Key Insights

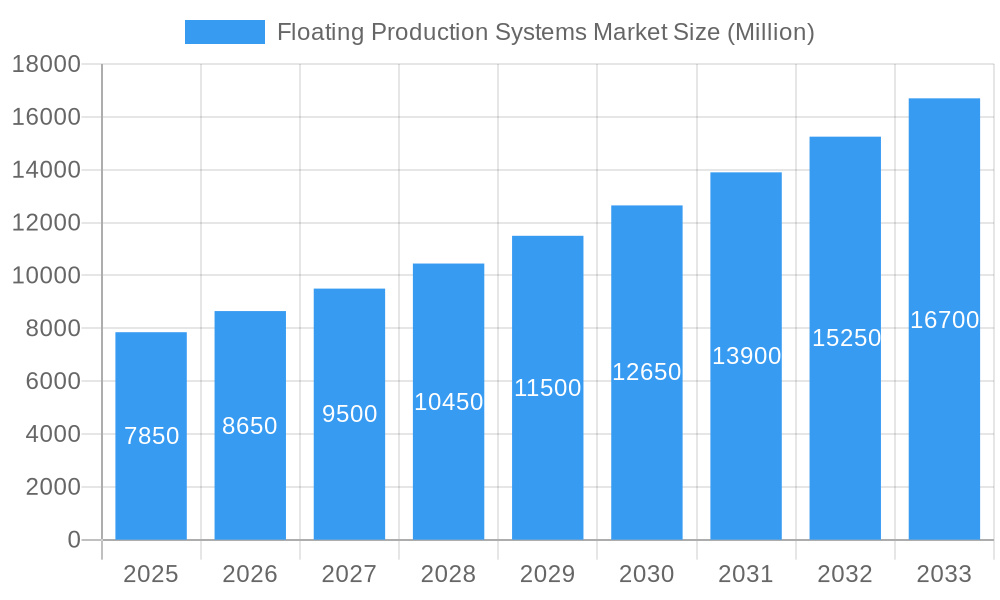

The Global Floating Production Systems (FPS) market is projected for significant expansion. With an estimated market size of $4.3 billion in the base year of 2024, the market is expected to achieve a Compound Annual Growth Rate (CAGR) of 12.5%. This robust growth is driven by increasing investments in offshore oil and gas exploration and production, especially in deeper and more challenging water depths. As onshore reserves diminish, the industry is increasingly leveraging FPS solutions for efficient hydrocarbon recovery from marginal fields and the development of ultra-deepwater reserves. Technological advancements in FPS design and deployment, coupled with the optimization of existing offshore assets and the potential for renewable energy integration, are further fueling market dynamism.

Floating Production Systems Market Market Size (In Billion)

The market is segmented by Type, with Floating Production Storage and Offloading (FPSO) units anticipated to lead due to their versatility. Tension Leg Platforms (TLP), SPARs, and Barges will also see substantial adoption, tailored to specific field characteristics. In terms of Water Depth, Deepwater and Ultra-deepwater applications are expected to dominate, reflecting the industry's focus on untapped reserves. Leading companies are driving innovation through advanced technologies and strategic collaborations. While challenges such as stringent environmental regulations, fluctuating oil prices, and high capital expenditure exist, the persistent global energy demand ensures a positive outlook for the FPS market.

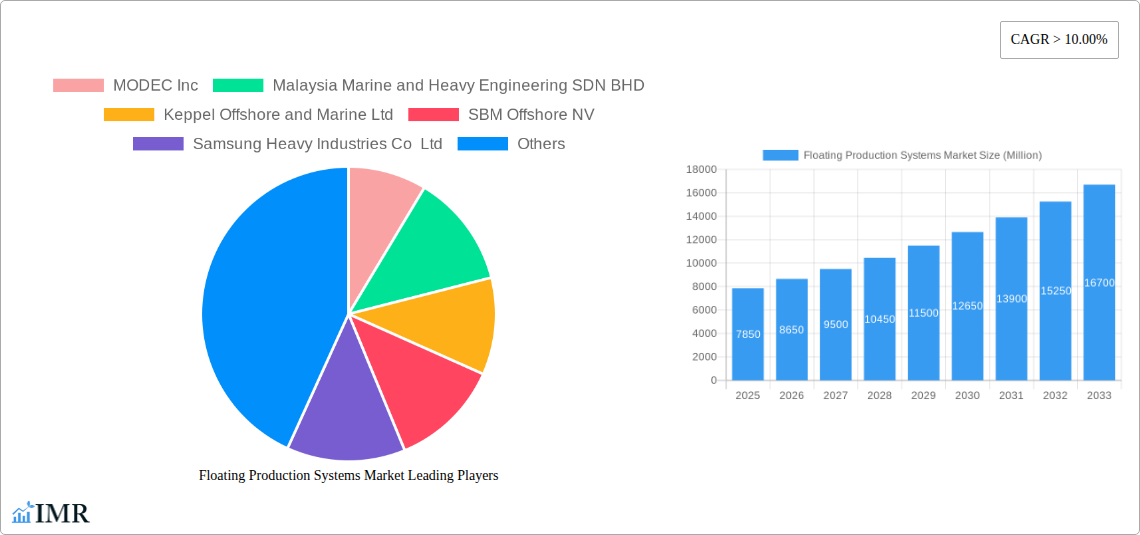

Floating Production Systems Market Company Market Share

Floating Production Systems Market: Revolutionizing Offshore Energy Extraction (2019-2033)

This comprehensive report analyzes the global Floating Production Systems market, a critical segment of the offshore oil and gas industry. We provide in-depth insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, and emerging opportunities. The study covers the period from 2019 to 2033, with a base year of 2025, offering a detailed forecast for 2025-2033. Discover how advancements in FPSO, Tension Leg Platform, SPAR, and Barge technologies are shaping the future of offshore energy production in shallow, deepwater, and ultra-deepwater environments.

Floating Production Systems Market Market Dynamics & Structure

The global Floating Production Systems market is characterized by a moderate to high degree of concentration, with a few key players holding significant market share. Technological innovation is a primary driver, fueled by the increasing demand for efficient and cost-effective solutions for offshore hydrocarbon extraction, especially in challenging deepwater and ultra-deepwater environments. Regulatory frameworks, while evolving to promote safety and environmental sustainability, can also influence project timelines and investment decisions. Competitive product substitutes are limited, primarily revolving around different types of floating production units and alternative offshore infrastructure. End-user demographics are dominated by major oil and gas exploration and production (E&P) companies. Mergers and acquisitions (M&A) are a significant trend, as companies seek to expand their capabilities, secure market share, and achieve economies of scale.

- Market Concentration: Dominated by established engineering, procurement, construction, and installation (EPCI) contractors and vessel manufacturers.

- Technological Innovation Drivers: Focus on enhanced oil recovery (EOR), improved uptime, reduced environmental impact, and cost optimization for complex offshore fields.

- Regulatory Frameworks: Increasing emphasis on environmental protection, safety standards, and decommissioning responsibilities.

- Competitive Product Substitutes: Primarily variations in FPSO designs, subsea processing, and umbilical technology.

- End-User Demographics: Major international oil companies (IOCs) and national oil companies (NOCs).

- M&A Trends: Strategic acquisitions to gain access to new technologies, geographical markets, and project pipelines.

Floating Production Systems Market Growth Trends & Insights

The Floating Production Systems market is experiencing robust growth, projected to expand significantly throughout the forecast period. This expansion is underpinned by a confluence of factors, including the continuous discovery of new offshore hydrocarbon reserves, particularly in deepwater and ultra-deepwater frontiers, and the need to monetize these discoveries efficiently. The adoption rates of floating production units, especially Floating Production Storage and Offloading (FPSO) vessels, are steadily increasing as operators seek flexible, cost-effective, and environmentally compliant solutions for field development. Technological disruptions are a constant theme, with innovations in modular designs, automation, digital twin technology for predictive maintenance, and advanced mooring systems enhancing operational efficiency and safety. Consumer behavior shifts within the E&P sector are also contributing, with a growing preference for lifecycle solutions and integrated project delivery models that minimize risks and optimize project economics. The market size is expected to witness a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching an estimated market value of USD X,XXX Million in 2033. Market penetration of advanced floating production technologies is anticipated to rise as operators increasingly leverage these systems for marginal fields and challenging reservoir conditions. The continuous drive to reduce operational expenditure (OPEX) and capital expenditure (CAPEX) further fuels the adoption of these sophisticated systems.

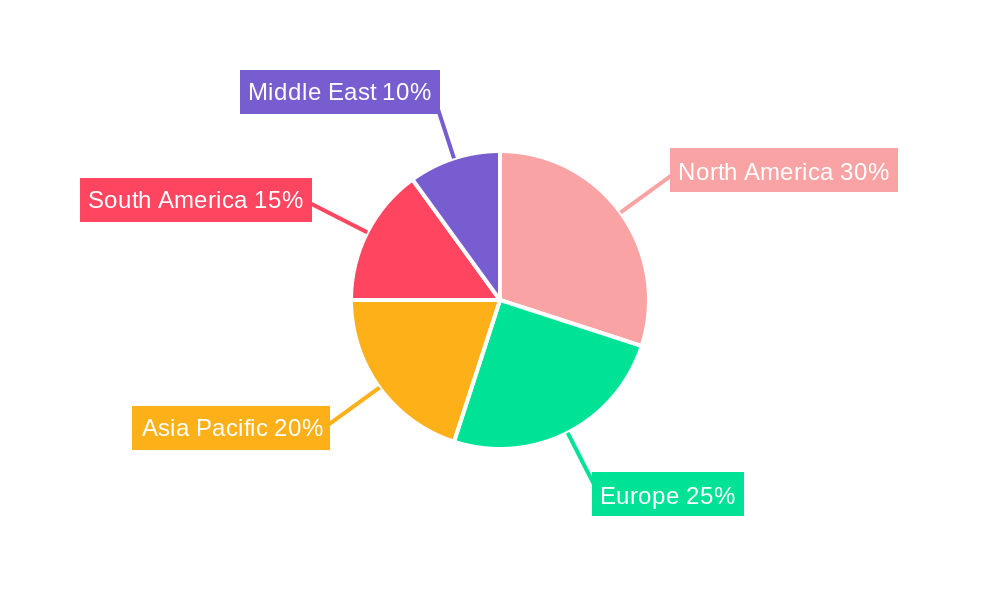

Dominant Regions, Countries, or Segments in Floating Production Systems Market

The Floating Production Storage and Offloading (FPSO) segment consistently dominates the Floating Production Systems market, driven by its unparalleled versatility, adaptability to various water depths and field sizes, and integrated functionality for storage and offloading. Its widespread application in numerous offshore projects globally solidifies its leading position. Among regions, Asia-Pacific is emerging as a significant growth driver, propelled by substantial offshore exploration activities and the development of numerous deepwater fields, particularly in countries like China, India, and Southeast Asian nations. However, North America, specifically the U.S. Gulf of Mexico, remains a mature yet dominant market, characterized by a high concentration of deepwater and ultra-deepwater projects utilizing sophisticated floating production technologies.

- Dominant Segment (Type): FPSO

- Market Share: Consistently holds the largest market share due to its adaptability and integrated functionality.

- Growth Potential: High, driven by new field developments and the need for flexible production solutions.

- Key Drivers: Cost-effectiveness for marginal fields, quick deployment capabilities, and suitability for a wide range of reservoir conditions.

- Dominant Region (Regional Analysis): North America (U.S. Gulf of Mexico)

- Market Share: Significant presence due to extensive deepwater and ultra-deepwater operations.

- Growth Potential: Steady, driven by ongoing exploration and production in mature deepwater basins.

- Dominance Factors: Mature offshore infrastructure, experienced E&P companies, and favorable geological conditions for deepwater reservoirs.

- Dominant Segment (Water Depth): Deepwater and Ultra-deepwater

- Market Share: Growing dominance as shallow water reserves deplete and exploration shifts to deeper, more challenging environments.

- Growth Potential: Exponential, driven by technological advancements enabling economic extraction from extreme depths.

- Dominance Factors: Technological advancements in mooring systems, risers, and subsea infrastructure; necessity for floating solutions in these depths.

Floating Production Systems Market Product Landscape

The Floating Production Systems market is characterized by continuous product innovation aimed at enhancing efficiency, safety, and environmental performance. FPSOs remain the cornerstone, with advancements focusing on increased processing capacity, improved turrets and mooring systems for harsher environments, and integrated digital solutions for remote monitoring and predictive maintenance. Tension Leg Platforms (TLPs) are gaining traction for their stability in deep to ultra-deep waters, with innovations in spar hull designs and tendon systems optimizing their performance. SPAR platforms are evolving with improved buoyancy and stability characteristics, making them suitable for a wider range of applications. Barge-based systems, while older, continue to be developed for specific shallow-water or marginal field applications, often incorporating modular designs for easier redeployment. The unique selling proposition of these systems lies in their ability to facilitate production in remote or challenging offshore locations where fixed platforms are not economically viable. Technological advancements include the development of hybrid renewable energy integration for offshore platforms, further reducing their carbon footprint.

Key Drivers, Barriers & Challenges in Floating Production Systems Market

Key Drivers:

- Growing Global Energy Demand: The perpetual need for oil and gas fuels offshore exploration and production.

- Depletion of Shallow Water Reserves: Drives investment into more challenging deepwater and ultra-deepwater environments, where floating systems are essential.

- Technological Advancements: Innovations in mooring, riser technology, and processing capabilities enable economic extraction from previously inaccessible fields.

- Cost-Effectiveness for Marginal Fields: Floating production units offer a flexible and often more economical solution for developing smaller offshore reserves.

- Environmental Regulations: Increasingly stringent regulations encourage the adoption of more efficient and environmentally friendly production methods, which floating systems can facilitate.

Barriers & Challenges:

- High Capital Investment: The upfront cost of designing, constructing, and installing floating production systems is substantial.

- Complex Project Management: Offshore projects are inherently complex, involving intricate logistics, stringent safety protocols, and long lead times.

- Supply Chain Constraints: Availability of specialized components, skilled labor, and shipyard capacity can pose significant challenges.

- Regulatory Hurdles and Permitting: Navigating diverse and evolving regulatory landscapes across different jurisdictions can lead to project delays.

- Volatile Oil and Gas Prices: Fluctuations in commodity prices can impact investment decisions and project viability, leading to project cancellations or deferrals.

- Geopolitical Risks: International relations and regional instability can affect offshore operations and investments.

Emerging Opportunities in Floating Production Systems Market

Emerging opportunities within the Floating Production Systems market lie in the development of smaller, modular, and standardized floating units that can be rapidly deployed for marginal field development and early production. The integration of renewable energy sources, such as offshore wind and solar power, into floating production platforms presents a significant opportunity to reduce their carbon footprint and operational costs. Furthermore, the increasing focus on subsea processing and tie-backs to existing floating infrastructure opens avenues for enhanced field recovery and extended field life. The growing interest in floating LNG (FLNG) facilities also represents a nascent but promising segment. The Arctic region, with its challenging conditions and untapped hydrocarbon potential, also presents a long-term opportunity for specialized floating production solutions.

Growth Accelerators in the Floating Production Systems Market Industry

Growth accelerators in the Floating Production Systems market are primarily driven by continuous technological breakthroughs that enhance the economic viability of offshore projects. The development of more efficient and robust mooring systems, advanced riser technologies, and high-pressure, high-temperature (HPHT) production capabilities are key catalysts. Strategic partnerships and collaborations between E&P companies, EPCI contractors, and technology providers are crucial for risk sharing and accelerating the development of complex projects. Furthermore, the adoption of digital technologies, including AI-driven predictive maintenance, advanced data analytics for reservoir management, and autonomous operations, is significantly improving operational efficiency and reducing downtime. Market expansion strategies, such as the development of solutions tailored for emerging offshore basins and the increasing focus on lifecycle services, also contribute to sustained growth.

Key Players Shaping the Floating Production Systems Market Market

- MODEC Inc.

- Malaysia Marine and Heavy Engineering SDN BHD

- Keppel Offshore and Marine Ltd

- SBM Offshore NV

- Samsung Heavy Industries Co Ltd

- Teekay Corporation

- Hyundai Heavy Industries Co Ltd

- TechnipFMC PLC

- Bumi Armada Berhad

- Mitsubishi Heavy Industries Ltd

Notable Milestones in Floating Production Systems Market Sector

- September 2022: Keppel Offshore & Marine secured a significant EPC tender from Petrobras for the P-83 FPSO, valued at USD 2.8 billion. This milestone underscores the demand for advanced FPSO solutions and highlights Keppel's strong position in the market, with delivery anticipated by the first half of 2027.

- November 2022: Exxon Mobil Corp. announced its intention to procure an additional FPSO vessel for its Guyana operations from SBM Offshore. The signing of an MoU between the two companies signifies continued confidence in SBM Offshore's capabilities and the strategic importance of Guyana as a major offshore development hub.

In-Depth Floating Production Systems Market Market Outlook

The outlook for the Floating Production Systems market remains exceptionally positive, driven by sustained global energy demand and the ongoing exploration of deepwater and ultra-deepwater reserves. Growth accelerators such as groundbreaking technological innovations in mooring and riser systems, coupled with the increasing integration of digital solutions for operational efficiency, will continue to propel the market forward. Strategic partnerships and the expansion into new geographical frontiers will further solidify market growth. The market's trajectory indicates a strong future potential, with a particular emphasis on sustainability, cost optimization, and the development of flexible, modular solutions to meet the evolving needs of the offshore oil and gas industry. Strategic opportunities abound for companies that can offer integrated lifecycle services and leverage cutting-edge technologies.

Floating Production Systems Market Segmentation

-

1. Type

- 1.1. FPSO

- 1.2. Tension Leg Platform

- 1.3. SPAR

- 1.4. Barge

-

2. Water Depth

- 2.1. Shallow Water

- 2.2. Deepwater and Ultra-deepwater

Floating Production Systems Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East

Floating Production Systems Market Regional Market Share

Geographic Coverage of Floating Production Systems Market

Floating Production Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; An Increase in the Use of LNG as an Energy Source

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Solar and Wind Energy

- 3.4. Market Trends

- 3.4.1 Floating Production

- 3.4.2 Storage

- 3.4.3 and Offloading (FPSO) to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Floating Production Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. FPSO

- 5.1.2. Tension Leg Platform

- 5.1.3. SPAR

- 5.1.4. Barge

- 5.2. Market Analysis, Insights and Forecast - by Water Depth

- 5.2.1. Shallow Water

- 5.2.2. Deepwater and Ultra-deepwater

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Floating Production Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. FPSO

- 6.1.2. Tension Leg Platform

- 6.1.3. SPAR

- 6.1.4. Barge

- 6.2. Market Analysis, Insights and Forecast - by Water Depth

- 6.2.1. Shallow Water

- 6.2.2. Deepwater and Ultra-deepwater

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Floating Production Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. FPSO

- 7.1.2. Tension Leg Platform

- 7.1.3. SPAR

- 7.1.4. Barge

- 7.2. Market Analysis, Insights and Forecast - by Water Depth

- 7.2.1. Shallow Water

- 7.2.2. Deepwater and Ultra-deepwater

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Floating Production Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. FPSO

- 8.1.2. Tension Leg Platform

- 8.1.3. SPAR

- 8.1.4. Barge

- 8.2. Market Analysis, Insights and Forecast - by Water Depth

- 8.2.1. Shallow Water

- 8.2.2. Deepwater and Ultra-deepwater

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Floating Production Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. FPSO

- 9.1.2. Tension Leg Platform

- 9.1.3. SPAR

- 9.1.4. Barge

- 9.2. Market Analysis, Insights and Forecast - by Water Depth

- 9.2.1. Shallow Water

- 9.2.2. Deepwater and Ultra-deepwater

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Floating Production Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. FPSO

- 10.1.2. Tension Leg Platform

- 10.1.3. SPAR

- 10.1.4. Barge

- 10.2. Market Analysis, Insights and Forecast - by Water Depth

- 10.2.1. Shallow Water

- 10.2.2. Deepwater and Ultra-deepwater

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 MODEC Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Malaysia Marine and Heavy Engineering SDN BHD

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Keppel Offshore and Marine Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SBM Offshore NV

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Samsung Heavy Industries Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Teekay Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hyundai Heavy Industries Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 TechnipFMC PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bumi Armada Berhad

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mitsubishi Heavy Industries Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 MODEC Inc

List of Figures

- Figure 1: Global Floating Production Systems Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Floating Production Systems Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Floating Production Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Floating Production Systems Market Revenue (billion), by Water Depth 2025 & 2033

- Figure 5: North America Floating Production Systems Market Revenue Share (%), by Water Depth 2025 & 2033

- Figure 6: North America Floating Production Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Floating Production Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Floating Production Systems Market Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Floating Production Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Floating Production Systems Market Revenue (billion), by Water Depth 2025 & 2033

- Figure 11: Europe Floating Production Systems Market Revenue Share (%), by Water Depth 2025 & 2033

- Figure 12: Europe Floating Production Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Floating Production Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Floating Production Systems Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Floating Production Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Floating Production Systems Market Revenue (billion), by Water Depth 2025 & 2033

- Figure 17: Asia Pacific Floating Production Systems Market Revenue Share (%), by Water Depth 2025 & 2033

- Figure 18: Asia Pacific Floating Production Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Floating Production Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Floating Production Systems Market Revenue (billion), by Type 2025 & 2033

- Figure 21: South America Floating Production Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Floating Production Systems Market Revenue (billion), by Water Depth 2025 & 2033

- Figure 23: South America Floating Production Systems Market Revenue Share (%), by Water Depth 2025 & 2033

- Figure 24: South America Floating Production Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Floating Production Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Floating Production Systems Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East Floating Production Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East Floating Production Systems Market Revenue (billion), by Water Depth 2025 & 2033

- Figure 29: Middle East Floating Production Systems Market Revenue Share (%), by Water Depth 2025 & 2033

- Figure 30: Middle East Floating Production Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East Floating Production Systems Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Floating Production Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Floating Production Systems Market Revenue billion Forecast, by Water Depth 2020 & 2033

- Table 3: Global Floating Production Systems Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Floating Production Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Floating Production Systems Market Revenue billion Forecast, by Water Depth 2020 & 2033

- Table 6: Global Floating Production Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Floating Production Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Floating Production Systems Market Revenue billion Forecast, by Water Depth 2020 & 2033

- Table 9: Global Floating Production Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Floating Production Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Floating Production Systems Market Revenue billion Forecast, by Water Depth 2020 & 2033

- Table 12: Global Floating Production Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Floating Production Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Floating Production Systems Market Revenue billion Forecast, by Water Depth 2020 & 2033

- Table 15: Global Floating Production Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Floating Production Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Floating Production Systems Market Revenue billion Forecast, by Water Depth 2020 & 2033

- Table 18: Global Floating Production Systems Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Floating Production Systems Market?

The projected CAGR is approximately 12.5%.

2. Which companies are prominent players in the Floating Production Systems Market?

Key companies in the market include MODEC Inc, Malaysia Marine and Heavy Engineering SDN BHD, Keppel Offshore and Marine Ltd, SBM Offshore NV, Samsung Heavy Industries Co Ltd, Teekay Corporation, Hyundai Heavy Industries Co Ltd, TechnipFMC PLC, Bumi Armada Berhad, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Floating Production Systems Market?

The market segments include Type, Water Depth.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.3 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; An Increase in the Use of LNG as an Energy Source.

6. What are the notable trends driving market growth?

Floating Production. Storage. and Offloading (FPSO) to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Solar and Wind Energy.

8. Can you provide examples of recent developments in the market?

In September 2022, Keppel Offshore & Marine won an engineering, procurement, and construction (EPC) tender from Petrobras for the P-83 FPSO, worth USD 2.8 billion. The FPSO is scheduled to be delivered by the first half of 2027.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Floating Production Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Floating Production Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Floating Production Systems Market?

To stay informed about further developments, trends, and reports in the Floating Production Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence