Key Insights

India's Battery Energy Storage Systems (BESS) market is demonstrating significant expansion, propelled by aggressive renewable energy objectives and the critical need for grid stability. The market is projected to reach 385 million by 2025, with a Compound Annual Growth Rate (CAGR) of 14%. Key growth drivers include supportive government policies for renewable energy integration, escalating electricity consumption, and the imperative for enhanced grid reliability. Lithium-ion batteries are anticipated to lead market share, owing to their superior energy density and extended lifespan, while lead-acid batteries will retain relevance in specific applications. The off-grid sector is expected to outpace the on-grid segment in growth, driven by the demand for energy storage in underserved regions. Leading states in BESS adoption include Gujarat, Maharashtra, and Tamil Nadu, attributed to their substantial renewable energy capacities. Other states are also witnessing increased investment and market development.

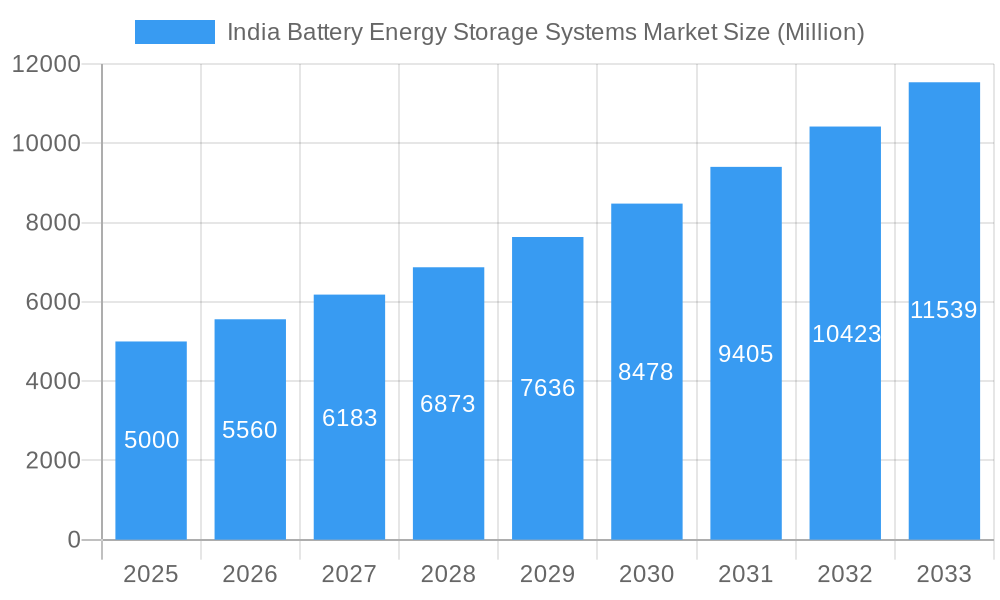

India Battery Energy Storage Systems Market Market Size (In Million)

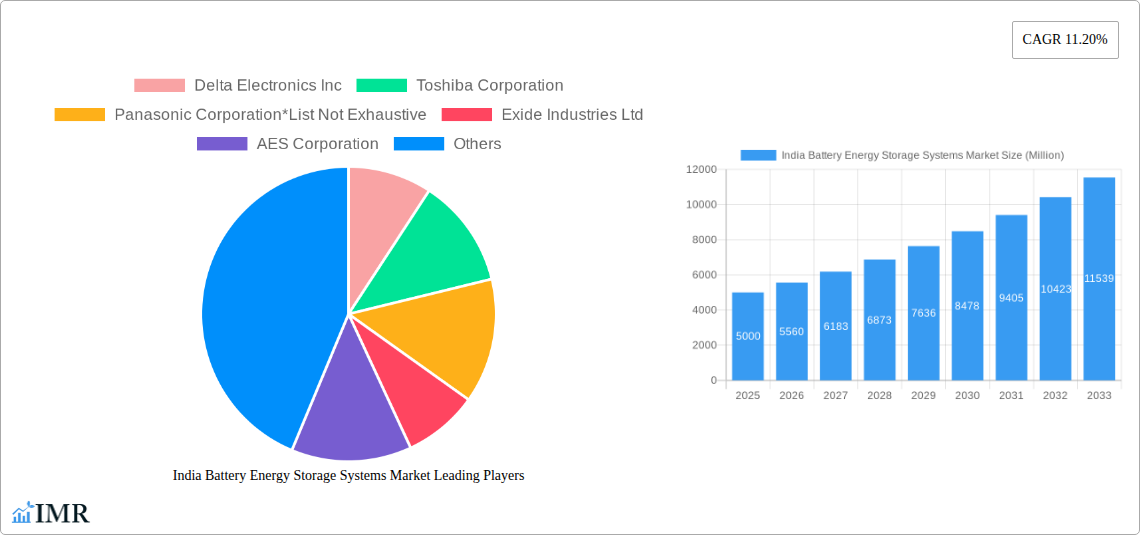

Market segmentation reveals the varied applications of BESS across India. While lithium-ion technology is dominant, the off-grid connection type is forecast for accelerated growth, influenced by increasing renewable energy deployment in rural areas. Prominent market participants such as Delta Electronics, Toshiba, Panasonic, Exide Industries, and AES Corporation are instrumental in driving technological innovation and market expansion. Nevertheless, challenges persist, including substantial upfront investment, limited awareness in some segments, and issues related to battery lifecycle management and recycling. The coming decade promises considerable technological advancements, robust policy frameworks, and infrastructural enhancements that will continue to define the growth trajectory of India's BESS market.

India Battery Energy Storage Systems Market Company Market Share

India Battery Energy Storage Systems (BESS) Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the burgeoning India Battery Energy Storage Systems (BESS) market, encompassing the historical period (2019-2024), base year (2025), and forecast period (2025-2033). It offers invaluable insights for industry professionals, investors, and policymakers seeking to navigate this rapidly evolving sector. The report segments the market by battery type (Lithium-ion, Lead-acid, Flow, Other Battery Types) and connection type (On-grid, Off-grid), providing a granular understanding of market dynamics and growth potential across various segments. Key players like Delta Electronics Inc, Toshiba Corporation, Panasonic Corporation, Exide Industries Ltd, AES Corporation, and Amara Raja Group are analyzed, alongside emerging opportunities and challenges. The report's quantitative and qualitative analyses are bolstered by recent industry developments and government initiatives.

India Battery Energy Storage Systems Market Dynamics & Structure

The Indian BESS market is characterized by increasing market concentration as larger players consolidate their positions. Technological innovation, particularly in Lithium-ion battery technology, is a major driver, spurred by government incentives and the growing need for grid stabilization and renewable energy integration. The regulatory framework is evolving, with supportive policies aimed at accelerating BESS adoption. Lead-acid batteries still hold a significant market share, but Lithium-ion is experiencing rapid growth. The market faces competition from other energy storage solutions, but BESS offers unique advantages in terms of scalability and efficiency. M&A activity is expected to increase as companies seek to expand their market presence and gain access to advanced technologies.

- Market Concentration: xx% of the market is controlled by the top 5 players (2025).

- Technological Innovation: Focus on improving battery lifespan, energy density, and cost-effectiveness.

- Regulatory Framework: Government initiatives and supportive policies drive market growth.

- Competitive Substitutes: Pumped hydro storage, compressed air energy storage (CAES).

- End-User Demographics: Primarily utilities, industrial users, and commercial & residential sectors.

- M&A Trends: xx M&A deals projected in the forecast period, driven by strategic expansion.

India Battery Energy Storage Systems Market Growth Trends & Insights

The Indian BESS market is experiencing exponential growth, driven by the government's ambitious renewable energy targets and increasing demand for grid stability. The market size is projected to reach xx Million units by 2033, exhibiting a CAGR of xx% during the forecast period. Adoption rates are accelerating as costs decline and technological advancements improve the performance and reliability of BESS systems. Technological disruptions, such as advancements in solid-state batteries, are poised to further enhance the market. Consumer behavior is shifting toward greater adoption of renewable energy sources, boosting demand for BESS solutions for energy storage and grid management.

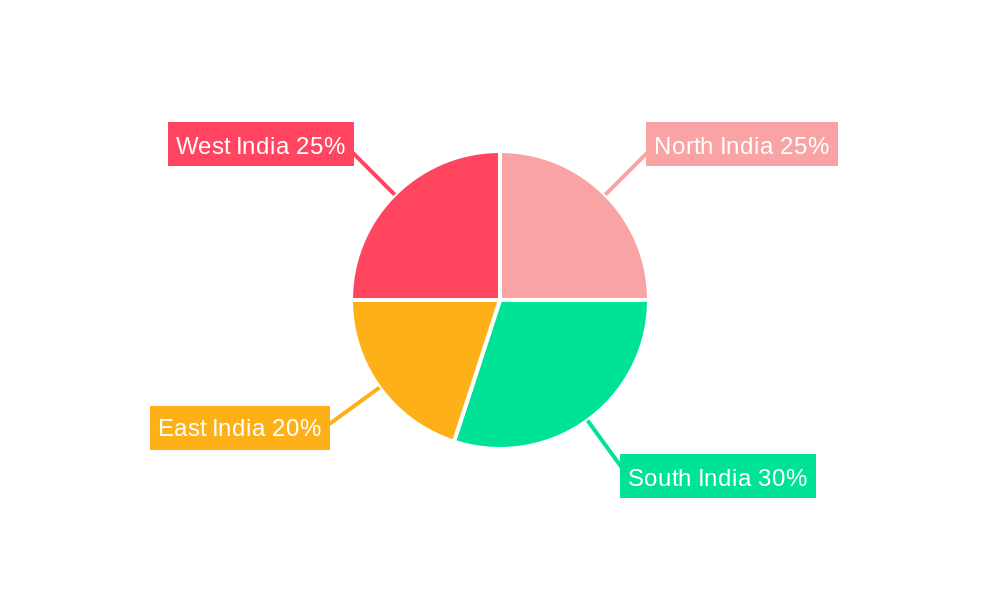

Dominant Regions, Countries, or Segments in India Battery Energy Storage Systems Market

The states of Maharashtra, Gujarat, and Karnataka are leading the market, driven by favorable policies, robust renewable energy infrastructure, and significant industrial presence. Within the segments, Lithium-ion batteries are gaining prominence due to their higher energy density and longer lifespan compared to lead-acid batteries. On-grid connections dominate the market, reflecting the increasing integration of BESS into the national grid for stability and reliability.

- Key Drivers:

- Government Incentives: USD 455.2 million incentive scheme announced in June 2023 for 400 MWh projects.

- Renewable Energy Integration: BESS crucial for managing intermittency of solar and wind power.

- Grid Modernization: BESS improving grid stability and reliability.

- Economic Policies: Favorable regulatory environment and investment incentives.

- Dominance Factors:

- Lithium-ion Battery Growth: Market share projected to reach xx% by 2033.

- On-grid Market Leadership: xx% market share projected by 2033.

- Regional Concentration: Maharashtra, Gujarat, and Karnataka account for xx% of market share.

India Battery Energy Storage Systems Market Product Landscape

The Indian BESS market offers a diverse range of products, from compact residential systems to large-scale utility-level solutions. Innovations focus on increasing energy density, enhancing safety features, and improving battery management systems. Advanced battery chemistries, such as solid-state batteries, are emerging, promising improved performance and longer lifespan. Unique selling propositions include modular designs, scalable systems, and integrated monitoring capabilities.

Key Drivers, Barriers & Challenges in India Battery Energy Storage Systems Market

Key Drivers:

- Increased renewable energy capacity requiring stable energy supply.

- Government support through financial incentives and favorable policies.

- Technological advancements leading to lower costs and improved efficiency.

Key Barriers & Challenges:

- High upfront capital costs for BESS systems, particularly for Lithium-ion batteries.

- Supply chain constraints and reliance on imports for some components.

- Lack of skilled workforce for installation and maintenance. This is estimated to cause a xx% slowdown in project implementation in the coming years.

Emerging Opportunities in India Battery Energy Storage Systems Market

- Growing adoption of BESS in microgrids and off-grid applications in rural areas.

- Expansion into new market segments, such as electric vehicles and data centers.

- Development of advanced battery technologies, such as solid-state and flow batteries.

Growth Accelerators in the India Battery Energy Storage Systems Market Industry

Technological advancements, strategic partnerships between battery manufacturers and energy companies, and the expansion of grid infrastructure are key catalysts driving long-term growth. Government initiatives promoting domestic manufacturing and reducing reliance on imports are also crucial for accelerating market expansion.

Key Players Shaping the India Battery Energy Storage Systems Market Market

- Delta Electronics Inc

- Toshiba Corporation

- Panasonic Corporation

- Exide Industries Ltd

- AES Corporation

- Amara Raja Group

Notable Milestones in India Battery Energy Storage Systems Market Sector

- June 2023: Indian government announces USD 455.2 million incentive scheme for 400 MWh battery storage projects.

- April 2023: India Grid Trust completes first BESS project at Dhule substation in Maharashtra.

In-Depth India Battery Energy Storage Systems Market Market Outlook

The Indian BESS market is poised for significant growth in the coming years, driven by a confluence of factors including government support, technological advancements, and the increasing adoption of renewable energy. Strategic partnerships, investments in domestic manufacturing, and the development of innovative battery technologies will further accelerate market expansion, creating lucrative opportunities for both established and emerging players.

India Battery Energy Storage Systems Market Segmentation

-

1. Battery Type

- 1.1. Lithium-ion

- 1.2. Lead-acid

- 1.3. Flow

- 1.4. Other Battery Types

-

2. Connection Type

- 2.1. On-grid

- 2.2. Off-grid

India Battery Energy Storage Systems Market Segmentation By Geography

- 1. India

India Battery Energy Storage Systems Market Regional Market Share

Geographic Coverage of India Battery Energy Storage Systems Market

India Battery Energy Storage Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Cost of Energy Storage Technologies4.; Government Initiatives to Promote Energy Storage Deployment

- 3.3. Market Restrains

- 3.3.1. 4.; Uncertainty in the Rules Governing Energy Storage Operations and Ownership

- 3.4. Market Trends

- 3.4.1. Lithium-ion Battery Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Battery Energy Storage Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 5.1.1. Lithium-ion

- 5.1.2. Lead-acid

- 5.1.3. Flow

- 5.1.4. Other Battery Types

- 5.2. Market Analysis, Insights and Forecast - by Connection Type

- 5.2.1. On-grid

- 5.2.2. Off-grid

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Delta Electronics Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Toshiba Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Panasonic Corporation*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Exide Industries Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AES Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amara Raja Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Delta Electronics Inc

List of Figures

- Figure 1: India Battery Energy Storage Systems Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Battery Energy Storage Systems Market Share (%) by Company 2025

List of Tables

- Table 1: India Battery Energy Storage Systems Market Revenue million Forecast, by Battery Type 2020 & 2033

- Table 2: India Battery Energy Storage Systems Market Revenue million Forecast, by Connection Type 2020 & 2033

- Table 3: India Battery Energy Storage Systems Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: India Battery Energy Storage Systems Market Revenue million Forecast, by Battery Type 2020 & 2033

- Table 5: India Battery Energy Storage Systems Market Revenue million Forecast, by Connection Type 2020 & 2033

- Table 6: India Battery Energy Storage Systems Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Battery Energy Storage Systems Market?

The projected CAGR is approximately 14%.

2. Which companies are prominent players in the India Battery Energy Storage Systems Market?

Key companies in the market include Delta Electronics Inc, Toshiba Corporation, Panasonic Corporation*List Not Exhaustive, Exide Industries Ltd, AES Corporation, Amara Raja Group.

3. What are the main segments of the India Battery Energy Storage Systems Market?

The market segments include Battery Type, Connection Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 385 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Cost of Energy Storage Technologies4.; Government Initiatives to Promote Energy Storage Deployment.

6. What are the notable trends driving market growth?

Lithium-ion Battery Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Uncertainty in the Rules Governing Energy Storage Operations and Ownership.

8. Can you provide examples of recent developments in the market?

June 2023: The Indian government shall offer USD 455.2 million as incentives to the companies for installing battery energy storage projects of 400 MWh. The government intends to reach its 2030 goal of 500 MW of renewable capacity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Battery Energy Storage Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Battery Energy Storage Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Battery Energy Storage Systems Market?

To stay informed about further developments, trends, and reports in the India Battery Energy Storage Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence