Key Insights

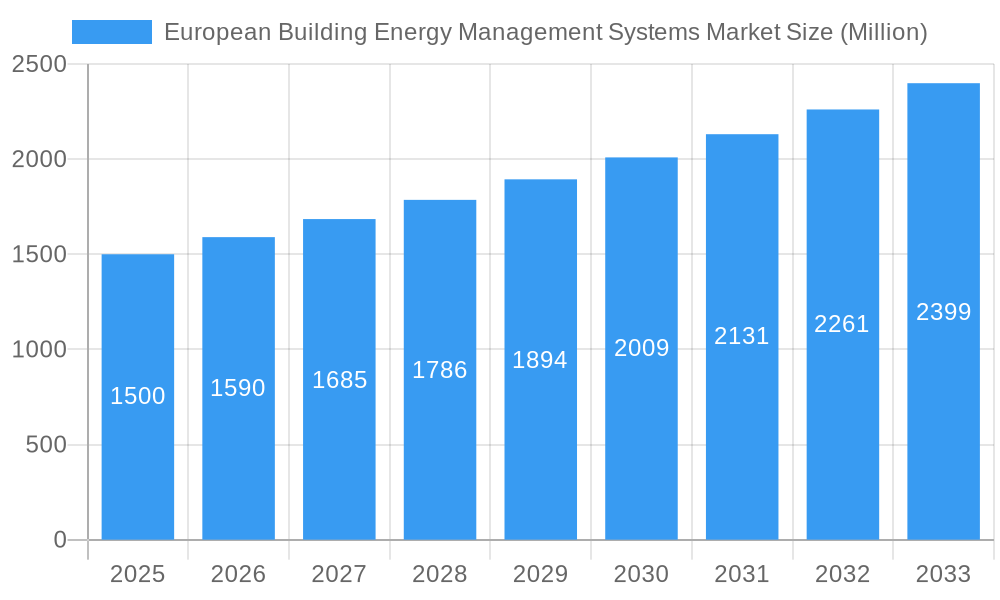

The European Building Energy Management Systems (BEMS) market is poised for significant expansion, driven by escalating energy costs, stringent environmental mandates, and the rapid integration of smart building technologies. Valued at 12974.6 million in 2024, the market is projected to achieve a Compound Annual Growth Rate (CAGR) of 12.2% through 2033. This growth is propelled by the increasing demand for energy efficiency across commercial, residential, and industrial sectors, as BEMS solutions optimize consumption and reduce operational expenses. Government incentives for sustainable building practices and renewable energy integration further bolster market expansion. The market comprises both software and hardware components, with commercial applications currently leading, although the residential sector shows substantial growth potential driven by smart home trends. Leading companies are innovating and expanding offerings to meet diverse building and energy requirements. The market's evolution is marked by the integration of IoT, AI, and cloud computing for advanced analytics and predictive maintenance.

European Building Energy Management Systems Market Market Size (In Billion)

While the outlook is positive, potential challenges include high initial investment costs, particularly for small enterprises, and the complexity of system integration and management. However, the substantial long-term benefits of energy savings, reduced carbon footprints, and enhanced building operational efficiency are expected to drive sustained market growth. Key markets include Germany, France, the UK, and Italy, with emerging opportunities in other regions as awareness of sustainable building practices grows. Continuous development of innovative, user-friendly, and cost-effective BEMS solutions will be crucial for realizing the market's full potential.

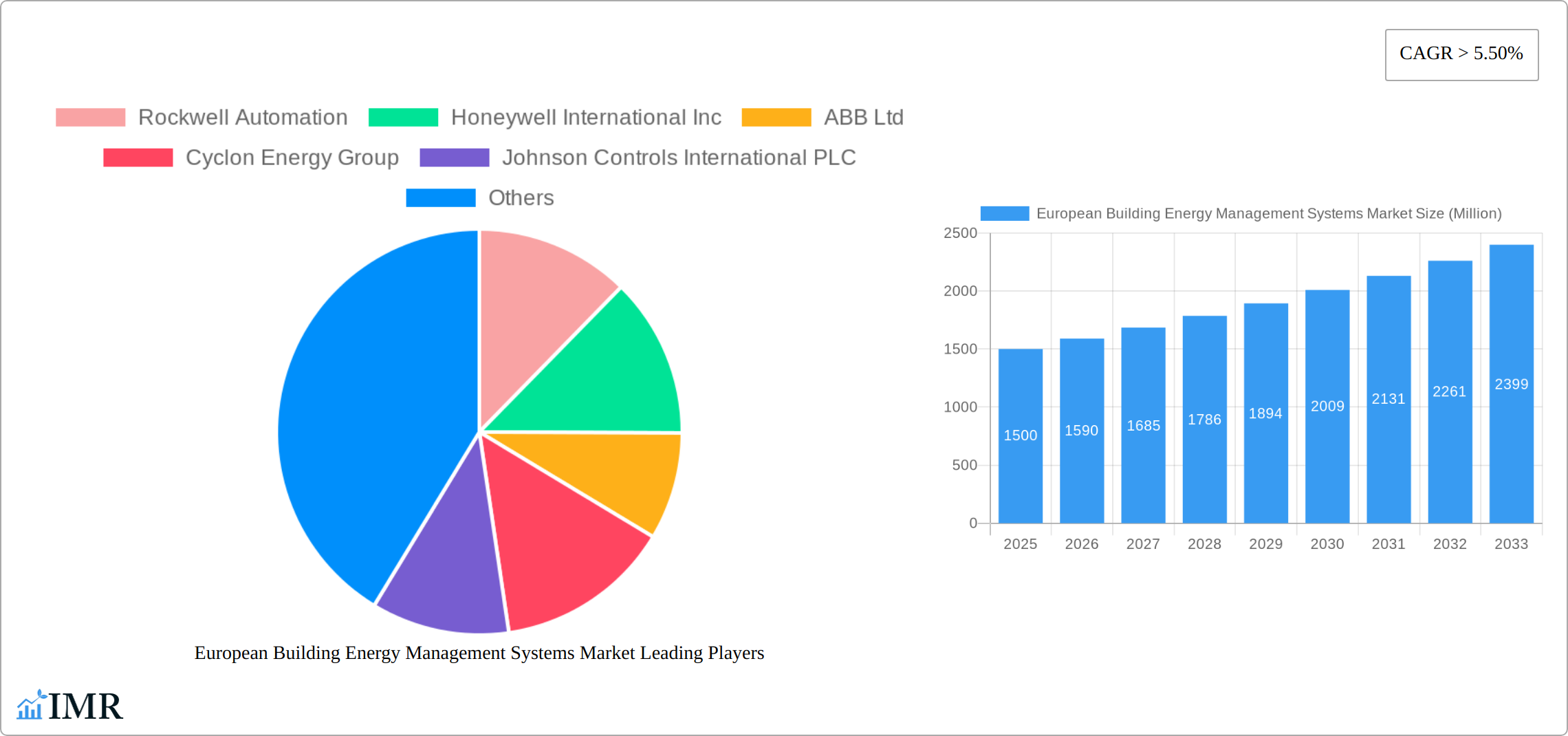

European Building Energy Management Systems Market Company Market Share

European Building Energy Management Systems (BEMS) Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the European Building Energy Management Systems (BEMS) market, encompassing its dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. The report segments the market by type (Software, Hardware) and deployment (Residential, Commercial, Industrial), providing granular insights into various market facets. This report is essential for industry professionals, investors, and stakeholders seeking a complete understanding of this rapidly evolving market. The European BEMS market is expected to reach xx Million units by 2033, exhibiting significant growth potential.

European Building Energy Management Systems Market Market Dynamics & Structure

The European BEMS market is characterized by a moderately concentrated landscape, with key players like Rockwell Automation, Honeywell International Inc, ABB Ltd, and Siemens AG holding significant market share. Technological innovation, driven by advancements in IoT, AI, and cloud computing, is a key growth driver. Stringent regulatory frameworks aimed at improving energy efficiency in buildings further propel market expansion. The market faces competition from alternative solutions, such as individual building automation systems, but the integrated nature and comprehensive data analysis capabilities of BEMS offer a compelling advantage. End-user demographics are diverse, ranging from residential homeowners to large commercial and industrial building owners. M&A activity has been moderate, with key players strategically acquiring smaller companies to expand their product portfolios and market reach.

- Market Concentration: Moderately concentrated, with top players holding approximately xx% market share in 2024.

- Technological Innovation: IoT, AI, and cloud computing are major drivers, enabling advanced analytics and remote management capabilities.

- Regulatory Framework: EU directives and national regulations supporting energy efficiency are key market drivers.

- Competitive Substitutes: Individual building automation systems pose some competition, but BEMS offers superior integration.

- End-User Demographics: Residential, commercial, and industrial sectors are all significant end-users.

- M&A Trends: A moderate level of M&A activity, driven by strategic acquisitions to expand market presence. Approximately xx M&A deals were recorded between 2019-2024.

European Building Energy Management Systems Market Growth Trends & Insights

The European BEMS market has witnessed robust growth over the past few years, driven by increasing awareness of energy efficiency and sustainability, coupled with supportive government policies. The market size expanded from xx Million units in 2019 to xx Million units in 2024, registering a CAGR of xx% during the historical period. Adoption rates are projected to accelerate during the forecast period (2025-2033), driven by factors such as declining hardware costs, rising energy prices, and the increasing availability of financing options for BEMS implementations. Technological disruptions, such as the rise of edge computing and improved cybersecurity features, further enhance the market's appeal. Consumer behavior is shifting towards greater adoption of smart building technologies, fostering the demand for BEMS solutions.

The commercial sector is the largest contributor to market revenue, accounting for approximately xx% in 2024. This is mainly attributed to the high energy consumption of commercial buildings. The industrial segment is also rapidly expanding as industrial plants strive to improve operational efficiency and reduce energy costs. We project an overall CAGR of xx% for the market during 2025-2033, driven by ongoing energy efficiency regulations, technological advancements, and increasing environmental concerns. Market penetration is expected to increase from xx% in 2024 to xx% in 2033.

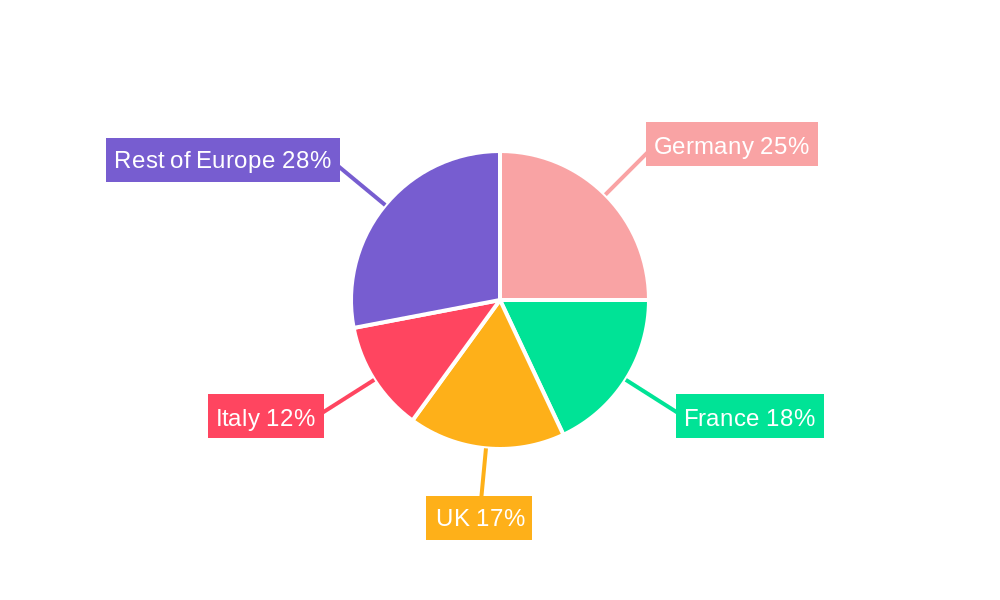

Dominant Regions, Countries, or Segments in European Building Energy Management Systems Market

Western Europe, spearheaded by Germany, France, and the United Kingdom, dominates the European Building Energy Management Systems (BEMS) market. This dominance stems from several factors: a substantial existing building stock ripe for modernization, robust economies capable of supporting significant investment in technology upgrades, and the implementation of stringent energy efficiency regulations. The commercial sector leads market demand, reflecting the high energy consumption inherent in these buildings and the increasing focus on optimizing operational efficiency and reducing carbon footprints. Germany maintains the largest market share, benefiting from its strong industrial base, proactive government policies promoting energy efficiency and renewable energy integration, and a highly developed smart building infrastructure. The UK and France follow closely, exhibiting similar market drivers and exhibiting a notable adoption rate of BEMS solutions across various building types.

Key Market Drivers:

- Stringent energy efficiency regulations and substantial financial incentives offered by Western European governments.

- High energy consumption in commercial buildings, creating a strong financial imperative for energy optimization.

- The rising adoption of sustainable building practices, driven by environmental concerns and corporate social responsibility initiatives.

- The accelerating adoption of smart building technologies across the commercial and industrial sectors, with BEMS acting as a central component.

- Ongoing economic recovery and substantial infrastructure development projects fueling investments in smart building technologies, including BEMS.

- Growing awareness among building owners and operators of the long-term cost savings and environmental benefits associated with BEMS implementation.

Factors Contributing to Market Dominance:

- A mature and substantial building stock in Western Europe providing a large target market for BEMS solutions.

- Well-established building management practices and expertise within the region, facilitating smoother integration of new technologies.

- Proactive government policies promoting energy efficiency and supporting the adoption of BEMS through various funding schemes and regulatory frameworks.

- A strong industrial base and robust economic growth in key countries, driving investment in innovative building technologies.

- A skilled workforce capable of installing, maintaining, and operating sophisticated BEMS.

European Building Energy Management Systems Market Product Landscape

BEMS solutions are evolving rapidly, incorporating cutting-edge technologies such as AI-powered predictive analytics, advanced data visualization tools, and enhanced cybersecurity measures. These advancements enhance energy efficiency, reduce operational costs, and provide better building management capabilities. Key features include centralized monitoring and control of building systems, automated energy optimization, real-time energy consumption data, and predictive maintenance capabilities. Unique selling propositions include seamless integration with other building systems, scalable architectures, and user-friendly interfaces. The market is seeing a trend toward cloud-based solutions, offering improved accessibility, scalability, and remote management capabilities.

Key Drivers, Barriers & Challenges in European Building Energy Management Systems Market

Key Drivers:

Stringent environmental regulations, rising energy costs, and the increasing focus on sustainable building practices are key drivers for the adoption of BEMS. Government incentives and subsidies aimed at boosting energy efficiency further enhance market growth. The increasing prevalence of smart building technologies and the integration of IoT devices within building infrastructures also contribute significantly.

Key Challenges & Restraints:

High initial investment costs, complex implementation procedures, and a lack of skilled workforce can hinder wider adoption. Cybersecurity concerns surrounding connected building systems and interoperability issues between different BEMS platforms pose significant challenges. Furthermore, regulatory complexities and varying standards across different European countries create barriers to market penetration.

Emerging Opportunities in European Building Energy Management Systems Market

The expansion of BEMS into untapped markets, such as smaller commercial buildings and residential sectors, presents significant opportunities. The development of innovative applications, like integrating BEMS with renewable energy sources and implementing advanced analytics for optimizing energy usage patterns, opens up new avenues for growth. A shift towards cloud-based solutions, which offer enhanced scalability and remote management features, will contribute to market expansion. The growing demand for improved building occupant comfort and health will further increase BEMS adoption.

Growth Accelerators in the European Building Energy Management Systems Market Industry

Technological advancements, such as the integration of AI, machine learning, and edge computing, enhance BEMS capabilities and drive adoption. Strategic partnerships between technology providers and building management companies facilitate wider market penetration. The expansion of government incentives and support for sustainable building practices will propel market growth. Furthermore, the increasing awareness of energy efficiency benefits among building owners and operators will continue to drive demand.

Key Players Shaping the European Building Energy Management Systems Market Market

- Rockwell Automation

- Honeywell International Inc

- ABB Ltd

- Cyclon Energy Group

- Johnson Controls International PLC

- Siemens AG

- Schneider Electric SE

- Veolia Environment SA

- EnerNOC Inc

- IBM Common Stock *List Not Exhaustive

Notable Milestones in European Building Energy Management Systems Market Sector

- November 2021: Lyon Confluence's urban redevelopment project in Lyon, France, incorporated green and energy efficiency objectives, leveraging BEMS for data collection.

- June 2021: Launch of the "Collecteif" project by Geonordo Environmental Technologies, implementing energy management systems in smart buildings across France, Italy, Norway, and Cyprus.

In-Depth European Building Energy Management Systems Market Market Outlook

The European BEMS market is poised for significant growth over the next decade, driven by converging factors such as increasing energy prices, stricter environmental regulations, and a greater emphasis on sustainable building practices. Strategic opportunities lie in developing innovative solutions that integrate renewable energy sources, improve building occupant comfort, and enhance cybersecurity measures. The continued expansion of smart building technologies and the increasing adoption of cloud-based BEMS solutions will further drive market growth and create substantial opportunities for key players.

European Building Energy Management Systems Market Segmentation

-

1. Type

- 1.1. Software

- 1.2. Hardware

-

2. Deployment

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

European Building Energy Management Systems Market Segmentation By Geography

- 1. Germany

- 2. Italy

- 3. United Kingdom

- 4. France

- 5. Rest of Europe

European Building Energy Management Systems Market Regional Market Share

Geographic Coverage of European Building Energy Management Systems Market

European Building Energy Management Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Oil and Gas Industry4.; Rapid Growth in the Industrial Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Fluctuation in Oil and Gas Prices

- 3.4. Market Trends

- 3.4.1. The Residential Sector Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Building Energy Management Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Software

- 5.1.2. Hardware

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. Italy

- 5.3.3. United Kingdom

- 5.3.4. France

- 5.3.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany European Building Energy Management Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Software

- 6.1.2. Hardware

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.2.3. Industrial

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Italy European Building Energy Management Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Software

- 7.1.2. Hardware

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.2.3. Industrial

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. United Kingdom European Building Energy Management Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Software

- 8.1.2. Hardware

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.2.3. Industrial

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. France European Building Energy Management Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Software

- 9.1.2. Hardware

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.2.3. Industrial

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Europe European Building Energy Management Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Software

- 10.1.2. Hardware

- 10.2. Market Analysis, Insights and Forecast - by Deployment

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.2.3. Industrial

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Rockwell Automation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Honeywell International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ABB Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cyclon Energy Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Johnson Controls International PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Siemens AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Schneider Electric SE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Veolia Environment SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 EnerNOC Inc *List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 IBM Common Stock

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Rockwell Automation

List of Figures

- Figure 1: European Building Energy Management Systems Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: European Building Energy Management Systems Market Share (%) by Company 2025

List of Tables

- Table 1: European Building Energy Management Systems Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: European Building Energy Management Systems Market Revenue million Forecast, by Deployment 2020 & 2033

- Table 3: European Building Energy Management Systems Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: European Building Energy Management Systems Market Revenue million Forecast, by Type 2020 & 2033

- Table 5: European Building Energy Management Systems Market Revenue million Forecast, by Deployment 2020 & 2033

- Table 6: European Building Energy Management Systems Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: European Building Energy Management Systems Market Revenue million Forecast, by Type 2020 & 2033

- Table 8: European Building Energy Management Systems Market Revenue million Forecast, by Deployment 2020 & 2033

- Table 9: European Building Energy Management Systems Market Revenue million Forecast, by Country 2020 & 2033

- Table 10: European Building Energy Management Systems Market Revenue million Forecast, by Type 2020 & 2033

- Table 11: European Building Energy Management Systems Market Revenue million Forecast, by Deployment 2020 & 2033

- Table 12: European Building Energy Management Systems Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: European Building Energy Management Systems Market Revenue million Forecast, by Type 2020 & 2033

- Table 14: European Building Energy Management Systems Market Revenue million Forecast, by Deployment 2020 & 2033

- Table 15: European Building Energy Management Systems Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: European Building Energy Management Systems Market Revenue million Forecast, by Type 2020 & 2033

- Table 17: European Building Energy Management Systems Market Revenue million Forecast, by Deployment 2020 & 2033

- Table 18: European Building Energy Management Systems Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Building Energy Management Systems Market?

The projected CAGR is approximately 12.2%.

2. Which companies are prominent players in the European Building Energy Management Systems Market?

Key companies in the market include Rockwell Automation, Honeywell International Inc, ABB Ltd, Cyclon Energy Group, Johnson Controls International PLC, Siemens AG, Schneider Electric SE, Veolia Environment SA, EnerNOC Inc *List Not Exhaustive, IBM Common Stock.

3. What are the main segments of the European Building Energy Management Systems Market?

The market segments include Type, Deployment.

4. Can you provide details about the market size?

The market size is estimated to be USD 12974.6 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Oil and Gas Industry4.; Rapid Growth in the Industrial Sector.

6. What are the notable trends driving market growth?

The Residential Sector Expected to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Fluctuation in Oil and Gas Prices.

8. Can you provide examples of recent developments in the market?

In November 2021, Lyon Confluence, the France-based public company, announced that it had started the urban redevelopment project in the city of Lyon, France. The project also includes the green and energy efficiency objectives of the buildings that are to be renovated. The devices and systems used for the data collection from the smart buildings include smart meters, building energy management systems, heat meters, and energy production systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Building Energy Management Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Building Energy Management Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Building Energy Management Systems Market?

To stay informed about further developments, trends, and reports in the European Building Energy Management Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence