Key Insights

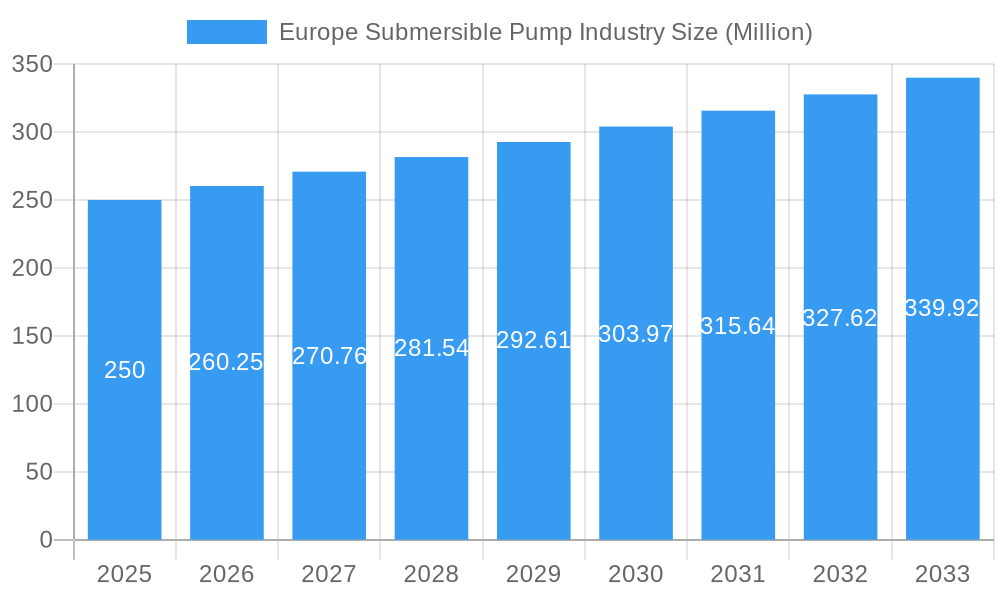

The European submersible pump market is set for significant expansion, with an estimated market size of €6.17 billion in 2025. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.9%, indicating a robust trajectory through 2033. This growth is primarily propelled by escalating demand in critical sectors such as water and wastewater treatment, where ongoing modernization and expansion efforts are paramount. Furthermore, continuous infrastructure development in the mining and construction industries significantly contributes to market expansion. A key trend is the increasing preference for energy-efficient electric-driven submersible pumps, coupled with the rising adoption of advanced, non-clog pumps designed for effective handling of diverse fluid types. Segments like high-head submersible pumps (above 100m) for deep-well applications are expected to exhibit superior growth, driven by specific regional infrastructure requirements. However, market expansion may encounter challenges from volatile raw material prices and potential economic downturns impacting infrastructure investments.

Europe Submersible Pump Industry Market Size (In Billion)

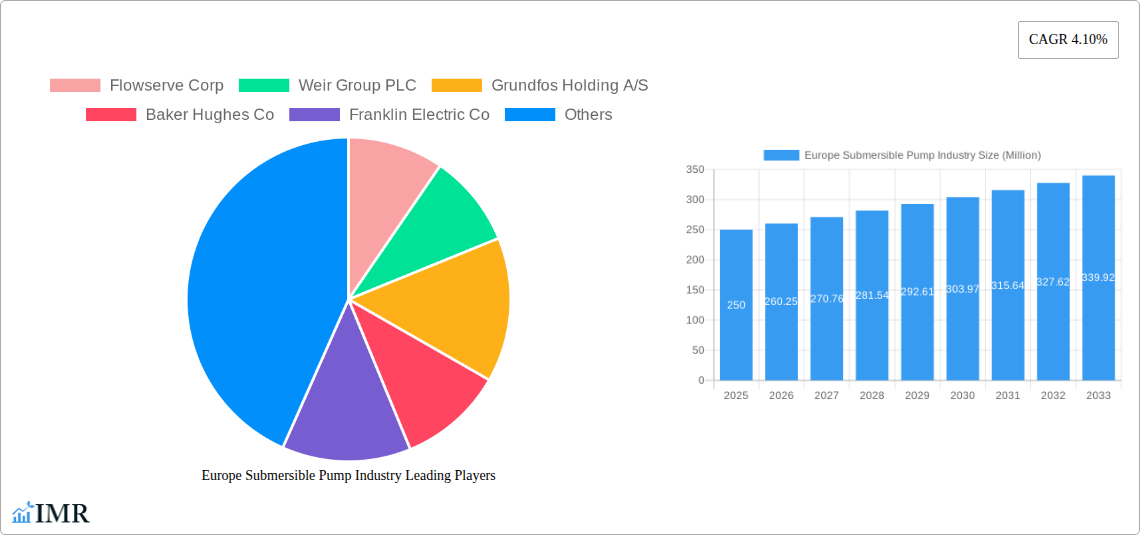

The competitive arena features established global leaders including Grundfos, Sulzer, and Flowserve, alongside prominent regional manufacturers. These entities are making substantial investments in research and development to pioneer advanced pump technologies and meet the distinct requirements of various end-users. The market's fragmented nature presents avenues for both large multinational corporations and specialized niche players. Future market success will depend on capitalizing on technological advancements, adapting to stringent environmental regulations, and effectively navigating challenges posed by fluctuating energy costs and raw material prices. This will necessitate strategic partnerships, collaborations, and a resolute focus on sustainable and energy-efficient solutions to ensure sustained long-term growth within the European submersible pump market. Borewell submersible pumps are anticipated to retain a substantial market share due to consistent demand in water extraction applications.

Europe Submersible Pump Industry Company Market Share

Europe Submersible Pump Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Europe submersible pump industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is essential for industry professionals, investors, and anyone seeking a deep understanding of this dynamic sector. The report segments the market by type (Borewell, Openwell, Non-clog), drive type (Electric, Hydraulic, Other), head (Below 50m, 50-100m, Above 100m), and end-user (Water & Wastewater, Oil & Gas, Mining & Construction, Others).

Europe Submersible Pump Industry Market Dynamics & Structure

The European submersible pump market is characterized by a moderately concentrated structure, with a few major players holding significant market share. Technological innovation, driven by increasing demand for energy efficiency and automation, is a key driver. Stringent environmental regulations and the need for sustainable water management are shaping the industry landscape. Competitive pressure from substitute technologies (e.g., alternative pumping systems) is moderate. The end-user demographic is diverse, with significant demand from the water and wastewater, oil and gas, and mining & construction sectors. M&A activity has been moderate in recent years, with strategic acquisitions aimed at expanding product portfolios and geographical reach.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025.

- Technological Innovation: Focus on energy-efficient motors, smart controls, and advanced materials.

- Regulatory Framework: Compliance with EU water directives and environmental regulations is crucial.

- Competitive Substitutes: Alternative pumping technologies, such as centrifugal pumps, pose a moderate threat.

- M&A Activity: xx major mergers and acquisitions occurred between 2019 and 2024.

Europe Submersible Pump Industry Growth Trends & Insights

The European submersible pump market witnessed a steady growth trajectory during the historical period (2019-2024). Driven by increasing urbanization, industrialization, and infrastructure development, the market is projected to experience robust growth during the forecast period (2025-2033). Adoption rates for advanced submersible pumps with smart features are rising, driven by the need for enhanced efficiency and remote monitoring capabilities. Technological disruptions, particularly in motor technology and control systems, are reshaping the industry. Consumer behavior is shifting towards energy-efficient and environmentally friendly solutions.

- Market Size (Million Units): 2019: xx; 2024: xx; 2025: xx; 2033: xx (projected)

- CAGR (2025-2033): xx%

- Market Penetration of Smart Pumps (2025): xx%

Dominant Regions, Countries, or Segments in Europe Submersible Pump Industry

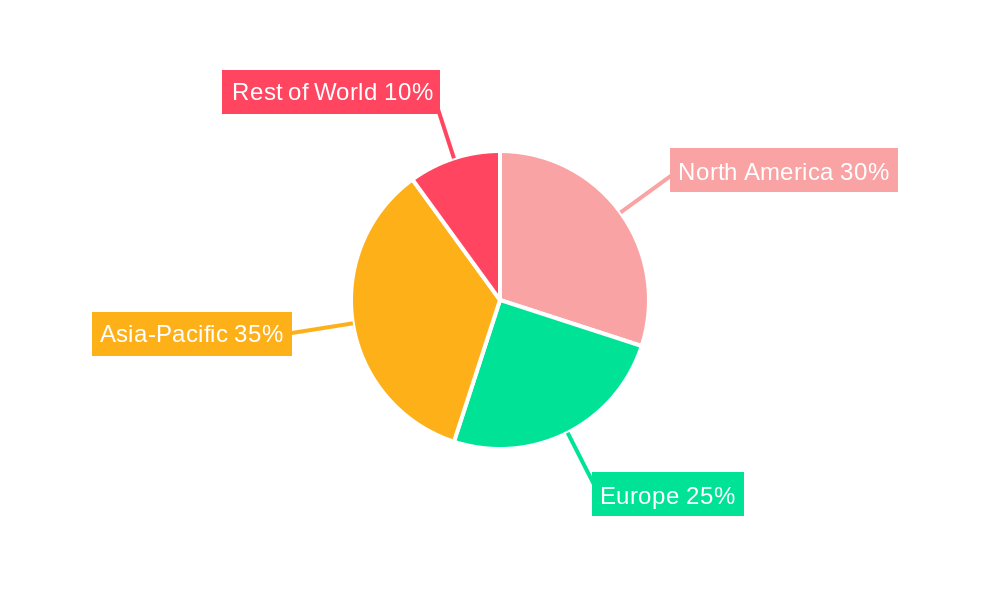

Germany, France, and the UK are leading the European submersible pump market, driven by strong industrial activity and robust infrastructure development. The water and wastewater sector remains the largest end-user segment, followed by the oil and gas industry. Within the product segments, electric-driven submersible pumps dominate due to their cost-effectiveness and ease of installation. The ‘Below 50m’ head segment holds the largest market share due to high demand in domestic and smaller industrial applications.

- Key Growth Drivers:

- Robust infrastructure development in key European countries.

- Growing demand for water and wastewater treatment solutions.

- Increasing investments in the oil and gas and mining sectors.

- Favorable government policies and regulations promoting energy efficiency.

- Dominant Segments:

- By Type: Electric Driven Submersible Pumps hold the largest share (xx%) in 2025.

- By Head: Below 50m accounts for xx% market share in 2025.

- By End-User: Water and Wastewater accounts for xx% market share in 2025.

Europe Submersible Pump Industry Product Landscape

The European submersible pump market features a diverse range of products, with a strong emphasis on innovation. Manufacturers are continuously developing energy-efficient motors, advanced materials, and smart control systems to enhance performance and reduce operating costs. Key features include variable speed drives for optimized energy consumption and remote monitoring capabilities for improved maintenance and operational efficiency. Unique selling propositions include robust designs for demanding applications and compact form factors for space-constrained installations.

Key Drivers, Barriers & Challenges in Europe Submersible Pump Industry

Key Drivers: Increasing urbanization and industrialization, stringent water management regulations, rising demand for energy-efficient solutions, and growing investments in infrastructure projects are driving market growth.

Challenges: Supply chain disruptions (material shortages and logistical delays) have impacted production and pricing. Stricter environmental regulations impose compliance costs. Intense competition from established and emerging players puts pressure on profit margins. The market is also impacted by fluctuating raw material prices.

Emerging Opportunities in Europe Submersible Pump Industry

The market presents several opportunities, including increased adoption of smart pumps in industrial applications, growth in the renewable energy sector (e.g., geothermal energy), and expanding applications in agricultural irrigation. Furthermore, the development of customized solutions for specific industry needs and expanding into underserved markets within Europe present substantial potential for growth.

Growth Accelerators in the Europe Submersible Pump Industry

Technological advancements in motor technology and materials science are key growth drivers. Strategic partnerships between pump manufacturers and automation companies are also accelerating market expansion. Focused market penetration strategies targeting niche applications and international expansion efforts will boost long-term growth.

Key Players Shaping the Europe Submersible Pump Industry Market

- Flowserve Corp

- Weir Group PLC

- Grundfos Holding A/S

- Baker Hughes Co

- Franklin Electric Co

- EBARA CORPORATION

- ITT Goulds Pumps Inc

- Borets International Ltd

- Atlas Copco AB Class A

- Halliburton Company

- Gorman-Rupp Co

- Sulzer AG

- Schlumberger Limited

- KSB SE & Co KgaA

Notable Milestones in Europe Submersible Pump Industry Sector

- 2020: Introduction of new energy-efficient pump models by several key players.

- 2022: Acquisition of a smaller pump manufacturer by a major player, expanding its product portfolio.

- 2023: Launch of a new smart pump technology with advanced monitoring capabilities. (Specific details would be added here for each milestone).

In-Depth Europe Submersible Pump Industry Market Outlook

The European submersible pump market is poised for continued growth, driven by ongoing technological innovation, supportive government policies, and increasing demand from key end-user sectors. Strategic investments in research and development, focused marketing efforts, and strategic partnerships will be crucial for success in this competitive market. Opportunities exist in developing energy-efficient and sustainable solutions, expanding into new market segments, and leveraging digital technologies for improved operational efficiency.

Europe Submersible Pump Industry Segmentation

-

1. Type

- 1.1. Borewell Submersible Pump

- 1.2. Openwell Submersible Pump

- 1.3. Non-clog Submersible Pump

-

2. Drive Type

- 2.1. Electric

- 2.2. Hydraulic

- 2.3. Other Drive Types

-

3. Head

- 3.1. Below 50 m

- 3.2. Between 50 m to 100 m

- 3.3. Above 100 m

-

4. End-User

- 4.1. Water and Wastewater

- 4.2. Oil and Gas Industry

- 4.3. Mining and Construction Industry

- 4.4. Other End Users

Europe Submersible Pump Industry Segmentation By Geography

- 1. Norway

- 2. Germany

- 3. Russia

- 4. United Kingdom

- 5. Rest of Europe

Europe Submersible Pump Industry Regional Market Share

Geographic Coverage of Europe Submersible Pump Industry

Europe Submersible Pump Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid Recovery in the Oil and Gas and Mining Industries4.; Surge in the Construction Industry

- 3.3. Market Restrains

- 3.3.1. 4.; High Maintenance and Operation Costs of Submersible Pump Restrain the Market

- 3.4. Market Trends

- 3.4.1. Oil and Gas Industry to Witness Significant Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Submersible Pump Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Borewell Submersible Pump

- 5.1.2. Openwell Submersible Pump

- 5.1.3. Non-clog Submersible Pump

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. Electric

- 5.2.2. Hydraulic

- 5.2.3. Other Drive Types

- 5.3. Market Analysis, Insights and Forecast - by Head

- 5.3.1. Below 50 m

- 5.3.2. Between 50 m to 100 m

- 5.3.3. Above 100 m

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. Water and Wastewater

- 5.4.2. Oil and Gas Industry

- 5.4.3. Mining and Construction Industry

- 5.4.4. Other End Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Norway

- 5.5.2. Germany

- 5.5.3. Russia

- 5.5.4. United Kingdom

- 5.5.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Norway Europe Submersible Pump Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Borewell Submersible Pump

- 6.1.2. Openwell Submersible Pump

- 6.1.3. Non-clog Submersible Pump

- 6.2. Market Analysis, Insights and Forecast - by Drive Type

- 6.2.1. Electric

- 6.2.2. Hydraulic

- 6.2.3. Other Drive Types

- 6.3. Market Analysis, Insights and Forecast - by Head

- 6.3.1. Below 50 m

- 6.3.2. Between 50 m to 100 m

- 6.3.3. Above 100 m

- 6.4. Market Analysis, Insights and Forecast - by End-User

- 6.4.1. Water and Wastewater

- 6.4.2. Oil and Gas Industry

- 6.4.3. Mining and Construction Industry

- 6.4.4. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Germany Europe Submersible Pump Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Borewell Submersible Pump

- 7.1.2. Openwell Submersible Pump

- 7.1.3. Non-clog Submersible Pump

- 7.2. Market Analysis, Insights and Forecast - by Drive Type

- 7.2.1. Electric

- 7.2.2. Hydraulic

- 7.2.3. Other Drive Types

- 7.3. Market Analysis, Insights and Forecast - by Head

- 7.3.1. Below 50 m

- 7.3.2. Between 50 m to 100 m

- 7.3.3. Above 100 m

- 7.4. Market Analysis, Insights and Forecast - by End-User

- 7.4.1. Water and Wastewater

- 7.4.2. Oil and Gas Industry

- 7.4.3. Mining and Construction Industry

- 7.4.4. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Russia Europe Submersible Pump Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Borewell Submersible Pump

- 8.1.2. Openwell Submersible Pump

- 8.1.3. Non-clog Submersible Pump

- 8.2. Market Analysis, Insights and Forecast - by Drive Type

- 8.2.1. Electric

- 8.2.2. Hydraulic

- 8.2.3. Other Drive Types

- 8.3. Market Analysis, Insights and Forecast - by Head

- 8.3.1. Below 50 m

- 8.3.2. Between 50 m to 100 m

- 8.3.3. Above 100 m

- 8.4. Market Analysis, Insights and Forecast - by End-User

- 8.4.1. Water and Wastewater

- 8.4.2. Oil and Gas Industry

- 8.4.3. Mining and Construction Industry

- 8.4.4. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. United Kingdom Europe Submersible Pump Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Borewell Submersible Pump

- 9.1.2. Openwell Submersible Pump

- 9.1.3. Non-clog Submersible Pump

- 9.2. Market Analysis, Insights and Forecast - by Drive Type

- 9.2.1. Electric

- 9.2.2. Hydraulic

- 9.2.3. Other Drive Types

- 9.3. Market Analysis, Insights and Forecast - by Head

- 9.3.1. Below 50 m

- 9.3.2. Between 50 m to 100 m

- 9.3.3. Above 100 m

- 9.4. Market Analysis, Insights and Forecast - by End-User

- 9.4.1. Water and Wastewater

- 9.4.2. Oil and Gas Industry

- 9.4.3. Mining and Construction Industry

- 9.4.4. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Europe Europe Submersible Pump Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Borewell Submersible Pump

- 10.1.2. Openwell Submersible Pump

- 10.1.3. Non-clog Submersible Pump

- 10.2. Market Analysis, Insights and Forecast - by Drive Type

- 10.2.1. Electric

- 10.2.2. Hydraulic

- 10.2.3. Other Drive Types

- 10.3. Market Analysis, Insights and Forecast - by Head

- 10.3.1. Below 50 m

- 10.3.2. Between 50 m to 100 m

- 10.3.3. Above 100 m

- 10.4. Market Analysis, Insights and Forecast - by End-User

- 10.4.1. Water and Wastewater

- 10.4.2. Oil and Gas Industry

- 10.4.3. Mining and Construction Industry

- 10.4.4. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Flowserve Corp

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Weir Group PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Grundfos Holding A/S

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Baker Hughes Co

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Franklin Electric Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 EBARA CORPORATION

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ITT Goulds Pumps Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Borets International Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Atlas Copco AB Class A

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Halliburton Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Gorman-Rupp Co

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Sulzer AG

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Schlumberger Limited

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 KSB SE & Co KgaA*List Not Exhaustive

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Flowserve Corp

List of Figures

- Figure 1: Europe Submersible Pump Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Submersible Pump Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Submersible Pump Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Submersible Pump Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: Europe Submersible Pump Industry Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 4: Europe Submersible Pump Industry Volume K Tons Forecast, by Drive Type 2020 & 2033

- Table 5: Europe Submersible Pump Industry Revenue billion Forecast, by Head 2020 & 2033

- Table 6: Europe Submersible Pump Industry Volume K Tons Forecast, by Head 2020 & 2033

- Table 7: Europe Submersible Pump Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 8: Europe Submersible Pump Industry Volume K Tons Forecast, by End-User 2020 & 2033

- Table 9: Europe Submersible Pump Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 10: Europe Submersible Pump Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 11: Europe Submersible Pump Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Europe Submersible Pump Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 13: Europe Submersible Pump Industry Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 14: Europe Submersible Pump Industry Volume K Tons Forecast, by Drive Type 2020 & 2033

- Table 15: Europe Submersible Pump Industry Revenue billion Forecast, by Head 2020 & 2033

- Table 16: Europe Submersible Pump Industry Volume K Tons Forecast, by Head 2020 & 2033

- Table 17: Europe Submersible Pump Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 18: Europe Submersible Pump Industry Volume K Tons Forecast, by End-User 2020 & 2033

- Table 19: Europe Submersible Pump Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Europe Submersible Pump Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 21: Europe Submersible Pump Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Europe Submersible Pump Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 23: Europe Submersible Pump Industry Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 24: Europe Submersible Pump Industry Volume K Tons Forecast, by Drive Type 2020 & 2033

- Table 25: Europe Submersible Pump Industry Revenue billion Forecast, by Head 2020 & 2033

- Table 26: Europe Submersible Pump Industry Volume K Tons Forecast, by Head 2020 & 2033

- Table 27: Europe Submersible Pump Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 28: Europe Submersible Pump Industry Volume K Tons Forecast, by End-User 2020 & 2033

- Table 29: Europe Submersible Pump Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Europe Submersible Pump Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 31: Europe Submersible Pump Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 32: Europe Submersible Pump Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 33: Europe Submersible Pump Industry Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 34: Europe Submersible Pump Industry Volume K Tons Forecast, by Drive Type 2020 & 2033

- Table 35: Europe Submersible Pump Industry Revenue billion Forecast, by Head 2020 & 2033

- Table 36: Europe Submersible Pump Industry Volume K Tons Forecast, by Head 2020 & 2033

- Table 37: Europe Submersible Pump Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 38: Europe Submersible Pump Industry Volume K Tons Forecast, by End-User 2020 & 2033

- Table 39: Europe Submersible Pump Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Europe Submersible Pump Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 41: Europe Submersible Pump Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 42: Europe Submersible Pump Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 43: Europe Submersible Pump Industry Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 44: Europe Submersible Pump Industry Volume K Tons Forecast, by Drive Type 2020 & 2033

- Table 45: Europe Submersible Pump Industry Revenue billion Forecast, by Head 2020 & 2033

- Table 46: Europe Submersible Pump Industry Volume K Tons Forecast, by Head 2020 & 2033

- Table 47: Europe Submersible Pump Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 48: Europe Submersible Pump Industry Volume K Tons Forecast, by End-User 2020 & 2033

- Table 49: Europe Submersible Pump Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 50: Europe Submersible Pump Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 51: Europe Submersible Pump Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 52: Europe Submersible Pump Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 53: Europe Submersible Pump Industry Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 54: Europe Submersible Pump Industry Volume K Tons Forecast, by Drive Type 2020 & 2033

- Table 55: Europe Submersible Pump Industry Revenue billion Forecast, by Head 2020 & 2033

- Table 56: Europe Submersible Pump Industry Volume K Tons Forecast, by Head 2020 & 2033

- Table 57: Europe Submersible Pump Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 58: Europe Submersible Pump Industry Volume K Tons Forecast, by End-User 2020 & 2033

- Table 59: Europe Submersible Pump Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Europe Submersible Pump Industry Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Submersible Pump Industry?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the Europe Submersible Pump Industry?

Key companies in the market include Flowserve Corp, Weir Group PLC, Grundfos Holding A/S, Baker Hughes Co, Franklin Electric Co, EBARA CORPORATION, ITT Goulds Pumps Inc, Borets International Ltd, Atlas Copco AB Class A, Halliburton Company, Gorman-Rupp Co, Sulzer AG, Schlumberger Limited, KSB SE & Co KgaA*List Not Exhaustive.

3. What are the main segments of the Europe Submersible Pump Industry?

The market segments include Type, Drive Type, Head, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.17 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid Recovery in the Oil and Gas and Mining Industries4.; Surge in the Construction Industry.

6. What are the notable trends driving market growth?

Oil and Gas Industry to Witness Significant Demand.

7. Are there any restraints impacting market growth?

4.; High Maintenance and Operation Costs of Submersible Pump Restrain the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Submersible Pump Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Submersible Pump Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Submersible Pump Industry?

To stay informed about further developments, trends, and reports in the Europe Submersible Pump Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence