war. Increased exports from Oseberg and Troll fields by approximately 1 bcm and Heidrun field by 0.4 bcm.

In-Depth Europe Natural Gas Industry Market Outlook

The future of the European natural gas market hinges on navigating the energy transition, addressing supply chain resilience issues, and managing geopolitical uncertainty. Continued investment in infrastructure, technological innovation in cleaner energy generation, and strategic partnerships will be crucial for long-term growth. The focus will be on energy security and affordability. The market will likely see a shift towards more diversified sources and a gradual decline in reliance on traditional gas sources. Strategic collaborations, technological advancements and diversified supply will be vital for capturing future opportunities.

Europe Natural Gas Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Natural Gas Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Natural Gas Industry Regional Market Share

Geographic Coverage of Europe Natural Gas Industry

Europe Natural Gas Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Upstream Sector to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Natural Gas Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Chevron Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BP PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Shell PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TotalEnergies SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eni SpA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ConocoPhillips

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Exxon Mobil Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Norwegian Energy Company ASA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Engie SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Electricite de France SA*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Chevron Corporation

List of Figures

- Figure 1: Europe Natural Gas Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Natural Gas Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Natural Gas Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Natural Gas Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Europe Natural Gas Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Europe Natural Gas Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Europe Natural Gas Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Europe Natural Gas Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Europe Natural Gas Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Europe Natural Gas Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Europe Natural Gas Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Europe Natural Gas Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Europe Natural Gas Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Europe Natural Gas Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Natural Gas Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Germany Europe Natural Gas Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Europe Natural Gas Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Natural Gas Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Natural Gas Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Europe Natural Gas Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Belgium Europe Natural Gas Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Sweden Europe Natural Gas Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Norway Europe Natural Gas Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Poland Europe Natural Gas Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Denmark Europe Natural Gas Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Natural Gas Industry?

The projected CAGR is approximately 1.4%.

2. Which companies are prominent players in the Europe Natural Gas Industry?

Key companies in the market include Chevron Corporation, BP PLC, Shell PLC, TotalEnergies SE, Eni SpA, ConocoPhillips, Exxon Mobil Corporation, Norwegian Energy Company ASA, Engie SA, Electricite de France SA*List Not Exhaustive.

3. What are the main segments of the Europe Natural Gas Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 401.9 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Upstream Sector to Witness Significant Growth.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In September 2022, the German government announced a USD 65 billion plan to help people and businesses cope with soaring prices. Several European nations introduce emergency measures to prepare for a long winter in the wake of disruption in Russian gas supplies to Europe following the Ukraine war.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Natural Gas Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Natural Gas Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Natural Gas Industry?

To stay informed about further developments, trends, and reports in the Europe Natural Gas Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence